- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Impact of Budget 2014 on Real Estate презентация

Содержание

- 1. Impact of Budget 2014 on Real Estate

- 2. FDI Investments Built up area for FDI

- 3. Housing for all A sum of 4,000

- 4. REITs Investor perspective on REITs Investors around

- 5. REITs There are five major reasons why

- 6. REITs Easy Exits: REITs are publically traded,

- 7. REITs Proposal on tax pass through status

- 8. Smart Cities Smart cities have become the

- 9. Expressways 37,880 Cr is allotted for the

- 10. Thank You Kin Housing Experience

Слайд 2FDI Investments

Built up area for FDI reduced from 50,000 square metres

to 20,000 square metres and capital from US$ 10 million to US$ 5 million for the development of smart cities.

Will allow less money to flow faster

Smaller projects can now raise money through FDI boosting affordable housing

Projects with a min of 30% of the total project cost allocated to affordable housing will get exemption from minimum built up area and capitalisation requirements, with the condition of three year lock-in.

This will again push a lot of focus on affordable housing which is the need of hour for the country.

Will allow less money to flow faster

Smaller projects can now raise money through FDI boosting affordable housing

Projects with a min of 30% of the total project cost allocated to affordable housing will get exemption from minimum built up area and capitalisation requirements, with the condition of three year lock-in.

This will again push a lot of focus on affordable housing which is the need of hour for the country.

Слайд 3Housing for all

A sum of 4,000 crores has been allocated for

affordable housing by government with a focus on “housing for all” facilities.

Increase in deduction limit on account of interest on loan in respect of self occupied house property from 1.5 to 2 Lakhs.

Increase in investment limit under section 80C of Income Tax act from 1 to 1.5 Lakhs.

Will help buyers with more income in hand encouraging them to invest in real estate

CSR participation which is mandatory for organizations now has a new inclusion in form of slum development

Increase in deduction limit on account of interest on loan in respect of self occupied house property from 1.5 to 2 Lakhs.

Increase in investment limit under section 80C of Income Tax act from 1 to 1.5 Lakhs.

Will help buyers with more income in hand encouraging them to invest in real estate

CSR participation which is mandatory for organizations now has a new inclusion in form of slum development

Слайд 4REITs

Investor perspective on REITs

Investors around the world have recognised real estate

as an asset class that is an essential part of a diversified portfolio.

REITs however are seen as a cost-effective and efficient way to access investment grade real estate in tandem with professional management

According to the draft guidelines, any investor, resident or foreign, can invest in REITs in India. However, initially, until the market develops, it is proposed that the units of the REITs may be offered only to HNIs/institutions.

The minimum capital required to invest in REITs would be Rs 200,000 as according to SEBI, the minimum unit size is Rs 100,000 and one needs to buy atleast two units to invest in REITs

REITs however are seen as a cost-effective and efficient way to access investment grade real estate in tandem with professional management

According to the draft guidelines, any investor, resident or foreign, can invest in REITs in India. However, initially, until the market develops, it is proposed that the units of the REITs may be offered only to HNIs/institutions.

The minimum capital required to invest in REITs would be Rs 200,000 as according to SEBI, the minimum unit size is Rs 100,000 and one needs to buy atleast two units to invest in REITs

Слайд 5REITs

There are five major reasons why an investor should invest in

REIT

Returns: REITs are required to distribute at least 90 per cent of the net income to the unit holders; thus, they offer an advantage over equity stocks where companies may choose not to pay dividends and hence it’s a more consistent form of return

Diversification: REIT has a low correlation with other asset classes, such as equities and bonds due to the fact that real estate earnings do not behave like corporate earnings.

Low correlation provides a better platform for diversification by reducing the volatility of a multi-asset portfolio.

Investment in REIT gives better diversification within the real estate asset class compared to direct investments that are capital intensive in nature. This provides the exposure to invest in different micro-markets that are indifferent phases of the real estate cycle

Returns: REITs are required to distribute at least 90 per cent of the net income to the unit holders; thus, they offer an advantage over equity stocks where companies may choose not to pay dividends and hence it’s a more consistent form of return

Diversification: REIT has a low correlation with other asset classes, such as equities and bonds due to the fact that real estate earnings do not behave like corporate earnings.

Low correlation provides a better platform for diversification by reducing the volatility of a multi-asset portfolio.

Investment in REIT gives better diversification within the real estate asset class compared to direct investments that are capital intensive in nature. This provides the exposure to invest in different micro-markets that are indifferent phases of the real estate cycle

Слайд 6REITs

Easy Exits: REITs are publically traded, therefore provide more advantages in

terms of liquidity compared to direct real estate investment. They also have potential for capital gains if the share price of the REIT rises

Transparency: REITs will be registered and regulated by SEBI, and they will adhere to high governance and information disclosure standards

Professionally managed: REITs are professionally managed and have access to a large capital base, which gives investors potential benefits, such as economies of scale, professional market knowledge and access to high value properties

Transparency: REITs will be registered and regulated by SEBI, and they will adhere to high governance and information disclosure standards

Professionally managed: REITs are professionally managed and have access to a large capital base, which gives investors potential benefits, such as economies of scale, professional market knowledge and access to high value properties

Слайд 7REITs

Proposal on tax pass through status for Real Estate Investment Trusts

(I-REITs) in India.

