By Kelly Schwedland

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Building the Billion Dollar SaaS Unicorn презентация

Содержание

- 1. Building the Billion Dollar SaaS Unicorn

- 2. Rising Table Stakes Christopher Janz, SaaS Investor http://tomtunguz.com/table-stakes-saas/

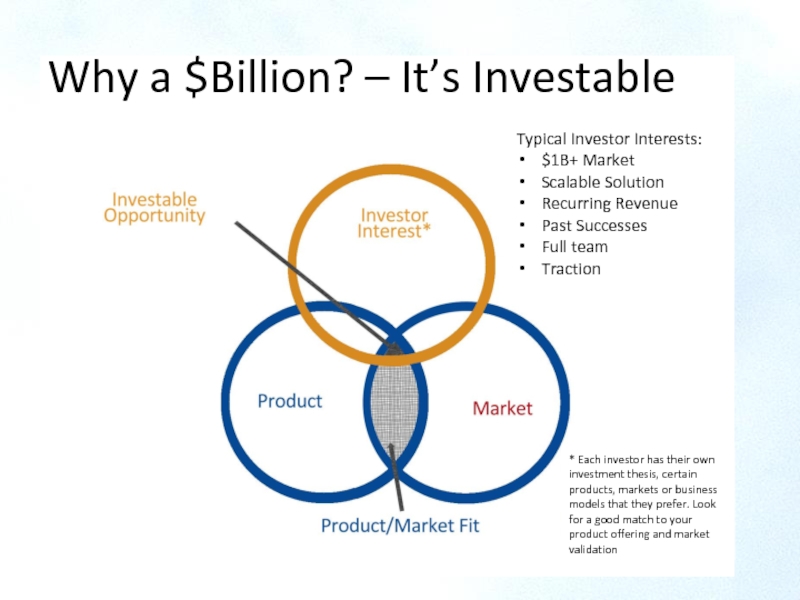

- 3. Why a $Billion? – It’s Investable *

- 4. Growth Stage Key Points Terms & Metrics Roadmap Sustaining Growth

- 5. I. Key Terms & Metrics for SaaS

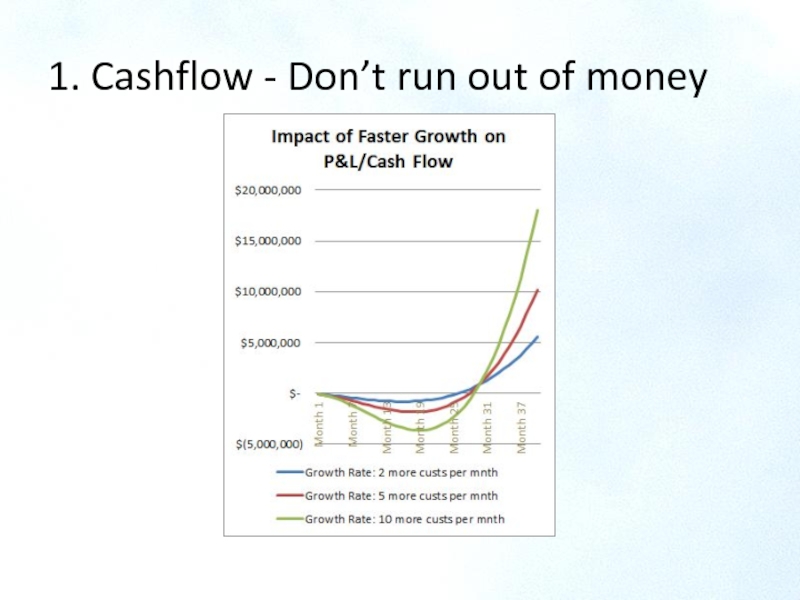

- 6. Impact of Faster Growth on P&L /

- 7. 2. MRR & ARR The First $1M

- 8. LTV > 3x CAC Months to

- 9. 4. Matching CAC, LTV & ACV Product

- 10. 5. Churn = # MRR this month

