- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Strategic decision-making is an iterative process презентация

Содержание

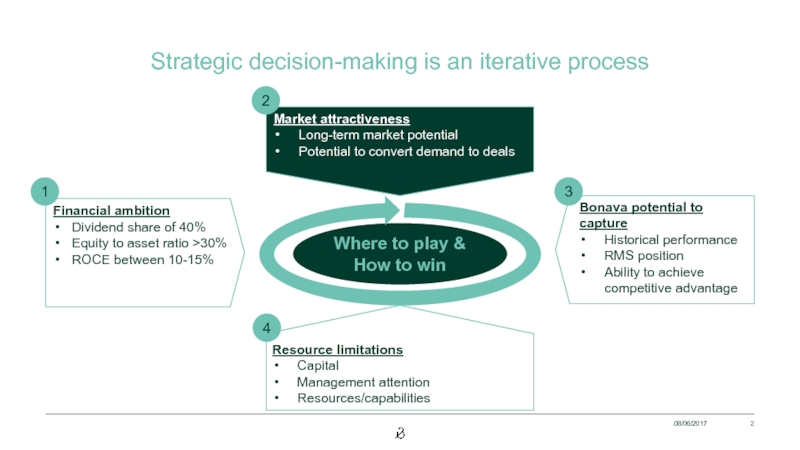

- 1. Strategic decision-making is an iterative process

- 2. Strategic decision-making is an iterative process Financial

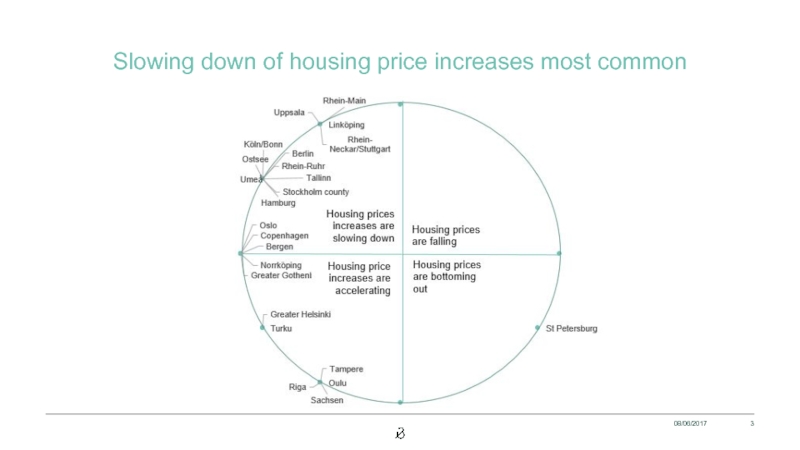

- 3. Slowing down of housing price increases most common 08/06/2017

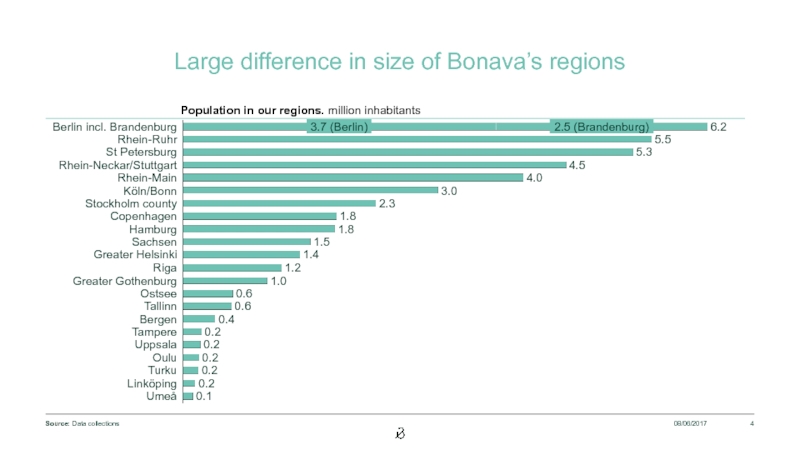

- 4. Large difference in size of Bonava’s regions

- 5. All regions have positive population growth rate

- 6. Differences in market risk parameters between our

- 7. Backup: What is included in ease

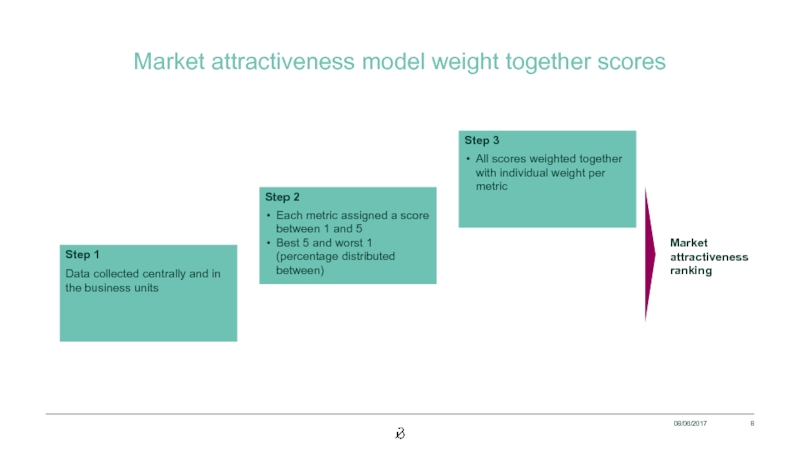

- 8. Market attractiveness model weight together scores 08/06/2017 Market attractiveness ranking

- 9. Back up: Details of model 1. Market

- 10. Sweden and Germany in top 08/06/2017

- 11. Agreed current situation at EMG meeting

- 12. Market attractiveness – Data driven strategy process

