- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Real Estate Trends and Outlook презентация

Содержание

- 2. Mel Watt Federal Housing Finance Agency (FHFA) Director

- 3. Real Estate Trends and Outlook Lawrence Yun,

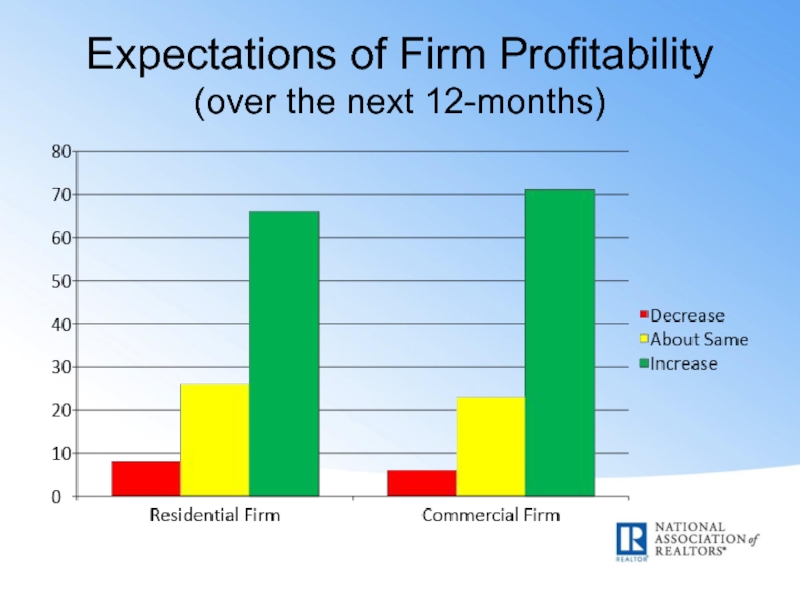

- 4. Expectations of Firm Profitability (over the next 12-months)

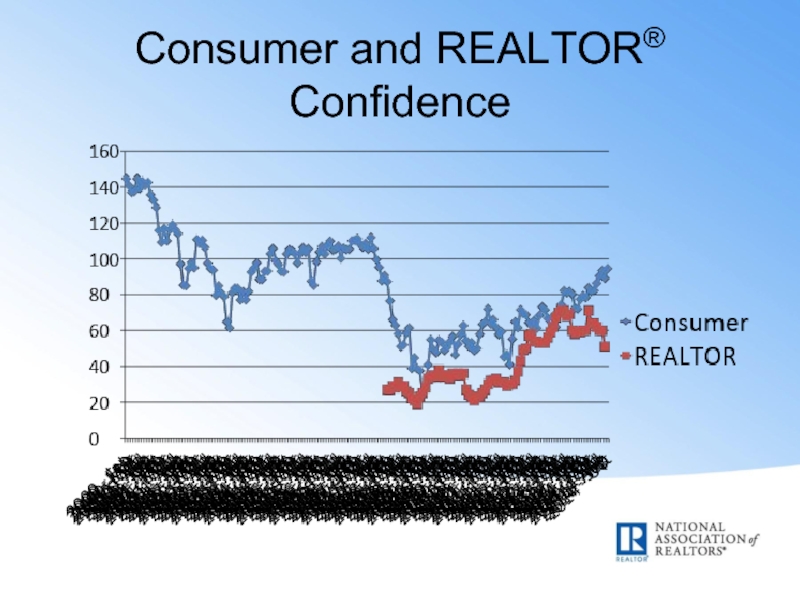

- 5. Consumer and REALTOR® Confidence

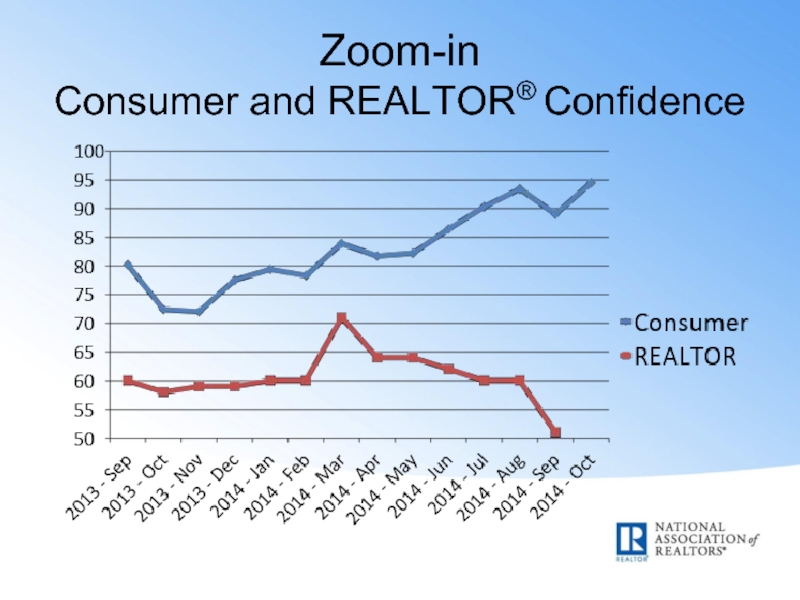

- 6. Zoom-in Consumer and REALTOR® Confidence

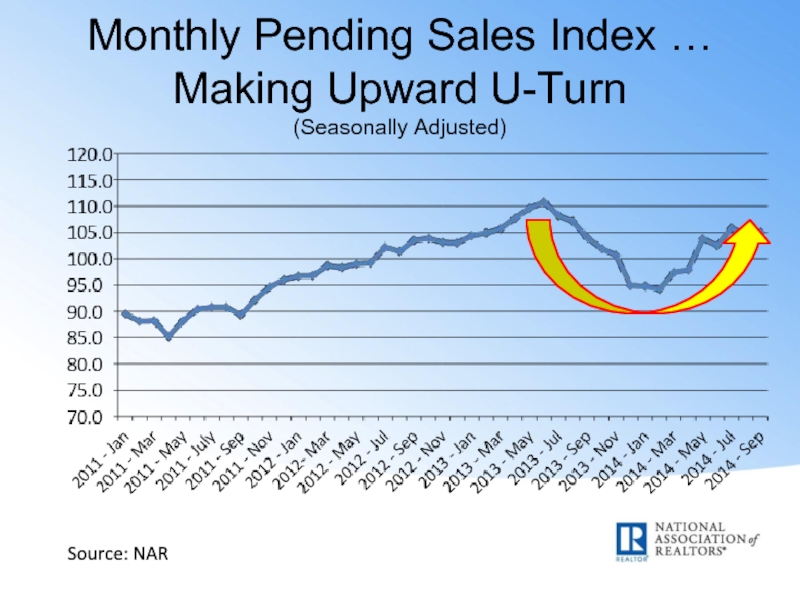

- 7. Monthly Pending Sales Index … Making Upward U-Turn (Seasonally Adjusted) Source: NAR

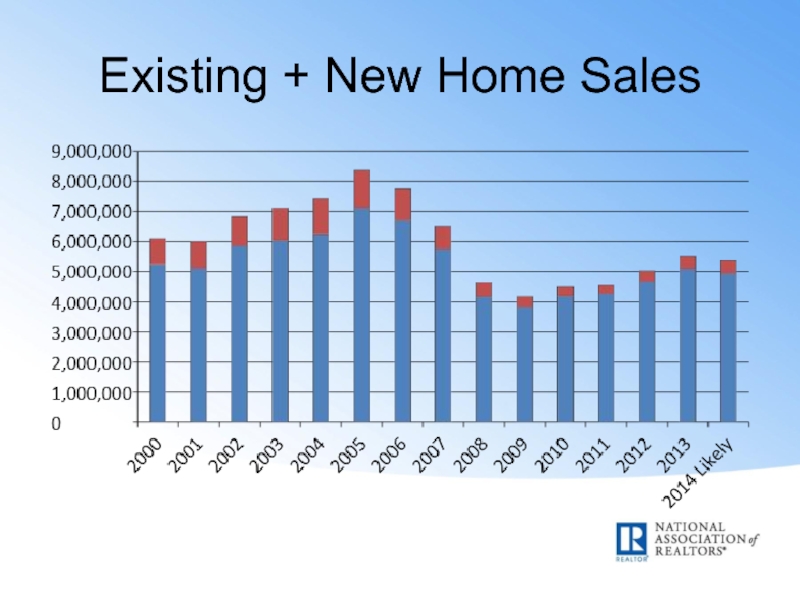

- 8. Existing + New Home Sales

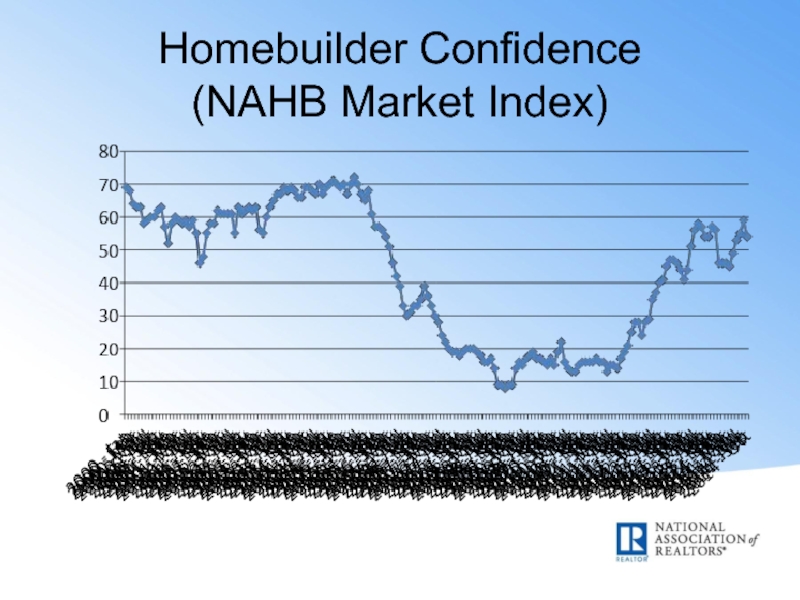

- 9. Homebuilder Confidence (NAHB Market Index)