- 11. 6. Cohort Analysis With a SaaS business

- 12. 7. LVR - Lead Velocity Rate Qualified

- 13. 8. TtV- Time to Value How fast

- 14. II. Roadmap

- 15. 5 ways to build a $B business

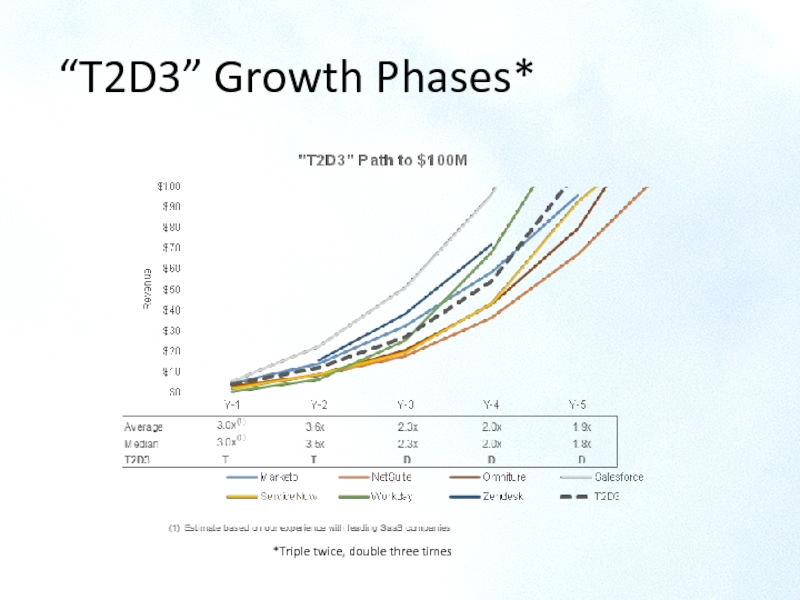

- 16. “T2D3” Growth Phases* *Triple twice, double three times

- 17. T2D3 Cont’d Phase 1: Establish a great

- 18. Phase 0: Lean Startup Process http://www.slideshare.net/KellySchwedland/lean-startup-basics-evidence-based-entrepreneurship

- 19. Phase 1: Product/Market/ (Team) Fit The Simple

- 20. Building a replicable model* http://www.slideshare.net/KellySchwedland/generic-system-strategy-flow-chart

- 21. III. Sustaining Growth http://chaotic-flow.com/media/saas-growth-strategy.pdf

