- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Book - Short Term Trading Strategies That Work презентация

Содержание

- 1. Book - Short Term Trading Strategies That Work

- 2. Larry Connors was a broker for Merrill

- 3. Quotes from the book

- 4. “The one thing [professional traders] have in

- 5. “They followed their dream and have become

- 6. “…the never ending challenge of figuring out

- 7. “Philosophically, I live in a world of

- 8. “First we’ll look at certain behavior which

- 9. “It’s one thing for someone to give

- 10. The Chapters

- 11. Think Differently Rule 1 – Buy

- 12. Rule 2 – Buy The Market After

- 13. Rule 3 – Buy Stocks Above Their

- 14. Rule 4 – Use The VIX To

- 15. Rule 5 – Stops Hurt The

- 16. Rule 6 – It Pays To Hold

- 17. Trading With Intra-Day Drops Making Edges

- 18. The 2 Period RSI The Traders

- 19. Double 7’s Strategy If the SPY is

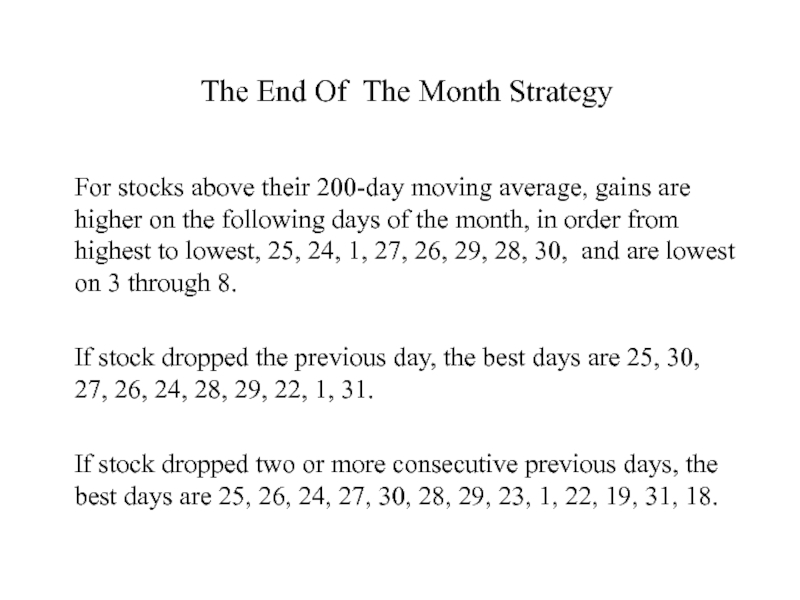

- 20. The End Of The Month Strategy For

- 21. Five Strategies To Time The Market

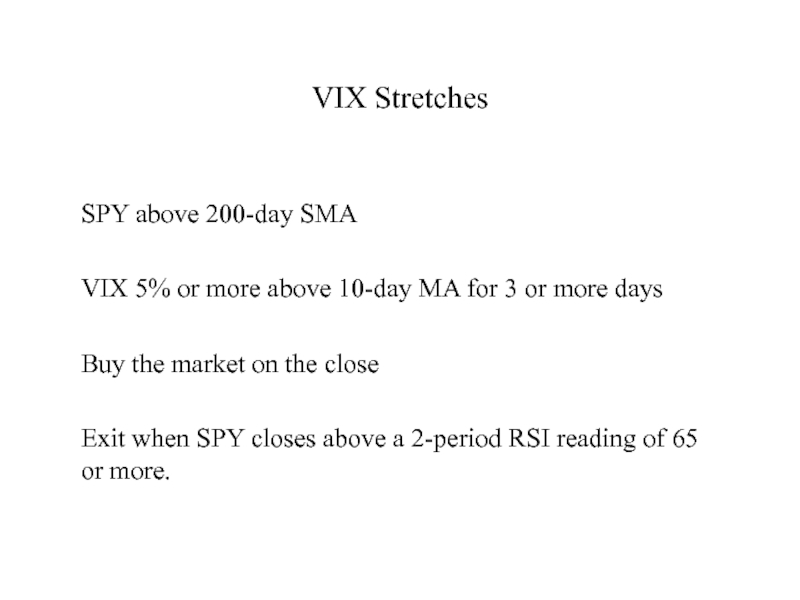

- 22. VIX Stretches SPY above 200-day SMA

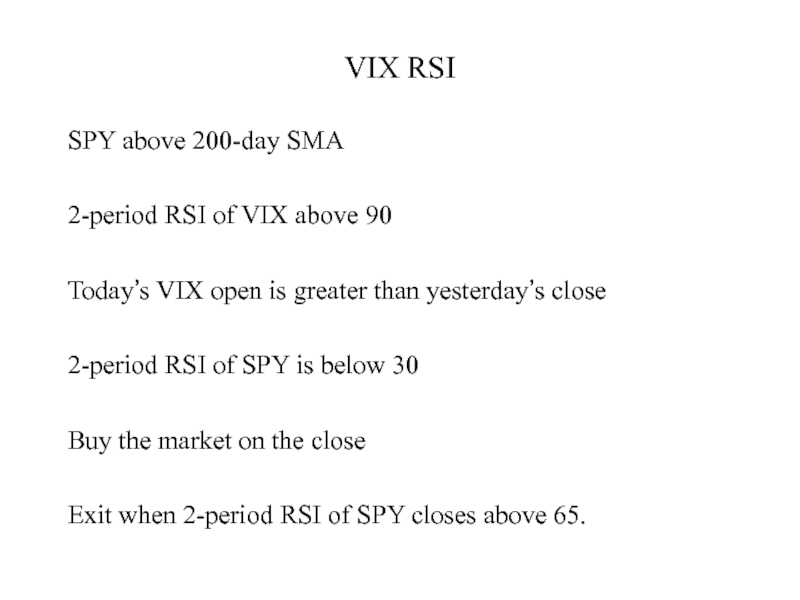

- 23. VIX RSI SPY above 200-day SMA

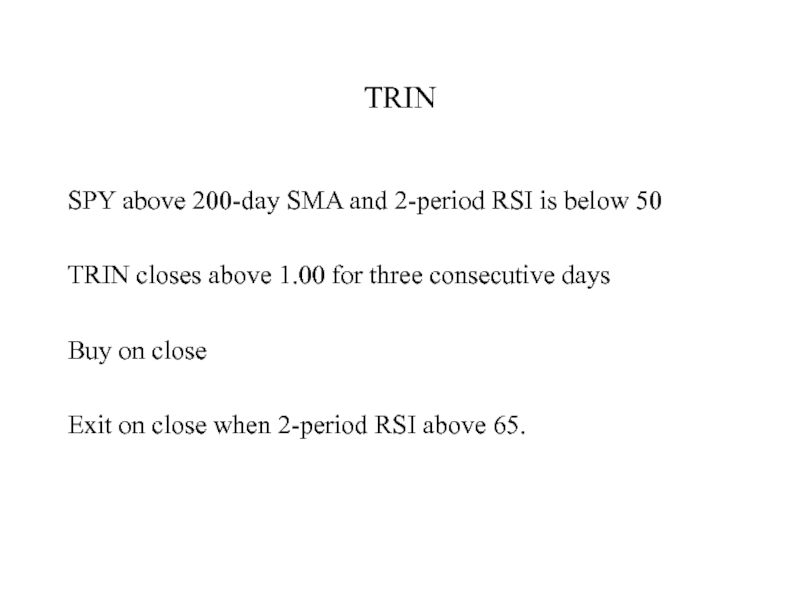

- 24. TRIN SPY above 200-day SMA and

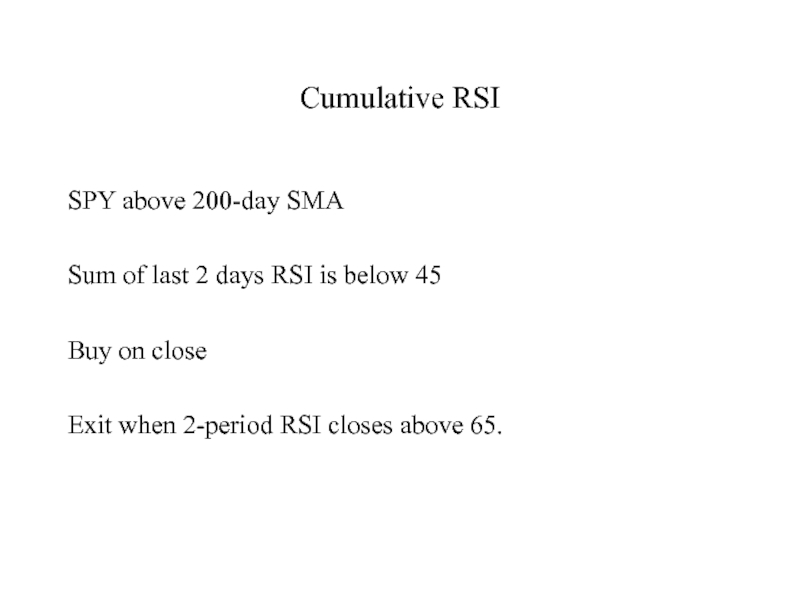

- 25. Cumulative RSI SPY above 200-day SMA

- 26. S&P Short SPY below 200-day SMA

- 27. Exit Strategies

- 28. Fixed Time Does not like. Should sell into strength.

- 29. First Up Close From Previous Day By Larry Williams, excellent strategy