Currently all assets are funded through banks – This will however allow a lot of investors to participate and fund real estate projects

REITs target completed projects and hence this will lead to faster project completion, and bring-in the much needed transparency.

Currently all assets are funded through banks – This will however allow a lot of investors to participate and fund real estate projects

REITs target completed projects and hence this will lead to faster project completion, and bring-in the much needed transparency.

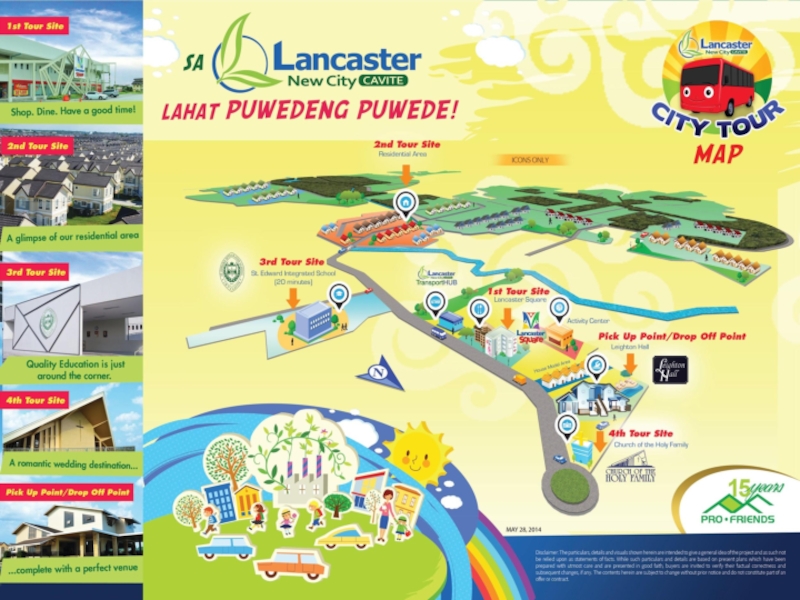

Слайд 8Smart Cities

Smart cities have become the buzz word in India ever

since PM Modi has started talking about it.

Rs 7,060 crore has been sanctioned to develop “100 smart cities”, as satellite towns of larger cities and by modernizing the existing mid-sized cities.

The Amritsar Kolkata Industrial master planning will be completed for the establishments of Industrial smart cities in seven States of India.

Master planning of three new smart cities in the Chennai-Bengaluru Industrial Corridor region, viz., Ponneri in Tamil Nadu, Krishnapatnam in Andhra Pradesh and Tumkur in Karnataka will also be completed.

Rs 7,060 crore has been sanctioned to develop “100 smart cities”, as satellite towns of larger cities and by modernizing the existing mid-sized cities.

The Amritsar Kolkata Industrial master planning will be completed for the establishments of Industrial smart cities in seven States of India.

Master planning of three new smart cities in the Chennai-Bengaluru Industrial Corridor region, viz., Ponneri in Tamil Nadu, Krishnapatnam in Andhra Pradesh and Tumkur in Karnataka will also be completed.

Слайд 9Expressways

37,880 Cr is allotted for the construction of highways and expressways

to NHAI, which includes 3000 Cr proposed in North East.

500 Cr will also be set aside by NHAI for project preparation

North eastern India which hasn’t been the focus of most budgets gets a reasonably bigger share this time

This will help develop the area, increase proximity and improve connectivity

Rs 100 crore provided for setting up a National Industrial Corridor Authority, with its headquarters in Pune.

Plan for the Bengaluru Mumbai Economic corridor (BMFC) and Vizag-Chennai corridor with the provisions for 20 new industrial clusters.

500 Cr will also be set aside by NHAI for project preparation

North eastern India which hasn’t been the focus of most budgets gets a reasonably bigger share this time

This will help develop the area, increase proximity and improve connectivity

Rs 100 crore provided for setting up a National Industrial Corridor Authority, with its headquarters in Pune.

Plan for the Bengaluru Mumbai Economic corridor (BMFC) and Vizag-Chennai corridor with the provisions for 20 new industrial clusters.

Слайд 10Thank You Kin Housing Experience Our goal is to create a culture where

relationships are not built on brokerage but on the ability to understand what you really need when you are looking to make an investment in a new property.

Connect with us at www.kinhousing.com or contact@kinhousing.com

You can also reach us at 1800 3000 5245