- 13. Beyond 2020 we should accelerate growth 08/06/2017

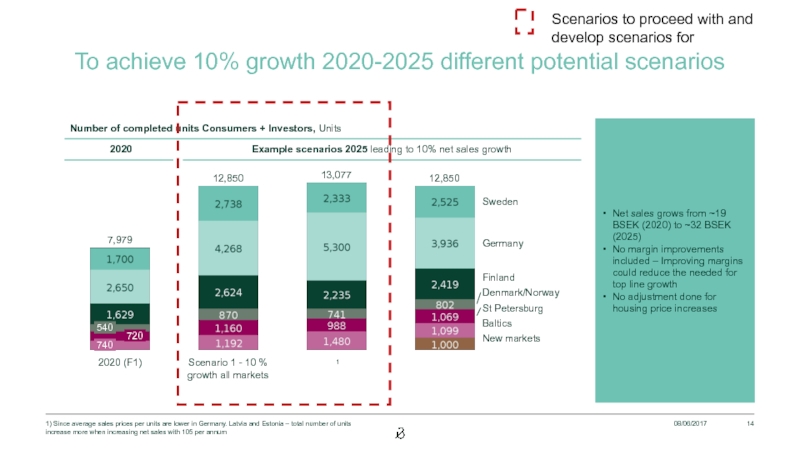

- 14. To achieve 10% growth 2020-2025 different potential

Слайд 2Strategic decision-making is an iterative process

Financial ambition

Dividend share of 40%

Equity to

ROCE between 10-15%

Where to play &

How to win

Bonava potential to capture

Historical performance

RMS position

Ability to achieve competitive advantage

Market attractiveness

Long-term market potential

Potential to convert demand to deals

Resource limitations

Capital

Management attention

Resources/capabilities

08/06/2017

1

2

3

4

Слайд 4Large difference in size of Bonava’s regions

08/06/2017

Source: Data collections

0.4

Ostsee

1.2

Greater Gothenburg

0.6

Tallinn

0.6

2.3

1.8

Rhein-Main

3.0

Köln/Bonn

Copenhagen

Stockholm county

5.3

Rhein-Ruhr

4.0

Rhein-Neckar/Stuttgart

4.5

St

5.5

2.5 (Brandenburg)

3.7 (Berlin)