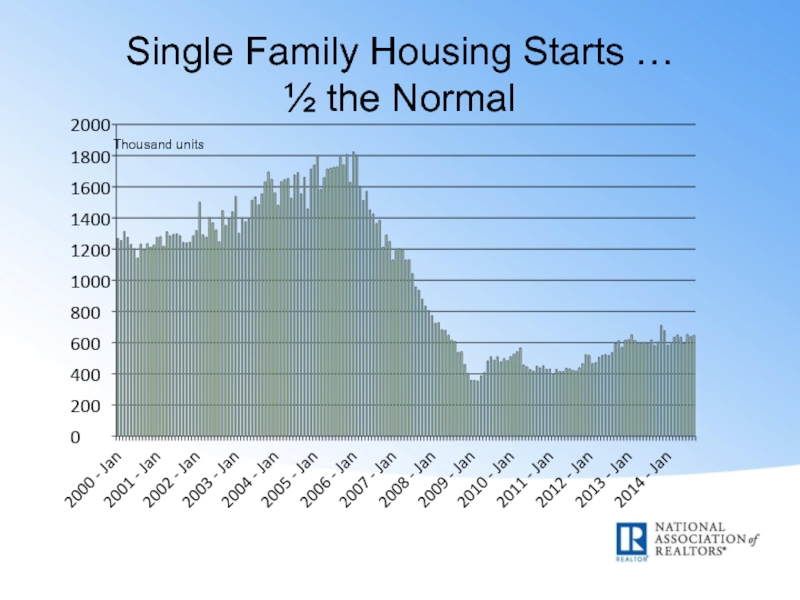

- 10. Single Family Housing Starts … ½ the Normal Thousand units

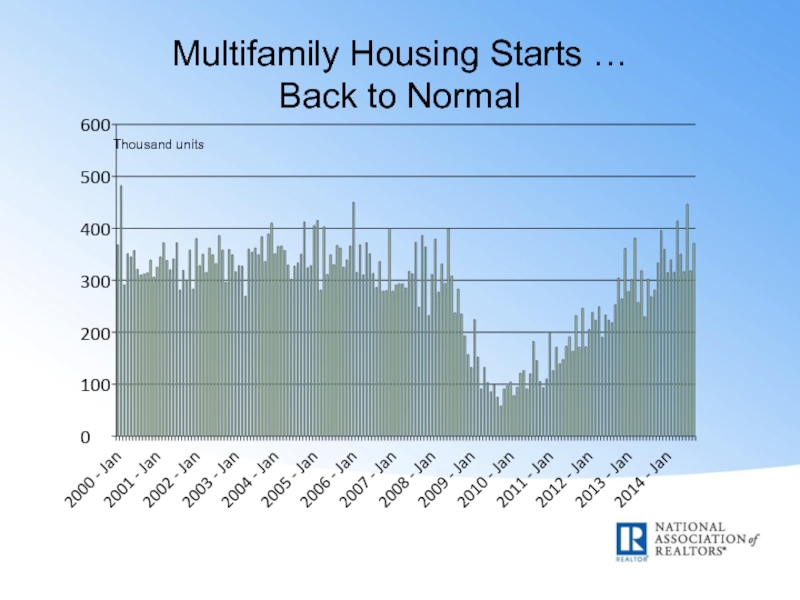

- 11. Multifamily Housing Starts … Back to Normal Thousand units

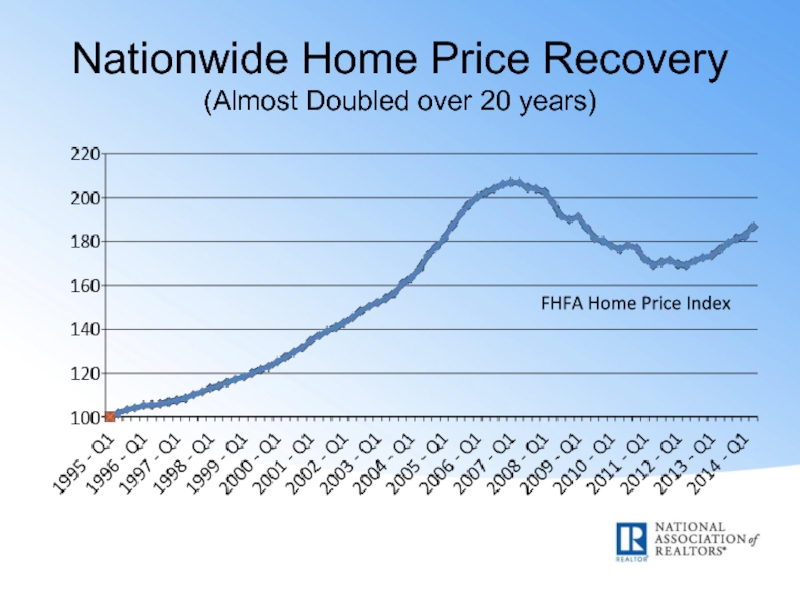

- 12. Nationwide Home Price Recovery (Almost Doubled over 20 years) FHFA Home Price Index

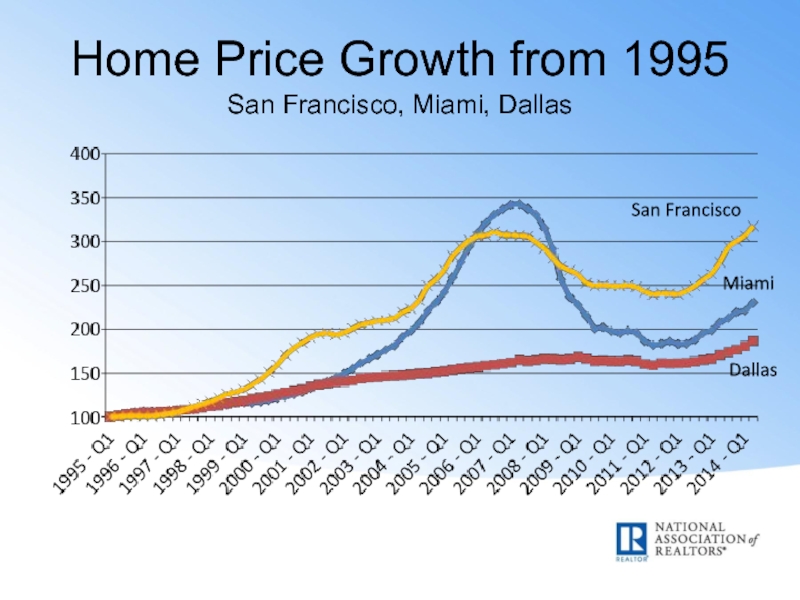

- 13. Home Price Growth from 1995 San Francisco, Miami, Dallas San Francisco Miami Dallas

