- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

HCA Surges Thanks to Obamacare презентация

Содержание

- 1. HCA Surges Thanks to Obamacare

- 2. HCA Holdings Inc. "Results for

- 3. Driving HCA’s surprising surge Second quarter sales

- 4. Driving HCA’s surprising surge Second quarter net

- 5. Driving HCA’s surprising surge Reform will boost

- 6. Driving HCA’s surprising surge Better than expected

- 7. Driving HCA’s surprising surge Guidance improves valuation.

- 8. Fool-worthy thoughts Full results will be reported

- 9. Six stock picks poised for incredible growth

Слайд 2HCA Holdings Inc.

"Results for the second quarter of 2014 exceeded our

internal expectations, both in terms of core operations and healthcare reform," said CEO R. Milton Johnson.

Слайд 3Driving HCA’s surprising surge

Second quarter sales will total $9.23 billion.

Up from

$8.45 billion last year.

Admissions at facilities open at least a year grew by 1.2%.

Higher admissions tied to reform driven enrollment expansion and an improving economy.

Revenue per equivalent admission grew 5.4%.

Admissions at facilities open at least a year grew by 1.2%.

Higher admissions tied to reform driven enrollment expansion and an improving economy.

Revenue per equivalent admission grew 5.4%.

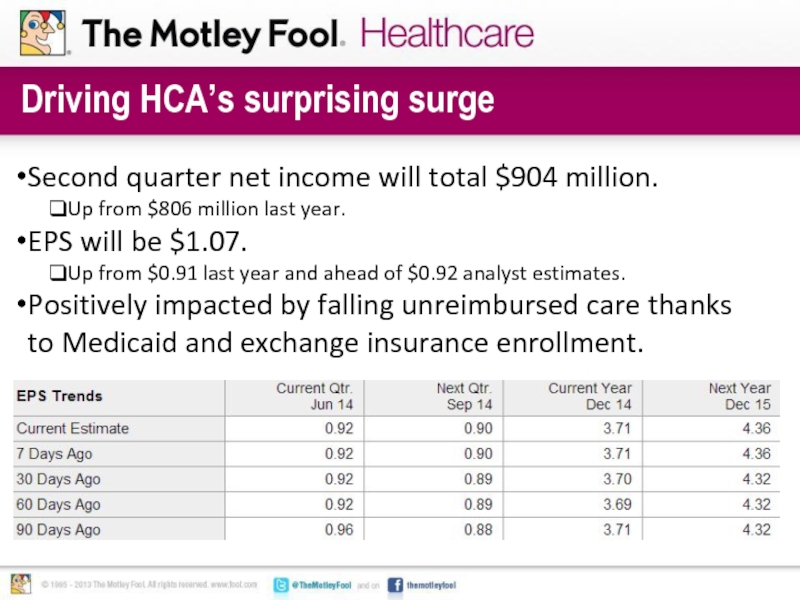

Слайд 4Driving HCA’s surprising surge

Second quarter net income will total $904 million.

Up

from $806 million last year.

EPS will be $1.07.

Up from $0.91 last year and ahead of $0.92 analyst estimates.

Positively impacted by falling unreimbursed care thanks to Medicaid and exchange insurance enrollment.

EPS will be $1.07.

Up from $0.91 last year and ahead of $0.92 analyst estimates.

Positively impacted by falling unreimbursed care thanks to Medicaid and exchange insurance enrollment.

