- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

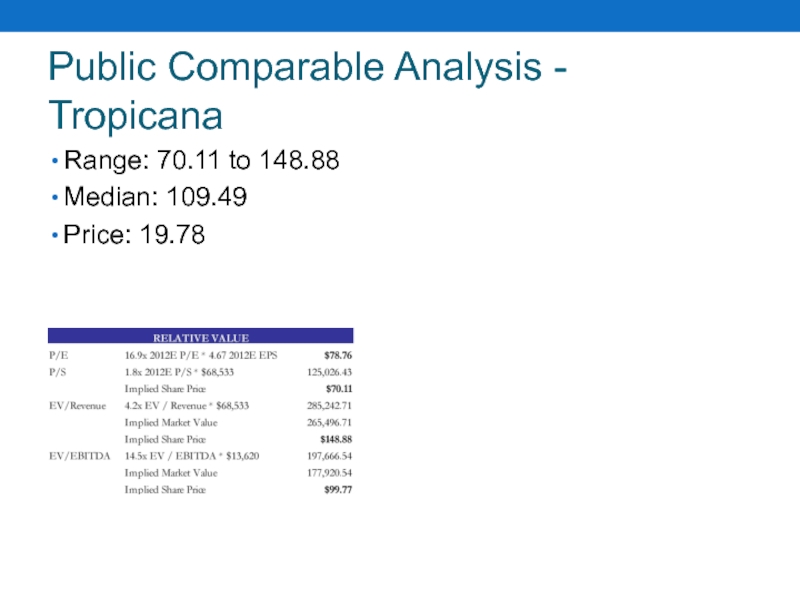

- Медицина

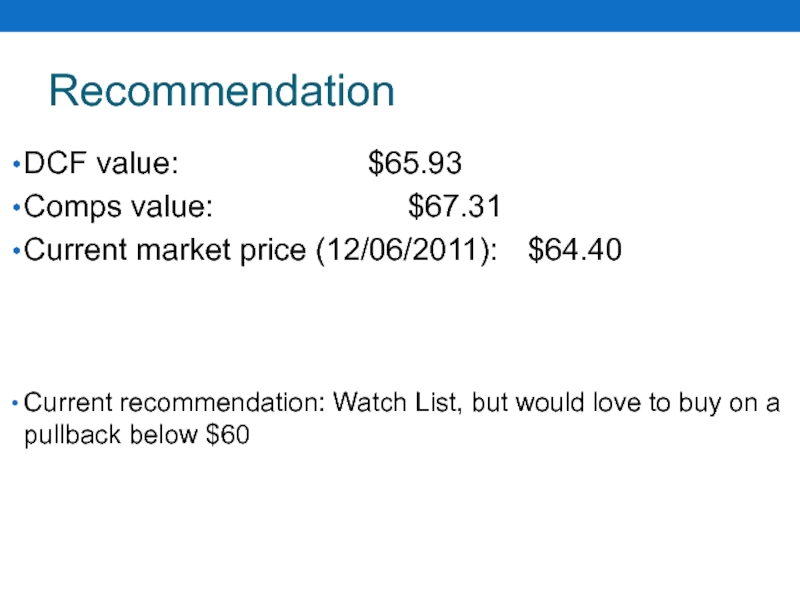

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Pepsico international презентация

Содержание

- 1. Pepsico international

- 2. PepsiCo, Inc. is a global food, snack

- 3. (5 Year) Stock Market Performance Blue line

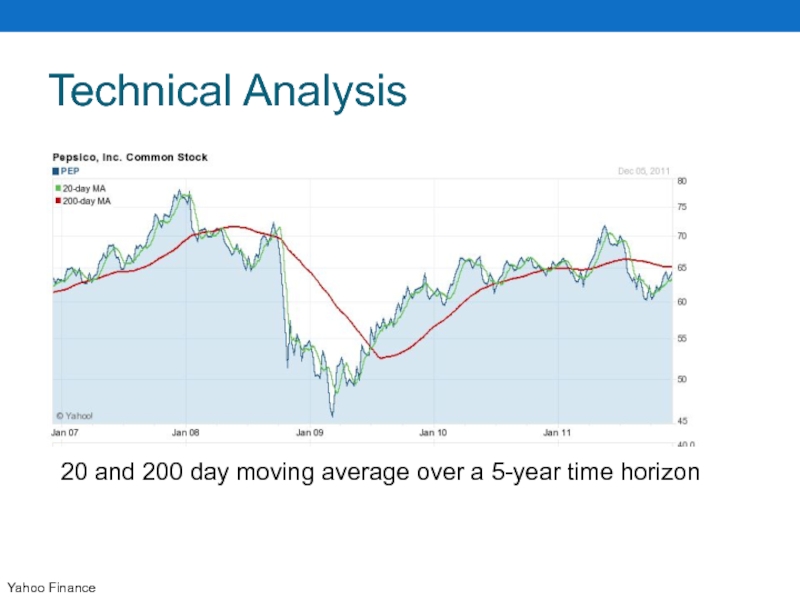

- 4. Technical Analysis Yahoo Finance 20 and 200 day moving average over a 5-year time horizon