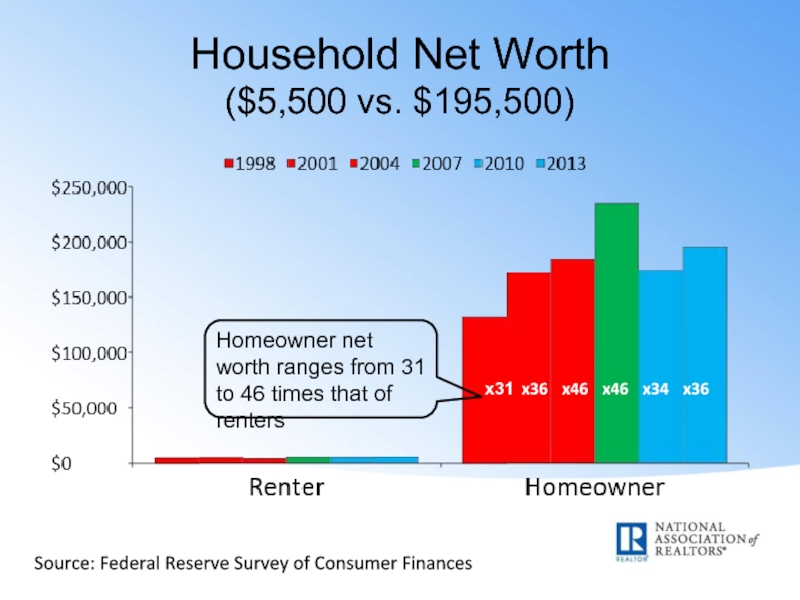

- 14. Household Net Worth ($5,500 vs. $195,500) x31

- 15. From 2010 to Today Homeowners Recovering Wealth

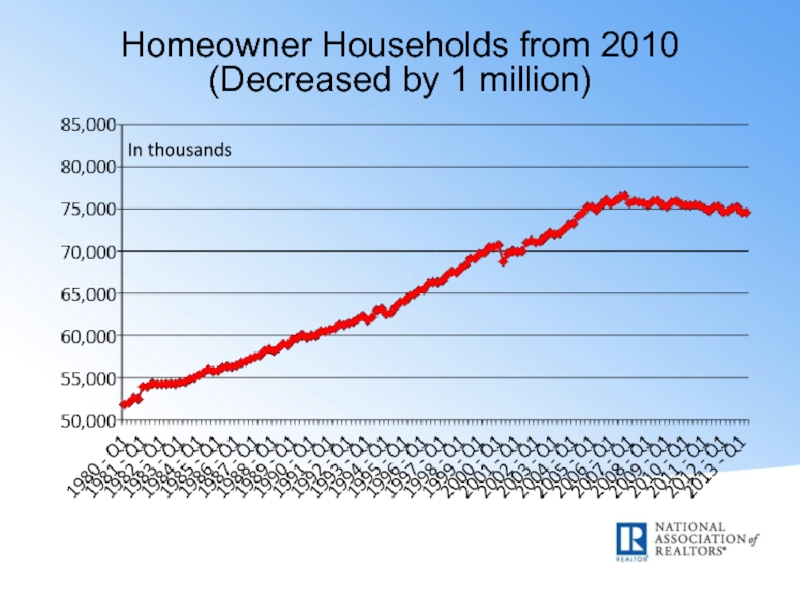

- 16. Homeowner Households from 2010 (Decreased by 1 million) In thousands

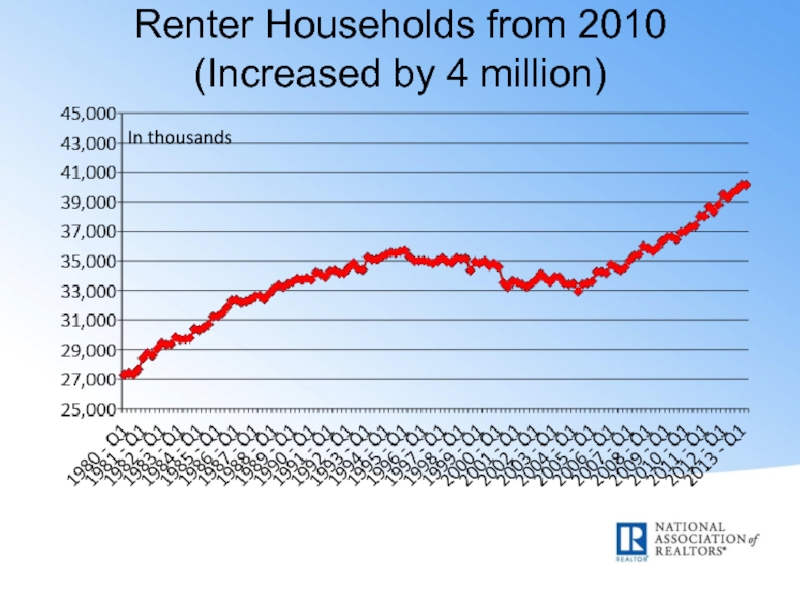

- 17. Renter Households from 2010 (Increased by 4 million) In thousands

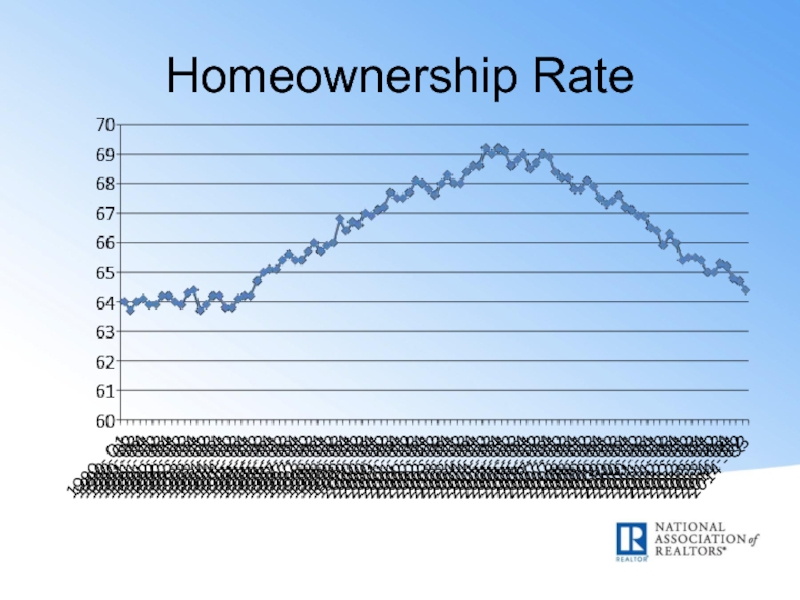

- 18. Homeownership Rate

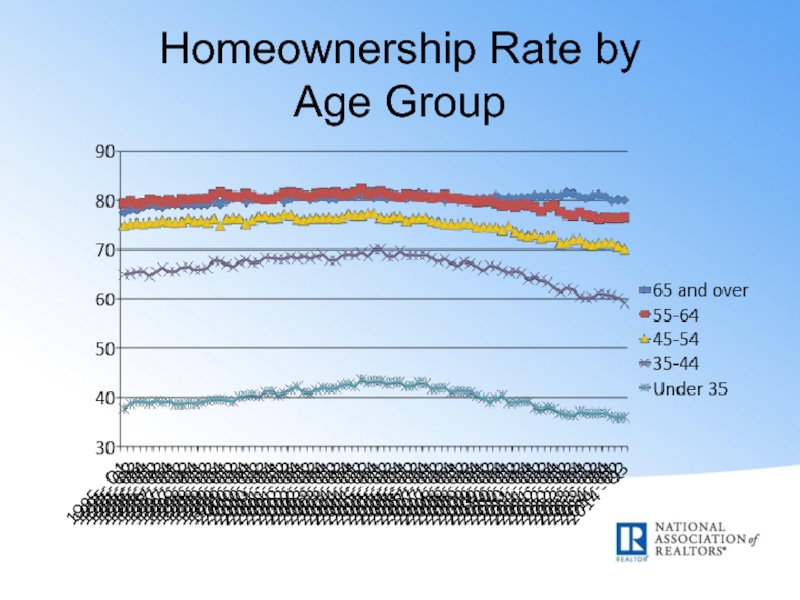

- 19. Homeownership Rate by Age Group

- 20. Harvard Elderly Housing Study One in Five

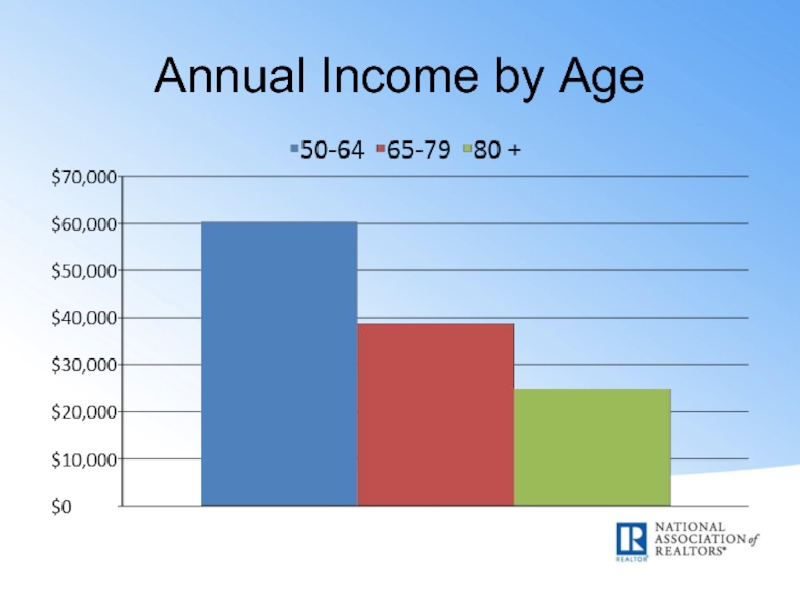

- 21. Annual Income by Age

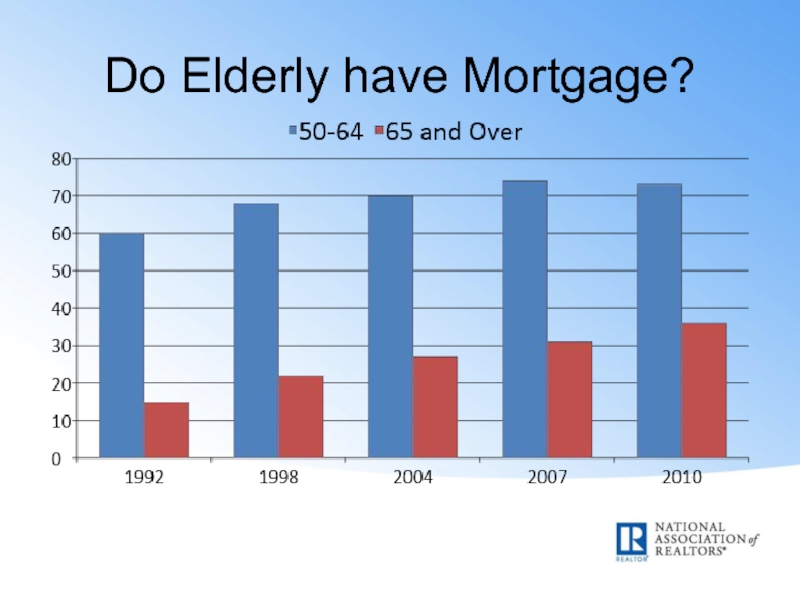

- 22. Do Elderly have Mortgage?

