- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Humongous Health-Care Stocks This Week презентация

Содержание

- 1. 3 Humongous Health-Care Stocks This Week

- 2. A lot of health-care stocks took a

- 3. Shares of the biopharmaceutical firm soared 22%

- 4. Positive phase 1 preliminary data was announced

- 5. Shares of the biotech climbed 18% higher

- 6. Specialty pharmaceutical company Mallinckrodt (NYSE: MNK) is

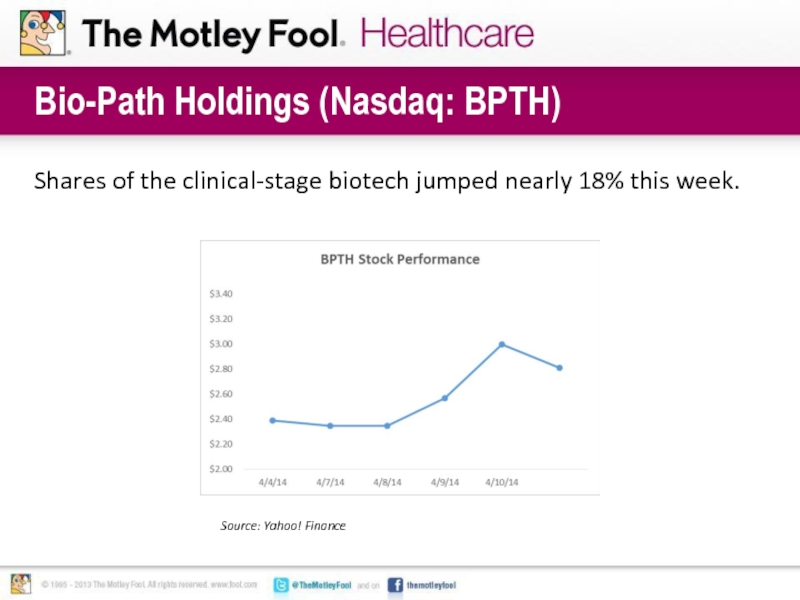

- 7. Shares of the clinical-stage biotech jumped nearly

- 8. No big announcements this week from Bio-Path.

- 9. Questcor won’t shoot up significantly, since the

- 10. Find out which stock The Motley Fool’s

Слайд 2A lot of health-care stocks took a beating this week. Not

Here are the three most humongous health-care stocks over the week ending April 11, 2014.

1

2

3

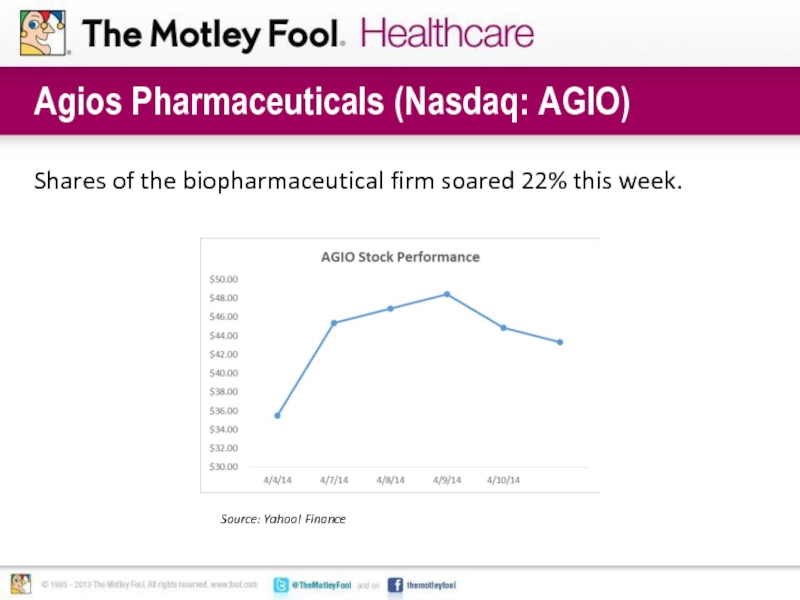

Слайд 3Shares of the biopharmaceutical firm soared 22% this week.

Agios Pharmaceuticals

Source: Yahoo! Finance

Слайд 4Positive phase 1 preliminary data was announced for cancer drug AG-221.

Agios

Clinical results were promising, with multiple complete remissions in patients with blood cancer.

Celgene (Nasdaq: CELG) stands as another winner, as AG-221 is part of a collaboration established between the big biotech and Agios in 2010.

Why Agios shares took off

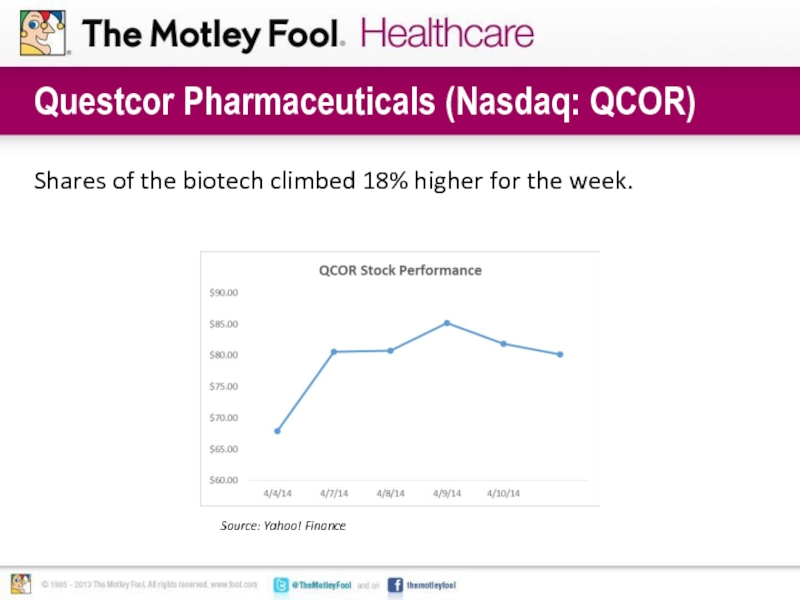

Слайд 5Shares of the biotech climbed 18% higher for the week.

Questcor

Source: Yahoo! Finance

Слайд 6Specialty pharmaceutical company Mallinckrodt (NYSE: MNK) is acquiring Questcor.

Shareholders will receive

The deal represents a 27% premium over Questcor’s closing price before the announcement.

Why Questcor shot up

Слайд 7Shares of the clinical-stage biotech jumped nearly 18% this week.

Bio-Path

Source: Yahoo! Finance

Слайд 8No big announcements this week from Bio-Path.

The biotech looks to be

Bio-Path’s Liposomal Grb-2 is in phase 1 clinical studies targeting several forms of leukemia and myelodysplastic syndrome.

Why Bio-Path boomed

Слайд 9Questcor won’t shoot up significantly, since the price of the acquisition

Bio-Path Holdings could continue its rebound, but major new developments are still in the future.

Agios’ early-stage results for AG-221 show considerable promise .

The partnership with Celgene gives Agios a leg up in continued development of the blood cancer drug.

A possibility also exists that Celgene could use some of its $5.6 billion in cash and short-term investments to scoop up Agios down the road.

Best pick to stay humongous?

?