- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tom Tunguz Redpoint Ventures tomtunguz.com презентация

Содержание

- 1. Tom Tunguz Redpoint Ventures tomtunguz.com

- 2. $3.5B under management Offices in California and China Seed, Series A, B and Growth Investments

- 3. How the Fundraising Market is Evolving

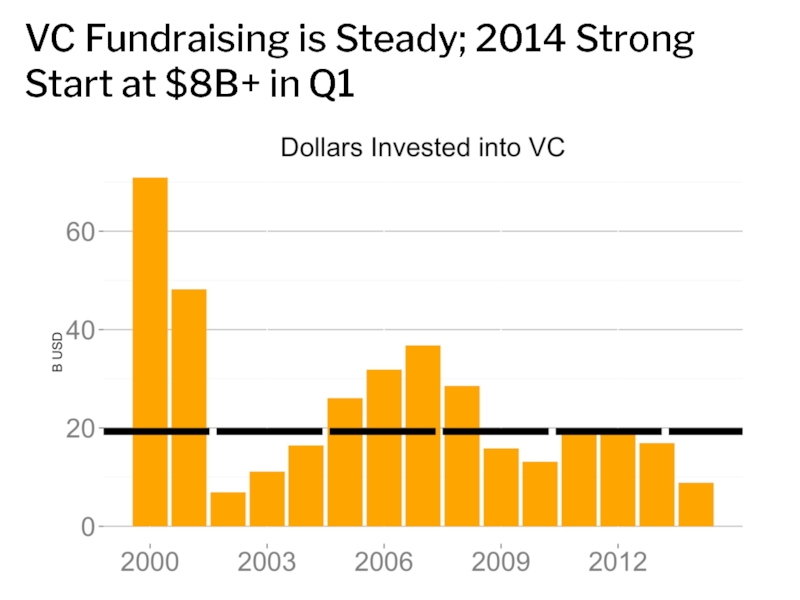

- 4. VC Fundraising is Steady; 2014 Strong Start at $8B+ in Q1

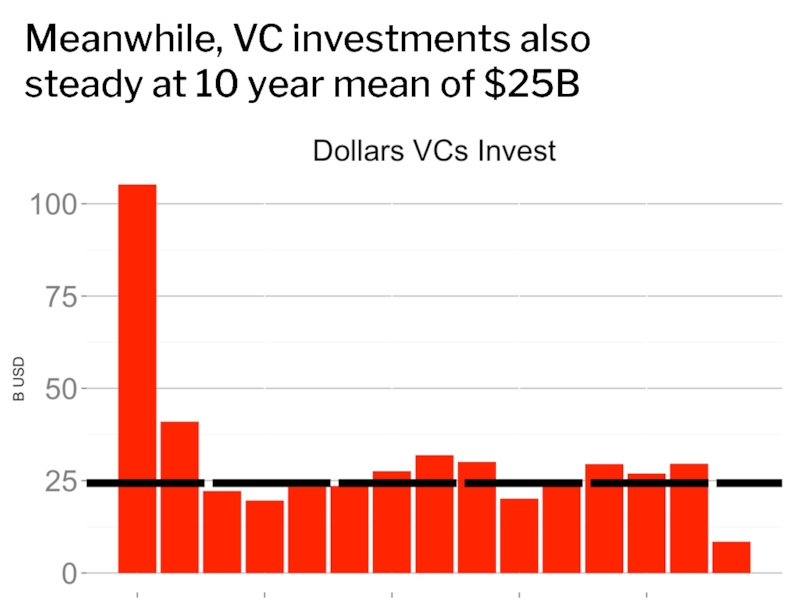

