- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Functions of money презентация

Содержание

- 1. Functions of money

- 2. “The Monetary System”

- 3. Contents Definition of Money… Kinds Of Money

- 4. What is Money????

- 5. “Money is a good that

- 6. Properties Of Money Liquidity Scarcity Portability Uniformity

- 7. Kinds Of Money Commodity money Convertible

- 8. Commodity money Can be used for other

- 9. Convertible Paper Money The paper money that

- 10. Inconvertible Paper Money The paper money that

- 11. Bank Deposits In current society most of

- 12. Electronic Money The money stored in certain

- 13. Functions of Money

- 14. Money as Medium of Exchange No wastage

- 15. Money as a unit of Account Provide

- 16. Money as a store of Value Ability

- 17. Are credit cards money???

- 18. Why people hold money???

- 19. Three motives of holding money!!! Transactions Demand Precautionary Demand Speculative Demand

- 20. Transactions Demand Stock of money to pay

- 21. Precautionary Motives The stock of money for

- 22. Speculative Motives Holding of money due to

- 23. INTEREST The major

- 24. Money Supply Definitions

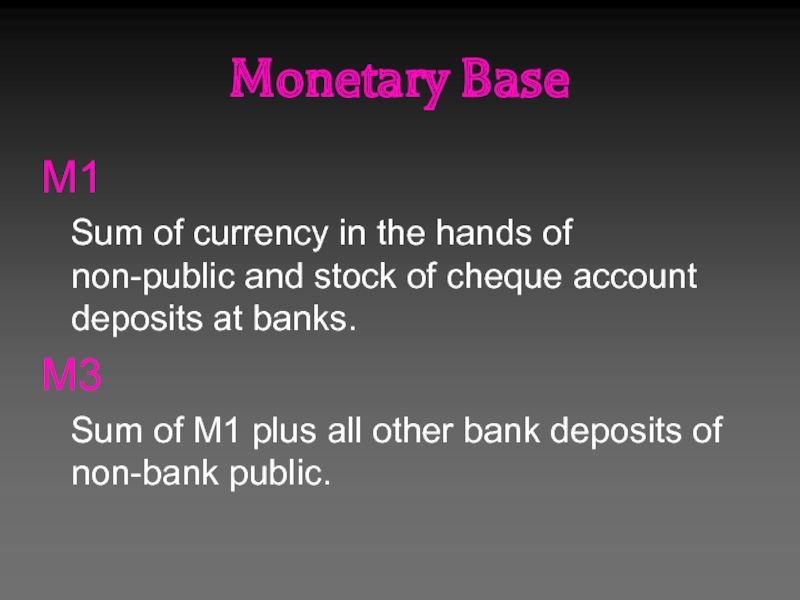

- 25. Monetary Base M1 Sum of

- 26. Broad Money M3 plus the

- 27. Currency Includes coins and paper money.