- 5. Yahoo Finance 20 and 200 day moving average over a 2-year time horizon

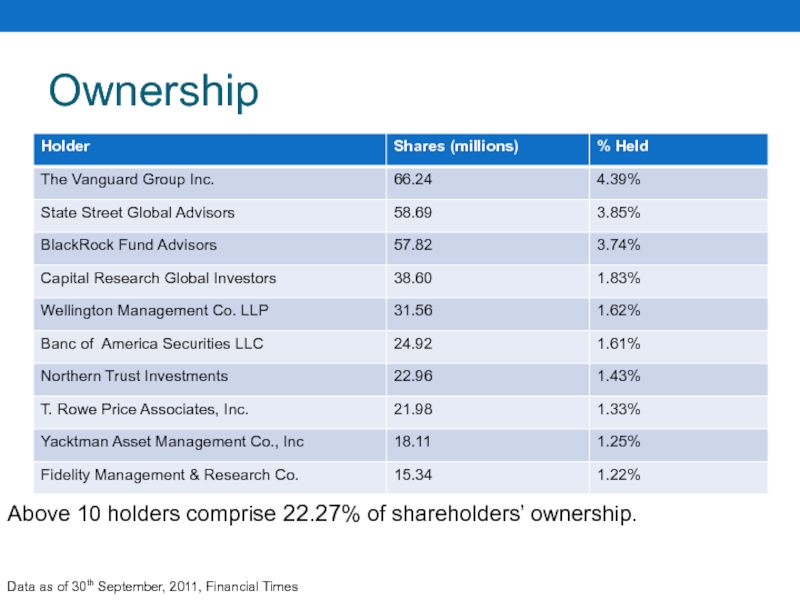

- 6. Ownership Above 10 holders comprise 22.27% of

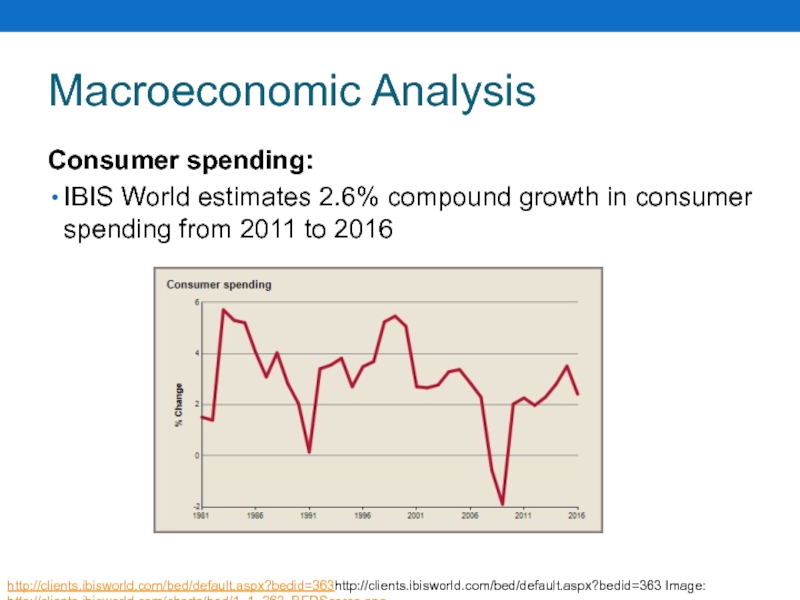

- 7. Macroeconomic Analysis Consumer spending: IBIS World estimates

- 8. Industry Analysis Soda Production in the US:

- 9. Industry Analysis (cont.) Snack Food Production in

- 10. Industry Analysis (cont.) Juice Production in the

- 11. Product Segments Source: Barclays “BTS” Consumer Conference, Sep 2011 http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