- 5. Meanwhile, VC investments also steady at 10 year mean of $25B

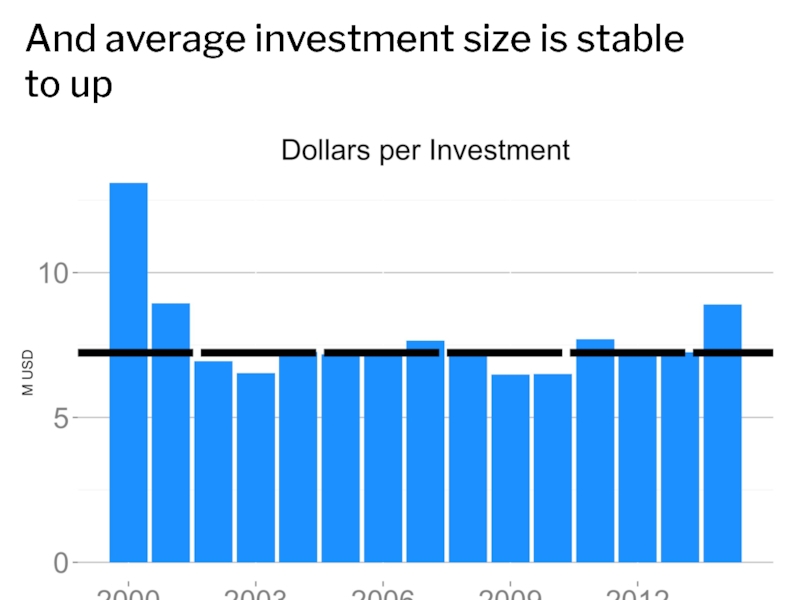

- 6. And average investment size is stable to up

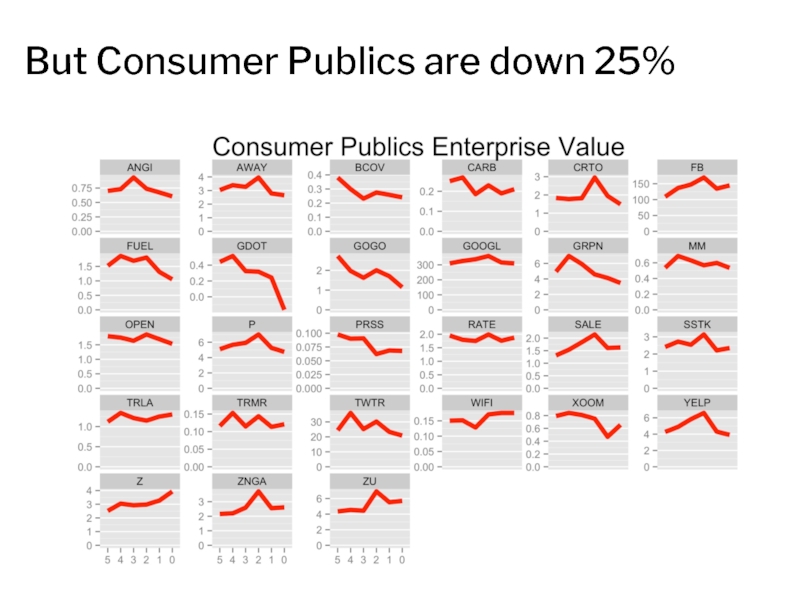

- 7. But Consumer Publics are down 25%

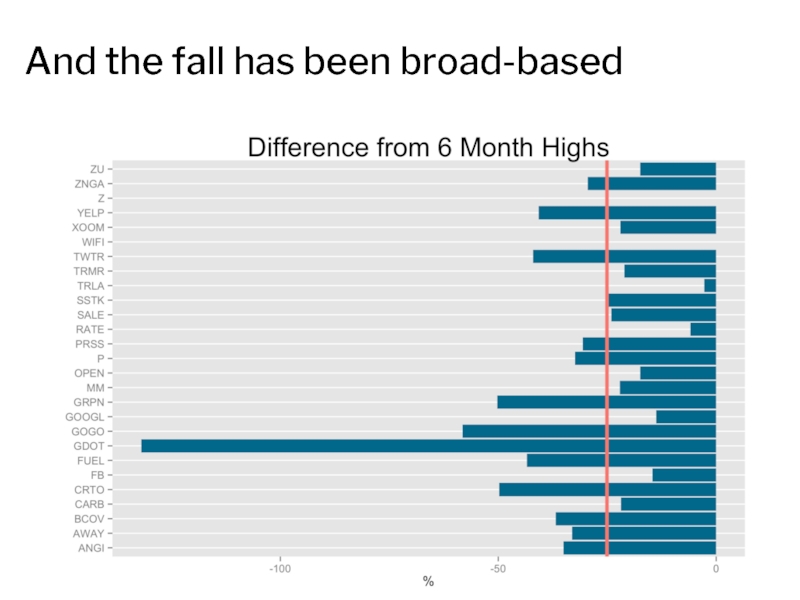

- 8. And the fall has been broad-based

- 9. Enterprise has been hit harder, falling 40%

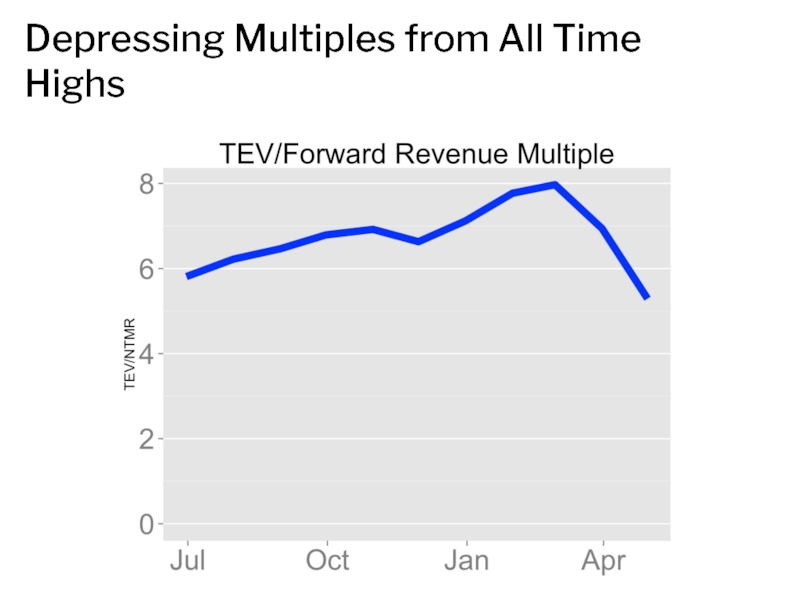

- 10. Depressing Multiples from All Time Highs

