- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

3 Stocks to Own For the Next Quarter-Century презентация

Содержание

- 1. 3 Stocks to Own For the Next Quarter-Century

- 2. Having a Long Time Horizon Makes Investing

- 3. What Makes a Good Stock to Hold

- 4. Idea #1: Berkshire Hathaway (BRK-A) Source: TMF.

- 5. Does Berkshire Hathaway Belong in Your Portfolio?

- 6. Idea #2: MasterCard (MA) Source: MasterCard. The

- 7. Does MasterCard Belong in Your Portfolio? Reasons

- 8. Idea #3: PepsiCo (PEP) Source: PepsiCo. This

- 9. Does PepsiCo Belong in Your Portfolio? Reasons

- 10. Create the Long-Term Portfolio You Need Concentrate

- 11. The $60,000 Social Security Bonus You Don’t

Слайд 2Having a Long Time Horizon Makes Investing Easier

Can evaluate long-term success

Gives the business enough time to take full advantage of growth opportunities.

Lets you put short-term results into broader context.

There are many advantages to focusing on stocks you can hold for 25 years or more.

Source: Rick Hunter.

Слайд 3What Makes a Good Stock to Hold for 25 Years?

Well-established stocks

New players in up-and-coming high-growth areas have huge potential but are riskier.

Consider personal need for capital appreciation vs. income.

Diversification makes it easier to take risks with individual picks.

If you want to hold a stock for 25 years, you should know where the company is and where it’s going.

Source: Wikimedia Commons.

Слайд 4Idea #1: Berkshire Hathaway (BRK-A)

Source: TMF.

This Warren Buffett-led conglomerate takes advantage

Слайд 5Does Berkshire Hathaway Belong in Your Portfolio?

Reasons to Own Berkshire:

Strong

Strategic vision focuses on investing opportunities with long time horizons, aligning interests with shareholders

Buffett’s reputation gives Berkshire access to investments that competitors can’t get

Reasons Not to Own Berkshire:

Uncertainty about success of Buffett’s eventual successor

Stock doesn’t provide any income through dividends

Слайд 6Idea #2: MasterCard (MA)

Source: MasterCard.

The debit- and credit-card network provider isn’t

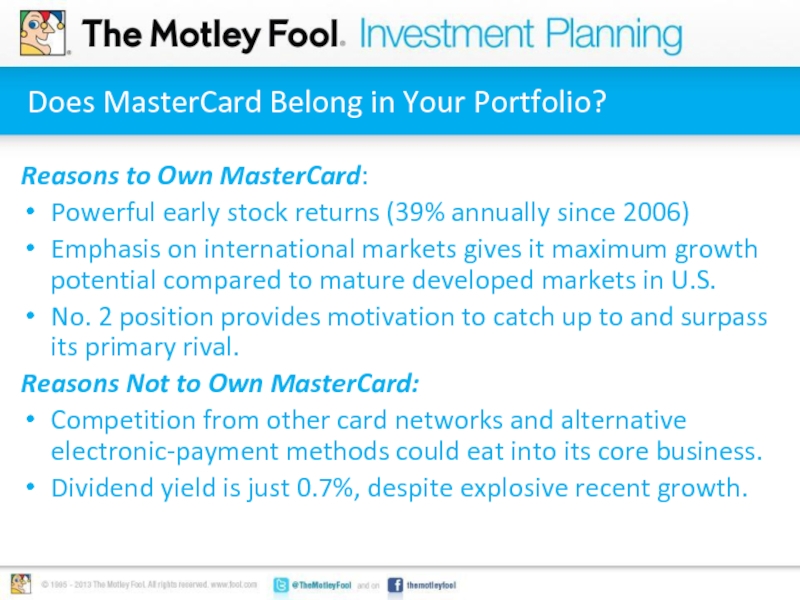

Слайд 7Does MasterCard Belong in Your Portfolio?

Reasons to Own MasterCard:

Powerful early

Emphasis on international markets gives it maximum growth potential compared to mature developed markets in U.S.

No. 2 position provides motivation to catch up to and surpass its primary rival.

Reasons Not to Own MasterCard:

Competition from other card networks and alternative electronic-payment methods could eat into its core business.

Dividend yield is just 0.7%, despite explosive recent growth.

Слайд 8Idea #3: PepsiCo (PEP)

Source: PepsiCo.

This beverage giant is best known for

Source: Jeepers Media under Creative Commons License..

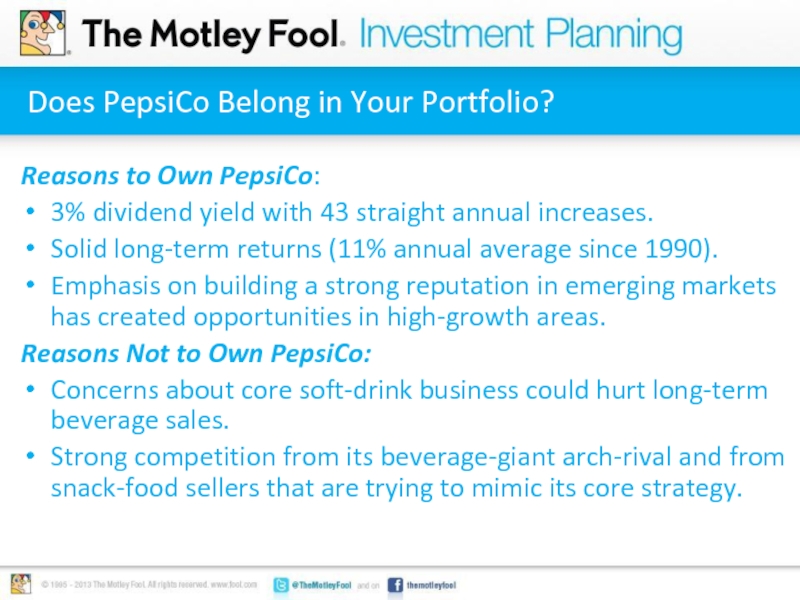

Слайд 9Does PepsiCo Belong in Your Portfolio?

Reasons to Own PepsiCo:

3% dividend

Solid long-term returns (11% annual average since 1990).

Emphasis on building a strong reputation in emerging markets has created opportunities in high-growth areas.

Reasons Not to Own PepsiCo:

Concerns about core soft-drink business could hurt long-term beverage sales.

Strong competition from its beverage-giant arch-rival and from snack-food sellers that are trying to mimic its core strategy.

Слайд 10Create the Long-Term Portfolio You Need

Concentrate on high-quality businesses.

Look for market

Set your sights high! Be patient to squeeze the most profit.

No company is assured success over a 25-year period, but you can put the odds in your favor.

Image: TMF.