- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Simultaneous games. Oligopoly. (Lecture 2) презентация

Содержание

- 1. Simultaneous games. Oligopoly. (Lecture 2)

- 2. Oligopoly Extreme forms of market structure are

- 3. Strategic interactions and oligopoly When making strategic

- 4. Demand and costs Demand: The market price

- 5. Monopoly The monopolist chooses Q to maximize

- 6. Perfect competition Many producers, the price is

- 7. The Cournot model What is the Cournot

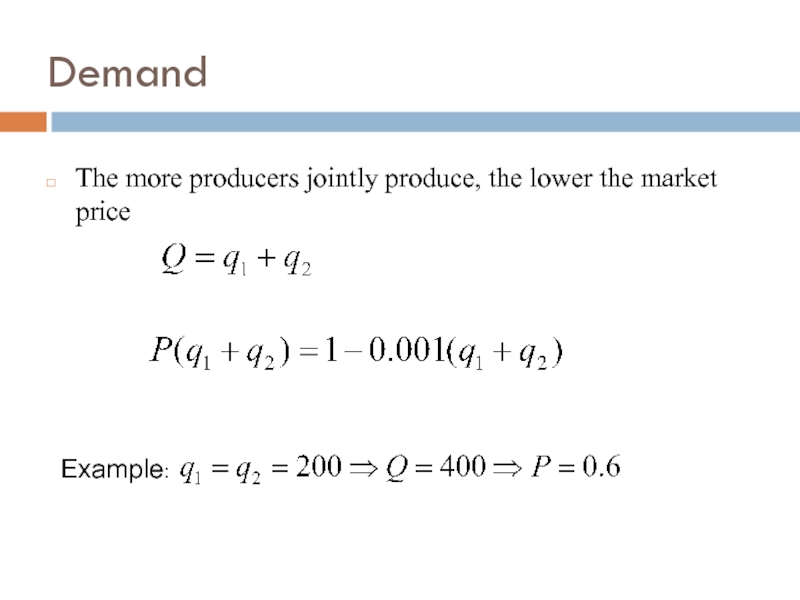

- 8. Demand The more producers jointly produce, the lower the market price Example:

