- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Financial planning презентация

Содержание

- 1. Financial planning

- 2. Plan of the day Today we

- 3. Financial Planning The class on financial

- 4. The Financial Planning Process Financial planning

- 5. The Financial Planning Process A key

- 6. The Financial Planning Process The financial

- 7. The Financial Planning Process – Remarks

- 8. The Financial Planning Process – Remarks

- 9. Financial planning – an example

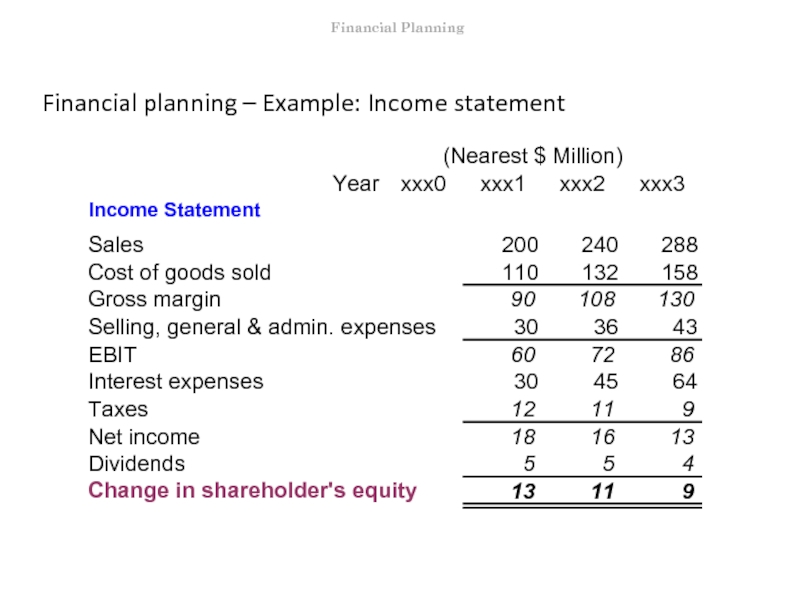

- 10. Financial planning – Example: Income statement

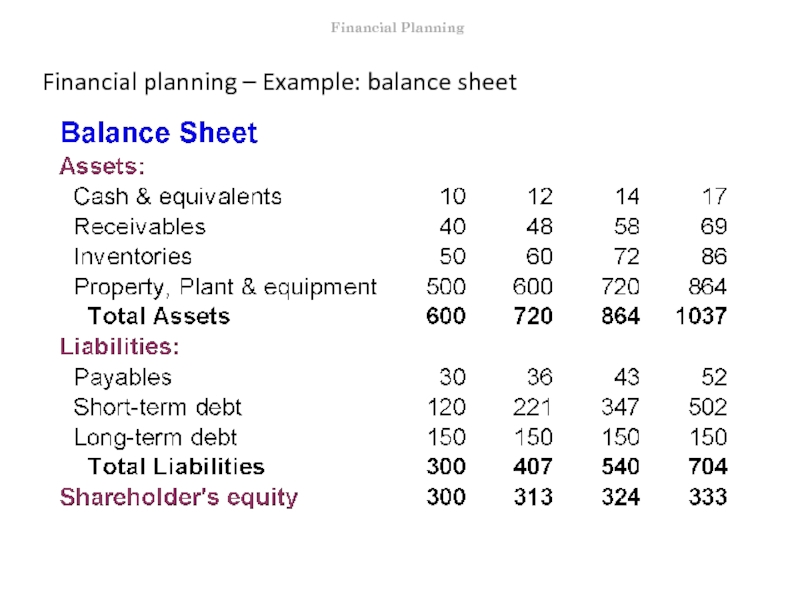

- 11. Financial planning – Example: balance sheet Financial Planning

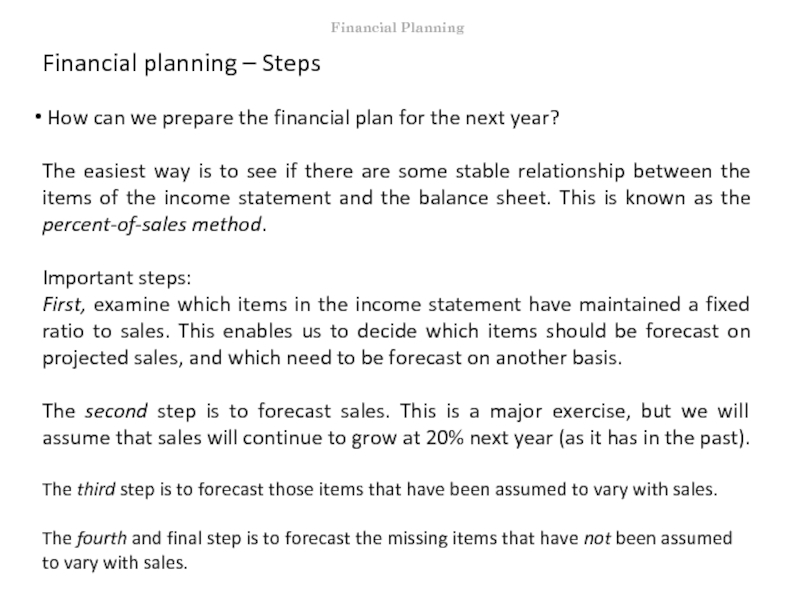

- 12. Financial planning – Steps How

- 13. Financial planning – First step Which items

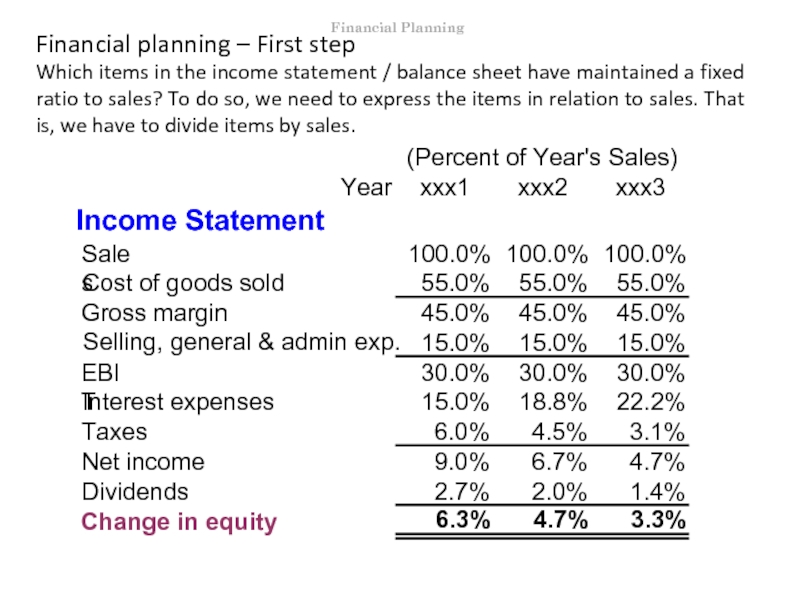

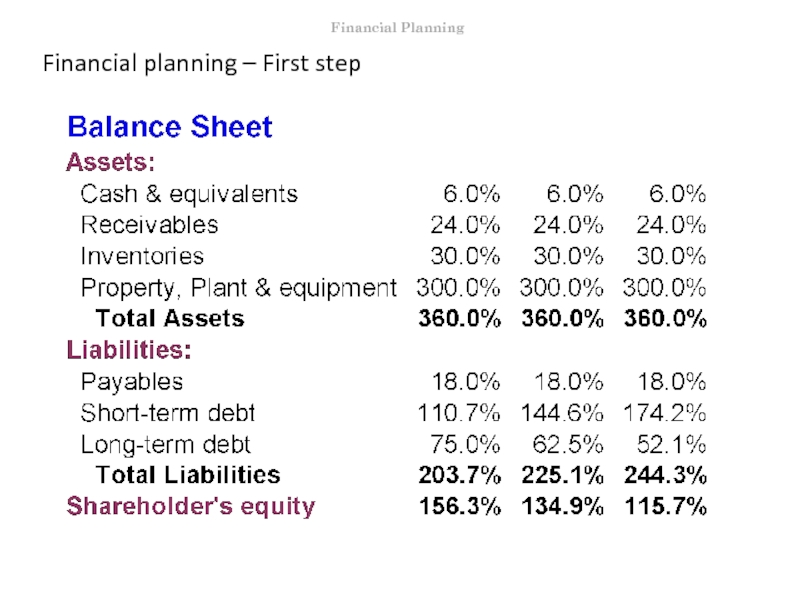

- 14. Financial planning – First step Financial Planning

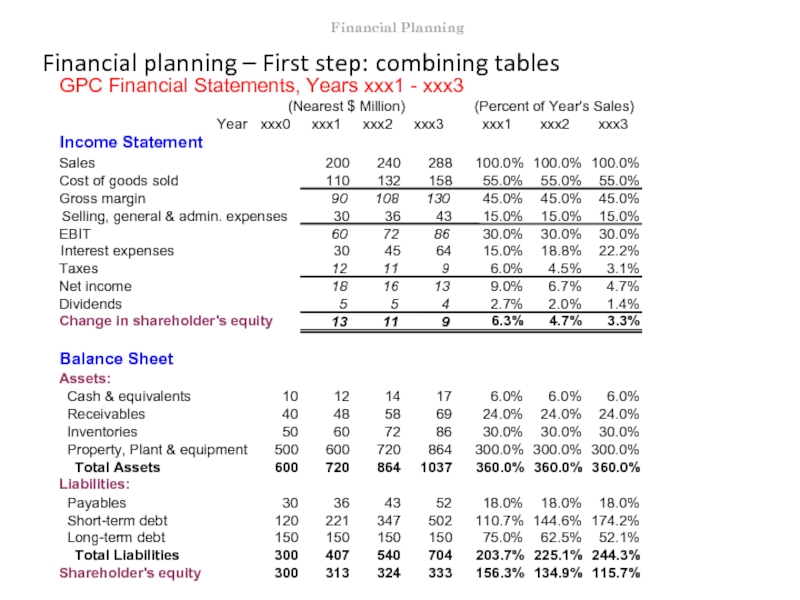

- 15. Financial planning – First step: combining tables

- 16. Financial planning – First step

- 17. Financial planning – Second and third step

- 18. Financial planning – Second and third step

- 19. Financial planning – Second and third step

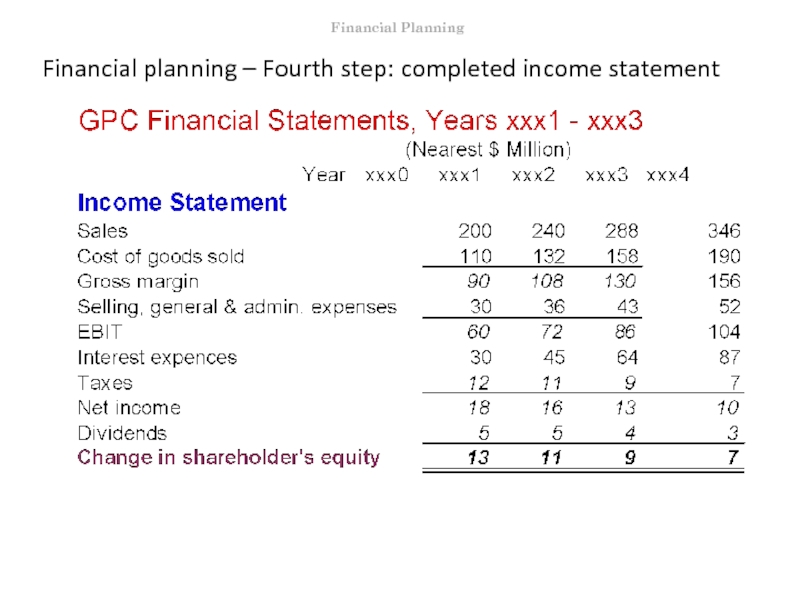

- 20. Financial planning – Fourth step: completing the

- 21. Financial planning – Fourth step: completed income statement Financial Planning

- 22. Financial planning – Fourth step: completing the

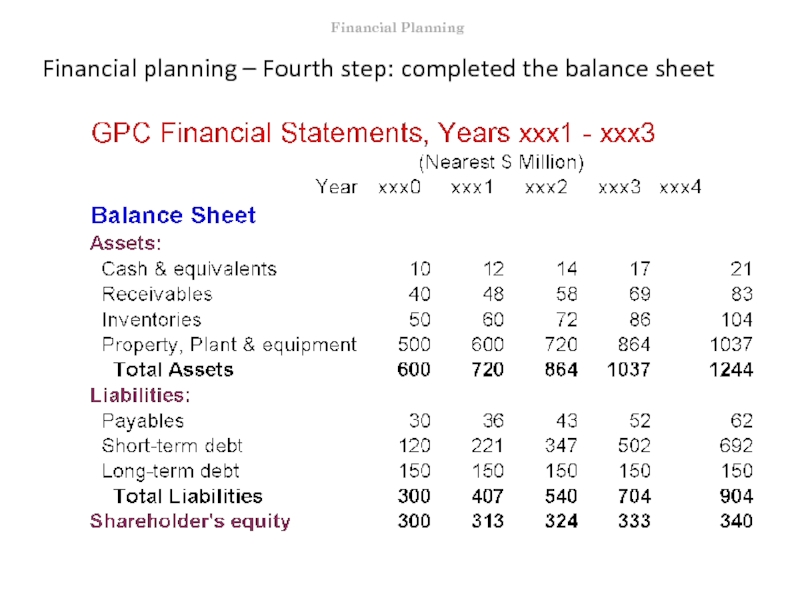

- 23. Financial planning – Fourth step: completed the balance sheet Financial Planning

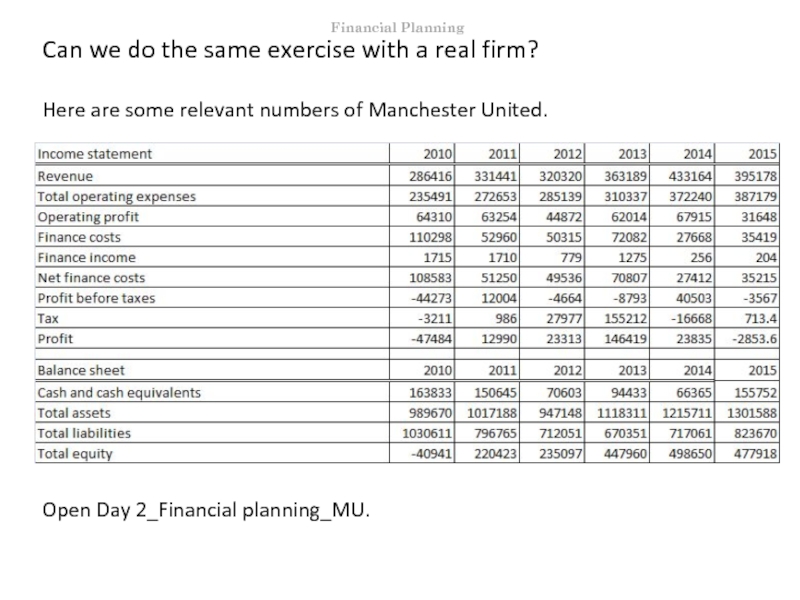

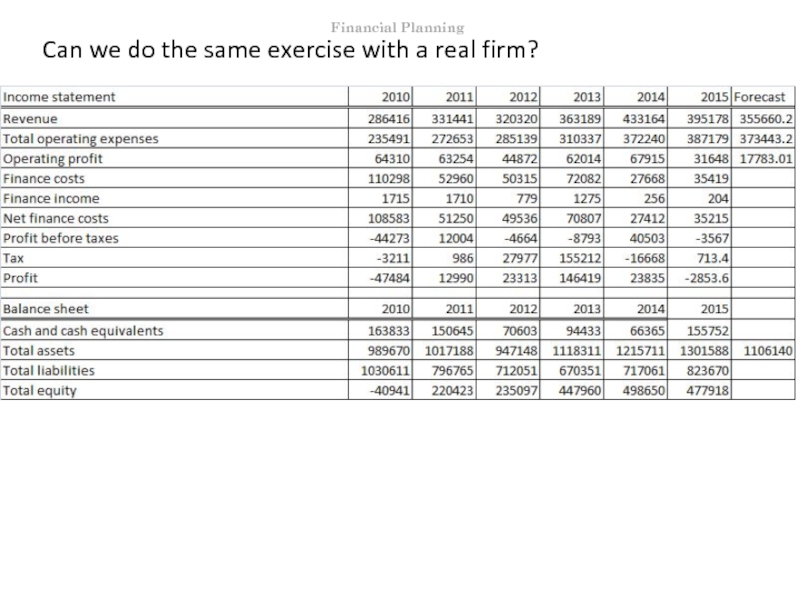

- 24. Can we do the same exercise with

- 25. Can we do the same exercise with

- 26. Can we do the same exercise with

- 27. Can we do the same exercise with

- 28. Can we do the same exercise with

- 29. Can we do the same exercise with

- 30. Can we do the same exercise with

- 31. Can we do the same exercise with

- 32. Can we do the same exercise with

- 33. Can we do the same exercise with

- 34. Can we do the same exercise with

- 35. Assignment 2 Choose any company that

- 36. Assignment 2 Choose wisely the company

- 37. Growth and need for external finance

- 38. Growth and need for external finance

- 39. Growth and need for external finance

- 40. Growth and need for external finance

- 41. Sustainable rate of growth The sustainable

- 42. Sustainable rate of growth There is

- 43. Working Capital Management An important part

- 44. Working Capital Management There is a

- 45. Efficient Management of Working Capital Principle:

- 46. Working Capital Management The longer the

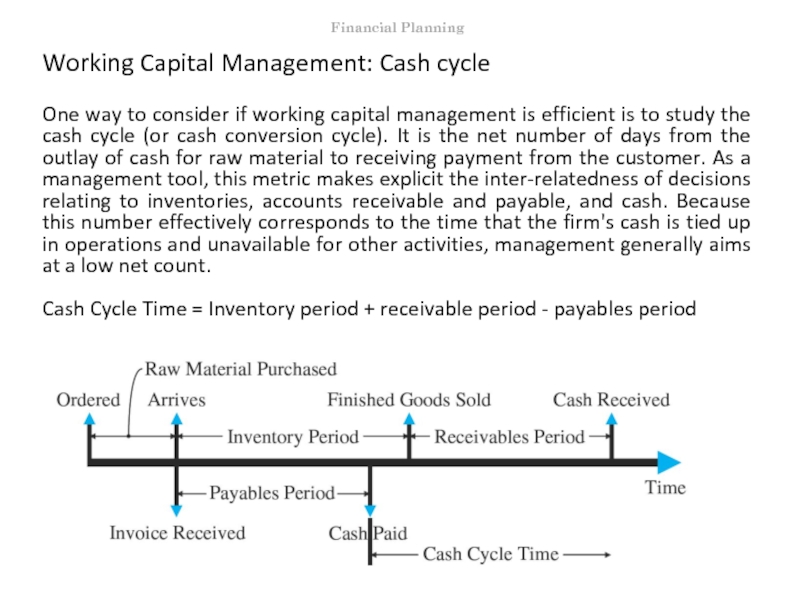

- 47. Working Capital Management: Cash cycle One

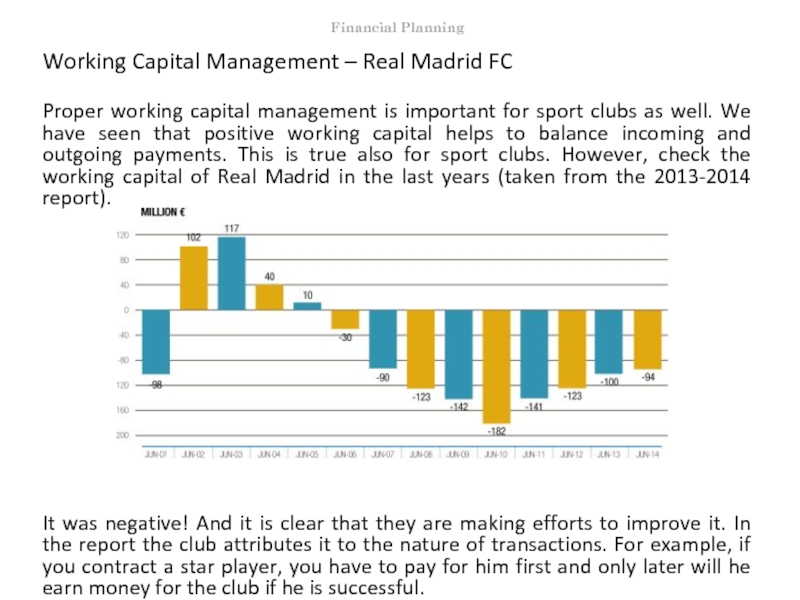

- 48. Working Capital Management – Real Madrid FC

- 49. Cash budgeting (This section builds heavily

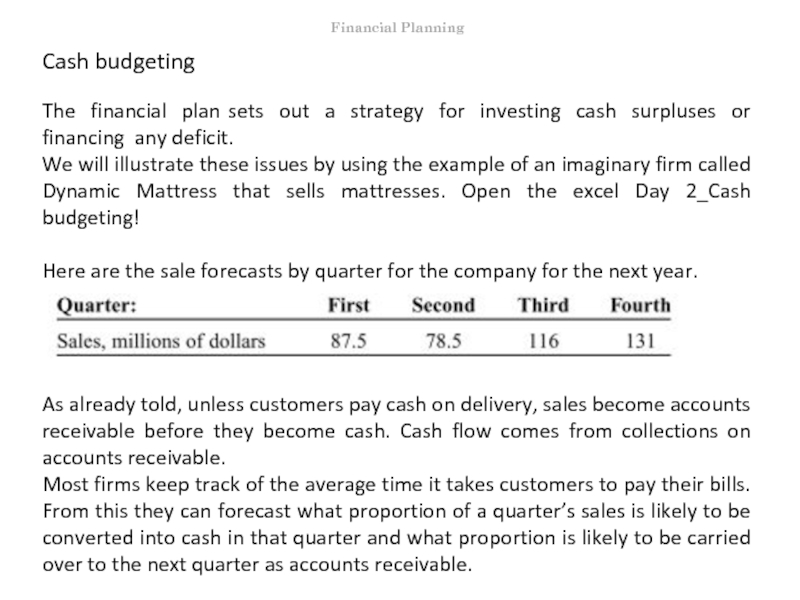

- 50. Cash budgeting The financial plan sets

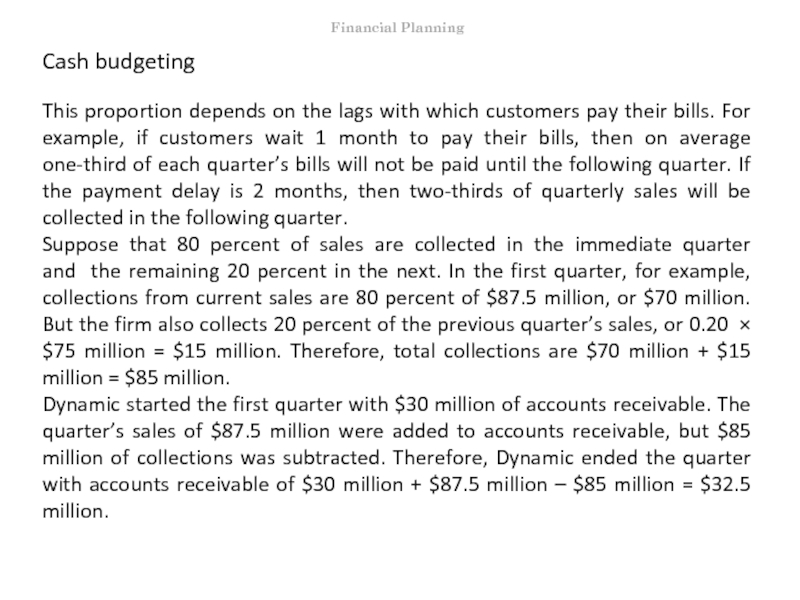

- 51. Cash budgeting This proportion depends on

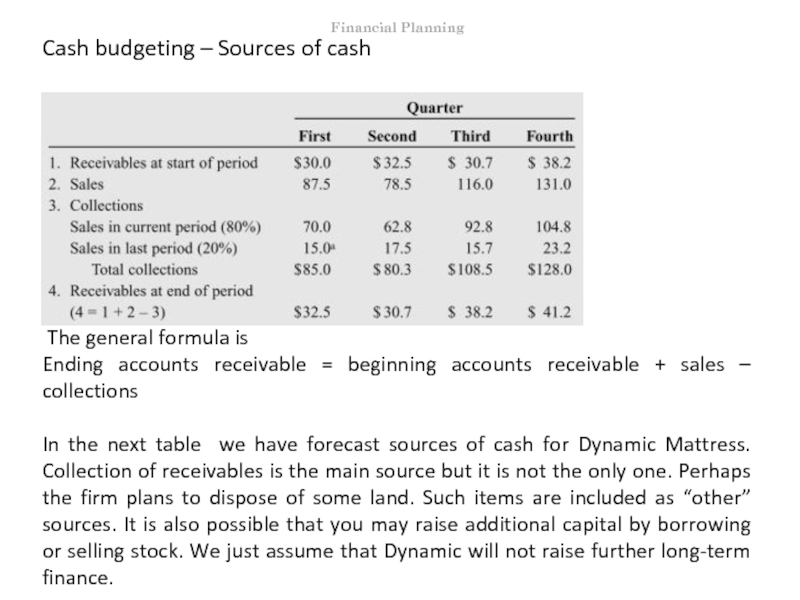

- 52. Cash budgeting – Sources of cash

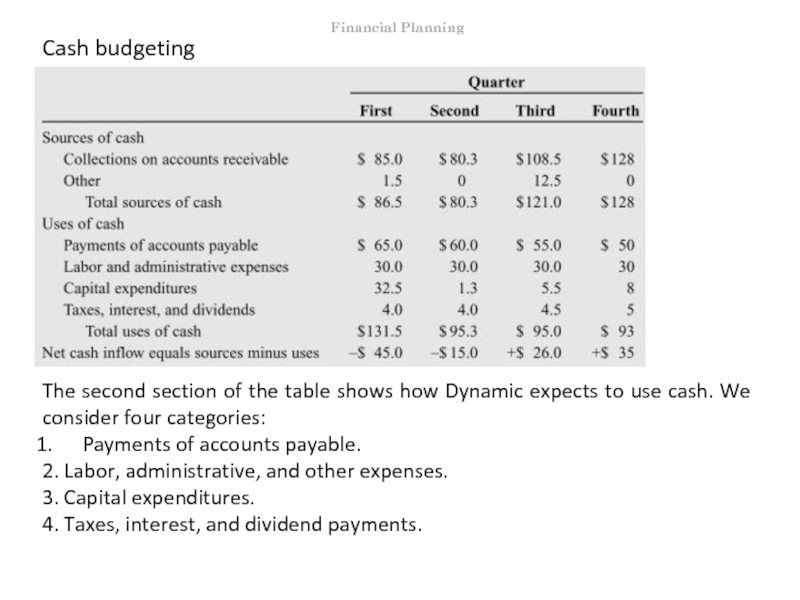

- 53. Cash budgeting

- 54. Cash budgeting – Uses of cash

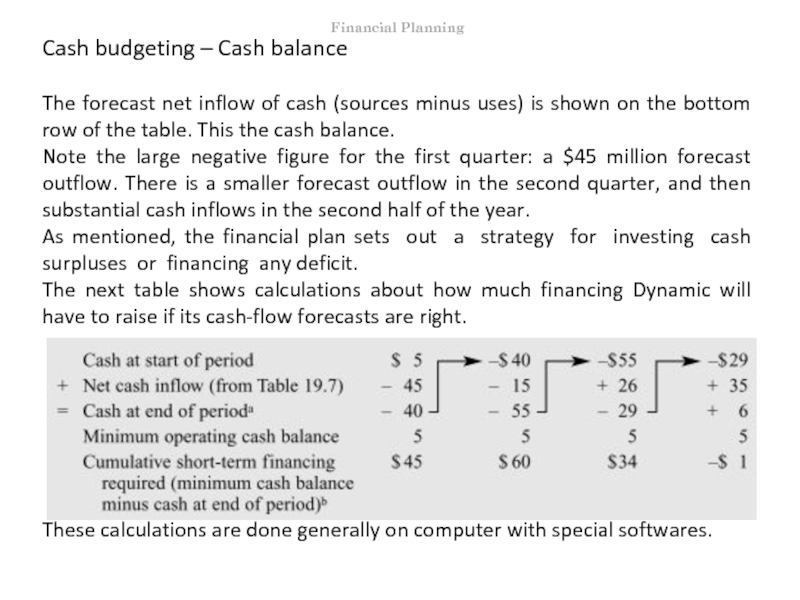

- 55. Cash budgeting – Cash balance The

- 56. Cash budgeting – Cash balance Dynamic

- 57. Cash budgeting – Cash balance Some

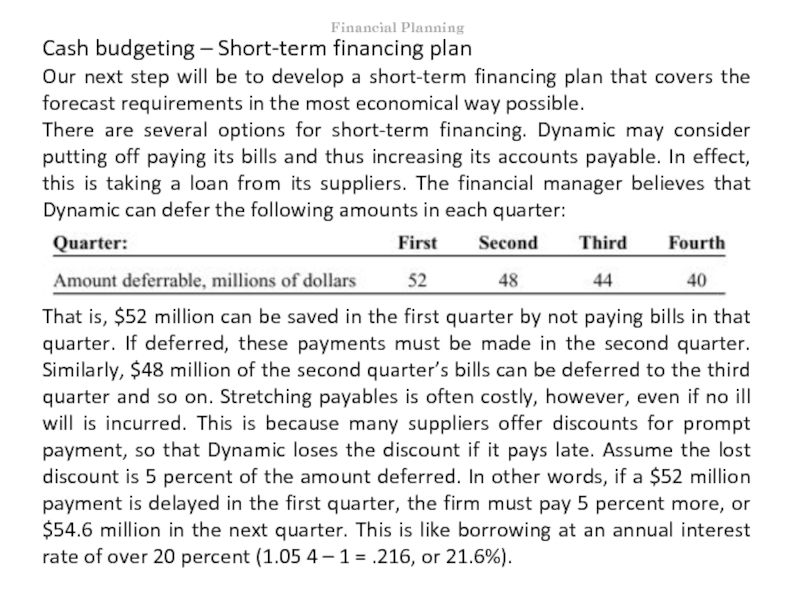

- 58. Cash budgeting – Short-term financing plan Our

- 59. Cash budgeting – Short-term financing plan

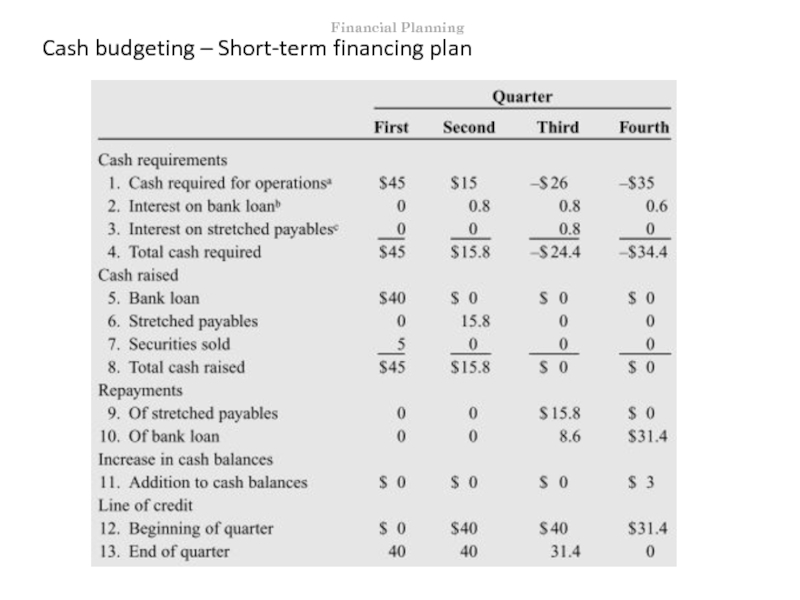

- 60. Cash budgeting – Short-term financing plan Financial Planning

- 61. Cash budgeting – Short-term financing plan

- 62. Cash budgeting – Evaluation of the plan

- 63. Cash budgeting – Evaluation of the plan

- 64. Cash budgeting – Evaluation of the plan

- 65. Cash budgeting – Sources of Short-Term Financing:

- 66. Cash budgeting – Sources of Short-Term Financing:

- 67. Cash budgeting – Sources of Short-Term Financing:

- 68. Cash budgeting – Sources of Short-Term Financing:

