- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Preparing for tax time returns Tax season insights for digital marketers презентация

Содержание

- 1. Preparing for tax time returns Tax season insights for digital marketers

- 2. Tax services is a $9.3 billion industry,

- 3. Taxpayers often turn to the IRS for

- 4. IRS resources are strained to respond The

- 5. Will your campaigns help taxpayers get the assistance they seek?

- 6. SOURCE: IBISWorld Industry Report

- 7. Less than 6% of Americans are unemployed1

- 8. Under the Affordable Care Act (ACA),

- 9. The premium tax credit may come with

- 10. SOURCE: 1Healthcare.gov, The fee you pay

- 11. SOURCE: Accounting Today, Supreme Court’s Same-Sex

- 12. Since 2009, electronic filing has grown by

- 13. SOURCE: Data analysis on IRS Weekly

- 14. SOURCE: Data analysis on IRS Weekly

- 15. Taxpayers are also getting help from

- 16. SOURCE: eMarketer, The U.S. Financial Services

- 17. SOURCE: Hitwise, Ratio of paid to

- 18. Bing Ads search performance trends

- 19. Make sure your budget is sufficient to

- 20. In line with Bing Ads searches, people

- 21. The IRS doesn’t advertise—this presents

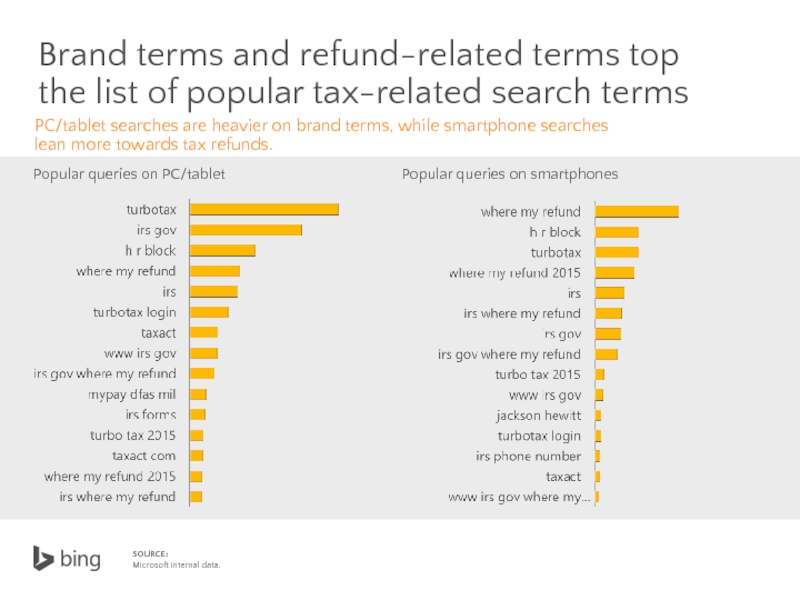

- 22. SOURCE: Microsoft internal data. Brand terms

- 23. Competition and increased interest drive up

- 24. SOURCE: Microsoft internal data. The

- 25. Take advantage of high search volume to

- 26. Cost-per-click follows search volume trends while click-through

- 27. Mobile search performance trends

- 28. Tax-related searches on smartphones follow

- 29. Refunds are top of mind among searchers

- 30. Smartphone searchers are more likely to click

- 31. Some tips to consider for tax season

- 32. Effectively reach your tax audience with Bing Ads

- 33. SOURCE: comScore qSearch (custom),

- 34. Our audience has a higher propensity

- 35. SOURCE: comScore Plan Metrix,

- 36. SOURCE: comScore Media Metrix, US, March

- 37. 2 in 5 tax website visits

- 38. Words that work Top tax ad copy

- 39. M

- 40. M

- 43. Should I bid on my brand

- 44. More clicks? Let’s break that down. Wouldn’t

- 45. Bidding on your brand terms reduces opportunities

- 46. Why advertise on Bing Ads?

- 47. Access searchers not reached on Google

- 48. Bing Ads is more cost effective than

- 49. Sitelink extensions Location extensions lift

- 50. You spoke, we listened. We heard feedback

- 51. It’s quick and easy to import your

- 52. @bingads linkedIn.com/company/bing-ads facebook.com/bingads blog.bingads.com instagram.com/bingads slideshare.net/bingads

- 53. © 2015 Microsoft Corporation. All rights reserved.