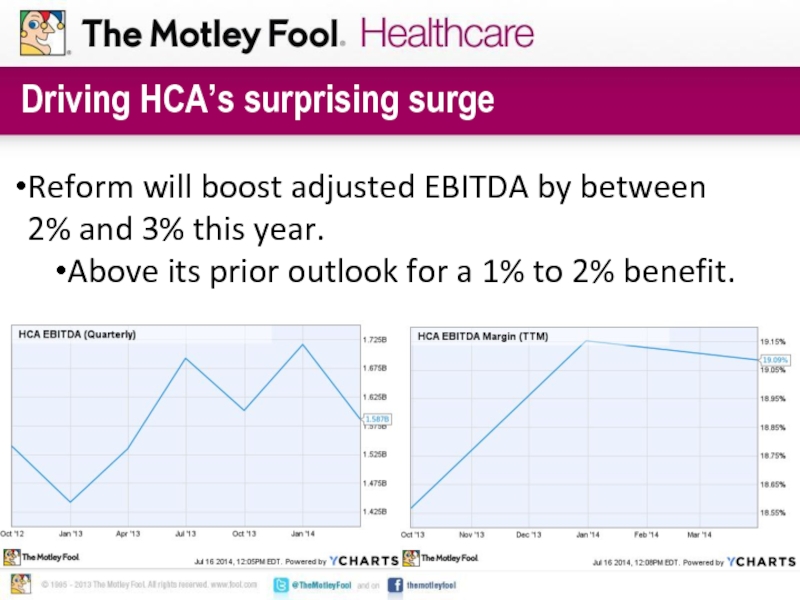

Слайд 5Driving HCA’s surprising surge

Reform will boost adjusted EBITDA by between 2%

and 3% this year.

Above its prior outlook for a 1% to 2% benefit.

Above its prior outlook for a 1% to 2% benefit.

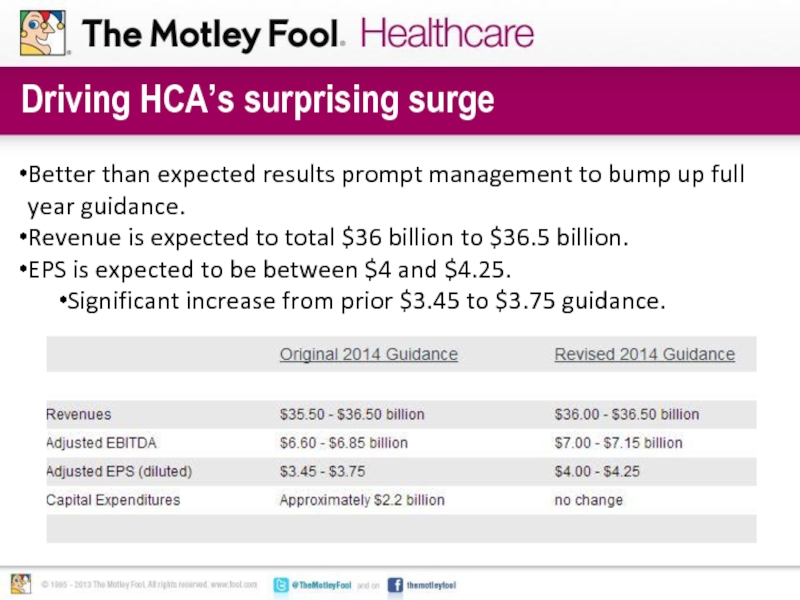

Слайд 6Driving HCA’s surprising surge

Better than expected results prompt management to bump

up full year guidance.

Revenue is expected to total $36 billion to $36.5 billion.

EPS is expected to be between $4 and $4.25.

Significant increase from prior $3.45 to $3.75 guidance.

Revenue is expected to total $36 billion to $36.5 billion.

EPS is expected to be between $4 and $4.25.

Significant increase from prior $3.45 to $3.75 guidance.

