- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tax system and taxes in Germany презентация

Содержание

- 1. Tax system and taxes in Germany

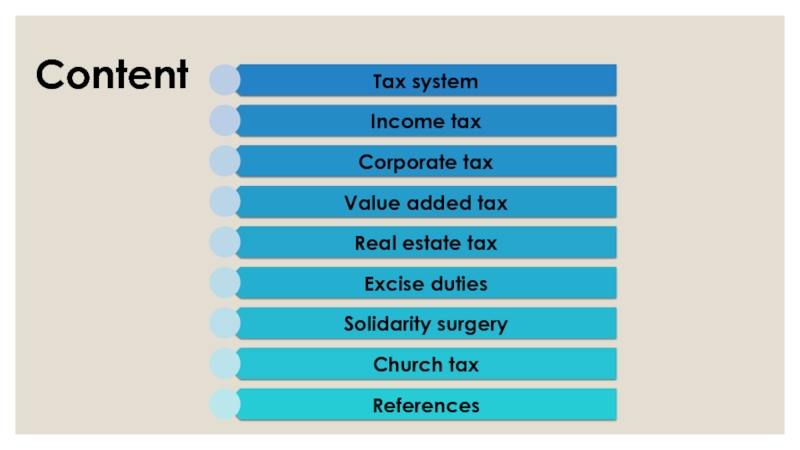

- 2. Content

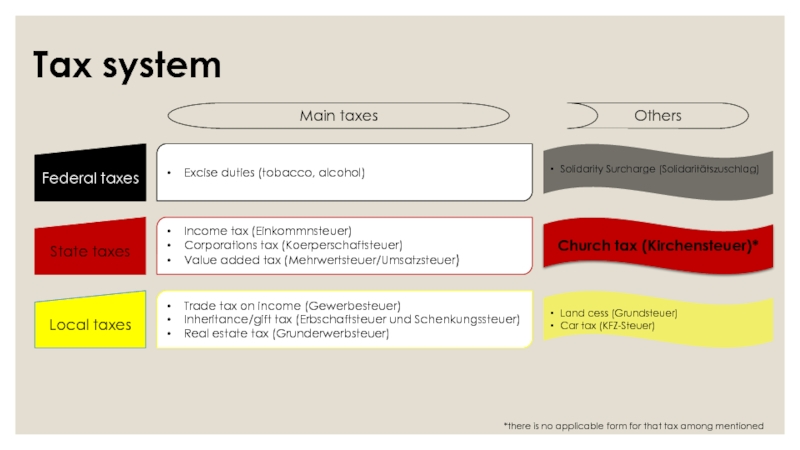

- 3. Tax system *there is no applicable form for that tax among mentioned Main taxes Others

