Pre-Money Conference - Jun '14

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

What I Learned Seed Investing Over the Last 10 Years презентация

Содержание

- 1. What I Learned Seed Investing Over the Last 10 Years

- 2. Brief bio Jeff Clavier (@jeff) French born

- 3. Pre-Money Conference - Jun '14

- 4. Flashback: Ten years ago Early days of

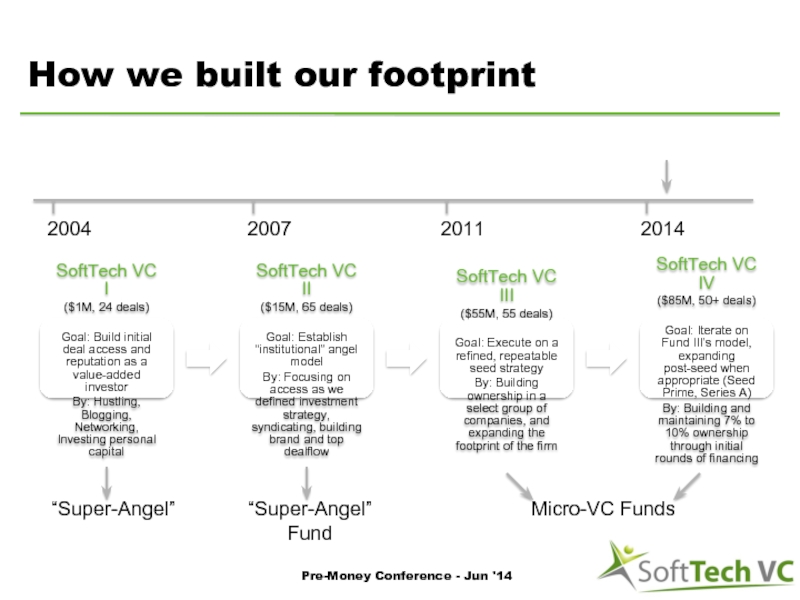

- 5. How we built our footprint Pre-Money Conference

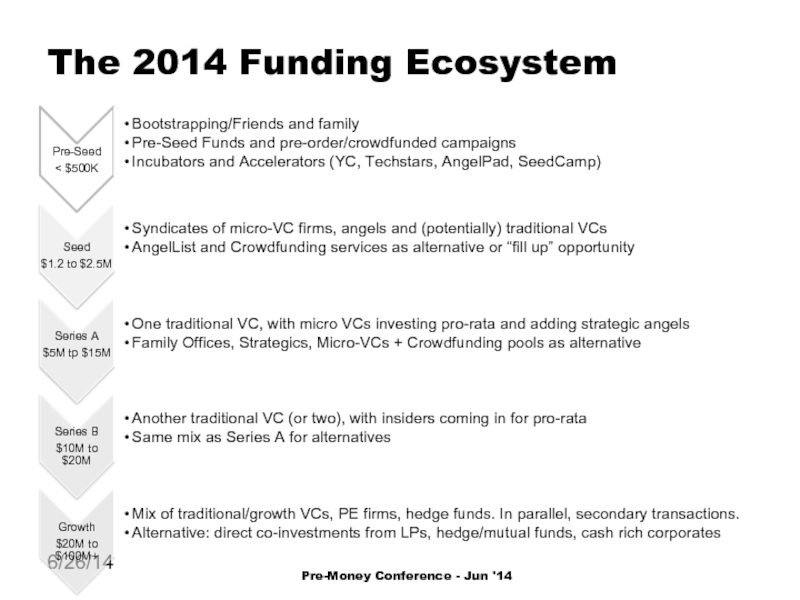

- 6. The 2014 Funding Ecosystem 6/26/14 Pre-Money Conference - Jun '14

- 7. What I Learned Seed Investing Over the

- 8. 1. Success + Reputation = Dealflow

- 9. 2. You need a clear “shtick” Critical

- 10. 3. Be explicit about your investment criteria

- 11. 4. Clear signs a deal is not

- 12. 5. Unique ideas no longer exist The

- 13. 6. Beware of the “Quick Pass”

