This Week

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Penn West Petroleum, Energy XXI, and Stone Energy Exploded Higher This Week презентация

Содержание

- 1. Why Penn West Petroleum, Energy XXI, and Stone Energy Exploded Higher This Week

- 2. The price of crude oil jumped

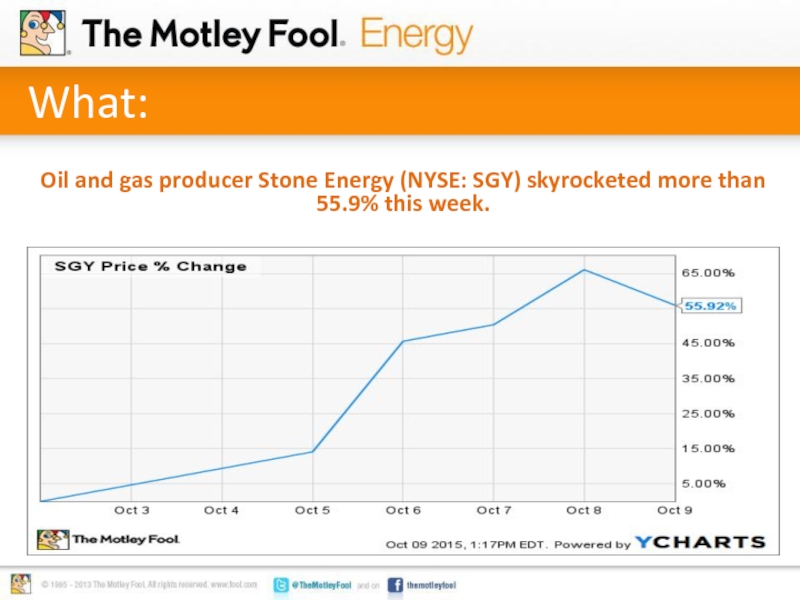

- 3. What: Oil and gas producer Stone Energy

- 4. So What: Key driver: With no news,

- 5. Now What: One of the reasons Stone

- 6. What: Oil producer Energy XXI (NASDAQ: EXXI) nearly doubled, leaping more than 96% this week.

- 7. So What: Key driver: Higher oil prices

- 8. Now What: Short covering was also likely

- 9. What: Canadian oil producer Penn West Petroleum’s

- 10. So What: Key driver: While higher oil

- 11. Now What: In addition to that, there

- 12. This could be the next billion-dollar iSecret

Слайд 2

The price of crude oil jumped this week, heading from $45

per barrel to more than $50 a barrel at one point. This fueled strong gains among oil stocks; however, according to S&P Capital IQ data, the best gains were made by Penn West Petroleum (NYSE: PWE), Energy XXI (NASDAQ: EXXI), and Stone Energy (NYSE: SGY).

Photo credit: TaxCredits.net

Слайд 4So What:

Key driver: With no news, the only catalyst this week

was oil induced buying

Short covering also likely played a roll in the rally as 27.2% of the float was sold short as of the end of September

Short covering also likely played a roll in the rally as 27.2% of the float was sold short as of the end of September

Слайд 5Now What:

One of the reasons Stone was so heavily shorted is

because it has a lot of debt, but higher oil prices make that debt more manageable

Key takeaway: Investors are growing less concerned now that oil appears to be on the upswing

Key takeaway: Investors are growing less concerned now that oil appears to be on the upswing