- 22. Median GP Ratio by year for Public

- 23. Accelerating Customer Acquisition and Retention Remove Buyer

- 24. Improving Lead to Conversion Ratio Measure and

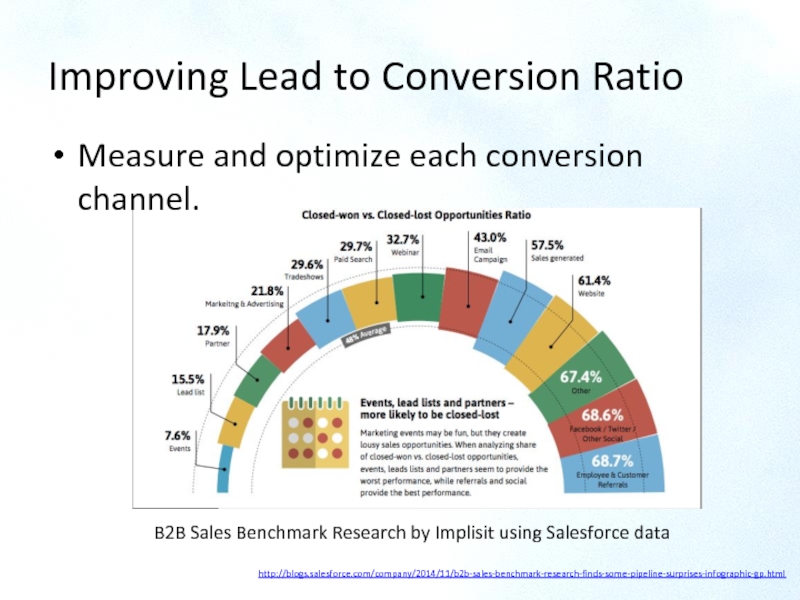

- 25. Polynomial Growth By Alex Moor, CEO of

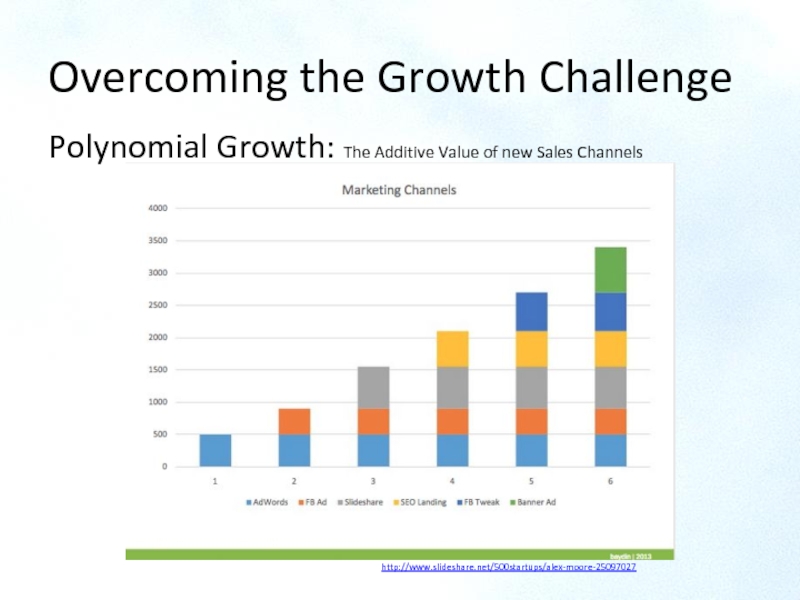

- 26. Median revenue per Employee by year since

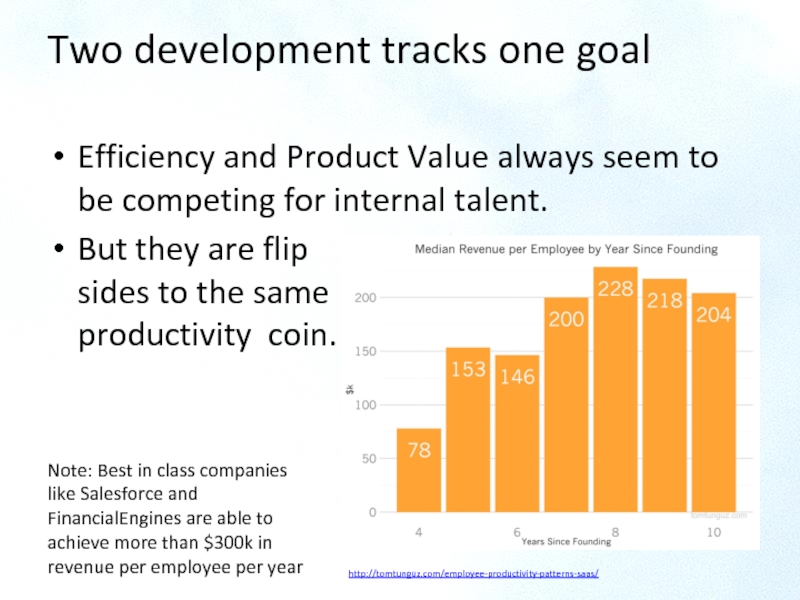

- 27. “Make no small plans for they have

- 28. Thanks Kelly Schwedland 219-405-5723 Kellys@ElevateVentures.com

- 29. More SaaS Resources http://www.saastr.com/ http://tomtunguz.com/categories/saas/ http://www.forentrepreneurs.com/saas/ http://sixteenventures.com/page/?s=B2B+SaaS Pitching a VC http://www.bothsidesofthetable.com/pitching-a-vc http://www.slideshare.net/KellySchwedland/how-to-pitch-a-vc-or-angel-and-get-funded

Слайд 1Building the

Billion Dollar

SaaS Unicorn

The CEO Guide of Key Insights

Слайд 3Why a $Billion? – It’s Investable

* Each investor has their own

Typical Investor Interests:

$1B+ Market

Scalable Solution

Recurring Revenue

Past Successes

Full team

Traction

Слайд 5I. Key Terms & Metrics for SaaS

Cash flow

MRR/ARR

CAC & LTV

ACV

Churn

Cohort analysis

LVR

TtV

If

For Developing a KPI dashboard for a SaaS company:

http://christophjanz.blogspot.de/2013/04/a-kpi-dashboard-for-early-stage-saas.html

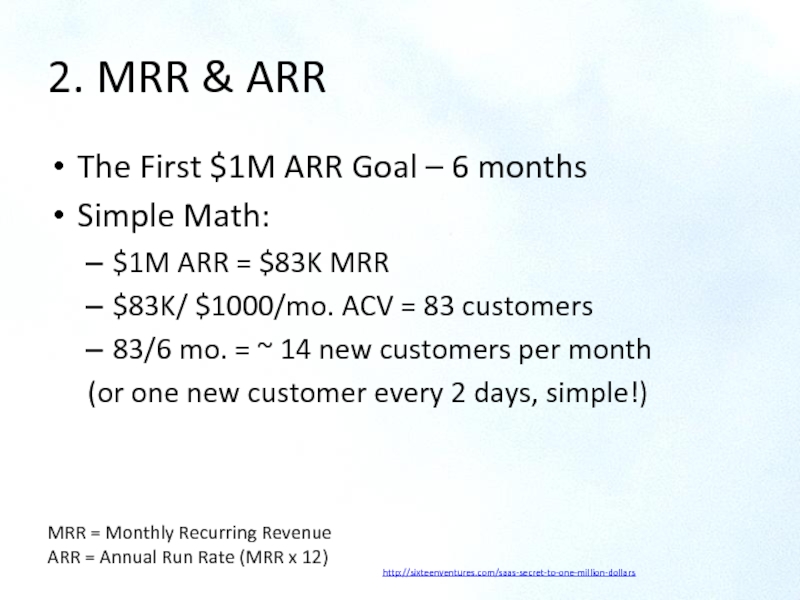

Слайд 72. MRR & ARR

The First $1M ARR Goal – 6 months

Simple

$1M ARR = $83K MRR

$83K/ $1000/mo. ACV = 83 customers

83/6 mo. = ~ 14 new customers per month

(or one new customer every 2 days, simple!)

http://sixteenventures.com/saas-secret-to-one-million-dollars

MRR = Monthly Recurring Revenue

ARR = Annual Run Rate (MRR x 12)

Слайд 8LTV > 3x CAC

Months to recover CAC < 12 Months

3.

Business model viability, in the majority of startups, will come down to balancing two variables:

CAC: Cost to Acquire Customers

LTV: Lifetime Value of a Customer or The ability to monetize those customers

http://www.forentrepreneurs.com/startup-killer/

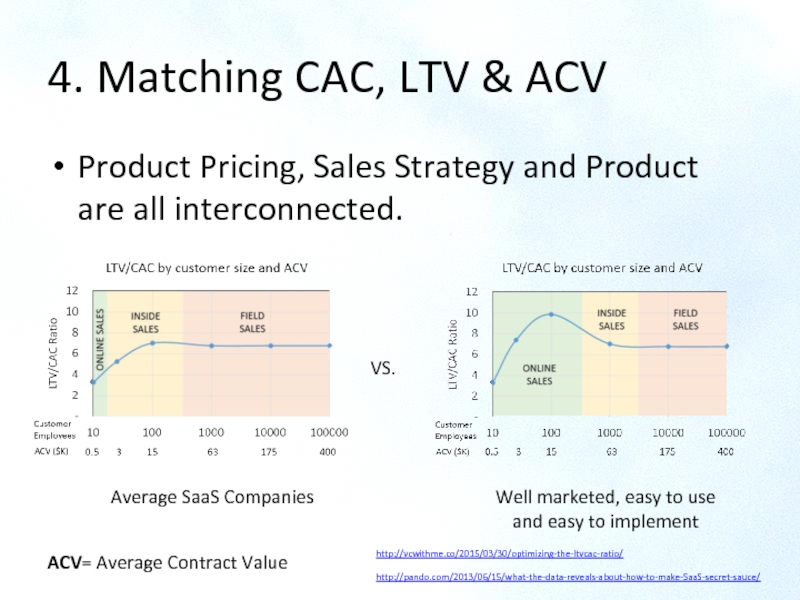

Слайд 94. Matching CAC, LTV & ACV

Product Pricing, Sales Strategy and Product

http://vcwithme.co/2015/03/30/optimizing-the-ltvcac-ratio/

http://pando.com/2013/06/15/what-the-data-reveals-about-how-to-make-SaaS-secret-sauce/

Average SaaS Companies

Well marketed, easy to use

and easy to implement

ACV= Average Contract Value

VS.