- 30. Close Above A New High A valid choice

- 31. Close Above Moving Average 5-day is first choice, then 10-day MA.

- 32. 2-Period RSI Closes above 65, 70 or 75.

- 33. Trailing Stops The tighter the stop,

- 34. Choose on exit strategy Stay with

- 35. The Mind

- 36. You must be prepared for any situation.

- 37. What would you do if: You

- 38. What would you do if: You

- 39. What would you do if: You

- 40. What would you do if: The

- 41. What would you do if: You

- 42. Interview with Richard J. Machowicz Martial arts

- 43. The Finale – a summary

- 44. 16 Short Term Trading Strategies That Work

- 45. Strategy 1 Buy pullbacks, not breakouts. The statistics overwhelmingly prove that.

- 46. Strategy 2 Buy the stock market

- 47. Strategy 3 Buy stocks above their 200-day moving average.

- 48. Strategy 4 Buy stocks when the

- 49. Strategy 5 Stops are potentially an expensive form of insurance.

- 50. Strategy 6 Hold positions overnight in times of concern.

- 51. Strategy 7 Buy stocks on intra-day

- 52. Strategy 8 Apply the 2-period RSI

- 53. Strategy 9 Buy the market and

- 54. Strategy 10 Trade with Cumulative RSI’s.

- 55. Strategy 11 Trade Double 7’s on U.S. and World Indices, and ETF’s.

- 56. Strategy 12 Time the market using

- 57. Strategy 13 Buy stocks at the

- 58. Strategy 14 There are many good

- 59. Strategy 15 Have a plan in

- 60. Strategy 16 The most important strategy

- 61. The End

Слайд 1Short Term Trading Strategies That Work

A Quantified Guide to Trading Stocks

