- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

How to Have Kids and Still Retire on Time презентация

Содержание

- 1. How to Have Kids and Still Retire on Time

- 2. This, according to the USDA, is

- 3. Four years of tuition, room, and board

- 4. Here’s How You Can Buck The Trend

- 5. The average American household has 2.3 cars

- 6. There are so many ways to save

- 7. Let’s factor in an extra 200 miles

- 8. The total cost for child care can

- 9. Investigate if it’s feasible for one parent

- 10. Let’s assume you live near family that

- 11. If we assume that your child goes

- 12. From Foolish colleague Morgan Housel: For

- 13. Average yearly tuition at a community college

- 14. The average American family will save in

- 15. Though you could easily cut back even

- 16. Live near your family, your job, and

- 17. If you really want to maximize your

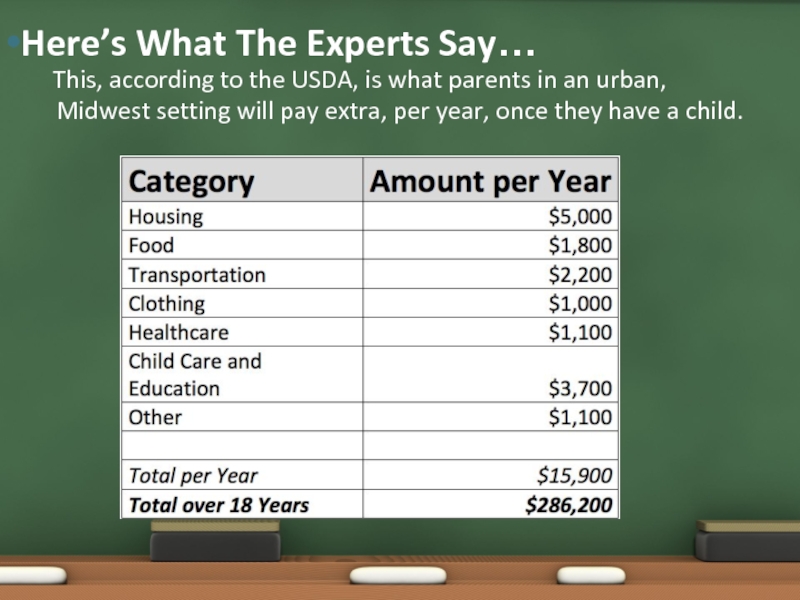

Слайд 2 This, according to the USDA, is what parents in an

Here’s What The Experts Say…

Слайд 3Four years of tuition, room, and board in today’s dollars at

New grand-total = $358,000

Don’t Forget About College

Слайд 5The average American household has 2.3 cars

Of these, at least one

Apparently, the addition of a child adds $2,200 in transportation costs per year—probably a combination of a bigger car and more driving.

Major Expense #1: Transportation

Слайд 6There are so many ways to save here:

Buy a used hybrid

Live close to work to make this more practical. Commuting is ridiculously expensive!

Bike more as a family for short-term trips: it costs nothing, is environmentally healthy, a great family activity, and encourages a healthy lifestyle.

The KISS Solution to Transportation

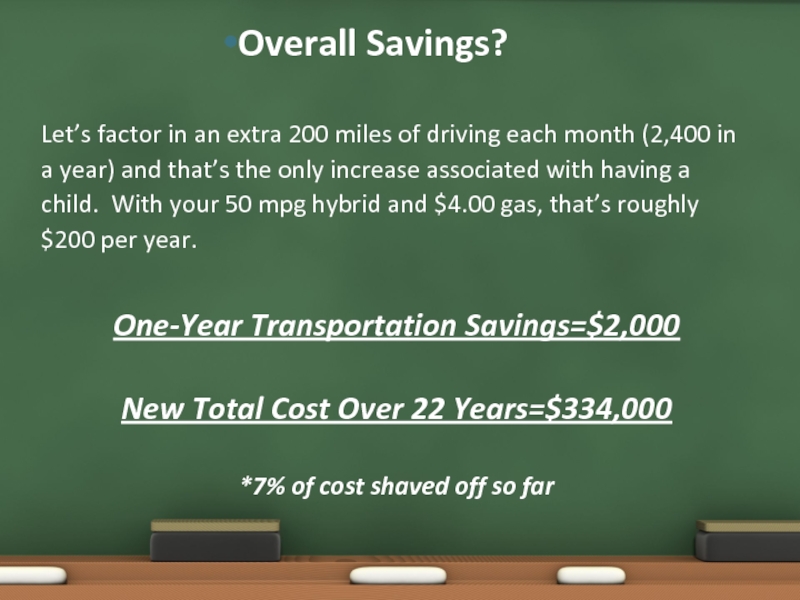

Слайд 7Let’s factor in an extra 200 miles of driving each month

One-Year Transportation Savings=$2,000

New Total Cost Over 22 Years=$334,000

*7% of cost shaved off so far

Overall Savings?