Berlin incl. Brandenburg

6.2

1.5

Sachsen

Hamburg

1.0

1.8

Greater Helsinki

1.4

Riga

Linköping

0.2

Turku

0.2

Oulu

Umeå

0.2

0.1

Tampere

0.2

Uppsala

Bergen

0.2

Population in our regions. million inhabitants

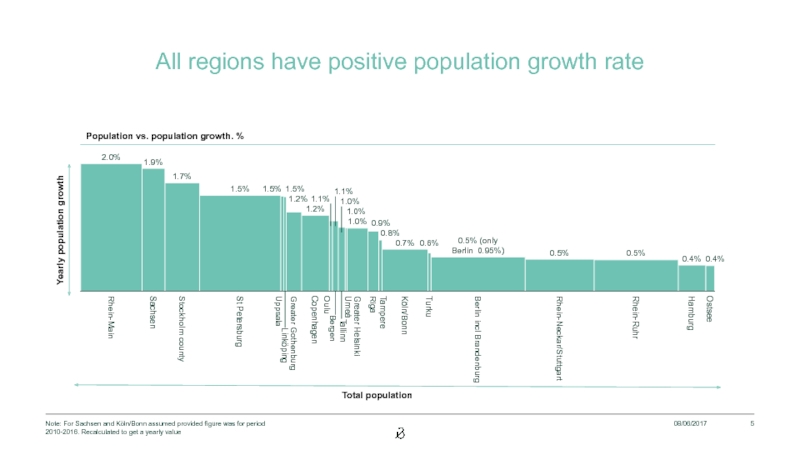

Слайд 5All regions have positive population growth rate

08/06/2017

Note: For Sachsen and Köln/Bonn

1.2%

Uppsala

Linköping

1.5%

Bergen

1.0%

1.0%

St Petersburg

Oulu

1.5%

Umeå

Greater Gothenburg

1.0%

Sachsen

1.9%

Stockholm county

1.1%

2.0%

Rhein-Main

Rhein-Ruhr

1.7%

1.5%

0.5%

0.5%

Hamburg

0.5% (only

Berlin 0.95%)

Ostsee

Rhein-Neckar/Stuttgart

0.4%

0.4%

Berlin incl Brandenburg

1.2%

Tallinn

Copenhagen

1.1%

Köln/Bonn

Turku

0.7%

0.8%

Tampere

Riga

0.9%

Greater Helsinki

0.6%

Population vs. population growth. %

Yearly population growth

Total population

Слайд 6Differences in market risk parameters between our markets

08/06/2017

Denmark

Norway

Copenhagen

Sweden

Lithaunia

Germany

Finland

Estonia

Latvia

Lithaunia

Norway

Denmark

Estonia

Russia

Latvia

Sweden

Finland

Germany

Ease of doing business

Currency volatility (compared to SEK). %

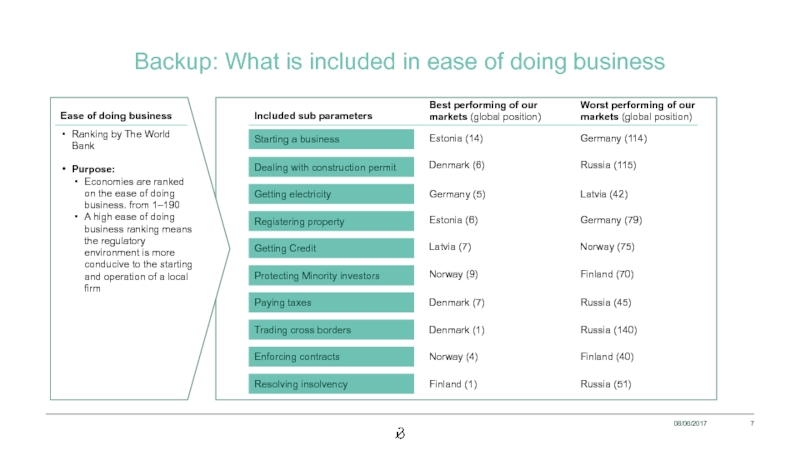

Слайд 7

Backup: What is included in ease of doing business

08/06/2017

Ease of doing

Ranking by The World Bank

Purpose:

Economies are ranked on the ease of doing business. from 1–190

A high ease of doing business ranking means the regulatory environment is more conducive to the starting and operation of a local firm

Included sub parameters

Starting a business

Estonia (14)

Germany (114)

Dealing with construction permit

Denmark (6)

Russia (115)

Getting electricity

Germany (5)

Latvia (42)

Registering property

Estonia (6)

Germany (79)