- 28. Cheque Account Deposits The total

- 29. Determination of Interest Rate

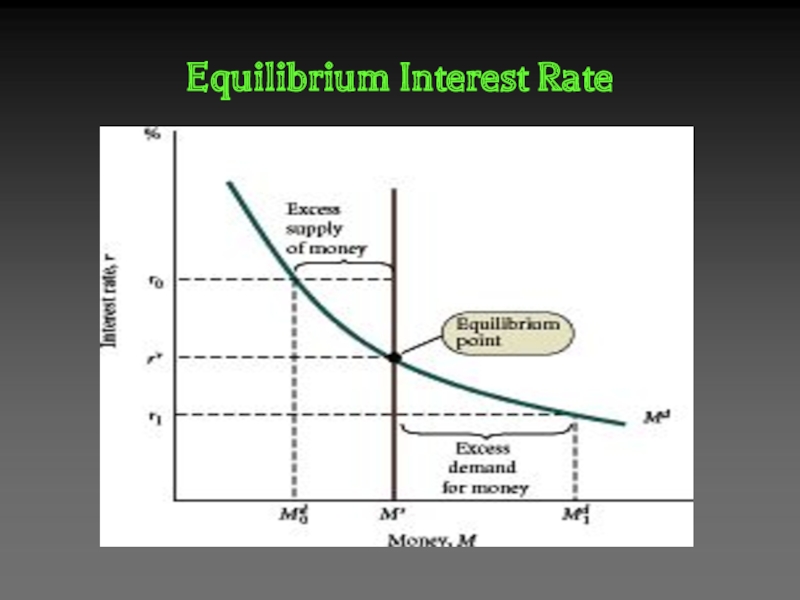

- 30. Equilibrium Interest Rate

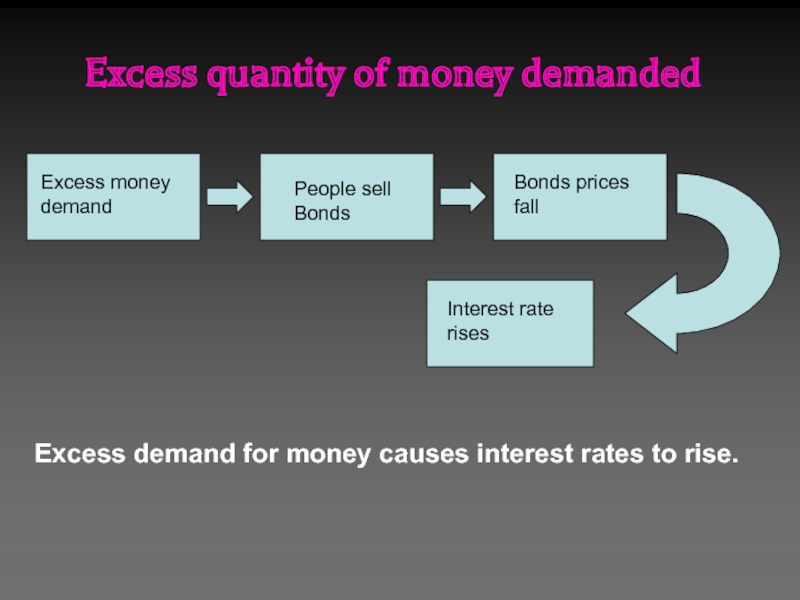

- 31. Excess quantity of money demanded Excess

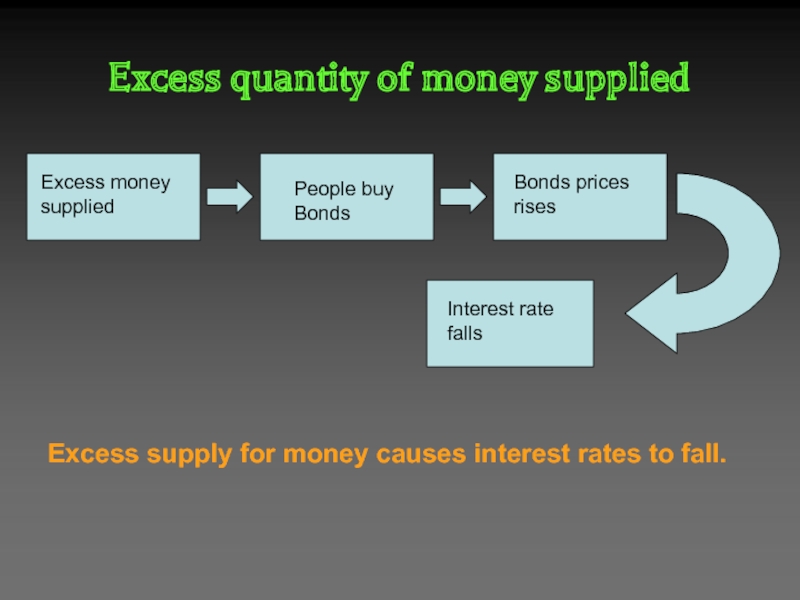

- 32. Excess quantity of money supplied Excess

- 33. Thanks a lottt!!!