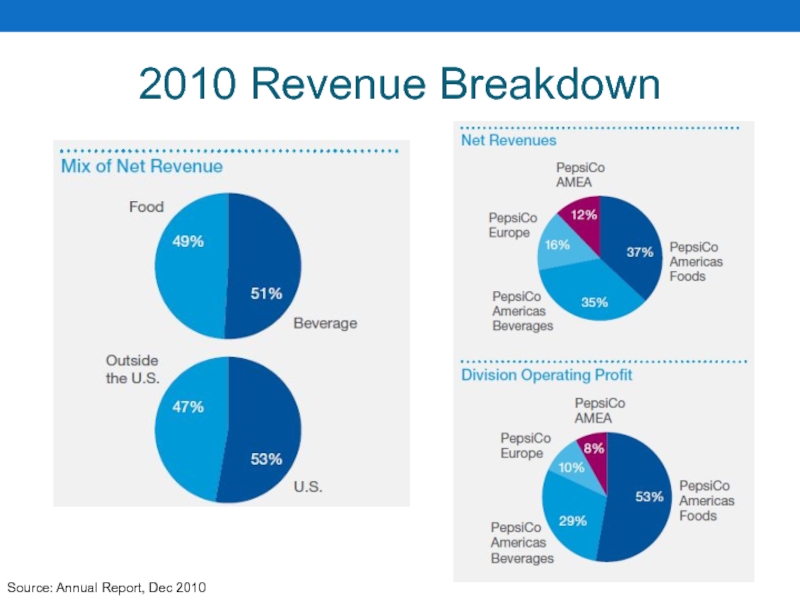

- 12. 2010 Revenue Breakdown Source: Annual Report, Dec 2010

- 13. Global Markets Exposure About $20 billion or

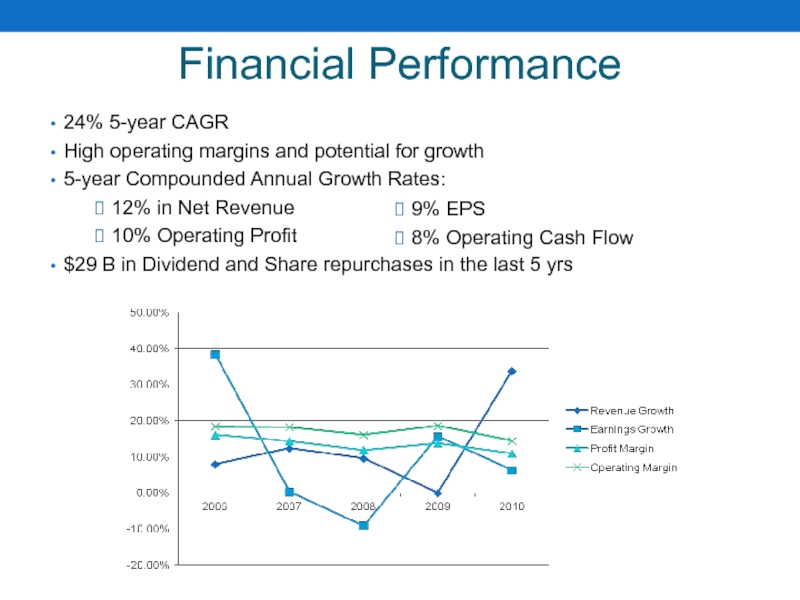

- 14. Financial Performance 24% 5-year CAGR High operating

- 15. Savory Snacks

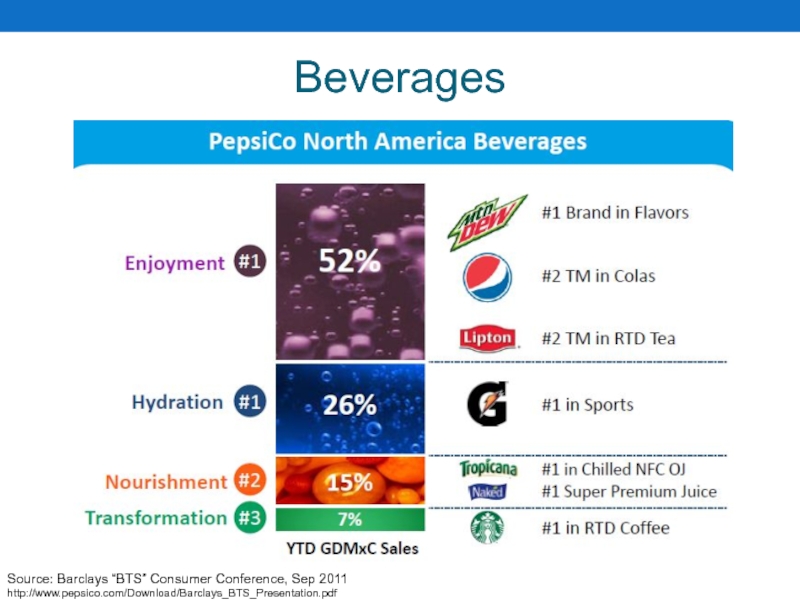

- 16. Beverages Source: Barclays “BTS” Consumer Conference, Sep 2011 http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

