Redfin In-Town Atlanta Team

April 10th, 2014

Brookhaven, GA

Hosted by: Danielle Coats

@Redfin | facebook.com/Redfin

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Redfin Home Buying ClassFirst Time Home Buyers & How to Win in Multiple Offers презентация

Содержание

- 1. Redfin Home Buying ClassFirst Time Home Buyers & How to Win in Multiple Offers

- 2. Agenda Overview of the process Are

- 3. A Little Bit About Redfin Redfin is

- 4. Understanding the Buying Process

- 5. Overview of a Buying a Home

- 6. Are You Ready to Buy?

- 7. Are You Ready to Buy? Do you

- 8. Understanding the Market

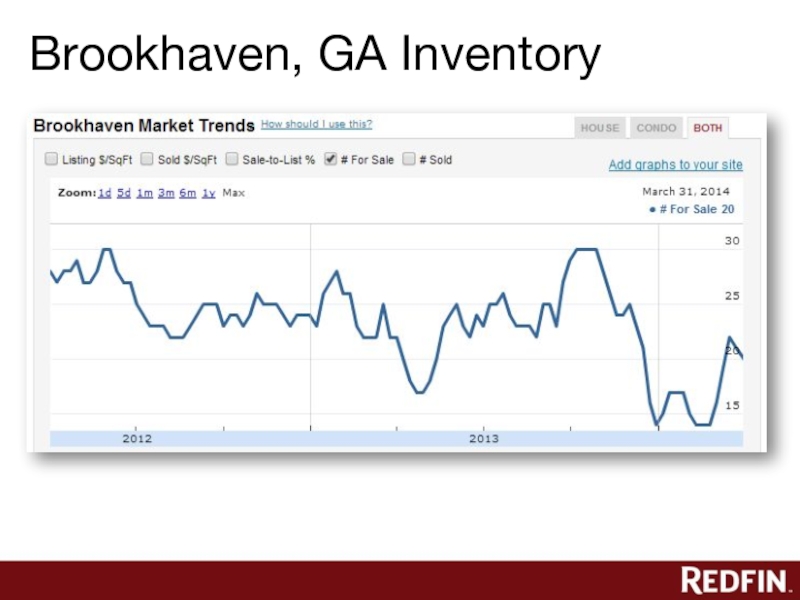

- 9. Brookhaven, GA Inventory

- 10. Rising Prices

- 11. Where Is the Market Headed? Supply of

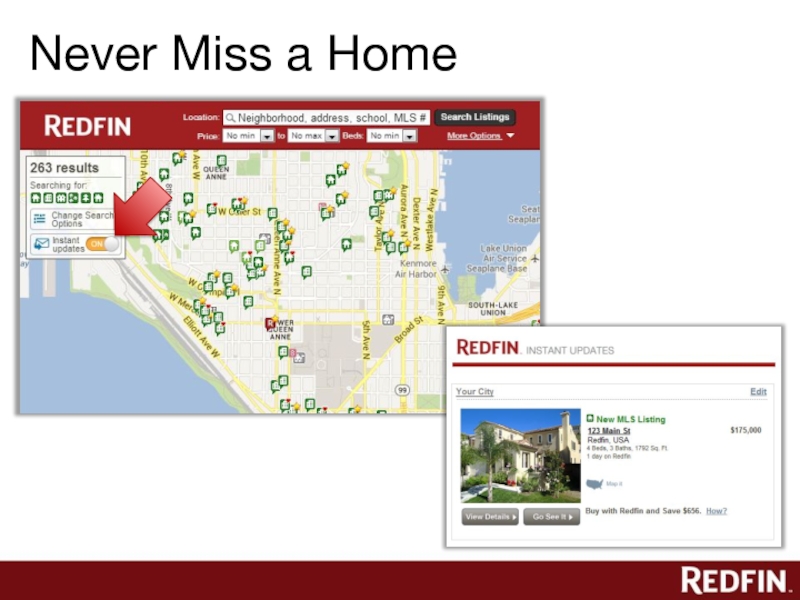

- 12. Never Miss A Home

- 13. Real Estate Sites: What to Look For

- 14. Never Miss a Home

- 15. Choosing the Right Agent

- 16. What to Ask Any Agent Is this

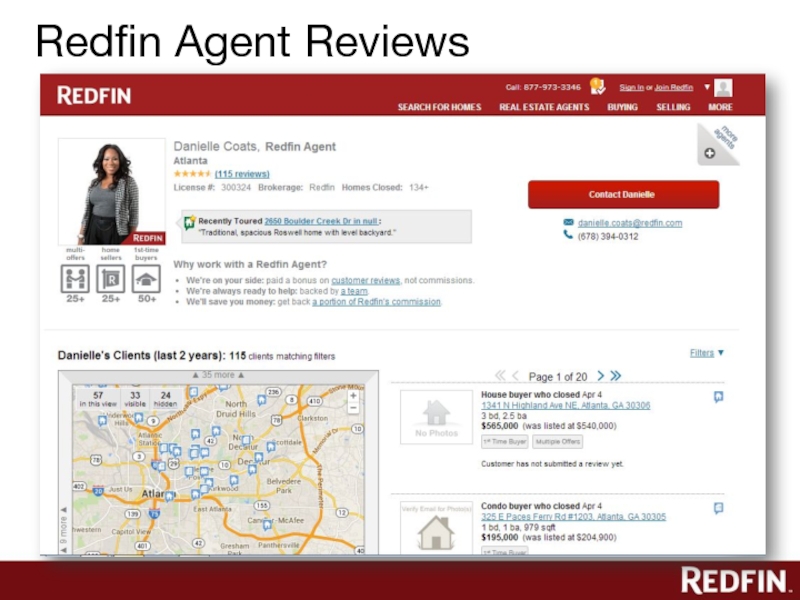

- 17. Redfin Agent Reviews

- 18. Redfin Partner Program Partner agents are employed

- 19. Seeing Homes in Person

- 20. Making the Most of Your Tour Bring

- 21. How Touring with Redfin Works Led by

- 22. Multiple Offers

- 23. Why all the Multiple Offers? What’s driving

- 24. Get Ready! Let’s

- 25. Get Ready! Obtain

- 26. Get Ready! Know the Numbers - Knowing

- 27. Get Ready! Documentation Having your finances and

- 28. Writing a Winning Offer Offer Price -

- 29. Writing a Winning Offer Highest & Best

- 30. Writing a Winning Offer TERMS - Understand

- 31. Earnest Money Deposit 1-3% of

- 32. Inspections: To Waive or Not To?

- 33. Writing a Winning Offer Use a Redfin

- 34. Financing Cash Cash offers can close in

- 35. Writing a Winning Offer Financing (continued)… Making

- 36. Writing a Winning Offer Personal Touch Including