- 14. 7- Think value add when syndicating In

- 15. 8. Founder accountability is key Too often

- 16. 9. Beating the Series A/B Crunch We

- 17. 10. Recycling does matter Say you have

- 18. 11. Without systems, you will drown The

- 19. If I could write to my younger

- 20. Good luck, and thank you! www.softtechvc.com @softtechvc Pre-Money Conference - Jun '14

- 21. But wait! There is more. (Yeah,

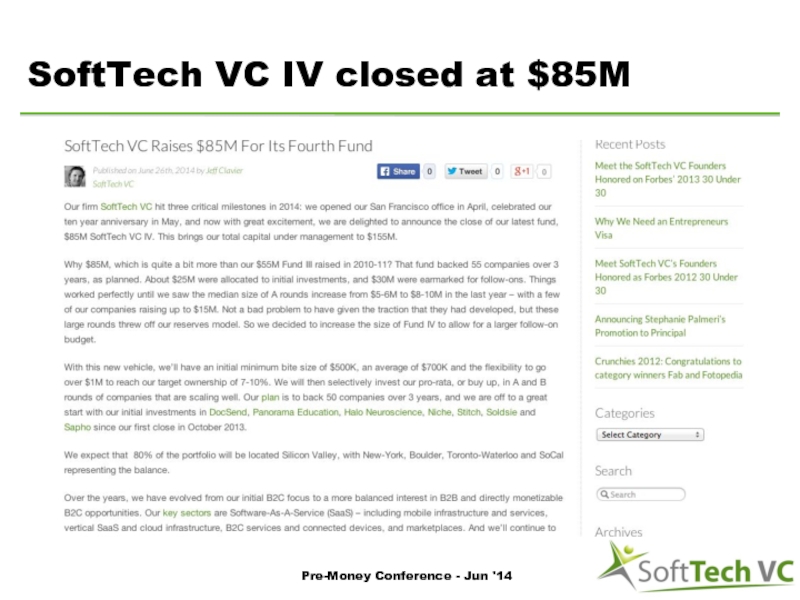

- 22. SoftTech VC IV closed at $85M Pre-Money Conference - Jun '14

- 23. $85M SoftTech VC IV Primer 50 seed

- 24. How we built our footprint SoftTech VC

- 25. Thank you! www.softtechvc.com @softtechvc Pre-Money Conference - Jun '14

Слайд 1What I Learned Seed Investing Over the

Last 10 Years

Jeff Clavier

Managing

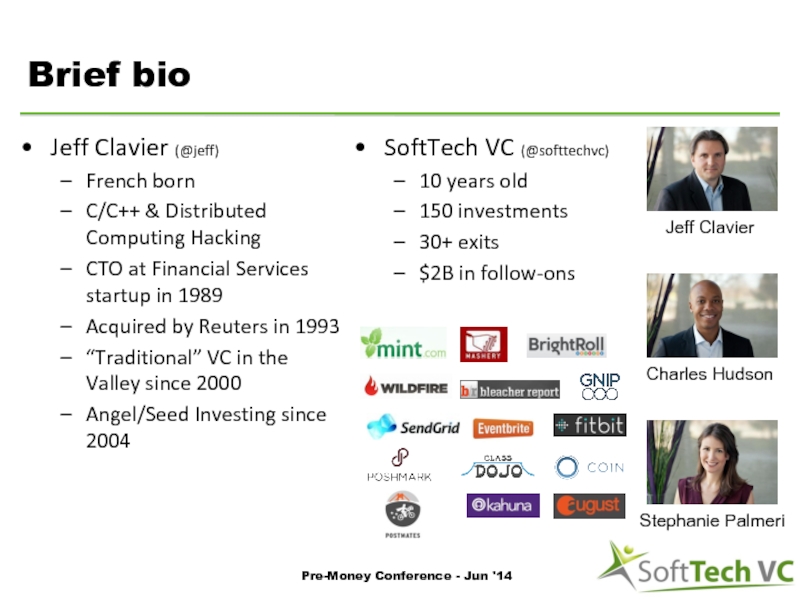

Слайд 2Brief bio

Jeff Clavier (@jeff)