Getting Credit

Latvia (7)

Norway (75)

Protecting Minority investors

Norway (9)

Finland (70)

Paying taxes

Denmark (7)

Russia (45)

Enforcing contracts

Norway (4)

Finland (40)

Trading cross borders

Denmark (1)

Russia (140)

Resolving insolvency

Finland (1)

Russia (51)

Best performing of our markets (global position)

Worst performing of our markets (global position)

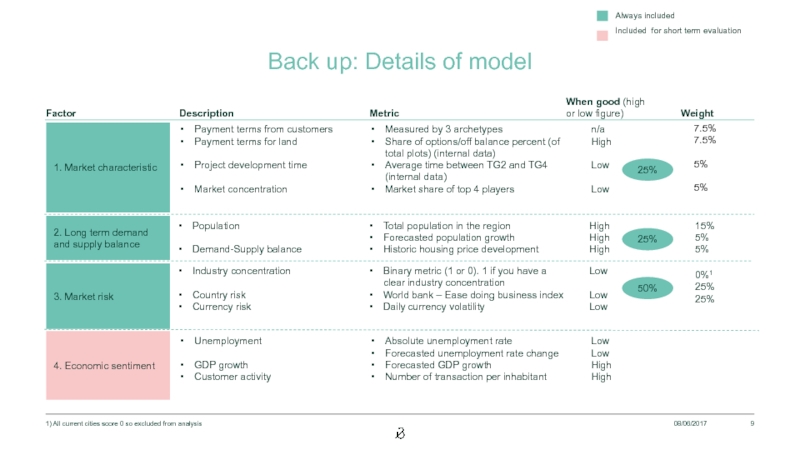

Слайд 9Back up: Details of model

1. Market characteristic

4. Economic sentiment

Factor

Description

Payment terms from

Payment terms for land

Project development time

Market concentration

Unemployment

GDP growth

Customer activity

08/06/2017

Always included

Included for short term evaluation

Measured by 3 archetypes

Share of options/off balance percent (of total plots) (internal data)

Average time between TG2 and TG4 (internal data)

Market share of top 4 players

Absolute unemployment rate

Forecasted unemployment rate change

Forecasted GDP growth

Number of transaction per inhabitant

Metric

When good (high or low figure)