- 69. Conclusion – Financial planning Hopefully, after

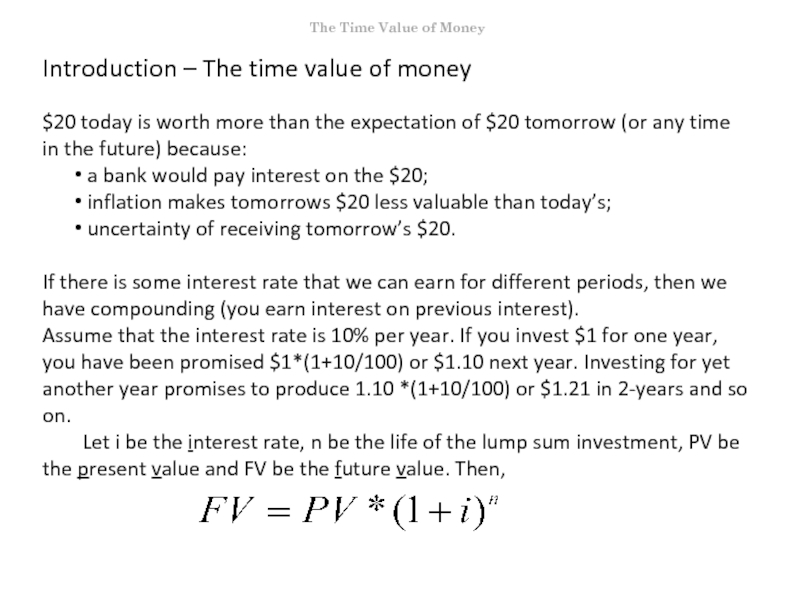

- 70. Introduction – The time value of money

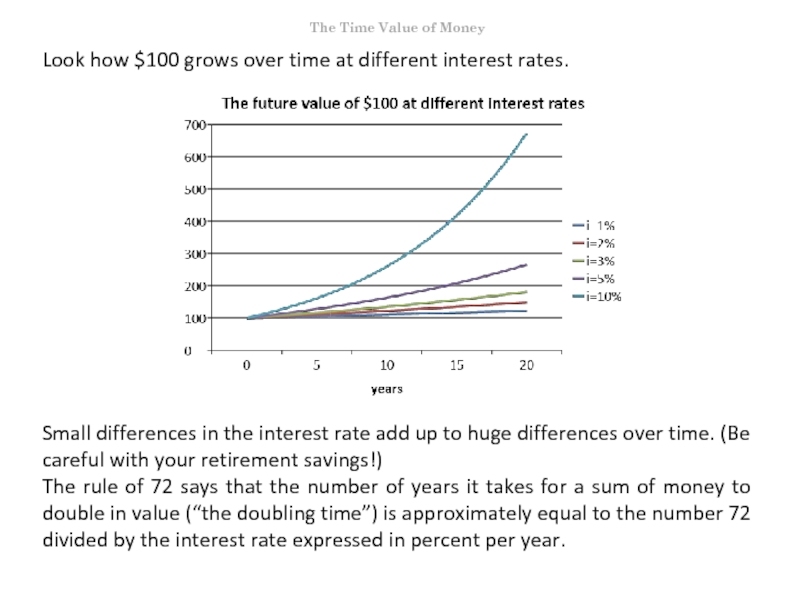

- 71. Look how $100 grows over time at

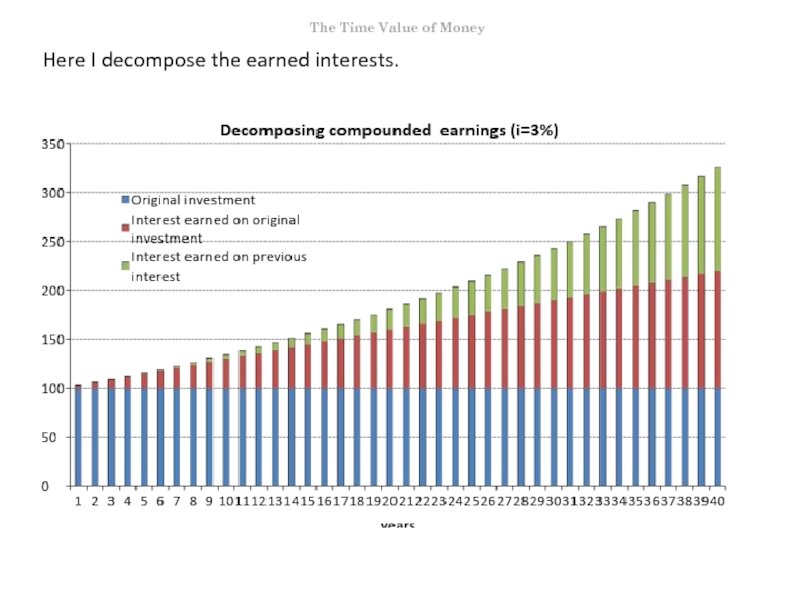

- 72. Here I decompose the earned interests.

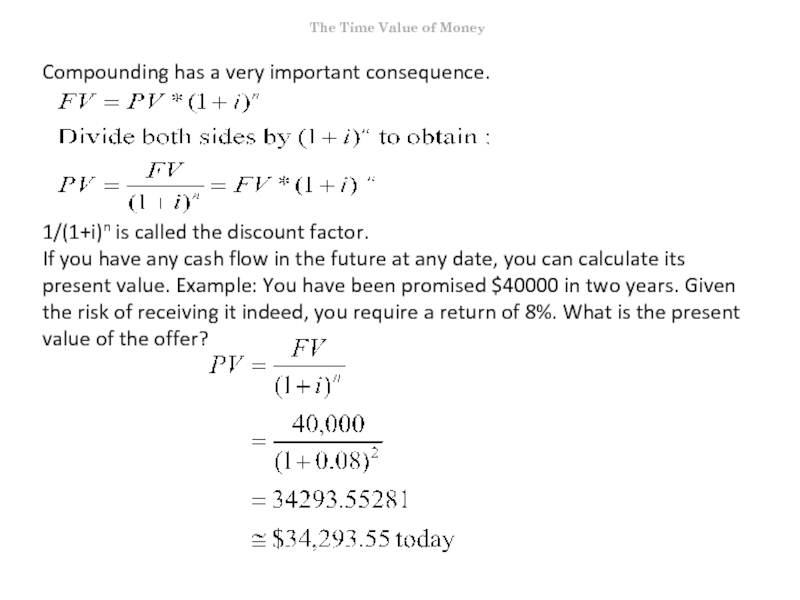

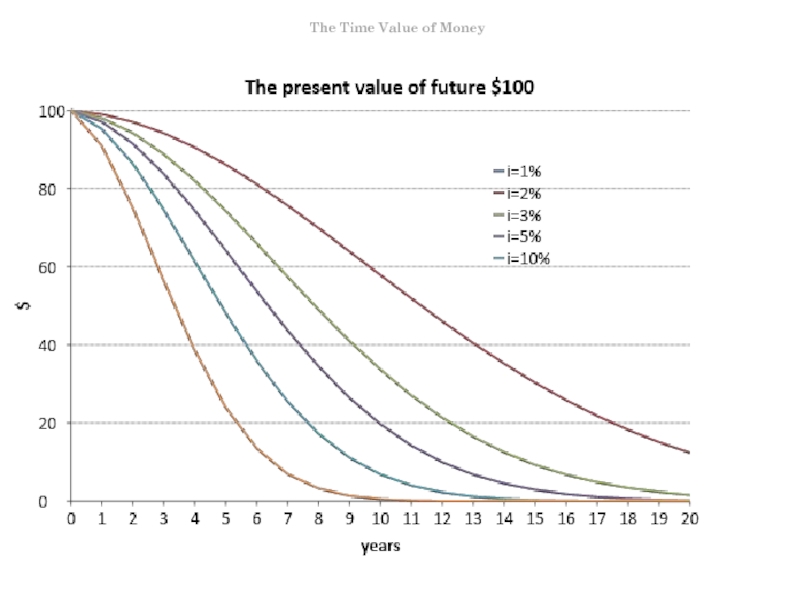

- 74. Compounding has a very important consequence.

- 75. The Time Value of Money

- 76. In 1995 Coca-Cola Enterprises needed to borrow

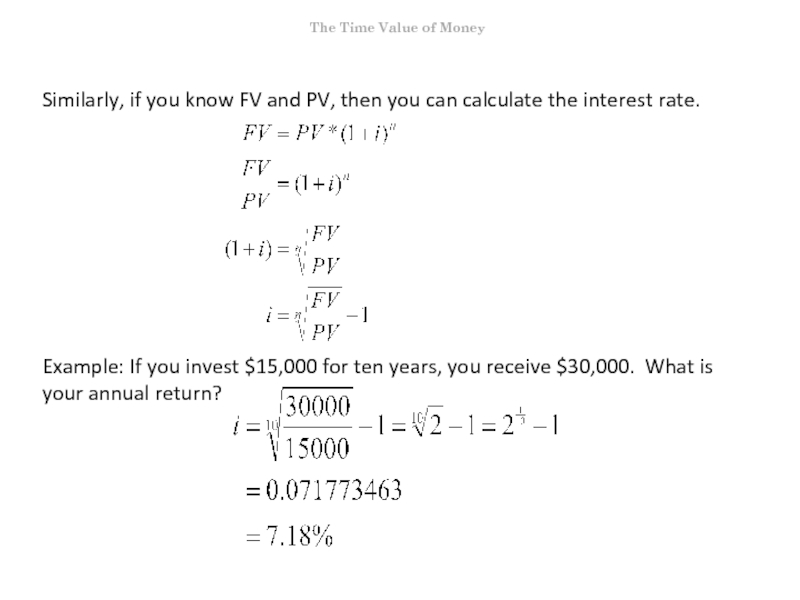

- 77. Similarly, if you know FV and PV,

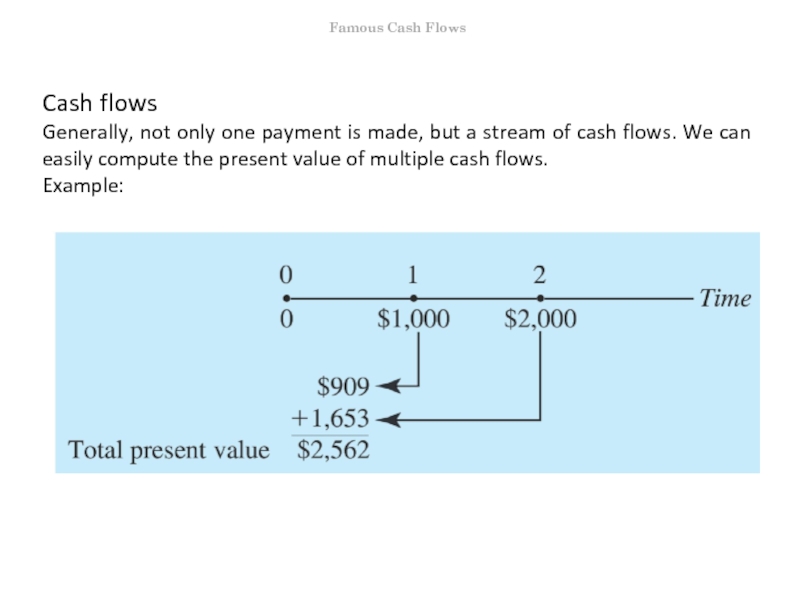

- 78. Cash flows Generally, not only one payment

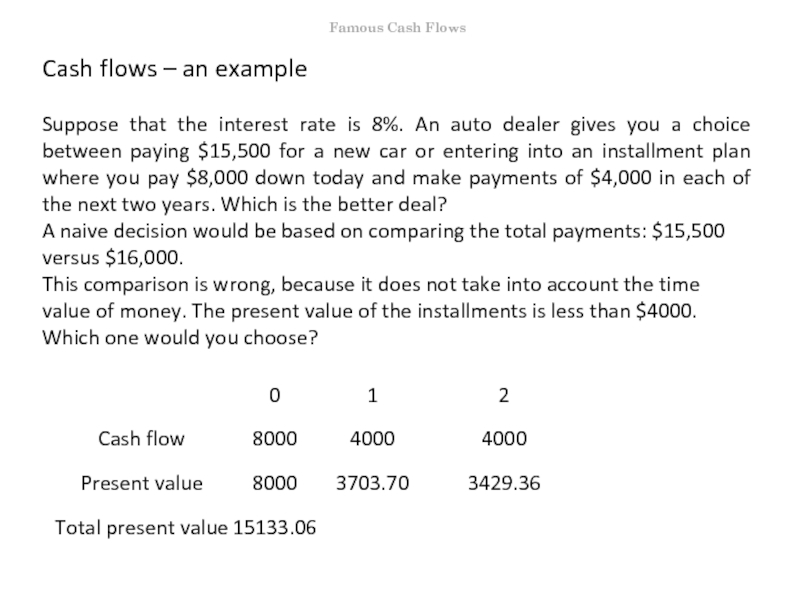

- 79. Cash flows – an example Suppose

- 80. Level cash flows There are cash

- 81. Annuity Annuity is a sequence of equally

- 82. The present value of an annuity How

- 83. Substract from line 4 line 2

- 84. Annuities example 1: Suppose that you want

- 85. Annuities example 2: Suppose that you want

- 86. How much of the monthly payments is

- 87. The retirement example Let’s see how we

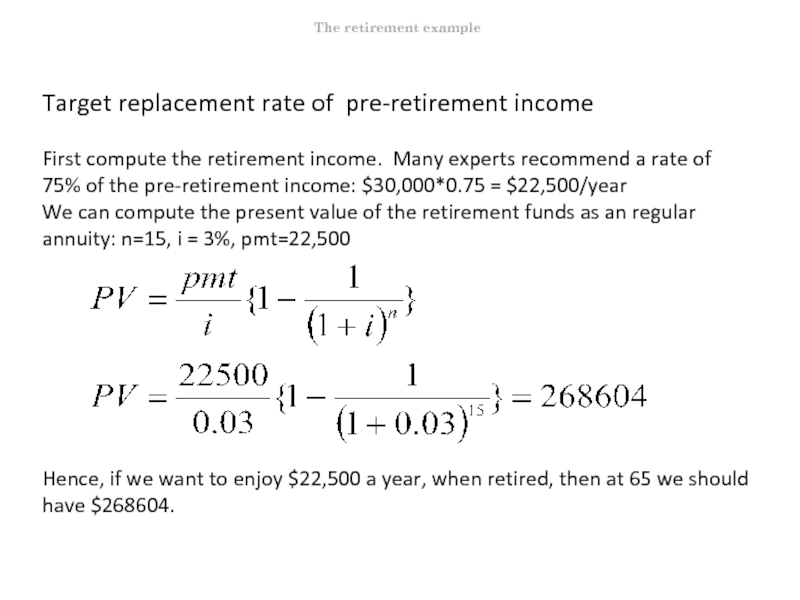

- 88. Target replacement rate of pre-retirement income

- 89. Target replacement rate of pre-retirement income

- 90. Target replacement rate of pre-retirement income

- 91. Maintain the same level of consumption spending

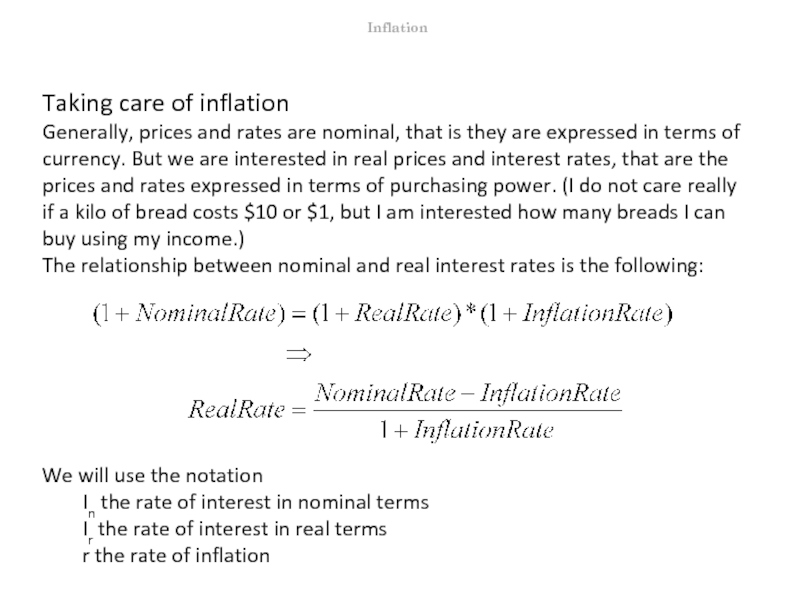

- 92. Taking care of inflation Generally, prices and

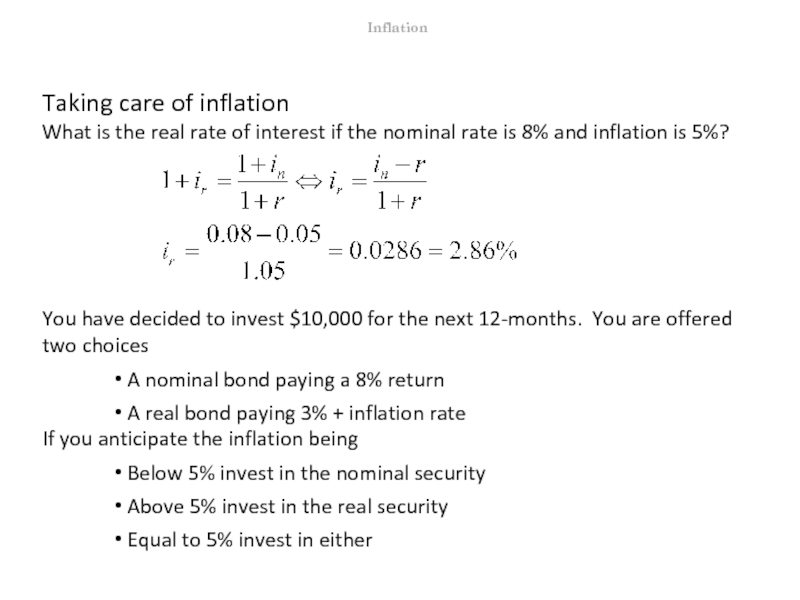

- 93. Taking care of inflation What is the

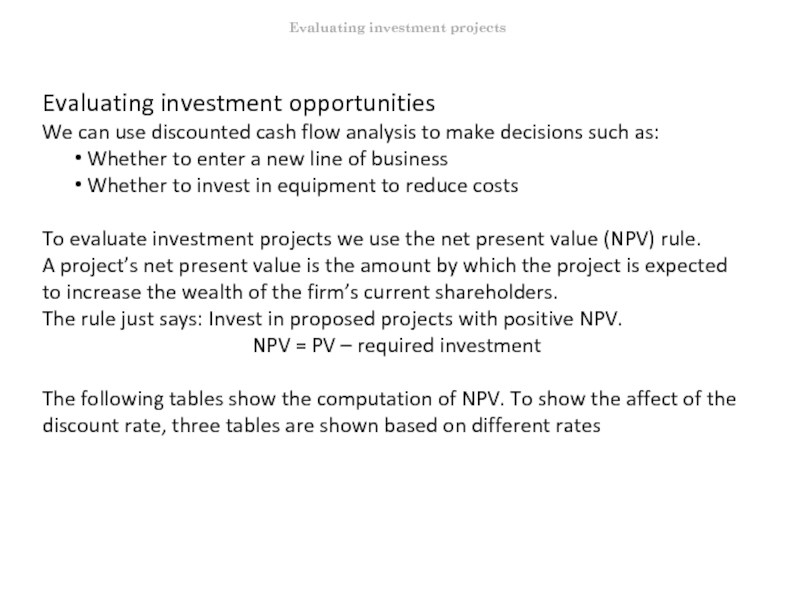

- 94. Evaluating investment opportunities We can use discounted

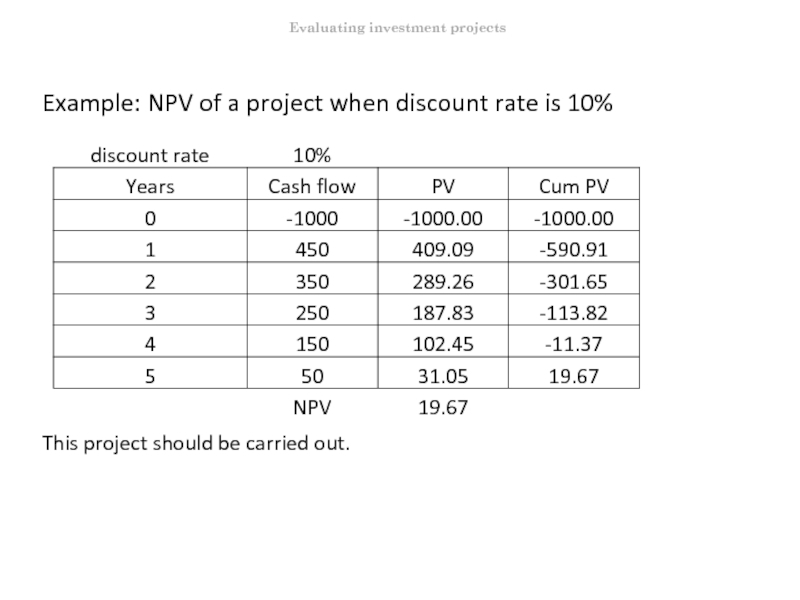

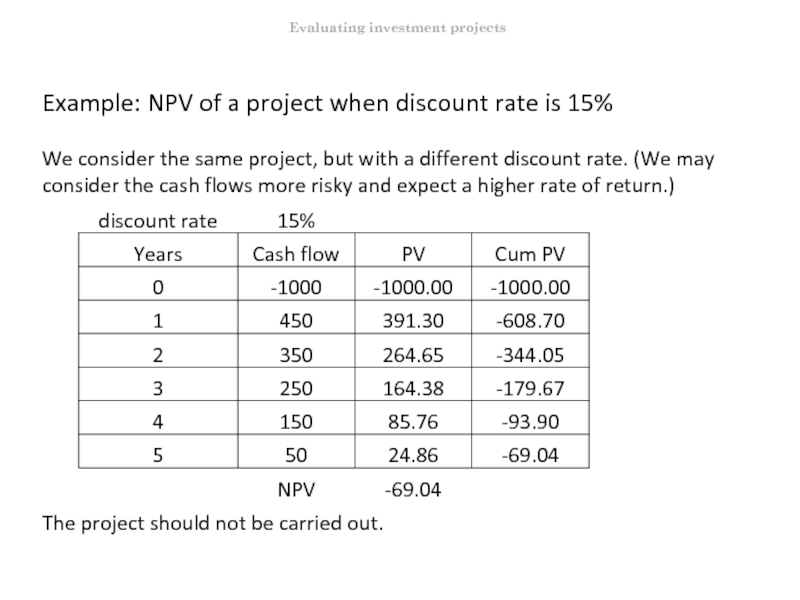

- 95. Example: NPV of a project when discount

- 96. Example: NPV of a project when discount

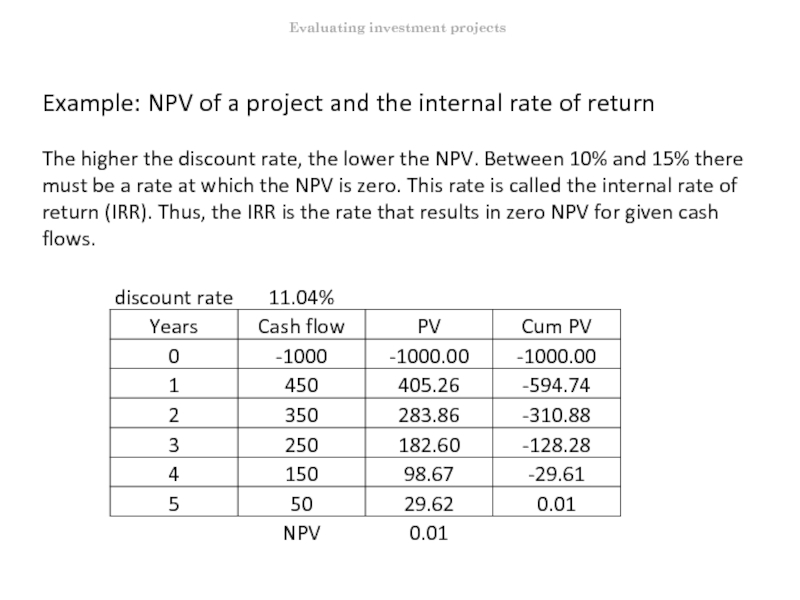

- 97. Example: NPV of a project and the

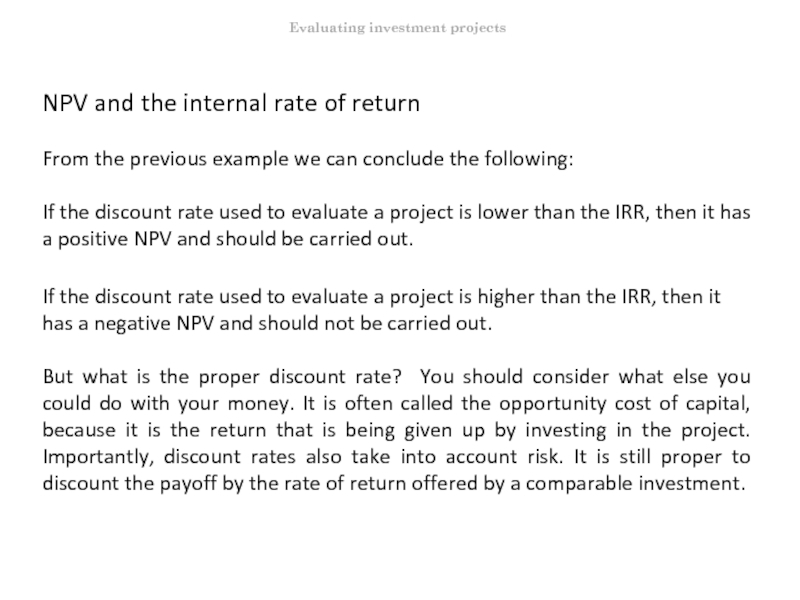

- 98. NPV and the internal rate of return

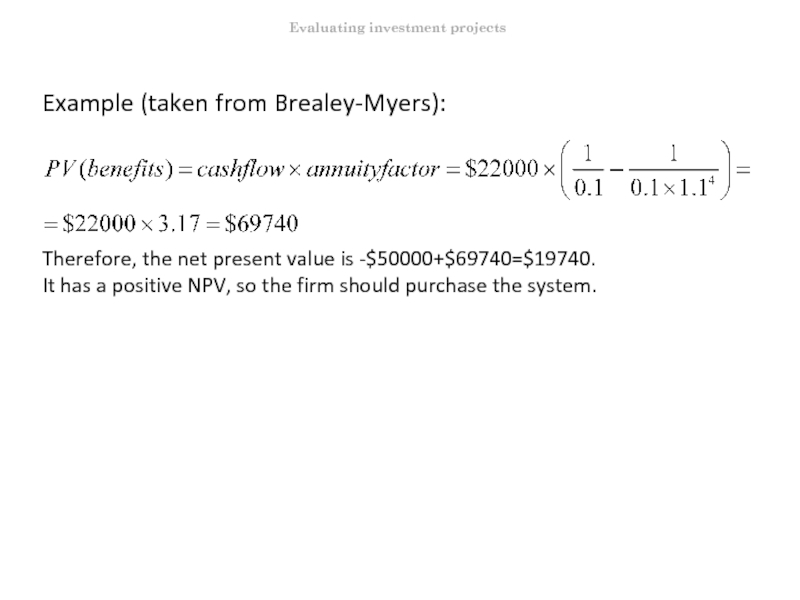

- 99. Example (taken from Brealey-Myers): Obsolete Technologies

- 100. Example (taken from Brealey-Myers):

- 101. Mutually exclusive projects We speak about

- 102. Mutually exclusive projects - example You

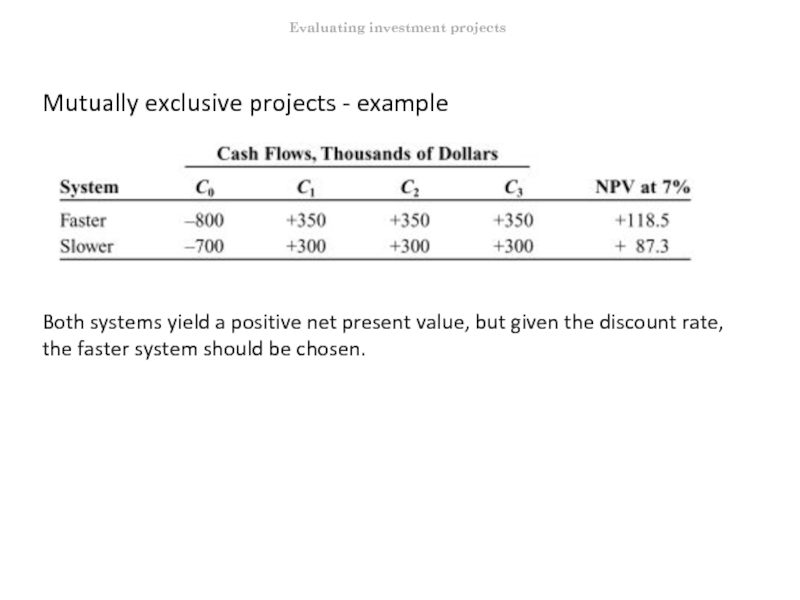

- 103. Mutually exclusive projects - example

- 104. Investment timing We return to Obsolete

- 105. Investment timing

- 106. Investment timing Isn’t a gain of

- 107. Investment timing If you postpone from

- 108. That’s all folks! We end this

Слайд 2Plan of the day

Today we will see financial planning and the

First we will speak in general about the process of financial planning.

Then we will go through an example in detail to see how the planning can be done. Afterwards, we will do financial planning for a sport club (Manchester United) based on real numbers. Thus, you can see that financial planning can be applied really and that after the class you will be able to make such plans.

Next, we will speak about the importance of external finance needs and sustainable rate of growth.

An important part of financial planning is to ensure that the daily operations of the company can be financed. Working capital management and cash budgeting deal with this issue.

Then we change topic and will study the time value of money, one of the pillars of finance.

The material that we cover builds strongly – as always - on

chapter 3 in Bodie – Merton - Cleeton, D. L. (2009). Financial Economics. Pearson/Prentice Hall

the chapter about working capital in Brealey – Myers: Principles of Corporate Finance.

Financial Planning

Слайд 3Financial Planning

The class on financial statements served to understand how a

If you are a manager, then you should understand how your firm works, but you should manage it as well. That means that you should set targets and see how those targets can be achieved and the appropriate financial background should be secured. Financial planning helps in this endeavour.

Financial Planning

Слайд 4The Financial Planning Process

Financial planning is a dynamic process that follows

The starting point is the strategic plan. Strategy guides the financial planning process by establishing overall business development guidelines and growth targets. Which businesses does the firm want to

enter

expand

contract

exit

and how quickly?

Hence, the strategic plan sets the targets that we want to achieve.

Financial Planning

Слайд 5The Financial Planning Process

A key factor in setting the strategy and

The revision of a financial plan is generally a function of the length of the planning horizon. Short-term plans are revised frequently, long-term plans are revised much less frequently.

Financial Planning

Слайд 6The Financial Planning Process

The financial planning horizon may be broken down

There is a forecasting exercise.

Management forecasts the key external factors, including level of economic activity, inflation, interest rates, and the competition’s output and prices.

Based on above, they next forecast revenues, expenses, cash flows, and implied need for external financing.

Setting targets.

Specific performance targets are generated for the divisions, functions and key individuals of the firm.

Periodic measurements of performance are made, and compared to the plan in order to correct either the plan or performance.

Periodically, key personnel are counseled, rewarded or punished, and a new iteration is instigated.

Financial Planning

Слайд 7The Financial Planning Process – Remarks

Some variables must be forecast

Some variables are highly volatile, and can’t be forecast effectively, so the best we can do is to plan for the unknown (contingency planning). If your company works in a developing country with unstable macroeconomic conditions, then forecasting inflation may be impossible.

Planning horizons must be appropriate.

For a magazine stand, a two year planning horizon may be far too long.

A pharmaceutical business (with long new-plant construction lead-times, and long drug development/testing/approval procedures) needs a planning horizon that may be as long a ten years.

Financial Planning

Слайд 8The Financial Planning Process – Remarks

A plan should always lead

A plan should make reasonable tradeoffs between flexibility and the cost of flexibility.

Financial Planning

Слайд 9Financial planning – an example

Consider the following example of a

Let us have a look first at the income statements and the balance sheets of the last three years!

Assume that it is all that we know about the company. (We are the new managers and we have been just hired.) How can we prepare the financial plan for the next year?

Assume also that taxes are 40% of the earnings after interest expenses are deducted.

Assume also that 30% of the earnings after taxes is paid out as dividend.

Financial Planning

Слайд 10Financial planning – Example: Income statement

Financial Planning

Year

xxx0

xxx1

xxx2

xxx3

Income Statement

Sales

200

240

288

Cost of goods sold

110

132

158

Gross margin

90

108

130

Selling, general & admin. expenses

30

36

43

EBIT

60

72

86

Interest expenses

30

45

64

Taxes

12

11

9

Net income

18

16

13

Dividends

5

5

4

Change in shareholder's equity

13

11

9

Слайд 12Financial planning – Steps

How can we prepare the financial plan

The easiest way is to see if there are some stable relationship between the items of the income statement and the balance sheet. This is known as the percent-of-sales method.

Important steps:

First, examine which items in the income statement have maintained a fixed ratio to sales. This enables us to decide which items should be forecast on projected sales, and which need to be forecast on another basis.

The second step is to forecast sales. This is a major exercise, but we will assume that sales will continue to grow at 20% next year (as it has in the past).

The third step is to forecast those items that have been assumed to vary with sales.

The fourth and final step is to forecast the missing items that have not been assumed to vary with sales.

Financial Planning

Слайд 13Financial planning – First step

Which items in the income statement /

Financial Planning

(Percent of Year's Sales)

Year

xxx1

xxx2

xxx3

Income Statement

Sales

100.0%

100.0%

100.0%

Cost of goods sold

55.0%

55.0%

55.0%

Gross margin

45.0%

45.0%

45.0%

Selling, general & admin exp.