- 4. Income tax Subjected to income tax

- 5. All profits are taxed at 15 percent

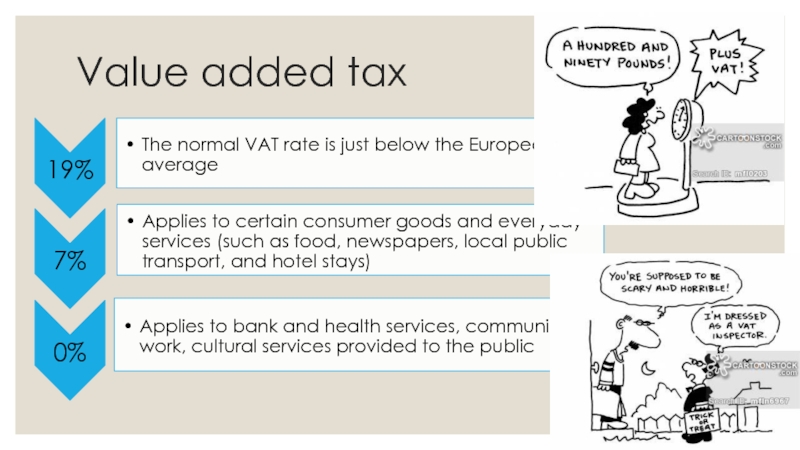

- 6. Value added tax

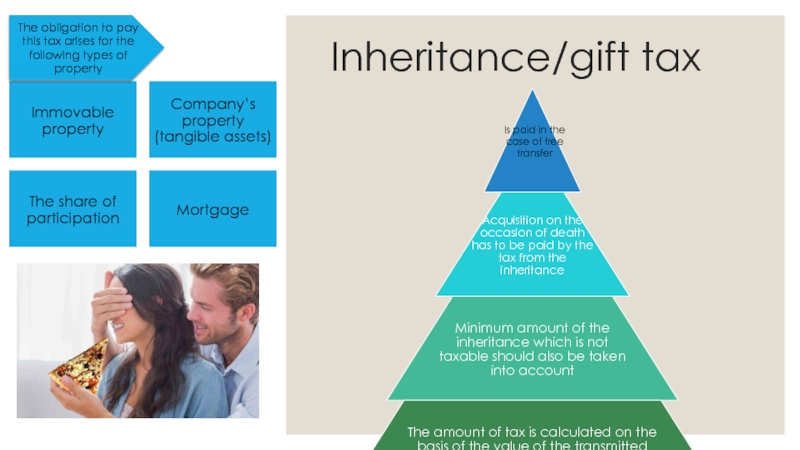

- 7. Inheritance/gift tax The obligation to

- 8. Real estate tax Combinations of at

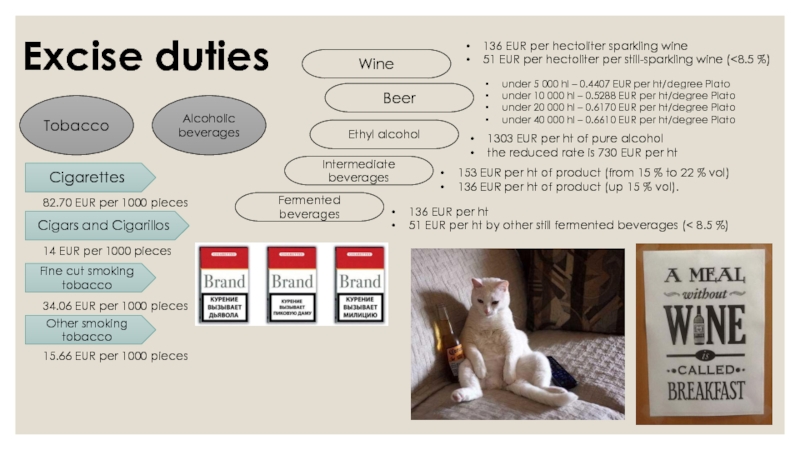

- 9. Excise duties Tobacco Alcoholic beverages Wine Beer

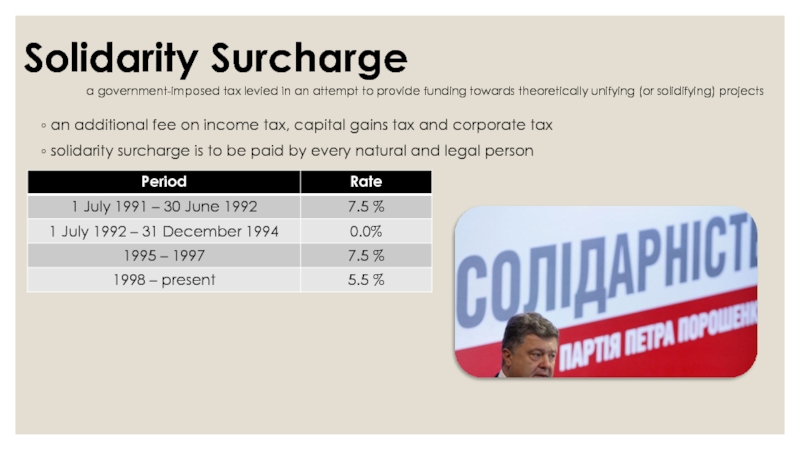

- 10. Solidarity Surcharge an additional fee on

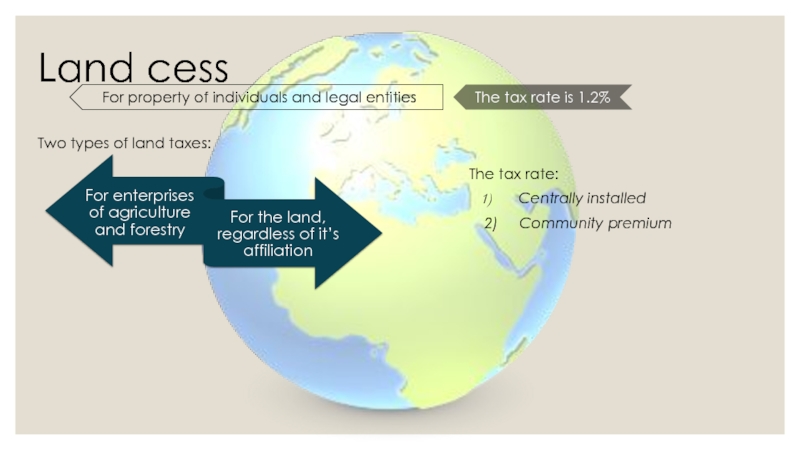

- 11. Land cess Centrally installed

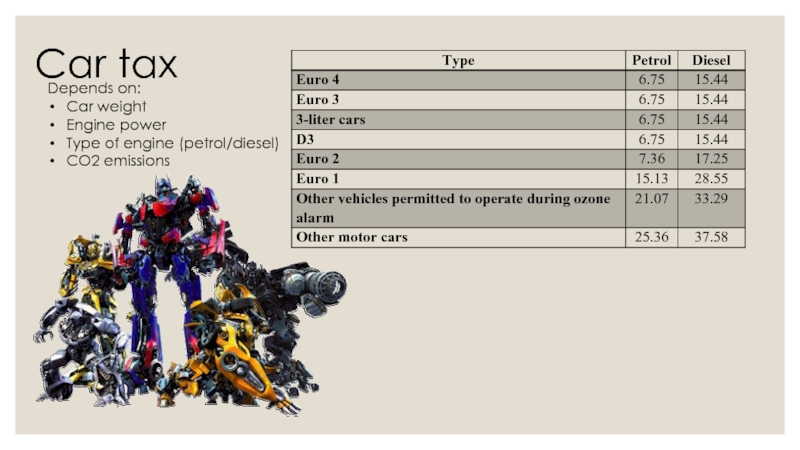

- 12. Car tax Depends on: Car weight Engine power Type of engine (petrol/diesel) CO2 emissions

- 13. Church tax Is imposed on members