Слайд 3Contents

Definition of Money…

Kinds Of Money

Functions Of Money

The Demand For Money

Four Money

Supply definitions

Determination of Rate of Interest

Determination of Rate of Interest

Слайд 5

“Money is a good that acts as a medium of

exchange in transactions, it is said that money act as a unit of account, a store of value and medium of exchange”

Слайд 7Kinds Of Money

Commodity money

Convertible paper money

Inconvertible money

Bank deposits

Electronic money

Слайд 8Commodity money

Can be used for other purposes.

Have inherent value.

Examples

Gold, Silk, Cattle, Silver

Слайд 9Convertible Paper Money

The paper money that can be convertible into gold

and silver.

Examples are Gold and Silver certificates…

Examples are Gold and Silver certificates…

Слайд 10Inconvertible Paper Money

The paper money that can’t be converted into Gold

and Silver.

Also called as Legal Tender Money.

Examples are Notes and Coins issued by government.

Also called as Legal Tender Money.

Examples are Notes and Coins issued by government.

Слайд 11Bank Deposits

In current society most of the money used is Bank

deposits…

Examples of Bank Deposits are

Demand deposits

Savings deposits

Time deposits

Negotiable certificates of deposit

Examples of Bank Deposits are

Demand deposits

Savings deposits

Time deposits

Negotiable certificates of deposit

Слайд 12Electronic Money

The money stored in certain electronic cash cards.

Transactions are made

electronically.

Examples are Credit Card, Debit card, Charge card etc…

Examples are Credit Card, Debit card, Charge card etc…

Слайд 14Money as Medium of Exchange

No wastage of time.

Higher volume of transactions.

Remove

the problem of coincidence of wants.

Widely acceptable.

Increase level of Trade.

Widely acceptable.

Increase level of Trade.

Слайд 15Money as a unit of Account

Provide a common measurement for the

relative value of goods.

The monitory unit may have different name in different countries.

The monitory unit may have different name in different countries.

Слайд 16Money as a store of Value

Ability of money to store value

over the time.

Durability factor enables to convert your income into future purchases.

Completely liquid.

However inflation can destroy this function.

Durability factor enables to convert your income into future purchases.

Completely liquid.

However inflation can destroy this function.

Слайд 20Transactions Demand

Stock of money to pay everyday expenses.

Quick and easy purchases

are main push to hold money.

The holder has to suffer “cost of holding”, namely interest rate you forego.

The holder has to suffer “cost of holding”, namely interest rate you forego.

Слайд 21Precautionary Motives

The stock of money for uncertain expenses.

People who don’t want

to go for loans have great interest to hold money.

Opportunity cost incurs of the interest forego.

Opportunity cost incurs of the interest forego.

Слайд 22Speculative Motives

Holding of money due to the expected rise in interest

rates.

People use to convert their money into interest bearing instruments such as bonds, stocks and other non-money financial assets.

People hold more when interest rate is low and hold less when interest rate is high.

People use to convert their money into interest bearing instruments such as bonds, stocks and other non-money financial assets.

People hold more when interest rate is low and hold less when interest rate is high.

Слайд 25Monetary Base

M1

Sum of currency in the hands of non-public

and stock of cheque account deposits at banks.

M3

Sum of M1 plus all other bank deposits of non-bank public.

M3

Sum of M1 plus all other bank deposits of non-bank public.

Слайд 26Broad Money

M3 plus the public’s deposits at non-bank financial

institutions less currency and bank deposits held by these NBFI’s.

Слайд 27Currency

Includes coins and paper money.

It constitute 20% of the M1

money supply.

Its purpose is to make small purchases.

Its purpose is to make small purchases.

Слайд 28Cheque Account Deposits

The total of cheque accounts balances in

banks convertible to currency on demand by writing a cheque without advance notice.

Saving Deposits

Inteset bearing accounts in banks drawnable by issuing pass book.

Saving Deposits

Inteset bearing accounts in banks drawnable by issuing pass book.

Слайд 31Excess quantity of money demanded

Excess money demand

Interest rate rises

People sell Bonds

Bonds

prices fall

Excess demand for money causes interest rates to rise.

Слайд 32Excess quantity of money supplied

Excess money supplied

Interest rate falls

People buy Bonds

Bonds

prices rises

Excess supply for money causes interest rates to fall.