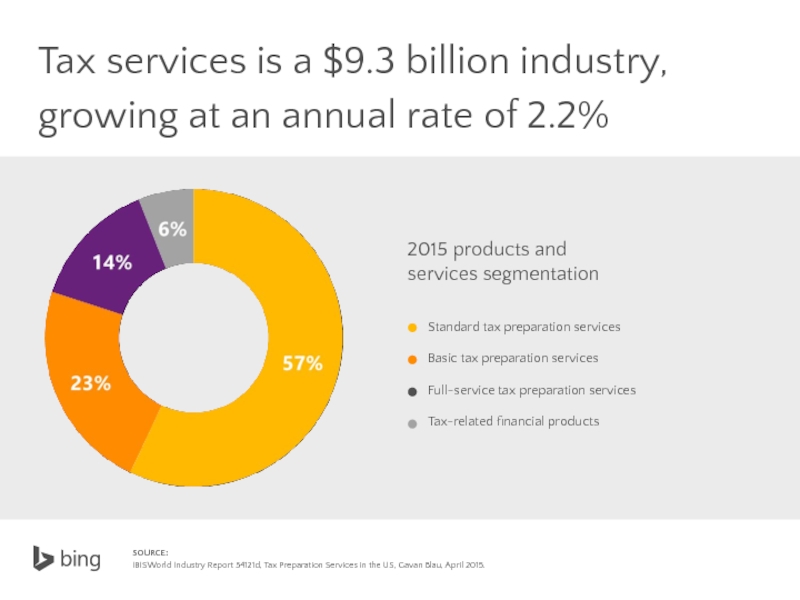

Слайд 2Tax services is a $9.3 billion industry, growing at an annual

2015 products and

services segmentation

SOURCE:

IBISWorld Industry Report 54121d, Tax Preparation Services in the US, Gavan Blau, April 2015.

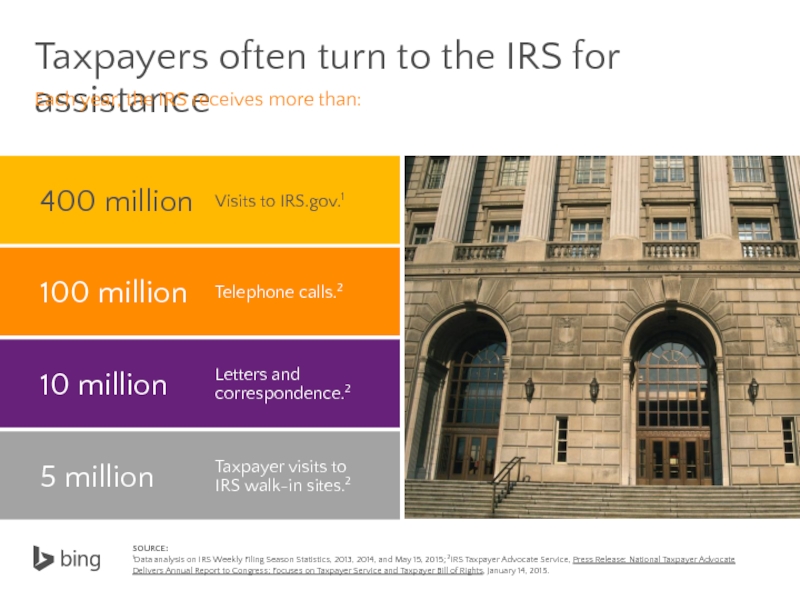

Слайд 3Taxpayers often turn to the IRS for assistance

Each year, the IRS

SOURCE:

1Data analysis on IRS Weekly Filing Season Statistics, 2013, 2014, and May 15, 2015; 2IRS Taxpayer Advocate Service, Press Release: National Taxpayer Advocate Delivers Annual Report to Congress; Focuses on Taxpayer Service and Taxpayer Bill of Rights, January 14, 2015.

