- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Бизнес недвижимости презентация

Содержание

- 1. Бизнес недвижимости

- 2. Деловая игра «Формирование портфеля недвижимости»

- 3. Содержание игры Добиться максимальной прибыли от инвестирования

- 4. Условия игры Each team (investment company)

- 5. Real Estate PORTFOLIO FORMING Portfolio Income

- 6. [Statistical Data]

- 7. Samples of Real Estate Market objects Real

- 8. Type 4 Type

- 9. Pessimistic Stable Optimistic [₤mln] Expected

- 10. Possible Portfolios Expected Portfolio Rent Incomes 100 [₤

- 11. Stochastic serial drawing for the Market

- 12. Different Portfolios Summary Results Checking on the

- 13. Different Portfolios Summary Results Checking on the

- 14. Market long-time tendencies What does it mean?

- 15. The Business Game Procedure (1) Start Conditions

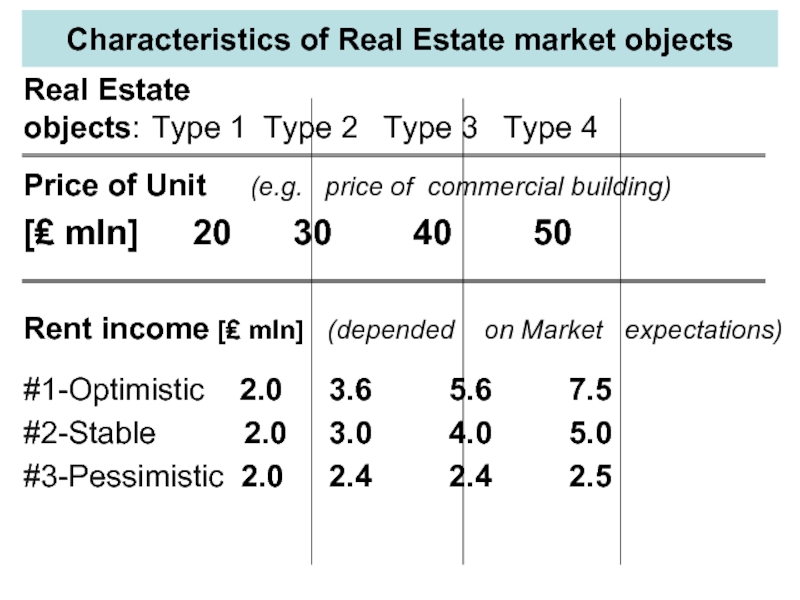

- 16. Characteristics of Real Estate market objects Real

Слайд 3Содержание игры

Добиться максимальной прибыли от инвестирования в недвижимость (приобретений приносящих доход

Доходы образуют арендные платежи, различные для различных типов приобретаемых объектов.

Инвестор формирует портфель, приобретая объекты с различными характеристиками ожидаемых доходов.

Арендные доходы, кроме различий объектов, зависят от будущих ситуаций на рынке: оптимистической (высокие доходы), стабильной (без изменений доходности), пессимистической (низкие доходы).

Ситуации имитируются вероятностным образом; при этом сформированный портфель не меняют.

Результат оценивается как суммарный арендный доход портфеля на протяжении рассматриваемого периода (пять лет).

Слайд 4Условия игры

Each team (investment company) forms its portfolio from acquired

It can choose different real estate assets for its portfolio.

It has no control over the market provided rent incomes.

As an experienced investor it understands difference of portfolio expected rent incomes for different market tendencies (positive or negative) during long-time period.

It knows that every year the rent income depends on market situation (optimistic, stable, pessimistic).

Each team must determine its risk strategy in order to form its portfolio with better rent income.

Teams compete to obtain the best portfolio income during long-time period after portfolios forming.