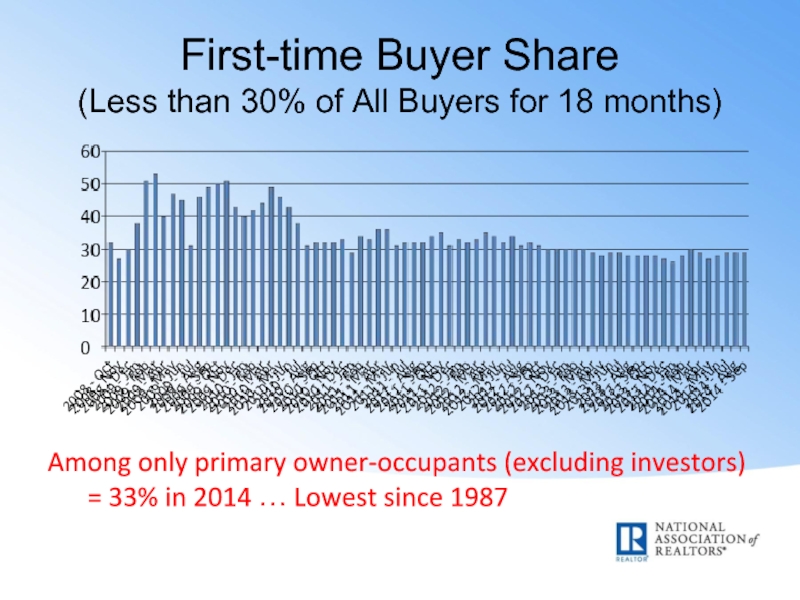

- 23. First-time Buyer Share (Less than 30%

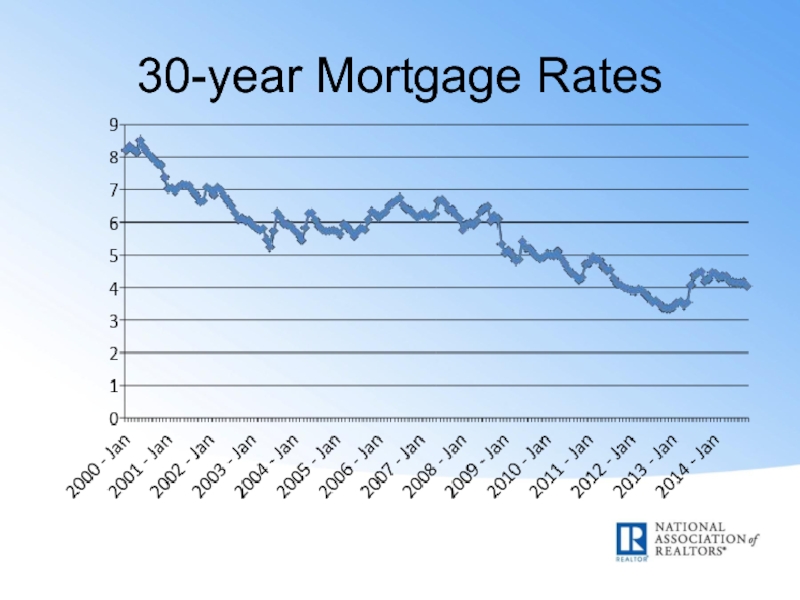

- 24. 30-year Mortgage Rates

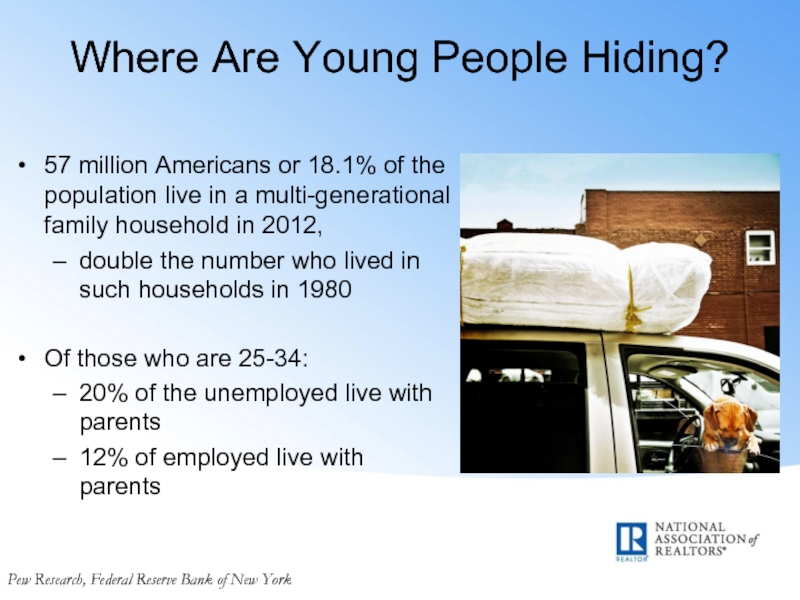

- 25. Where Are Young People Hiding? 57 million

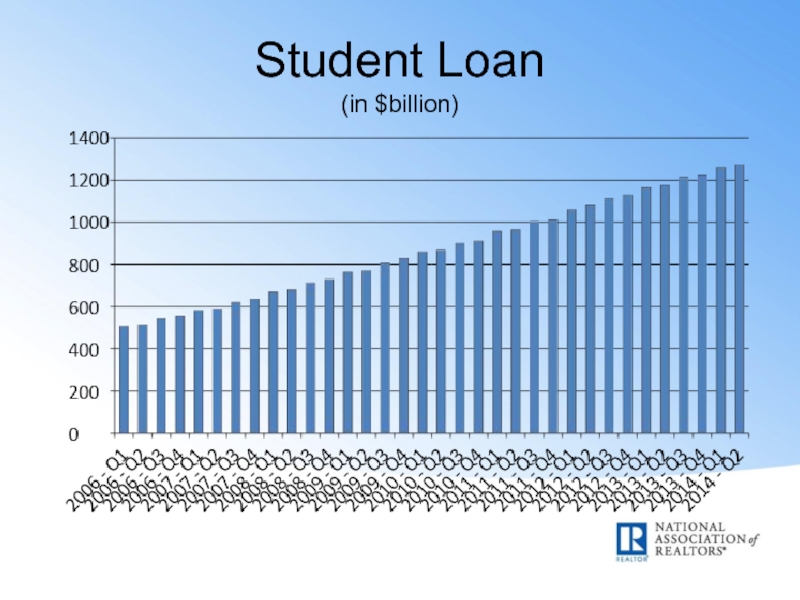

- 26. Student Loan (in $billion)

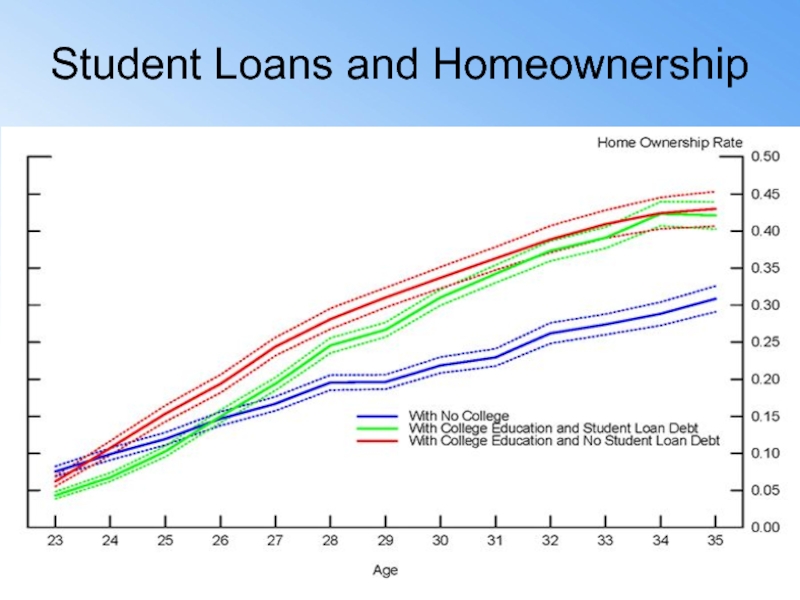

- 27. Student Loans and Homeownership

- 28. Desire of Gen Y to Buy a

- 29. Opening the Credit Box FICO New Method

- 30. 10 best cities for millennials

- 31. Millennial Housing Demand Returns Austin Dallas-Ft.

- 32. The Economist – July 19, 2014

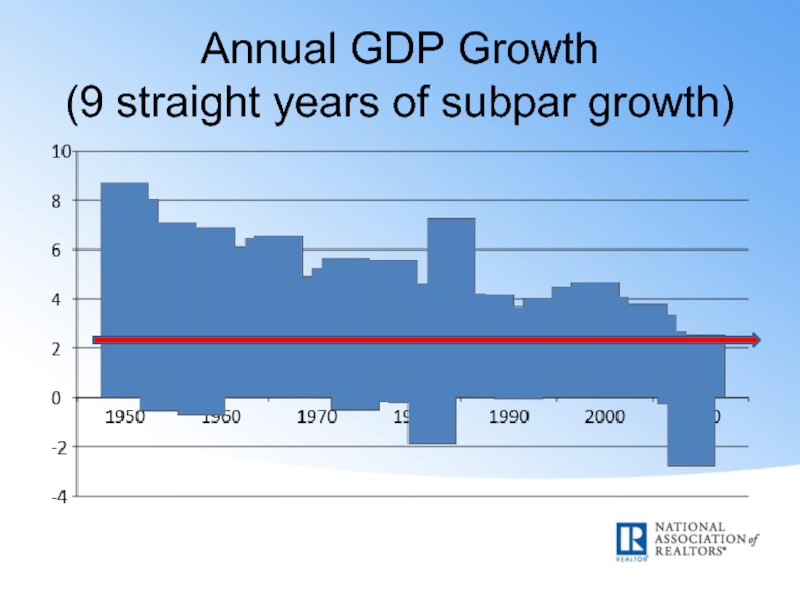

- 33. Annual GDP Growth (9 straight years of subpar growth)

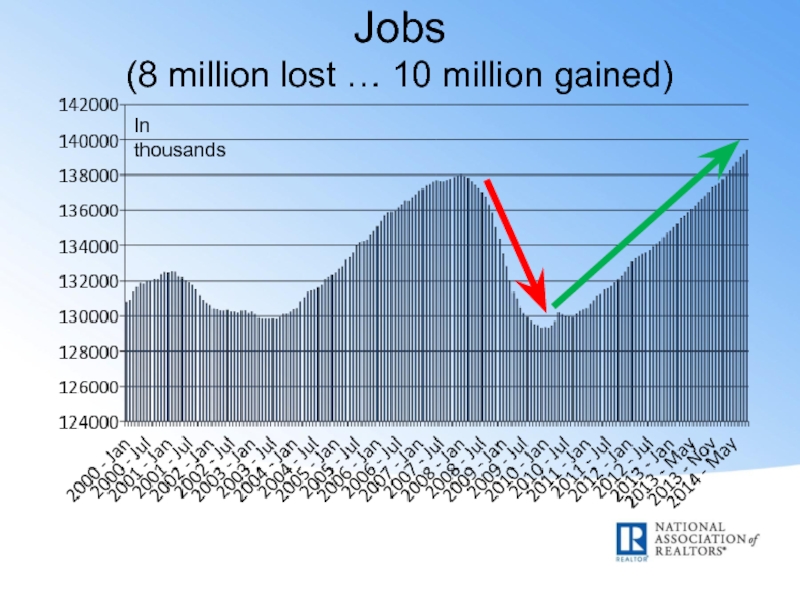

- 34. Jobs (8 million lost … 10 million gained) In thousands

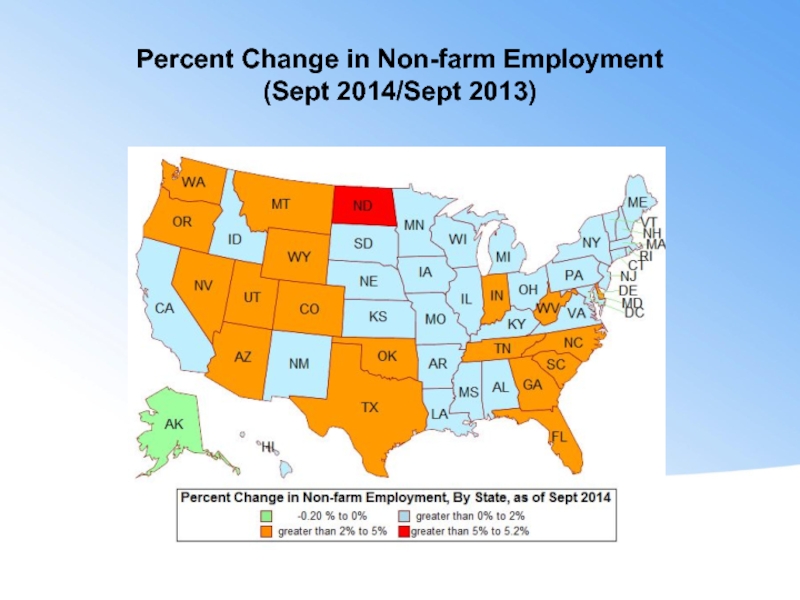

- 35. Percent Change in Non-farm Employment (Sept 2014/Sept 2013)