- 11. Public markets depressing multiples… But the

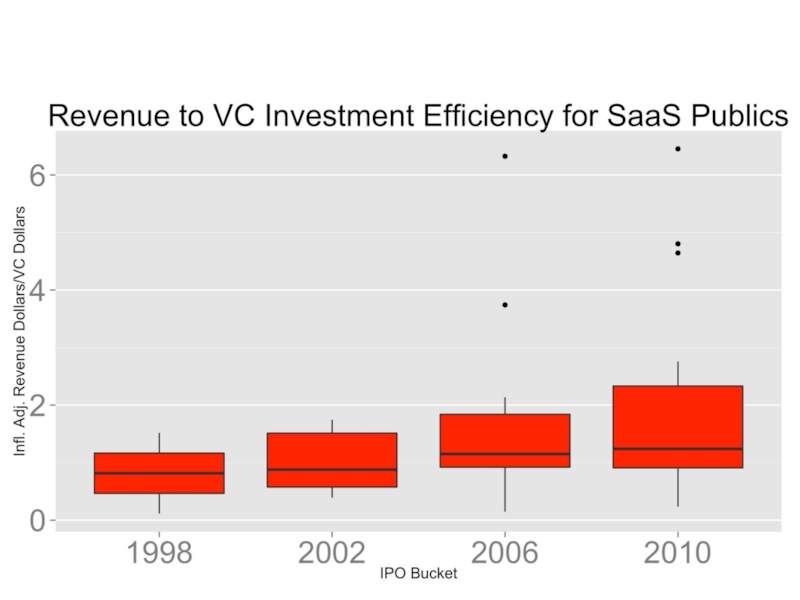

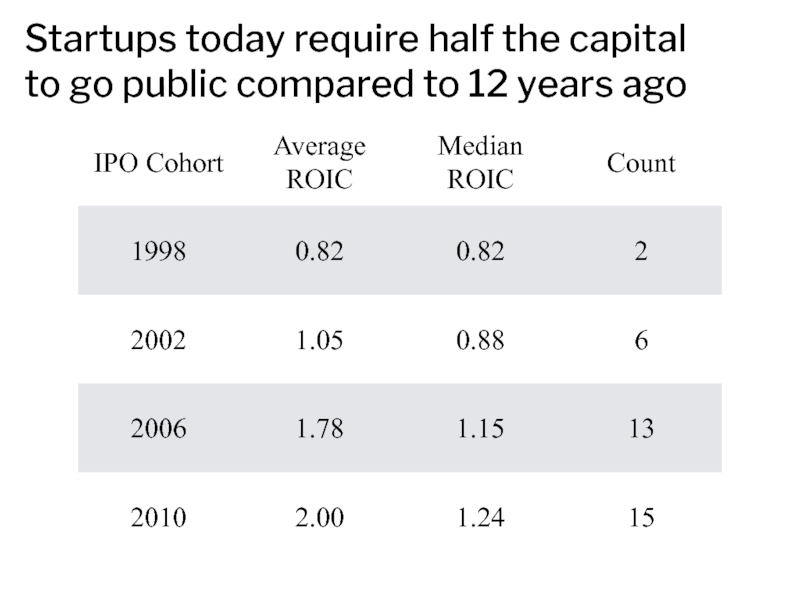

- 12. Startups Are Markedly More Capital Efficient

- 14. Startups today require half the capital to go public compared to 12 years ago

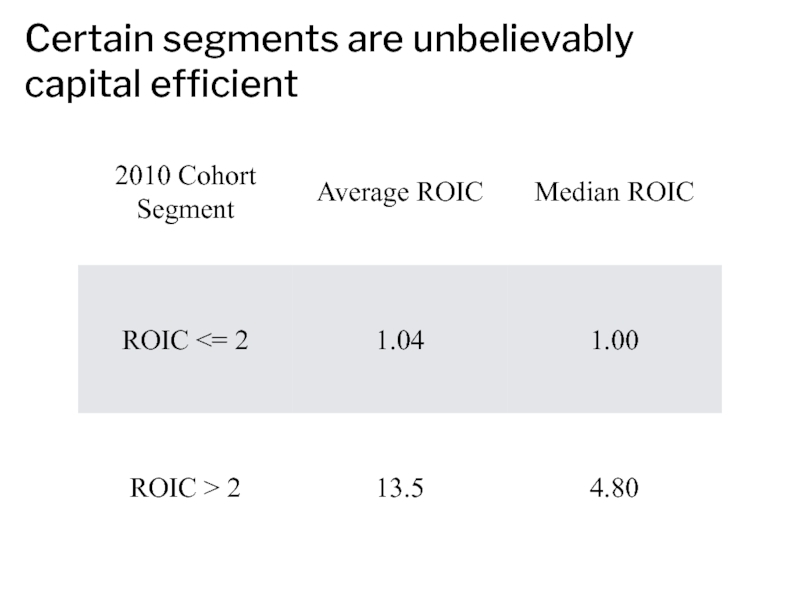

- 15. Certain segments are unbelievably capital efficient

- 16. Recent IPOs are 2x more VC dollar

- 17. Is Seed the New A?

