- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

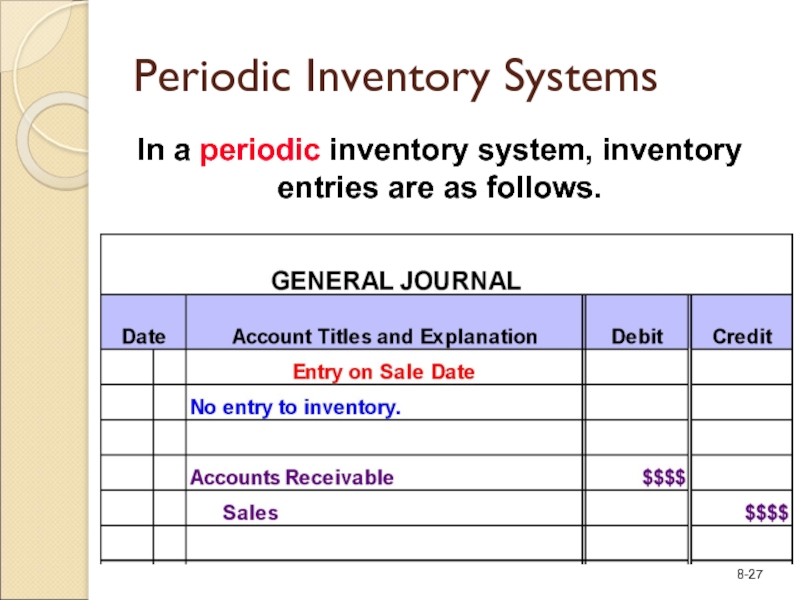

- Литература

- Маркетинг

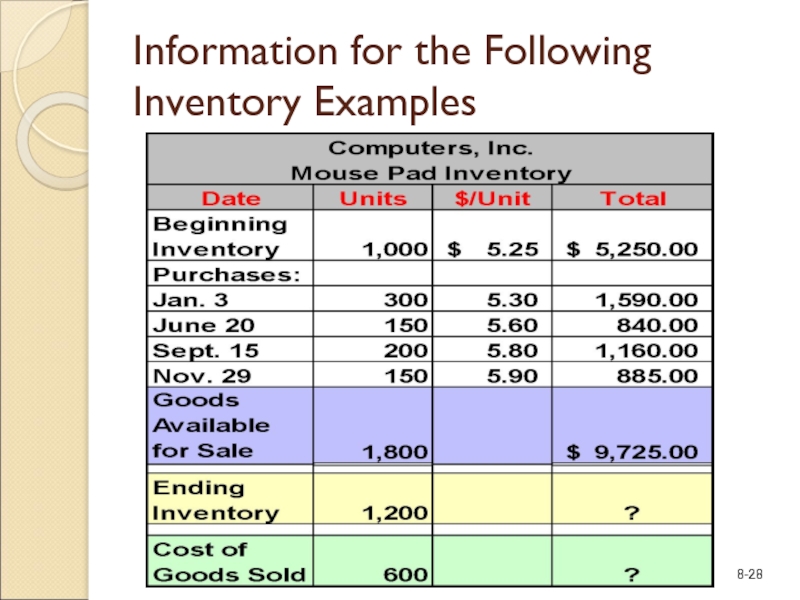

- Математика

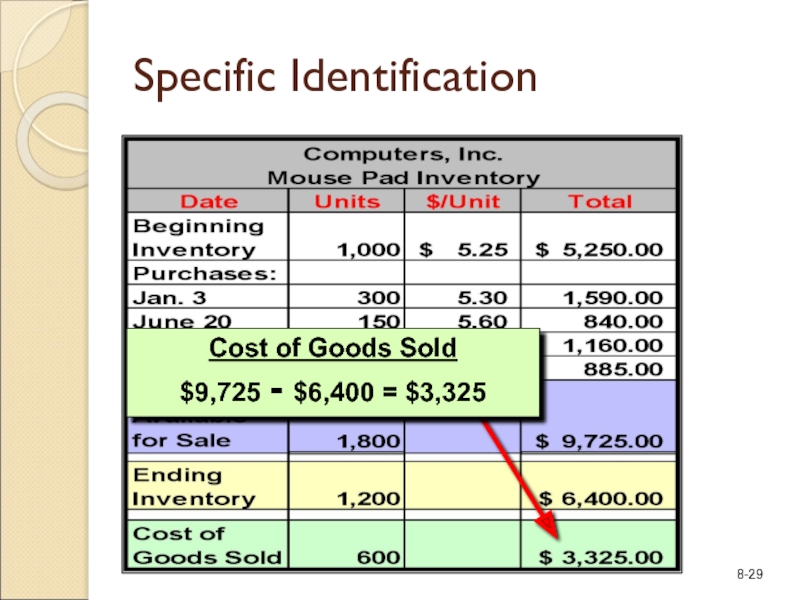

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

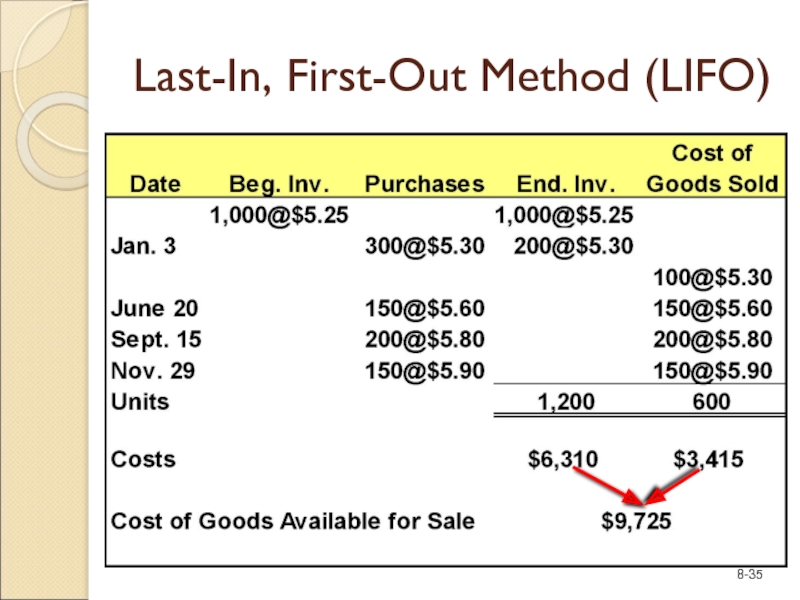

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Inventories and the Cost of Goods Sold презентация