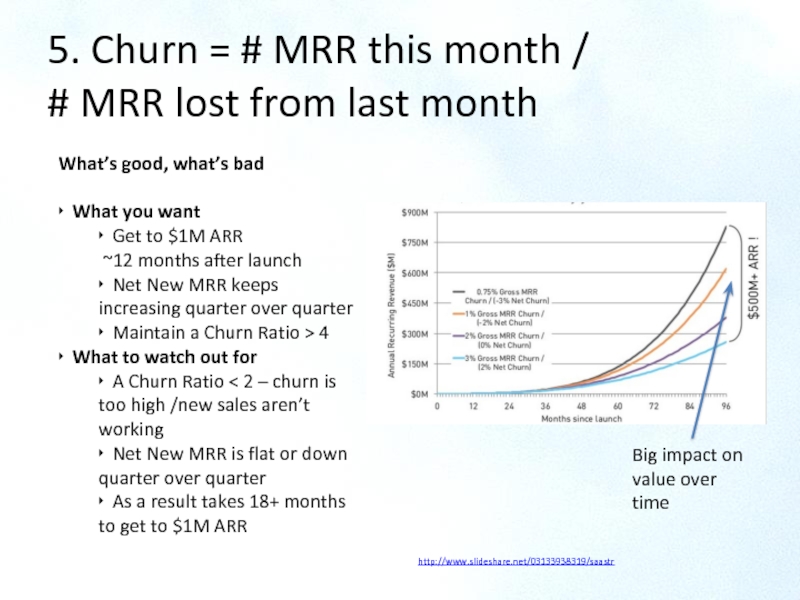

Слайд 105. Churn = # MRR this month / # MRR lost

http://www.slideshare.net/03133938319/saastr

Big impact on value over time

What’s good, what’s bad

‣ What you want

‣ Get to $1M ARR

~12 months after launch

‣ Net New MRR keeps increasing quarter over quarter

‣ Maintain a Churn Ratio > 4

‣ What to watch out for

‣ A Churn Ratio < 2 – churn is too high /new sales aren’t working

‣ Net New MRR is flat or down quarter over quarter

‣ As a result takes 18+ months to get to $1M ARR

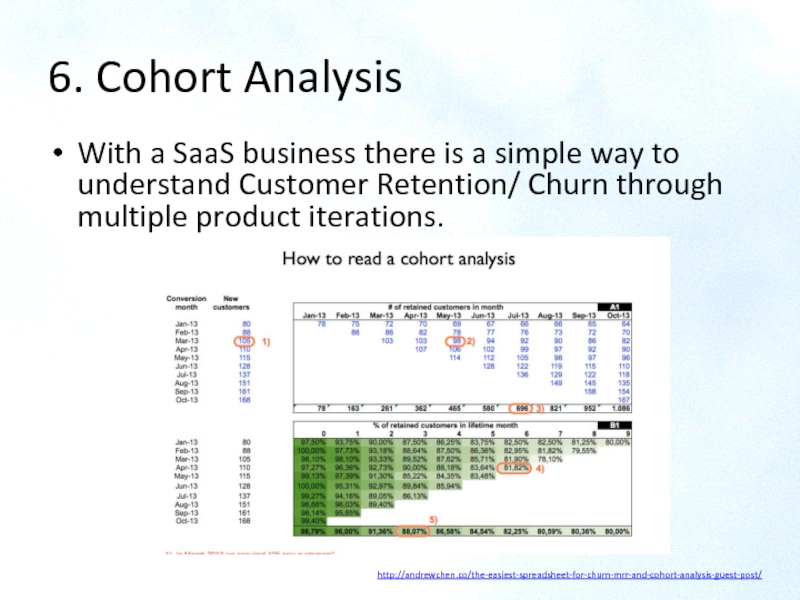

Слайд 116. Cohort Analysis

With a SaaS business there is a simple way

http://andrewchen.co/the-easiest-spreadsheet-for-churn-mrr-and-cohort-analysis-guest-post/

Слайд 127. LVR - Lead Velocity Rate

Qualified Lead Velocity Rate (LVR), your

Grow your LVR about 10-20% greater than your desired MRR growth — you’ll hit your revenue goals.