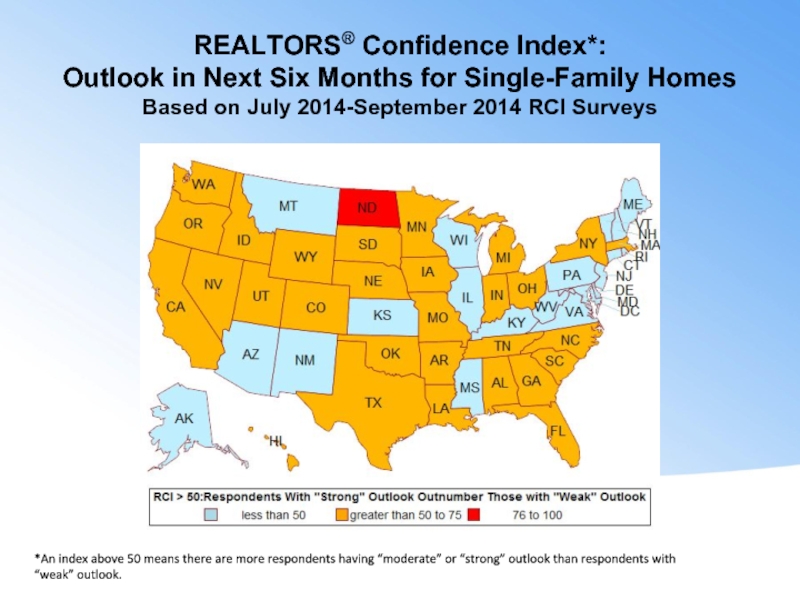

- 36. REALTORS® Confidence Index*: Outlook in

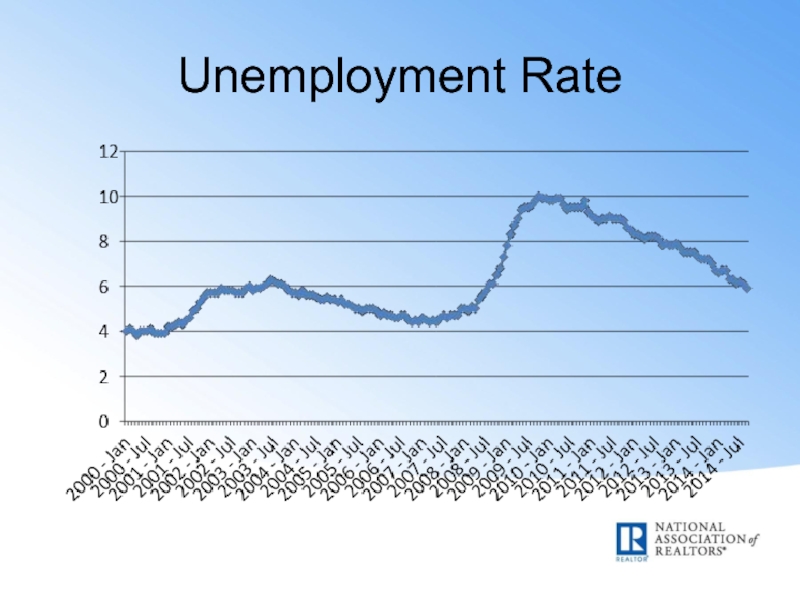

- 37. Unemployment Rate

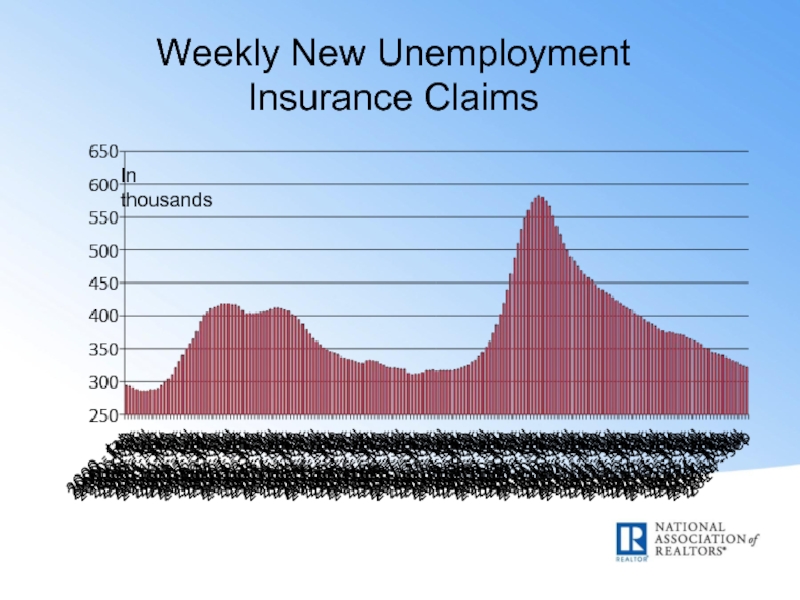

- 38. Weekly New Unemployment Insurance Claims In thousands

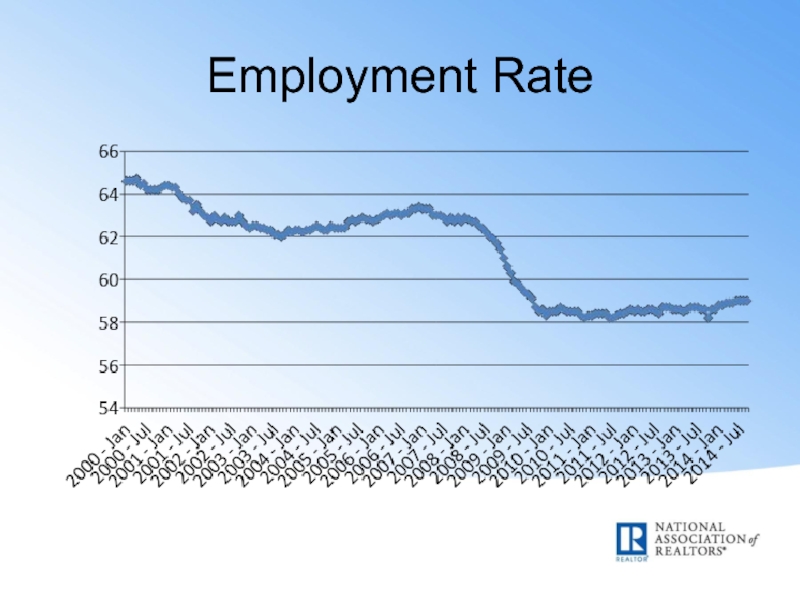

- 39. Employment Rate

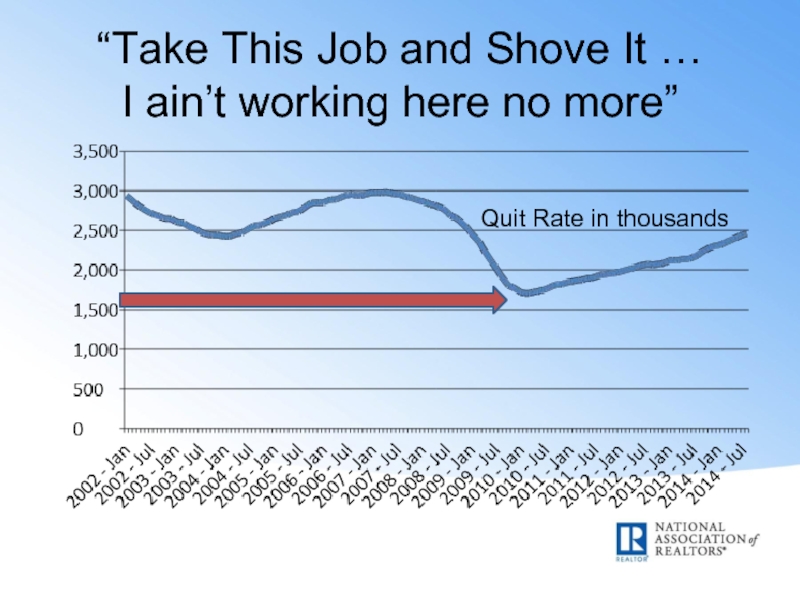

- 40. “Take This Job and Shove It …

- 41. Monetary Policy by Federal Reserve (zero rate policy for 6 years!) %

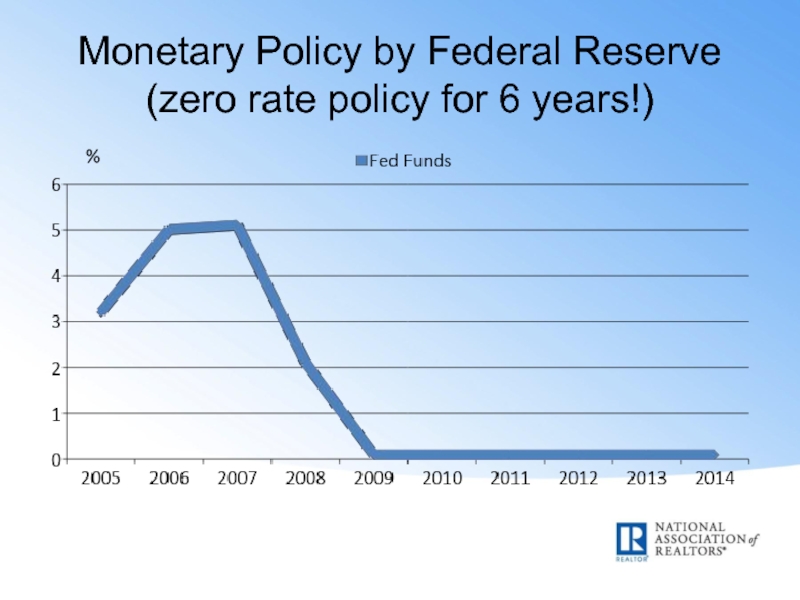

- 42. Non-worrisome CPI Inflation – Yet COLA of 1.7% in 2015

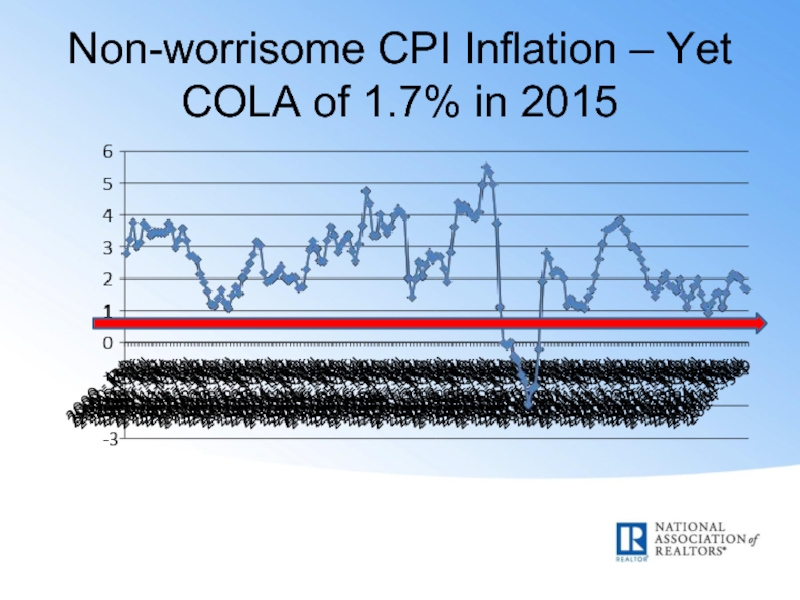

- 43. Rising Renters’ and Homeowners’ Rent Growth (Above 3%)