Содержание

- 1. Inventories and the Cost of Goods Sold

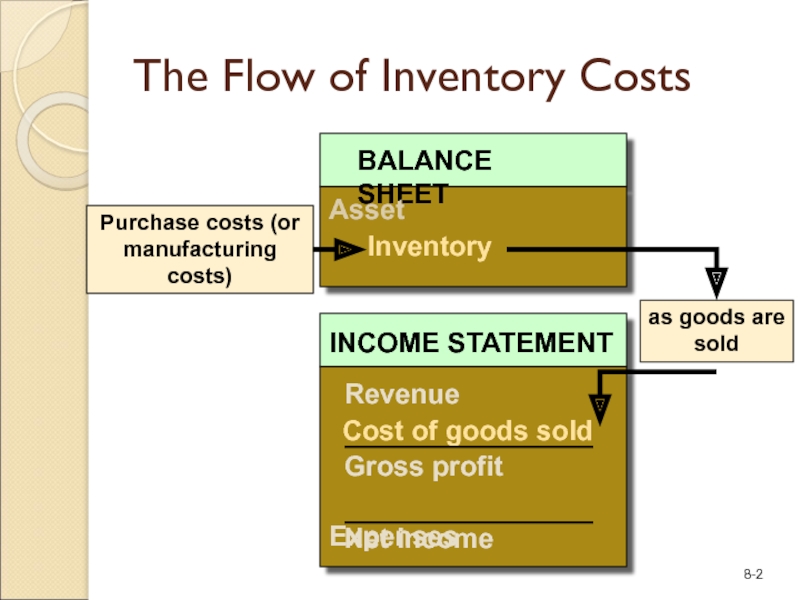

- 2. as goods are sold The Flow of Inventory Costs

- 3. In a perpetual inventory system, inventory entries

- 4. When identical units of inventory have different

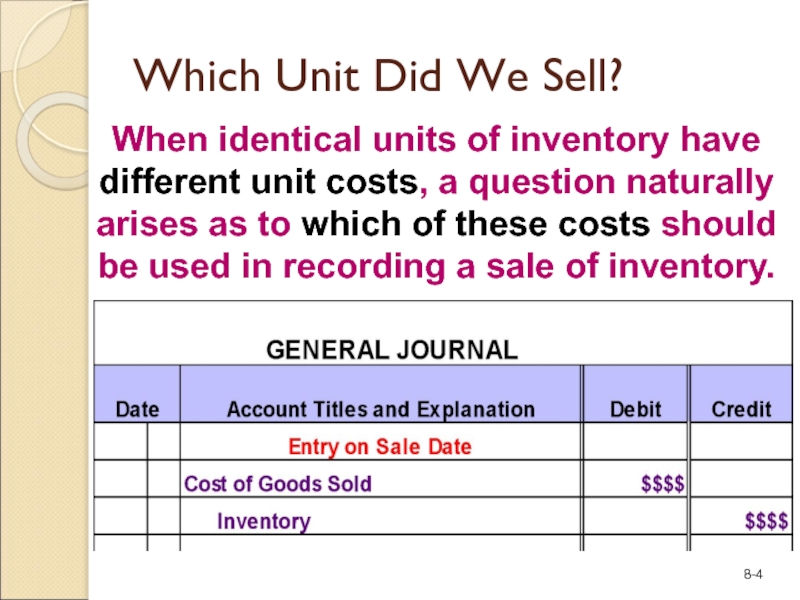

- 5. Inventory Subsidiary Ledger A separate subsidiary account

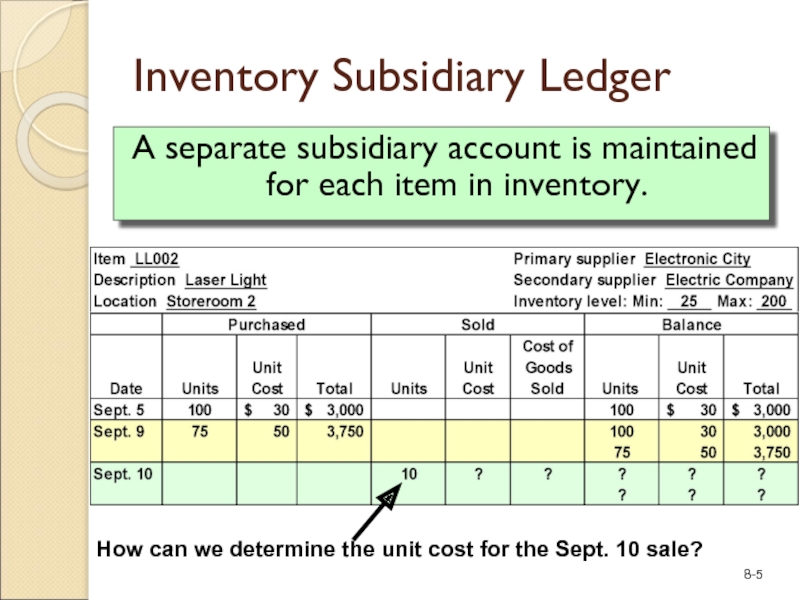

- 6. The Bike Company (TBC) Data for an Illustration

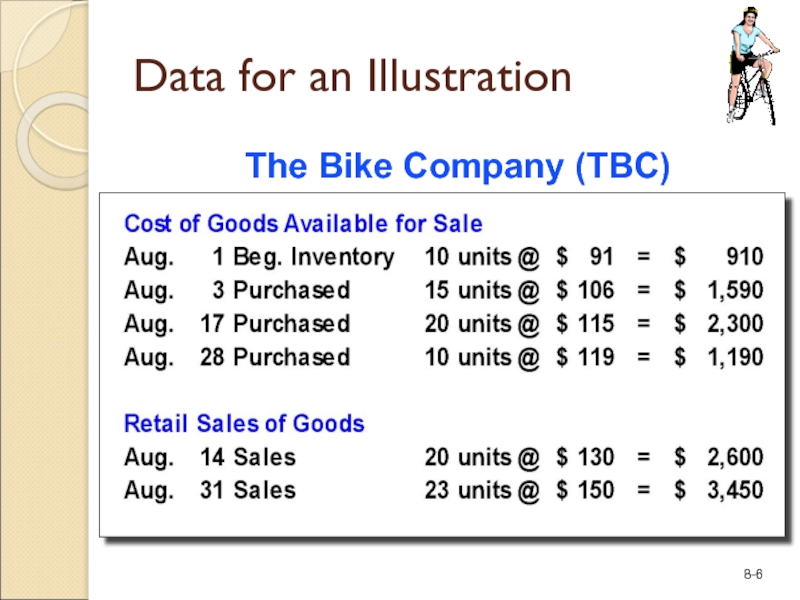

- 7. On August 14, TBC sold 20 bikes

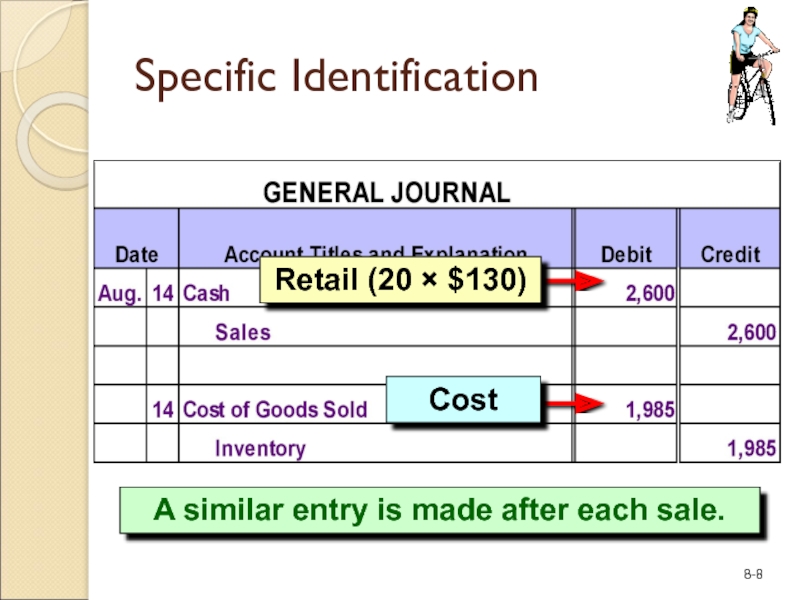

- 8. A similar entry is made after each sale. Specific Identification

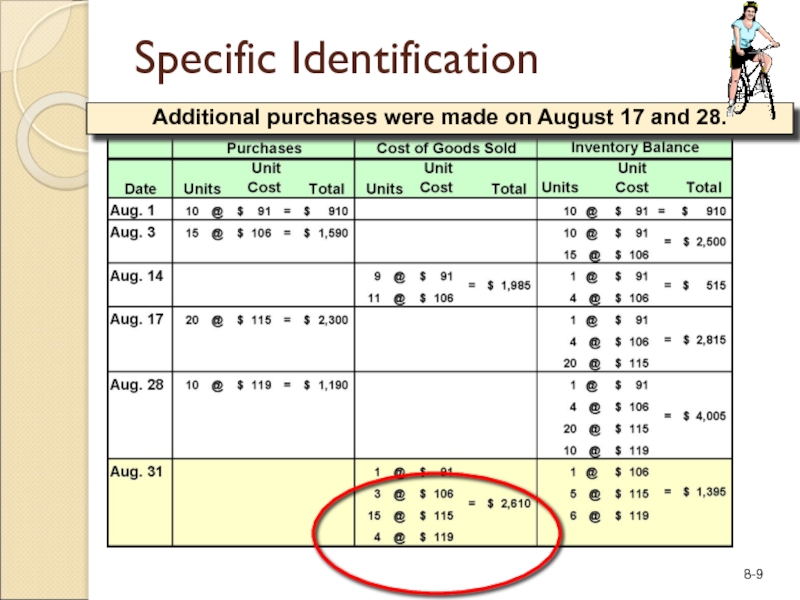

- 9. Additional purchases were made on August 17 and 28. Specific Identification

- 10. Balance Sheet Inventory = $1,395

- 11. Average-Cost Method The average cost per unit

- 12. Average-Cost Method Additional purchases were made

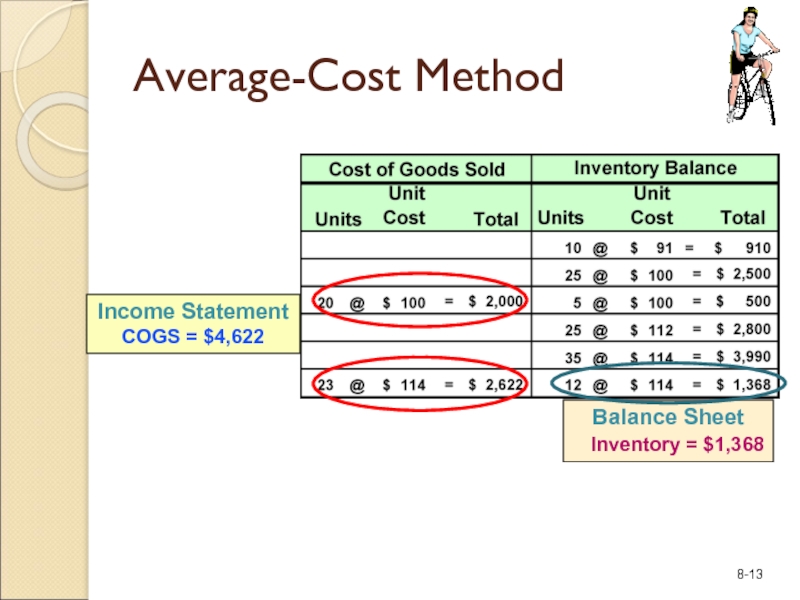

- 13. Income Statement COGS = $4,622 Balance Sheet

- 14. On August 14, TBC sold 20 bikes for $130 each. First-In, First-Out Method (FIFO)