You’ll see the future of your business 12-18 months out, clear as can be.

http://www.saastr.com/why-lead-velocity-rate-lvr-is-the-most-important-metric-in-saas/

Слайд 138. TtV- Time to Value

How fast can a customer derive value

Ways to Improve:

Simplicity wins… be feature-complete, not feature-rich

Hack the onboarding flow

Document, Document, Document

Quantify, Set goals and Benchmark

http://www.rre.com/blog/89

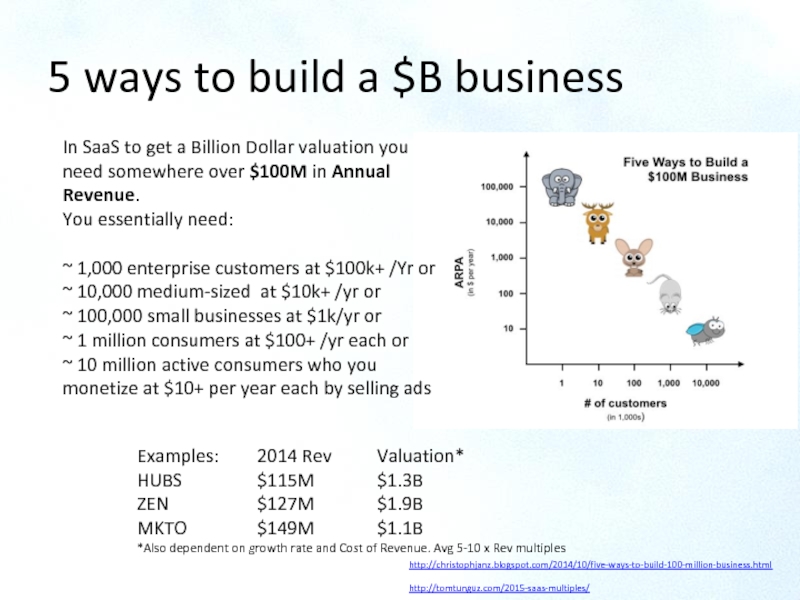

Слайд 155 ways to build a $B business

http://christophjanz.blogspot.com/2014/10/five-ways-to-build-100-million-business.html

http://tomtunguz.com/2015-saas-multiples/

In SaaS to get a

You essentially need:

~ 1,000 enterprise customers at $100k+ /Yr or

~ 10,000 medium-sized at $10k+ /yr or

~ 100,000 small businesses at $1k/yr or

~ 1 million consumers at $100+ /yr each or

~ 10 million active consumers who you monetize at $10+ per year each by selling ads

