- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

7 Questions Every Investor Ought to Ask About Warren Buffett презентация

Содержание

- 1. 7 Questions Every Investor Ought to Ask About Warren Buffett

- 2. The $64 Billion Question: What’s Buffett Worth?

- 3. How Has Berkshire Hathaway Performed? Compounded annual

- 4. What Are Berkshire Hathaway’s Top 5 Holdings?

- 5. Is Warren Buffett a Value or Growth

- 6. Is Warren Buffett a Value or Growth

- 7. Has Buffett’s Investment Approach Changed? As an

- 8. Has Buffett’s Investment Approach Changed? (Part 2)

- 9. What Is Buffett’s Biggest Investment Mistake? Before

- 10. What Is Buffett’s Biggest Investment Mistake? (Part

- 11. Is Copycatting Buffett a Viable Strategy? In

- 12. Bonus: Does Buffett Enjoy Japanese Cuisine? Did

- 13. The Motley Fool’s special report, Warren Buffett’s Greatest Wisdom

Слайд 2The $64 Billion Question: What’s Buffett Worth?

As of March 21, Warren

Buffett is the third wealthiest person in the world, trailing only Bill Gates and Mexico’s Carlos Slim.

Source: Bloomberg Billionaires ranking

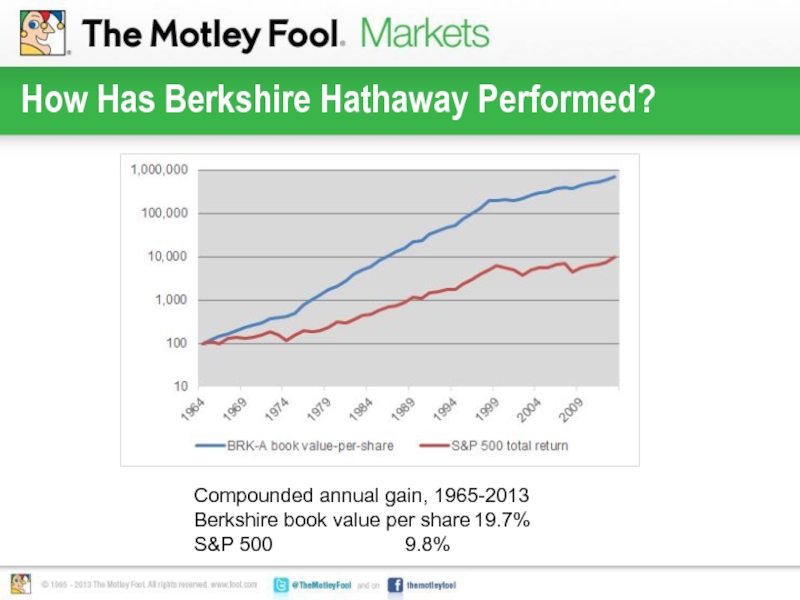

Слайд 3How Has Berkshire Hathaway Performed?