- 17. Carbonated Soft Drinks Sustain powerhouse brands Sierra

- 18. Hydration & Nourishment Gatorade 11% Sales growth

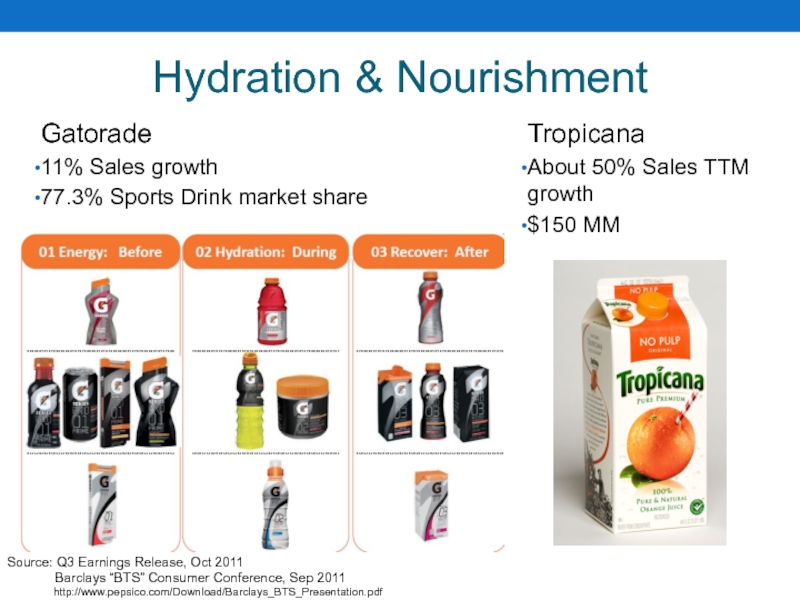

- 19. Nutrition Top 3 globally in Nutrition, aiming

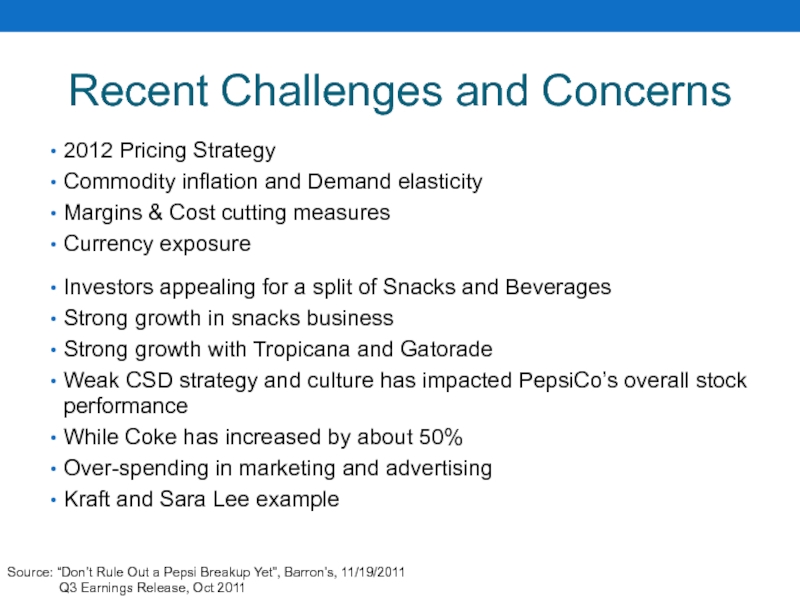

- 20. Recent Challenges and Concerns 2012 Pricing Strategy

- 21. The Power of One Two powerful businesses

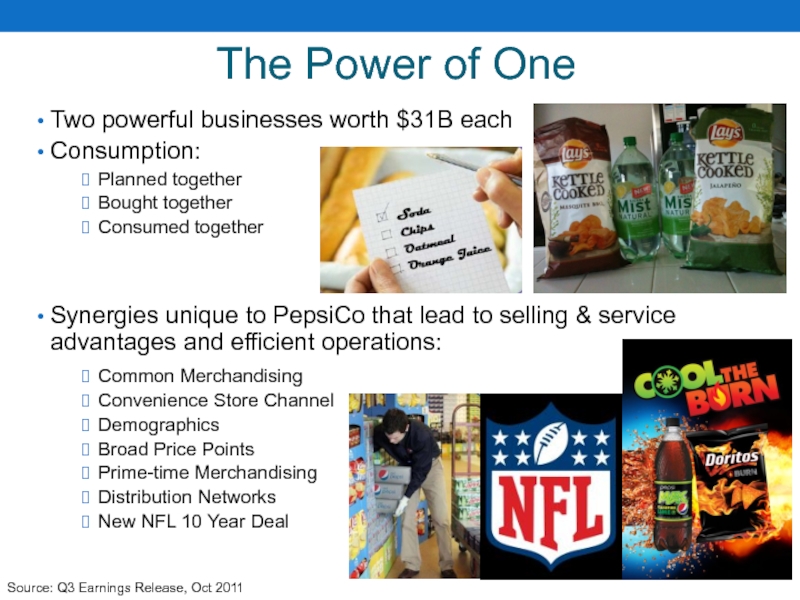

- 22. Public Comparable Analysis Quaker/Nutrition SWX:NESN Nestlé S.A.

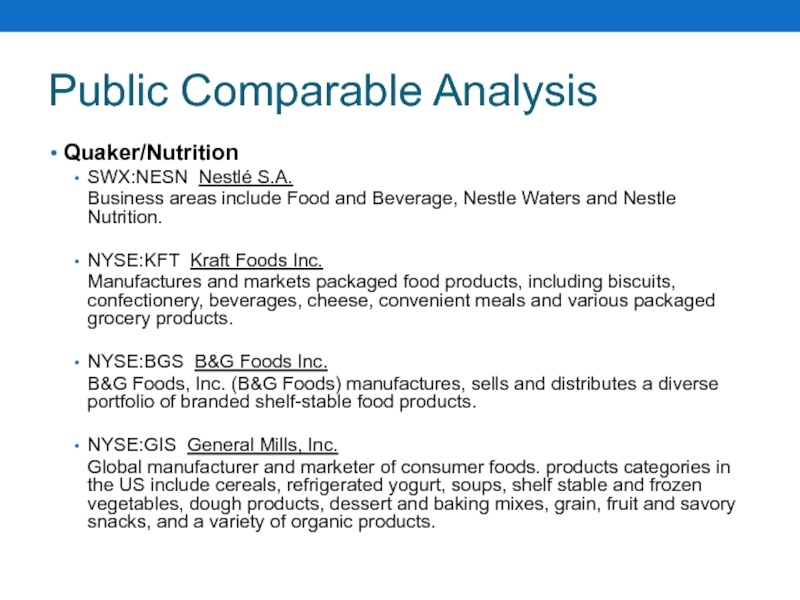

- 23. Public Comparable Analysis - Quaker Range: 66.49 to 73.73 Median: 71.06 Price: 8.36

