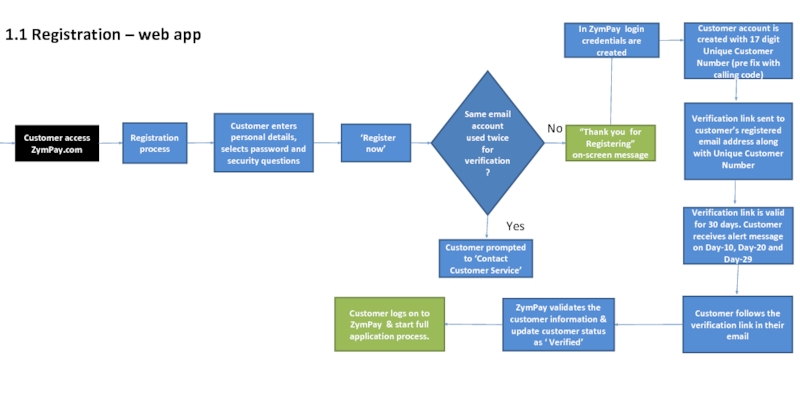

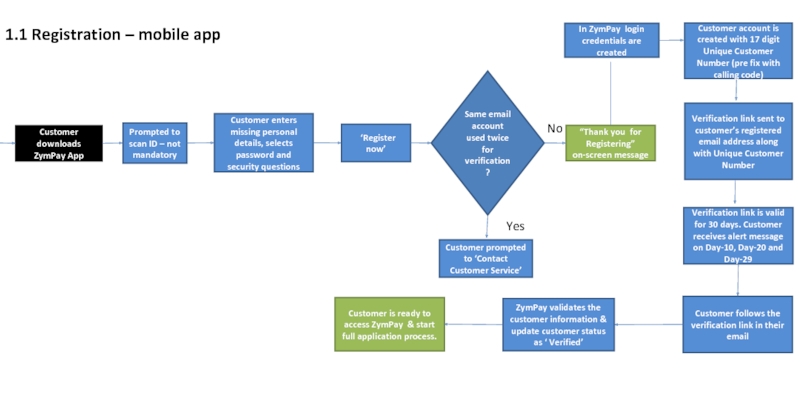

In ZymPay login credentials are created

“Thank you for Registering” on-screen message

‘Register now’

Customer account is created with 17 digit Unique Customer Number (pre fix with calling code)

Verification link sent to customer’s registered email address along with Unique Customer Number

Verification link is valid for 30 days. Customer receives alert message on Day-10, Day-20 and Day-29

ZymPay validates the customer information & update customer status as ‘ Verified’

Customer logs on to ZymPay & start full application process.

Customer access ZymPay.com

Customer prompted to ‘Contact Customer Service’

yes

No

Customer follows the verification link in their email

Same email account used twice for verification?

Yes

![1.4 Card Allocation Process [excl. IDL]Customer Status set to ‘awaiting card’ZymPay Identifies & groups all](/img/tmb/2/159428/9e5744f0592b40b81edb4aff55c078bc-800x.jpg)

![3.1 On-line transactions [Web application]Customer log-in on web applicationSelects serviceMoney Transfer [MT]Bill paymentMobile top-up1. MTSelects](/img/tmb/2/159428/d8697b5fec953a3a02c4ae6ec63a118e-800x.jpg)

![3.1 On-line transactions [Web application]Customer log-in on web applicationSelects serviceMoney Transfer [MT]Bill paymentMobile top-up2. Bill](/img/tmb/2/159428/4fe3387f6402b587db14fbb769a7195e-800x.jpg)