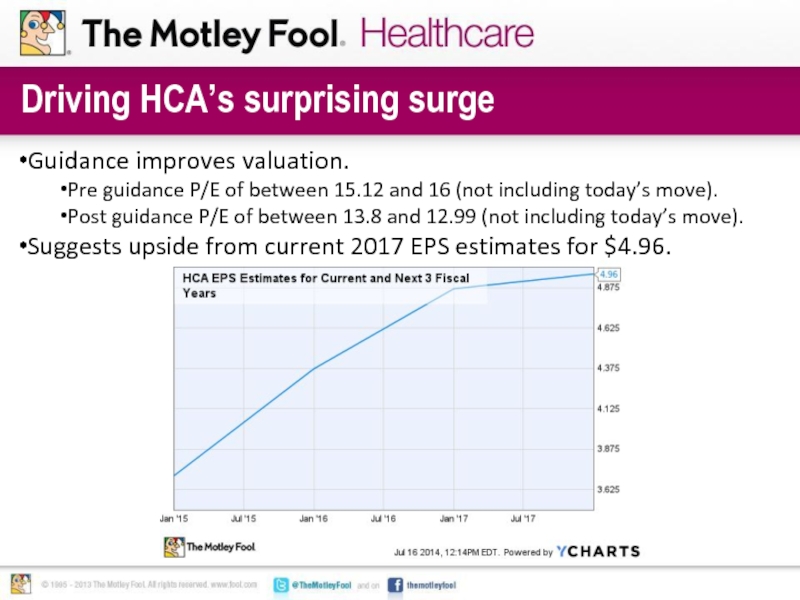

Слайд 7Driving HCA’s surprising surge

Guidance improves valuation.

Pre guidance P/E of between 15.12

and 16 (not including today’s move).

Post guidance P/E of between 13.8 and 12.99 (not including today’s move).

Suggests upside from current 2017 EPS estimates for $4.96.

Post guidance P/E of between 13.8 and 12.99 (not including today’s move).

Suggests upside from current 2017 EPS estimates for $4.96.

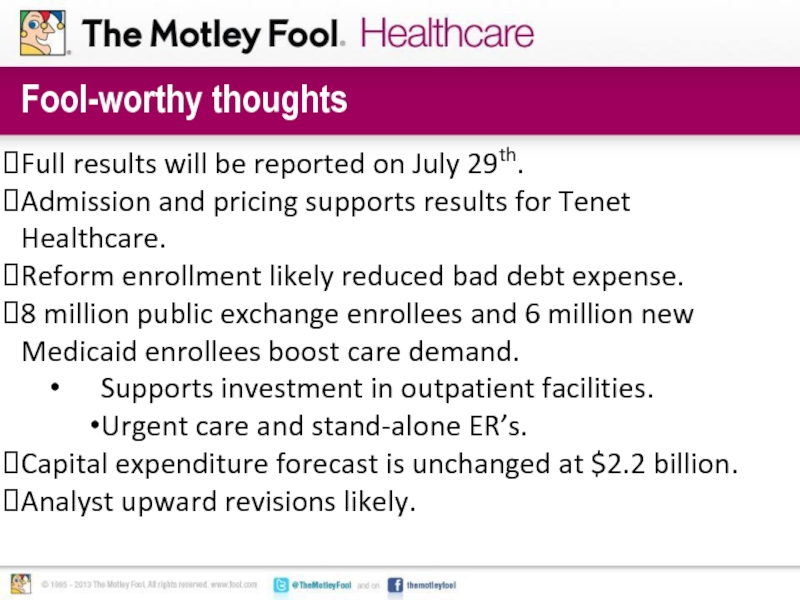

Слайд 8Fool-worthy thoughts

Full results will be reported on July 29th.

Admission and pricing

supports results for Tenet Healthcare.

Reform enrollment likely reduced bad debt expense.

8 million public exchange enrollees and 6 million new Medicaid enrollees boost care demand.

Supports investment in outpatient facilities.

Urgent care and stand-alone ER’s.

Capital expenditure forecast is unchanged at $2.2 billion.

Analyst upward revisions likely.

Reform enrollment likely reduced bad debt expense.

8 million public exchange enrollees and 6 million new Medicaid enrollees boost care demand.

Supports investment in outpatient facilities.

Urgent care and stand-alone ER’s.

Capital expenditure forecast is unchanged at $2.2 billion.

Analyst upward revisions likely.

Слайд 9Six stock picks poised for incredible growth

Six stock picks poised for

incredible growth

Six stock picks poised for incredible growth

Crush non-dividend investors over the long haul.