- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Accounting Cycle: Capturing Economic Events презентация

Содержание

- 1. The Accounting Cycle: Capturing Economic Events

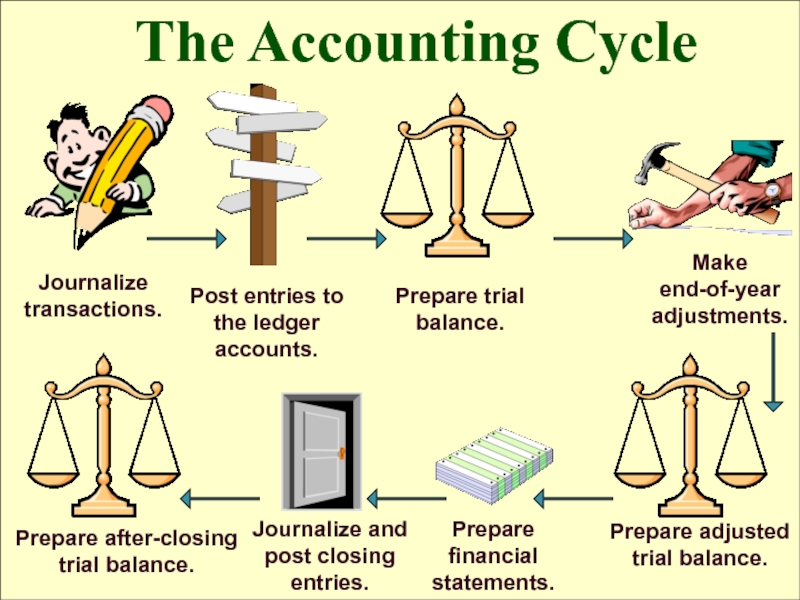

- 2. The Accounting Cycle

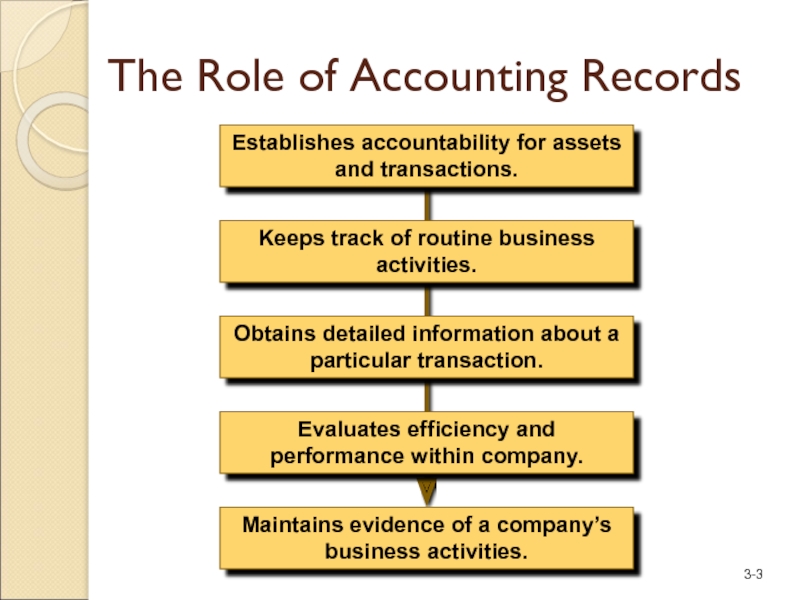

- 3. The Role of Accounting Records Establishes accountability

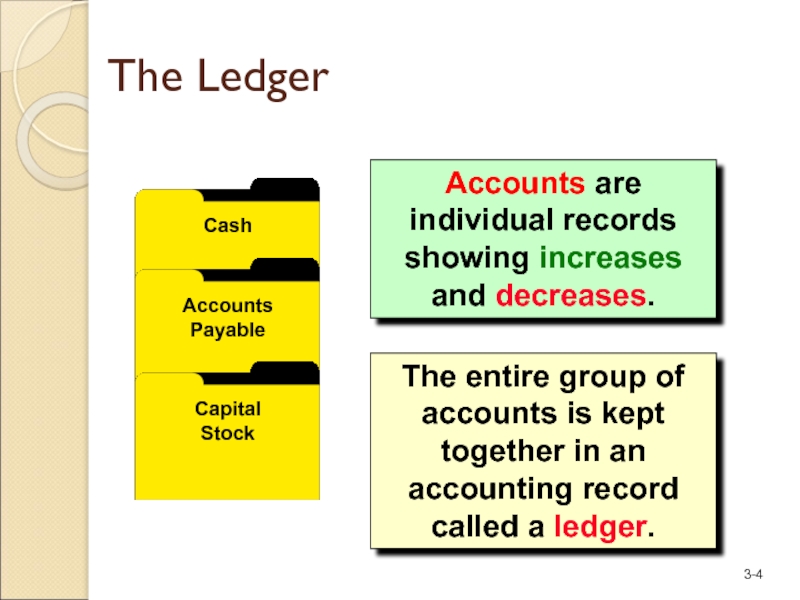

- 4. The Ledger The entire group of accounts

- 5. The Use of Accounts Increases are

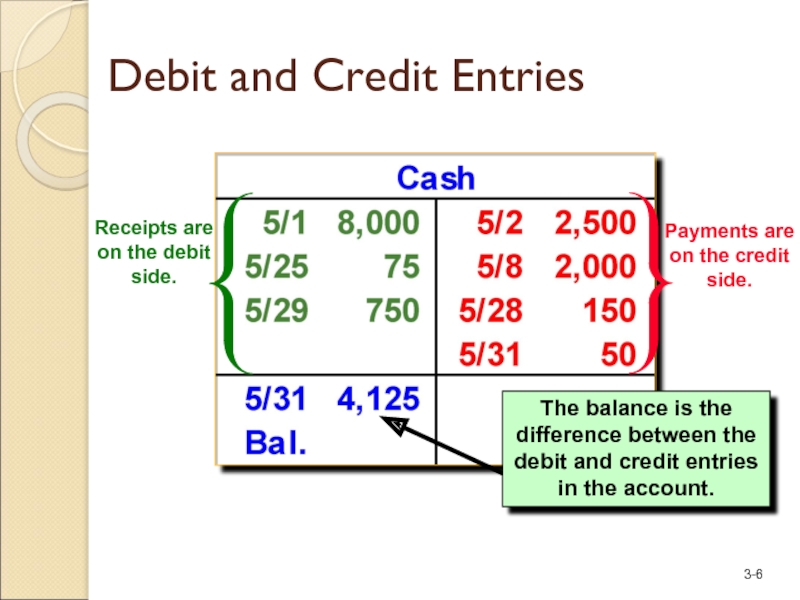

- 6. Debit and Credit Entries

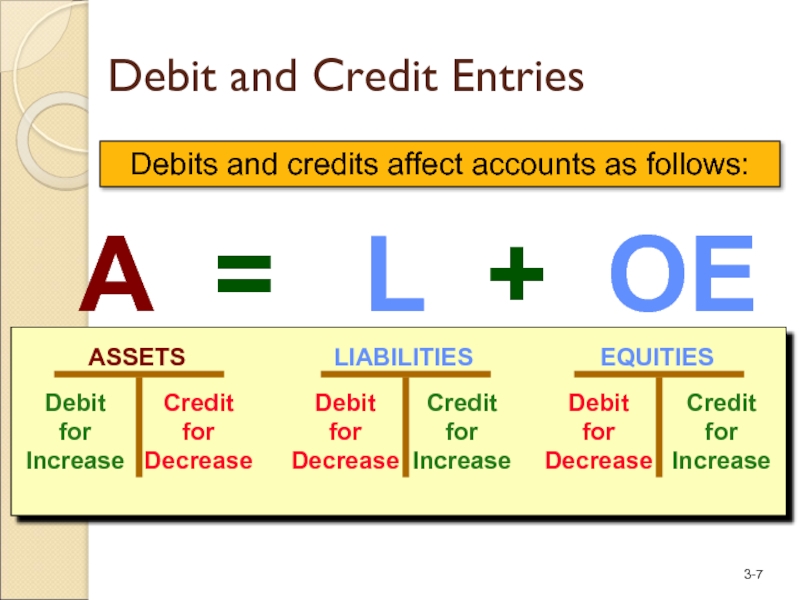

- 7. A = L + OE

- 8. A = L + OE Debit

- 9. Let’s record selected transactions for JJ’s Lawn Care Service in the accounts.

- 10. May 1: Jill Jones and her

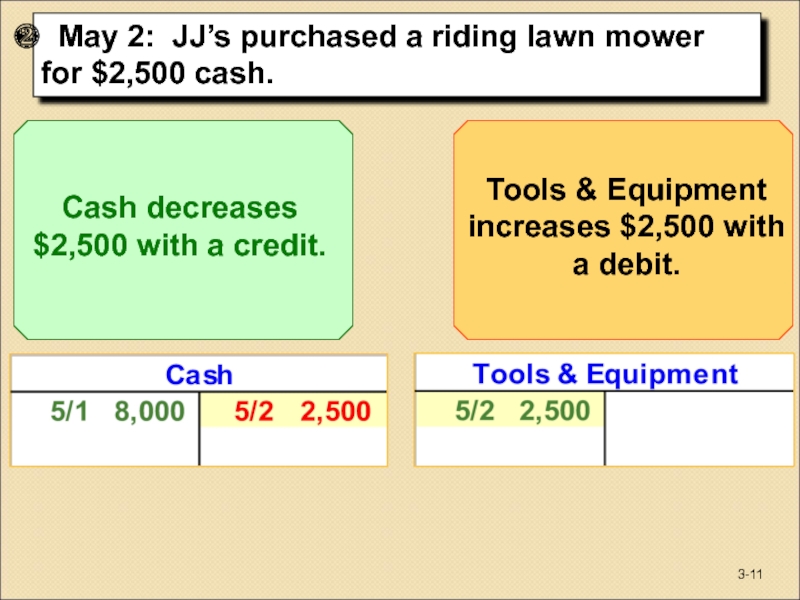

- 11. May 2: JJ’s purchased a riding lawn mower for $2,500 cash. 3-

- 12. May 8: JJ’s purchased a $15,000

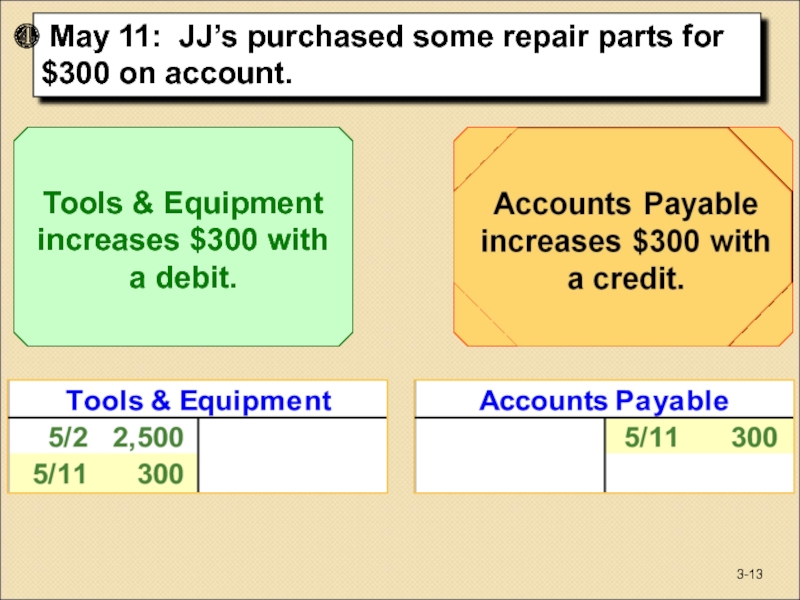

- 13. May 11: JJ’s purchased some repair parts for $300 on account. 3-

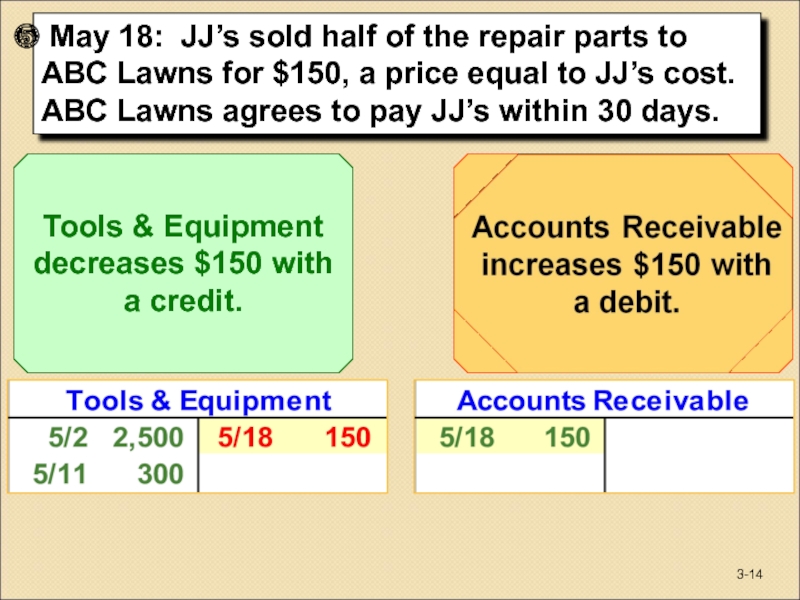

- 14. May 18: JJ’s sold half of

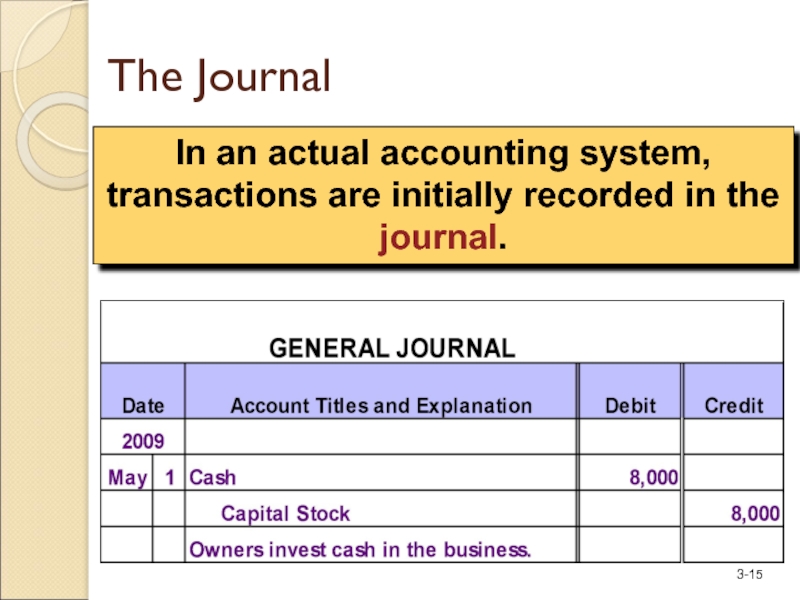

- 15. In an actual accounting system, transactions are initially recorded in the journal. The Journal

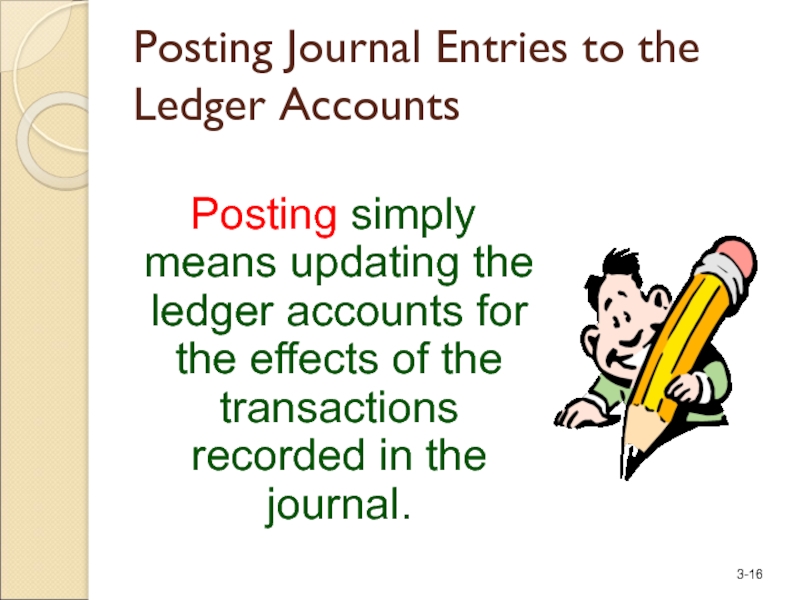

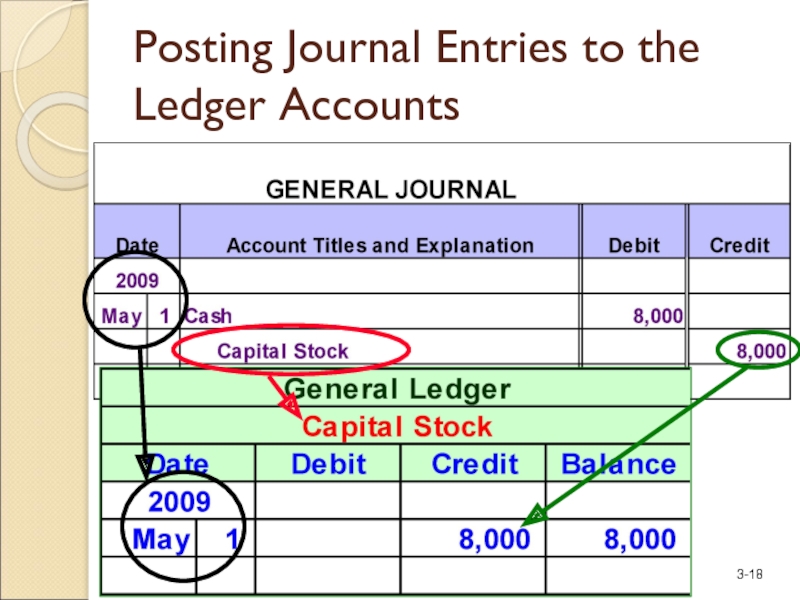

- 16. Posting Journal Entries to the Ledger Accounts

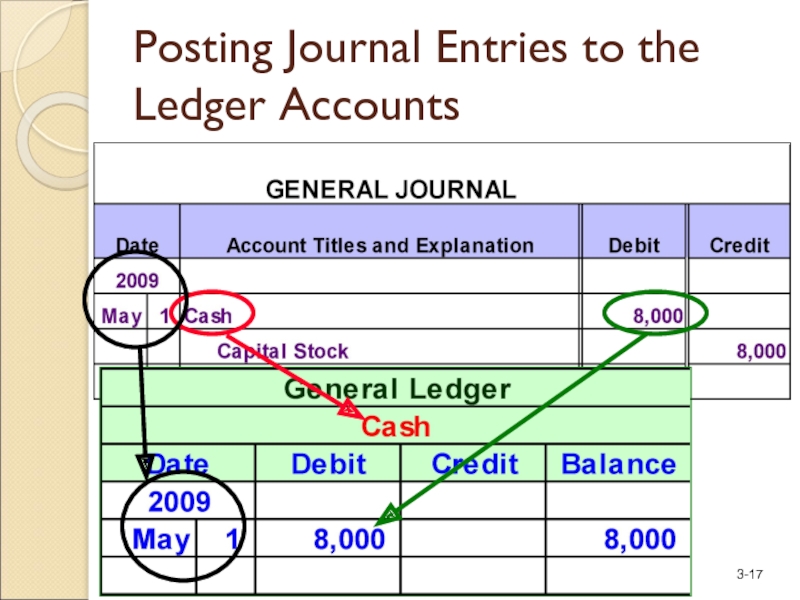

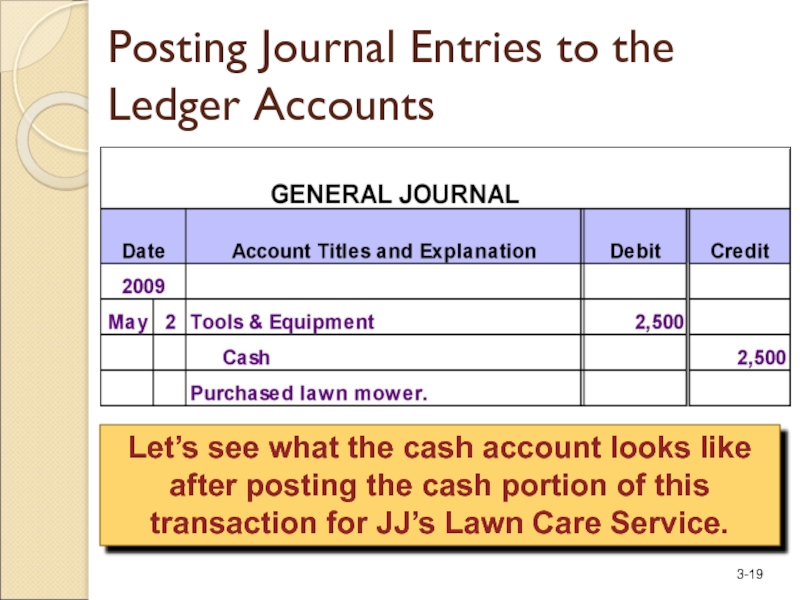

- 17. Posting Journal Entries to the Ledger Accounts

- 18. Posting Journal Entries to the Ledger Accounts

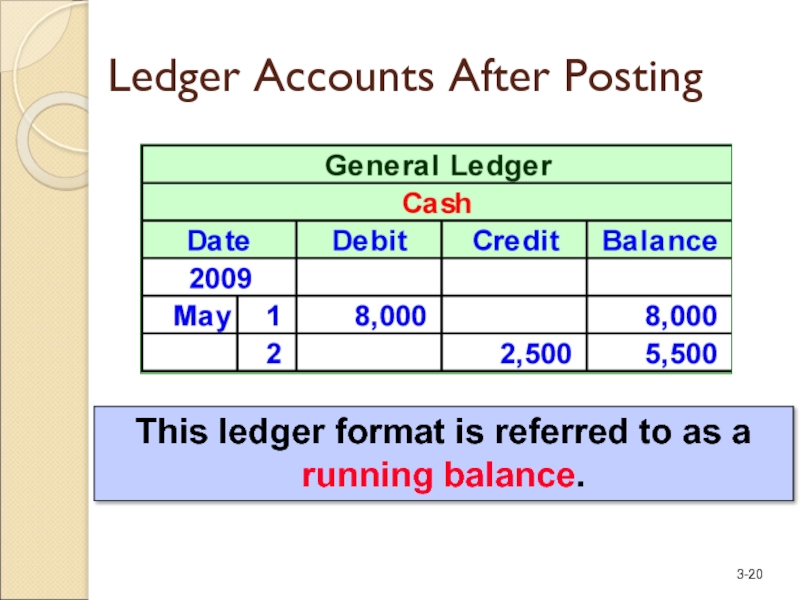

- 19. Let’s see what the cash account looks

- 20. This ledger format is referred to as a running balance. Ledger Accounts After Posting

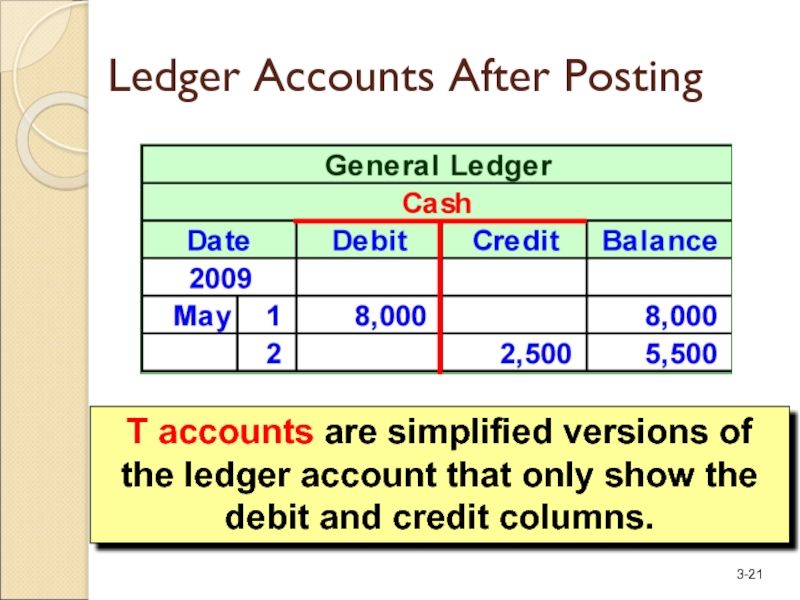

- 21. T accounts are simplified versions of the

- 22. Net income is not an asset ⎯

- 23. A = L + OE Retained Earnings

- 24. The income statement summarizes the profitability of

- 25. Accounting Periods Time Period Principle To provide

- 26. Revenue and Expenses The price for

- 27. The Revenue Principle: When To Record Revenue

- 28. The Matching Principle: When To Record Expenses

- 29. The Accrual Basis of Accounting Current

- 30. Debit and Credit Rules for Revenue and

- 31. Payments to owners decrease owners’ equity. Owners’ investments increase owners’ equity. Dividends

- 32. Let’s analyze the revenue and expense transactions

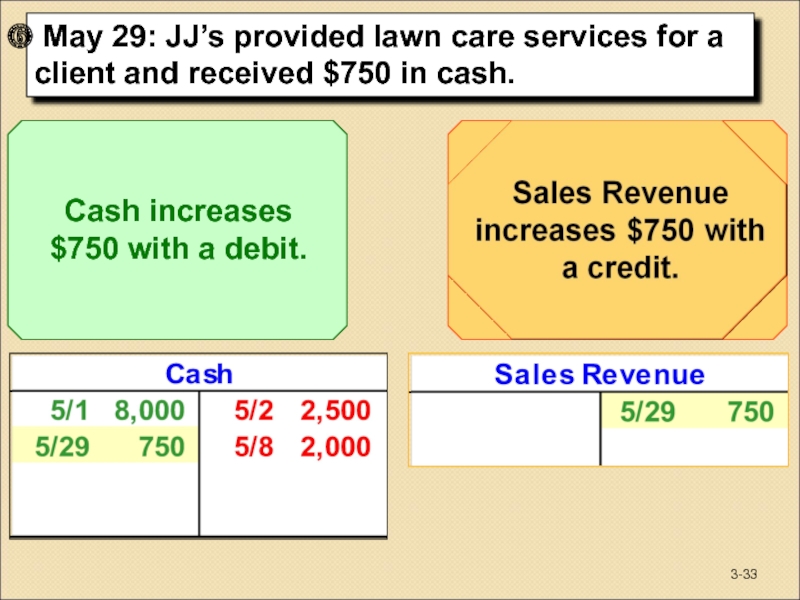

- 33. May 29: JJ’s provided lawn care

- 34. May 31: JJ’s purchased gasoline for

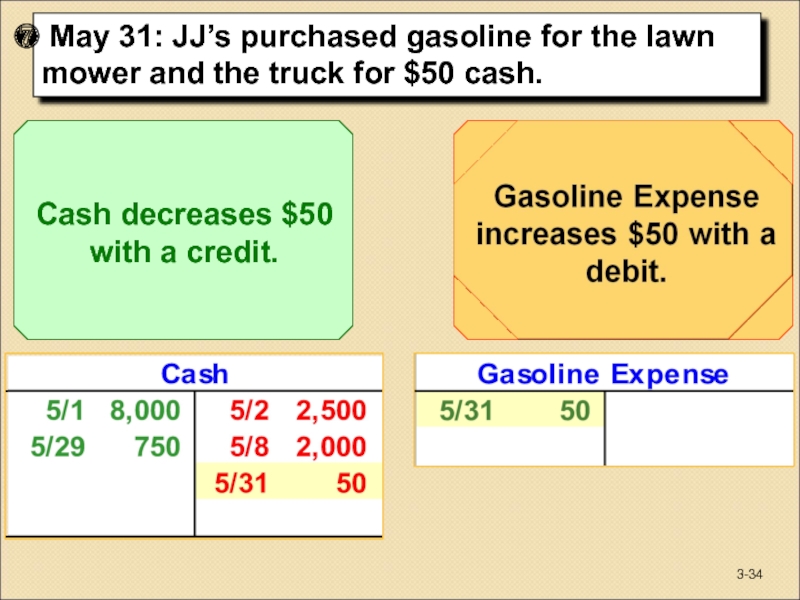

- 35. May 31: JJ’s Lawn Care paid

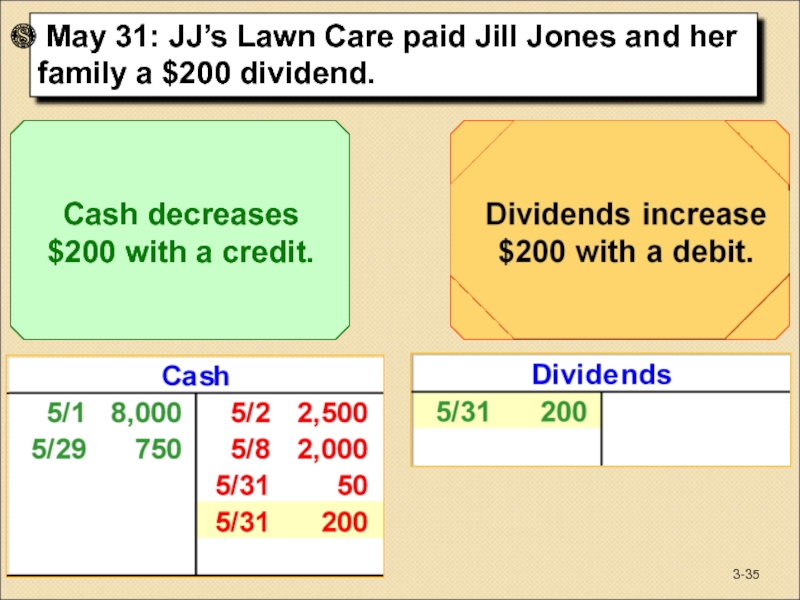

- 36. Now, let’s look at the Trial Balance

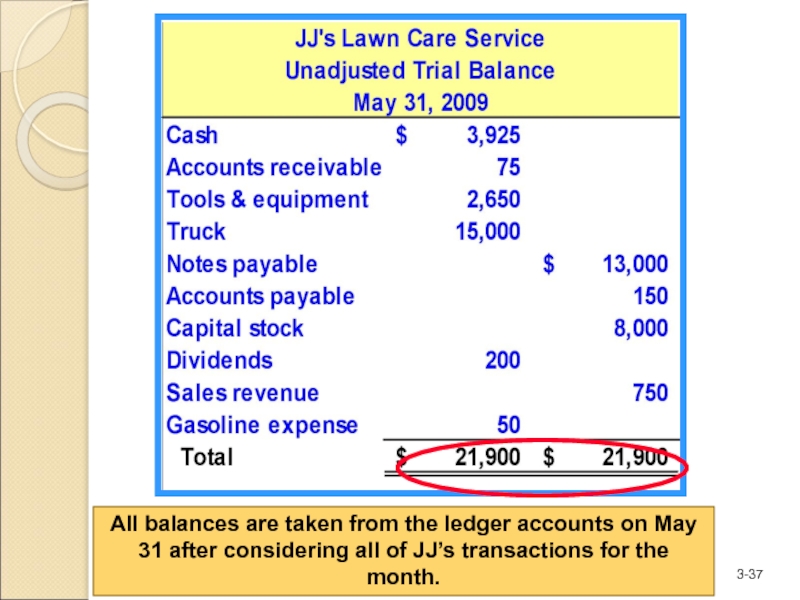

- 37. All balances are taken from the

- 38. The Accounting Cycle in Perspective Accountants spend

- 39. End of Chapter 3

Слайд 3The Role of Accounting Records

Establishes accountability for assets and transactions.

Keeps track

Obtains detailed information about a particular transaction.

Evaluates efficiency and performance within company.

Maintains evidence of a company’s business activities.

Слайд 4The Ledger

The entire group of accounts is kept together in an

Cash

Accounts Payable

Capital

Stock

Accounts are individual records showing increases and decreases.

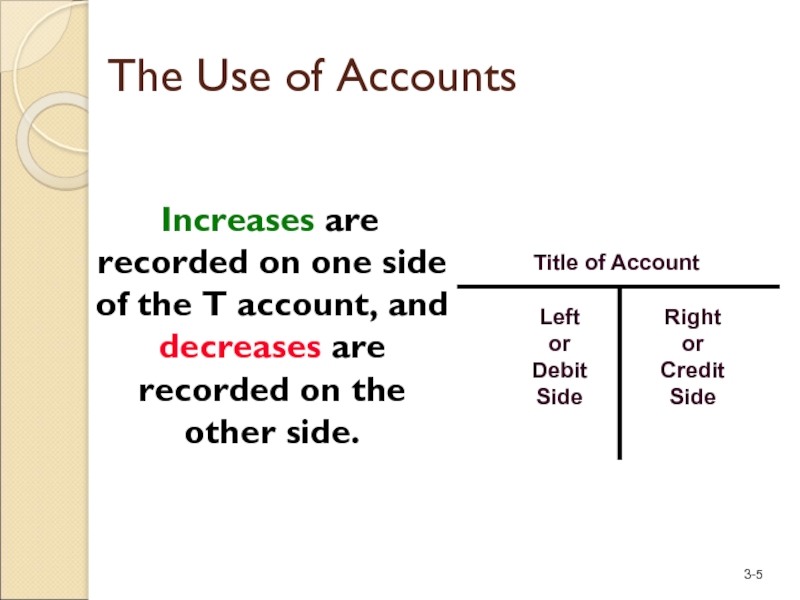

Слайд 5The Use of Accounts

Increases are recorded on one side of

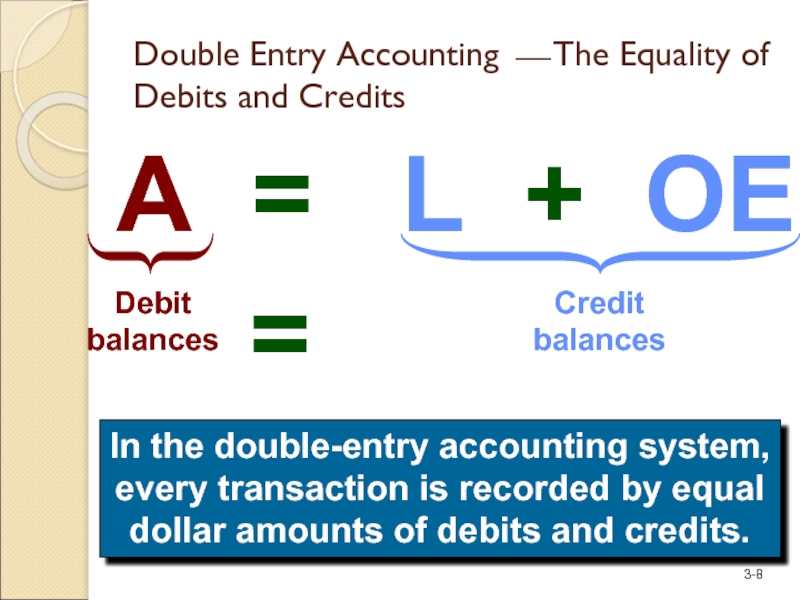

Слайд 8A = L + OE

Debit balances

Credit balances

=

In the double-entry accounting

Double Entry Accounting ⎯ The Equality of Debits and Credits

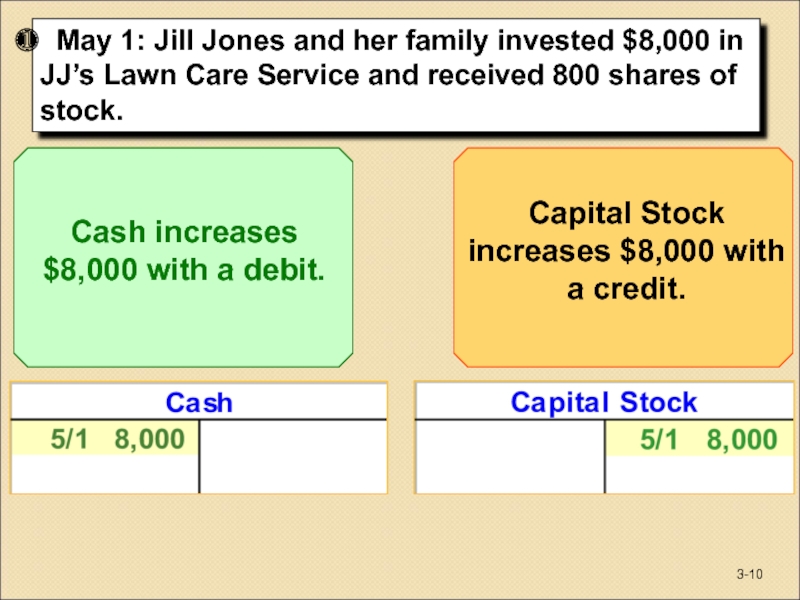

Слайд 10 May 1: Jill Jones and her family invested $8,000 in

3-

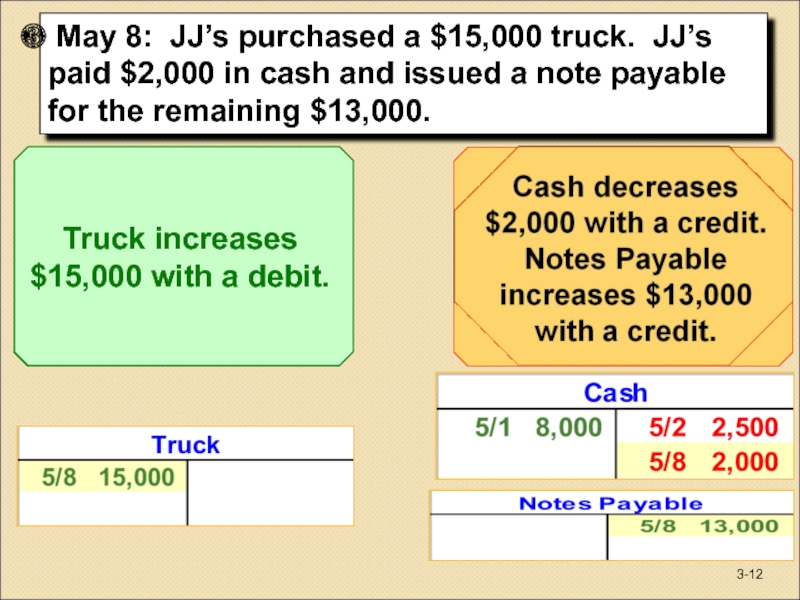

Слайд 12 May 8: JJ’s purchased a $15,000 truck. JJ’s paid $2,000

3-

Слайд 14 May 18: JJ’s sold half of the repair parts to

3-

Слайд 15In an actual accounting system, transactions are initially recorded in the

The Journal

Слайд 16Posting Journal Entries to the Ledger Accounts

Posting simply means updating

Слайд 19Let’s see what the cash account looks like after posting the

Posting Journal Entries to the Ledger Accounts

Слайд 21T accounts are simplified versions of the ledger account that only

Ledger Accounts After Posting

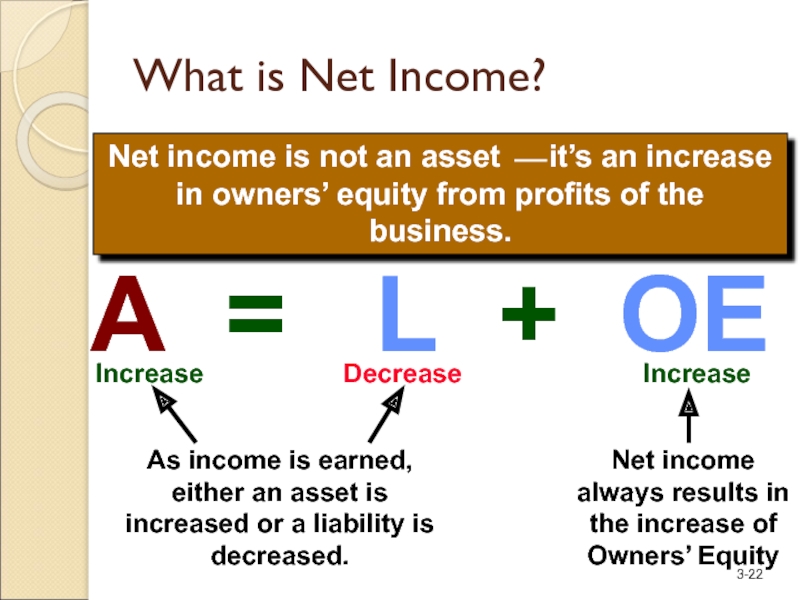

Слайд 22Net income is not an asset ⎯ it’s an increase in

A = L + OE

What is Net Income?

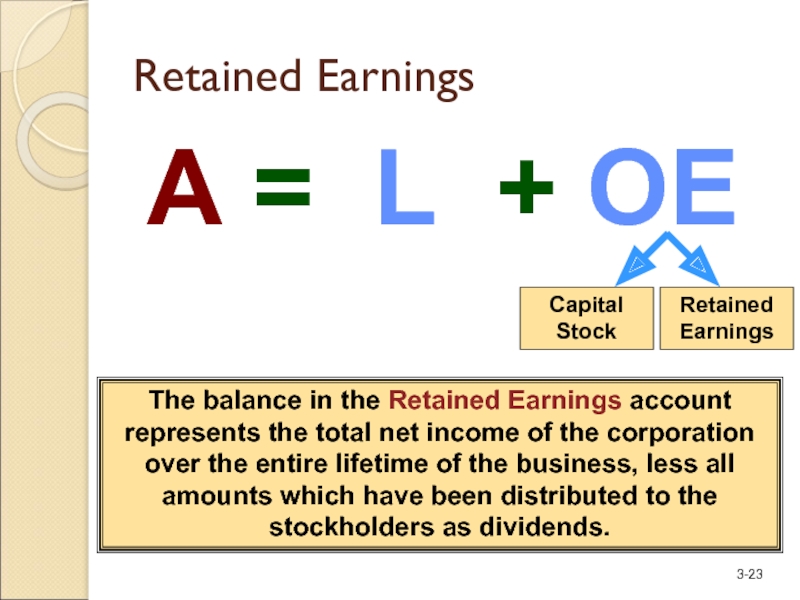

Слайд 23A = L + OE

Retained Earnings

Capital Stock

Retained Earnings

The balance in the

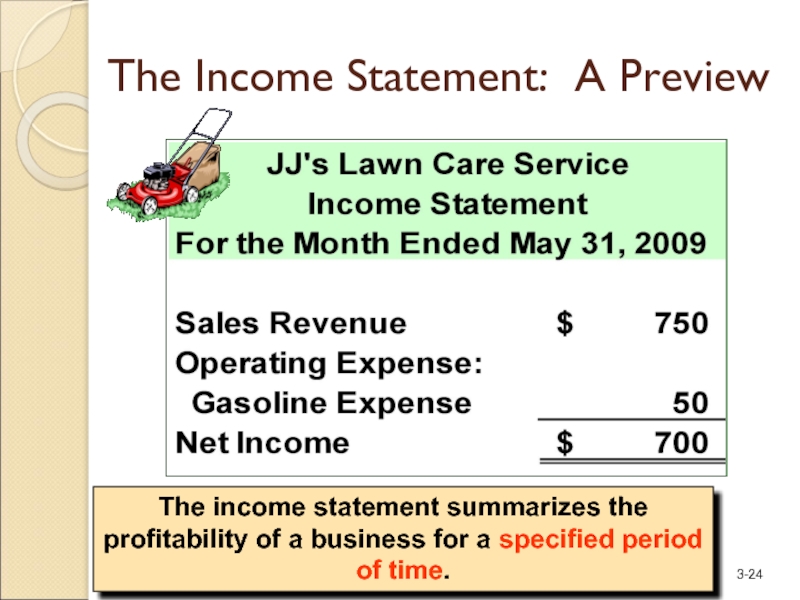

Слайд 24The income statement summarizes the profitability of a business for a

The Income Statement: A Preview

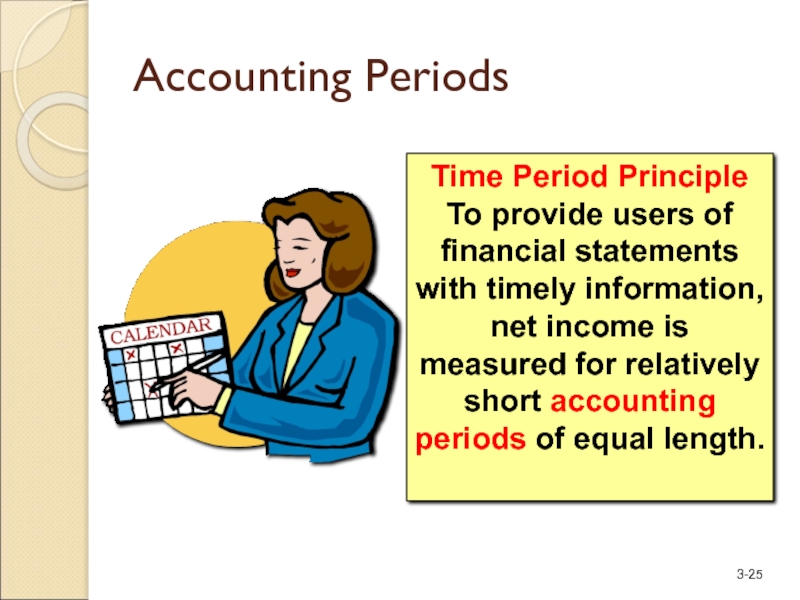

Слайд 25Accounting Periods

Time Period Principle

To provide users of financial statements with timely

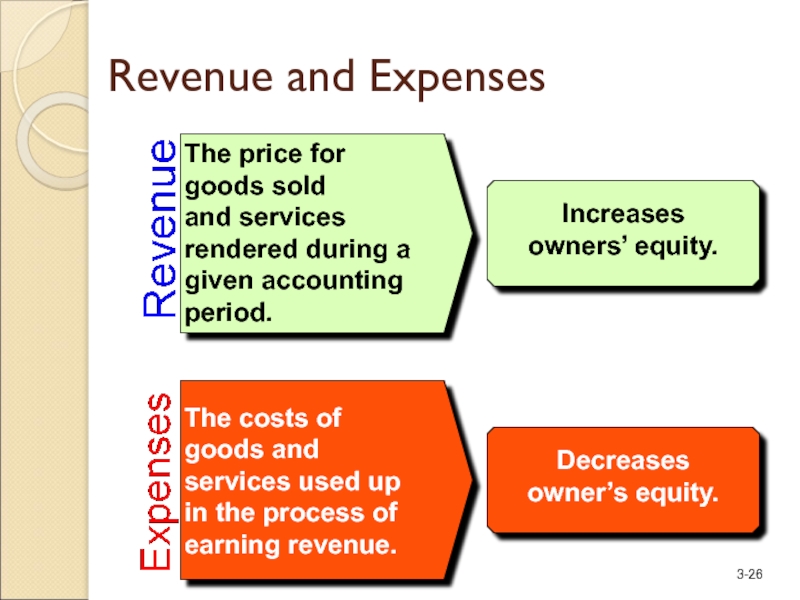

Слайд 26Revenue and Expenses

The price for goods sold

and services rendered during

Increases owners’ equity.

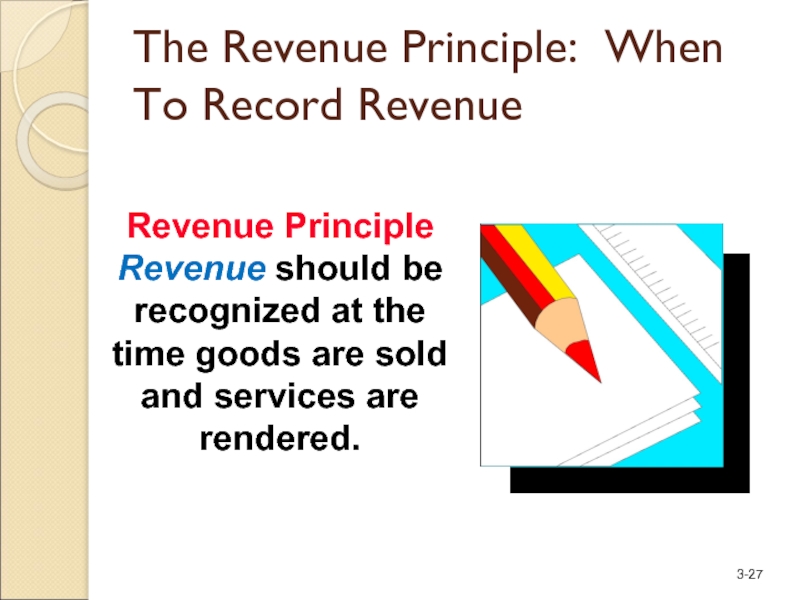

Слайд 27The Revenue Principle: When To Record Revenue

Revenue Principle

Revenue should be recognized

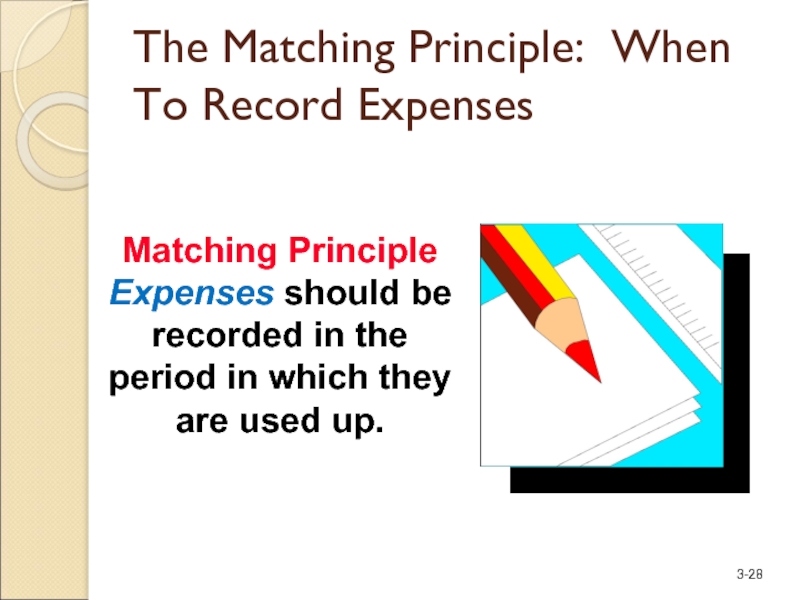

Слайд 28The Matching Principle: When To Record Expenses

Matching Principle

Expenses should be recorded

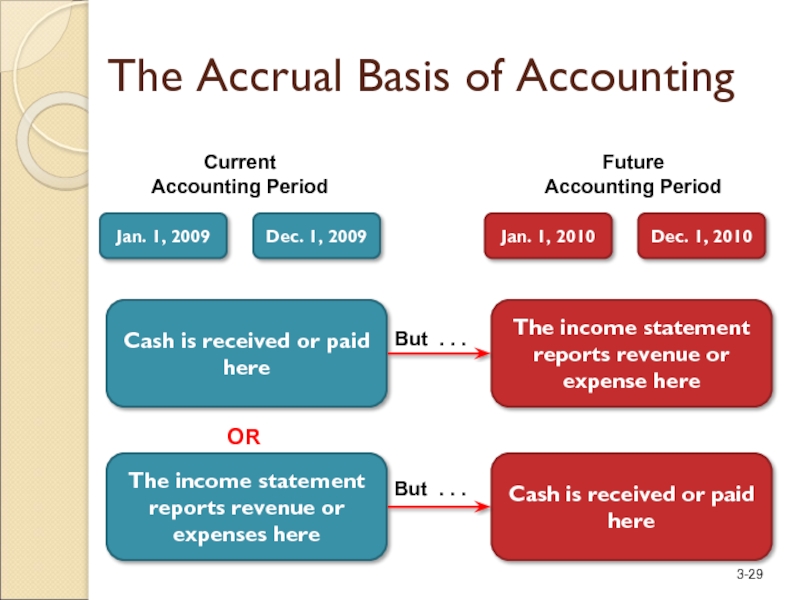

Слайд 29The Accrual Basis of Accounting

Current

Accounting Period

Future

Accounting Period

Jan. 1, 2009

Dec. 1,

Jan. 1, 2010

Dec. 1, 2010

Cash is received or paid here

The income statement reports revenue or expense here

The income statement reports revenue or expenses here

Cash is received or paid here

OR

But . . .

But . . .

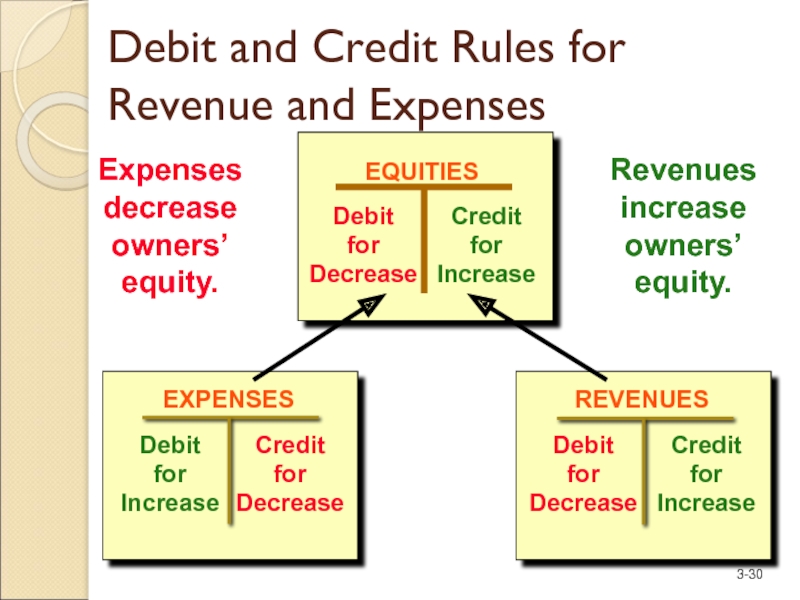

Слайд 30Debit and Credit Rules for Revenue and Expenses

EQUITIES

Debit for

Credit for Increase

Expenses decrease owners’ equity.

Revenues increase owners’ equity.

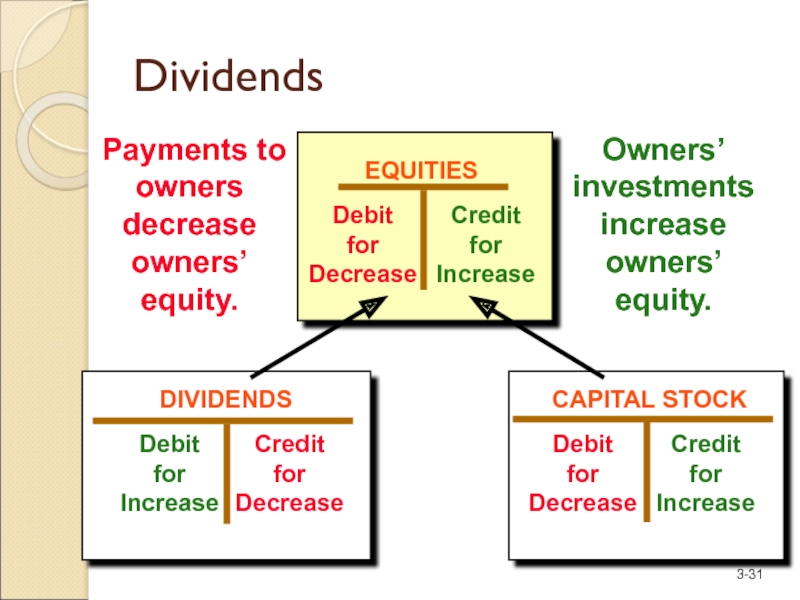

Слайд 31

Payments to owners decrease owners’ equity.

Owners’ investments increase owners’ equity.

Dividends

Слайд 32Let’s analyze the revenue and expense transactions for JJ’s Lawn Care

We will also analyze a dividend transaction.

Слайд 37

All balances are taken from the ledger accounts on May 31