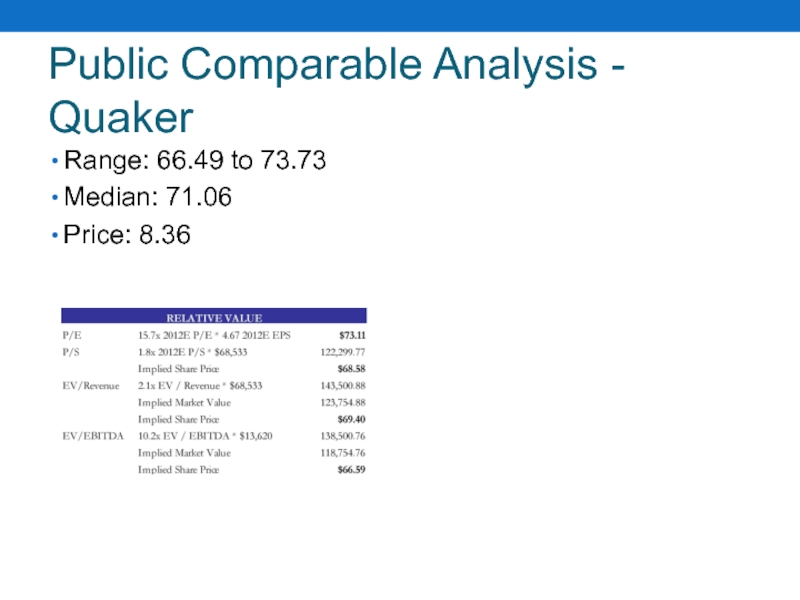

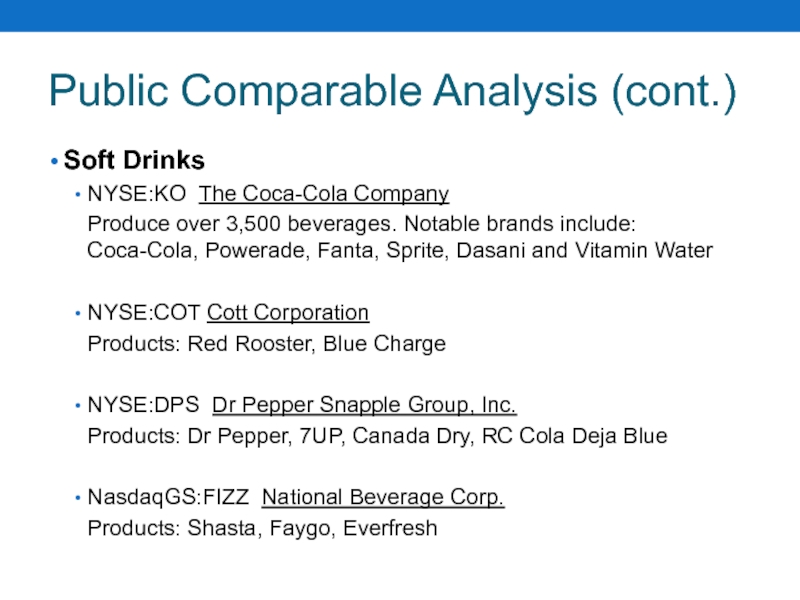

- 24. Public Comparable Analysis (cont.) Soft Drinks

- 25. Public Comparable Analysis – Soft Drinks Range: 5029 to 81.79 Median: 56.40 Price: 24.00

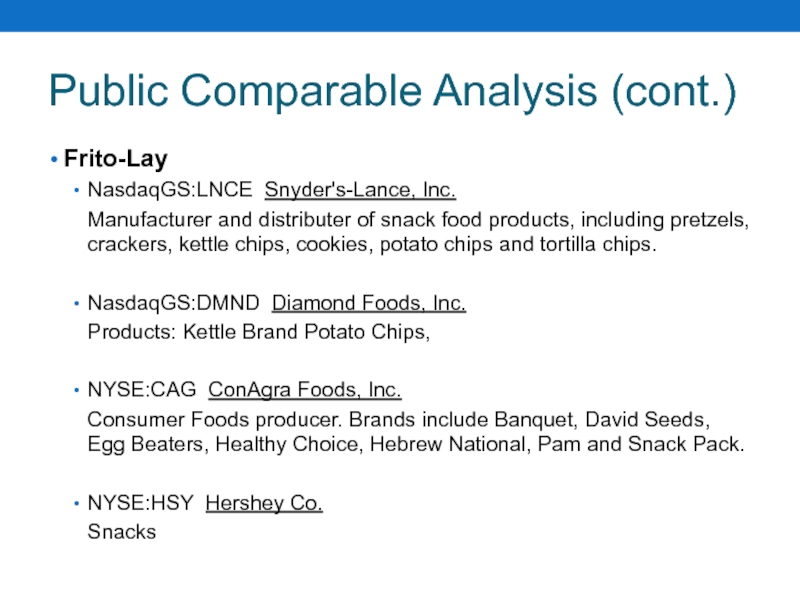

- 26. Public Comparable Analysis (cont.) Frito-Lay NasdaqGS:LNCE

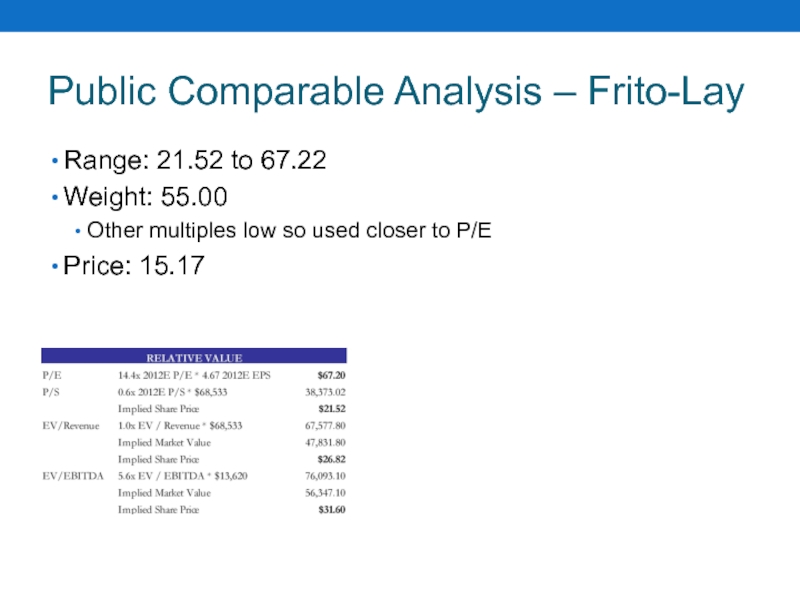

- 27. Public Comparable Analysis – Frito-Lay Range: 21.52

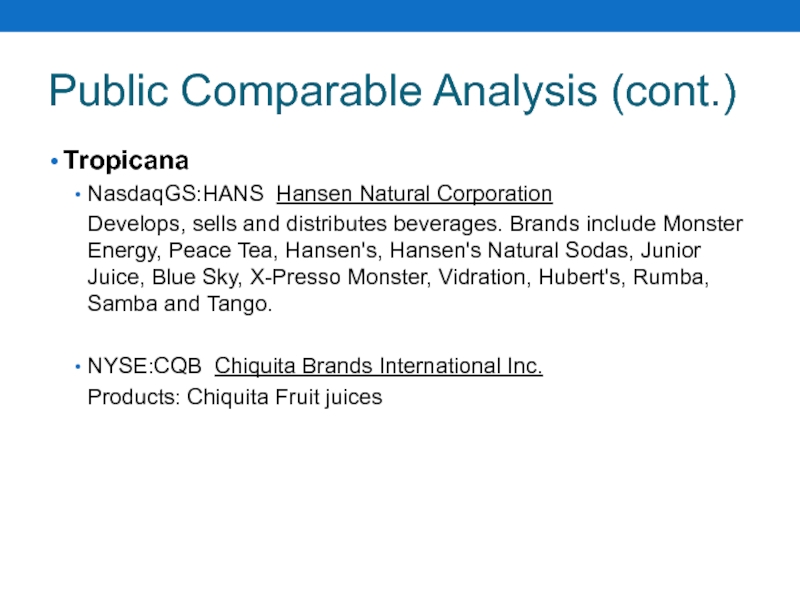

- 28. Public Comparable Analysis (cont.) Tropicana NasdaqGS:HANS

- 29. Public Comparable Analysis - Tropicana Range: 70.11 to 148.88 Median: 109.49 Price: 19.78