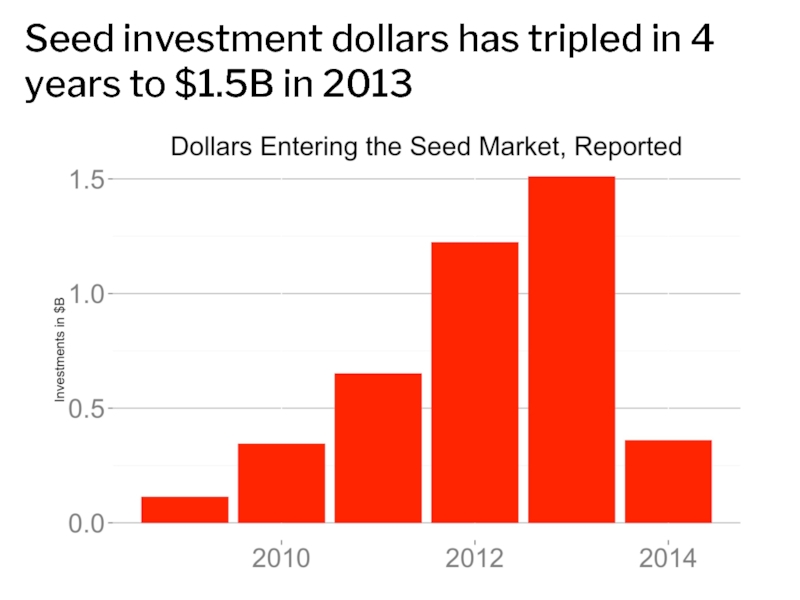

- 18. Seed investment dollars has tripled in 4 years to $1.5B in 2013

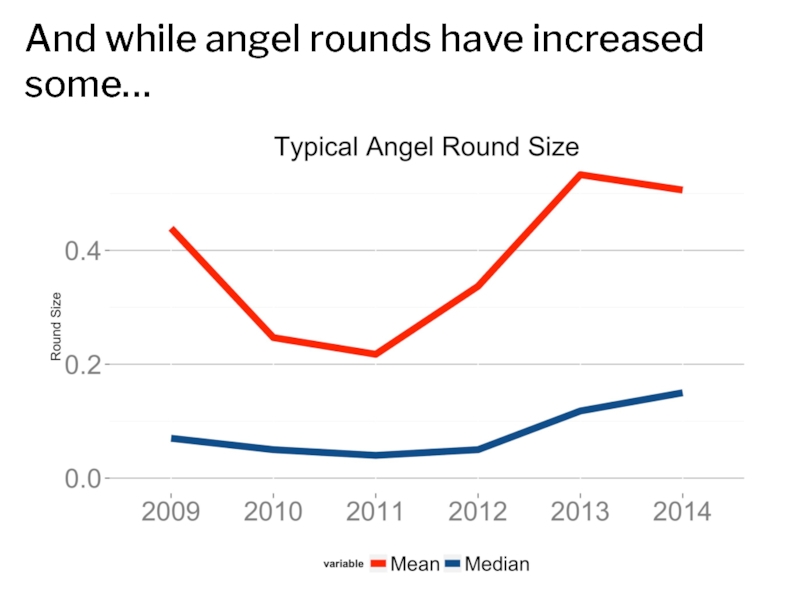

- 19. And while angel rounds have increased some…

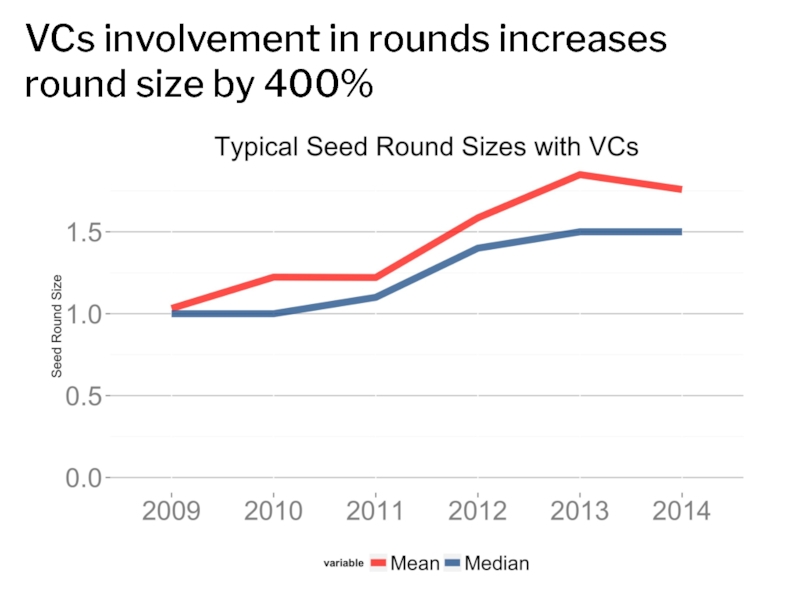

- 20. VCs involvement in rounds increases round size by 400%

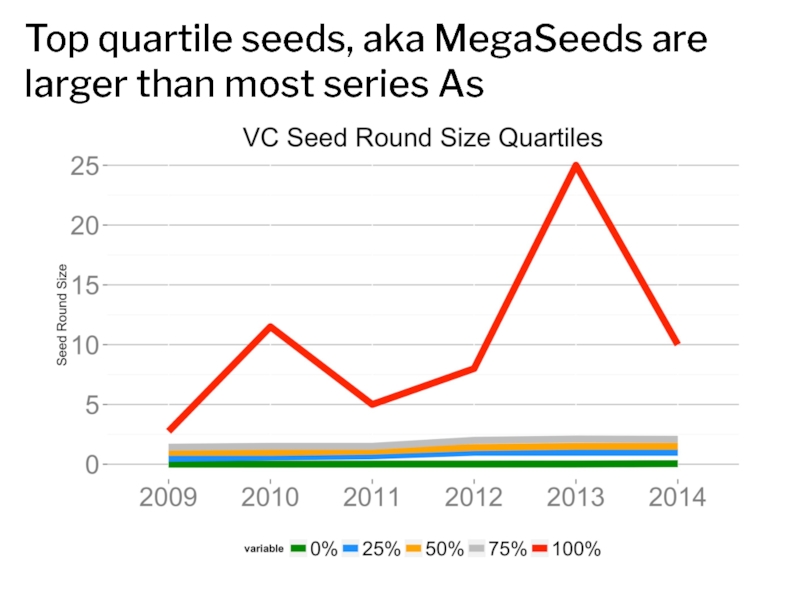

- 21. Top quartile seeds, aka MegaSeeds are larger than most series As

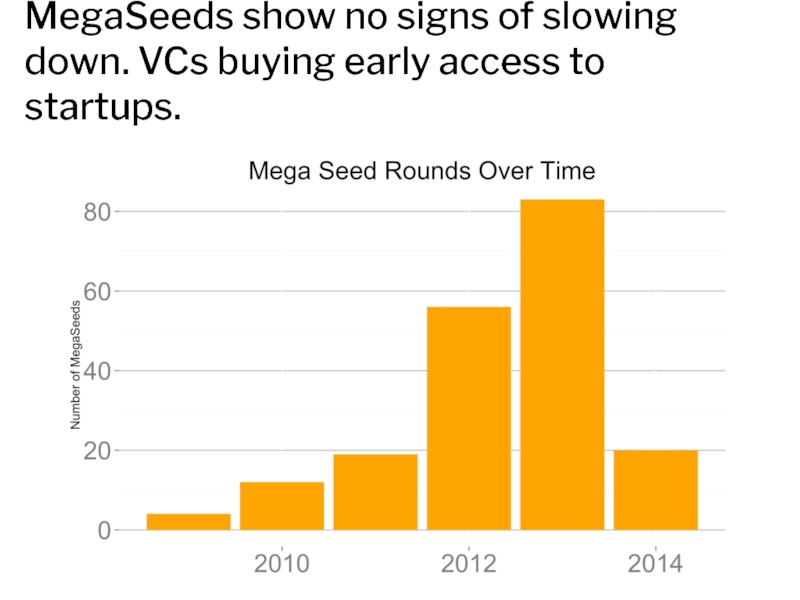

- 22. MegaSeeds show no signs of slowing down. VCs buying early access to startups.