Examples: 2014 Rev Valuation*

HUBS $115M $1.3B

ZEN $127M $1.9B

MKTO $149M $1.1B

*Also dependent on growth rate and Cost of Revenue. Avg 5-10 x Rev multiples

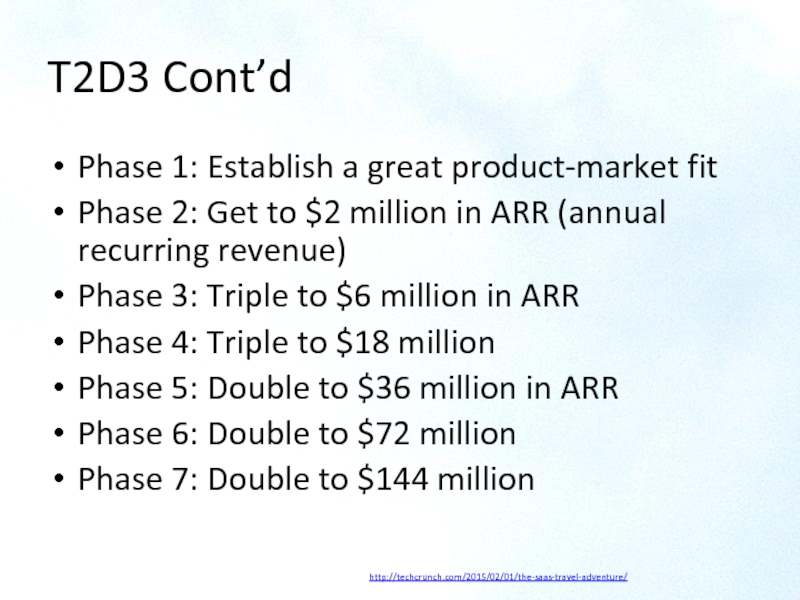

Слайд 17T2D3 Cont’d

Phase 1: Establish a great product-market fit

Phase 2: Get to

Phase 3: Triple to $6 million in ARR

Phase 4: Triple to $18 million

Phase 5: Double to $36 million in ARR

Phase 6: Double to $72 million

Phase 7: Double to $144 million

http://techcrunch.com/2015/02/01/the-saas-travel-adventure/

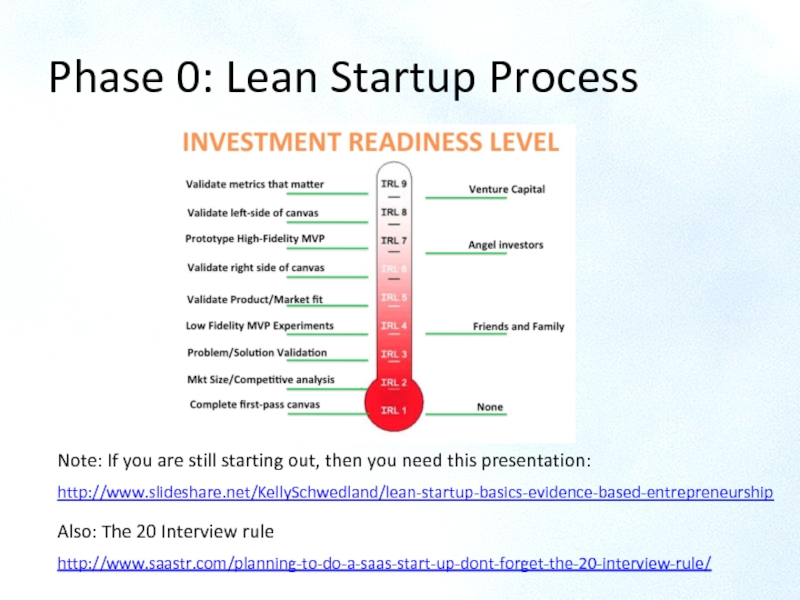

Слайд 18Phase 0: Lean Startup Process

http://www.slideshare.net/KellySchwedland/lean-startup-basics-evidence-based-entrepreneurship

Also: The 20 Interview rule

http://www.saastr.com/planning-to-do-a-saas-start-up-dont-forget-the-20-interview-rule/

Note: If you

Слайд 19Phase 1: Product/Market/ (Team) Fit

The Simple definition – When your problems

The only thing that matters: Market

Warning signs you aren’t there:

Product Market Fit Myths

http://pmarchive.com/guide_to_startups_part4.html

http://vcwithme.co/2014/11/10/five-signs-your-product-market-fit-isnt-real/

http://www.feld.com/archives/2015/01/illusion-product-market-fit-saas-companies.html