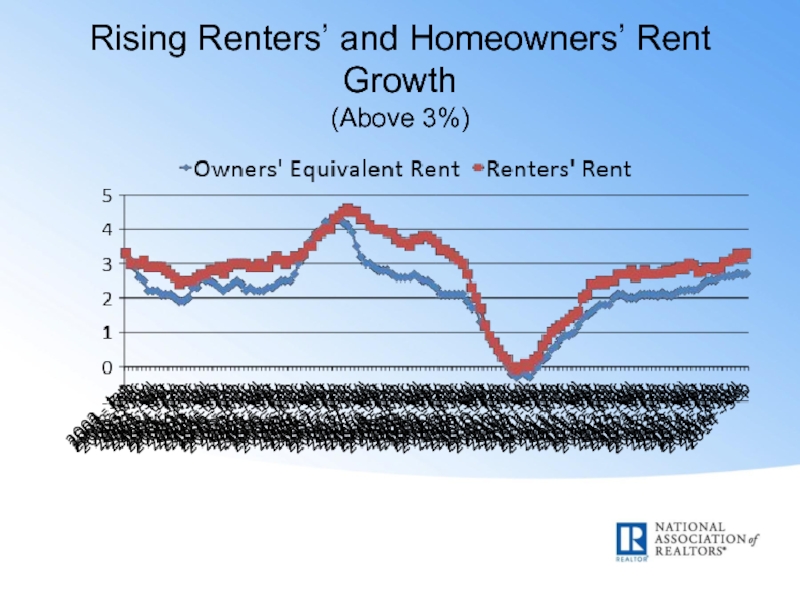

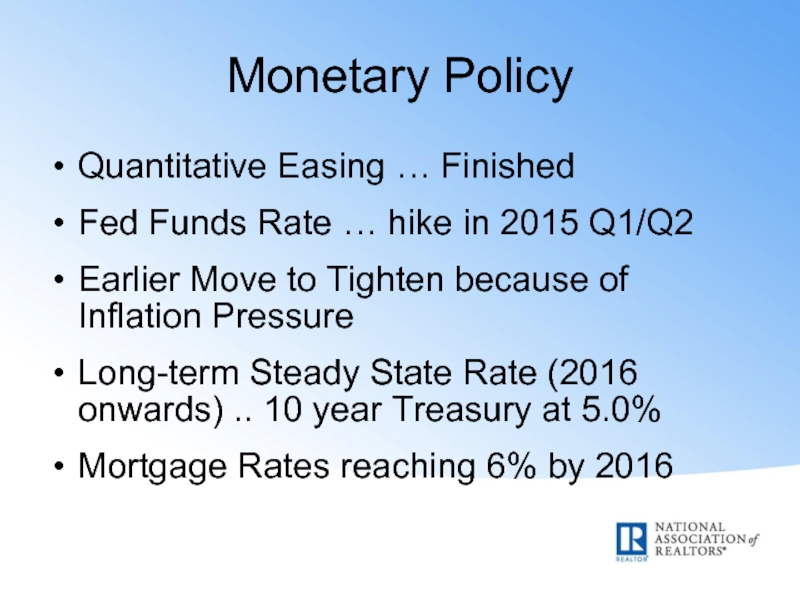

- 44. Monetary Policy Quantitative Easing … Finished Fed

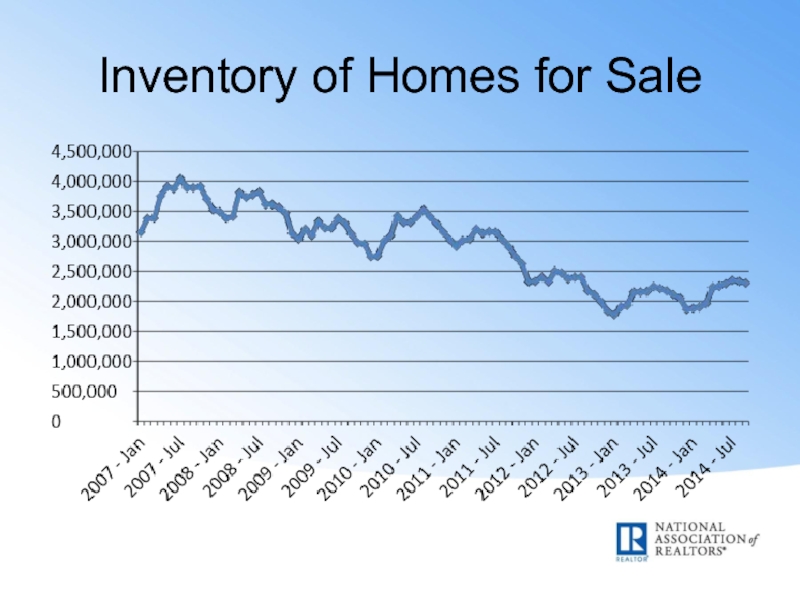

- 45. Inventory of Homes for Sale

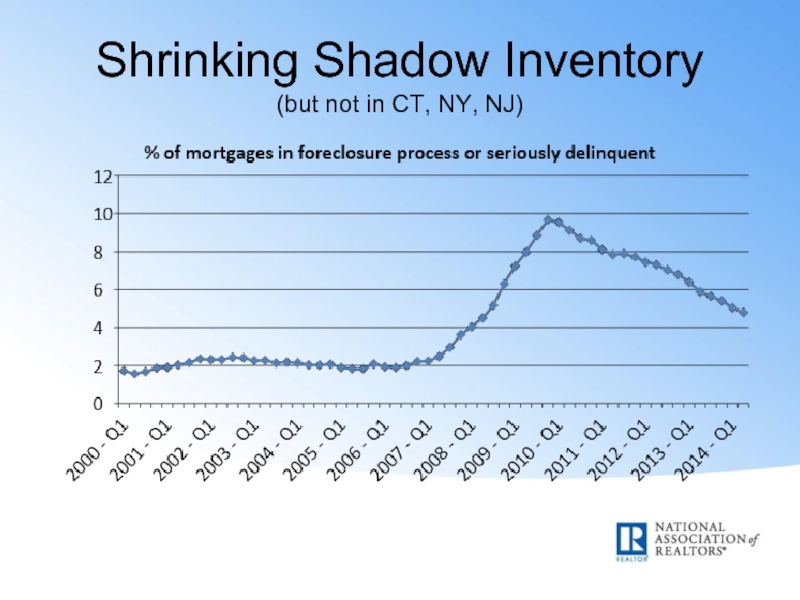

- 46. Shrinking Shadow Inventory (but not in CT, NY, NJ)

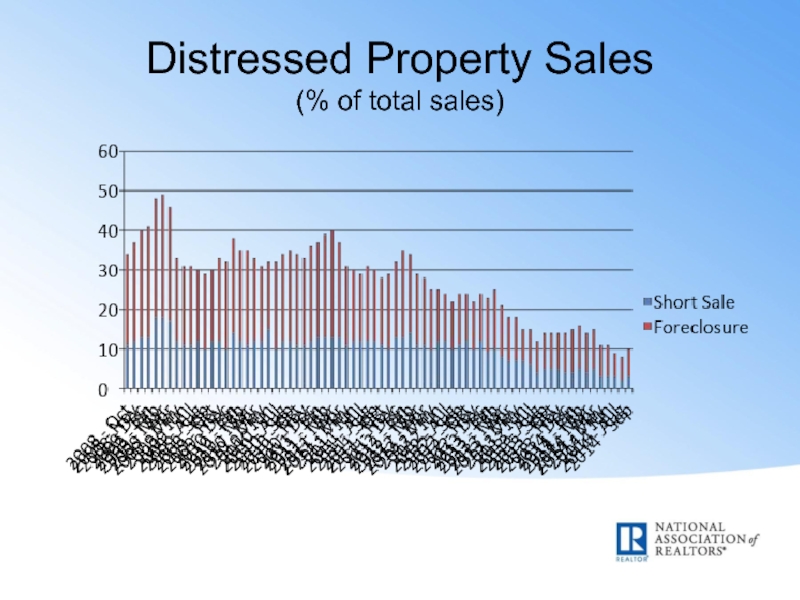

- 47. Distressed Property Sales (% of total sales)