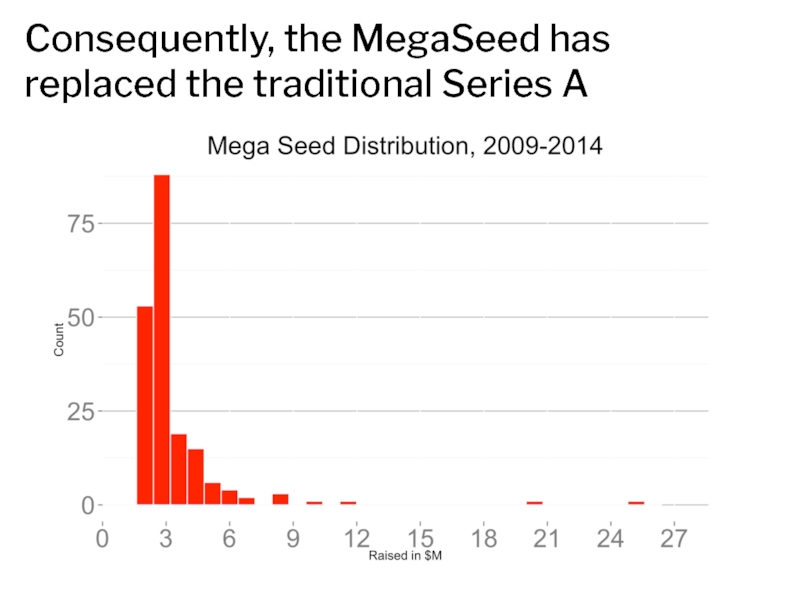

- 23. Consequently, the MegaSeed has replaced the traditional Series A

- 24. VCs have 4x’ed the size of a

- 25. Startup Fundraising Playbook

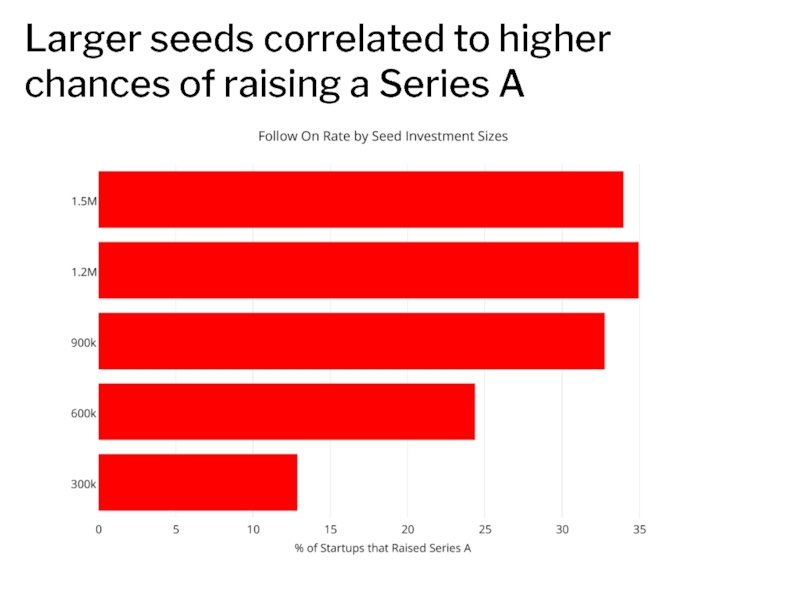

- 26. Larger seeds correlated to higher chances of raising a Series A

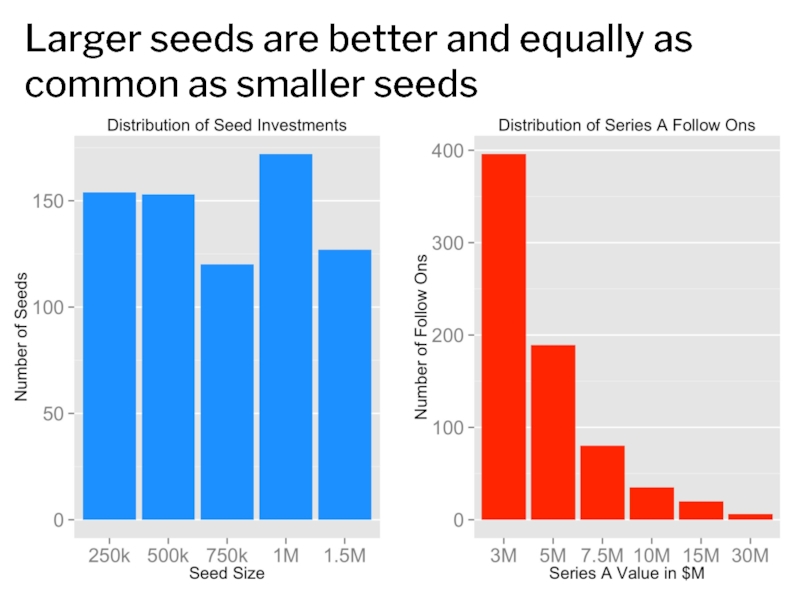

- 27. Larger seeds are better and equally as common as smaller seeds

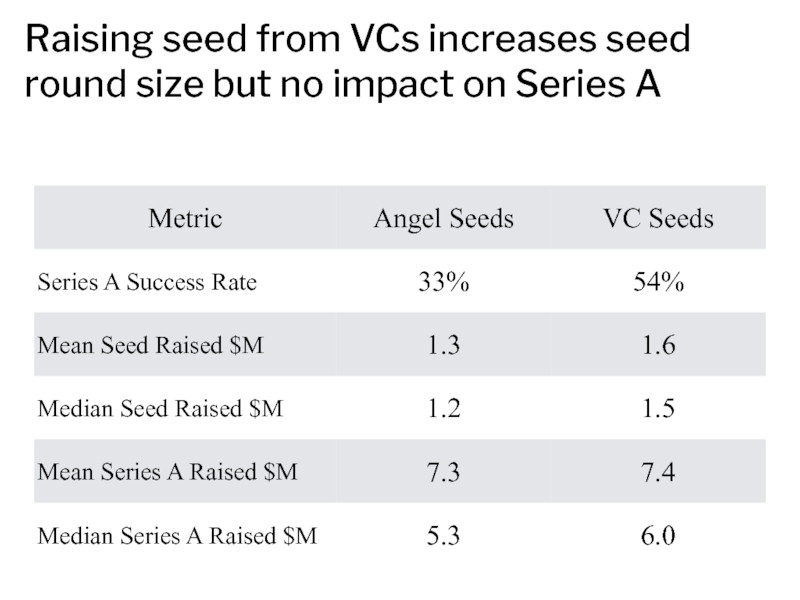

- 28. Raising seed from VCs increases