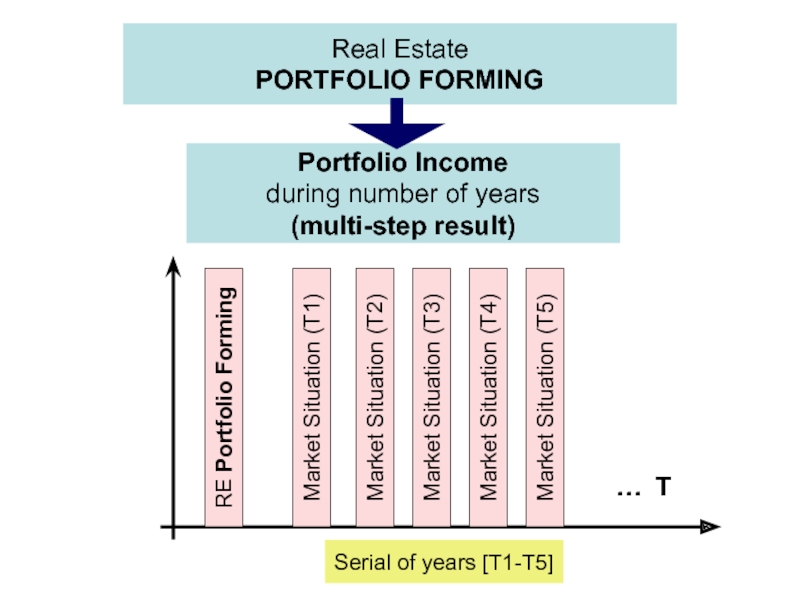

Слайд 5Real Estate

PORTFOLIO FORMING

Portfolio Income

during number of years

(multi-step result)

RE Portfolio Forming

Market Situation (T1)

Market Situation (T2)

Market Situation (T3)

Market Situation (T4)

Market Situation (T5)

Serial of years [T1-T5]

… T

Слайд 6

[Statistical Data] t=0 1 2

Future Expectations

TO BE DRAWN

t

₤ mln

? ? ? ? ?

? ? ? ? ?

? ? ? ? ?

Information:

*Price of asset

*Rent Income

*Market

stochastic

expectations

PORTFOLIO FORMING

Rent Income of real estate assets

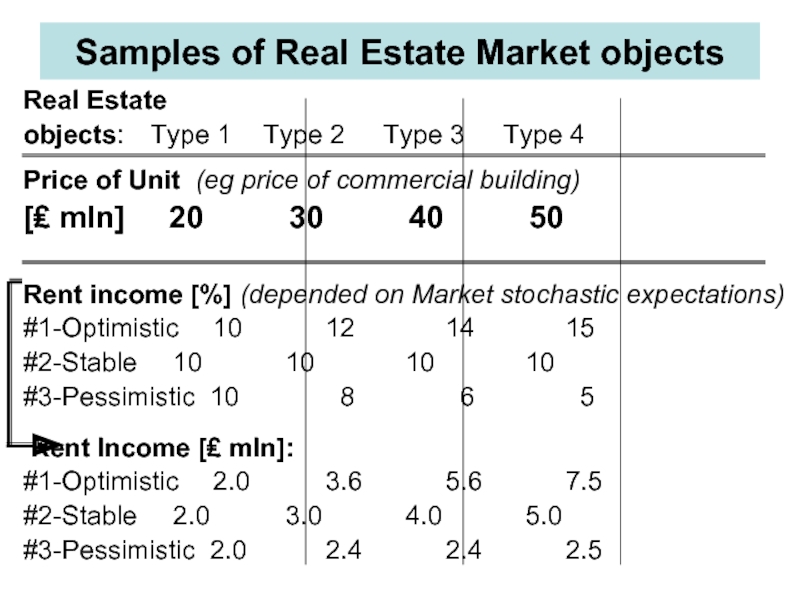

Слайд 7Samples of Real Estate Market objects

Real Estate

objects: Type 1 Type 2 Type 3 Type

Price of Unit (eg price of commercial building)

[₤ mln] 20 30 40 50

Rent income [%] (depended on Market stochastic expectations)

#1-Optimistic 10 12 14 15

#2-Stable 10 10 10 10

#3-Pessimistic 10 8 6 5

Rent Income [₤ mln]:

#1-Optimistic 2.0 3.6 5.6 7.5

#2-Stable 2.0 3.0 4.0 5.0

#3-Pessimistic 2.0 2.4 2.4 2.5

Слайд 8

Type 4

Type 3

Type 2

Type 1

Expected Rent Income for different Real Estate

and different Market situation

Pessimistic Stable Optimistic

Expected Rent Income [₤mln]