15.0%

15.0%

15.0%

EBIT

30.0%

30.0%

30.0%

Interest expenses

15.0%

18.8%

22.2%

Taxes

6.0%

4.5%

3.1%

Net income

9.0%

6.7%

4.7%

Dividends

2.7%

2.0%

1.4%

Change in equity

6.3%

4.7%

3.3%

Слайд 15Financial planning – First step: combining tables

Financial Planning

GPC Financial

(Nearest $ Million)

(Percent of Year's Sales)

Year

xxx0

xxx1

xxx2

xxx3

xxx1

xxx2

xxx3

Income Statement

Sales

200

240

288

100.0%

100.0%

100.0%

Cost of goods sold

110

132

158

55.0%

55.0%

55.0%

Gross margin

90

108

130

45.0%

45.0%

45.0%

Selling, general & admin. expenses

30

36

43

15.0%

15.0%

15.0%

EBIT

60

72

86

30.0%

30.0%

30.0%

Interest expenses

30

45

64

15.0%

18.8%

22.2%

Taxes

12

11

9

6.0%

4.5%

3.1%

Net income

18

16

13

9.0%

6.7%

4.7%

Dividends

5

5

4

2.7%

2.0%

1.4%

Change in shareholder's equity

13

11

9

6.3%

4.7%

3.3%

Balance Sheet

Assets:

Cash & equivalents

10

12

14

17

6.0%

6.0%

6.0%

Receivables

40

48

58

69

24.0%

24.0%

24.0%

Inventories

50

60

72

86

30.0%

30.0%

30.0%

Property, Plant & equipment

500

600

720

864

300.0%

300.0%

300.0%

Total Assets

600

720

864

1037

360.0%

360.0%

360.0%

Liabilities:

Payables

30

36

43

52

18.0%

18.0%

18.0%

Short-term debt

120

221

347

502

110.7%

144.6%

174.2%

Long-term debt

150

150

150

150

75.0%

62.5%

52.1%

Total Liabilities

300

407

540

704

203.7%

225.1%

244.3%

Shareholder's equity

300

313

324

333

156.3%

134.9%

115.7%

Слайд 16Financial planning – First step

We compare everything to sales since

We see that costs of goods sold, gross margin and SGA expenses have a fixed ratio to sales. (Obviously, in real life these ratios are not that stable.) As a consequence, EBIT is also a stable share of sales. However, the share of interest expenses is not stable.

Similarly, all items of the asset side has a fixed ratio to sales. It is not the case for liabilities as there only payables have a fixed ratio, while short-term and long-term debt has an unstable relation to sales.

Financial Planning

Слайд 17Financial planning – Second and third step

The second step is to

Once we have the forecast for sales, based on the fixed ratios we can forecast the items with these fixed ratios.

For example, we have seen that costs of goods sold is 55% of sales. If we expect sales to rise by 20% to 345.6 million dollars, then our projection for costs of goods sold is 55%*345.6=190.08.

In the same vein, we have seen that total assets are 360% of sales. Thus, if sales amount to 345.6 million dollars, then our forecast for total assets is 1244.16 million dollars.

We can do the same with all the items in the income statement and the balance sheet that have a fixed ratio to sales.

If we do this step, then we will have the following tables.

Financial Planning

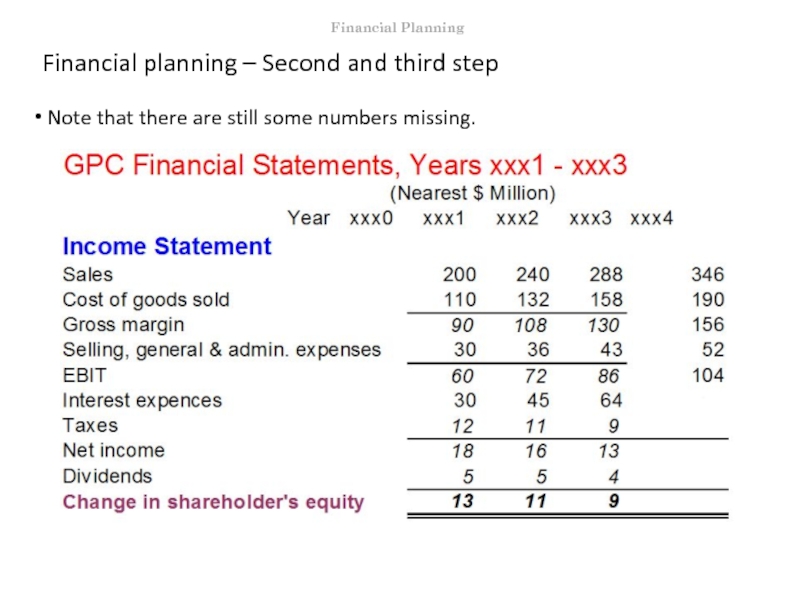

Слайд 18Financial planning – Second and third step

Note that there are

Financial Planning

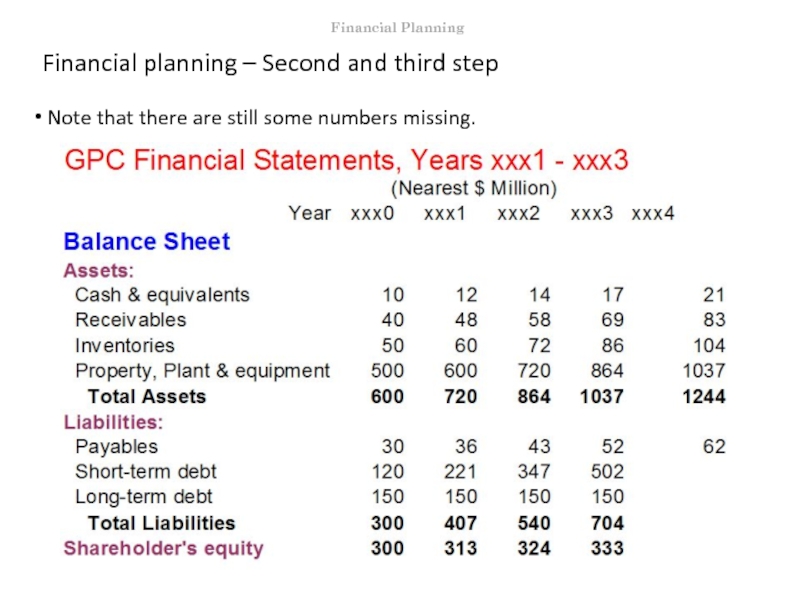

Слайд 19Financial planning – Second and third step

Note that there are

Financial Planning

Слайд 20Financial planning – Fourth step: completing the income statement

We need to

Note that we need to find out the interest rate expenses (and then we can calculate also taxes) in the income statements. Interest is paid on debt that appears on the liability side of the balance sheet.

Let us assume that interest rate on long-term debt is 8%, and on short-term debt is 15%. Since the outstanding short-term debt is 501.72 million dollars, and the outstanding long-term debt is 150 million dollars, so the interest to be paid is 0.08*501.72 + 0.15*150 = 87.26. Hence, taxes 0.4*(103.68-87.26)=6.57 million dollars. In fact, this information on interest rates is generally known.

Since the dividend pay-out ratio is given (30% of the net income), we can compute it as well. Net income=103.86-87.26-6.57=9.85, so the dividend is 2.96.

The part of the net income that is not paid out as dividend increases the shareholder’s equity, that is the wealth of the shareholders. In our case, it is 9.85-2.96=6.9 million dollars.

We have completed the income statement!

Financial Planning

Слайд 22Financial planning – Fourth step: completing the balance sheet

We have obtained

There are two missing numbers in the balance sheet: short-term and long-term debt.

We know that total asset = total liability + equity, so total liability= total asset – equity, that is total liability= 1244.16 -340.14=904.02. From the liability items we have forecasted already payables to be 62.21. Then, short-term debt + long-term debt = total liabilites – payables = 904.02-62.21=841.41.

To see how much of this sum goes to these debts we need additional assumptions. Assume that there is no change in long-term debt. Then, short-term debt =$841.41 - 150 = $691.81 million.

We have completed the balance sheet! We have prepared a financial plan for the next year.

Financial Planning

Слайд 24Can we do the same exercise with a real firm?

Here are

Open Day 2_Financial planning_MU.

Financial Planning

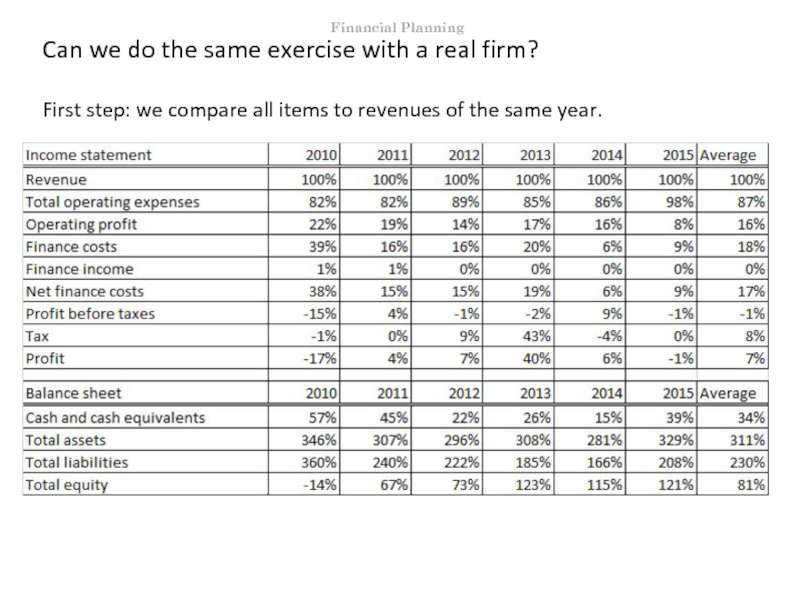

Слайд 25Can we do the same exercise with a real firm?

First step:

Financial Planning

Слайд 26Can we do the same exercise with a real firm?

Obviously, here

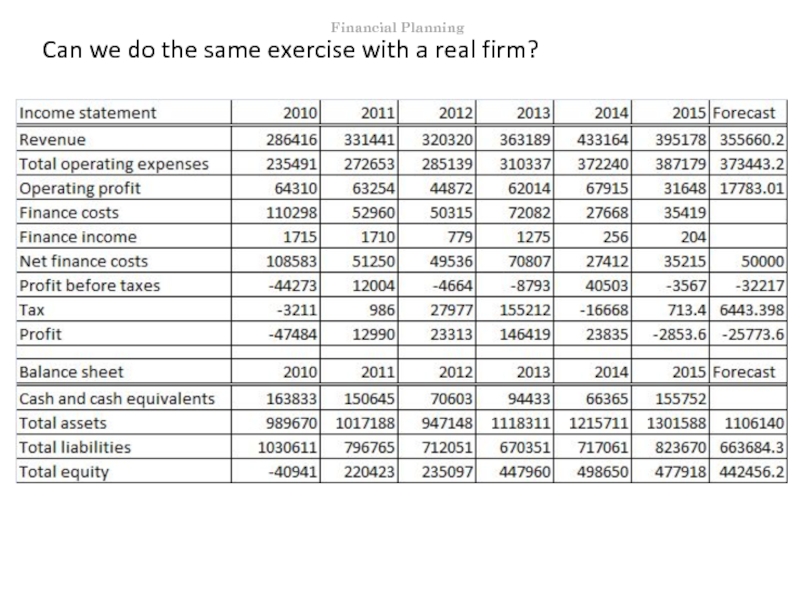

Second step is to forecast revenues. It is easy to calculate the change in revenues for the last years. These numbers are: 16% for 2011, -3% for 2012, 13% for 2013, 19% for 2014 and -9% for 2015. The average is about 7%. We may implement this number with additional information. For instance, we think that MU is not going to play in any international tournament next year, leading to a 10% decrease in revenue! Then for 2016 we expect it to be 355660.2.

Now, based on the fixed ratios we can forecast the items with fixed ratios. Which items do we consider to have a fixed ratio. On the next slide I also represent the averages of the percentages.

Financial Planning

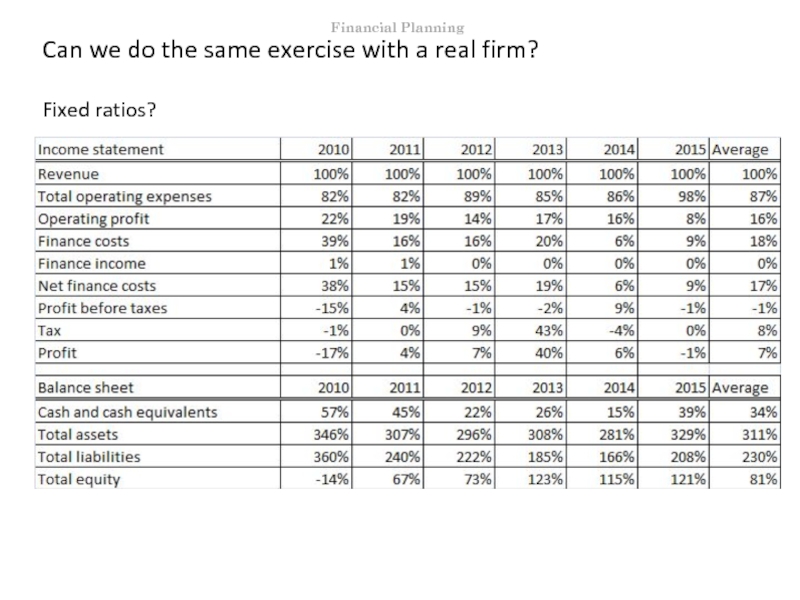

Слайд 28Can we do the same exercise with a real firm?

Fixed ratios?

As

Therefore, total operating expenses = 105%*355660.2=373443.2, operating profit = 5%*355660.2=17783.01, total assets = 311%*355660.2= 1106140.

We were only able to fill in some slots, but we are advancing.

Financial Planning

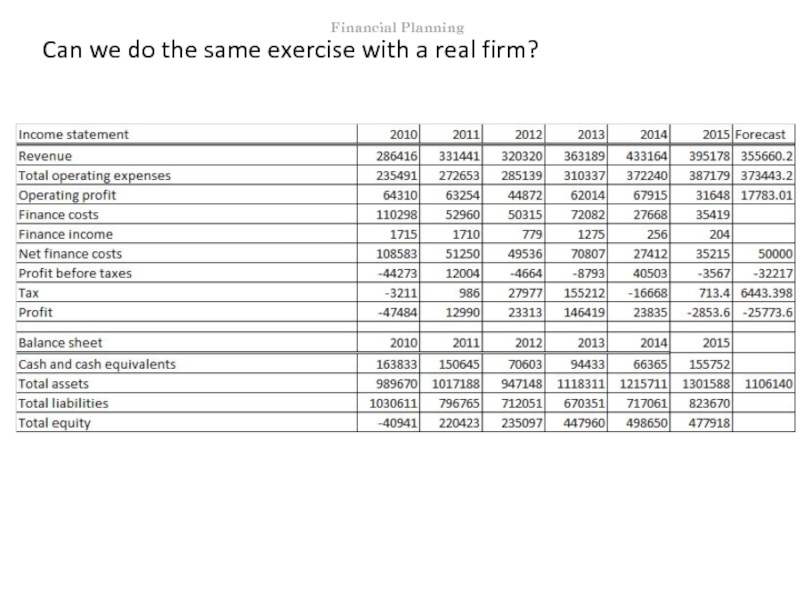

Слайд 30Can we do the same exercise with a real firm?

The next

Net finance costs are determined mostly by debt service. That is, MU has debt and has to pay interests and pay back the principal amount. These costs can be projected easily. Suppose that you have 1 million dollar of debt that matures in 3 years and you have to pay 10% interest plus pay back the 1 million dollar in the last year. Then you know that in the next 3 years you have to pay 100000$, 100000$ and 100000$ + 1000000$. For simplicity, we assume that the net finance cost is 50000.

Tax is a certain percent of profits. (I do not understand why it varied so drastically in previous years.) If we assume that it is x percent of profits, then we can forecast it. Assume that the tax burden is 20%.

Now we can complete the income statement.

Financial Planning

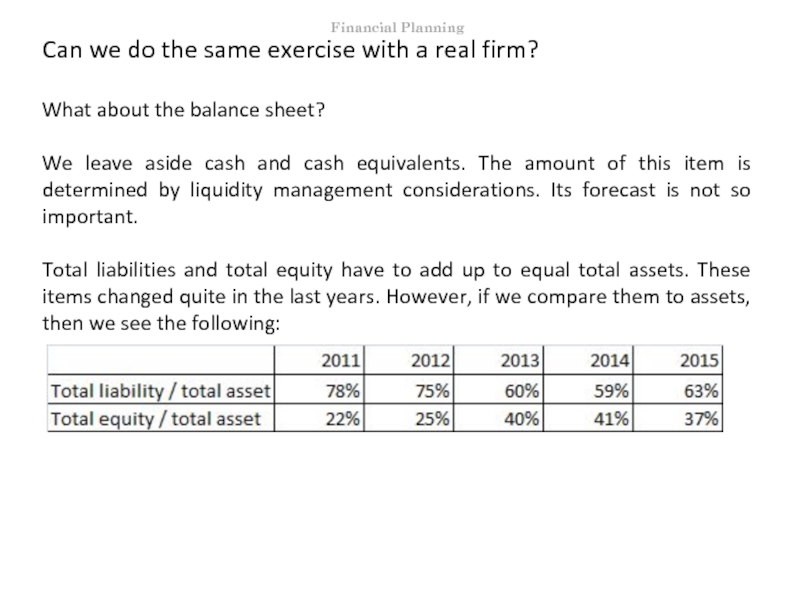

Слайд 32Can we do the same exercise with a real firm?

What about

We leave aside cash and cash equivalents. The amount of this item is determined by liquidity management considerations. Its forecast is not so important.

Total liabilities and total equity have to add up to equal total assets. These items changed quite in the last years. However, if we compare them to assets, then we see the following:

Financial Planning

Слайд 33Can we do the same exercise with a real firm?

Hence, it

It shows a change in the way Manchester United is financed. Before the funding relied more heavily on external funds, but for some reason the owners decided to increase internal funding.

The good news is that we can use these new numbers for our forecast.

We are ready with a real forecast.

Financial Planning

Слайд 35Assignment 2

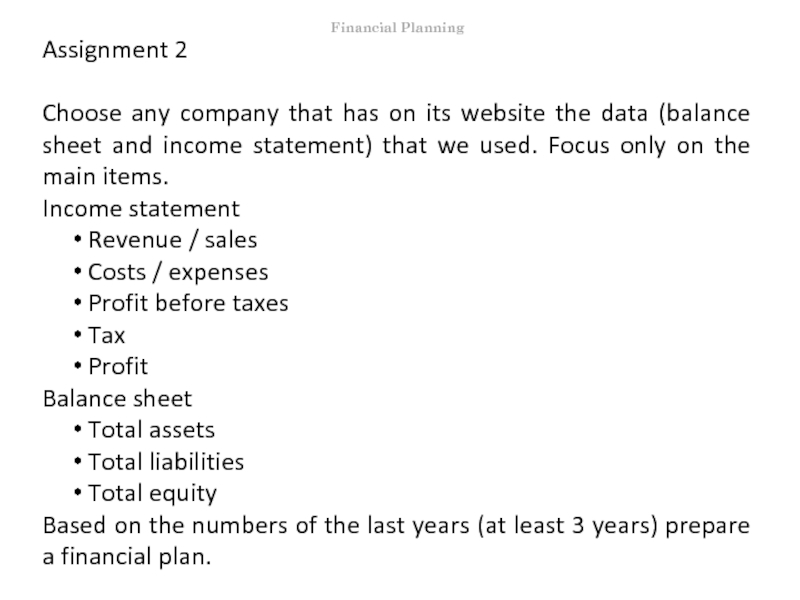

Choose any company that has on its website the data

Income statement

Revenue / sales

Costs / expenses

Profit before taxes

Tax

Profit

Balance sheet

Total assets

Total liabilities

Total equity

Based on the numbers of the last years (at least 3 years) prepare a financial plan.

Financial Planning

Слайд 36Assignment 2

Choose wisely the company as you may need to come

Financial Planning

Слайд 37Growth and need for external finance

In the previous example we have

This is the amount of exteral funding that the firm needs to meet its target. The firm may decide to increase short-term debt or increase long-term debt or issue new shares.

Let us see how this external funding depends on the growth of revenues! We can compute the external funds needed directly.

Let

S1 be the sales in next year

S0 be the sales this year

A[S] be the assets that vary with sales

L[S] be the liabilities that vary with sales

d be the dividend pay-out ratio

t be the tax rate

Financial Planning

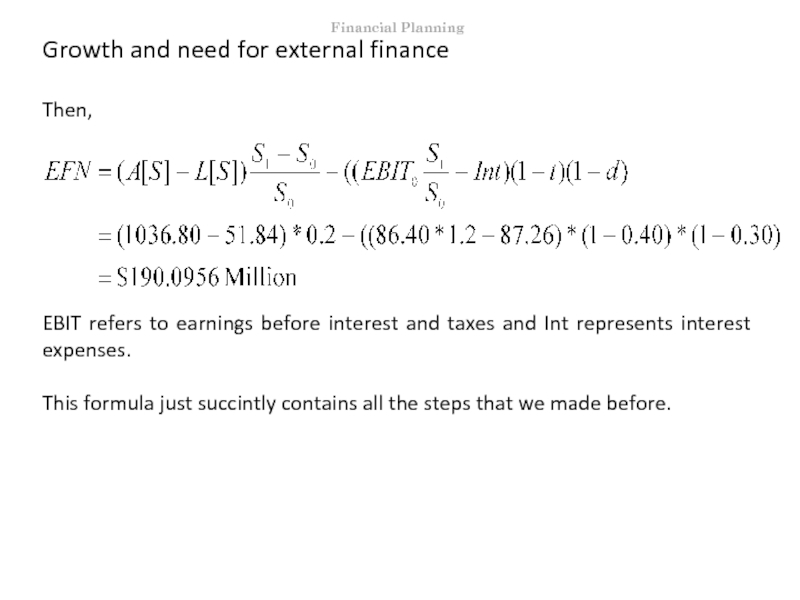

Слайд 38Growth and need for external finance

Then,

EBIT refers to earnings before

This formula just succintly contains all the steps that we made before.

Financial Planning

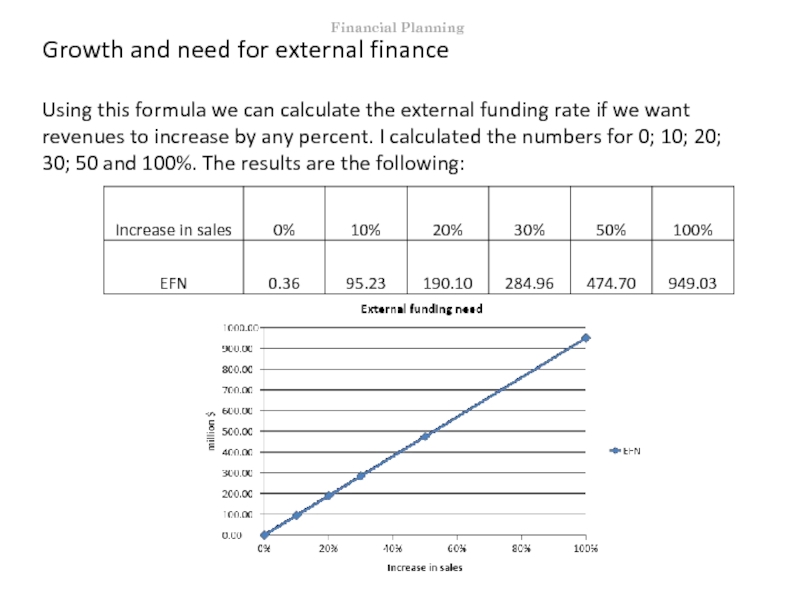

Слайд 39Growth and need for external finance

Using this formula we can calculate

Financial Planning

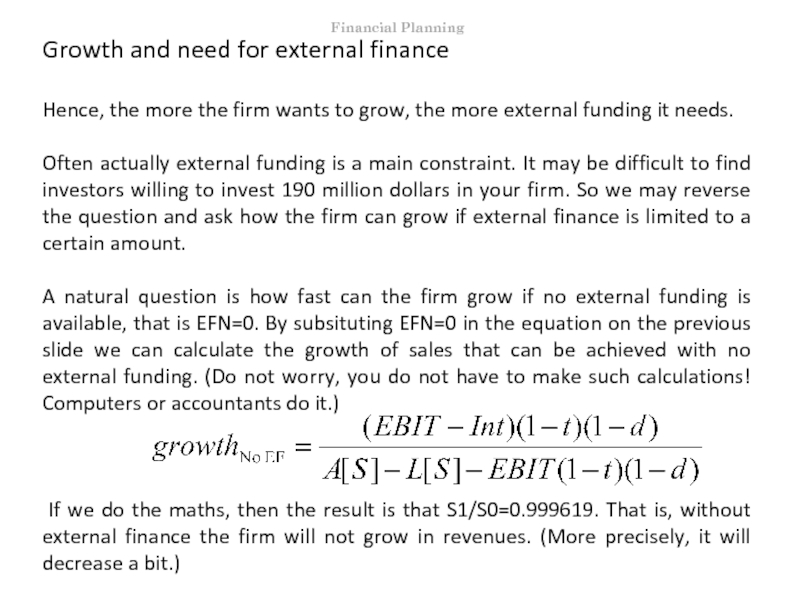

Слайд 40Growth and need for external finance

Hence, the more the firm wants

Often actually external funding is a main constraint. It may be difficult to find investors willing to invest 190 million dollars in your firm. So we may reverse the question and ask how the firm can grow if external finance is limited to a certain amount.

A natural question is how fast can the firm grow if no external funding is available, that is EFN=0. By subsituting EFN=0 in the equation on the previous slide we can calculate the growth of sales that can be achieved with no external funding. (Do not worry, you do not have to make such calculations! Computers or accountants do it.)

If we do the maths, then the result is that S1/S0=0.999619. That is, without external finance the firm will not grow in revenues. (More precisely, it will decrease a bit.)

Financial Planning

Слайд 41Sustainable rate of growth

The sustainable growth rate is a measure of

If there is no external finance, then the growth of the shareholders’ equity constrains the growth of the firm. The growth of the equity is the amount of profits not paid out to the shareholders.

The numerator of the previous formula is the earning (profit) of the firm once interest expenses, taxes and dividend have been paid. This is the amount that the shareholders equity is increasing. The higher is this amount, the more can the firm grow.

The growth of the shareholders equity is determined by how profitably the firm uses the equity which is measured by the return on equity (RoE). Hence, the higher is RoE, the higher is the growth of the shareholders equity and in turn the higher is the sustainable rate of growth.

Financial Planning

Слайд 42Sustainable rate of growth

There is an easy formula to calculate sustainable

Sustainable Rate of Growth = (1-d)*RoE

It just tells that the higher is the RoE (and hence the profits) and the higher share of that profit is retained (that is the smaller d), the more can the firm grow.

How is the sustainable growth of Manchester United?

In the last two years MU did not pay dividends, so d=0. The RoE of MU equals -0.18%, so MU can grow without external finance at that rate. We have seen that actually MU decreased more during 2015 (-9%).

Financial Planning

Слайд 43Working Capital Management

An important part of financial planning and management is

In many instances companies need to spend money on costs before getting some revenue from selling its product. Generally, you incur costs before the revenues, e.g. you buy the raw material and ingredients of your product, you make the product and only afterwards can you sell it.

Working capital measures this difference between short-term assets and liabilities.

Working capital = Current assets - current liabilities

Remember that current assets are cash and other assets expected to be converted to cash or consumed in a year. Receivables and inventory is also part of current assets.

Current liabilities are reasonably expected to be liquidated within a year. They usually include payables such as wages, accounts, taxes.

Financial Planning

Слайд 44Working Capital Management

There is a problem if you have to pay

In other words, a company may have a lot of profitable assets, but may be unable to convert those assets into cash and have financing problems. For instance, you may sell a lot of your products, but if your clients pay you later, then you may be short of liquidity. Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term debt and upcoming operational expenses. The management of working capital involves managing inventories, accounts receivable and payable, and cash.

Note that if you have a positive working capital, then you expect to have more current asset (cash, receivables and inventory) than current liabilities (money that you have to pay within a year) and then there is a good chance that you will have enough money to settle those bills.

Financial Planning

Слайд 45Efficient Management of Working Capital Principle:

Minimize the investment in non-earning assets

Maximizing the use of free credit such as prepayments by customers or accounts payable. This free credit because for instance an account that is payable means that you have the product, but you have not paid for it yet. So you can use it for free.

The two advices help decrease the time between the selling of your product and the arrival of money for it and therefore they reduce the working capital need.

The amount of time it takes to turn the net current assets and current liabilities into cash is called working capital cycle (or cash cycle time).

Financial Planning

Слайд 46Working Capital Management

The longer the working capital cycle is, the longer

A positive working capital cycle balances incoming and outgoing payments to minimize net working capital and maximize free cash flow. For example, a company that pays its suppliers in 30 days but takes 60 days to collect its receivables has a working capital cycle of 30 days. This 30 day cycle usually needs to be funded through some way of funding, for instance a bank credit. The interest on this financing is a cost that reduces the company's profitability.

Growing businesses require cash, and being able to free up cash by shortening the working capital cycle is the most inexpensive way to grow.

Financial Planning

Слайд 47Working Capital Management: Cash cycle

One way to consider if working capital

Cash Cycle Time = Inventory period + receivable period - payables period

Financial Planning

Слайд 48Working Capital Management – Real Madrid FC

Proper working capital management is

It was negative! And it is clear that they are making efforts to improve it. In the report the club attributes it to the nature of transactions. For example, if you contract a star player, you have to pay for him first and only later will he earn money for the club if he is successful.

Financial Planning

Слайд 49Cash budgeting

(This section builds heavily on the chapter about working capital

We have seen the importance of working capital management. Concretely, we have seen that it is of utmost importance to ensure that the company has always enough money. Cash budgeting is about planning and forecasting future sources and uses of cash.

These forecasts serve two purposes. First, they alert the financial manager to future cash needs. Second, the cash-flow forecasts provide a standard, or budget, against which subsequent performance can be judged.

There are three common steps to preparing a cash budget:

Step 1. Forecast the sources of cash. The largest inflow of cash comes from payments by the firm’s customers.

Step 2. Forecast uses of cash.

Step 3. Calculate whether the firm is facing a cash shortage or surplus.

Financial Planning

Слайд 50Cash budgeting

The financial plan sets out a strategy for investing cash

We will illustrate these issues by using the example of an imaginary firm called Dynamic Mattress that sells mattresses. Open the excel Day 2_Cash budgeting!

Here are the sale forecasts by quarter for the company for the next year.

As already told, unless customers pay cash on delivery, sales become accounts receivable before they become cash. Cash flow comes from collections on accounts receivable.

Most firms keep track of the average time it takes customers to pay their bills. From this they can forecast what proportion of a quarter’s sales is likely to be converted into cash in that quarter and what proportion is likely to be carried over to the next quarter as accounts receivable.

Financial Planning

Слайд 51Cash budgeting

This proportion depends on the lags with which customers pay

Suppose that 80 percent of sales are collected in the immediate quarter and the remaining 20 percent in the next. In the first quarter, for example, collections from current sales are 80 percent of $87.5 million, or $70 million. But the firm also collects 20 percent of the previous quarter’s sales, or 0.20 × $75 million = $15 million. Therefore, total collections are $70 million + $15 million = $85 million.

Dynamic started the first quarter with $30 million of accounts receivable. The quarter’s sales of $87.5 million were added to accounts receivable, but $85 million of collections was subtracted. Therefore, Dynamic ended the quarter with accounts receivable of $30 million + $87.5 million – $85 million = $32.5 million.

Financial Planning

Слайд 52Cash budgeting – Sources of cash

The general formula is

Ending accounts

In the next table we have forecast sources of cash for Dynamic Mattress. Collection of receivables is the main source but it is not the only one. Perhaps the firm plans to dispose of some land. Such items are included as “other” sources. It is also possible that you may raise additional capital by borrowing or selling stock. We just assume that Dynamic will not raise further long-term finance.

Financial Planning

Слайд 53Cash budgeting

The second section of the table shows how Dynamic expects

Payments of accounts payable.

2. Labor, administrative, and other expenses.

3. Capital expenditures.

4. Taxes, interest, and dividend payments.

Financial Planning

Слайд 54Cash budgeting – Uses of cash

Some details.

1. Payments of accounts payable.

2. Labor, administrative, and other expenses. This category includes all other regular business expenses.

3. Capital expenditures. Note that Dynamic Mattress plans a major outlay of cash in the first quarter to pay for a long-term asset.

4. Taxes, interest, and dividend payments. This includes interest on currently outstanding long-term debt and dividend payments to stockholders.

Financial Planning

Слайд 55Cash budgeting – Cash balance

The forecast net inflow of cash (sources

Note the large negative figure for the first quarter: a $45 million forecast outflow. There is a smaller forecast outflow in the second quarter, and then substantial cash inflows in the second half of the year.

As mentioned, the financial plan sets out a strategy for investing cash surpluses or financing any deficit.

The next table shows calculations about how much financing Dynamic will have to raise if its cash-flow forecasts are right.

These calculations are done generally on computer with special softwares.

Financial Planning

Слайд 56Cash budgeting – Cash balance

Dynamic starts the year with $5 million

outflow in the first quarter, and so Dynamic will have to obtain at least $45 million – $5 million = $40 million of additional financing. This would leave the firm with a forecast cash balance of exactly zero at the start of the second quarter.

Most financial managers regard a planned cash balance of zero as driving too close to the edge of the cliff. They establish a minimum operating cash balance to absorb unexpected cash inflows and outflows. We will assume that Dynamic’s minimum operating cash balance is $5 million. That means it will have to raise $45 million instead of $40 million in the first quarter, and $15 million more in the second quarter. Thus its cumulative financing requirement is $60 million in the second quarter. Fortunately, this is the peak; the cumulative requirement declines in the third quarter when its $26 million net cash inflow reduces its cumulative financing requirement to $34 million. In the final quarter Dynamic is out of the woods. Its $35 million net cash inflow is enough to eliminate short-term financing and actually increase cash balances above the $5 million minimum acceptable balance.

Financial Planning

Слайд 57Cash budgeting – Cash balance

Some remarks.

The large cash outflows in

In the table we use only a best guess about future cash flows. It is a good idea to think about the uncertainty in your estimates. For example, you could undertake a sensitivity analysis, in which you inspect how Dynamic’s cash requirements would be affected by a shortfall in sales or by a delay in collections.