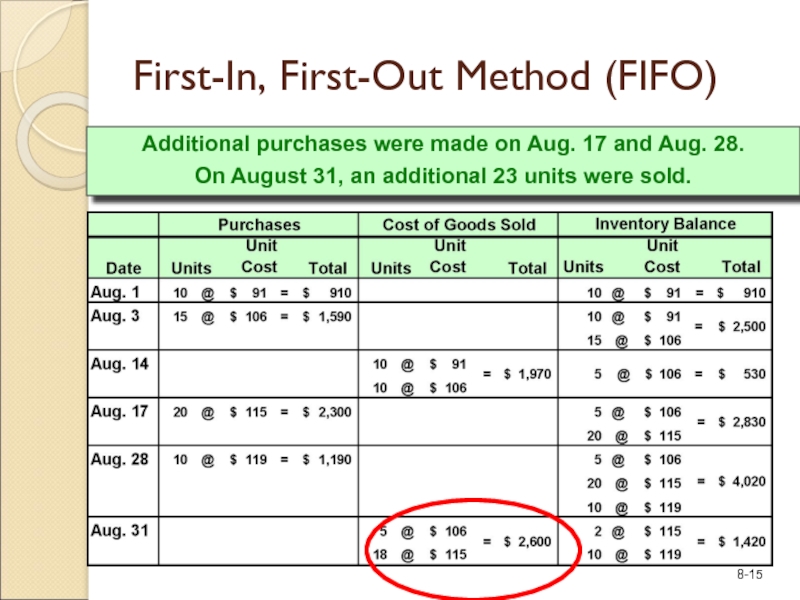

- 15. Additional purchases were made on Aug. 17

- 16. First-In, First-Out Method (FIFO) Balance Sheet

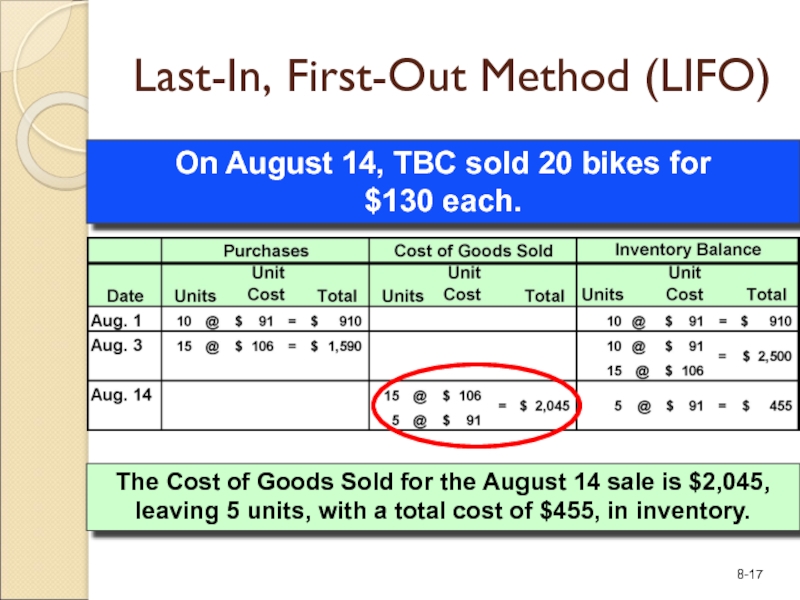

- 17. On August 14, TBC sold 20 bikes

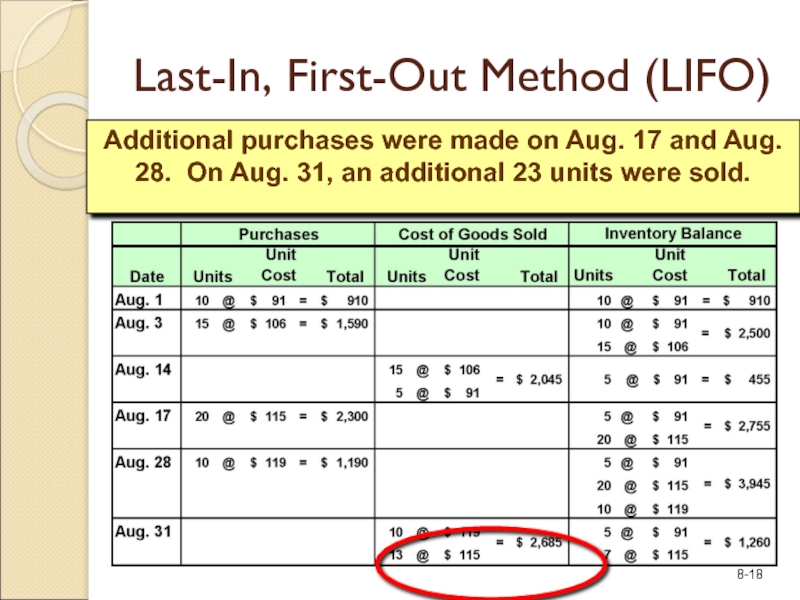

- 18. Last-In, First-Out Method (LIFO) Additional purchases

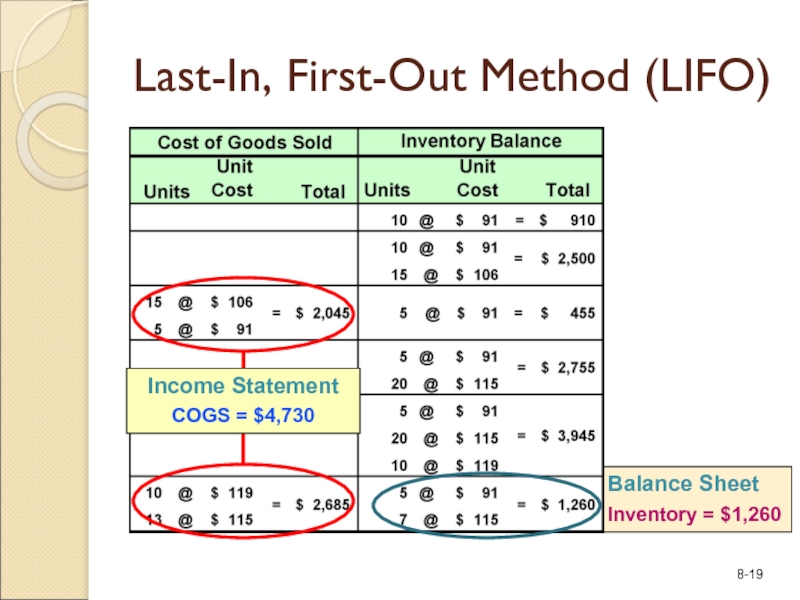

- 19. Balance Sheet Inventory = $1,260 Last-In, First-Out

- 21. Once a company has adopted a particular

- 22. The primary reason for taking a physical

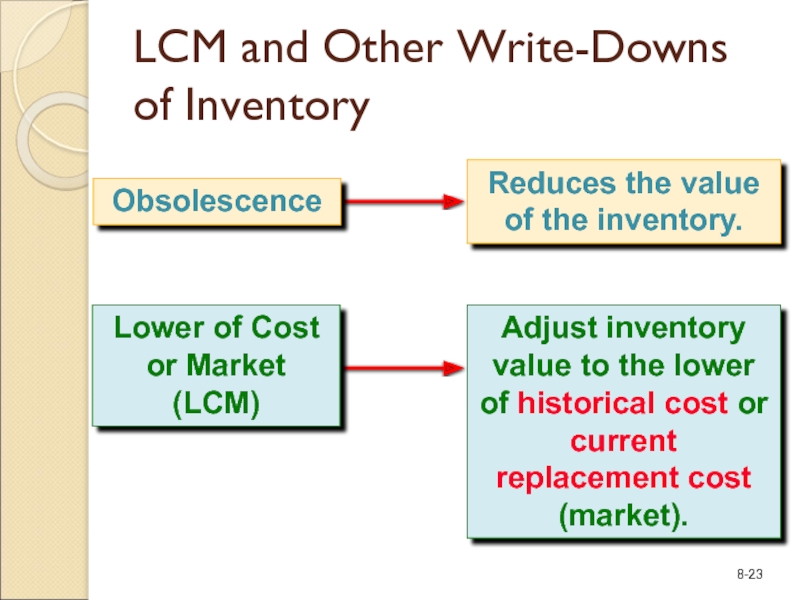

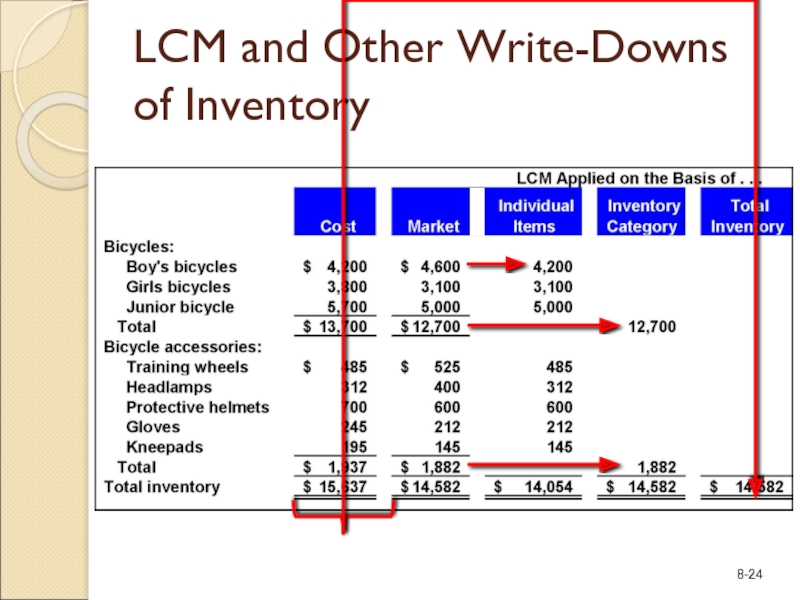

- 23. LCM and Other Write-Downs of Inventory

- 24. LCM and Other Write-Downs of Inventory

- 25. Year End A sale should be recorded

- 26. In a periodic inventory system, inventory entries

- 27. In a periodic inventory system, inventory entries are as follows. Periodic Inventory Systems