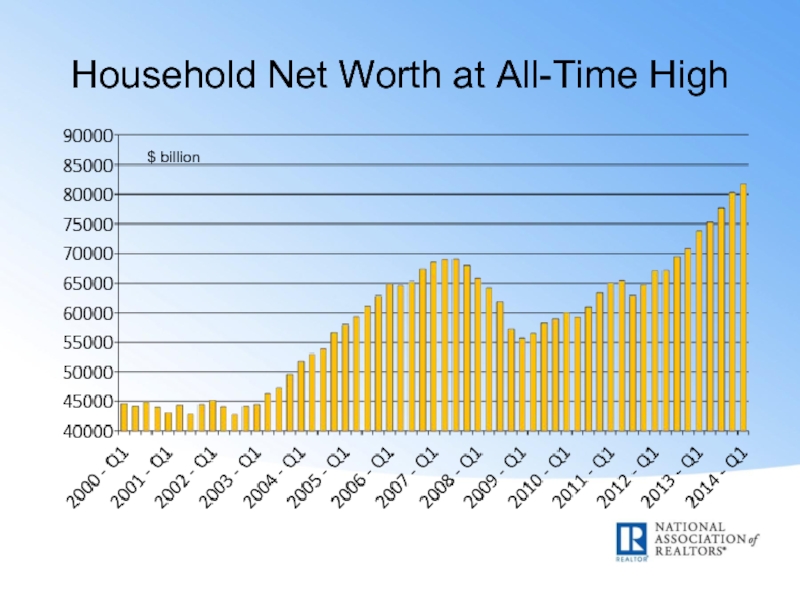

- 48. Household Net Worth at All-Time High $ billion

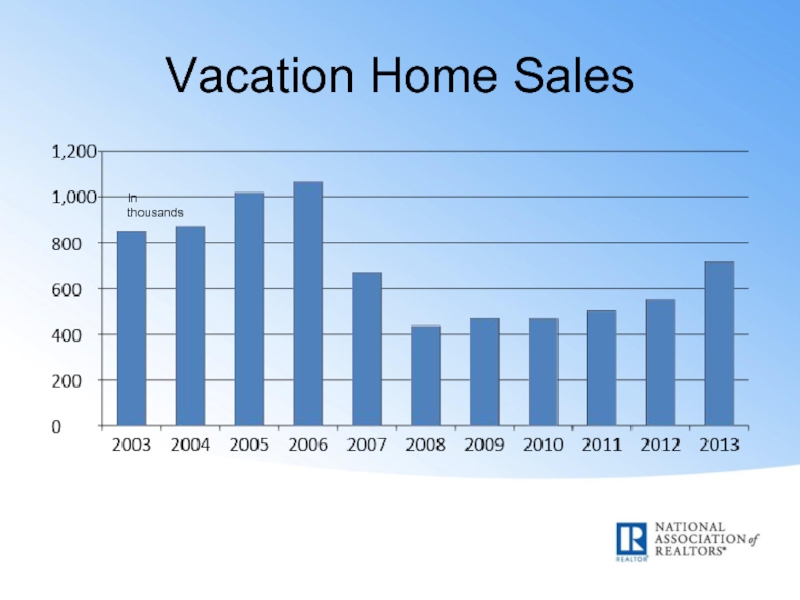

- 49. Vacation Home Sales In thousands

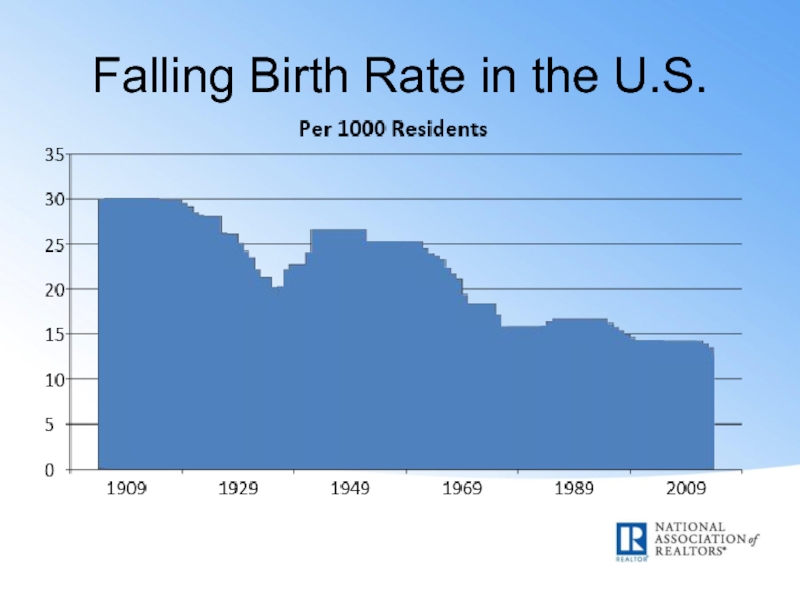

- 50. Falling Birth Rate in the U.S.

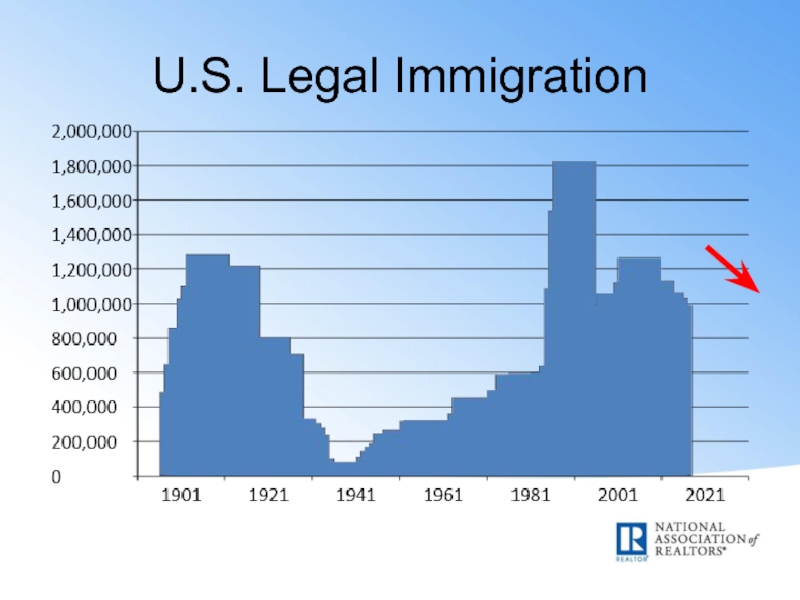

- 51. U.S. Legal Immigration

- 52. Next China? … Mexico + Latin America!