- 14. References Business Development Corporation. German Tax System

Слайд 1Tax system and taxes in Germany

Made by

2nd year students

Management department

Kuznetsova Elena

Polozova

Siliutina Daria

Shtepina Marina

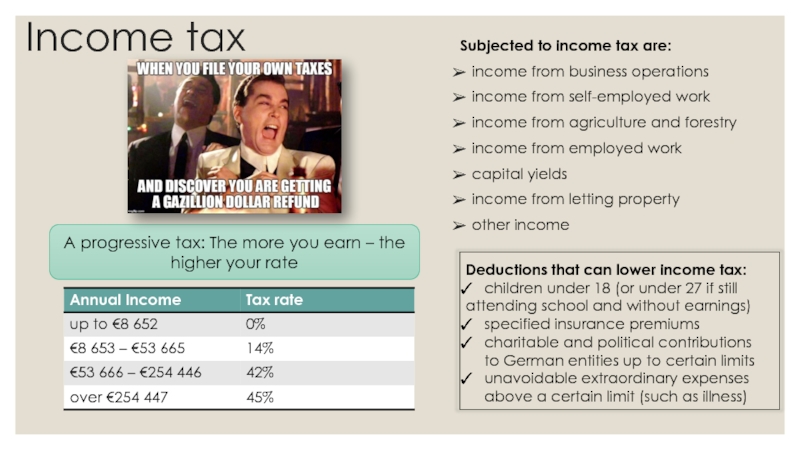

Слайд 4Income tax

Subjected to income tax are:

income from business operations

income

income from agriculture and forestry

income from employed work

capital yields

income from letting property

other income

A progressive tax: The more you earn – the higher your rate

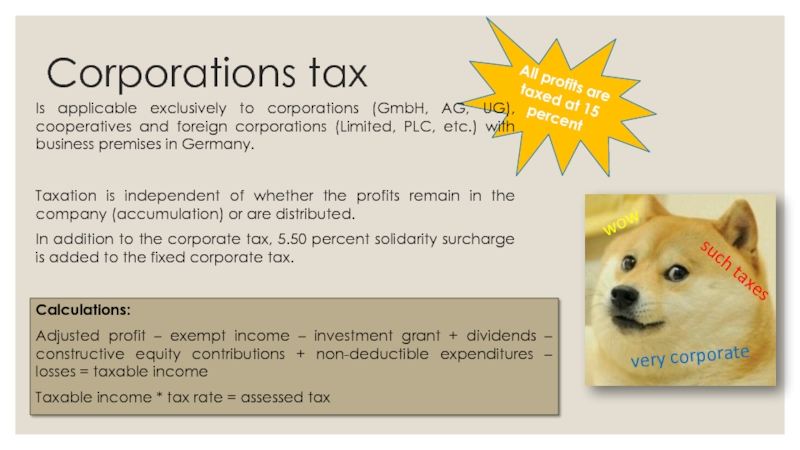

Слайд 5All profits are taxed at 15 percent

Corporations tax

Is applicable exclusively

Taxation is independent of whether the profits remain in the company (accumulation) or are distributed.