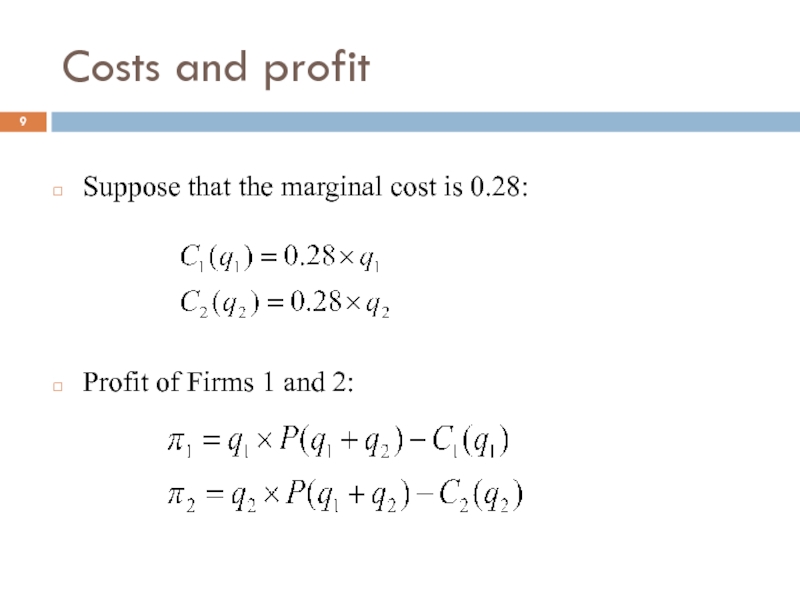

- 9. Costs and profit Suppose that the marginal

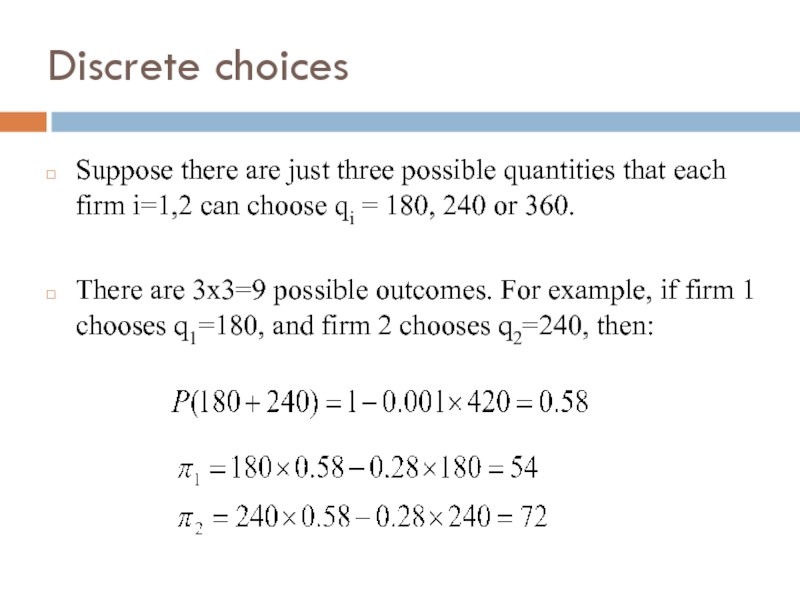

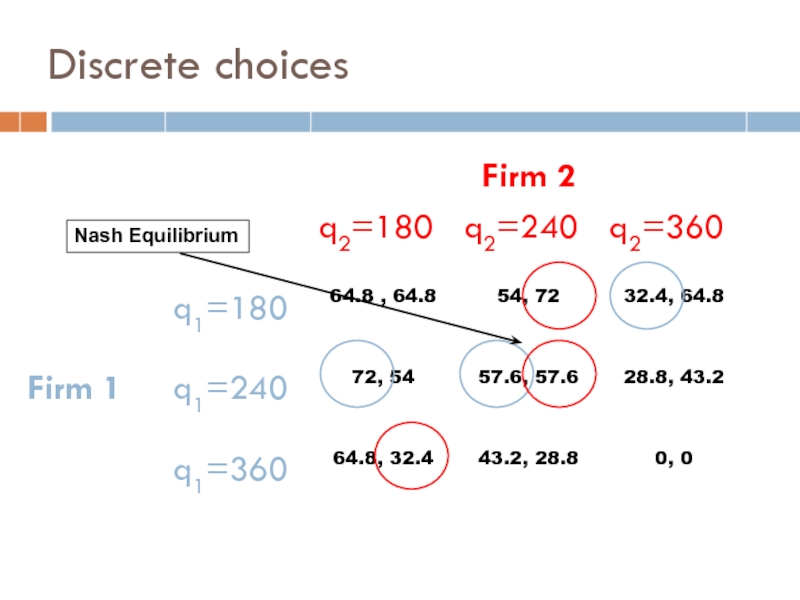

- 10. Discrete choices Suppose there are just three

- 11. Discrete choices Nash Equilibrium

- 12. Continuous choices Discrete games are not

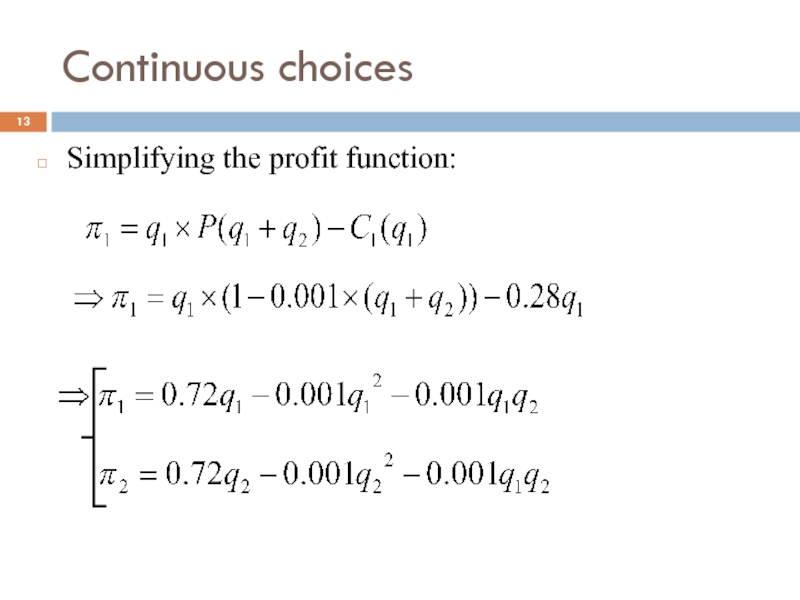

- 13. Continuous choices Simplifying the profit function:

- 14. Best responses We find the Nash equilibrium

- 15. Best responses

- 16. Best responses 360 720 q1 q2 0

- 17. 360 720 q1 q2 Best responses Firm

- 18. Nash equilibrium Nash Equilibrium is where best

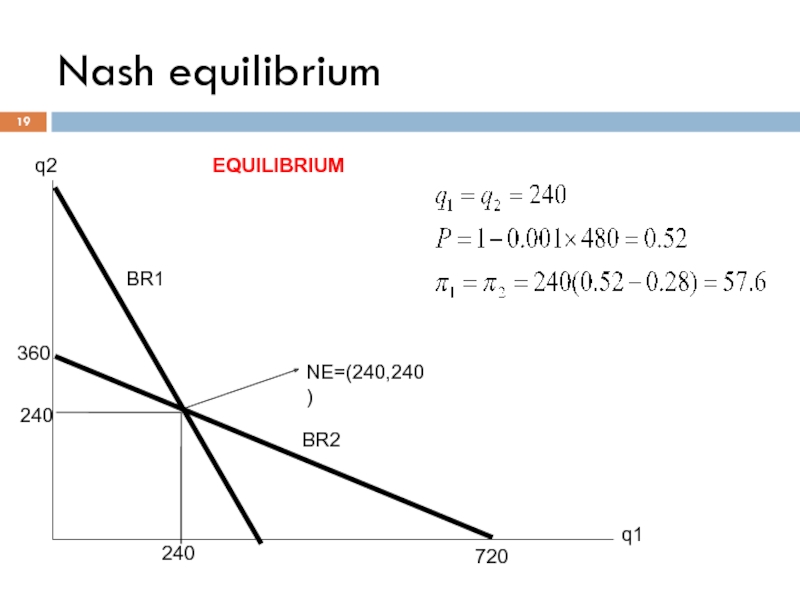

- 19. 360 720 q1 q2 NE=(240,240) Nash equilibrium EQUILIBRIUM BR1 BR2 240 240

- 20. Nash equilibrium 360 720 q1 q2

- 21. Effect of market structure Oligopoly delivers an

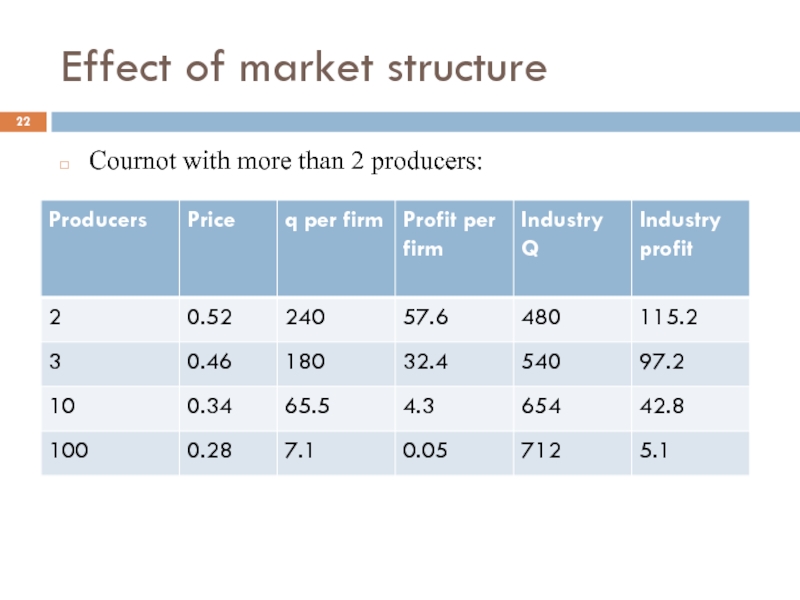

- 22. Effect of market structure Cournot with more than 2 producers:

- 23. Effect of market structure Having fewer producers

- 24. Wouldn’t the two producers be better off

- 25. Cartel “The OPEC cartel agreed on Wednesday

- 26. 360 720 q1 q2 NE=(240,240) Cartel stability

- 27. Cartel stability Each producer makes more profit

- 28. Cartel stability “The coffee bean cartel, the

- 29. Cartel stability To summarize… Producers have incentive

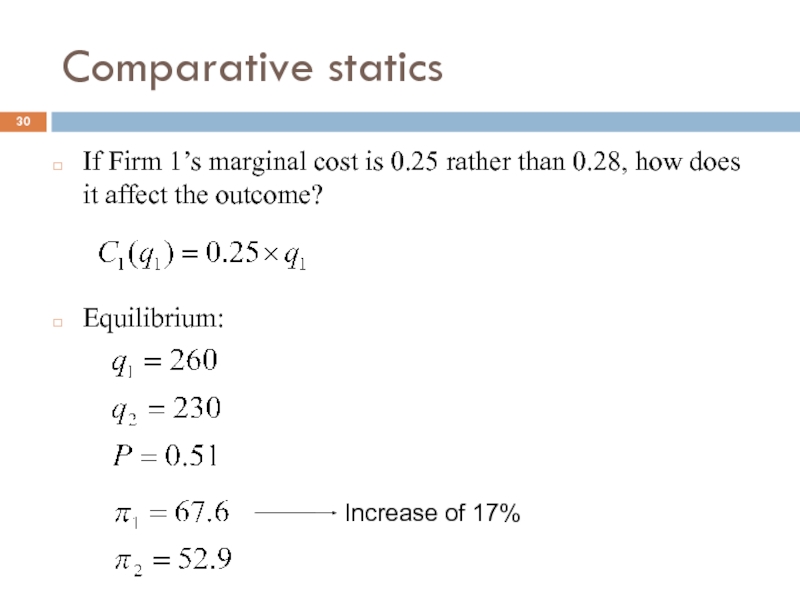

- 30. Comparative statics If Firm 1’s marginal cost

- 31. Summary Nash equilibrium and continuous choices. Oligopoly

Слайд 2Oligopoly

Extreme forms of market structure are uncomplicated:

Monopoly: one producer, no strategic

Perfect competition: many producers, price is given, no strategic interaction

Oligopoly: the industry is dominated by a small number of large firms. Intermediate case, between perfect competition and monopoly.

Smartphones industry

Oil producers

Accounting Big 4

Boeing and Airbus

Слайд 3Strategic interactions and oligopoly

When making strategic decisions (on prices, quantity, advertising,

Payoff interdependency: A producer’s payoff depends on what the other producers do.

Use of game theory.

Application of NE to oligopoly theory. Analysis of the decision of how much to produce (quantity).