8

7

6

5

4

3

2

Possible non-linear one

Слайд 9 Pessimistic Stable Optimistic

[₤mln] Expected Rent Income for different Portfolios

(of

15

14

13

12

11

10

9

8

7

6

5

100=50+50

100=40+30+30

100=

20+20+20+20+20

Слайд 10Possible Portfolios Expected Portfolio Rent Incomes 100 [₤ mln] for different Market

Different #1-Optimistic #2-Stable #3-Pessimistic

combinations

from types {1-4} [₤ mln] [₤ mln] [₤ mln]

100 = 50+50 7.5+7.5 = 15 5+5 = 10 2.5+2.5 = 5

100 = 40+40+20 5.6+5.6+2=13.2 4+4+2=10 2.4+2.4+2=6.8

100 = 50+30+20 7.5+3.6+2=13.1 5+3+2=10 2.5+2.4+2=6.9

100 = 40+30+30 5.6+3.6+3.6=12.8 4+3+3=10 2.4+2.4+2.4=7.2

100 = 40+20+20+20 5.6+2+2+2=11.6 4+2+2+2=10 2.4+2+2+2=8.4

100 = 30+30+20+20 3.6+3.6+2+2=11.2 3+3+2+2=10 2.4+2.4+2+2=8.8

100 = 20+20+20+20+20 2+2+2+2+2= 10 2+2+2+2+2=10 2+2+2+2+2=10

Full list of Rent Incomes for

₤mln100 Portfolio of different combinations

Слайд 11Stochastic serial drawing for the Market situations: Stable / Optimistic /

SAMPLE of Distribution: PROBABILITY

CUBE {1-6}, e.g.: Pessimistic {1,2,3} 1/2

Stable {4} 1/6

Optimistic {5,6} 1/3

Future periods [t]

1 2 3 4 5

Pessim. Stable Optimist.

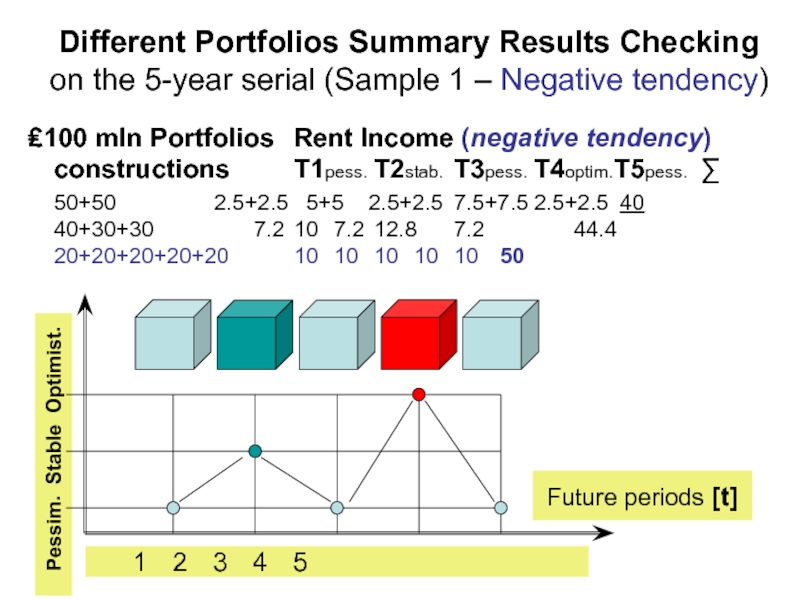

Слайд 12Different Portfolios Summary Results Checking on the 5-year serial (Sample 1 –

₤100 mln Portfolios Rent Income (negative tendency)

constructions T1pess. T2stab. T3pess. T4optim. T5pess. ∑

50+50 2.5+2.5 5+5 2.5+2.5 7.5+7.5 2.5+2.5 40

40+30+30 7.2 10 7.2 12.8 7.2 44.4

20+20+20+20+20 10 10 10 10 10 50

Future periods [t]

1 2 3 4 5

Pessim. Stable Optimist.