- 37. Writing a Winning Offer Closing & Possession

- 38. How Redfin Helps Redfin agents close more

- 39. Acceptance to Closing

- 40. Steps After Mutual Acceptance (Binding) Earnest money

- 41. What are Contingencies? This means the seller

- 42. What is Escrow? Escrow is a third

- 43. Title Companies Prepares the final documents, including

- 44. Closing: HUD–1 Settlement

- 45. Signing and Closing A few days before

- 46. Selling Your Home with Redfin

- 47. We’re on your side Agents paid on

- 48. All Done!

- 49. So What Now? Make sure it’s

- 50. Thanks for Coming! Questions? Get in touch:

Слайд 1Redfin Home Buying Class First Time Home Buyers & How to Win

in Multiple Offers

Слайд 2

Agenda

Overview of the process

Are you ready to buy?

Understanding the market

Never miss

a home

Choosing an agent

Touring

Mortgages

Multiple Offers

Making a Winning Offer!

Acceptance to closing

Choosing an agent

Touring

Mortgages

Multiple Offers

Making a Winning Offer!

Acceptance to closing

Слайд 3A Little Bit About Redfin

Redfin is a real estate brokerage on

a mission to make buying and selling a home better for you.

Accountability: we’re on your side, giving you honest advice

Technology: sellers get more traffic; buyers tour homes first

Value: a full-service brokerage that saves you thousands

No obligation

Accountability: we’re on your side, giving you honest advice

Technology: sellers get more traffic; buyers tour homes first

Value: a full-service brokerage that saves you thousands

No obligation

Слайд 7Are You Ready to Buy?

Do you have a family and need

room to grow?

Do you expect to stay put for 5 or more years?

Have you saved up for a down payment? 3.5% to 20+%

Have you saved up for closing costs? Typically 0-2%

Can you rent for less?

Do you expect to stay put for 5 or more years?