- 28. Information for the Following Inventory Examples

- 29. Specific Identification

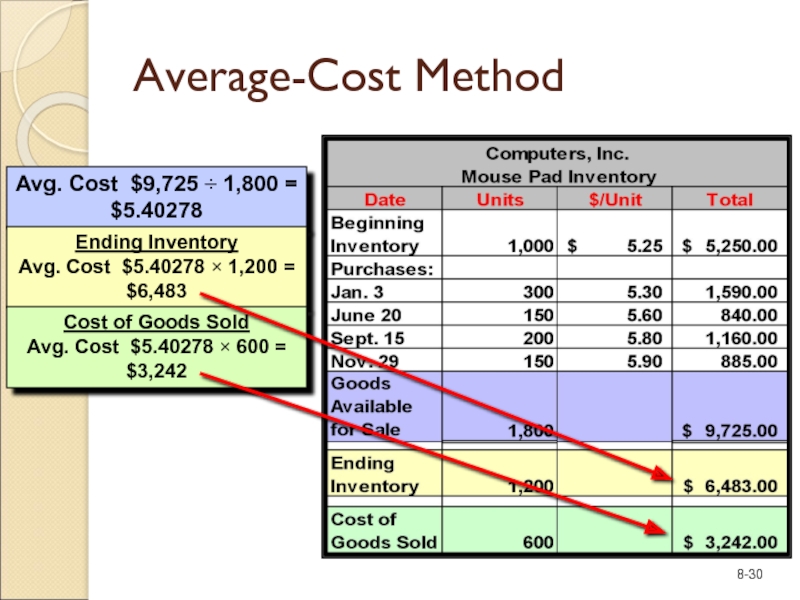

- 30. Avg. Cost $9,725 ÷ 1,800 = $5.40278

- 31. Remember: Start with the 11/29 purchase and

- 32. Now, let’s complete the table. First-In, First-Out

- 33. Completing the table summarizes the computations just made. First-In, First-Out Method (FIFO)

- 34. Remember: Start with beginning inventory and then

- 35. Last-In, First-Out Method (LIFO) Now, we have

- 36. Completing the table summarizes the computations just made. Last-In, First-Out Method (LIFO)