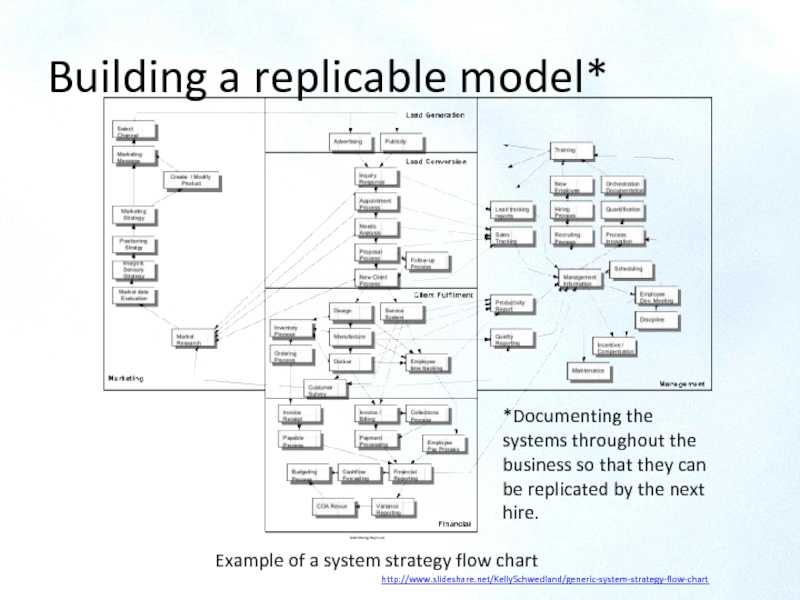

Слайд 20Building a replicable model*

http://www.slideshare.net/KellySchwedland/generic-system-strategy-flow-chart

*Documenting the systems throughout the business so

Example of a system strategy flow chart

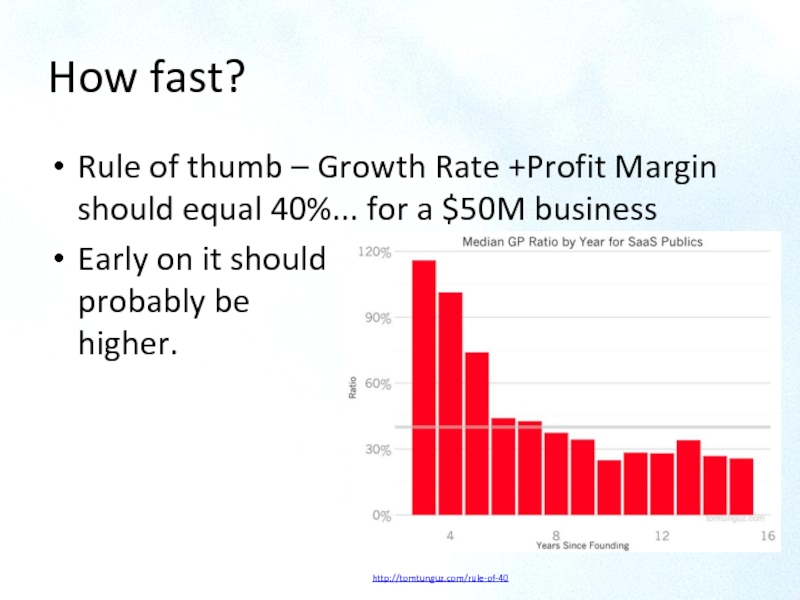

Слайд 22Median GP Ratio by year for Public SaaS companies

How fast?

Rule

Early on it should probably be higher.

http://tomtunguz.com/rule-of-40

Слайд 23Accelerating Customer Acquisition and Retention

Remove Buyer Roadblocks:

Increase Awareness

Facilitate Evaluation

Streamline Purchase

Simplify Onboarding

Improve

Remind Customers of Value they are getting

Triggered up-selling and cross-selling that expanded usage of your service (and revenue)

http://chaotic-flow.com/SaaS-marketing-accelerating-customer-acquisition/

http://sixteenventures.com/customer-retention-profitability

Слайд 24Improving Lead to Conversion Ratio

Measure and optimize each conversion channel.

http://blogs.salesforce.com/company/2014/11/b2b-sales-benchmark-research-finds-some-pipeline-surprises-infographic-gp.html

B2B Sales

Слайд 25Polynomial Growth By Alex Moor, CEO of Baydin

Overcoming the Growth Challenge

http://www.slideshare.net/500startups/alex-moore-25097027

Polynomial

Слайд 26Median revenue per Employee by year since founding

Two development tracks one

Efficiency and Product Value always seem to be competing for internal talent.

But they are flip

sides to the same

productivity coin.

http://tomtunguz.com/employee-productivity-patterns-saas/

Note: Best in class companies like Salesforce and FinancialEngines are able to achieve more than $300k in revenue per employee per year