Have you saved up for a down payment? 3.5% to 20+%

Have you saved up for closing costs? Typically 0-2%

Can you rent for less?

Слайд 11Where Is the Market Headed?

Supply of homes is at a five-year

low and won’t increase much more this year

Rents have been rising, making buying more attractive

Market stabilized – price increases in many areas

Rate increases – biggest potential issue for buyers

Rents have been rising, making buying more attractive

Market stabilized – price increases in many areas

Rate increases – biggest potential issue for buyers

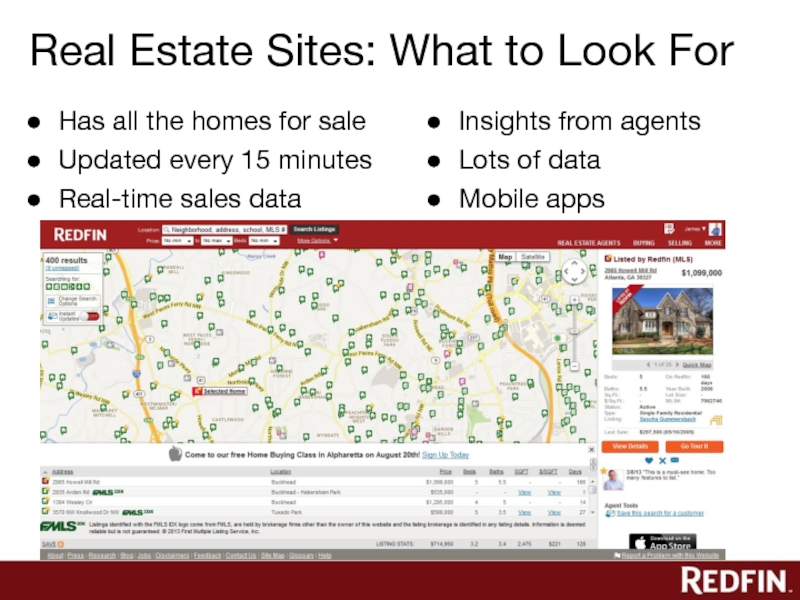

Слайд 13Real Estate Sites: What to Look For

Has all the homes for

sale

Updated every 15 minutes

Real-time sales data

Updated every 15 minutes

Real-time sales data

Insights from agents

Lots of data

Mobile apps

Слайд 16What to Ask Any Agent

Is this your full-time job?

Where were your

last five deals?

Who else will be working with me?

When am I committed to working with you?

Has a client ever filed a complaint?

How are you paid?

Can I see some reviews of your work?

Who else will be working with me?

When am I committed to working with you?

Has a client ever filed a complaint?

How are you paid?

Can I see some reviews of your work?

Слайд 18Redfin Partner Program

Partner agents are employed by other brokerages, and have

teamed up with us to provide Redfin-certified service

We’ll refer you to a Partner Agent when:

A home is below Redfin’s minimum price

A home is outside of our service area

If it’s in your financial advantage to work with a partner

We’re experiencing unusually high customer demand

We survey all partner agent clients

All surveys are published on their Redfin page

97% of customers would recommend Redfin Partners

We’ll refer you to a Partner Agent when:

A home is below Redfin’s minimum price

A home is outside of our service area

If it’s in your financial advantage to work with a partner

We’re experiencing unusually high customer demand

We survey all partner agent clients

All surveys are published on their Redfin page

97% of customers would recommend Redfin Partners

Слайд 20Making the Most of Your Tour

Bring a camera, notebook & tape

measure

See how much sunlight the place gets

Check the bathrooms for rot & mold

Look for wavy or discolored wood siding

Make sure water spouts drain away from house

Take stock of storage space

Turn off any music playing in house

Check for hardwood floors

Peek into the attic

Bring a marble or two

When sharing a wall, make sure it’s thick

Ignore the appliances and carpets

Check the closets

Get the disclosure packet

Compare the property’s tax records to the listing details

See how much sunlight the place gets

Check the bathrooms for rot & mold

Look for wavy or discolored wood siding

Make sure water spouts drain away from house

Take stock of storage space

Turn off any music playing in house

Check for hardwood floors

Peek into the attic

Bring a marble or two

When sharing a wall, make sure it’s thick

Ignore the appliances and carpets

Check the closets

Get the disclosure packet

Compare the property’s tax records to the listing details

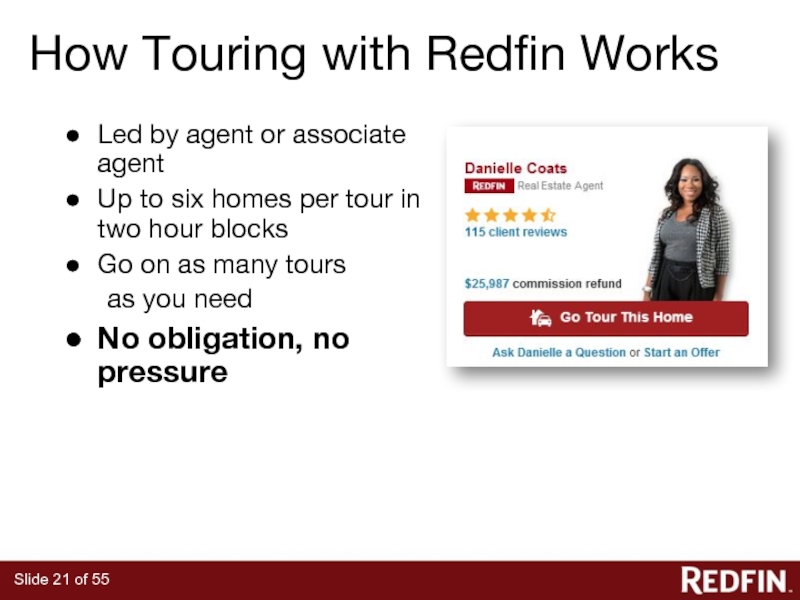

Слайд 21How Touring with Redfin Works

Led by agent or associate agent

Up to

six homes per tour in two hour blocks

Go on as many tours

as you need

No obligation, no pressure

Go on as many tours

as you need

No obligation, no pressure

Слайд 23Why all the Multiple Offers?

What’s driving the sudden demand for homes?

Interest

rates still at historical lows

Foreign investors, all-cash buyers

Buyers are not shying away from bidding wars

LOW INVENTORY

Months of Supply – The time it would take to sell through all the homes on the market, given the current pace of sales

In a balanced market, Months of Supply is between 5-6 months

--- Anything less is a seller’s market

Foreign investors, all-cash buyers

Buyers are not shying away from bidding wars

LOW INVENTORY

Months of Supply – The time it would take to sell through all the homes on the market, given the current pace of sales

In a balanced market, Months of Supply is between 5-6 months

--- Anything less is a seller’s market

Слайд 24Get Ready!

Let’s Do our Homework

Buyer’s agent should call the listing

agent, to find out what the sellers situation is & why they are selling

What are the sellers’ motivations?

Will they need to remain at the property after closing?

Do they need a quick sale?

Request for copies of disclosures and reports

Find out how many disclosure packages have been sent out to other buyers, has there been heavy traffic?

Is there an offer due date? How should offers be submitted – via email, drop off at listing office or in person?

Build rapport with listing agent and check scouting report

What are the sellers’ motivations?

Will they need to remain at the property after closing?

Do they need a quick sale?

Request for copies of disclosures and reports

Find out how many disclosure packages have been sent out to other buyers, has there been heavy traffic?

Is there an offer due date? How should offers be submitted – via email, drop off at listing office or in person?

Build rapport with listing agent and check scouting report

Слайд 25Get Ready!

Obtain a Pre-Approval Letter

Your Lender is part of our

Team!

Ask your loan officer how they can help you in a competitive situation (shorter contingency period, quick closing?)

Request that your LO be available to speak with the listing agent

Get a preapproval letter with your maximum approval amount, you can customize later if necessary

Use a lender with local expertise- in a competitive situation it can be the difference between winning and losing

Get full underwriter approval --No pre-qualification letters please

Ask your loan officer how they can help you in a competitive situation (shorter contingency period, quick closing?)

Request that your LO be available to speak with the listing agent

Get a preapproval letter with your maximum approval amount, you can customize later if necessary

Use a lender with local expertise- in a competitive situation it can be the difference between winning and losing

Get full underwriter approval --No pre-qualification letters please

Слайд 26Get Ready!

Know the Numbers - Knowing what to offer and being

confident in your offer price makes the process less stressful.

