By Sean O’Reilly

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Is Jack in the Box’s Share Buyback Program a Good Deal for Shareholders? презентация

Содержание

- 1. Is Jack in the Box’s Share Buyback Program a Good Deal for Shareholders?

- 2. Buffett on Buybacks “There is only one

- 3. A $200 Million Announcement On

- 4. A Solid Third Quarter Reported 3rd

- 5. Why the drop? Stock fell 6% on

- 6. What Would Warren Do? Is

- 7. What Would Warren Do? There are

- 8. Not JACK’s First Buyback Rodeo

- 9. JACK’s buyback record is questionable Buyback’s

- 10. Best use of shareholders’ capital? JACK currently

- 11. Best use of shareholders’ capital? S&P 500

- 12. Foolish Bottom Line Buyback is expensive based

Слайд 2Buffett on Buybacks

“There is only one combination of facts that makes

it advisable for a company to repurchase its shares: First, the company has available funds -- cash plus sensible borrowing capacity -- beyond the near-term needs of the business and, second, finds its stock selling in the market below its intrinsic value, conservatively calculated.”

-- Warren Buffett, 1999 Berkshire Hathaway Chairman’s Letter to Shareholders

-- Warren Buffett, 1999 Berkshire Hathaway Chairman’s Letter to Shareholders

Слайд 3A $200 Million Announcement

On September 21, 2015 Jack in the

Box announced a new $200 million share repurchase program

This was part of JACKs’ recent efforts in recent years to “return capital to shareholders”

Follows $317 million worth of share repurchases so far in FY 2015

Company initiated a dividend in 2014

Is this the best use of shareholder’s capital?

This was part of JACKs’ recent efforts in recent years to “return capital to shareholders”

Follows $317 million worth of share repurchases so far in FY 2015

Company initiated a dividend in 2014

Is this the best use of shareholder’s capital?

Слайд 4A Solid Third Quarter

Reported 3rd quarter FY 2015 results on August

5, 2015:

Earnings per share grew 16.9% year over year to $0.76

Revenue growth was lackluster, rising just 3.1%

Same store sales growth compared to the same period last year was within expectations:

Jack in the Box Restaurants: 7.3% increase

Qdoba- 7.7%

GAAP operating earnings per share guidance for the full year was raised slightly

Earnings per share grew 16.9% year over year to $0.76

Revenue growth was lackluster, rising just 3.1%

Same store sales growth compared to the same period last year was within expectations:

Jack in the Box Restaurants: 7.3% increase

Qdoba- 7.7%

GAAP operating earnings per share guidance for the full year was raised slightly

Слайд 5Why the drop?

Stock fell 6% on the earnings news, and continued

to slide from $97 to a recent $75

Forward guidance was the culprit:

Previously guided for 50 to 60 new Qdoba restaurants this year, this was lowered to 40 to 45

Full year Same-store sales at company-owned Jack in the Box locations projected to grow 5.0 to 5.5%

Forward guidance was the culprit:

Previously guided for 50 to 60 new Qdoba restaurants this year, this was lowered to 40 to 45

Full year Same-store sales at company-owned Jack in the Box locations projected to grow 5.0 to 5.5%

Слайд 6What Would Warren Do?

Is JACKs’ latest share repurchase program a prime

example of intelligent capital allocation, or a waste of shareholders’ money ?

Слайд 7What Would Warren Do?

There are four possible uses for shareholder’s capital:

Capital

investments

Dividends

Share repurchases

Acquisitions

Dividends

Share repurchases

Acquisitions

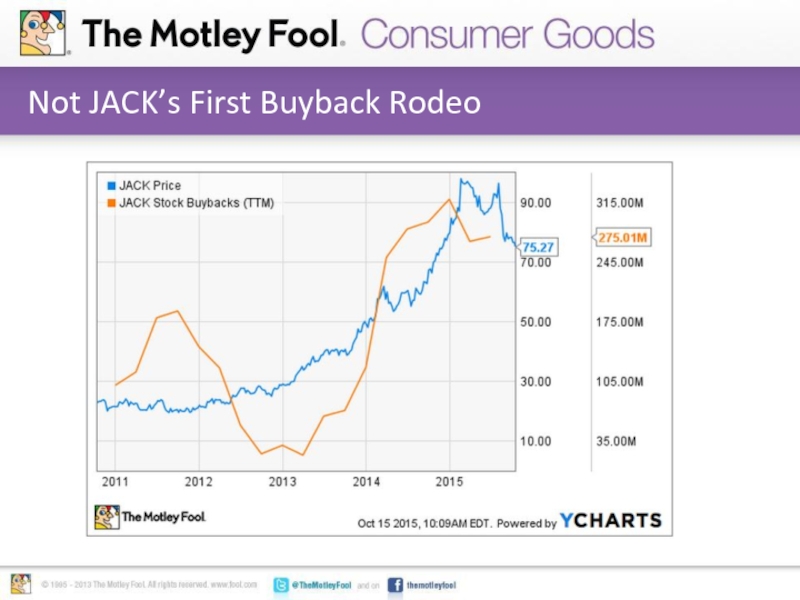

Слайд 9JACK’s buyback record is questionable

Buyback’s made in FY 2012 were beneficial

in light of current share price

Company has spent even more on buybacks as share price has tripled

Suggests the recent $200 million buyback is being made out of habit

Company has spent even more on buybacks as share price has tripled

Suggests the recent $200 million buyback is being made out of habit

Слайд 10Best use of shareholders’ capital?

