- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

5 Reasons You Should Love Visa and MasterCard презентация

Содержание

- 1. 5 Reasons You Should Love Visa and MasterCard

- 2. Attractive Investments While they’re household names and

- 3. 1. Remarkable growth Since 2009 MasterCard and

- 4. 1. Remarkable growth Yet it isn’t just

- 5. 2. Astounding profitability Part of the reason

- 6. 3. Dominant market position Part of the

- 7. 4. Commitment to shareholder returns As with

- 8. 4. Commitment to shareholder returns 2009 Visa

- 9. 4. Commitment to shareholder returns “Today’s actions

- 10. 4. Commitment to shareholder returns “We also

- 11. 5. Reasonable valuation While the price-to-earnings ratio

- 12. Your credit card may soon be worthless.

Слайд 2Attractive Investments

While they’re household names and likely already in your wallets,

Visa and MasterCard are also compelling investments.

And if you can’t decide which specific one to buy, it turns out, together they have five identical reasons to be put on your investment watch list.

And if you can’t decide which specific one to buy, it turns out, together they have five identical reasons to be put on your investment watch list.

Слайд 31. Remarkable growth

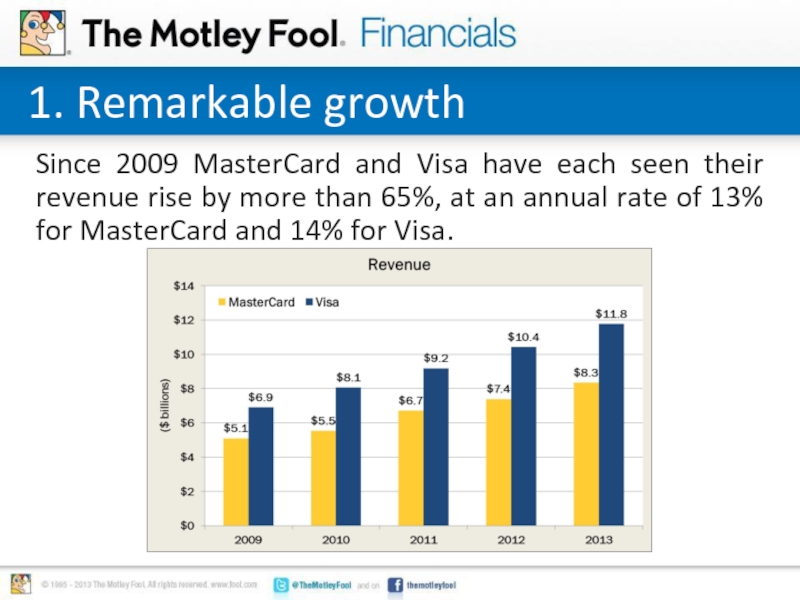

Since 2009 MasterCard and Visa have each seen their

revenue rise by more than 65%, at an annual rate of 13% for MasterCard and 14% for Visa.

Слайд 41. Remarkable growth

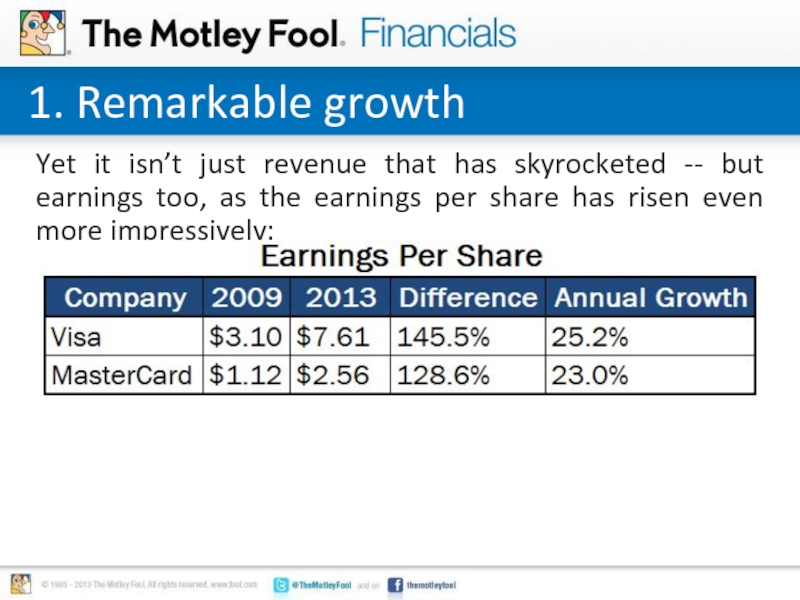

Yet it isn’t just revenue that has skyrocketed --

but earnings too, as the earnings per share has risen even more impressively:

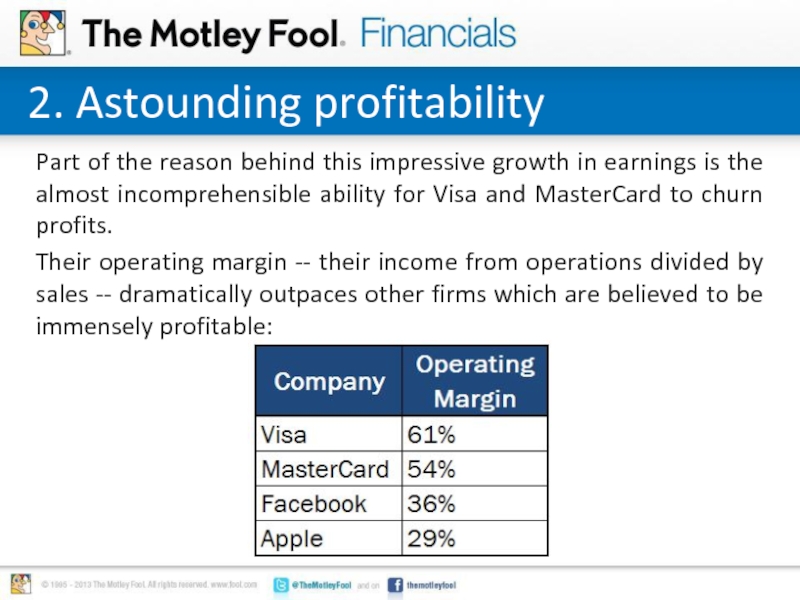

Слайд 52. Astounding profitability

Part of the reason behind this impressive growth in

earnings is the almost incomprehensible ability for Visa and MasterCard to churn profits.

Their operating margin -- their income from operations divided by sales -- dramatically outpaces other firms which are believed to be immensely profitable:

Their operating margin -- their income from operations divided by sales -- dramatically outpaces other firms which are believed to be immensely profitable:

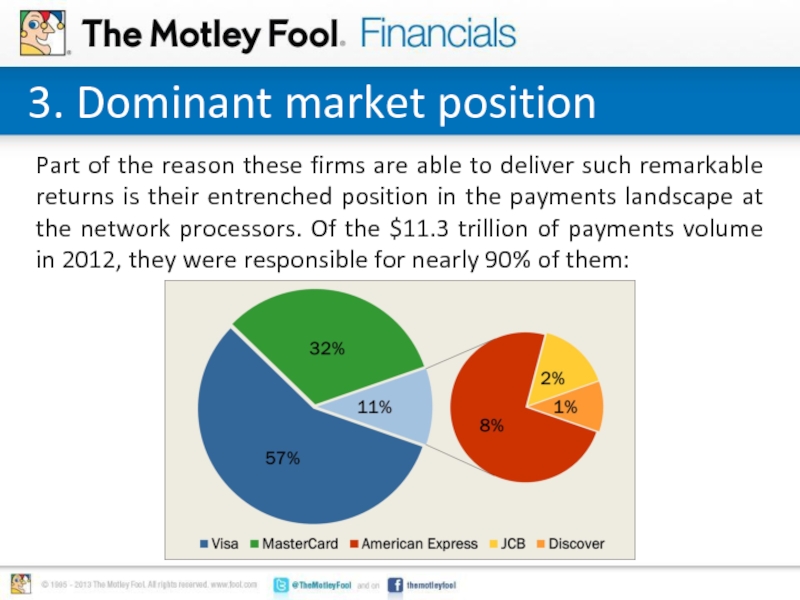

Слайд 63. Dominant market position

Part of the reason these firms are able

to deliver such remarkable returns is their entrenched position in the payments landscape at the network processors. Of the $11.3 trillion of payments volume in 2012, they were responsible for nearly 90% of them:

Слайд 74. Commitment to shareholder returns

As with any investment, one thing to

consider is not only its ability to generate money – which Visa and MasterCard are clearly doing -- but also its willingness to return it back to shareholders.