Run a Comparative Market Analysis (CMA)

Understand pricing for the area

Determine your maximum price

Calculate payment difference at incremental price points

$5,000 more equals $?/month

Know When To Walk Away

You can’t control what someone else is willing to pay

Run a Comparative Market Analysis (CMA)

Understand pricing for the area

Determine your maximum price

Calculate payment difference at incremental price points

$5,000 more equals $?/month

Know When To Walk Away

You can’t control what someone else is willing to pay

Слайд 27Get Ready!

Documentation

Having your finances and other required documents in order prior

to making an offer can accelerate the process. Here’s what we’ll need at a minimum to include with your offer:

Pre-Approval Letter

Not a pre-qualification

Proof of Funds

Bank statement, 401k, brokerage statement

Earnest Money Deposit Check

Just a copy (picture, scan or fax)

Pre-Approval Letter

Not a pre-qualification

Proof of Funds

Bank statement, 401k, brokerage statement

Earnest Money Deposit Check

Just a copy (picture, scan or fax)

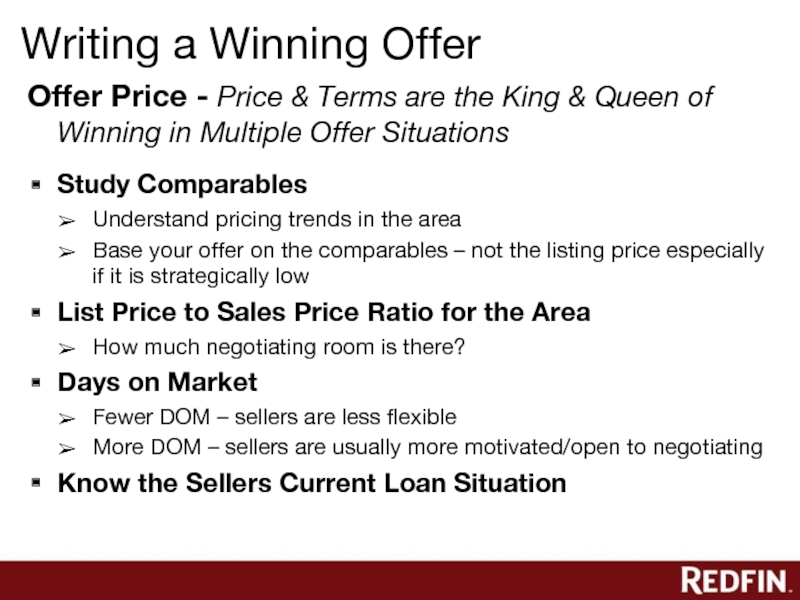

Слайд 28Writing a Winning Offer

Offer Price - Price & Terms are the

King & Queen of Winning in Multiple Offer Situations

Study Comparables

Understand pricing trends in the area

Base your offer on the comparables – not the listing price especially if it is strategically low

List Price to Sales Price Ratio for the Area

How much negotiating room is there?

Days on Market

Fewer DOM – sellers are less flexible

More DOM – sellers are usually more motivated/open to negotiating

Know the Sellers Current Loan Situation

Study Comparables

Understand pricing trends in the area

Base your offer on the comparables – not the listing price especially if it is strategically low

List Price to Sales Price Ratio for the Area

How much negotiating room is there?

Days on Market

Fewer DOM – sellers are less flexible

More DOM – sellers are usually more motivated/open to negotiating

Know the Sellers Current Loan Situation

Слайд 29Writing a Winning Offer

Highest & Best

In a multiple offer situation you

may have only one shot at offering and no opportunity to further negotiate

Blind betting – you don’t know what the other offers are

What is the maximum price you are willing to pay for this property?

How much do you really want this property?

Determine your walk away price

Go in with your highest price and best terms right from the start

Blind betting – you don’t know what the other offers are

What is the maximum price you are willing to pay for this property?

How much do you really want this property?

