recovery for FireEye in the coming year.

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Will FireEye Stock Recover in 2016? презентация

Содержание

- 1. Will FireEye Stock Recover in 2016?

- 2. Situation FireEye, Inc. stock appreciated rapidly in

- 3. 1) External factors behind the stock decline

- 5. 2) Factors specific to FireEye Fiscal Q3

- 6. 2) Factors specific to FireEye (cont.) While

- 7. Demand is also under scrutiny The perceived

- 8. Factors which may lift FireEye in 2016

- 9. Factors which may lift FireEye in 2016

- 11. “Consistent with the history of cyber

- 12. Going Forward As we discussed earlier in

- 13. The next billion-dollar iSecret The world's

Слайд 2Situation

FireEye, Inc. stock appreciated rapidly in the first half of 2015,

at one point rising more than 70% for the year.

The back half of the year has resulted in a different outcome. The "FEYE" symbol lost all of its gains after June, and is now down 33% as the year winds to a close.

The back half of the year has resulted in a different outcome. The "FEYE" symbol lost all of its gains after June, and is now down 33% as the year winds to a close.

Слайд 31) External factors behind the stock decline

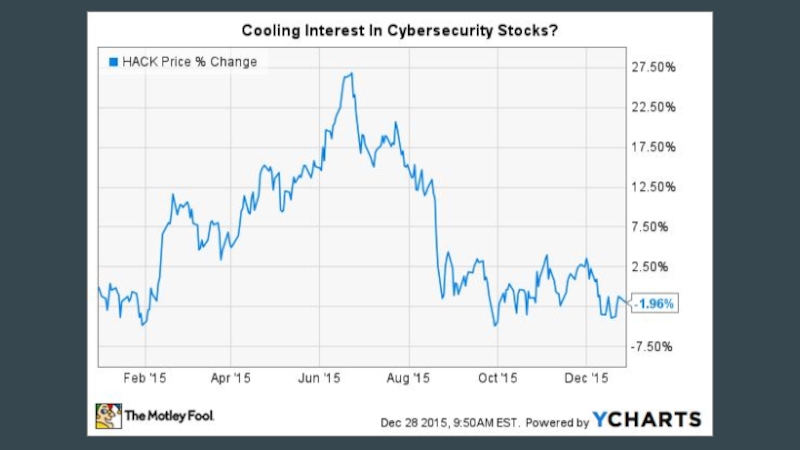

The overall stock market has

drifted lower since summer, and the cyber security sector has in particular deteriorated. On the following slide we see a year-to-date chart of the PureFunds ISE Cyber Security ETF:

Слайд 52) Factors specific to FireEye

Fiscal Q3 2015 earnings released in early

November showed evidence of slowing growth. Billlings of $210.6 million missed the company's own guidance range of $225-$230 million.

Management scaled back full year billings guidance to $780-800 million, from a previous band of $840-$850 million.

Management scaled back full year billings guidance to $780-800 million, from a previous band of $840-$850 million.

Слайд 62) Factors specific to FireEye (cont.)

While many cyber security companies operate

in the red, FireEye's losses are heavier than competitors'.

For example, FireEye posted a 74% negative operating income margin in its most recent quarter. This compares unfavorably to peers Splunk Inc. (negative 42% in most recent quarter) and Palo Alto Networks Inc. (negative 10% in most recent quarter).

For example, FireEye posted a 74% negative operating income margin in its most recent quarter. This compares unfavorably to peers Splunk Inc. (negative 42% in most recent quarter) and Palo Alto Networks Inc. (negative 10% in most recent quarter).

Слайд 7Demand is also under scrutiny

The perceived need for cyber security products

by organizations is cyclical, and often news-driven. Prominent cyber attacks tend to drive sales (and stock prices of security companies).

We are currently in a relatively quiet news cycle.

FireEye's CEO blamed a recent cyber espionage cooperation agreement (in principle) between the U.S. and China as a factor in weakening demand.

We are currently in a relatively quiet news cycle.

FireEye's CEO blamed a recent cyber espionage cooperation agreement (in principle) between the U.S. and China as a factor in weakening demand.

Слайд 8Factors which may lift FireEye in 2016

Increased success of Mandiant professionals,

the consultant group FireEye acquired last year, which routinely lands large software and monitoring contracts.

A resumption of billings growth. As FireEye's customer base matures, the company has the potential to sell additional products to its current clients, alongside new customer sales, lifting billings.

Continued work on operating margin. The company's profitability is actually improving, after previous quarters of negative 100%+ operating income margin. But it needs to bring margins closer in line with peers.

A resumption of billings growth. As FireEye's customer base matures, the company has the potential to sell additional products to its current clients, alongside new customer sales, lifting billings.

Continued work on operating margin. The company's profitability is actually improving, after previous quarters of negative 100%+ operating income margin. But it needs to bring margins closer in line with peers.

Слайд 9Factors which may lift FireEye in 2016 (cont.)

Continued aggressive development of

software-as-a-service offerings, in the mold of the popular "FireEye as a Service" cloud-based threat detection and prevention software.

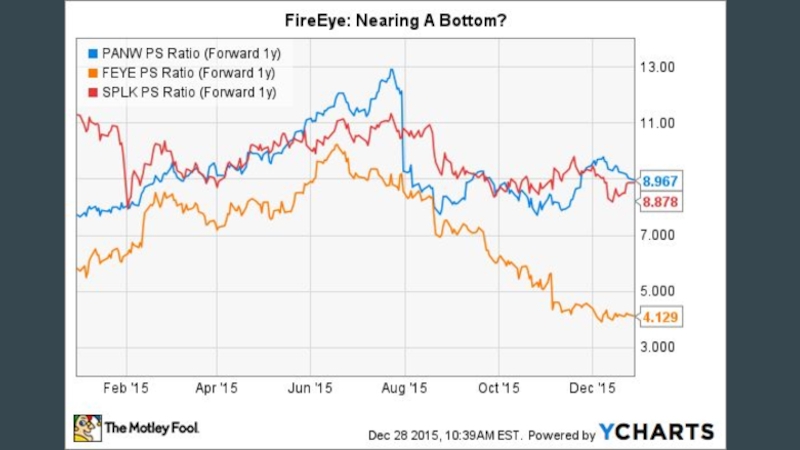

A perception that the company is now fairly valued, or cheap, may help lift FireEye stock next year. As you can see from the following slide, FireEye now trades at one-half the forward price-to-sales valuation of competitors Splunk and Palo Alto Networks:

A perception that the company is now fairly valued, or cheap, may help lift FireEye stock next year. As you can see from the following slide, FireEye now trades at one-half the forward price-to-sales valuation of competitors Splunk and Palo Alto Networks:

Слайд 11

“Consistent with the history of cyber security as defenses against attacks

increase, the attackers adapt. The only way to keep up is to be the vanguard of the industry. The threat intelligence we gain from our fast service and Mandiant professional services offerings creates a sustainable, competitive advantage for us, an advantage that remains uniquely ours, as well as we continue to be the first to the major breaches."

--CEO Dave DeWalt, Q3 2015 Earnings Call

--CEO Dave DeWalt, Q3 2015 Earnings Call

Above all, FireEye should seek to hone its competitive advantages:

Слайд 12Going Forward

As we discussed earlier in this presentation, demand for cyber

security products ebbs and flows through each calendar year. It's an external factor which FireEye has little control over. So, the company should redouble its efforts to grab market share while whittling away at its negative margins. This is the foundation for a rebound in FireEye stock in 2016.

Слайд 13The next billion-dollar iSecret

The world's biggest tech company forgot to

show you something at its recent event, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early-in-the-know investors! To be one of them, just click here.