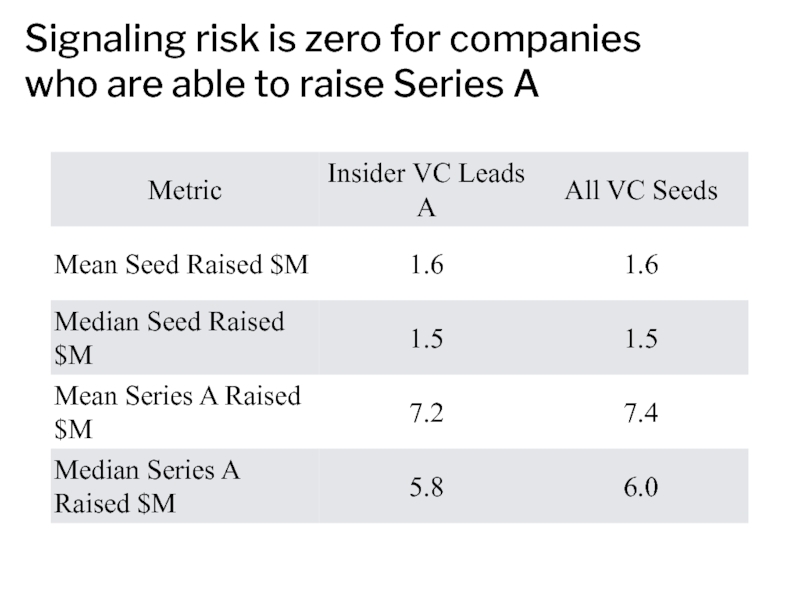

- 29. Signaling risk is zero for companies who are able to raise Series A

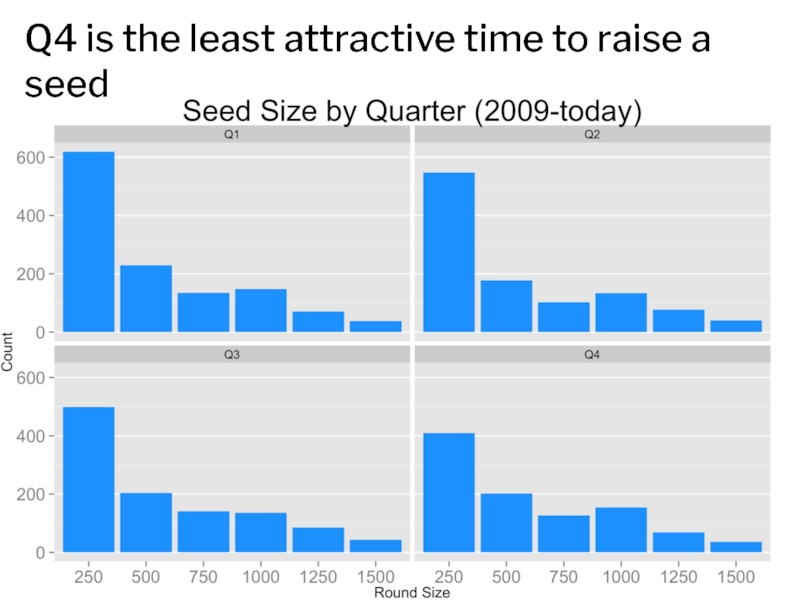

- 30. Q4 is the least attractive time to raise a seed

- 31. Raise more than $900k Easier to do

- 32. Impact of Increasing Seed Investment in Follow On Rounds

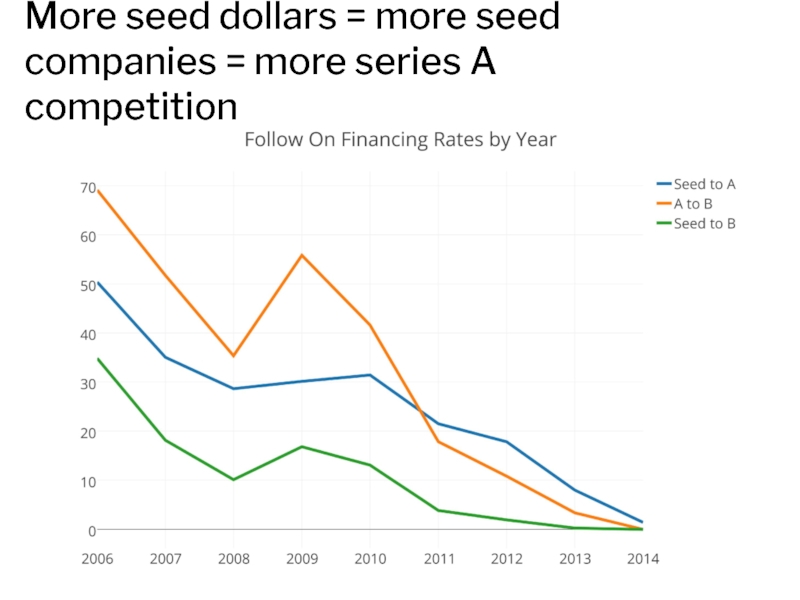

- 33. More seed dollars = more seed companies = more series A competition

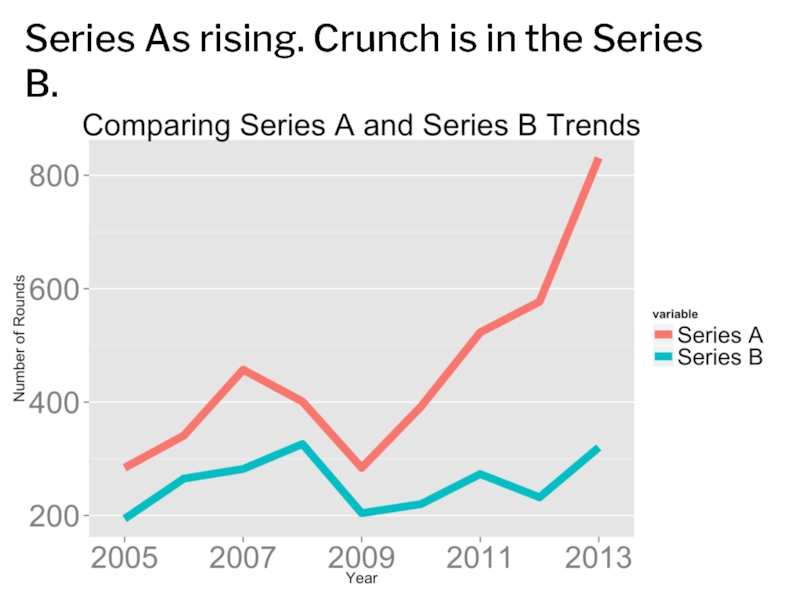

- 34. Series As rising. Crunch is in the Series B.

