- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Results for Q2 Fiscal 2016 презентация

Содержание

- 1. Results for Q2 Fiscal 2016

- 2. Risks and Non-GAAP Disclosures This presentation contains

- 3. Q2 FY2016 Income Statement Highlights Please

- 4. Quarterly Financial Highlights Please refer to the

- 5. Quarterly Operating Performance by Business Group Please

- 6. Other Income Statement Highlights Q2 FY16 was

- 7. Cash Flows, Net Working Capital & Share

- 8. Balanced Capital Structure Key characteristics: No near-term

- 9. Q2 FY2016 Highlights and Key Trends Strong

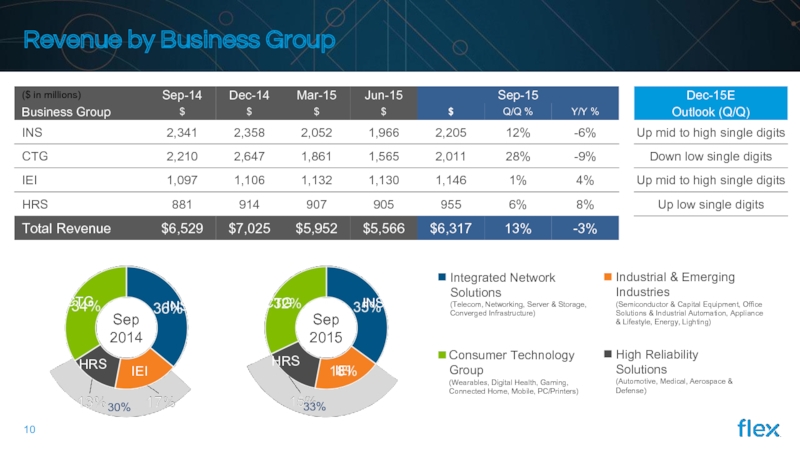

- 10. Revenue by Business Group

- 11. ($ in millions, except per share amounts)

- 12. For more information go to investors.flextronics.com

Слайд 2Risks and Non-GAAP Disclosures

This presentation contains forward-looking statements, which are based

If this presentation references non-GAAP financial measures, these measures are located on the “Investor Relations” section of our website, www.flextronics.com along with the required reconciliation to the most comparable GAAP financial measures.

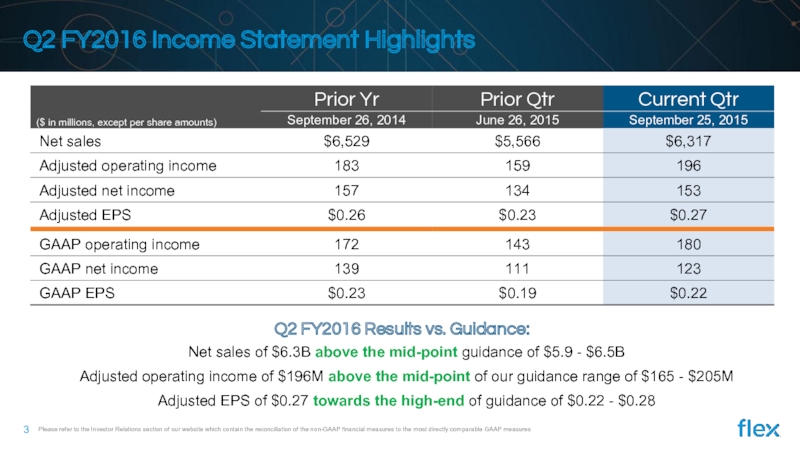

Слайд 3Q2 FY2016 Income Statement Highlights

Please refer to the Investor Relations

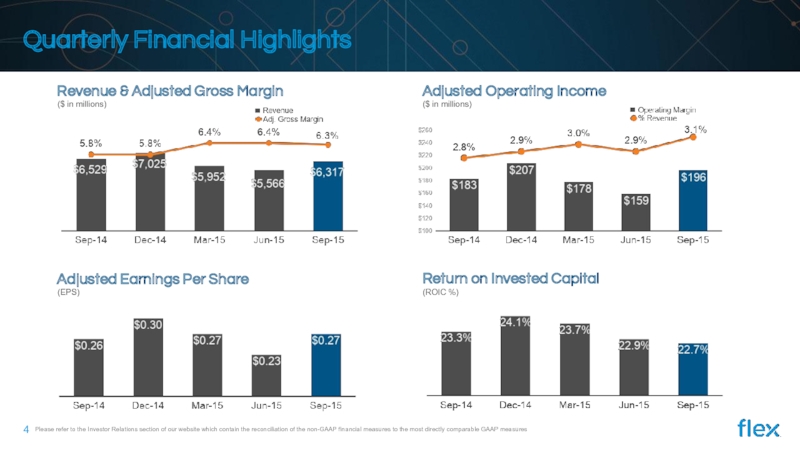

Слайд 4Quarterly Financial Highlights

Please refer to the Investor Relations section of our

Return on Invested Capital

(ROIC %)

Adjusted Earnings Per Share

(EPS)

Adjusted Operating Income

($ in millions)

Revenue & Adjusted Gross Margin

($ in millions)

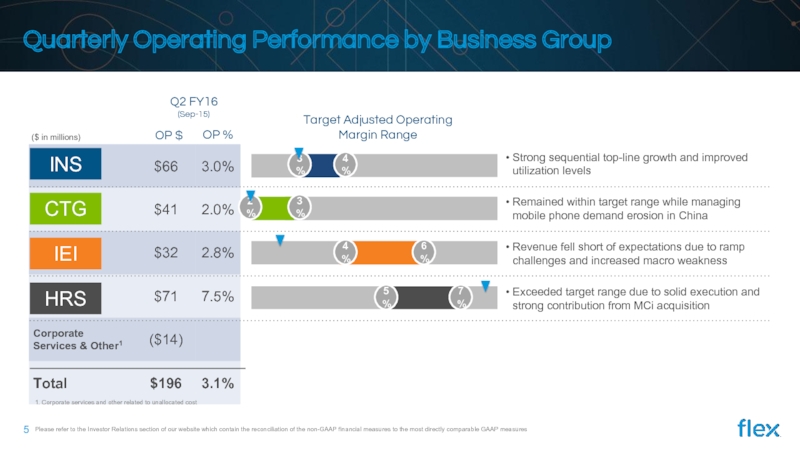

Слайд 5Quarterly Operating Performance by Business Group

Please refer to the Investor Relations

INS

CTG

HRS

($ in millions)

IEI

Target Adjusted Operating Margin Range

1. Corporate services and other related to unallocated cost

OP $

OP %

3%

5%

7%

3%

4%

4%

6%

Strong sequential top-line growth and improved utilization levels

Remained within target range while managing mobile phone demand erosion in China

Q2 FY16

(Sep-15)

Exceeded target range due to solid execution and strong contribution from MCi acquisition

Revenue fell short of expectations due to ramp challenges and increased macro weakness

2%

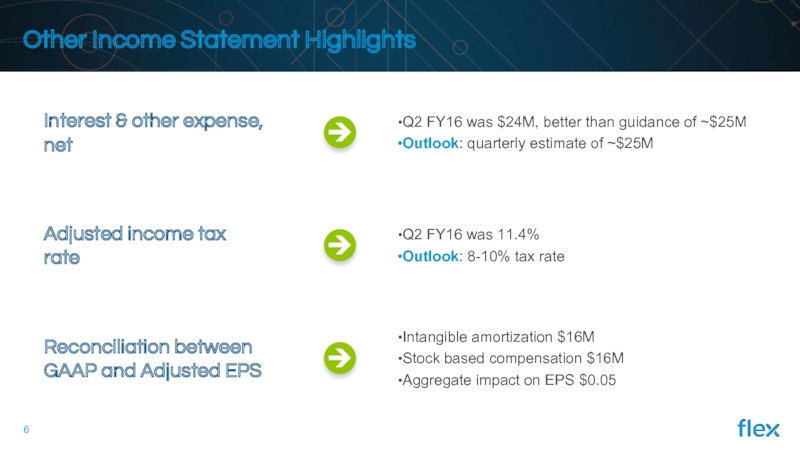

Слайд 6Other Income Statement Highlights

Q2 FY16 was $24M, better than guidance of

Outlook: quarterly estimate of ~$25M

Interest & other expense, net

Q2 FY16 was 11.4%

Outlook: 8-10% tax rate

Adjusted income tax rate

Intangible amortization $16M

Stock based compensation $16M

Aggregate impact on EPS $0.05

Reconciliation between GAAP and Adjusted EPS

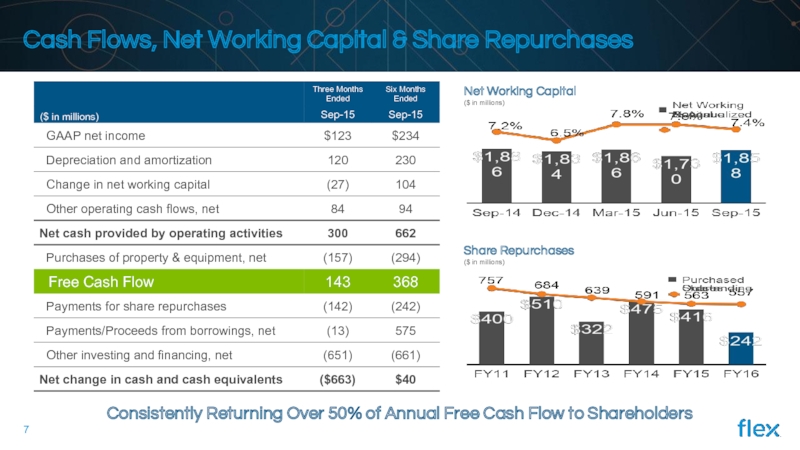

Слайд 7Cash Flows, Net Working Capital & Share Repurchases

Consistently Returning Over 50%

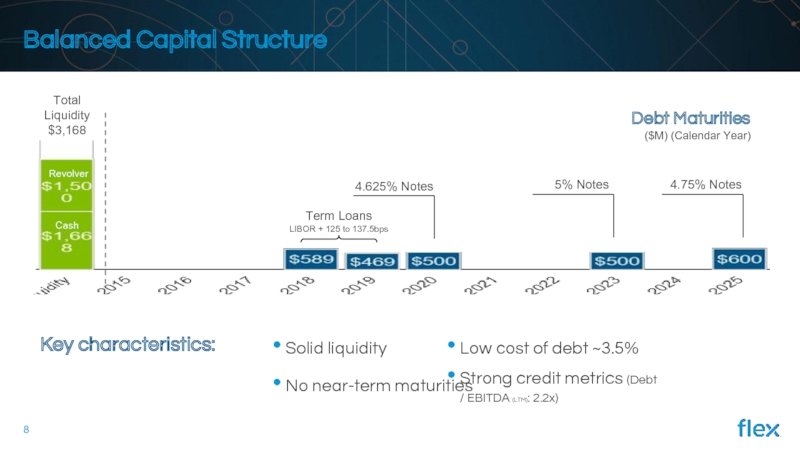

Слайд 8Balanced Capital Structure

Key characteristics:

No near-term maturities

Low cost of debt ~3.5%

Solid liquidity

Strong

Слайд 9Q2 FY2016 Highlights and Key Trends

Strong SG&A control, with costs running

Capex expected in-line or below depreciation for rest of the fiscal year

Controlling the Controllable

Sketch-to-scale engagement model well received by customers

Nike partnership exemplifies sketch-to-scale value proposition and fresh approach to innovation, design and manufacturing

Improving Engagement Model

Invested $142M to repurchase ~13M shares or ~2% of float

NEXTracker acquisition complements our $1B+ Energy business and drives accretive growth, margin, EPS and cash flow

Deploying Capital In A Disciplined Way

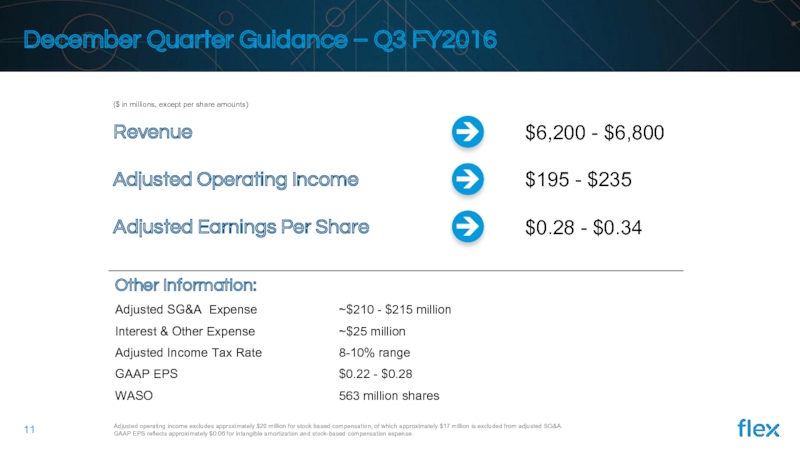

Слайд 11($ in millions, except per share amounts)

Adjusted operating income excludes approximately

GAAP EPS reflects approximately $0.06 for intangible amortization and stock-based compensation expense.

$6,200 - $6,800

Revenue

$195 - $235

Adjusted Operating Income

$0.28 - $0.34

Adjusted Earnings Per Share

December Quarter Guidance – Q3 FY2016