French born

C/C++ & Distributed Computing Hacking

CTO at Financial

Acquired by Reuters in 1993

“Traditional” VC in the Valley since 2000

Angel/Seed Investing since 2004

SoftTech VC (@softtechvc)

10 years old

150 investments

30+ exits

$2B in follow-ons

Pre-Money Conference - Jun '14

Jeff Clavier

Charles Hudson

Stephanie Palmeri

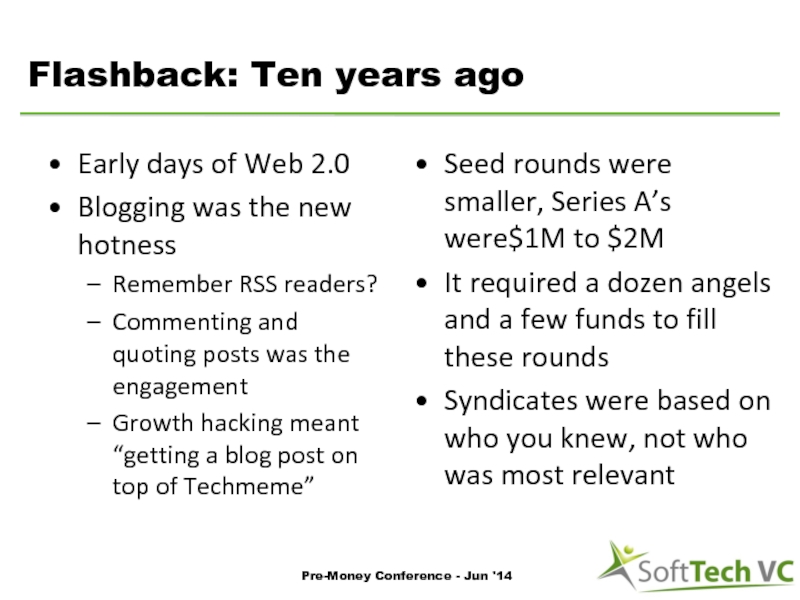

Слайд 4Flashback: Ten years ago

Early days of Web 2.0

Blogging was the new

Remember RSS readers?

Commenting and quoting posts was the engagement

Growth hacking meant “getting a blog post on top of Techmeme”