And here too, MasterCard and Visa excel.

And here too, MasterCard and Visa excel.

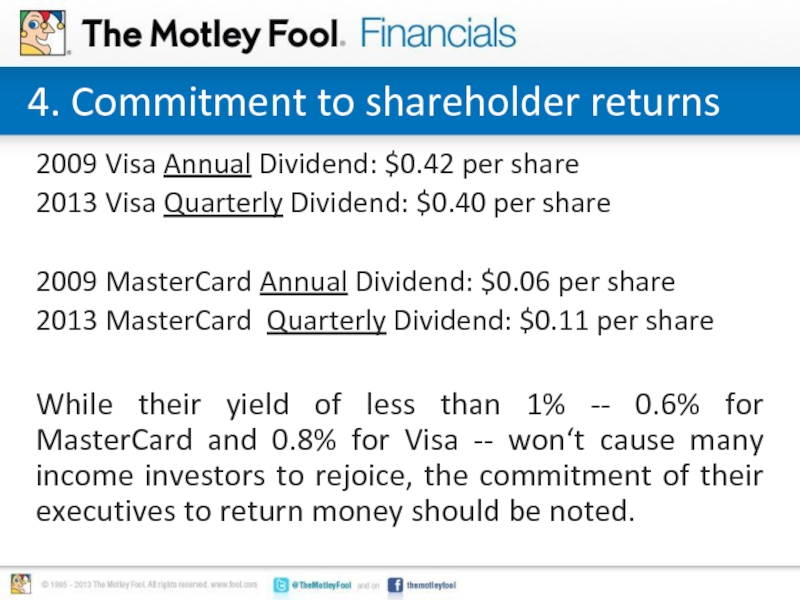

Слайд 84. Commitment to shareholder returns

2009 Visa Annual Dividend: $0.42 per share

2013

Visa Quarterly Dividend: $0.40 per share

2009 MasterCard Annual Dividend: $0.06 per share

2013 MasterCard Quarterly Dividend: $0.11 per share

While their yield of less than 1% -- 0.6% for MasterCard and 0.8% for Visa -- won‘t cause many income investors to rejoice, the commitment of their executives to return money should be noted.

2009 MasterCard Annual Dividend: $0.06 per share

2013 MasterCard Quarterly Dividend: $0.11 per share

While their yield of less than 1% -- 0.6% for MasterCard and 0.8% for Visa -- won‘t cause many income investors to rejoice, the commitment of their executives to return money should be noted.

Слайд 94. Commitment to shareholder returns

“Today’s actions reflect our ongoing commitment to

deliver shareholder value as well as our confidence in the long-term growth and financial performance of our Company.”

Said MasterCard’s president and chief executive officer, Ajay Banga, on the announcement of it increase its dividend by 83% and $3.5 billion in share repurchases.

Said MasterCard’s president and chief executive officer, Ajay Banga, on the announcement of it increase its dividend by 83% and $3.5 billion in share repurchases.

Слайд 104. Commitment to shareholder returns

“We also have been consistent and decisive

in returning excess cash to shareholders and maintain this commitment. Both the [increases] reflect this and our continued confidence in our ability to grow our business over the long term globally.”

Noted Visa’s CEO Charlie Scharf when the firm announced it would be buying back $5 billion of its stock and raising its dividend 21%.

Noted Visa’s CEO Charlie Scharf when the firm announced it would be buying back $5 billion of its stock and raising its dividend 21%.

Слайд 115. Reasonable valuation

While the price-to-earnings ratio of 27 for Visa and

29 for MasterCard are certainly higher than many companies -- the S&P 500 stands at 18.6 currently -- the reality is the companies have an almost unparalleled ability to deliver returns, so it’s understandable the value is so high.

While the price is high, one has to think, as Buffett might say, these are “wonderful companies at fair prices.”

While the price is high, one has to think, as Buffett might say, these are “wonderful companies at fair prices.”