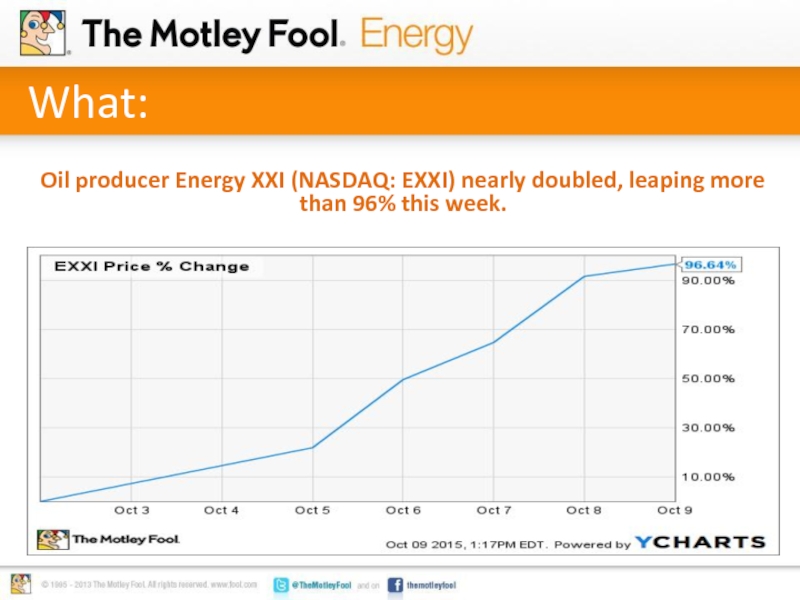

Слайд 7So What:

Key driver: Higher oil prices

Energy XXI did make a move

to bolster its liquidity as it filed to sell up to $500 million worth of mixed securities

EXXI also had its credit rating downgraded by S&P

EXXI also had its credit rating downgraded by S&P

Слайд 8Now What:

Short covering was also likely a big fuel behind the

buying this week

Key takeaway: Higher oil prices, plus the potential for improved liquidity, had investors breathing a huge sigh of relief

Key takeaway: Higher oil prices, plus the potential for improved liquidity, had investors breathing a huge sigh of relief

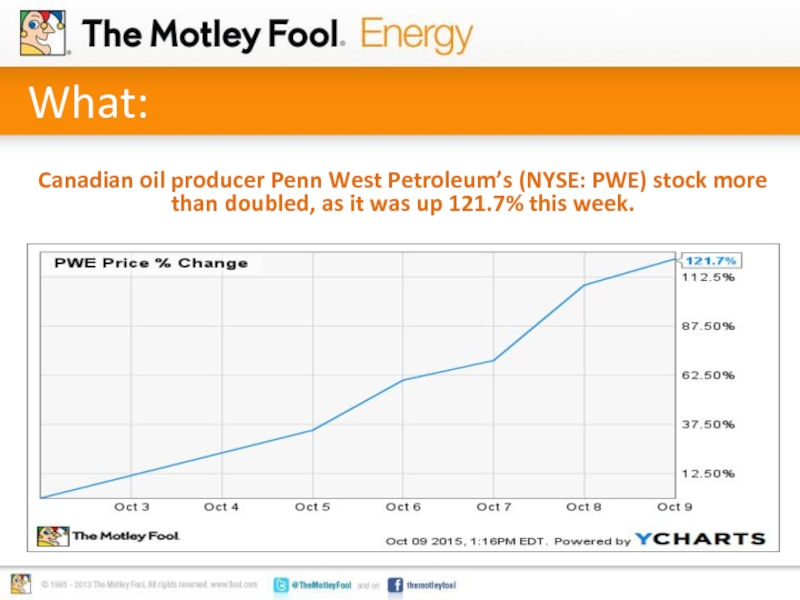

Слайд 9What:

Canadian oil producer Penn West Petroleum’s (NYSE: PWE) stock more than

doubled, as it was up 121.7% this week.

Слайд 10So What:

Key driver: While higher oil prices helped, M&A news fueled

Penn West this week

First, Penn West sold a non-core asset for roughly $200 million, with plans to use the cash to pay down debt

First, Penn West sold a non-core asset for roughly $200 million, with plans to use the cash to pay down debt

Слайд 11Now What:

In addition to that, there was speculation in the market

that Penn West itself is an acquisition target, especially after a notable acquisition overture was announced in Canada

Key takeaway: Higher oil, better liquidity, and M&A movement has investors buying

Key takeaway: Higher oil, better liquidity, and M&A movement has investors buying