Compounded annual gain, 1965-2013

Berkshire book value per

S&P 500 9.8%

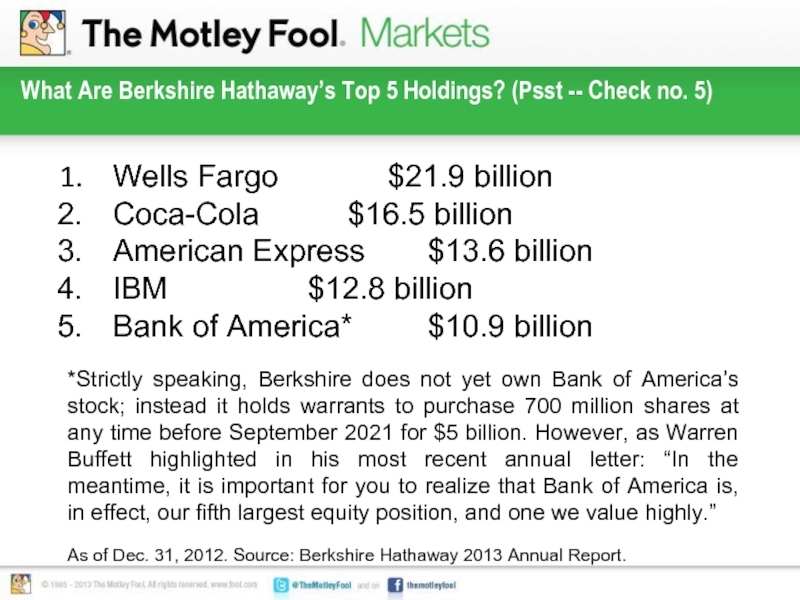

Слайд 4What Are Berkshire Hathaway’s Top 5 Holdings? (Psst -- Check no.

Wells Fargo $21.9 billion

Coca-Cola $16.5 billion

American Express $13.6 billion

IBM $12.8 billion

Bank of America* $10.9 billion

*Strictly speaking, Berkshire does not yet own Bank of America’s stock; instead it holds warrants to purchase 700 million shares at any time before September 2021 for $5 billion. However, as Warren Buffett highlighted in his most recent annual letter: “In the meantime, it is important for you to realize that Bank of America is, in effect, our fifth largest equity position, and one we value highly.”

As of Dec. 31, 2012. Source: Berkshire Hathaway 2013 Annual Report.

Слайд 5Is Warren Buffett a Value or Growth Investor?

Warren Buffett is a

Answer: The dichotomy between “growth” and “value” is a false one that Buffett explicitly rejects.

Слайд 6Is Warren Buffett a Value or Growth Investor? (Part 2)

“Growth can

-- Berkshire Hathaway 2000 Chairman’s Letter

Слайд 7Has Buffett’s Investment Approach Changed?

As an investor, Warren Buffett was first

Слайд 8Has Buffett’s Investment Approach Changed? (Part 2)

Under the influence of Philip

As Buffett once quipped: “It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Слайд 9What Is Buffett’s Biggest Investment Mistake?

Before it became his investment vehicle,

I had now committed a major amount of money to a terrible business. And Berkshire Hathaway became the base for everything pretty much that I've done since. So in 1967, when a good insurance company came along, I bought it for Berkshire Hathaway. … But always, we were carrying this anchor. And for 20 years, I fought the textile business before I gave up. [If] instead of putting that money into the textile business originally, we [had] just started out with the insurance company, Berkshire would be worth twice as much as it is now.

Слайд 10What Is Buffett’s Biggest Investment Mistake? (Part 2)

The worst aspect of

Buffett had struck a gentleman’s agreement with Berkshire Hathaway’s then-CEO, Seabury Stanton, according to which the company would repurchase Buffett’s shares at $11.50 per share. When Stanton made a formal tender offer, the price was $11 3/8.

As Buffett recounts: “[T]his made me mad. So I went out and started buying the stock, and I bought control of the company, and fired Mr. Stanton.”

Source: CNBC.

Слайд 11Is Copycatting Buffett a Viable Strategy?

In a 2008 paper, two academics

A hypothetical portfolio that mimics the investments at the beginning of the following month after they are publicly disclosed also earns significantly positive abnormal returns of 10.75% over the S&P 500 Index.

The study period was 1976-2006. Will this anomaly/strategy remain profitable going forward? An educated guess: Yes, but the margin of outperformance will fall -- Buffett is better known for focusing, and is now forced to focus, on mega-cap names in order to move the needle on Berkshire’s investment portfolio.

Слайд 12Bonus: Does Buffett Enjoy Japanese Cuisine?

Did you know? Warren Buffett once

Of the meal, Buffett said: “It was the worst. I've had others like it, but it was by far the worst. I will never eat Japanese food again.”

Source: The Snowball, Alice Schroeder.