- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Corporate GovernanceIntroduction презентация

Содержание

- 1. Corporate GovernanceIntroduction

- 2. Pledgeable income and efficiency From the “traditional”

- 3. Basic framework Assume (p+Δp)XH – I >

- 4. The basic idea of “corporate governance” can

- 5. Mechanisms Executive compensation Rationale: aligning managers’ objectives

- 6. Mechanisms (cont-d) Board of directors Supposed to

- 7. Mechanisms (cont-d) Large investors: monitoring and control

- 8. Mechanisms (cont-d) Takeovers Ex-ante effect: managerial discipline

- 9. Mechanisms (cont-d) “Gatekeepers” Auditors Financial Analysts Credit

- 10. Mechanisms (cont-d) Minority shareholder actions Proxy Fights

- 11. Other mechanisms Adopting US GAAP, IFRS (IAS)

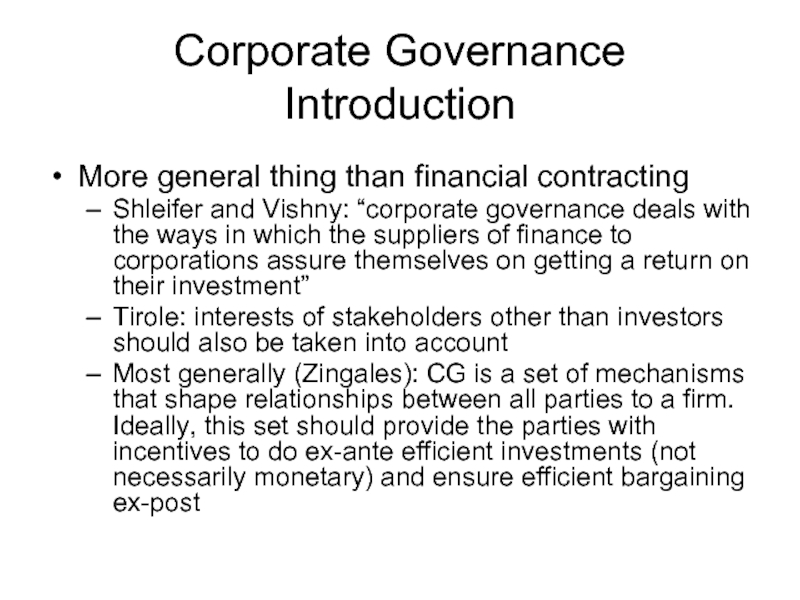

Слайд 1Corporate Governance

Introduction

More general thing than financial contracting

Shleifer and Vishny: “corporate governance

Tirole: interests of stakeholders other than investors should also be taken into account

Most generally (Zingales): CG is a set of mechanisms that shape relationships between all parties to a firm. Ideally, this set should provide the parties with incentives to do ex-ante efficient investments (not necessarily monetary) and ensure efficient bargaining ex-post

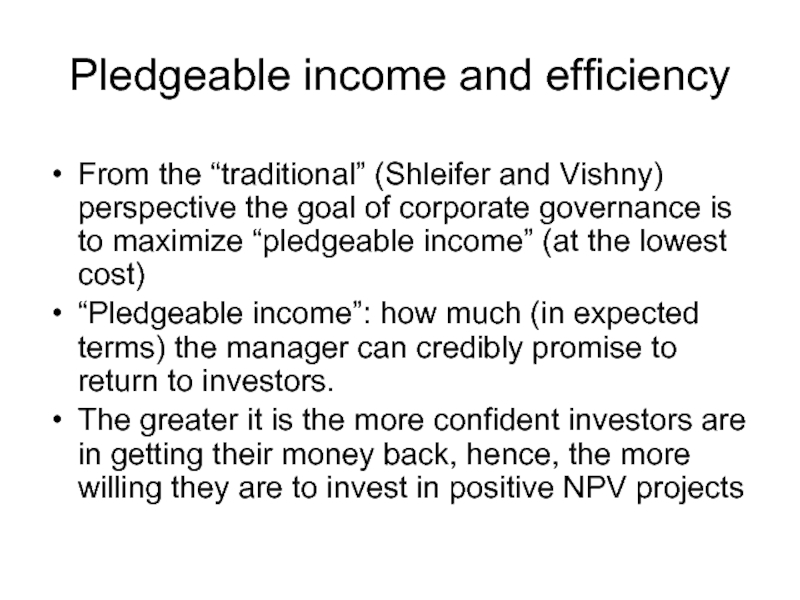

Слайд 2Pledgeable income and efficiency

From the “traditional” (Shleifer and Vishny) perspective the

“Pledgeable income”: how much (in expected terms) the manager can credibly promise to return to investors.