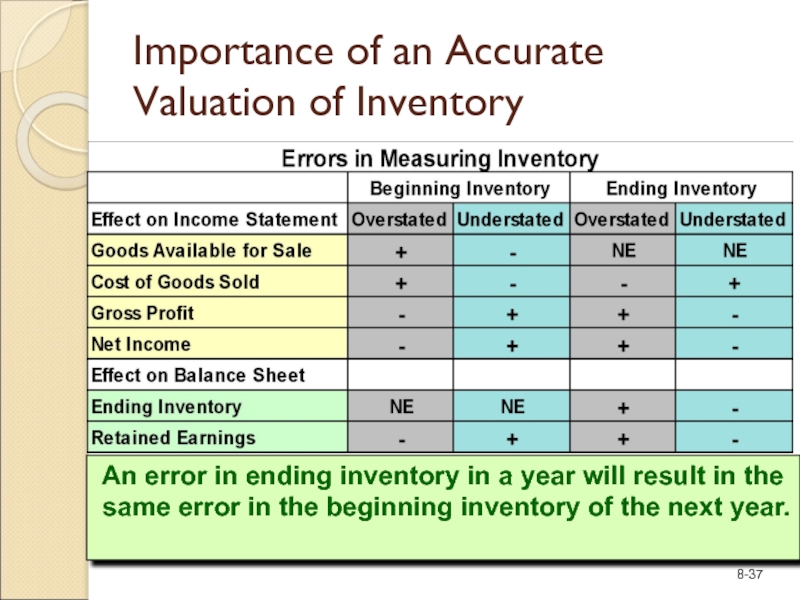

- 37. An error in ending inventory in a

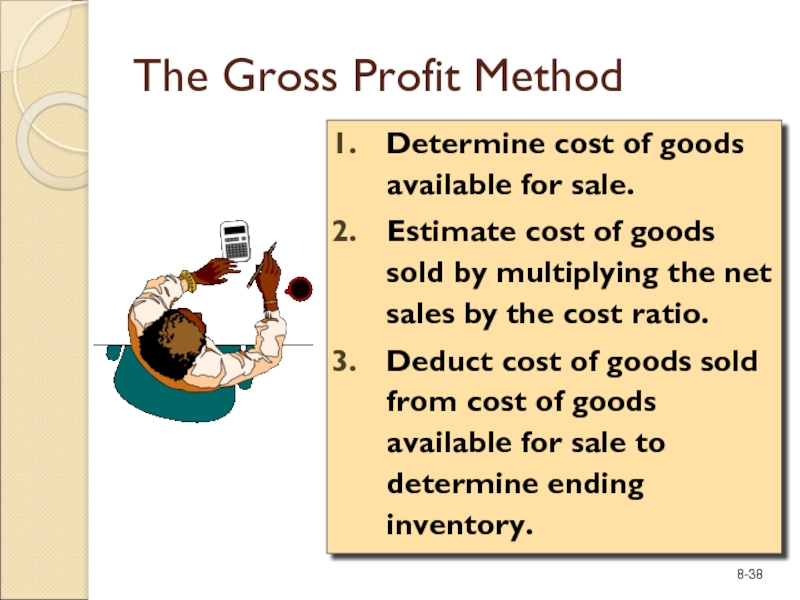

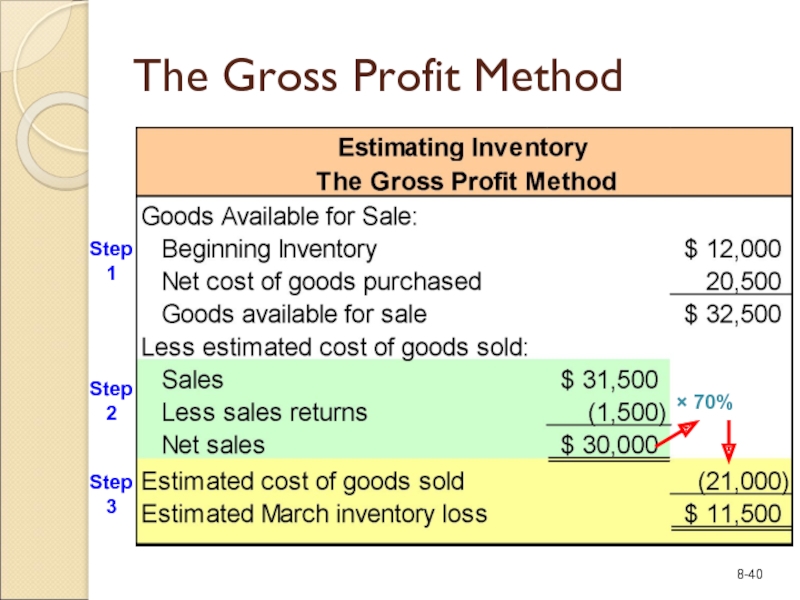

- 38. The Gross Profit Method Determine cost of

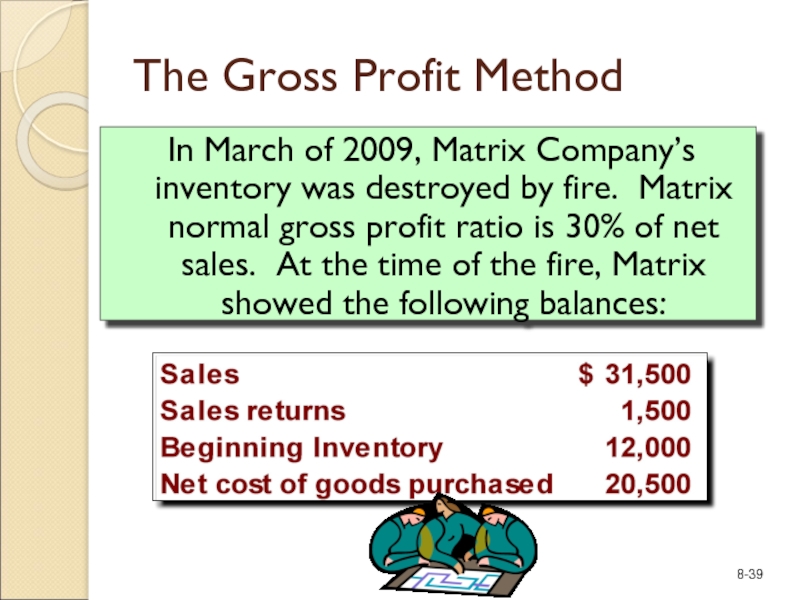

- 39. The Gross Profit Method In March of

- 40. The Gross Profit Method Step

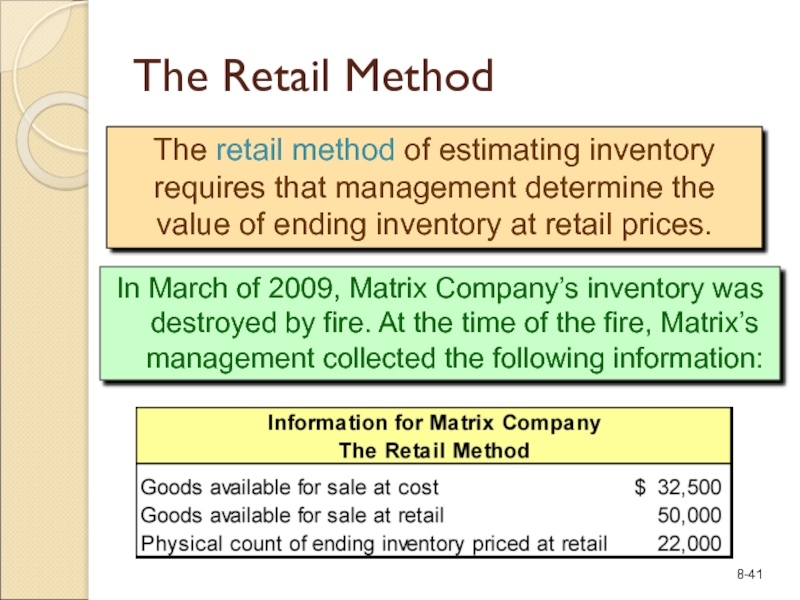

- 41. The Retail Method The retail method of

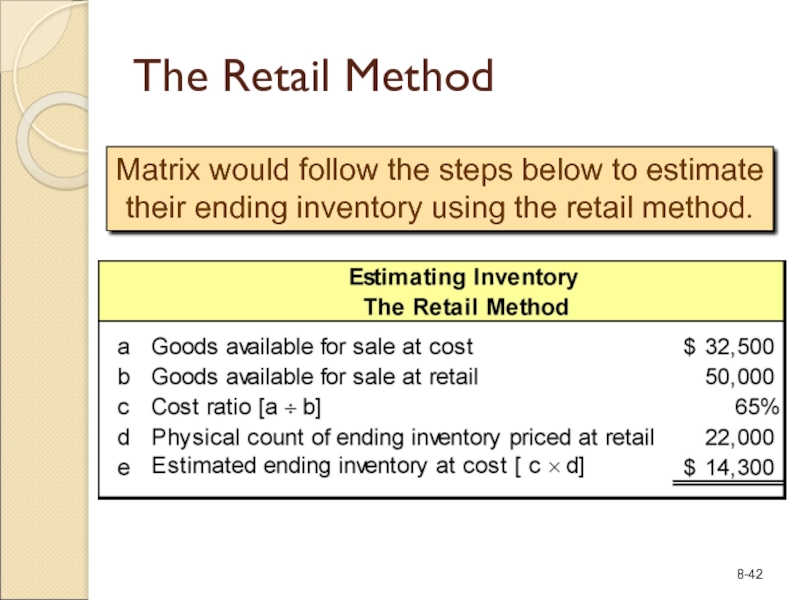

- 42. The Retail Method Matrix would follow the

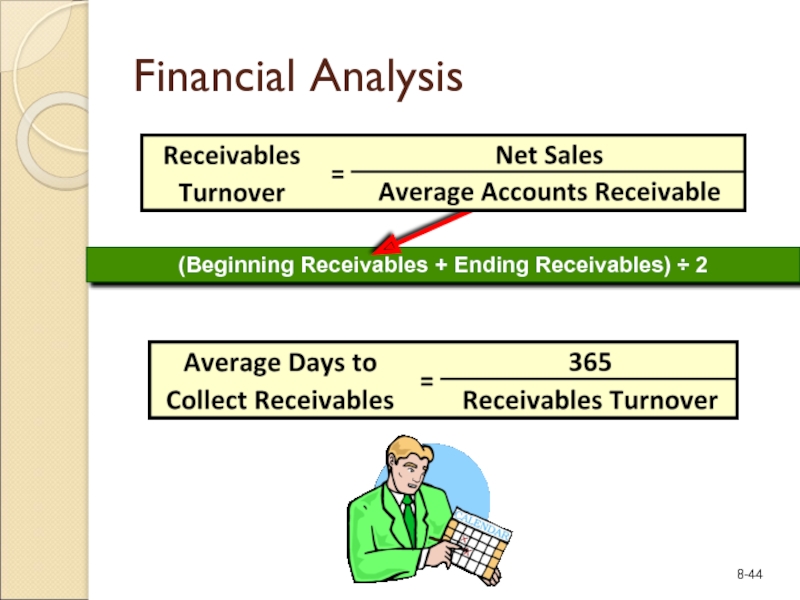

- 43. (Beginning Inventory + Ending Inventory) ÷ 2 Financial Analysis

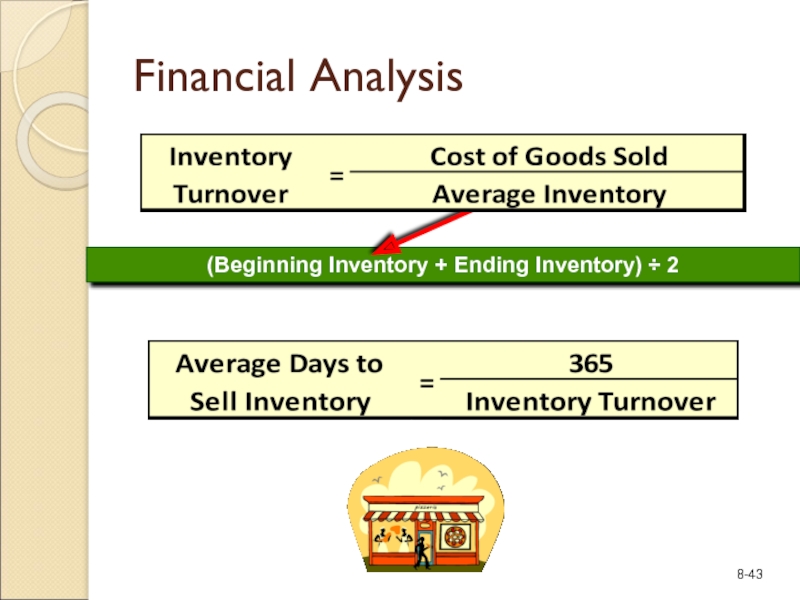