In addition to the corporate tax, 5.50 percent solidarity surcharge is added to the fixed corporate tax.

Calculations:

Adjusted profit – exempt income – investment grant + dividends – constructive equity contributions + non-deductible expenditures – losses = taxable income

Taxable income * tax rate = assessed tax

Слайд 7

Inheritance/gift tax

The obligation to pay this tax arises for the following

Слайд 8Real estate tax

Combinations of at least 95% share of the

The real property tax burden is calculated by multiplying:

the assessed value of the real property

the real property tax rate

the municipal multiplier

Acquisition of the immovable property

Changes of the owners

Combinations of at least 95% share of the business association

are charged from a variety of real estate transactions:

Слайд 9Excise duties

Tobacco

Alcoholic beverages

Wine

Beer

Fermented beverages

Intermediate beverages

Ethyl alcohol

136 EUR per hectoliter sparkling wine

51 EUR per hectoliter per still-sparkling wine (<8.5 %)

under 5 000 hl – 0.4407 EUR per ht/degree Plato

under 10 000 hl – 0.5288 EUR per ht/degree Plato

under 20 000 hl – 0.6170 EUR per ht/degree Plato

under 40 000 hl – 0.6610 EUR per ht/degree Plato

136 EUR per ht

51 EUR per ht by other still fermented beverages (< 8.5 %)

153 EUR per ht of product (from 15 % to 22 % vol)

136 EUR per ht of product (up 15 % vol).

1303 EUR per ht of pure alcohol

the reduced rate is 730 EUR per ht

Cigarettes

Cigars and Cigarillos

Fine cut smoking tobacco

82.70 EUR per 1000 pieces

14 EUR per 1000 pieces

34.06 EUR per 1000 pieces

Other smoking tobacco

15.66 EUR per 1000 pieces

Слайд 10Solidarity Surcharge

an additional fee on income tax, capital gains tax

solidarity surcharge is to be paid by every natural and legal person

a government-imposed tax levied in an attempt to provide funding towards theoretically unifying (or solidifying) projects

Слайд 11Land cess

Centrally installed

2) Community premium

For property of individuals and legal entities

The tax rate is 1.2%

Two types of land taxes:

The tax rate:

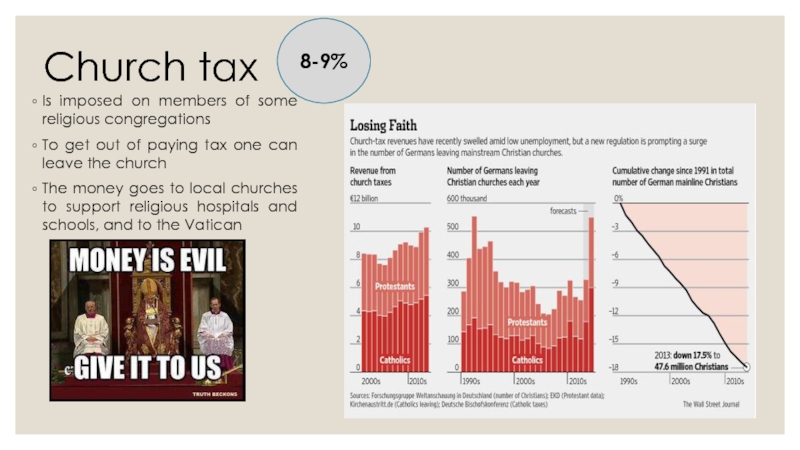

Слайд 13Church tax

Is imposed on members of some religious congregations

To get

The money goes to local churches to support religious hospitals and schools, and to the Vatican

8-9%

Слайд 14References

Business Development Corporation. German Tax System [Report]//Lubeck. – 2005. – p.

Efimova E. G., Pospelova E. B. Taxes and tax system [Book]//M: 2014. – p. 235

Popova L. V. Countries` taxes [Book]//M: 2008. – p. 376

Corporatepartner. Taxes in Germany [Electronic resource]: URL: http://www.clever-invest.ru/nalogooblozhenie/nalogi-v-germanii.php (5. 02. 17)

![ReferencesBusiness Development Corporation. German Tax System [Report]//Lubeck. – 2005. – p. 6Efimova E. G., Pospelova](/img/tmb/2/150287/def2191e4ecf037a50fd270d54382aff-800x.jpg)