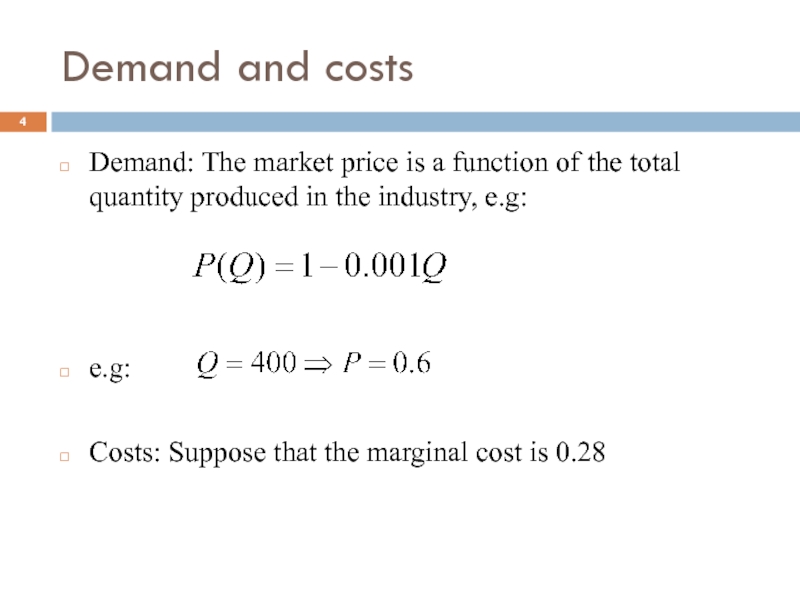

Слайд 4Demand and costs

Demand: The market price is a function of the

e.g:

Costs: Suppose that the marginal cost is 0.28

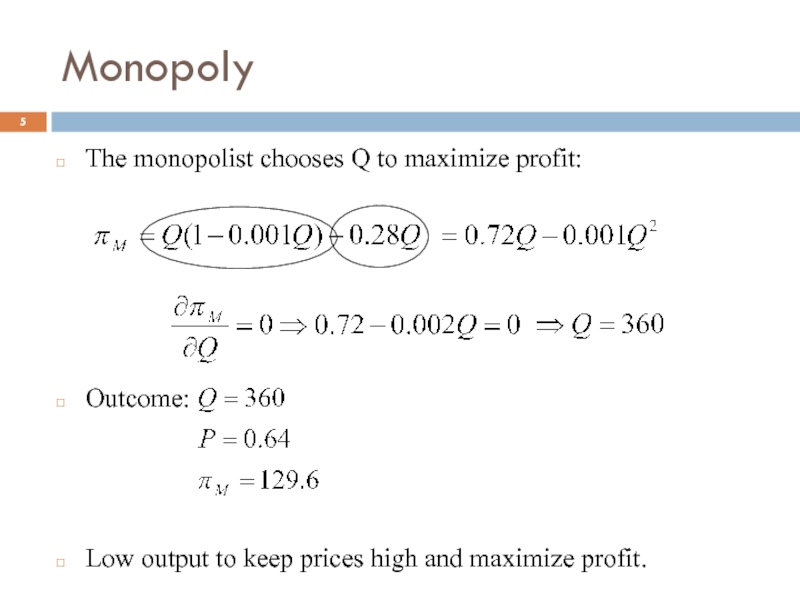

Слайд 5Monopoly

The monopolist chooses Q to maximize profit:

Outcome:

Low output to keep prices

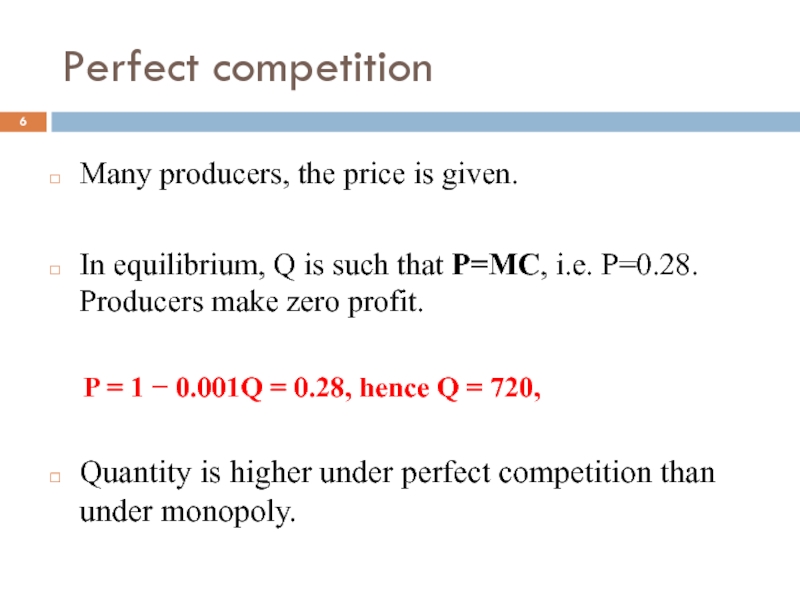

Слайд 6Perfect competition

Many producers, the price is given.

In equilibrium, Q is such

P = 1 − 0.001Q = 0.28, hence Q = 720,

Quantity is higher under perfect competition than under monopoly.

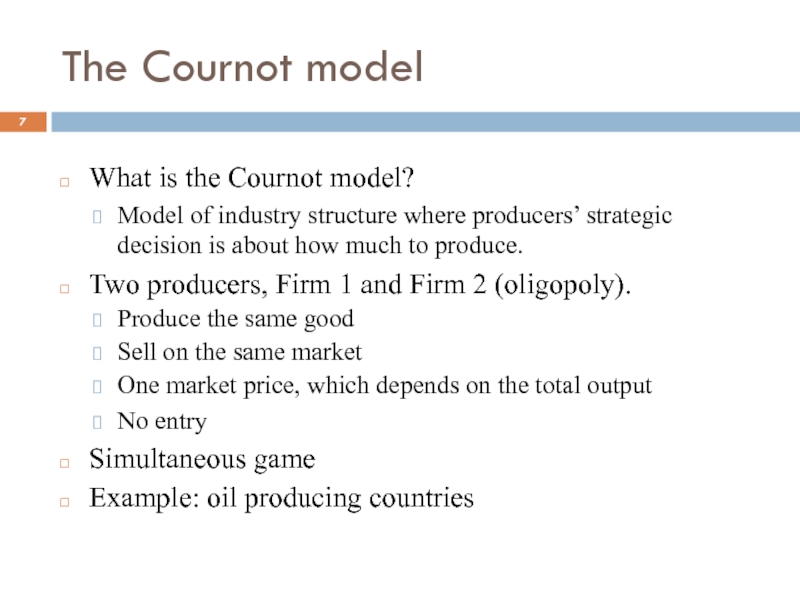

Слайд 7The Cournot model

What is the Cournot model?

Model of industry structure where

Two producers, Firm 1 and Firm 2 (oligopoly).

Produce the same good

Sell on the same market

One market price, which depends on the total output

No entry

Simultaneous game

Example: oil producing countries

Слайд 10Discrete choices

Suppose there are just three possible quantities that each firm

There are 3x3=9 possible outcomes. For example, if firm 1 chooses q1=180, and firm 2 chooses q2=240, then:

Слайд 12Continuous choices

Discrete games are not suitable to analyze the decision of

Producers are not limited to just 3 levels of production.

Quantity is a continuous variable, not a discrete one.

We now assume that producers can produce any quantity.

How much to produce?

More units sold means more volume, but lower price.

Essential to take into account the other producer’s behavior.

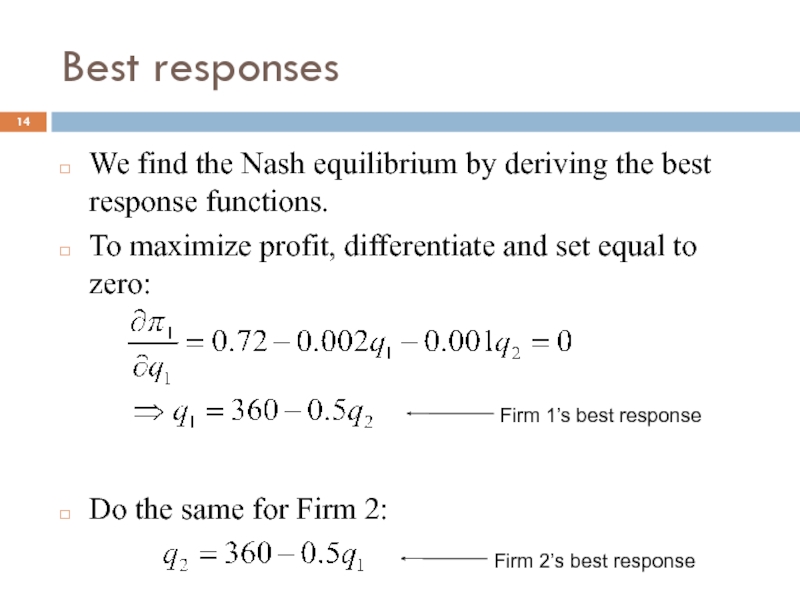

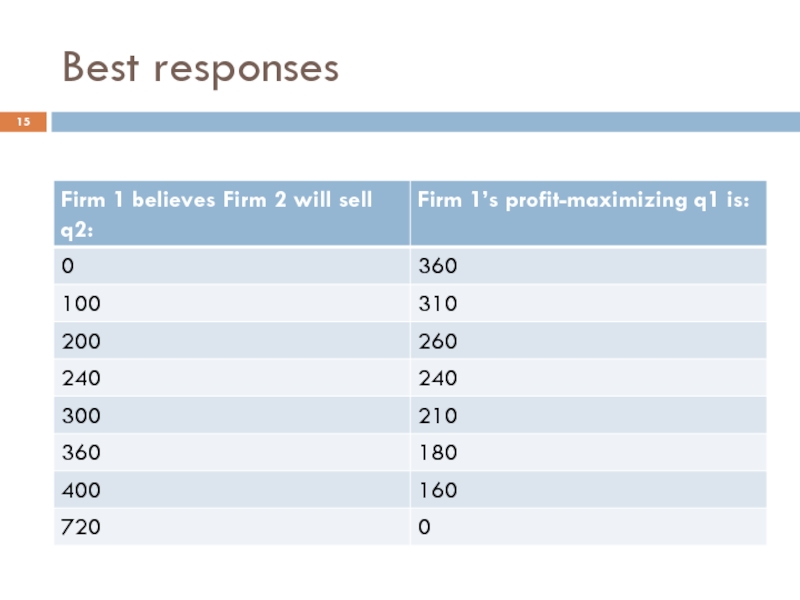

Слайд 14Best responses

We find the Nash equilibrium by deriving the best response

To maximize profit, differentiate and set equal to zero:

Do the same for Firm 2:

Firm 1’s best response

Firm 2’s best response

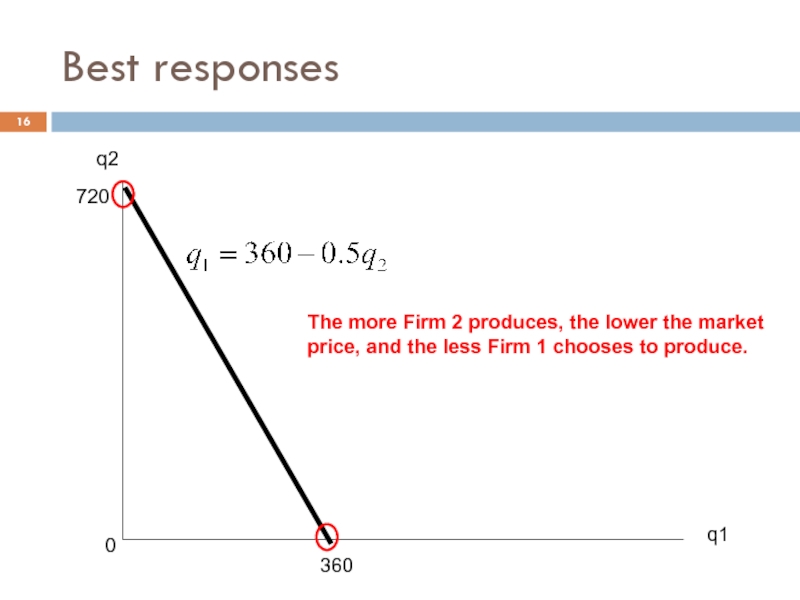

Слайд 16Best responses

360

720

q1

q2

0

The more Firm 2 produces, the lower the market

price, and

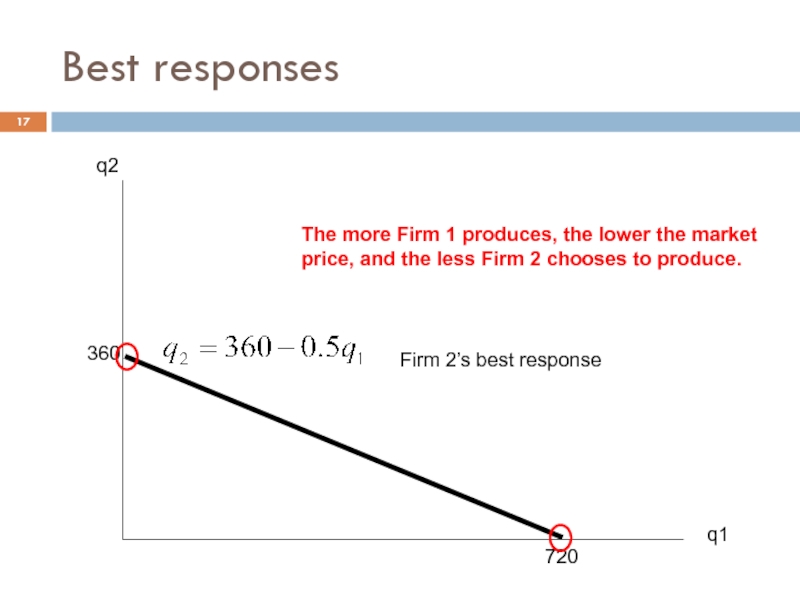

Слайд 17360

720

q1

q2

Best responses

Firm 2’s best response

The more Firm 1 produces, the lower

price, and the less Firm 2 chooses to produce.

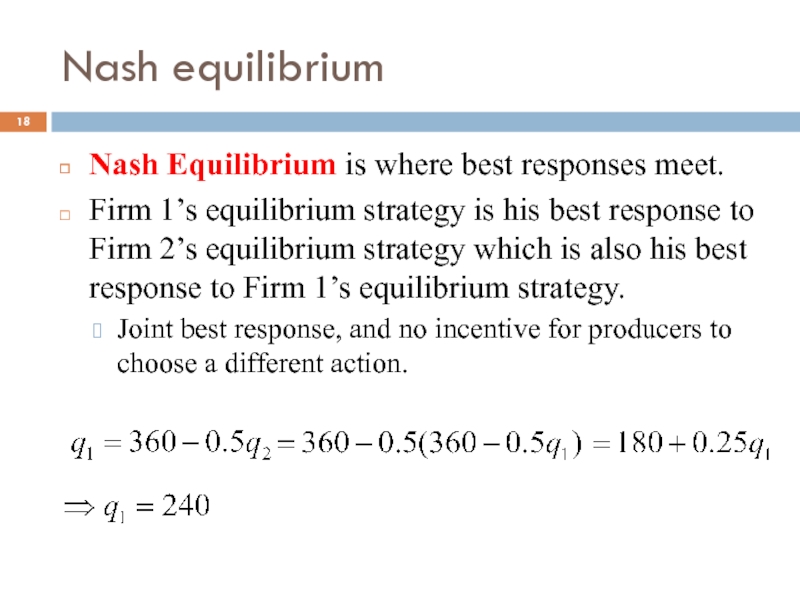

Слайд 18Nash equilibrium

Nash Equilibrium is where best responses meet.