- 44. Financial Analysis (Beginning Receivables + Ending Receivables) ÷ 2

- 45. End of Chapter 8

Слайд 3In a perpetual inventory system, inventory entries parallel the flow of

The Flow of Inventory Costs

Слайд 4When identical units of inventory have different unit costs, a question

Which Unit Did We Sell?

Слайд 5Inventory Subsidiary Ledger

A separate subsidiary account is maintained for each item

How can we determine the unit cost for the Sept. 10 sale?

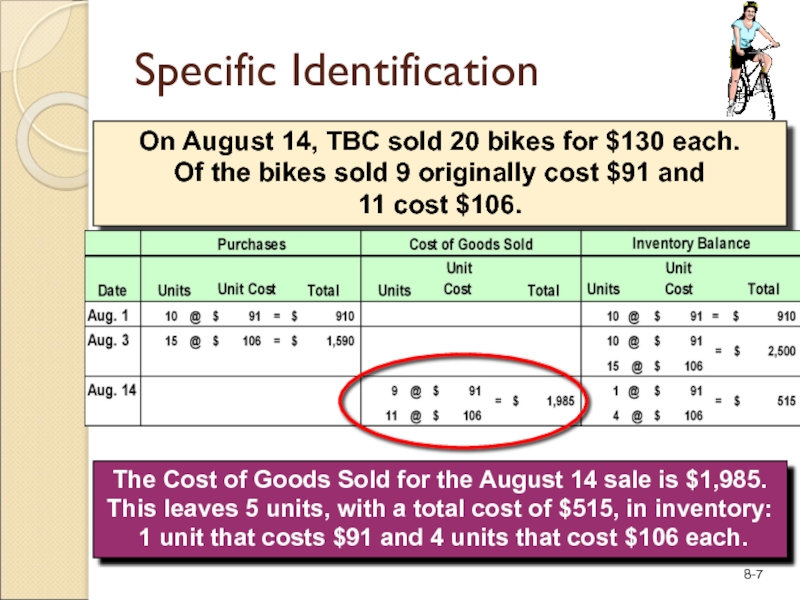

Слайд 7On August 14, TBC sold 20 bikes for $130 each.

Of

Specific Identification

The Cost of Goods Sold for the August 14 sale is $1,985. This leaves 5 units, with a total cost of $515, in inventory:

1 unit that costs $91 and 4 units that cost $106 each.

Слайд 11Average-Cost Method

The average cost per unit must be computed prior to

On August 14, TBC sold 20 bikes for $130 each.

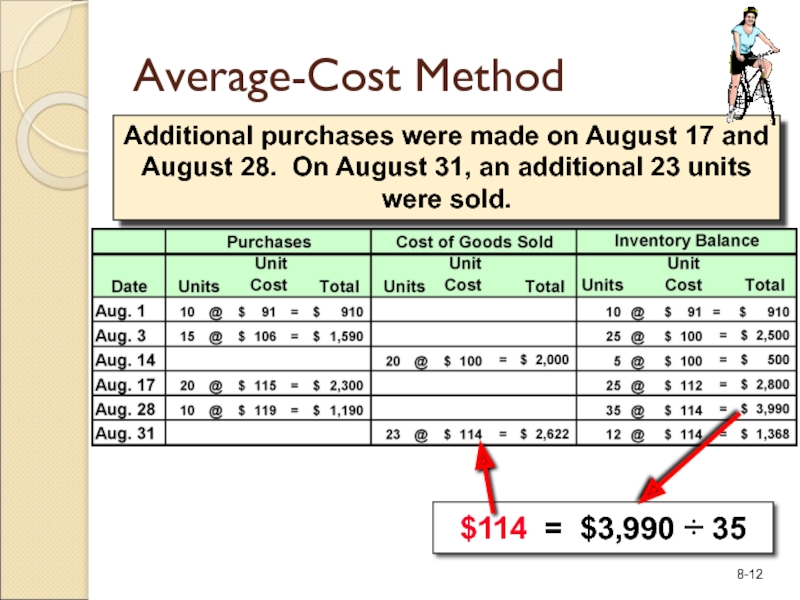

Слайд 12Average-Cost Method

Additional purchases were made on August 17 and August 28.

Слайд 15Additional purchases were made on Aug. 17 and Aug. 28.

On August

First-In, First-Out Method (FIFO)

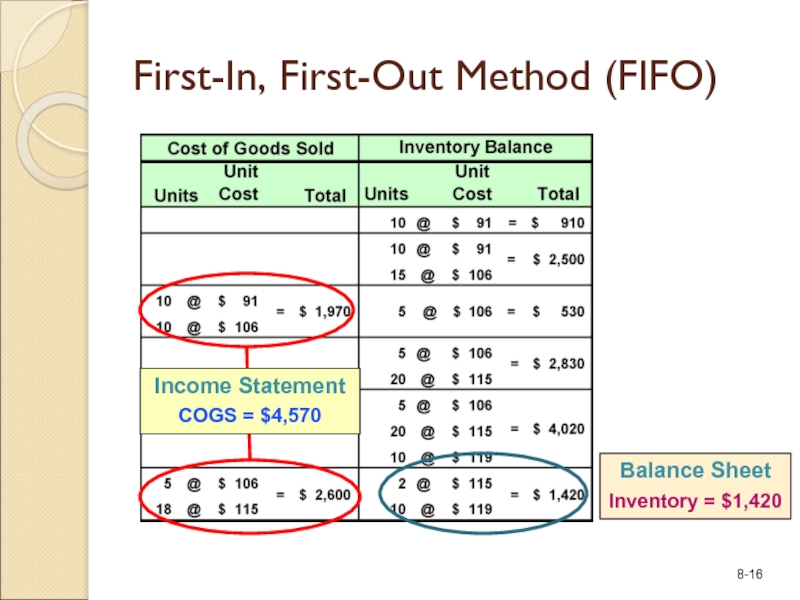

Слайд 16First-In, First-Out Method (FIFO)

Balance Sheet

Inventory = $1,420

Income Statement

COGS = $4,570

Слайд 17On August 14, TBC sold 20 bikes for

$130 each.