JACK currently trades for 25 times forward

earnings estimates and 20 times trailing free cash flow

Analysts estimate earnings per share growth of 12% per annum through fiscal year 2019

JACKs’ return on equity has averaged 18.7% over the last five years

Share repurchases and dividends are greater than free cash flow

Analysts estimate earnings per share growth of 12% per annum through fiscal year 2019

JACKs’ return on equity has averaged 18.7% over the last five years

Share repurchases and dividends are greater than free cash flow

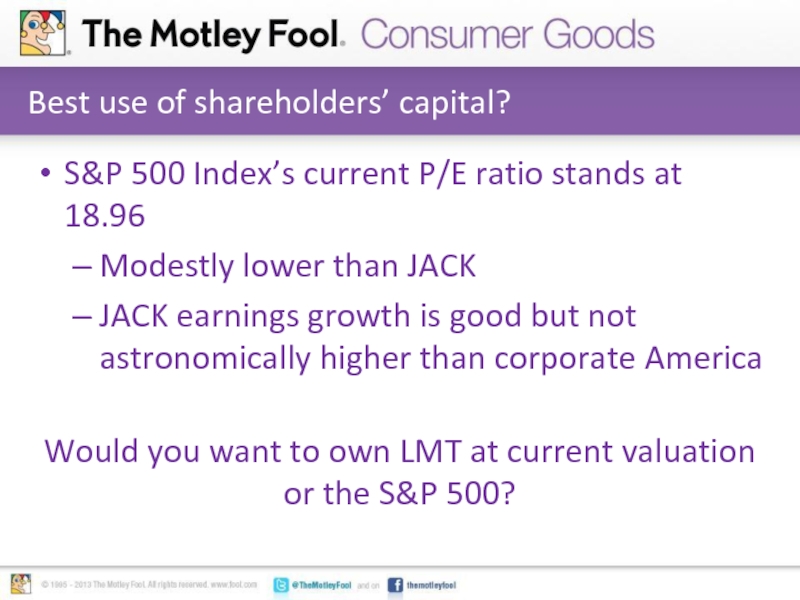

Слайд 11Best use of shareholders’ capital?

S&P 500 Index’s current P/E ratio stands

at 18.96

Modestly lower than JACK

JACK earnings growth is good but not astronomically higher than corporate America

Would you want to own LMT at current valuation or the S&P 500?

Modestly lower than JACK

JACK earnings growth is good but not astronomically higher than corporate America

Would you want to own LMT at current valuation or the S&P 500?

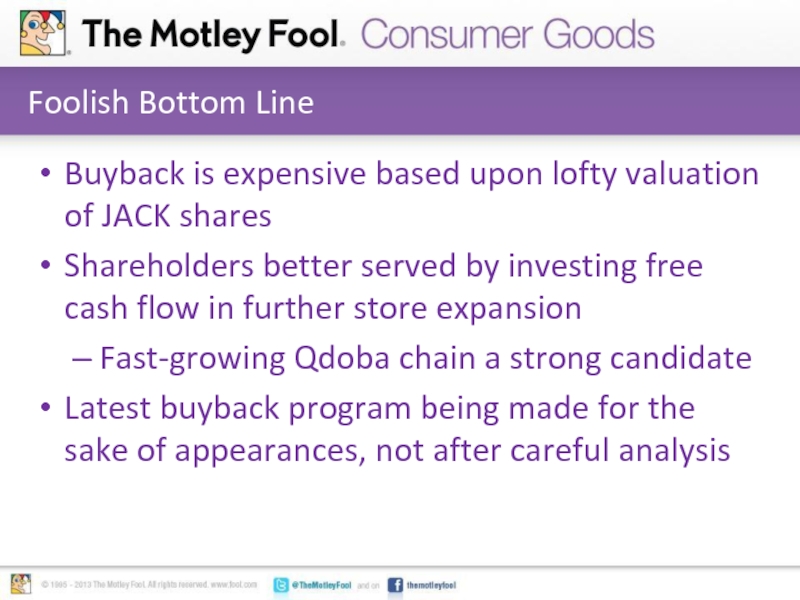

Слайд 12Foolish Bottom Line

Buyback is expensive based upon lofty valuation of JACK

shares

Shareholders better served by investing free cash flow in further store expansion

Fast-growing Qdoba chain a strong candidate

Latest buyback program being made for the sake of appearances, not after careful analysis

Shareholders better served by investing free cash flow in further store expansion

Fast-growing Qdoba chain a strong candidate

Latest buyback program being made for the sake of appearances, not after careful analysis