Firm 1’s equilibrium strategy

Joint best response, and no incentive for producers to choose a different action.

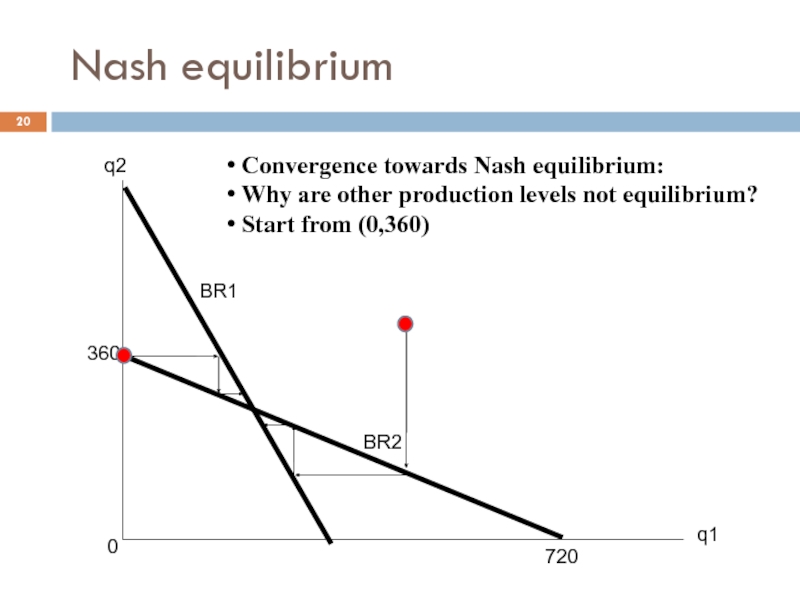

Слайд 20Nash equilibrium

360

720

q1

q2

Convergence towards Nash equilibrium:

Why are other production levels

Start from (0,360)

BR1

BR2

0

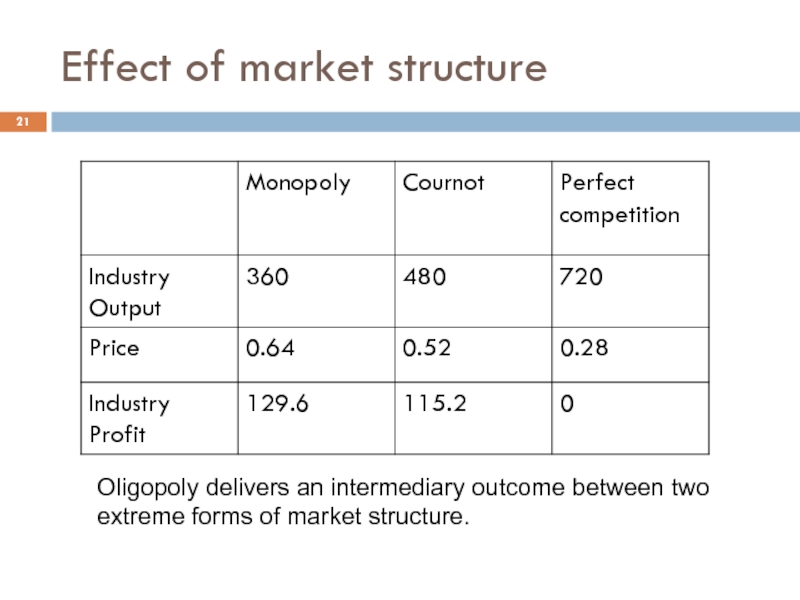

Слайд 21Effect of market structure

Oligopoly delivers an intermediary outcome between two

extreme forms

Слайд 23Effect of market structure

Having fewer producers is associated with:

Lower total output

Higher

Higher profitability

Empirical evidence shows that profitability is on average higher in highly concentrated industries.

Слайд 24Wouldn’t the two producers be better off cooperating rather than competing?

Both producers could maximize joint profit by jointly producing the monopolist output level: Q=360, i.e. 180 for each producer.

The monopolist profit (129.6) is then shared between the two producers (i.e. 64.8 for each, instead of 57.6 if they play the NE).

Cartel

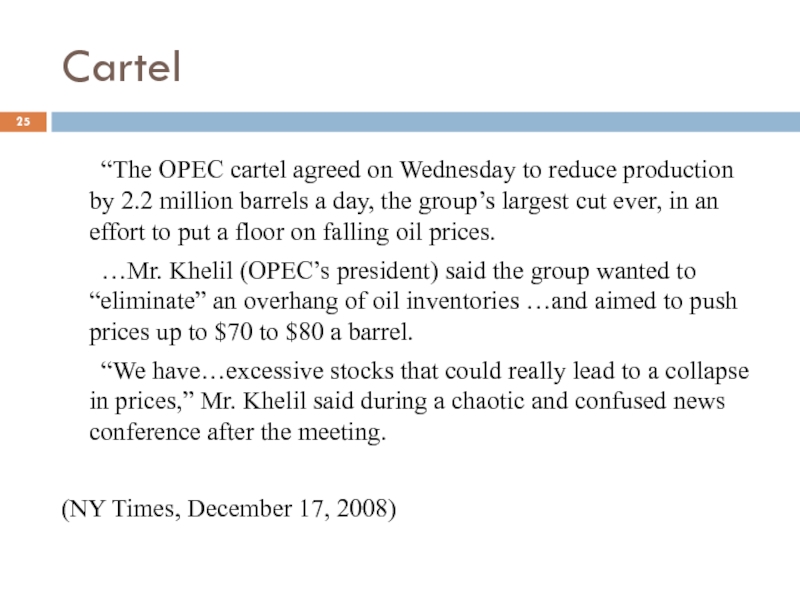

Слайд 25Cartel

“The OPEC cartel agreed on Wednesday to reduce production by 2.2

…Mr. Khelil (OPEC’s president) said the group wanted to “eliminate” an overhang of oil inventories …and aimed to push prices up to $70 to $80 a barrel.

“We have…excessive stocks that could really lead to a collapse in prices,” Mr. Khelil said during a chaotic and confused news conference after the meeting.

(NY Times, December 17, 2008)

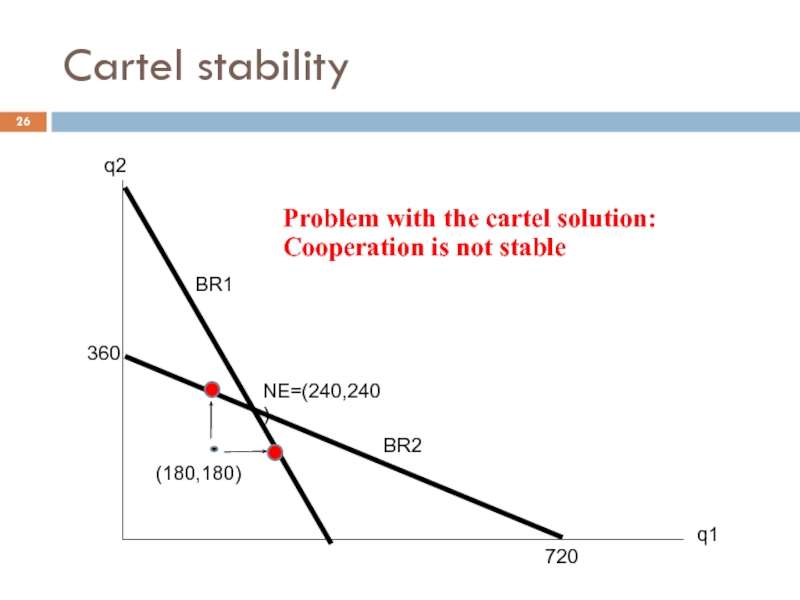

Слайд 26360

720

q1

q2

NE=(240,240)

Cartel stability

BR1

BR2

(180,180)

Problem with the cartel solution:

Cooperation is not stable

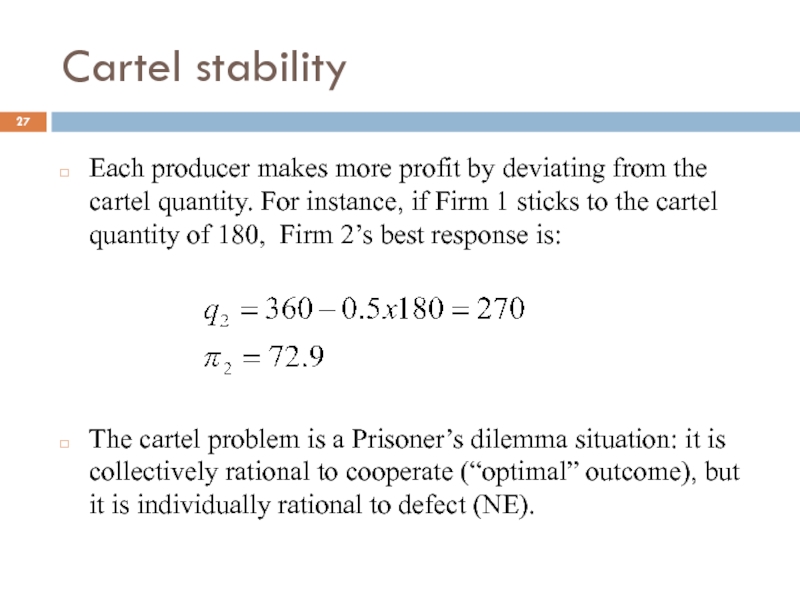

Слайд 27Cartel stability

Each producer makes more profit by deviating from the cartel

The cartel problem is a Prisoner’s dilemma situation: it is collectively rational to cooperate (“optimal” outcome), but it is individually rational to defect (NE).

Слайд 28Cartel stability

“The coffee bean cartel, the Association of Coffee Producing Countries,

(BBC News, October 19, 2001)

Слайд 29Cartel stability

To summarize…

Producers have incentive to form cartels, but cartels are

Q: How to explain the fact that some cartels are quite stable, unlike what is predicted in the Cournot model?

List of cartel violations in the European Union

http://ec.europa.eu/competition/cartels/cases/cases.html

Слайд 30Comparative statics

If Firm 1’s marginal cost is 0.25 rather than 0.28,

Equilibrium:

Increase of 17%

Слайд 31Summary

Nash equilibrium and continuous choices.

Oligopoly and quantity competition: Cournot model.

Trade-off between

Strategic interactions yield a unique NE, with intermediate output level.

The cartel solution is more profitable but not stable.