n/a

High

Low

Low

Low

Low

High

High

Weight

25%

2. Long term demand and supply balance

Population

Demand-Supply balance

Total population in the region

Forecasted population growth

Historic housing price development

High

High

High

3. Market risk

Industry concentration

Country risk

Currency risk

Binary metric (1 or 0). 1 if you have a clear industry concentration

World bank – Ease doing business index

Daily currency volatility

Low

Low

Low

25%

50%

7.5%

7.5%

5%

5%

15%

5%

5%

0%1

25%

25%

1) All current cities score 0 so excluded from analysis

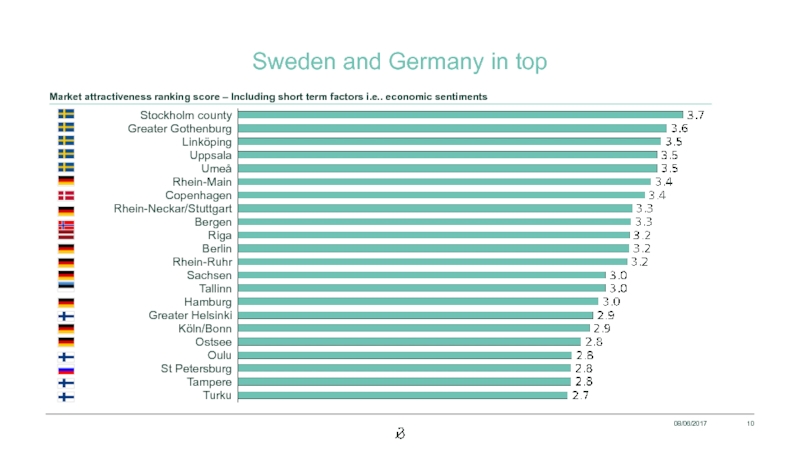

Слайд 10Sweden and Germany in top

08/06/2017

Ostsee

Oulu

St Petersburg

Tampere

Turku

Linköping

Köln/Bonn

Stockholm county

Greater Gothenburg

Greater Helsinki

Hamburg

Tallinn

Rhein-Neckar/Stuttgart

Bergen

Berlin

Rhein-Ruhr

Sachsen

Uppsala

Rhein-Main

Riga

Copenhagen

Umeå

Market attractiveness ranking

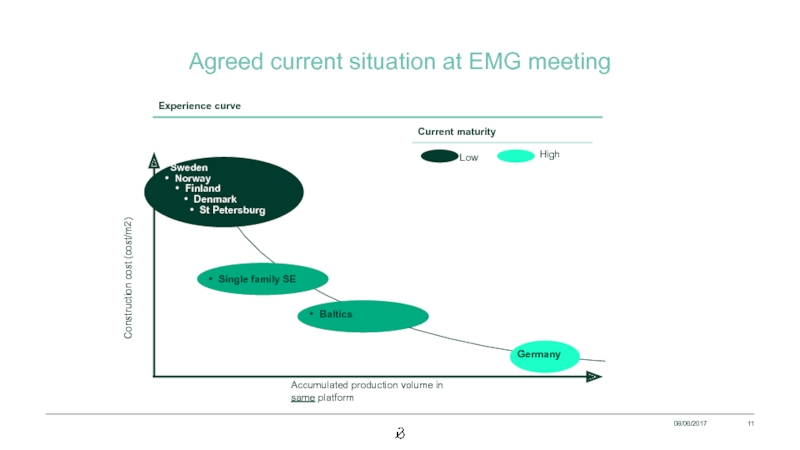

Слайд 11

Agreed current situation at EMG meeting

08/06/2017

Construction cost (cost/m2)

Accumulated production volume in

Sweden

Norway

Finland

Denmark

St Petersburg

Single family SE

Germany

Experience curve

Baltics

Слайд 12Market attractiveness – Data driven strategy process

Strategic ideas

Beyond 2020

What if the

Agenda

08/06/2017

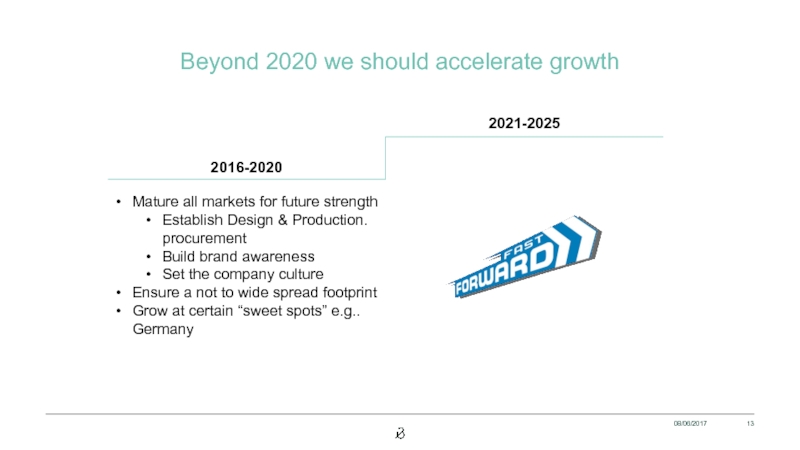

Слайд 13Beyond 2020 we should accelerate growth

08/06/2017

2016-2020

2021-2025

Mature all markets for future strength

Establish

Build brand awareness

Set the company culture

Ensure a not to wide spread footprint

Grow at certain “sweet spots” e.g.. Germany

Слайд 14To achieve 10% growth 2020-2025 different potential scenarios

08/06/2017

1) Since average sales

Baltics

Denmark/Norway

740

540

720

13,077

Scenario 1 - 10 % growth all markets

2020 (F1)

1

12,850

7,979

New markets

Germany

Sweden

Finland

12,850

St Petersburg

Number of completed units Consumers + Investors, Units

2020

Example scenarios 2025 leading to 10% net sales growth

Net sales grows from ~19 BSEK (2020) to ~32 BSEK (2025)

No margin improvements included – Improving margins could reduce the needed for top line growth

No adjustment done for housing price increases

Scenarios to proceed with and develop scenarios for