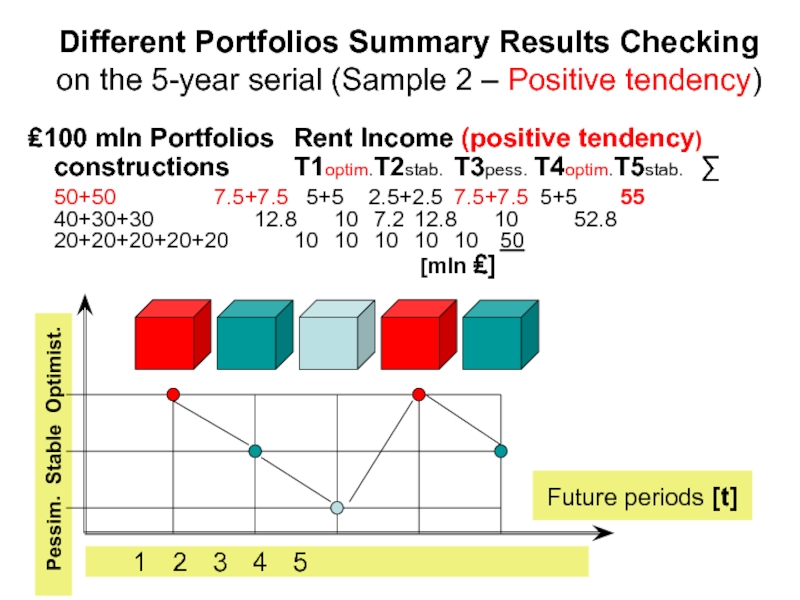

Слайд 13Different Portfolios Summary Results Checking on the 5-year serial (Sample 2 –

₤100 mln Portfolios Rent Income (positive tendency)

constructions T1optim. T2stab. T3pess. T4optim. T5stab. ∑

50+50 7.5+7.5 5+5 2.5+2.5 7.5+7.5 5+5 55

40+30+30 12.8 10 7.2 12.8 10 52.8

20+20+20+20+20 10 10 10 10 10 50

[mln ₤]

Future periods [t]

1 2 3 4 5

Pessim. Stable Optimist.

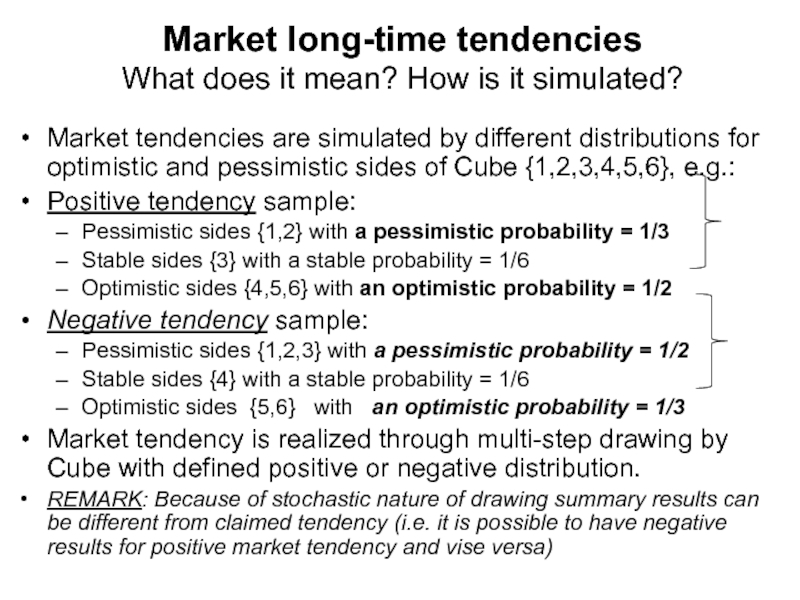

Слайд 14Market long-time tendencies

What does it mean? How is it simulated?

Market tendencies

Positive tendency sample:

Pessimistic sides {1,2} with a pessimistic probability = 1/3

Stable sides {3} with a stable probability = 1/6

Optimistic sides {4,5,6} with an optimistic probability = 1/2

Negative tendency sample:

Pessimistic sides {1,2,3} with a pessimistic probability = 1/2

Stable sides {4} with a stable probability = 1/6

Optimistic sides {5,6} with an optimistic probability = 1/3

Market tendency is realized through multi-step drawing by Cube with defined positive or negative distribution.