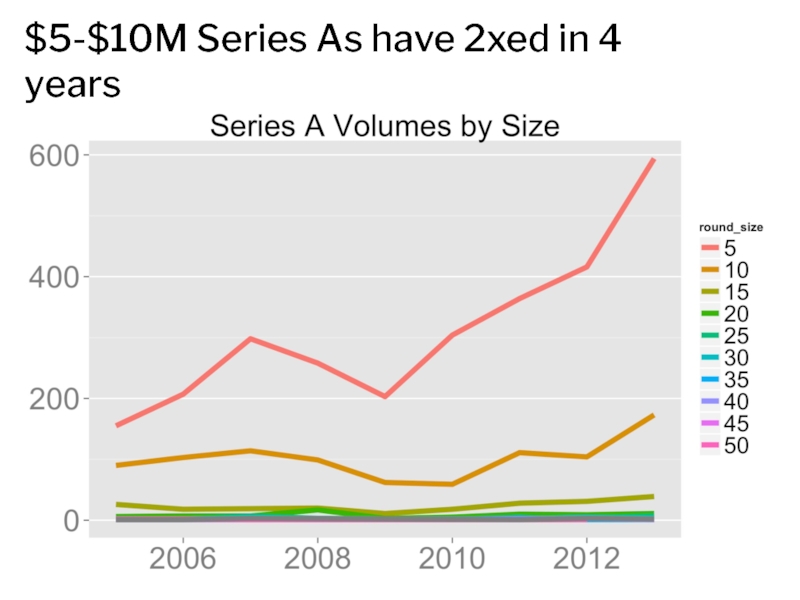

- 35. $5-$10M Series As have 2xed in 4 years

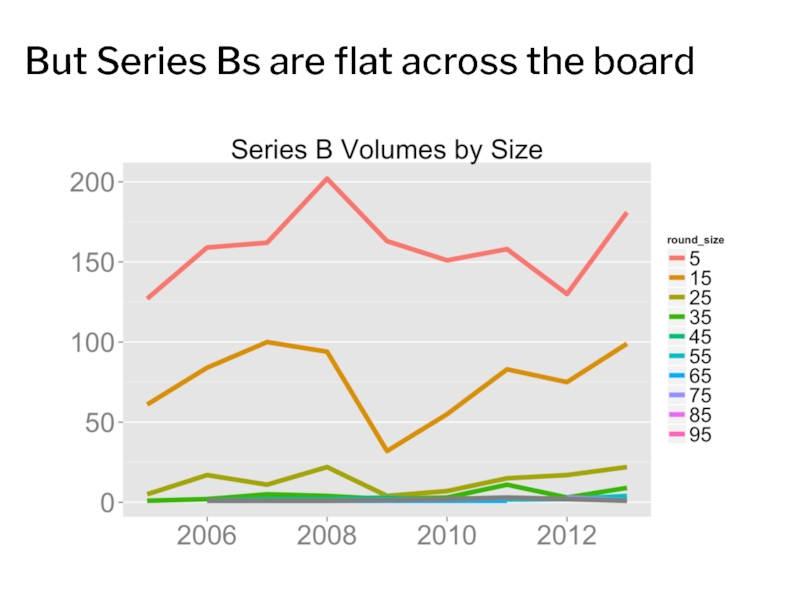

- 36. But Series Bs are flat across the board

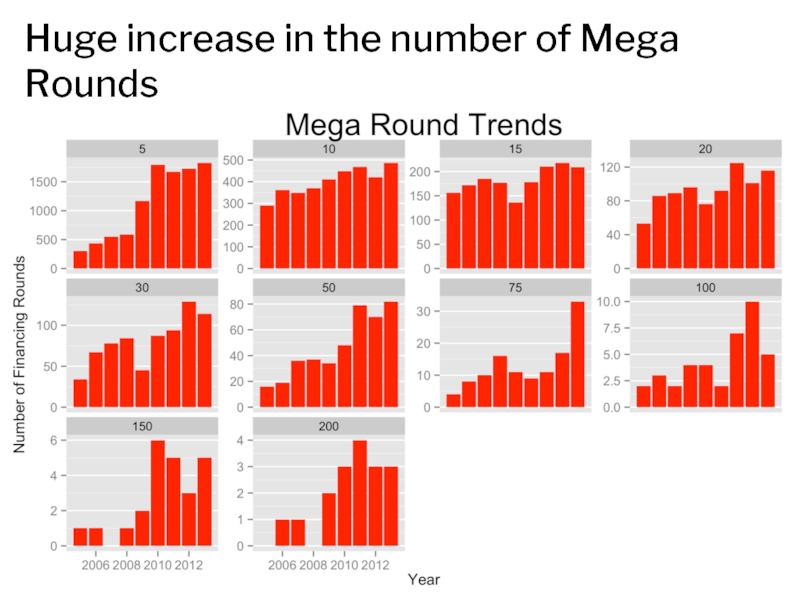

- 37. Huge increase in the number of Mega Rounds

- 38. Series A investment up 200%, responding to

- 40. Appendix

- 41. qs

Слайд 2$3.5B under management

Offices in California and China

Seed, Series A, B and

Слайд 11Public markets depressing multiples…

But the venture market is increasingly competitive

Net effect: relative stability in the fundraising market

Two Forces in Tension

Слайд 16Recent IPOs are 2x more VC dollar efficient as their older

Outliers require negligible capital before IPO because of more efficient avenues of customer acquisition

Net effect: startups need to raise less capital and will require a different pattern of financing