By Larry Connors and Cesar Alvarez

Published 2009

Слайд 2Larry Connors was a broker for Merrill Lynch in 1982. In

Слайд 4“The one thing [professional traders] have in common is that they

Слайд 5“They followed their dream and have become successful because of their

Слайд 6“…the never ending challenge of figuring out a game that may

Слайд 7“Philosophically, I live in a world of reversion to the mean

Слайд 8“First we’ll look at certain behavior which is inherent in the

Слайд 9“It’s one thing for someone to give you a handful of

Слайд 11Think Differently

Rule 1 – Buy Pullbacks Not Breakouts

After the market has

After the market has risen three days in a row, it has on average lost money over the next five trading days.

Слайд 12Rule 2 – Buy The Market After It’s Dropped; Not After

After the market has dropped three days in a row, it has risen more than 4 times it’s average weekly gain over the next five trading days.

After the market has risen three days in a row, it has on average lost money over the next five trading days.

Слайд 13Rule 3 – Buy Stocks Above Their 200-Day Moving Average, Not

This rule is not fool-proof.

Many good stocks represent real value below the 200-day MA but it’s easier and less stressful to follow this rule.

Large losses can be prevented by following this rule.

Слайд 14Rule 4 – Use The VIX To Your Advantage…Buy The Fear,

If SPY (or SPX) is above it’s 200-day moving average, the higher the VIX is above it’s 10-day simple moving average it’s more likely oversold and a rally is near.