The greater it is the more confident investors are in getting their money back, hence, the more willing they are to invest in positive NPV projects

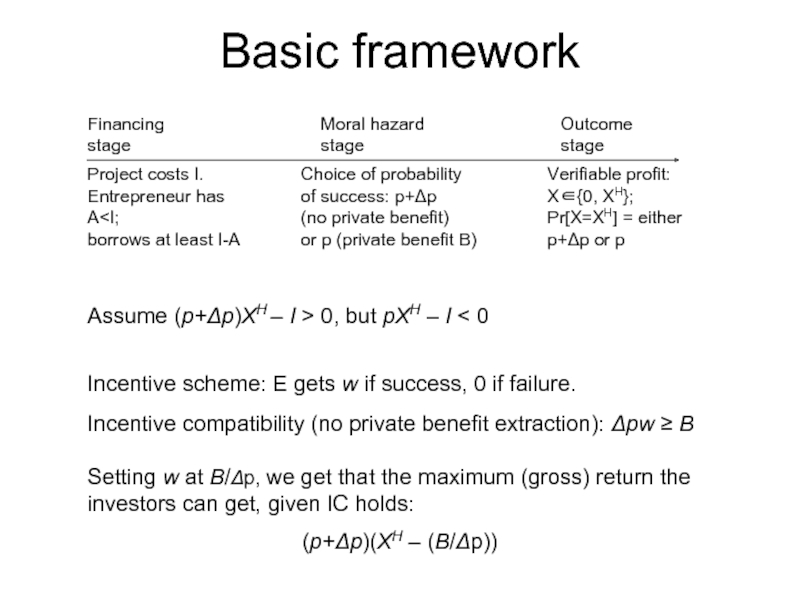

Слайд 3Basic framework

Assume (p+Δp)XH – I > 0, but pXH – I

Incentive scheme: E gets w if success, 0 if failure.

Incentive compatibility (no private benefit extraction): Δpw ≥ B

Setting w at B/Δp, we get that the maximum (gross) return the investors can get, given IC holds:

(p+Δp)(XH – (B/Δp))

Financing stage

Project costs I.

Entrepreneur has A Moral hazard stage Choice of probability of success: p+Δp

(no private benefit)

or p (private benefit B) Outcome stage Verifiable profit:

X∈{0, XH};

Pr[X=XH] = either p+Δp or p

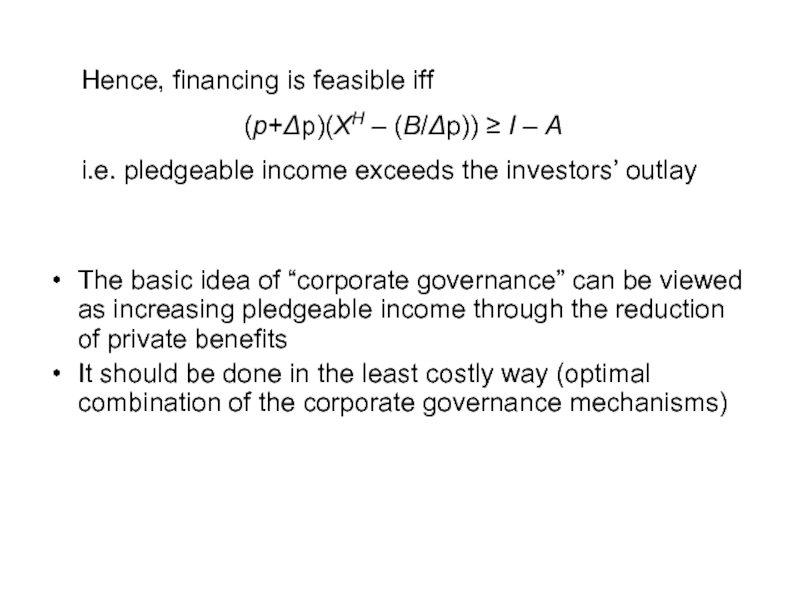

Слайд 4The basic idea of “corporate governance” can be viewed as increasing

It should be done in the least costly way (optimal combination of the corporate governance mechanisms)

Hence, financing is feasible iff

(p+Δp)(XH – (B/Δp)) ≥ I – A

i.e. pledgeable income exceeds the investors’ outlay

Слайд 5Mechanisms

Executive compensation

Rationale: aligning managers’ objectives with the shareholders’ interests ⇒ need

Has risen in the US since 1970, especially due to a rise in the use of stock options in 90’s ⇒ high pay-performance sensitivity (in the US equity based compensation is on average 50-60% of the total compensation)

But is it an outcome of optimal contracting? Evidence suggests that maybe not, managers can pay themselves too much because they capture the process of setting compensation

Stock-based compensation involves costs: e.g. short termism, excessive risk (stock options), insufficient effort (stock options), earnings manipulation…

Слайд 6Mechanisms (cont-d)

Board of directors

Supposed to protect shareholders and oversee management

In reality

Hence, in theory, need for “independent” directors

But overall empirical evidence yields very ambiguous conclusions about the effects board composition on firm value

Слайд 7Mechanisms (cont-d)

Large investors: monitoring and control

Reduce (discourage) managerial opportunism (self-dealing)

But involve

Lack of diversification

Lack of liquidity

Excessive monitoring

Pursuing own goals at the expense of other investors

Слайд 8Mechanisms (cont-d)

Takeovers

Ex-ante effect: managerial discipline

Ex-post: efficient allocation of assets

Value increasing takeovers

Value decreasing takeovers should fail

Failure of both goals may occur in reality

Слайд 9Mechanisms (cont-d)

“Gatekeepers”

Auditors

Financial Analysts

Credit Rating Agencies

Should warn investors if things go wrong

In

Conflicts of interest

Lack of incentives (lack of competition)

Слайд 10Mechanisms (cont-d)

Minority shareholder actions

Proxy Fights (vote for removal of current management)

Shareholder

Shareholder litigation

Overall, minority shareholder actions are rare outside US and UK, empirically have rather limited effect

Russia: Hermitage case (see Dyck, Volchkova and Zingales (2005))

Слайд 11Other mechanisms

Adopting US GAAP, IFRS (IAS)

Hiring an independent auditor

Cross listing (listing

Sound dividend policy

…

We will consider Large Shareholders and Takeovers in more detail now…