REMARK: Because of stochastic nature of drawing summary results can be different from claimed tendency (i.e. it is possible to have negative results for positive market tendency and vise versa)

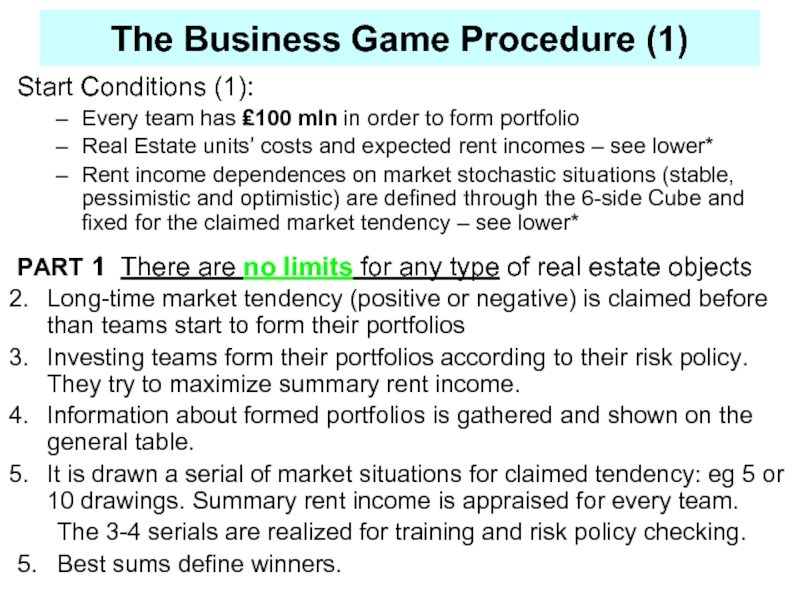

Слайд 15The Business Game Procedure (1)

Start Conditions (1):

Every team has ₤100 mln

Real Estate units’ costs and expected rent incomes – see lower*

Rent income dependences on market stochastic situations (stable, pessimistic and optimistic) are defined through the 6-side Cube and fixed for the claimed market tendency – see lower*

PART 1 There are no limits for any type of real estate objects

Long-time market tendency (positive or negative) is claimed before than teams start to form their portfolios

Investing teams form their portfolios according to their risk policy. They try to maximize summary rent income.

Information about formed portfolios is gathered and shown on the general table.

It is drawn a serial of market situations for claimed tendency: eg 5 or 10 drawings. Summary rent income is appraised for every team.

The 3-4 serials are realized for training and risk policy checking.

5. Best sums define winners.

Слайд 16Characteristics of Real Estate market objects

Real Estate

objects: Type 1 Type 2 Type 3 Type

Price of Unit (e.g. price of commercial building)

[₤ mln] 20 30 40 50

Rent income [₤ mln] (depended on Market expectations)

#1-Optimistic 2.0 3.6 5.6 7.5

#2-Stable 2.0 3.0 4.0 5.0

#3-Pessimistic 2.0 2.4 2.4 2.5

![[Statistical Data] t=0 1 2 3 4 5](/img/tmb/2/194616/80e03bd2569aec34c27d0b5c875df382-800x.jpg)

![Type 4Type 3Type 2Type 1Expected Rent Income for different Real Estate Types [1-4]and different Market](/img/tmb/2/194616/1d9e5ea21448c17e715abe99ea6212dc-800x.jpg)

![Pessimistic Stable Optimistic[₤mln] Expected Rent Income for different Portfolios(of ₤mln 100 each portfolio)15141312111098765100=50+50100=40+30+30100=20+20+20+20+20](/img/tmb/2/194616/0927308518a03324c3150abb0693b6f5-800x.jpg)

![Possible Portfolios Expected Portfolio Rent Incomes 100 [₤ mln] for different Market situations Different #1-Optimistic #2-Stable #3-Pessimisticcombinations](/img/tmb/2/194616/46f3df3bdce62114718d7dea60cda629-800x.jpg)