Startups are far more capital efficient than they used to be

Слайд 24VCs have 4x’ed the size of a traditional angel-only seed round

VC

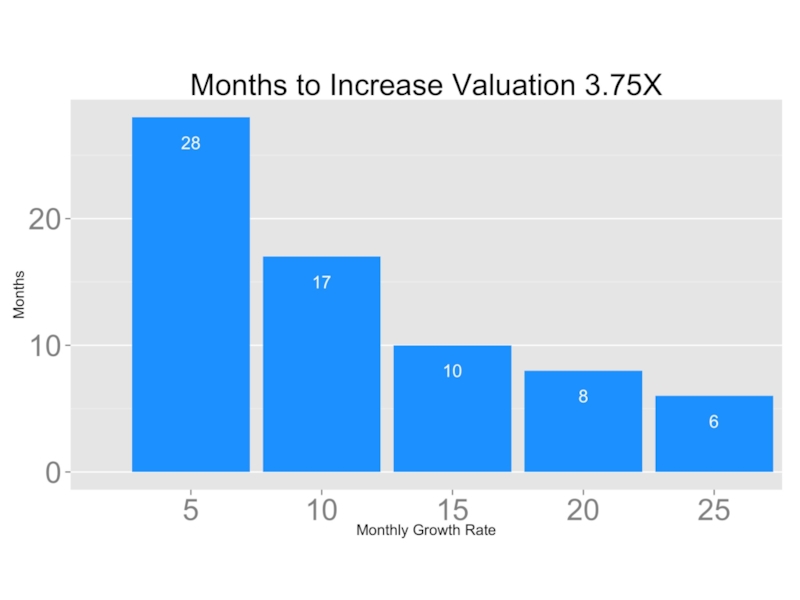

Net effect: Series A investment sizes have increased because capital startups are further along than before

Competition in the VC market has pushed VCs to invest in seeds

Слайд 31Raise more than $900k

Easier to do with VC involvement. Typical round

Raise earlier in the year if you can

Best practices for raising a seed

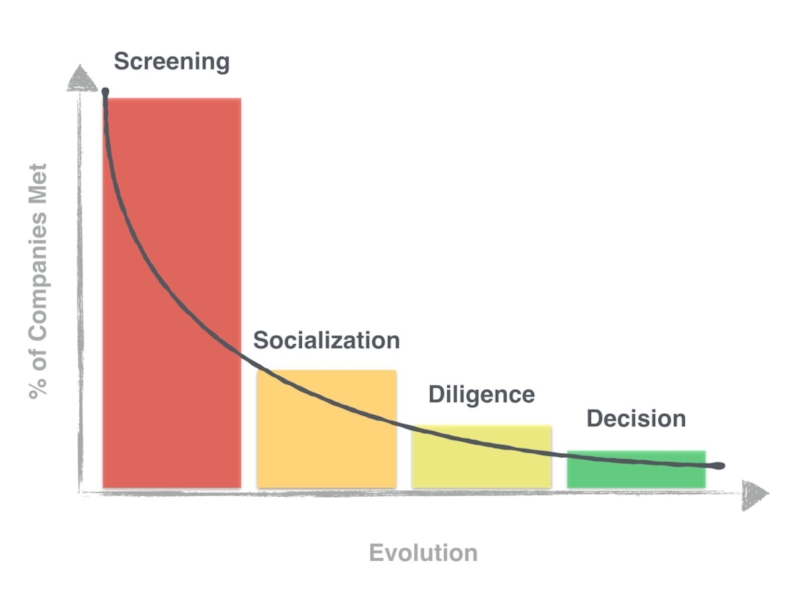

Слайд 38Series A investment up 200%, responding to increase in company formation

Series B flat, creating a crunch for follow-ons

Clear winners able to delay IPO/M&A for years because of IPO-sized rounds available in the private markets

Net effect: Winners have access to tons of capital. Others may struggle with the Series B crunch.

Series A and B and later rounds are in flux