Last-In,

The Cost of Goods Sold for the August 14 sale is $2,045, leaving 5 units, with a total cost of $455, in inventory.

Слайд 18Last-In, First-Out Method (LIFO)

Additional purchases were made on Aug. 17 and

Слайд 19Balance Sheet

Inventory = $1,260

Last-In, First-Out Method (LIFO)

Income Statement

COGS = $4,730

Слайд 21Once a company has adopted a particular accounting method, it should

The Principle of Consistency

Слайд 22The primary reason for taking a physical inventory is to adjust

Taking a Physical Inventory

Слайд 25Year End

A sale should be recorded when title to the merchandise

F.O.B. shipping point ⎯ title passes to buyer at the point of shipment.

F.O.B. destination point ⎯ title passes to buyer at the point of destination.

Goods In Transit

Слайд 26In a periodic inventory system, inventory entries are as follows.

Note that

Periodic Inventory Systems

Слайд 30Avg. Cost $9,725 ÷ 1,800 = $5.40278

Average-Cost Method

Ending Inventory

Avg. Cost

Cost of Goods Sold

Avg. Cost $5.40278 × 600 = $3,242

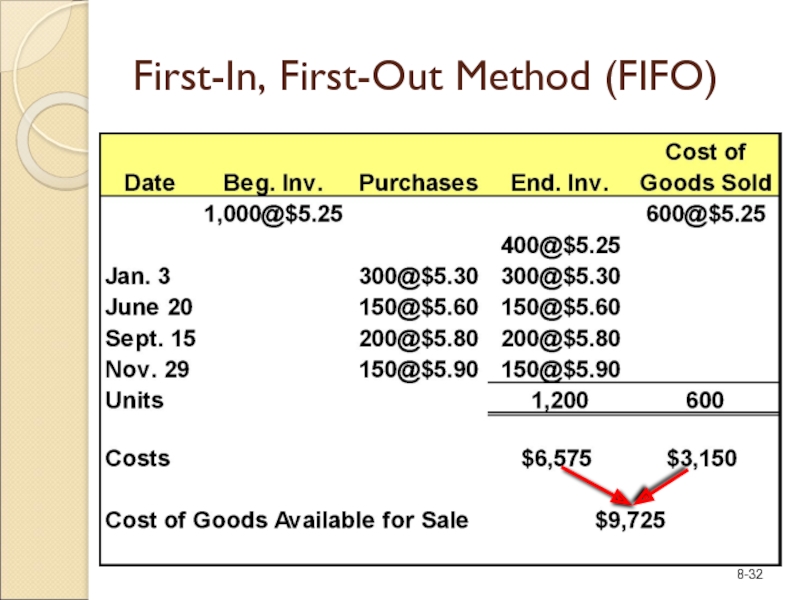

Слайд 31Remember: Start with the 11/29 purchase and then add other purchases

First-In, First-Out Method (FIFO)

Слайд 32Now, let’s complete the table.

First-In, First-Out Method (FIFO)

Now, we have allocated

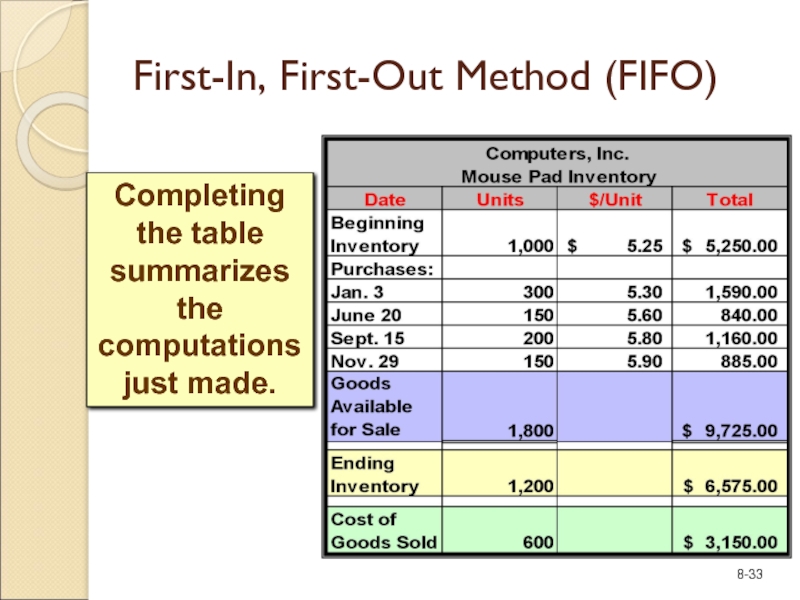

Слайд 33Completing the table summarizes the computations just made.

First-In, First-Out Method (FIFO)

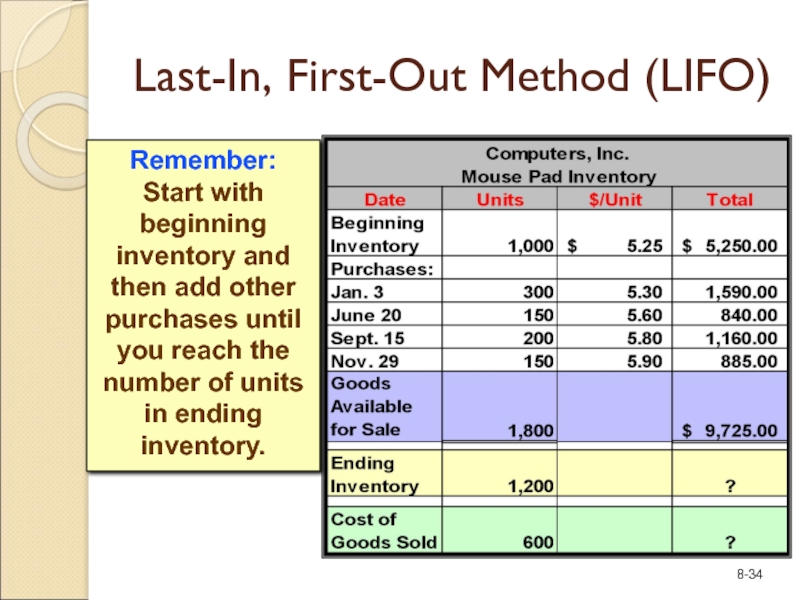

Слайд 34Remember: Start with beginning inventory and then add other purchases until

Last-In, First-Out Method (LIFO)

Слайд 35Last-In, First-Out Method (LIFO)

Now, we have allocated the cost to all

Next, let’s complete the table.

Слайд 37An error in ending inventory in a year will result in

Importance of an Accurate Valuation of Inventory

Слайд 38The Gross Profit Method

Determine cost of goods available for sale.

Estimate cost

Deduct cost of goods sold from cost of goods available for sale to determine ending inventory.

Слайд 39The Gross Profit Method

In March of 2009, Matrix Company’s inventory was

Слайд 41The Retail Method

The retail method of estimating inventory requires that management

In March of 2009, Matrix Company’s inventory was destroyed by fire. At the time of the fire, Matrix’s management collected the following information: