- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Bank regulation презентация

Содержание

- 1. Bank regulation

- 2. Need for banking regulation? Banks’ fragility Systemic risk Protection of depositors

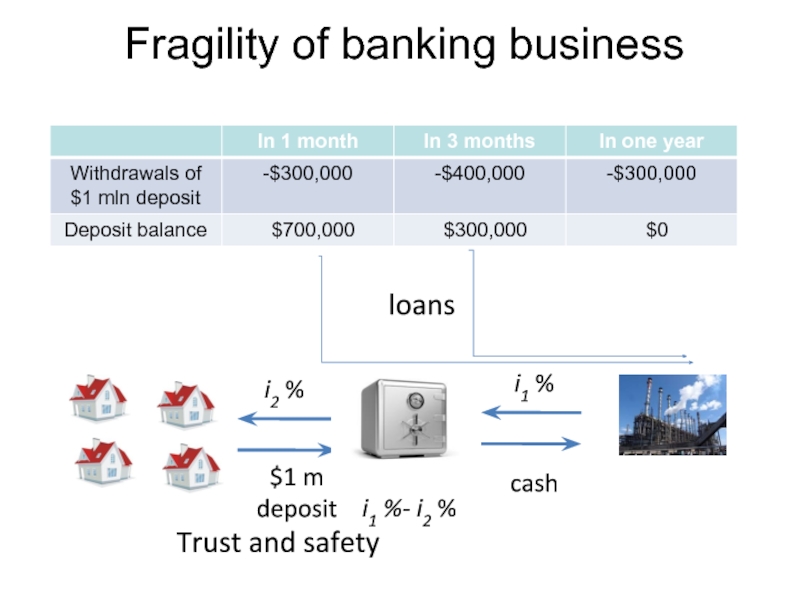

- 3. Fragility of banking business $1 m deposit

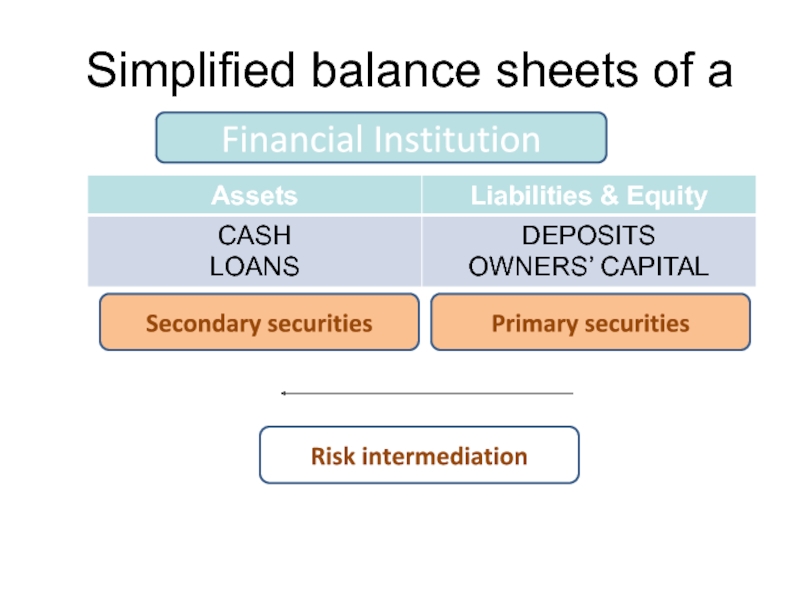

- 4. Simplified balance sheets of a Financial Institution Secondary securities Primary securities Risk intermediation

- 5. E.g. 1. Deposits’ Withdrawals and Systemic Risk

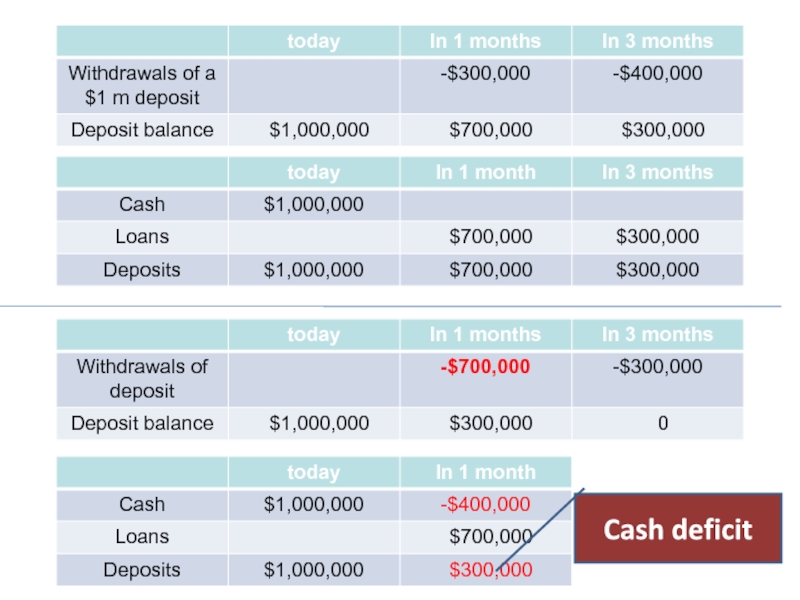

- 6. Cash deficit

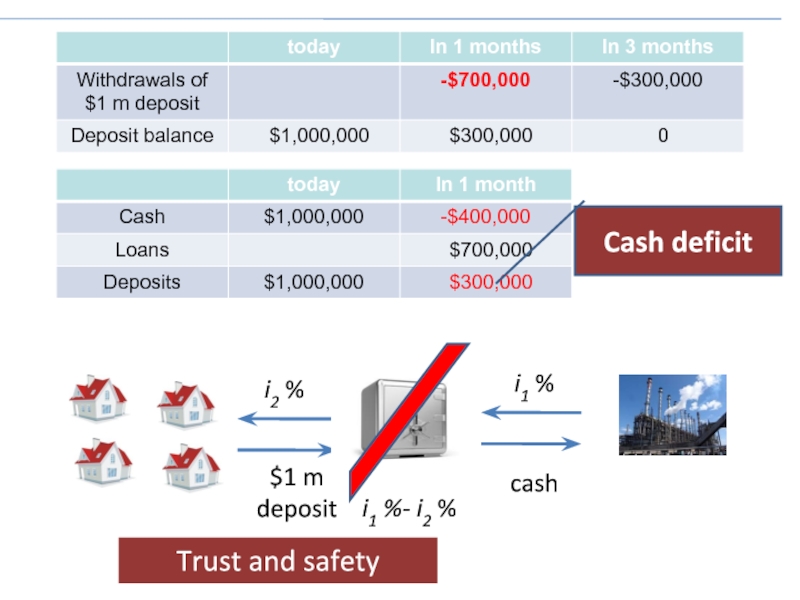

- 7. Cash deficit $1 m deposit cash i1

- 8. Bank panic and bank runs $1 m

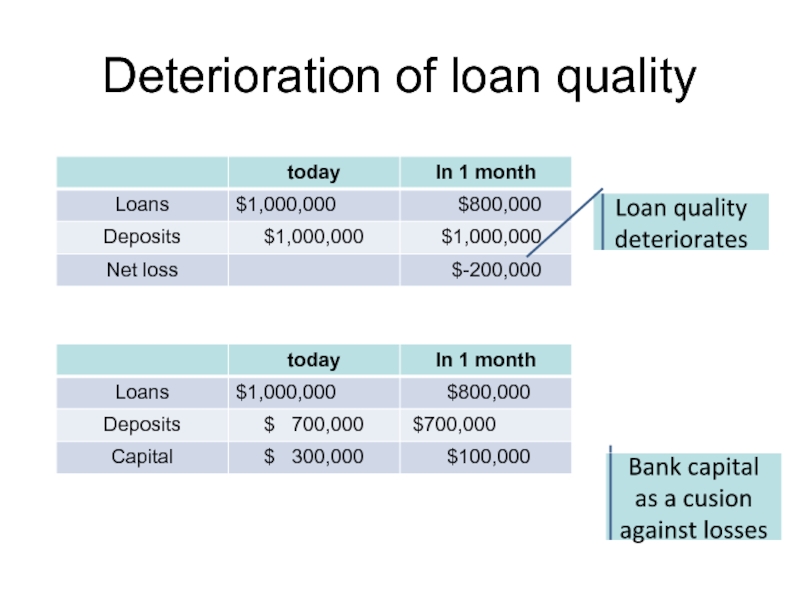

- 9. E.g.2. Deterioration of loans quality

- 10. Deterioration of loan quality Loan quality deteriorates Bank capital as a cusion against losses

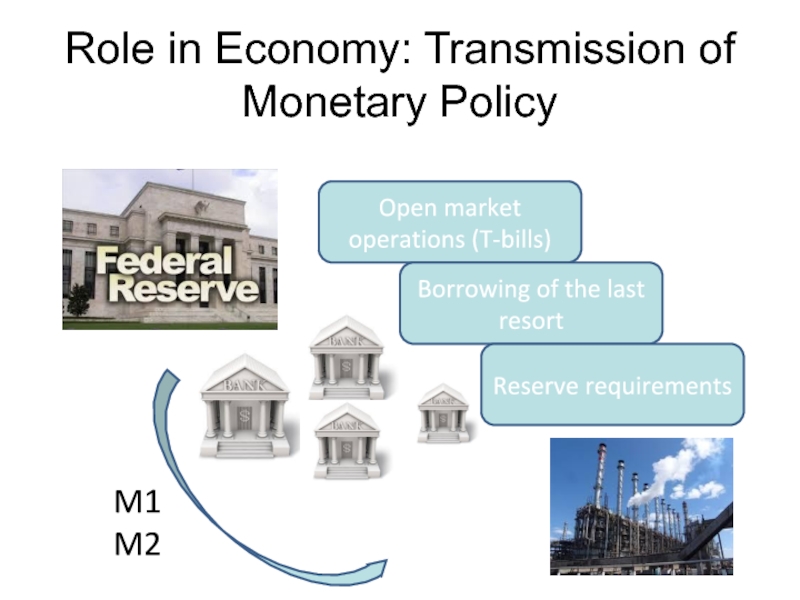

- 11. Role in Economy: Transmission of Monetary Policy

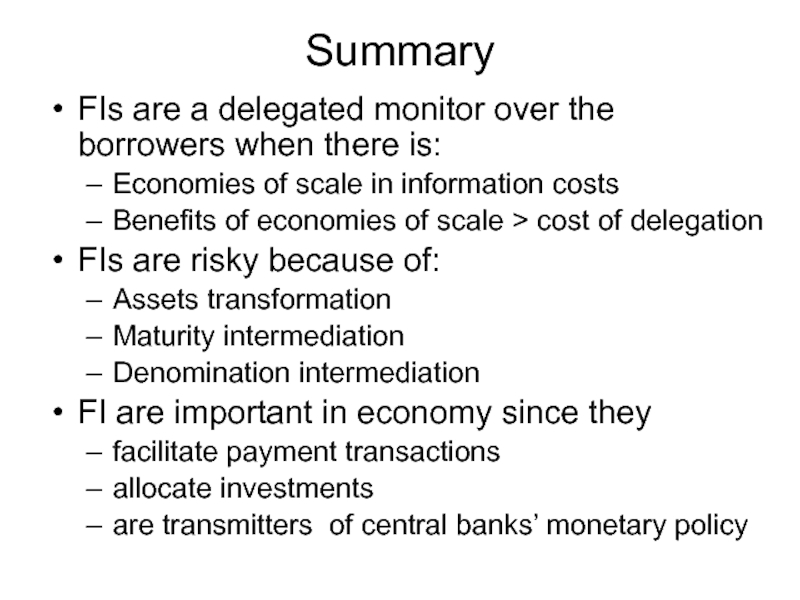

- 12. Summary FIs are a delegated monitor over

- 13. Central Banks 1991 1913 1998 1864

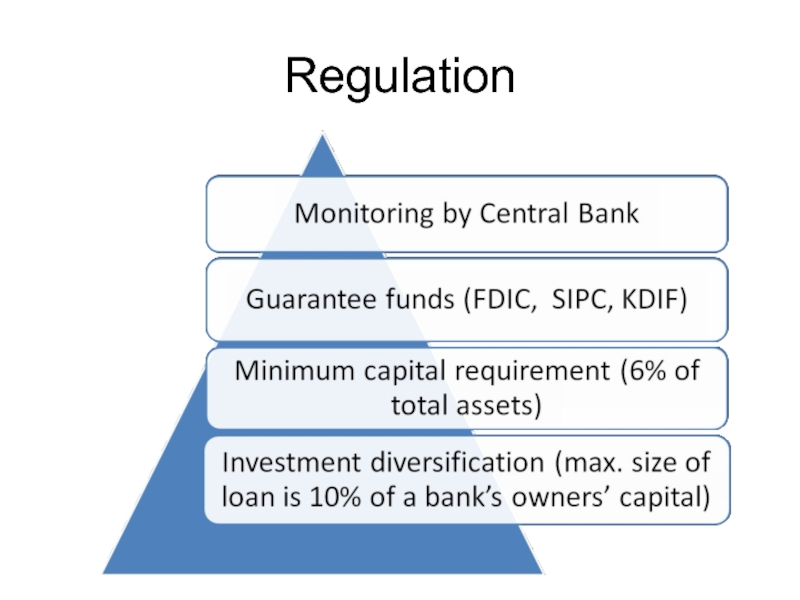

- 14. Regulation

- 15. Banks supervision: central banks Control over money

- 16. Deposits insurance Federal Deposit Insurance Corporation (FDIC)

- 17. Banks supervision: restriction on entry Chartering and

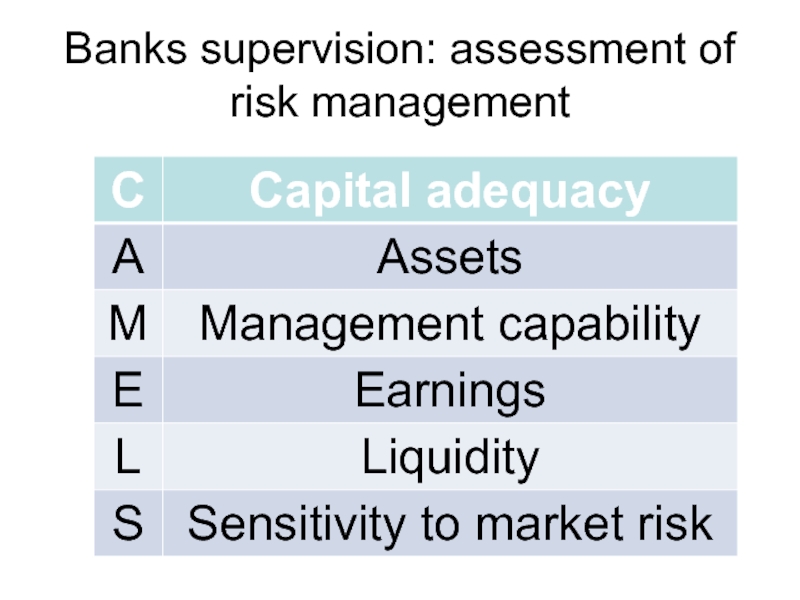

- 18. Banks supervision: assessment of risk management

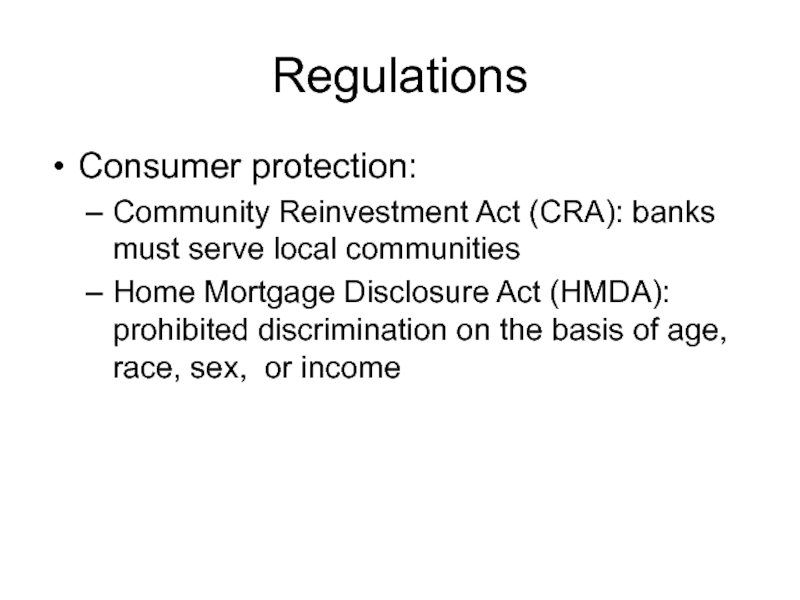

- 19. Regulations Consumer protection: Community Reinvestment Act

- 20. Regulation NOT TO REGULATE NOT TO REGULATE

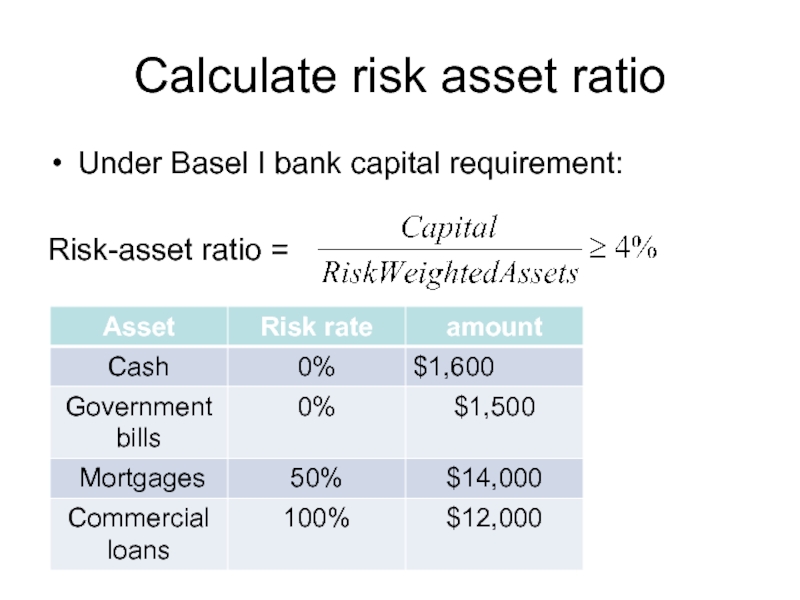

- 21. Calculate risk asset ratio Under Basel I

Слайд 4Simplified balance sheets of a

Financial Institution

Secondary securities

Primary securities

Risk intermediation

Слайд 10Deterioration of loan quality

Loan quality deteriorates

Bank capital as a cusion against

losses

Слайд 11Role in Economy: Transmission of Monetary Policy

Open market operations (T-bills)

Borrowing of

the last resort

Reserve requirements

M1 M2

Слайд 12Summary

FIs are a delegated monitor over the borrowers when there is:

Economies

of scale in information costs

Benefits of economies of scale > cost of delegation

FIs are risky because of:

Assets transformation

Maturity intermediation

Denomination intermediation

FI are important in economy since they

facilitate payment transactions

allocate investments

are transmitters of central banks’ monetary policy

Benefits of economies of scale > cost of delegation

FIs are risky because of:

Assets transformation

Maturity intermediation

Denomination intermediation

FI are important in economy since they

facilitate payment transactions

allocate investments

are transmitters of central banks’ monetary policy

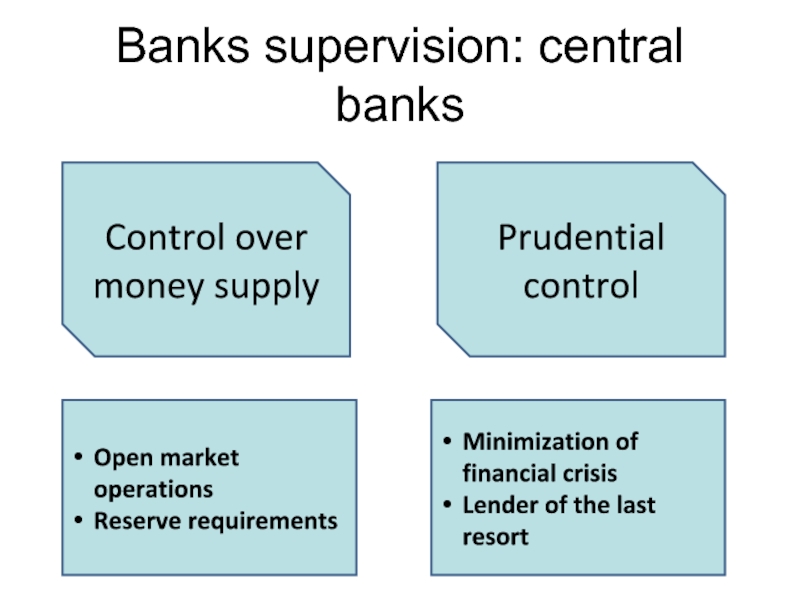

Слайд 15Banks supervision: central banks

Control over money supply

Prudential control

Open market operations

Reserve requirements

Minimization

of financial crisis

Lender of the last resort

Lender of the last resort

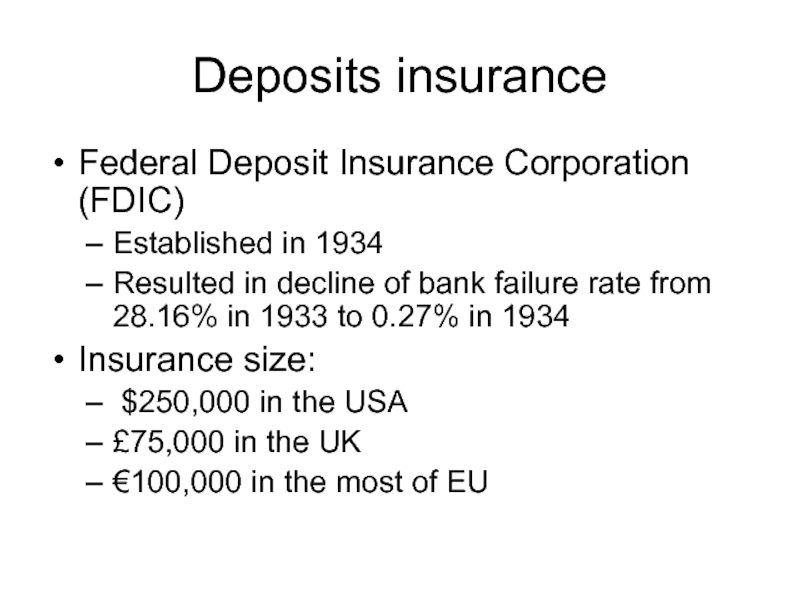

Слайд 16Deposits insurance

Federal Deposit Insurance Corporation (FDIC)

Established in 1934

Resulted in decline of

bank failure rate from 28.16% in 1933 to 0.27% in 1934

Insurance size:

$250,000 in the USA

£75,000 in the UK

€100,000 in the most of EU

Insurance size:

$250,000 in the USA

£75,000 in the UK

€100,000 in the most of EU

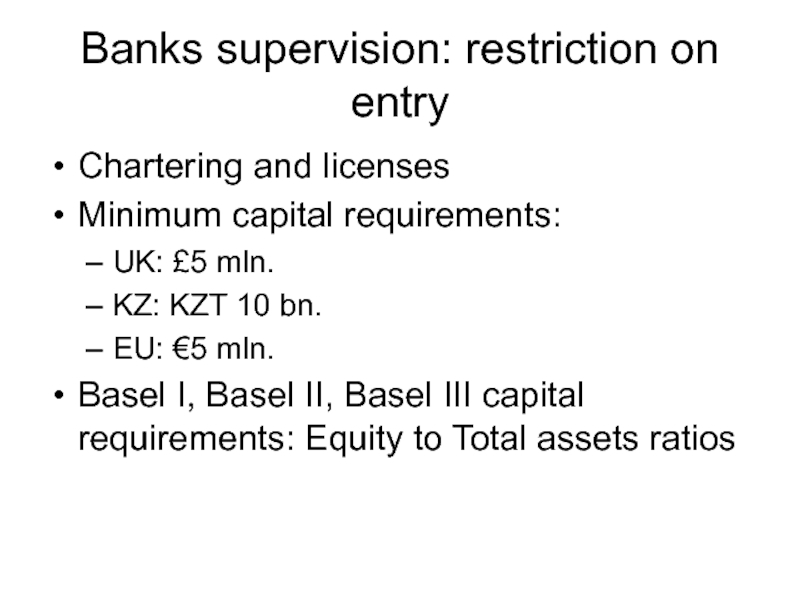

Слайд 17Banks supervision: restriction on entry

Chartering and licenses

Minimum capital requirements:

UK: £5 mln.

KZ:

KZT 10 bn.

EU: €5 mln.

Basel I, Basel II, Basel III capital requirements: Equity to Total assets ratios

EU: €5 mln.

Basel I, Basel II, Basel III capital requirements: Equity to Total assets ratios

Слайд 19Regulations

Consumer protection:

Community Reinvestment Act (CRA): banks must serve local communities

Home

Mortgage Disclosure Act (HMDA): prohibited discrimination on the basis of age, race, sex, or income