- 30. Recommendation DCF value: $65.93 Comps value: $67.31

Слайд 1Presented By: Aaron Czerkies

Jonathan Barki

Amin Rizwan

Chris Tsoulakas

Frank Damian

PepsiCo, Inc. NYSE:PEP

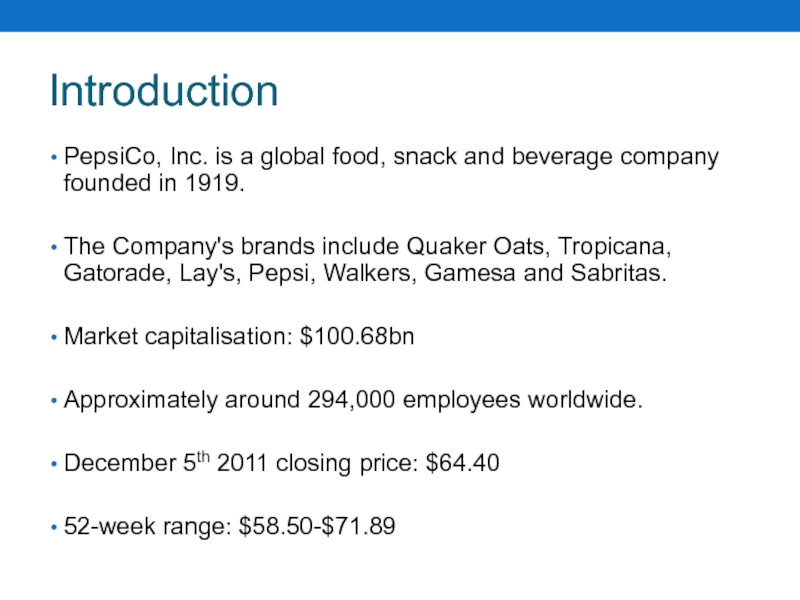

Слайд 2PepsiCo, Inc. is a global food, snack and beverage company founded

The Company's brands include Quaker Oats, Tropicana, Gatorade, Lay's, Pepsi, Walkers, Gamesa and Sabritas.

Market capitalisation: $100.68bn

Approximately around 294,000 employees worldwide.

December 5th 2011 closing price: $64.40

52-week range: $58.50-$71.89

Introduction

Слайд 3(5 Year) Stock Market Performance

Blue line – iShares S&P Global Consumer Staples (KXI)

Red

Green – S&P 500 index

Yahoo Finance

Слайд 6Ownership

Above 10 holders comprise 22.27% of shareholders’ ownership.

Data as of 30th

Слайд 7Macroeconomic Analysis

Consumer spending:

IBIS World estimates 2.6% compound growth in consumer spending

http://clients.ibisworld.com/bed/default.aspx?bedid=363http://clients.ibisworld.com/bed/default.aspx?bedid=363 Image: http://clients.ibisworld.com/charts/bed/1_1_363_BEDScores.png

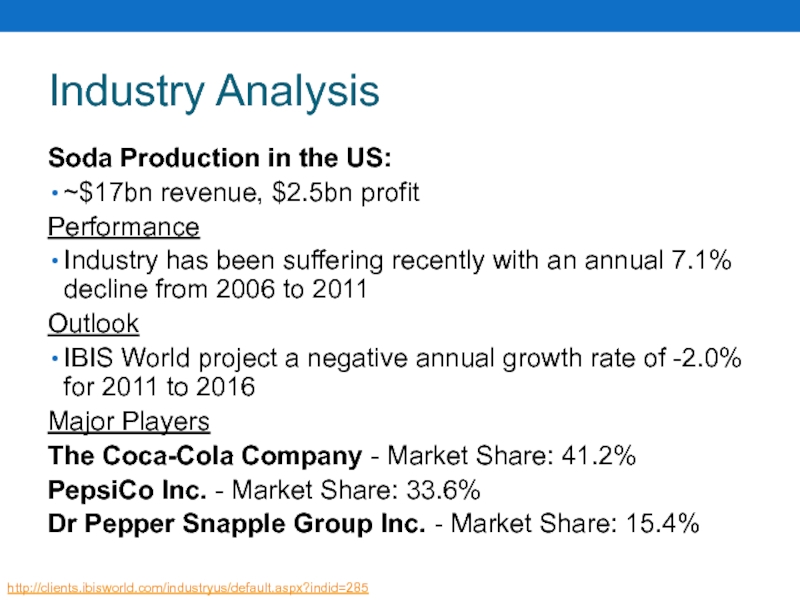

Слайд 8Industry Analysis

Soda Production in the US:

~$17bn revenue, $2.5bn profit

Performance

Industry has been

Outlook

IBIS World project a negative annual growth rate of -2.0% for 2011 to 2016

Major Players

The Coca-Cola Company - Market Share: 41.2%

PepsiCo Inc. - Market Share: 33.6%

Dr Pepper Snapple Group Inc. - Market Share: 15.4%

http://clients.ibisworld.com/industryus/default.aspx?indid=285

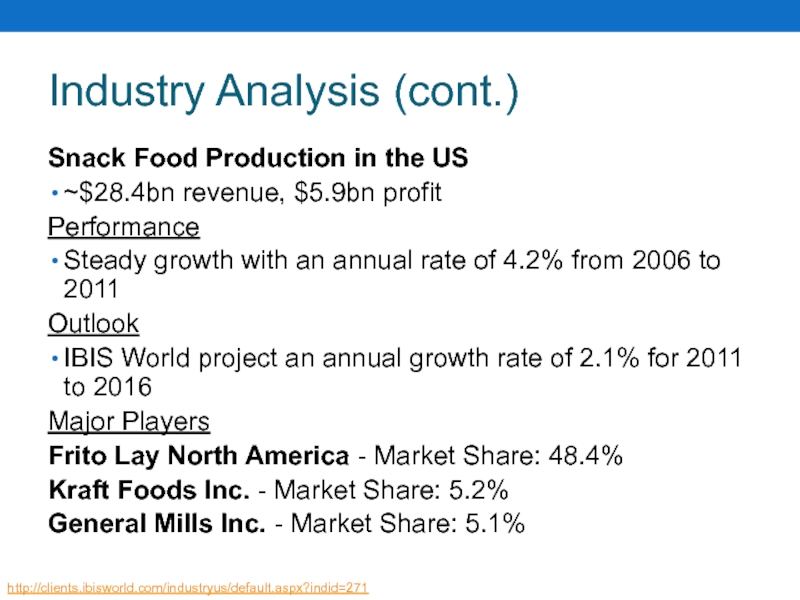

Слайд 9Industry Analysis (cont.)

Snack Food Production in the US

~$28.4bn revenue, $5.9bn profit

Performance

Steady

Outlook

IBIS World project an annual growth rate of 2.1% for 2011 to 2016

Major Players

Frito Lay North America - Market Share: 48.4%

Kraft Foods Inc. - Market Share: 5.2%

General Mills Inc. - Market Share: 5.1%

http://clients.ibisworld.com/industryus/default.aspx?indid=271

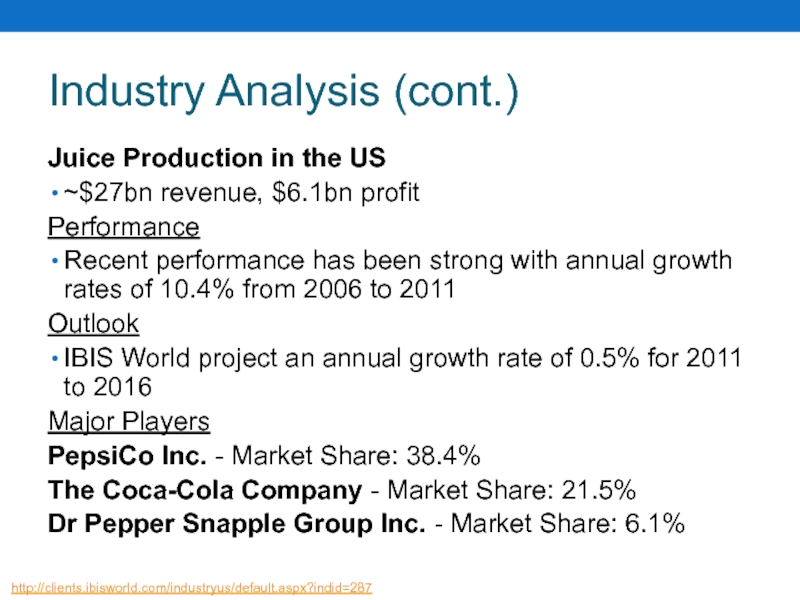

Слайд 10Industry Analysis (cont.)

Juice Production in the US

~$27bn revenue, $6.1bn profit

Performance

Recent performance

Outlook

IBIS World project an annual growth rate of 0.5% for 2011 to 2016

Major Players

PepsiCo Inc. - Market Share: 38.4%

The Coca-Cola Company - Market Share: 21.5%

Dr Pepper Snapple Group Inc. - Market Share: 6.1%

http://clients.ibisworld.com/industryus/default.aspx?indid=287

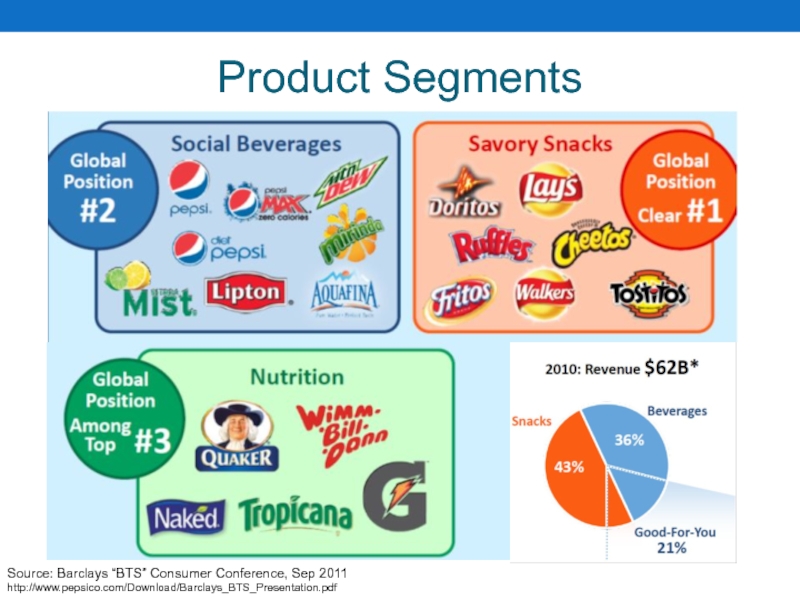

Слайд 11Product Segments

Source: Barclays “BTS” Consumer Conference, Sep 2011

http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

Слайд 13Global Markets Exposure

About $20 billion or 31% of Revenue from emerging

Focus on growth in Central Asia and Eastern Europe

70% growth of sales in Russia over last 2 years

Robust economic indicators, low debt ratios, good foreign exchange reserves

Wimm-Bill-Dann acquisition

66% at $3.8 B total ownership to 77%

15 Aug 2011, ‘squeeze-out demand’ for other 23%

3,883.70 Russian rubles per share

Source: Q3 Earnings Release, Oct 2011

Слайд 14Financial Performance

24% 5-year CAGR

High operating margins and potential for growth

5-year Compounded

12% in Net Revenue

10% Operating Profit

$29 B in Dividend and Share repurchases in the last 5 yrs

9% EPS

8% Operating Cash Flow

Слайд 15 Savory Snacks

Frito Lay’s World’s largest Food

Doritos $4 B, Cheetos $3.1 B, Ruffles $2.6bn,

Tositos $1.7bn, Fritos $1.3bn

Transnational expansion strategy through balance between:

Localization

Maintaining consistent quality standards and cooking processes

5-year CAGR:

3% Volume

8% Revenue

8% NOPBT

Source: Q3 Earnings Release, Oct 2011

Слайд 16Beverages

Source: Barclays “BTS” Consumer Conference, Sep 2011

http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

Слайд 17Carbonated Soft Drinks

Sustain powerhouse brands

Sierra Mist, +7% in volume

Mountain Dew, +2.5%

Pepsi Max, +93% in volume

Focused advertising & marketing campaigns

Pepsi Max

Diet Pepsi

Pepsi

Social media exposure

Continue innovating products

Pepsi Next

Develop Occasion-based marketing

On-the-Go Refreshment

Special Occasion and Celebrations

Meal-time and Snacking

Source: Q3 Earnings Release, Oct 2011

Слайд 18Hydration & Nourishment

Gatorade

11% Sales growth

77.3% Sports Drink market share

Tropicana

About 50% Sales

$150 MM

Source: Q3 Earnings Release, Oct 2011

Barclays “BTS” Consumer Conference, Sep 2011

http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

Слайд 19Nutrition

Top 3 globally in Nutrition, aiming to be $30B business by

Huge growth potential, 5-year double-digit revenue CAGR

Strong demographic and consumer interest in health and wellness

Aging population seeking healthy and tasty foods

On-the-Go consumers and their demand for convenience

Source: Q3 Earnings Release, Oct 2011

Barclays “BTS” Consumer Conference, Sep 2011

http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

Слайд 20Recent Challenges and Concerns

2012 Pricing Strategy

Commodity inflation and Demand elasticity

Margins &

Currency exposure

Investors appealing for a split of Snacks and Beverages

Strong growth in snacks business

Strong growth with Tropicana and Gatorade

Weak CSD strategy and culture has impacted PepsiCo’s overall stock performance

While Coke has increased by about 50%

Over-spending in marketing and advertising

Kraft and Sara Lee example

Source: “Don’t Rule Out a Pepsi Breakup Yet”, Barron’s, 11/19/2011

Q3 Earnings Release, Oct 2011

Слайд 21The Power of One

Two powerful businesses worth $31B each

Consumption:

Planned together

Bought together

Consumed

Synergies unique to PepsiCo that lead to selling & service advantages and efficient operations:

Common Merchandising

Convenience Store Channel

Demographics

Broad Price Points

Prime-time Merchandising

Distribution Networks

New NFL 10 Year Deal

Source: Q3 Earnings Release, Oct 2011

Слайд 22Public Comparable Analysis

Quaker/Nutrition

SWX:NESN Nestlé S.A.

Business areas include Food and Beverage,

NYSE:KFT Kraft Foods Inc.

Manufactures and markets packaged food products, including biscuits, confectionery, beverages, cheese, convenient meals and various packaged grocery products.

NYSE:BGS B&G Foods Inc.

B&G Foods, Inc. (B&G Foods) manufactures, sells and distributes a diverse portfolio of branded shelf-stable food products.

NYSE:GIS General Mills, Inc.

Global manufacturer and marketer of consumer foods. products categories in the US include cereals, refrigerated yogurt, soups, shelf stable and frozen vegetables, dough products, dessert and baking mixes, grain, fruit and savory snacks, and a variety of organic products.

Слайд 24Public Comparable Analysis (cont.)

Soft Drinks

NYSE:KO The Coca-Cola Company

Produce over

NYSE:COT Cott Corporation

Products: Red Rooster, Blue Charge

NYSE:DPS Dr Pepper Snapple Group, Inc.

Products: Dr Pepper, 7UP, Canada Dry, RC Cola Deja Blue

NasdaqGS:FIZZ National Beverage Corp.

Products: Shasta, Faygo, Everfresh

Слайд 26Public Comparable Analysis (cont.)

Frito-Lay

NasdaqGS:LNCE Snyder's-Lance, Inc.

Manufacturer and distributer of

NasdaqGS:DMND Diamond Foods, Inc.

Products: Kettle Brand Potato Chips,

NYSE:CAG ConAgra Foods, Inc.

Consumer Foods producer. Brands include Banquet, David Seeds, Egg Beaters, Healthy Choice, Hebrew National, Pam and Snack Pack.

NYSE:HSY Hershey Co.

Snacks

Слайд 27Public Comparable Analysis – Frito-Lay

Range: 21.52 to 67.22

Weight: 55.00

Other multiples low

Price: 15.17

Слайд 28Public Comparable Analysis (cont.)

Tropicana

NasdaqGS:HANS Hansen Natural Corporation

Develops, sells and

NYSE:CQB Chiquita Brands International Inc.

Products: Chiquita Fruit juices