Seed rounds were smaller, Series A’s were$1M to $2M

It required a dozen angels and a few funds to fill these rounds

Syndicates were based on who you knew, not who was most relevant

Pre-Money Conference - Jun '14

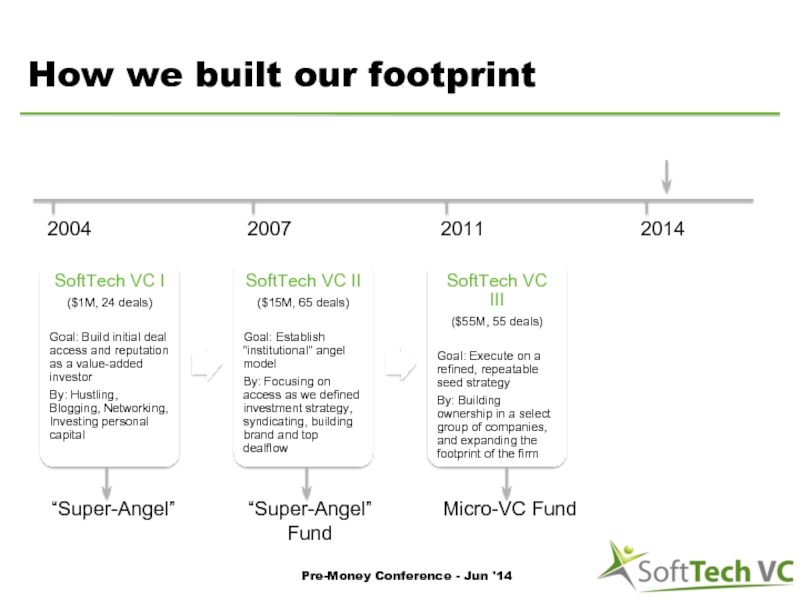

Слайд 5How we built our footprint

Pre-Money Conference - Jun '14

2004

2007

2011

2014

“Super-Angel”

“Super-Angel”

Fund

Micro-VC Fund

Слайд 7What I Learned Seed Investing Over the

Last 10 Years

Disclaimer: your

Pre-Money Conference - Jun '14

Слайд 81. Success + Reputation = Dealflow

In order to get access to

Pre-Money Conference - Jun '14

Слайд 92. You need a clear “shtick”

Critical with both entrepreneurs and LPs

CBInsights

Unless you have an established brand and track record, you need a differentiated strategy:

Geography, sectors and industries, stage, value-add, infrastructure and ecosystem

Pre-Money Conference - Jun '14

Слайд 103. Be explicit about your investment criteria

Apply your investment thesis as

Sector, Location,…

How we summarize our criteria?

Answer Yes to:

Like these founders? Are they a particular fit for this market?

Are you passionate about the product?

Do you LOVE this deal?

When you start investing, you’ll love each and every deal

Is it fundable in 12 to 18 months?

Pre-Money Conference - Jun '14

Слайд 114. Clear signs a deal is not for you

“They don't know

When you have that feeling about founders, it’s time to move to the next deal in the funnel

As you due diligence founders, markets and customers, every piece of information you collect should make you increasingly excited

Over time, you’ll develop a “spidey sense” that will tell you something is off – every single time I ignored it, I lost my capital

Pre-Money Conference - Jun '14

Слайд 125. Unique ideas no longer exist

The notion of a “unique idea”

It’s all about executing better, faster and bigger

Competitors will pop up within weeks of your launch

And they will get funded

For investors, that means you can also wait for the right team

Pre-Money Conference - Jun '14

Слайд 13 6. Beware of the “Quick Pass”

What’s common to all these

I passed on all of them because they did not feel interesting or performing – or I was “too busy”

How do you avoid the “Quick Pass”?

Ideally you‘d keep an open mind as to the merits of every opportunity, especially if founders are legit and you respect the referrer

PS: It’s really hard – still making that mistake too often

Pre-Money Conference - Jun '14

Слайд 147- Think value add when syndicating

In this environment (135 micro-VCs, 100s

Value add (experience, connections, expertise, brand name) will be paramount to get you in a deal

Building a strong syndicate that helps fix the shortcomings/challenges of founders is key

That’s why party rounds are so atrocious – no one cares, no one helps

Smart founders will optimize for “Investor Market Fit” - when they have several options

Pre-Money Conference - Jun '14

Слайд 158. Founder accountability is key

Too often investors think keeping portfolio cos

Agree early on a reporting schedule and a simple one-sheet template

Summary of progress against plan / Highlights / Lowlights / KPIs / Cash on hand & Runway / Key asks to investors

Especially important if there is no board, and founders are first timers

Once you realize something is off, it is most likely too late – runway rarely allows for a “warm reboot”

Pre-Money Conference - Jun '14

Слайд 169. Beating the Series A/B Crunch

We had 18 companies raise $200M

Suggestions

Have a clear “Hot or Not” map for sectors you invest in, and understand runway implications for the Not’s

Early on establish and validate hurdles to clear in order to get the next round

Pre-market early with the “most likely/best fit” group of investors

Even great, promising startups require solid runway

Pre-Money Conference - Jun '14

Слайд 1710. Recycling does matter

Say you have a $50M fund, and you

To produce a $200M total return, you’d need a 5.5X performance if you don’t put “fees in the ground”

200 / (50 * (1 – 25%)) = 5.5

Recycling means that you don’t distribute all proceeds back to LPs, or use your clawback clause

Cashflow/distribution optimization is tricky

Pre-Money Conference - Jun '14

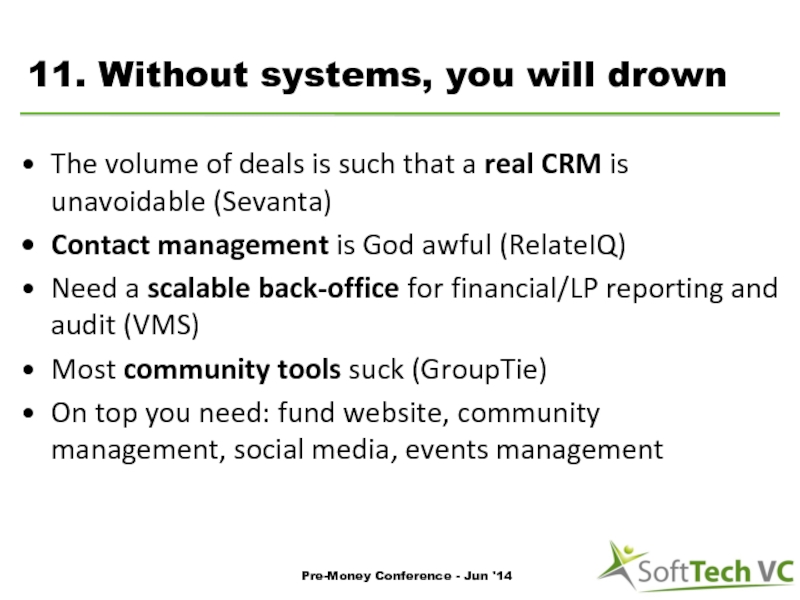

Слайд 1811. Without systems, you will drown

The volume of deals is such

Contact management is God awful (RelateIQ)

Need a scalable back-office for financial/LP reporting and audit (VMS)

Most community tools suck (GroupTie)

On top you need: fund website, community management, social media, events management

Pre-Money Conference - Jun '14

Слайд 19If I could write to my younger self

Don’t say No to

Pre-Money Conference - Jun '14

Слайд 21But wait!

There is more.

(Yeah, I have always wanted to do this)

Pre-Money

Слайд 23$85M SoftTech VC IV Primer

50 seed deals over 3 years

$500K to

$35M = 50 deals @ $700K

$50M allocated to Series As and Bs follow-ons

Geos: SF/SV, NY, SoCal, Boulder, Toronto

Target ownership: 7 to 10%

Always syndicating with peer micro-VCs and angels

Sectors

New Areas: VR/glasses, BTC, drones, Digital Health

Pre-Money Conference - Jun '14

Слайд 24How we built our footprint

SoftTech VC I

($1M, 24 deals)

Goal: Build initial

By: Hustling, Blogging, Networking, Investing personal capital

SoftTech VC II

($15M, 65 deals)

Goal: Establish “institutional” angel model

By: Focusing on access as we defined investment strategy, syndicating, building brand and top dealflow

SoftTech VC III

($55M, 55 deals)

Goal: Execute on a refined, repeatable seed strategy

By: Building ownership in a select group of companies, and expanding the footprint of the firm

SoftTech VC IV

($85M, 50+ deals)

Goal: Iterate on Fund III’s model, expanding post-seed when appropriate (Seed Prime, Series A)

By: Building and maintaining 7% to 10% ownership through initial rounds of financing

Pre-Money Conference - Jun '14

2004

2007

2011

2014

“Super-Angel”

“Super-Angel”

Fund

Micro-VC Funds