Слайд 8The total cost for child care can vary wildly. In the

The USDA lumps child care and education (private school tuition) into one, and over 18 years, the average family pays $3,800 per year.

Major Expense #2: Child Care/Education

Слайд 9Investigate if it’s feasible for one parent to stay home for

If that’s not possible, move near grandparents or other family members (aka free babysitters).

Send your kids to the local public school. As a former teacher, I can tell you that parents are every bit—if not more—influential as the specific school your child attends in their future academic success

The KISS Solution to Child care/Education

Слайд 10Let’s assume you live near family that can help look after

One-Year Child Care/Education Savings: $3,800

New Total Cost Over 22 Years: $266,000

*26% shaved off so far

Overall Savings?

Слайд 11If we assume that your child goes to a four-year, public

Over four years, that comes to $72,000.

Major Expense #3: College

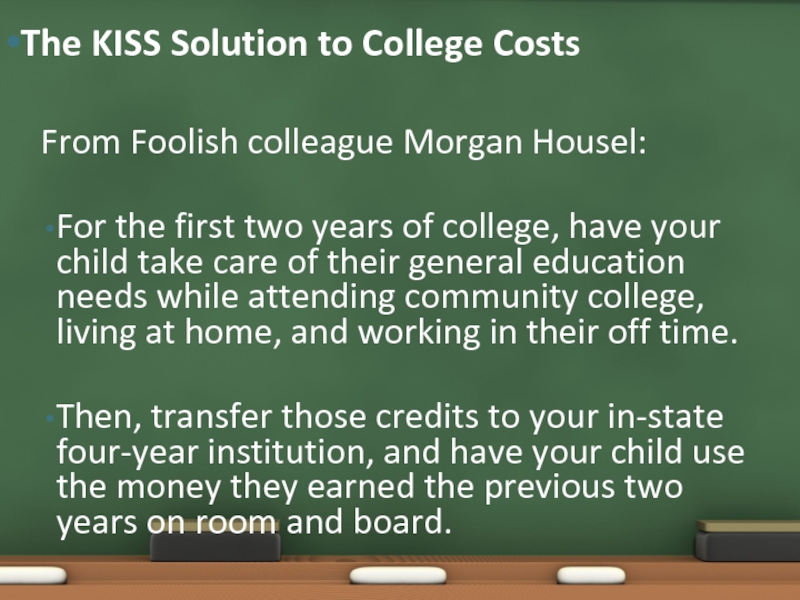

Слайд 12From Foolish colleague Morgan Housel:

For the first two years of college,

Then, transfer those credits to your in-state four-year institution, and have your child use the money they earned the previous two years on room and board.

The KISS Solution to College Costs

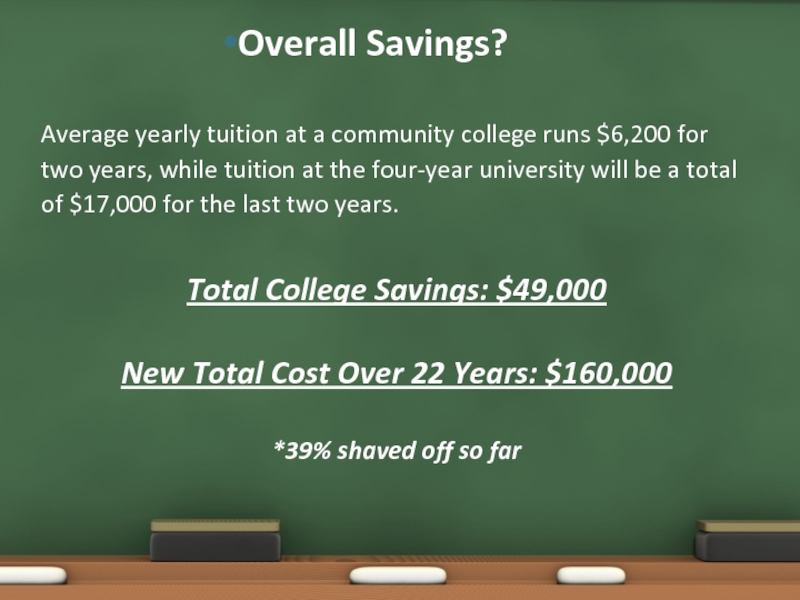

Слайд 13Average yearly tuition at a community college runs $6,200 for two

Total College Savings: $49,000

New Total Cost Over 22 Years: $160,000

*39% shaved off so far

Overall Savings?