Financial Planning

Слайд 58Cash budgeting – Short-term financing plan

Our next step will be to

There are several options for short-term financing. Dynamic may consider putting off paying its bills and thus increasing its accounts payable. In effect, this is taking a loan from its suppliers. The financial manager believes that Dynamic can defer the following amounts in each quarter:

That is, $52 million can be saved in the first quarter by not paying bills in that quarter. If deferred, these payments must be made in the second quarter. Similarly, $48 million of the second quarter’s bills can be deferred to the third quarter and so on. Stretching payables is often costly, however, even if no ill will is incurred. This is because many suppliers offer discounts for prompt payment, so that Dynamic loses the discount if it pays late. Assume the lost discount is 5 percent of the amount deferred. In other words, if a $52 million payment is delayed in the first quarter, the firm must pay 5 percent more, or $54.6 million in the next quarter. This is like borrowing at an annual interest rate of over 20 percent (1.05 4 – 1 = .216, or 21.6%).

Financial Planning

Слайд 59Cash budgeting – Short-term financing plan

Alternatively, Dynamic can borrow up to

With these two options, the short-term financing strategy is obvious: use the lower cost bank loan first. Stretch payables only if you can’t borrow enough from the bank.

The next table shows the resulting plan. The first panel (cash requirements) sets out the cash that needs to be raised in each quarter. The second panel (cash raised) describes the various sources of financing the firm plans to use. The third and fourth panels describe how the firm will use net cash inflows when they turn positive.

Financial Planning

Слайд 61Cash budgeting – Short-term financing plan

In the first quarter the plan

In the second quarter, an additional $15 million must be raised to cover the net cash outflow predicted earlier. In addition, $0.8 million must be raised to pay interest on the bank loan. Therefore, the plan calls for Dynamic to maintain its bank borrowing and to stretch $15.8 million in payables. Notice that in the first two quarters, when net cash flow from operations is negative, the firm maintains its cash balance at the minimum acceptable level. Additions to cash balances are zero. Similarly, repayments of outstanding debt are zero. In fact outstanding debt rises in each of these quarters.

In the third and fourth quarters, the firm generates a cash-flow surplus, so the plan calls for Dynamic to pay off its debt. First it pays off stretched payables, as it is required to do, and then it uses any remaining cash-flow surplus to pay down its bank loan. In the third quarter, all of the net cash inflow is used to reduce outstanding short-term borrowing. In the fourth quarter, the firm pays off its remaining short-term borrowing and uses the extra $3 million to increase its cash balances.

Financial Planning

Слайд 62Cash budgeting – Evaluation of the plan

Does the plan solve Dynamic’s

this plan is its reliance on stretching payables, an extremely expensive financing device. Remember that it costs Dynamic 5 percent per quarter to delay paying bills—20 percent per year at simple interest. This first plan should merely stimulate the financial manager to search for cheaper sources of short-term borrowing.

The financial manager would ask several other questions as well. For example:

1. Does Dynamic need a larger reserve of cash or marketable securities to guard against, say, its customers stretching their payables (thus slowing down collections on accounts receivable)?

2. Does the plan yield satisfactory current and quick ratios? Its bankers may be worried if these ratios deteriorate.

3. Are there hidden costs to stretching payables? Will suppliers begin to doubt Dynamic’s creditworthiness?

Financial Planning

Слайд 63Cash budgeting – Evaluation of the plan

4. Should Dynamic try to

5. Perhaps the firm’s operating and investment plans can be adjusted to make the short-term financing problem easier. Is there any easy way of deferring the first quarter’s large cash outflow? For example, suppose that the large capital investment in the first quarter is for new machinery to be delivered and installed in the first half of the year. The new machines are not scheduled to be ready for full-scale use until August. Perhaps the machine manufacturer could be persuaded to accept 60 percent of the purchase price on delivery and 40 percent when the machines are installed and operating satisfactorily.

Financial Planning

Слайд 64Cash budgeting – Evaluation of the plan

4. Should Dynamic try to

5. Perhaps the firm’s operating and investment plans can be adjusted to make the short-term financing problem easier. Is there any easy way of deferring the first quarter’s large cash outflow? For example, suppose that the large capital investment in the first quarter is for new machinery to be delivered and installed in the first half of the year. The new machines are not scheduled to be ready for full-scale use until August. Perhaps the machine manufacturer could be persuaded to accept 60 percent of the purchase price on delivery and 40 percent when the machines are installed and operating satisfactorily.

Important message: Short-term financing plans must be developed by trial and error. You lay out one plan, think about it, then try again with different assumptions on financing and investment alternatives. You continue until you can think of no further improvements.

Financial Planning

Слайд 65Cash budgeting – Sources of Short-Term Financing: Bank loans

Let us briefly

Bank loans

The simplest and most common source of short-term finance is an unsecured loan from a bank. For example, Dynamic might have a standing arrangement with its bank allowing it to borrow up to $40 million. The firm can borrow and repay whenever it wants so long as it does not exceed the credit limit. This kind of arrangement is called a line of credit.

Lines of credit are typically reviewed annually, and it is possible that the bank may seek to cancel it if the firm’s creditworthiness deteriorates. If the firm wants to be sure that it will be able to borrow, it can enter into a revolving credit agreement with the bank. Revolving credit arrangements usually last for a few years and formally commit the bank to lending up to the agreed limit. In return the bank will require the firm to pay a commitment fee of around 0.25 percent on any unused amount.

Most bank loans have durations of only a few months. For example, Dynamic may need a loan to cover a seasonal increase in inventories, and the loan is then repaid as the goods are sold.

Financial Planning

Слайд 66Cash budgeting – Sources of Short-Term Financing: Bank loans

However, banks also

Financial Planning

Слайд 67Cash budgeting – Sources of Short-Term Financing: Commercial Papers

Commercial papers

When banks

Commercial paper has a maximum maturity of 9 months. Commercial paper is not secured, but companies generally back their issue of paper by arranging a special backup line of credit with a bank. This guarantees that they can find the money to repay the paper, and the risk of default is therefore small.

Financial Planning

Слайд 68Cash budgeting – Sources of Short-Term Financing: Secured loans

Secured loans

Many short-term

only $75,000. The safety margin (or haircut, as it is called) is likely to be even larger in the case of loans that are secured by inventory.

Financial Planning

Слайд 69Conclusion – Financial planning

Hopefully, after this lesson you are convinced about

We carried out some simple financial planning. Although they were more simple than planning in real life, but they contained the elements that you need to know if you are to make a financial plan.

We have also seen how working capital management and cash budgeting works. These complement and enhance financial planning and are essential for the good working of any company.

Financial Planning

Слайд 70Introduction – The time value of money

$20 today is worth more

a bank would pay interest on the $20;

inflation makes tomorrows $20 less valuable than today’s;

uncertainty of receiving tomorrow’s $20.

If there is some interest rate that we can earn for different periods, then we have compounding (you earn interest on previous interest).

Assume that the interest rate is 10% per year. If you invest $1 for one year, you have been promised $1*(1+10/100) or $1.10 next year. Investing for yet another year promises to produce 1.10 *(1+10/100) or $1.21 in 2-years and so on.

Let i be the interest rate, n be the life of the lump sum investment, PV be the present value and FV be the future value. Then,

The Time Value of Money

Слайд 71Look how $100 grows over time at different interest rates.

Small differences

The rule of 72 says that the number of years it takes for a sum of money to double in value (“the doubling time”) is approximately equal to the number 72 divided by the interest rate expressed in percent per year.

The Time Value of Money

Слайд 73

The Time Value of Money

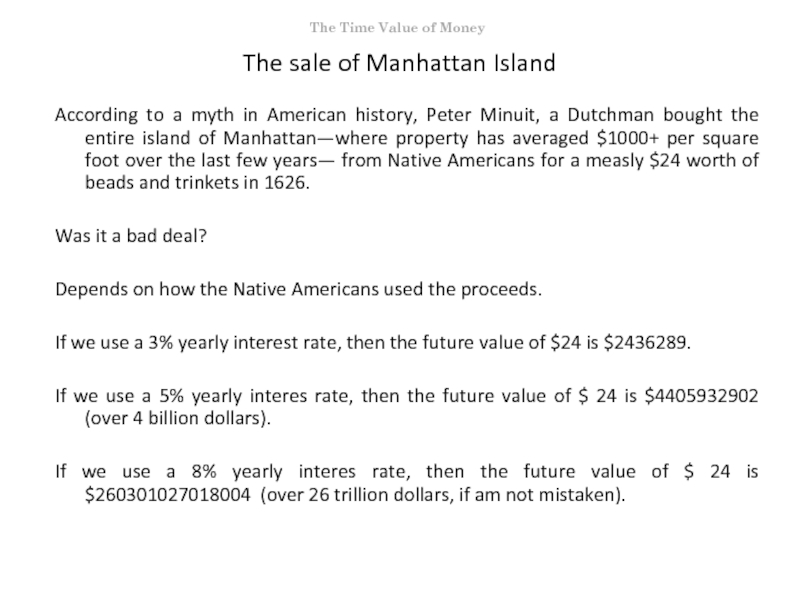

The sale of Manhattan Island

According to a

Was it a bad deal?

Depends on how the Native Americans used the proceeds.

If we use a 3% yearly interest rate, then the future value of $24 is $2436289.

If we use a 5% yearly interes rate, then the future value of $ 24 is $4405932902 (over 4 billion dollars).

If we use a 8% yearly interes rate, then the future value of $ 24 is $260301027018004 (over 26 trillion dollars, if am not mistaken).

Слайд 74Compounding has a very important consequence.

1/(1+i)n is called the discount factor.

If

The Time Value of Money

Слайд 76In 1995 Coca-Cola Enterprises needed to borrow about a quarter of

How much would you have been prepared to pay for one of the company’s IOUs?

The Time Value of Money

Слайд 77Similarly, if you know FV and PV, then you can calculate

Example: If you invest $15,000 for ten years, you receive $30,000. What is your annual return?

The Time Value of Money

Слайд 78Cash flows

Generally, not only one payment is made, but a stream

Example:

Famous Cash Flows

Слайд 79Cash flows – an example

Suppose that the interest rate is 8%.

A naive decision would be based on comparing the total payments: $15,500

versus $16,000.

This comparison is wrong, because it does not take into account the time value of money. The present value of the installments is less than $4000.

Which one would you choose?

Famous Cash Flows

Слайд 80Level cash flows

There are cash flows that feature very regular payments.

For

We will consider now such cash flows. Due to the equal payments, there are easy formulas to calculate the present value of such cash flows.

Famous Cash Flows

Слайд 81Annuity

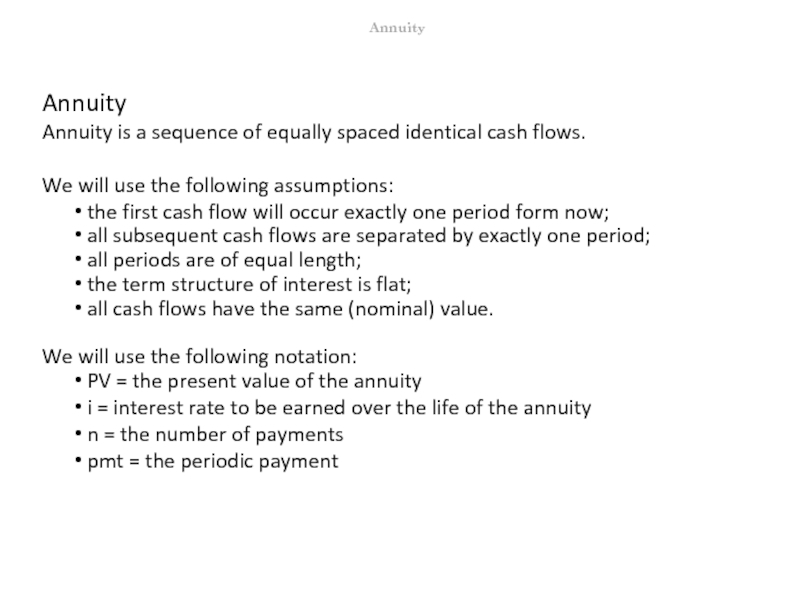

Annuity is a sequence of equally spaced identical cash flows.

We

the first cash flow will occur exactly one period form now;

all subsequent cash flows are separated by exactly one period;

all periods are of equal length;

the term structure of interest is flat;

all cash flows have the same (nominal) value.

We will use the following notation:

PV = the present value of the annuity

i = interest rate to be earned over the life of the annuity

n = the number of payments

pmt = the periodic payment

Annuity

Слайд 82The present value of an annuity

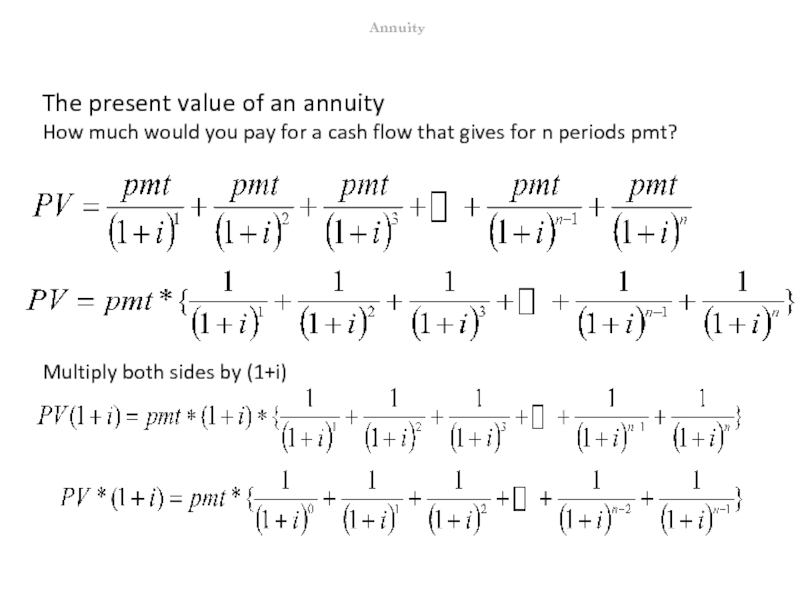

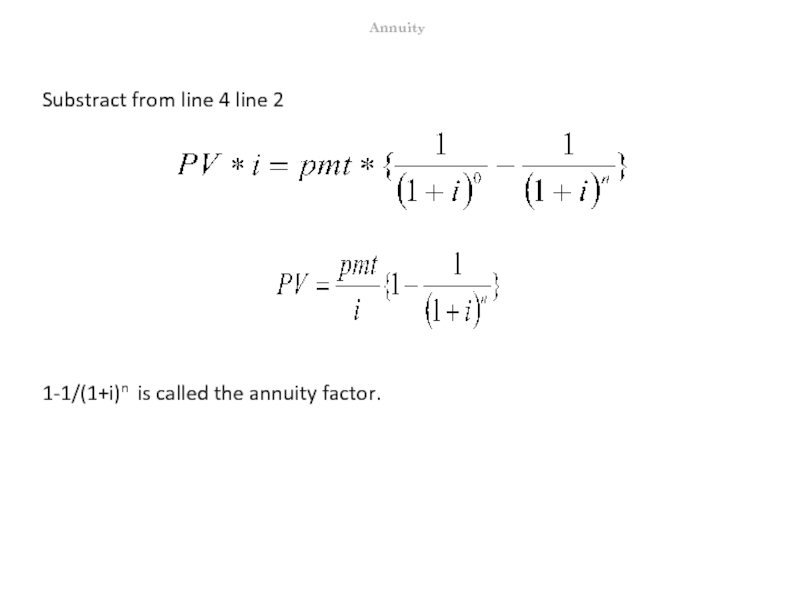

How much would you pay for

Multiply both sides by (1+i)

Annuity

Слайд 84Annuities example 1:

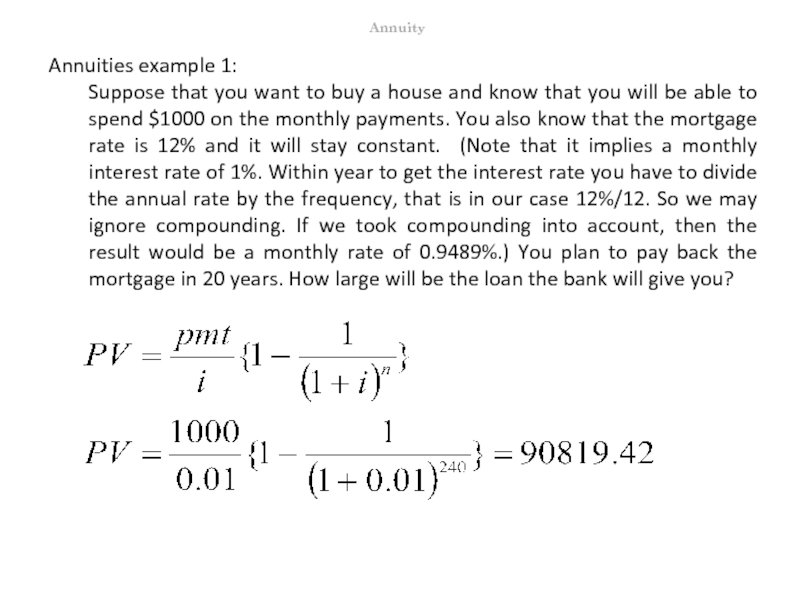

Suppose that you want to buy a house and

Annuity

Слайд 85Annuities example 2:

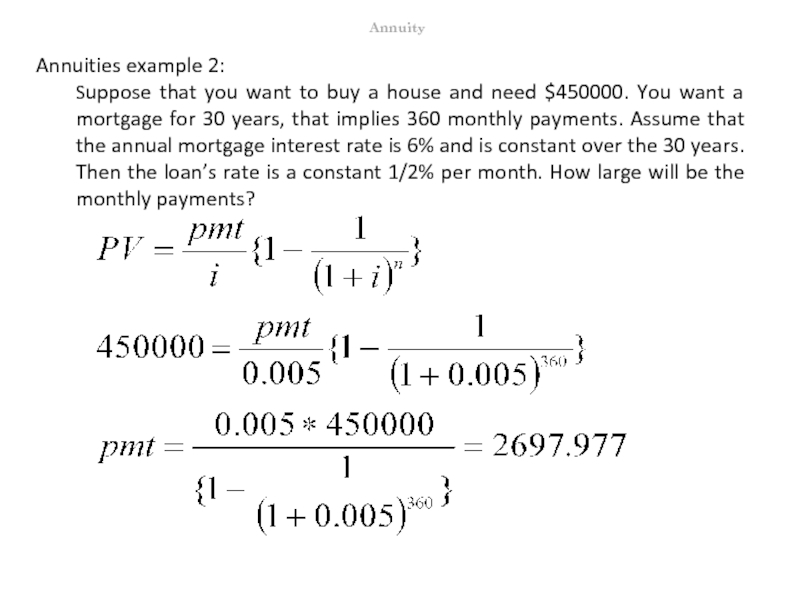

Suppose that you want to buy a house and

Annuity

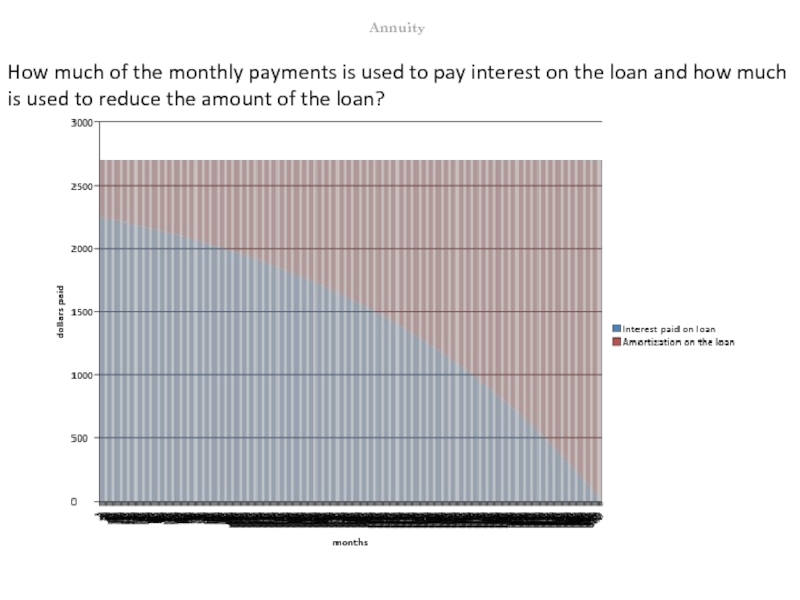

Слайд 86How much of the monthly payments is used to pay interest

Annuity

Слайд 87The retirement example

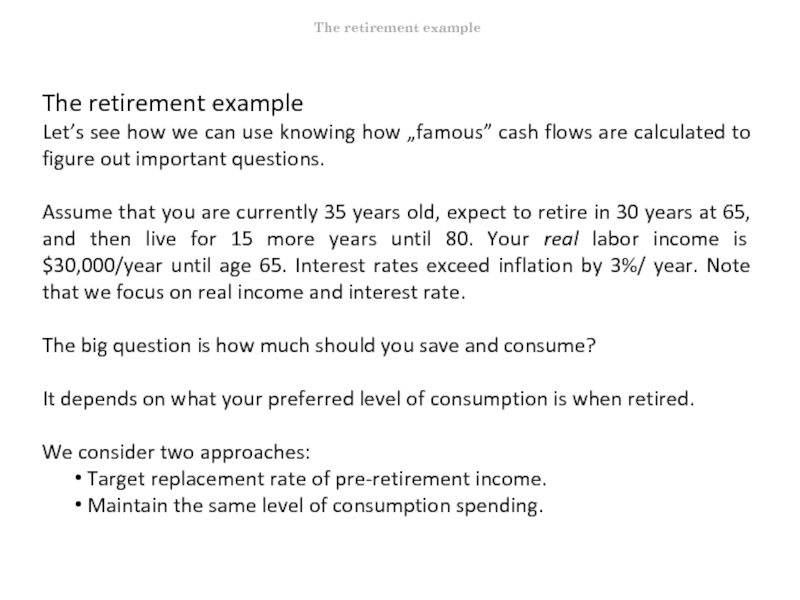

Let’s see how we can use knowing how „famous”

Assume that you are currently 35 years old, expect to retire in 30 years at 65, and then live for 15 more years until 80. Your real labor income is $30,000/year until age 65. Interest rates exceed inflation by 3%/ year. Note that we focus on real income and interest rate.

The big question is how much should you save and consume?

It depends on what your preferred level of consumption is when retired.

We consider two approaches:

Target replacement rate of pre-retirement income.

Maintain the same level of consumption spending.

The retirement example

Слайд 88Target replacement rate of pre-retirement income

First compute the retirement income. Many

We can compute the present value of the retirement funds as an regular annuity: n=15, i = 3%, pmt=22,500

Hence, if we want to enjoy $22,500 a year, when retired, then at 65 we should have $268604.

The retirement example

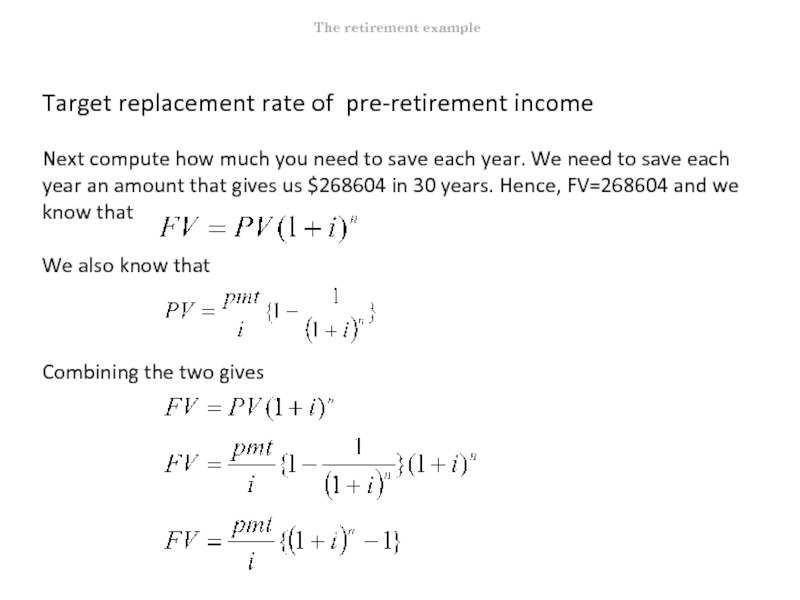

Слайд 89Target replacement rate of pre-retirement income

Next compute how much you need

We also know that

Combining the two gives

The retirement example

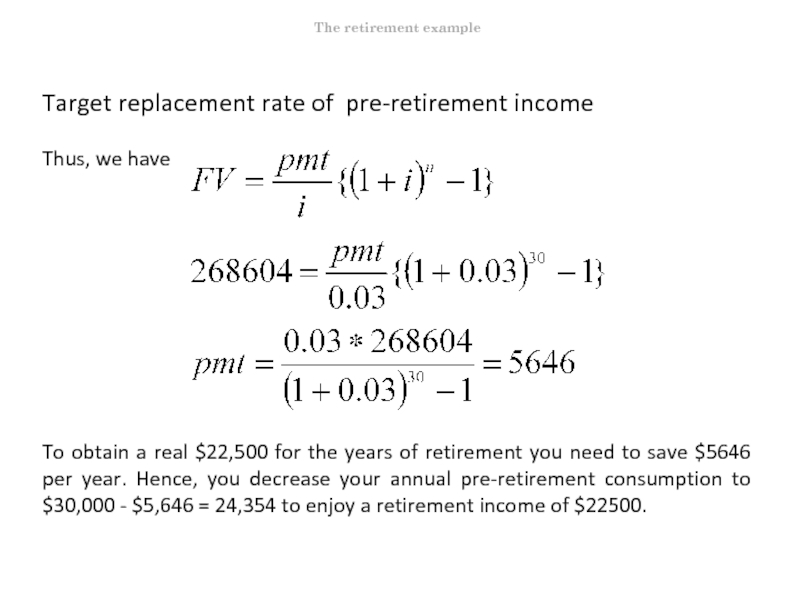

Слайд 90Target replacement rate of pre-retirement income

Thus, we have

To obtain a real

The retirement example

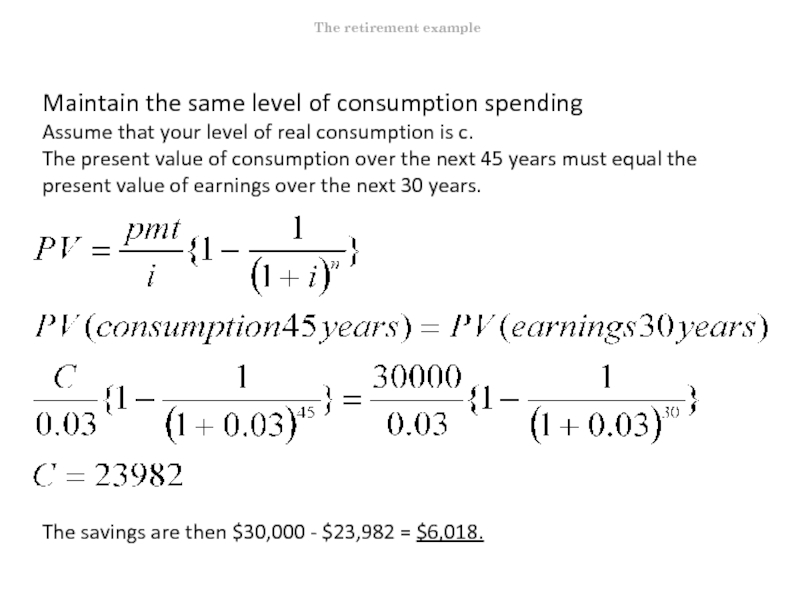

Слайд 91Maintain the same level of consumption spending

Assume that your level of

The present value of consumption over the next 45 years must equal the present value of earnings over the next 30 years.

The savings are then $30,000 - $23,982 = $6,018.

The retirement example

Слайд 92Taking care of inflation

Generally, prices and rates are nominal, that is

The relationship between nominal and real interest rates is the following:

We will use the notation

In the rate of interest in nominal terms

Ir the rate of interest in real terms

r the rate of inflation

Inflation

Слайд 93Taking care of inflation

What is the real rate of interest if

You have decided to invest $10,000 for the next 12-months. You are offered two choices

A nominal bond paying a 8% return

A real bond paying 3% + inflation rate

If you anticipate the inflation being

Below 5% invest in the nominal security

Above 5% invest in the real security

Equal to 5% invest in either

Inflation

Слайд 94Evaluating investment opportunities

We can use discounted cash flow analysis to make

Whether to enter a new line of business

Whether to invest in equipment to reduce costs

To evaluate investment projects we use the net present value (NPV) rule.

A project’s net present value is the amount by which the project is expected to increase the wealth of the firm’s current shareholders.

The rule just says: Invest in proposed projects with positive NPV.

NPV = PV – required investment

The following tables show the computation of NPV. To show the affect of the discount rate, three tables are shown based on different rates

Evaluating investment projects

Слайд 95Example: NPV of a project when discount rate is 10%

This project

Evaluating investment projects

Слайд 96Example: NPV of a project when discount rate is 15%

We consider

The project should not be carried out.

Evaluating investment projects

Слайд 97Example: NPV of a project and the internal rate of return

The

Evaluating investment projects

Слайд 98NPV and the internal rate of return

From the previous example we

If the discount rate used to evaluate a project is lower than the IRR, then it has a positive NPV and should be carried out.

If the discount rate used to evaluate a project is higher than the IRR, then it has a negative NPV and should not be carried out.

But what is the proper discount rate? You should consider what else you could do with your money. It is often called the opportunity cost of capital, because it is the return that is being given up by investing in the project. Importantly, discount rates also take into account risk. It is still proper to discount the payoff by the rate of return offered by a comparable investment.

Evaluating investment projects

Слайд 99Example (taken from Brealey-Myers):

Obsolete Technologies is considering the purchase of a

Note that the computer system does not generate any sales, but if the expected cost savings are realized, the company’s cash flows will be $22,000 a year higher as a result of buying the computer. Thus we can say that the computer increases cash flows by $22,000 a year for each of 4 years.

To calculate present value, we can simply discount each of these cash flows by 10 percent. However, it is smarter to recognize that the cash flows are level and therefore you can use the annuity formula to calculate the present value:

Evaluating investment projects

Слайд 100Example (taken from Brealey-Myers):

Therefore, the net present value is -$50000+$69740=$19740.

It has

Evaluating investment projects

Слайд 101Mutually exclusive projects

We speak about mutually exclusive projects if there are

You could build an apartment block on a vacant site or build an office block.

You could build a 5-story office block or a 50-story one.

You could heat it with oil or with natural gas.

You could build it today, or wait a year to start construction.

When you have to choose between mutually exclusive projects, then calculate the NPV of each project and choose the one whose NPV is highest.

Evaluating investment projects

Слайд 102Mutually exclusive projects - example

You are offered two competing softwares to

Evaluating investment projects

Слайд 103Mutually exclusive projects - example

Both systems yield a positive net present

Evaluating investment projects

Слайд 104Investment timing

We return to Obsolete Technologies that was contemplating the purchase

However, the financial manager is not persuaded. She reasons that the price of computers is continually falling and therefore proposes postponing the purchase, arguing that the NPV of the system will be even higher if the firm waits until the following year. Unfortunately, she has been making the same argument for 10 years and the company is steadily losing business to competitors with more efficient systems. Is there a flaw in her reasoning?

When is it best to commit to a positive-NPV investment? Investment timing problems all involve choices among mutually exclusive investments. You can either proceed with the project now, or you can do so later. You can’t do both.

The next Table lays out the basic data for Obsolete.

Evaluating investment projects

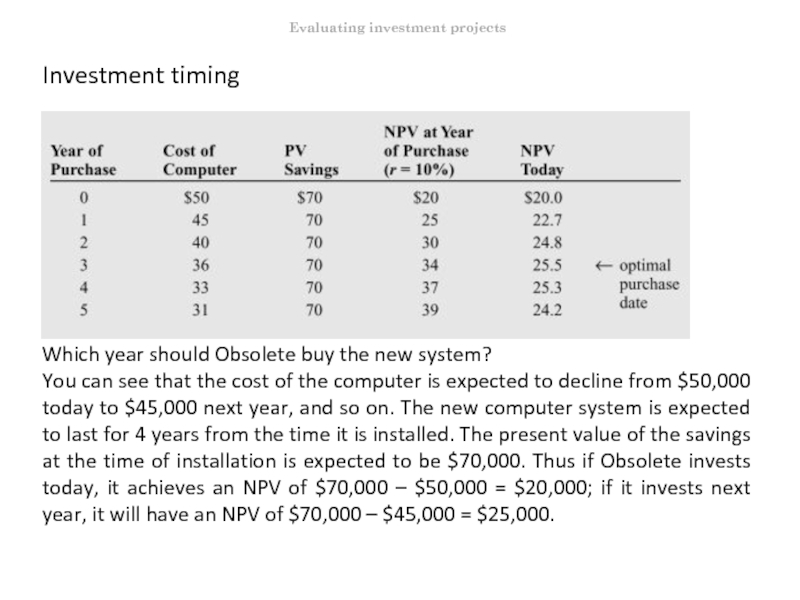

Слайд 105Investment timing

Which year should Obsolete buy the new system?

You can see

Evaluating investment projects

Слайд 106Investment timing

Isn’t a gain of $25,000 better than one of $20,000?

There is a trade-off. The sooner you can capture the $70,000 savings the better, but if it costs you less to realize those savings by postponing the investment, it may pay you to do so. If you postpone purchase by 1 year, the gain from buying a computer rises from $20,000 to $25,000, an increase of 25 percent. Since the cost of capital is only 10 percent, it pays to postpone at least until Year 1.

Evaluating investment projects

Слайд 107Investment timing

If you postpone from Year 3 to Year 4, the

The decision rule for investment timing is to choose the investment date that

results in the highest net present value today.

Evaluating investment projects

Слайд 108That’s all folks!

We end this course here.

I hope you have

Hedging and insurance