Determine your walk away price

Go in with your highest price and best terms right from the start

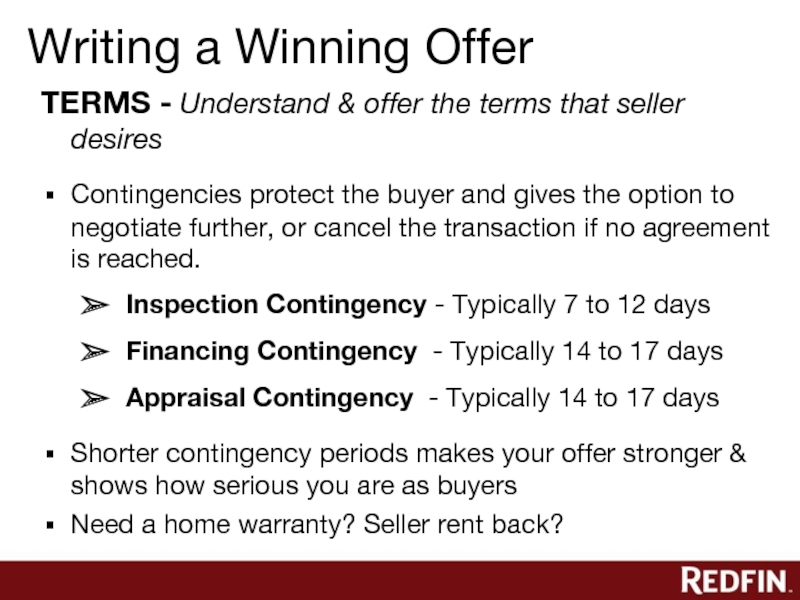

Слайд 30Writing a Winning Offer

TERMS - Understand & offer the terms that

seller desires

Contingencies protect the buyer and gives the option to negotiate further, or cancel the transaction if no agreement is reached.

Inspection Contingency - Typically 7 to 12 days

Financing Contingency - Typically 14 to 17 days

Appraisal Contingency - Typically 14 to 17 days

Shorter contingency periods makes your offer stronger & shows how serious you are as buyers

Need a home warranty? Seller rent back?

Contingencies protect the buyer and gives the option to negotiate further, or cancel the transaction if no agreement is reached.

Inspection Contingency - Typically 7 to 12 days

Financing Contingency - Typically 14 to 17 days

Appraisal Contingency - Typically 14 to 17 days

Shorter contingency periods makes your offer stronger & shows how serious you are as buyers

Need a home warranty? Seller rent back?

Слайд 31Earnest Money Deposit

1-3% of purchase price is typical for this area

A

higher EMD shows you are serious buyers and could make the sellers consider your offer more

To be submitted to escrow within 3 business days of acceptance – include copy with offer

The check is cashed, held at escrow & applied to your down payment at closing

Refunded if you cancel as a result of a contingency

Could be in jeopardy if you cancel after you’ve removed all contingencies

To be submitted to escrow within 3 business days of acceptance – include copy with offer

The check is cashed, held at escrow & applied to your down payment at closing

Refunded if you cancel as a result of a contingency

Could be in jeopardy if you cancel after you’ve removed all contingencies

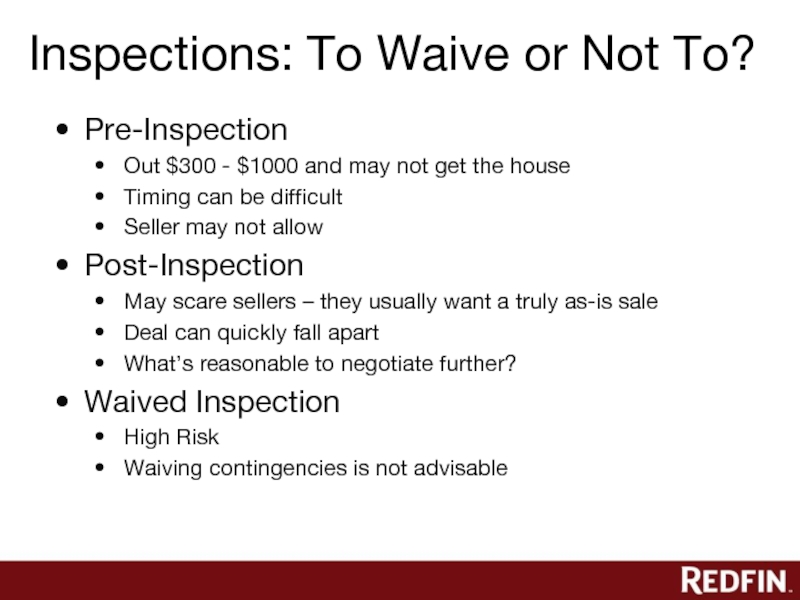

Слайд 32Inspections: To Waive or Not To?

Pre-Inspection

Out $300 - $1000 and may

not get the house

Timing can be difficult

Seller may not allow

Post-Inspection

May scare sellers – they usually want a truly as-is sale

Deal can quickly fall apart

What’s reasonable to negotiate further?

Waived Inspection

High Risk

Waiving contingencies is not advisable

Timing can be difficult

Seller may not allow

Post-Inspection

May scare sellers – they usually want a truly as-is sale

Deal can quickly fall apart

What’s reasonable to negotiate further?

Waived Inspection

High Risk

Waiving contingencies is not advisable

Слайд 33Writing a Winning Offer

Use a Redfin Preferred Lender

*In no way does

Redfin benefit financially from recommending lenders – we just think they’re great lenders!

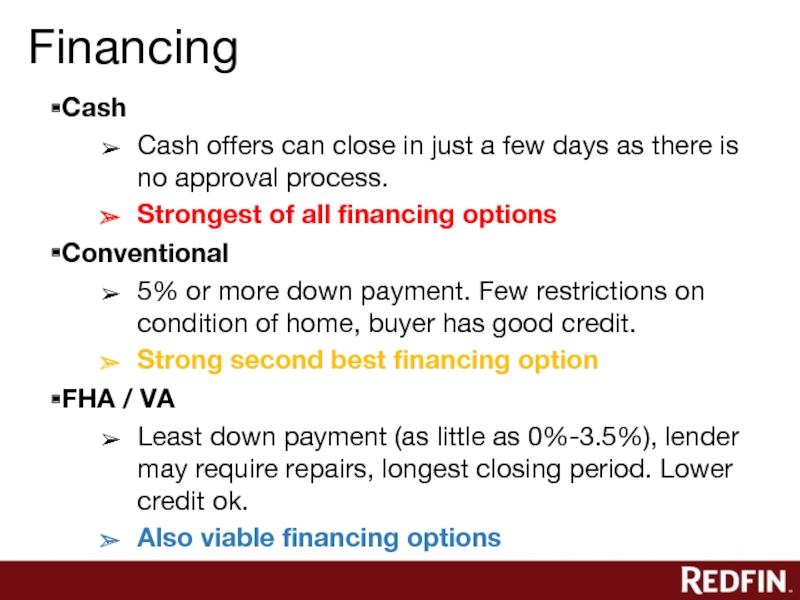

Слайд 34Financing

Cash

Cash offers can close in just a few days as there

is no approval process.

Strongest of all financing options

Conventional

5% or more down payment. Few restrictions on condition of home, buyer has good credit.

Strong second best financing option

FHA / VA

Least down payment (as little as 0%-3.5%), lender may require repairs, longest closing period. Lower credit ok.

Also viable financing options

Strongest of all financing options

Conventional

5% or more down payment. Few restrictions on condition of home, buyer has good credit.

Strong second best financing option

FHA / VA

Least down payment (as little as 0%-3.5%), lender may require repairs, longest closing period. Lower credit ok.

Also viable financing options

Слайд 35Writing a Winning Offer

Financing (continued)…

Making the seller comfortable with your ability

to purchase their property is key to getting your financed offer accepted.

Present a Solid Pre-Approval

Get a Loan Commitment – this will set you ahead of almost all other offers

Show the maximum amount you qualify for

List your FICO scores, DTI’s, etc. if possible

Use a Lender with Local Presence & Expertise

Easy to contact and part of our team

Offer to have lender speak directly to Listing Agent (LA) and/or seller

Present a Solid Pre-Approval

Get a Loan Commitment – this will set you ahead of almost all other offers

Show the maximum amount you qualify for

List your FICO scores, DTI’s, etc. if possible

Use a Lender with Local Presence & Expertise

Easy to contact and part of our team

Offer to have lender speak directly to Listing Agent (LA) and/or seller

Слайд 36Writing a Winning Offer

Personal Touch

Including a short letter to the seller

and a picture may help the seller connect and consider your offer.

Include a bit about you, your family, your profession.

Comment on the things you liked about the seller’s home.

Send your agent a family photo to include.

Won’t help with a bank owned properties or investor sellers

Include a bit about you, your family, your profession.

Comment on the things you liked about the seller’s home.

Send your agent a family photo to include.