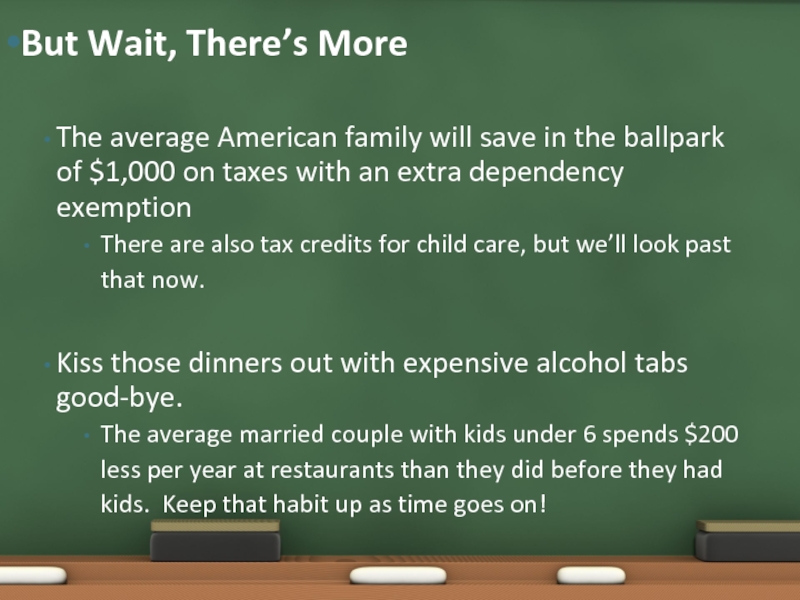

Слайд 14The average American family will save in the ballpark of $1,000

There are also tax credits for child care, but we’ll look past that now.

Kiss those dinners out with expensive alcohol tabs good-bye.

The average married couple with kids under 6 spends $200 less per year at restaurants than they did before they had kids. Keep that habit up as time goes on!

But Wait, There’s More

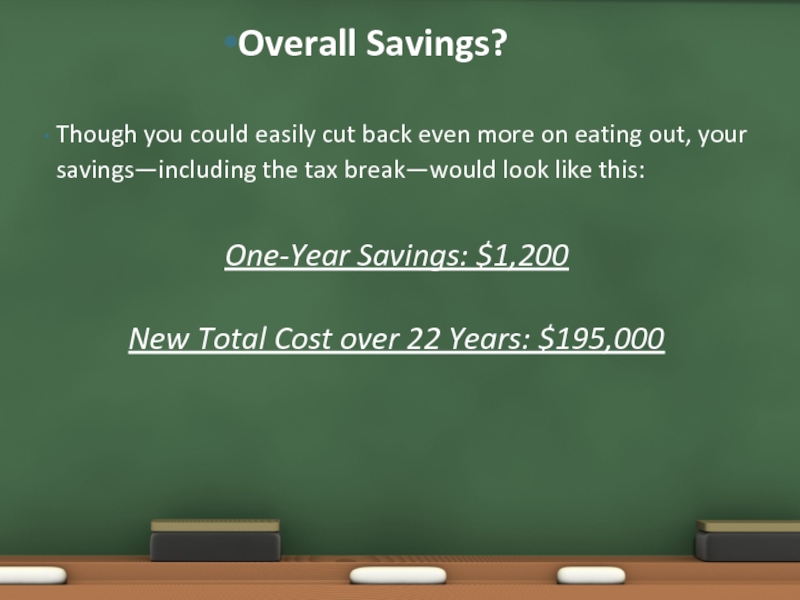

Слайд 15Though you could easily cut back even more on eating out,

One-Year Savings: $1,200

New Total Cost over 22 Years: $195,000

Overall Savings?

Слайд 16Live near your family, your job, and your schools—this saves you

Send your kids to public schools.

In this case, we eliminated 46% of potential costs associated with having kids.

That being said, everyone’s situation is unique, and won’t necessarily mimic these numbers.

Key Takeaways

Слайд 17If you really want to maximize your retirement, make sure you’re

A Simple Social Security Strategy to Take Advantage of a Little-Known IRS Rule

And one more thing…