The VIX 5% rule

- If 5% above it’s 10-day SMA, buy the market.

- If 5% below it’s 10-day SMA, lock in gains (and don’t buy).

Слайд 15Rule 5 – Stops Hurt

The tighter your stops, the less

You can control losses with position size and money management

Слайд 16Rule 6 – It Pays To Hold Positions Overnight

During the test

Buying the SPY on the close and selling on the open gained 171.40 points.

Слайд 17Trading With Intra-Day Drops

Making Edges Even Bigger

The greater the

The greater the intra-day selloff, the better the performance over the next five days.

Слайд 18The 2 Period RSI

The Traders Holy Grail of Indicators

For stocks

a 2-period RSI above 90 should not be bought.

Aggressive traders might prepare to short them.

Readings below 10 are oversold.

Readings beyond these are even better.

These were tested up to one week.

Trades held one week did better than less time.

Слайд 19Double 7’s Strategy

If the SPY is above it’s 200-day moving average

If it closes at a 7-day high, sell your long position.

Слайд 20The End Of The Month Strategy

For stocks above their 200-day moving

If stock dropped the previous day, the best days are 25, 30, 27, 26, 24, 28, 29, 22, 1, 31.

If stock dropped two or more consecutive previous days, the best days are 25, 26, 24, 27, 30, 28, 29, 23, 1, 22, 19, 31, 18.

Слайд 22VIX Stretches

SPY above 200-day SMA

VIX 5% or more above 10-day

Buy the market on the close

Exit when SPY closes above a 2-period RSI reading of 65 or more.

Слайд 23VIX RSI

SPY above 200-day SMA

2-period RSI of VIX above 90

Today’s VIX

2-period RSI of SPY is below 30

Buy the market on the close

Exit when 2-period RSI of SPY closes above 65.

Слайд 24TRIN

SPY above 200-day SMA and 2-period RSI is below 50

TRIN

Buy on close

Exit on close when 2-period RSI above 65.

Слайд 25Cumulative RSI

SPY above 200-day SMA

Sum of last 2 days RSI

Buy on close

Exit when 2-period RSI closes above 65.

Слайд 26S&P Short

SPY below 200-day SMA

Market closes up 4 or more

Sell on close

Cover short when SPY closes under it’s 5-period MA.

Слайд 33Trailing Stops

The tighter the stop, the worse the performance.

Few

Слайд 34Choose on exit strategy

Stay with it

Remember - the stronger the move

Слайд 36You must be prepared for any situation.

You need to know how

Know the appropriate action to take.

Have the discipline to do it.

Слайд 37What would you do if:

You start trading a new strategy that

Слайд 38What would you do if:

You start trading a new strategy that

Слайд 39What would you do if:

You have lost money eight consecutive days,

Слайд 41What would you do if:

You are long 1000 shares, you place

Слайд 42Interview with Richard J. Machowicz

Martial arts specialist, Navy SEAL instructor.

Author of

Why people achieve great success in trading and all walks of life.

http://www.tradingmarkets.com/.site/stocks/tradinglessons/interviews/Not-Dead-Cant-Quit-No-Limit-Thinking-with-Navy-Sea-77443.cfm

Слайд 46Strategy 2

Buy the stock market after it has dropped multiple

Слайд 48Strategy 4

Buy stocks when the VIX is 5% or more

Lock in gains (or short stocks) when the VIX is 5% or more below it’s 10-period moving average.

Слайд 52Strategy 8

Apply the 2-period RSI to all of your trading.

Слайд 56Strategy 12

Time the market using TRIN, the VIX, the 2-period

Слайд 57Strategy 13

Buy stocks at the end of the month, especially

Слайд 58Strategy 14

There are many good exit strategies. The key is

Слайд 59Strategy 15

Have a plan in place to deal with the

Professional trading requires professional preparation.

Слайд 60Strategy 16

The most important strategy begins with your mind.

Your mind

The more focused you are on your targets, the more successful and profitable you will become.

![“The one thing [professional traders] have in common is that they know what it’s like](/img/tmb/5/435660/7f91ca3c80aa3f19f447f9c9b86e715b-800x.jpg)