Won’t help with a bank owned properties or investor sellers

Слайд 37Writing a Winning Offer

Closing & Possession

Closing - Chat with your lender

and see how quick they can close. Flexibility with closing can make a huge difference

Take Possession

At closing or does the seller need a Rent Back?

The seller may needs to stay longer but want to close sooner to have access to the funds

Seller pays buyers PITI while occupying the home after settlement

Deposit & Rent is held at escrow upon closing

Usually a max of 30 days – anything more requires lender approval

Take Possession

At closing or does the seller need a Rent Back?

The seller may needs to stay longer but want to close sooner to have access to the funds

Seller pays buyers PITI while occupying the home after settlement

Deposit & Rent is held at escrow upon closing

Usually a max of 30 days – anything more requires lender approval

Слайд 38How Redfin Helps

Redfin agents close more deals than an average agent,

we know the market and how to get the job done.

Help determine market price

CMA, trends and stats

Understand the listing agent’s negotiation style

Average discount, market time and offer process

Established relationships with listing agents

We know what questions to ask, what to say, when to say it

Write crisp, clean offer quickly

Docusign, electronic offer process

Team structure allows agent to focus on writing your offer

Help determine market price

CMA, trends and stats

Understand the listing agent’s negotiation style

Average discount, market time and offer process

Established relationships with listing agents

We know what questions to ask, what to say, when to say it

Write crisp, clean offer quickly

Docusign, electronic offer process

Team structure allows agent to focus on writing your offer

Слайд 40Steps After Mutual Acceptance (Binding)

Earnest money deposit – usually about 1%,

within 3 days

Inspection – approximately $400 - $600, depending on size

Other inspections – sewer scope, well, septic, stucco, pool, radon, mold, tree, termite, etc.

Loan application – 5 days or less

Title review

Appraisal

Loan approval

Other Contingencies

Walk through

Closing

Receive your keys!

Inspection – approximately $400 - $600, depending on size

Other inspections – sewer scope, well, septic, stucco, pool, radon, mold, tree, termite, etc.

Loan application – 5 days or less

Title review

Appraisal

Loan approval

Other Contingencies

Walk through

Closing

Receive your keys!

Слайд 41What are Contingencies?

This means the seller has accepted an offer on

the property, but success may still depend on passing a home inspection or getting financing.

Other types:

Appraisal – Performed in conjunction with financing

Financing

Termite

Other

Other types:

Appraisal – Performed in conjunction with financing

Financing

Termite

Other

Слайд 42What is Escrow?

Escrow is a third party intermediary that represents neither

the buyer nor the seller.

What do they do?

Hold the earnest money

Arrange for payoff of any liens (seller’s mortgage, utilities, etc.)

Coordinate the signing appointments for all parties

Receive and disburse funds for closing

Arrange to notify county offices to change ownership

What do they do?

Hold the earnest money

Arrange for payoff of any liens (seller’s mortgage, utilities, etc.)

Coordinate the signing appointments for all parties

Receive and disburse funds for closing

Arrange to notify county offices to change ownership

Слайд 43Title Companies

Prepares the final documents, including the HUD-1

Examines and clears the

title to the property

Records the deed, mortgage and any other recordable instruments

Issues title insurance to the lender and the buyer

Records the deed, mortgage and any other recordable instruments

Issues title insurance to the lender and the buyer

Слайд 45Signing and Closing

A few days before closing you will sign your

closing documents and have a walk through.

On closing day, you’ll probably get your keys at about 5pm.

On closing day, you’ll probably get your keys at about 5pm.

Слайд 47We’re on your side

Agents paid on your satisfaction

Double your exposure

Premium

placement on Redfin

Zillow, Trulia, Craigslist and Realtor

1.5% listing fee

Professional photos

Beautiful flyers

Zillow, Trulia, Craigslist and Realtor

1.5% listing fee

Professional photos

Beautiful flyers

Better Service, Lower Fees

Слайд 49So What Now?

Make sure it’s the right time for you

Start

browsing online

Check out our Home Buying Guide

Find the right agent

Look for a local lender and get pre-approved

Start seeing homes in person

Make an offer & close the deal

Check out our Home Buying Guide

Find the right agent

Look for a local lender and get pre-approved

Start seeing homes in person

Make an offer & close the deal

Слайд 50Thanks for Coming!

Questions? Get in touch:

Danielle Coats danielle.coats@redfin.com

Check out our upcoming classes:

http://www.redfin.com/events