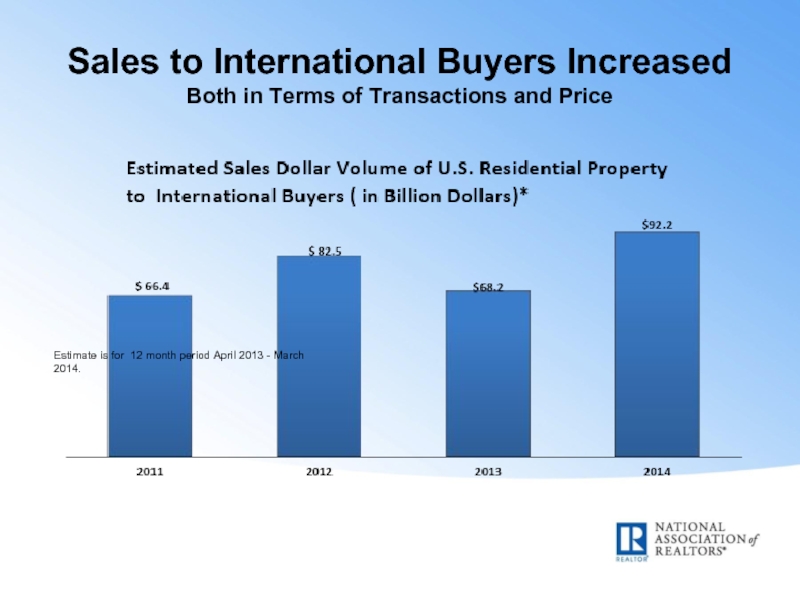

- 53. Sales to International Buyers Increased Both in

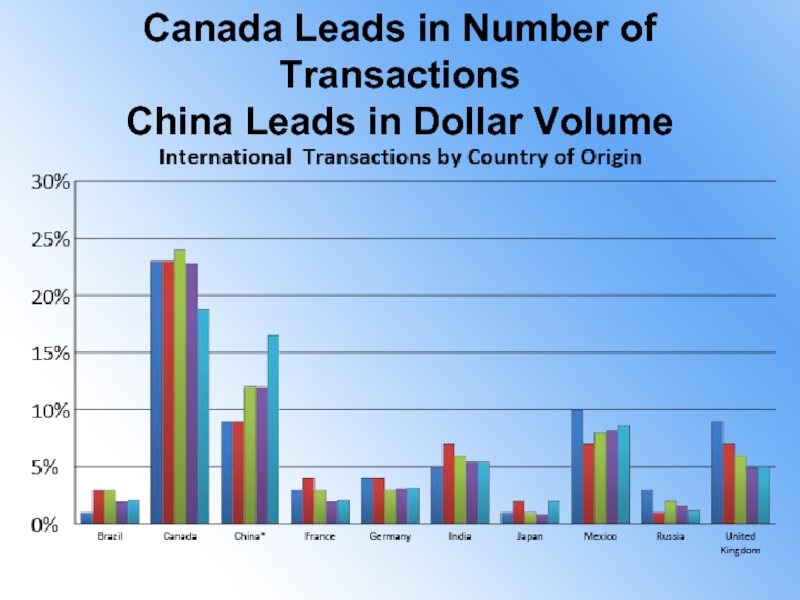

- 54. Canada Leads in Number of Transactions China Leads in Dollar Volume

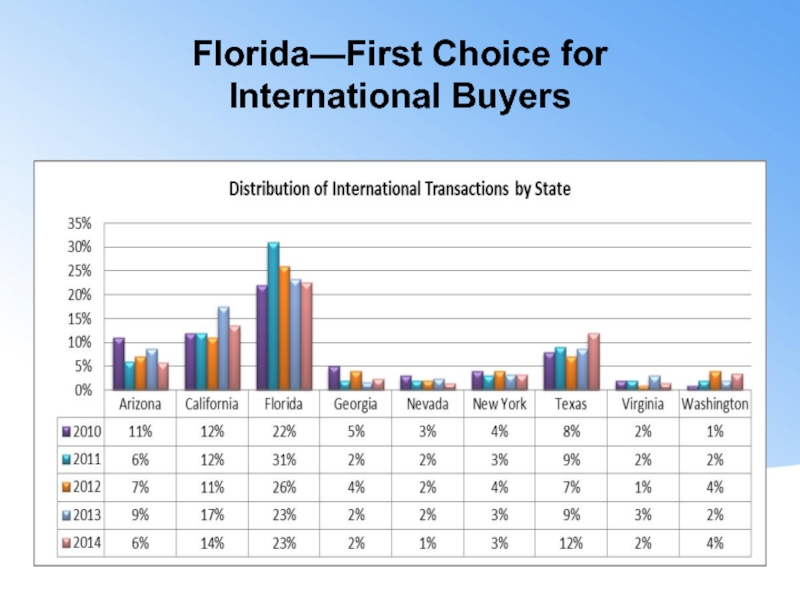

- 55. Florida—First Choice for International Buyers

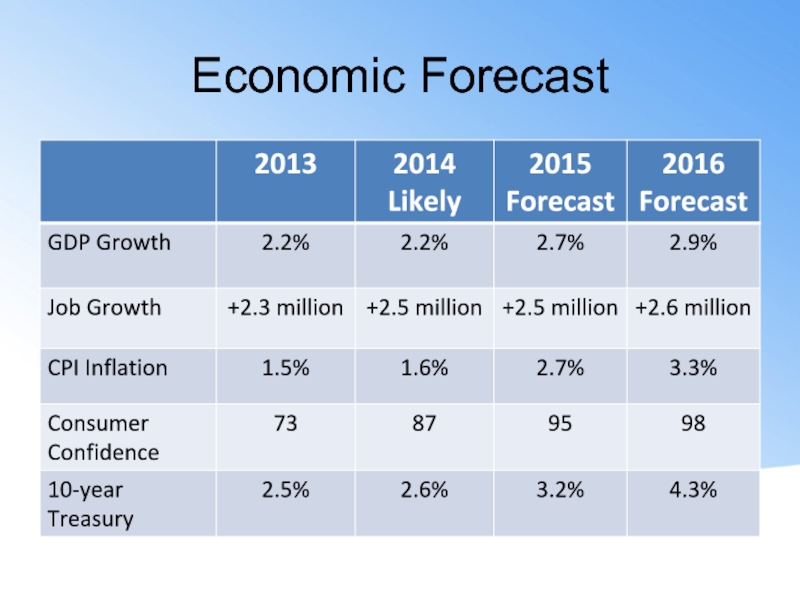

- 56. Economic Forecast

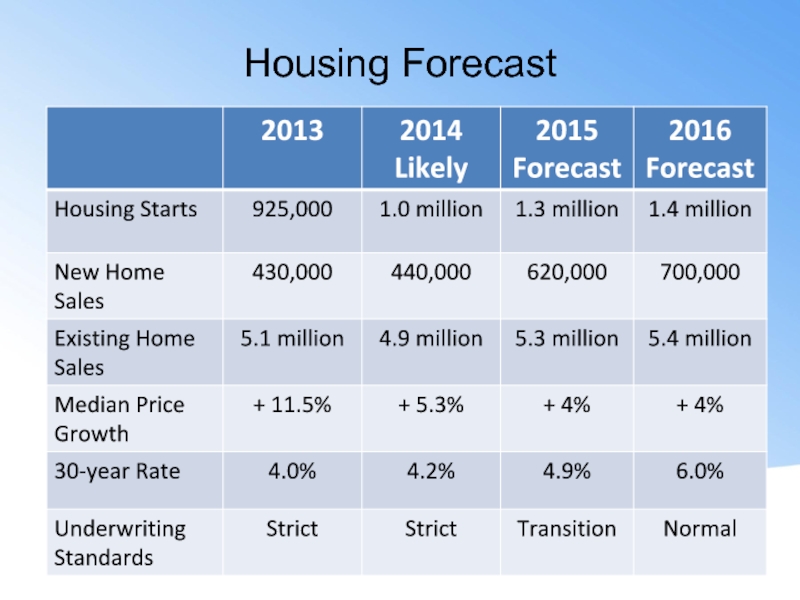

- 57. Housing Forecast

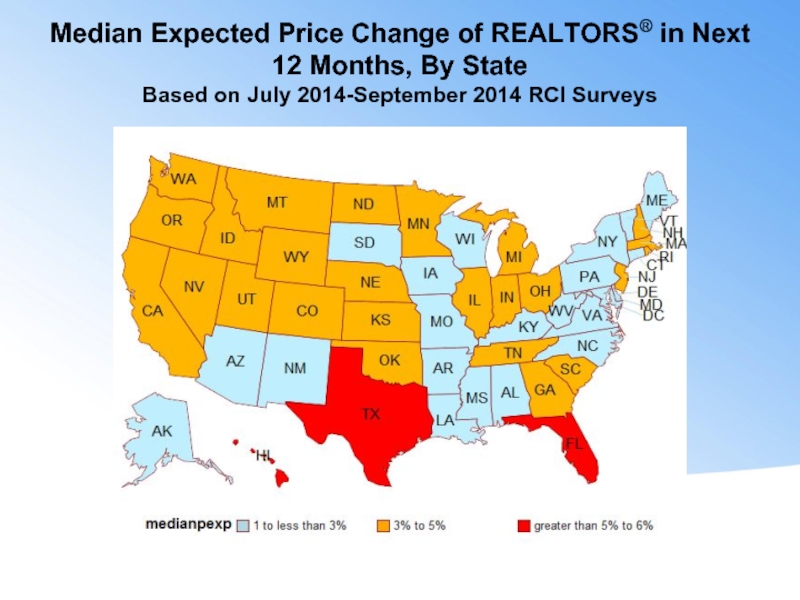

- 58. Median Expected Price Change of

- 59. Let’s Spin the Bottle !

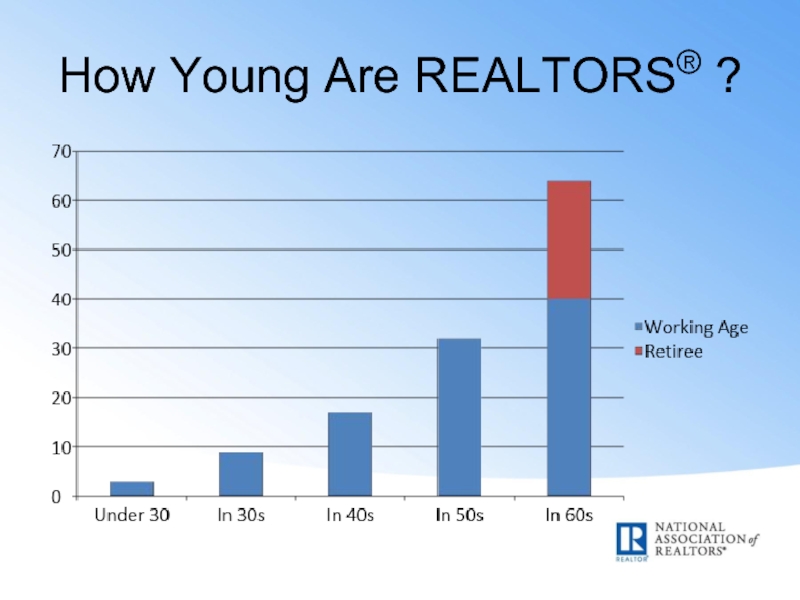

- 60. How Young Are REALTORS® ?

- 61. Spin the Globe … Find the Source of Improving Standard of Living

- 62. When, How, What, Why? British Glorious Revolution

- 63. Participants in Democracy to Protect Property Rights!

Слайд 3Real Estate Trends and Outlook

Lawrence Yun, Ph.D.

Chief Economist

NATIONAL ASSOCIATION of REALTORS®

Presentation

New Orleans, LA

November 7, 2014

Слайд 14Household Net Worth

($5,500 vs. $195,500)

x31

x46

x36

x34

x46

Homeowner net worth ranges from 31 to

x36

Source: Federal Reserve Survey of Consumer Finances

Слайд 15From 2010 to Today

Homeowners

Recovering Wealth for those who bought during the

Accumulating Wealth for those who bought since 2010

Renters

No progress

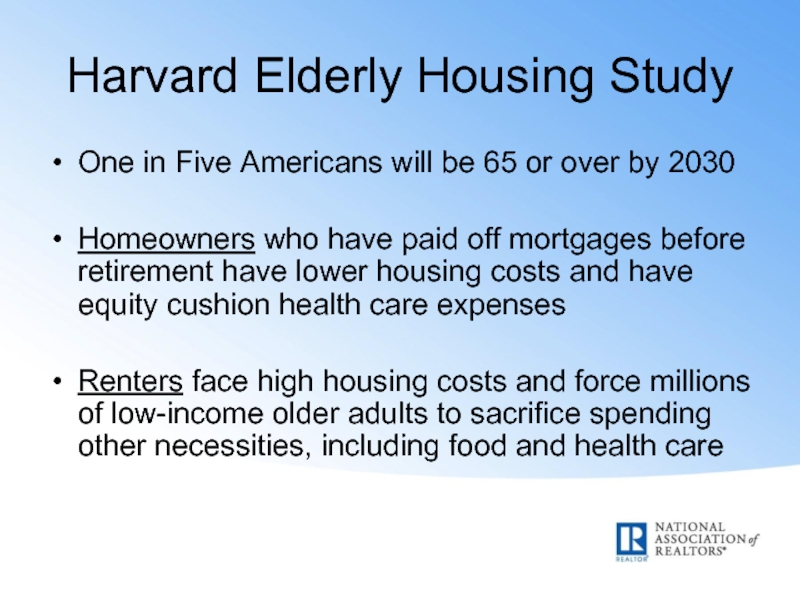

Слайд 20Harvard Elderly Housing Study

One in Five Americans will be 65 or

Homeowners who have paid off mortgages before retirement have lower housing costs and have equity cushion health care expenses

Renters face high housing costs and force millions of low-income older adults to sacrifice spending other necessities, including food and health care

Слайд 23First-time Buyer Share (Less than 30% of All Buyers for 18

Among only primary owner-occupants (excluding investors)

= 33% in 2014 … Lowest since 1987

Слайд 25Where Are Young People Hiding?

57 million Americans or 18.1% of the

double the number who lived in such households in 1980

Of those who are 25-34:

20% of the unemployed live with parents

12% of employed live with parents

Pew Research, Federal Reserve Bank of New York

Слайд 28Desire of Gen Y to Buy a Home?

75% believe home ownership

73% believe ownership is an excellent investment

59% of young renters (18 to 39) believe owning a home makes more sense, but 73% of young renters also believe it would be difficult to get a mortgage today

REALTOR® Education Opportunity

Many young people think 20 percent down payment is needed !

Fannie Mae, 2013 Demand Institute Housing and Community Survey

Слайд 29Opening the Credit Box

FICO New Method

Thank You Director Mel Watt

But, please

Not Yet a Thank You Secretary Julian Castro

FHA premiums need to come down commensurate with falling default rate

Historic low mortgage default rates on recent vintages (2010-2014)

Слайд 30

10 best cities for millennials to buy a home

By MarketWatch

Published: Aug 3,

Слайд 31Millennial Housing Demand Returns

Austin

Dallas-Ft. Worth

Denver

Des Moines

Grand Rapids

Minneapolis

New Orleans

Ogden

Salt Lake City

Seattle-Tacoma

Слайд 36

REALTORS® Confidence Index*:

Outlook in Next Six Months for Single-Family Homes

*An index above 50 means there are more respondents having “moderate” or “strong” outlook than respondents with “weak” outlook.

Слайд 44Monetary Policy

Quantitative Easing … Finished

Fed Funds Rate … hike in 2015

Earlier Move to Tighten because of Inflation Pressure

Long-term Steady State Rate (2016 onwards) .. 10 year Treasury at 5.0%

Mortgage Rates reaching 6% by 2016

Слайд 53Sales to International Buyers Increased

Both in Terms of Transactions and Price

Estimate

Слайд 58

Median Expected Price Change of REALTORS® in Next 12 Months, By

Слайд 62When, How, What, Why?

British Glorious Revolution of 1688

William and Mary

Power not with King but with people via Parliament

No Taxation with Representation

Life, Liberty, and (Acquire) Property

American Revolution of 1776

Power resides not with King but with people

No Taxation with Representation

Life, Liberty, and the Pursuit of Happiness