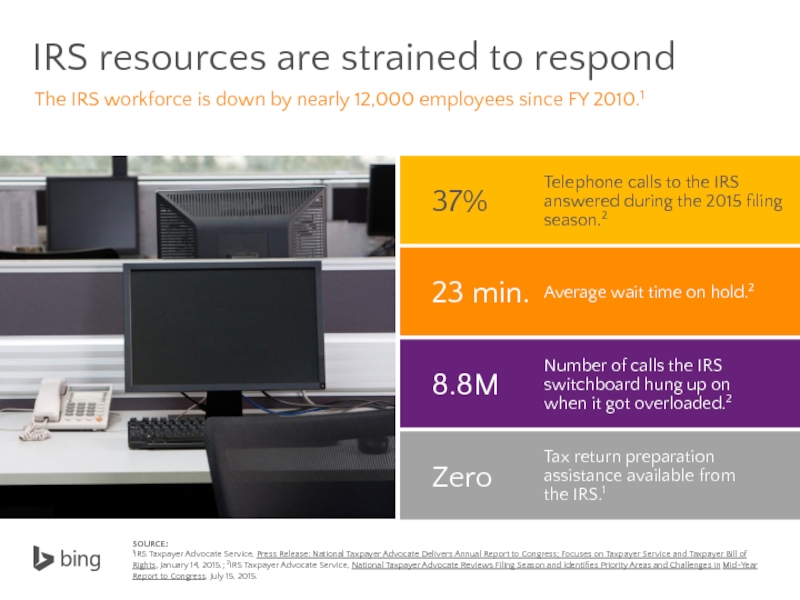

Слайд 4IRS resources are strained to respond

The IRS workforce is down by

SOURCE:

1IRS Taxpayer Advocate Service, Press Release: National Taxpayer Advocate Delivers Annual Report to Congress; Focuses on Taxpayer Service and Taxpayer Bill of Rights, January 14, 2015.; 2IRS Taxpayer Advocate Service, National Taxpayer Advocate Reviews Filing Season and Identifies Priority Areas and Challenges in Mid-Year Report to Congress, July 15, 2015.

Слайд 6

SOURCE:

IBISWorld Industry Report 54121d, Tax Preparation Services in the US,

Factors affecting

this tax season

Слайд 7Less than 6% of Americans are unemployed1

SOURCE:

1IBISWorld Business Environment Report,

Tip

Have a local office? Use Location Targeting, Location Extensions, and Call Extensions to capture nearby taxpayers searching for help.

With low unemployment rates for the next few years,

filing volumes will stay high.

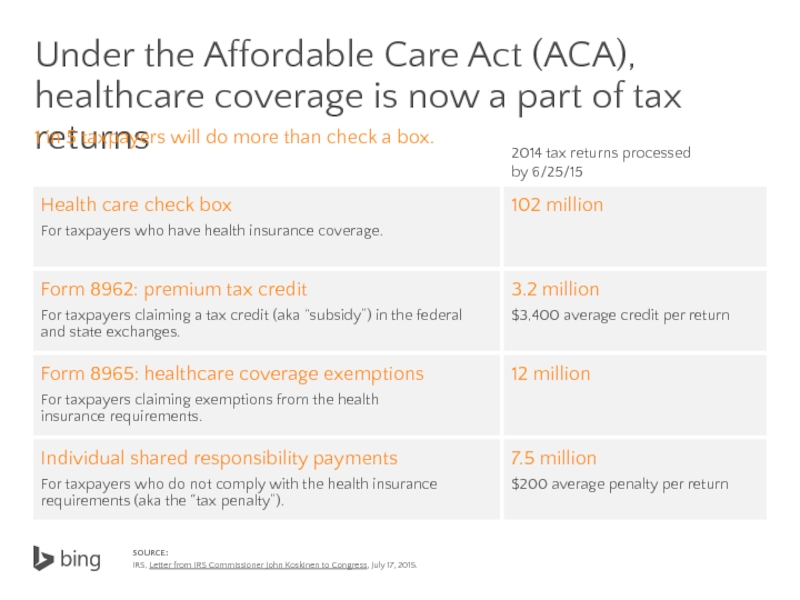

Слайд 8Under the Affordable Care Act (ACA), healthcare coverage is now a

2014 tax returns processed

by 6/25/15

Form 8962: premium tax credit

For taxpayers claiming a tax credit (aka “subsidy”) in the federal

and state exchanges.

3.2 million

$3,400 average credit per return

Form 8965: healthcare coverage exemptions

For taxpayers claiming exemptions from the health

insurance requirements.

12 million

Individual shared responsibility payments

For taxpayers who do not comply with the health insurance

requirements (aka the “tax penalty”).

7.5 million

$200 average penalty per return

Health care check box

For taxpayers who have health insurance coverage.

102 million

1 in 5 taxpayers will do more than check a box.

SOURCE:

IRS, Letter from IRS Commissioner John Koskinen to Congress, July 17, 2015.

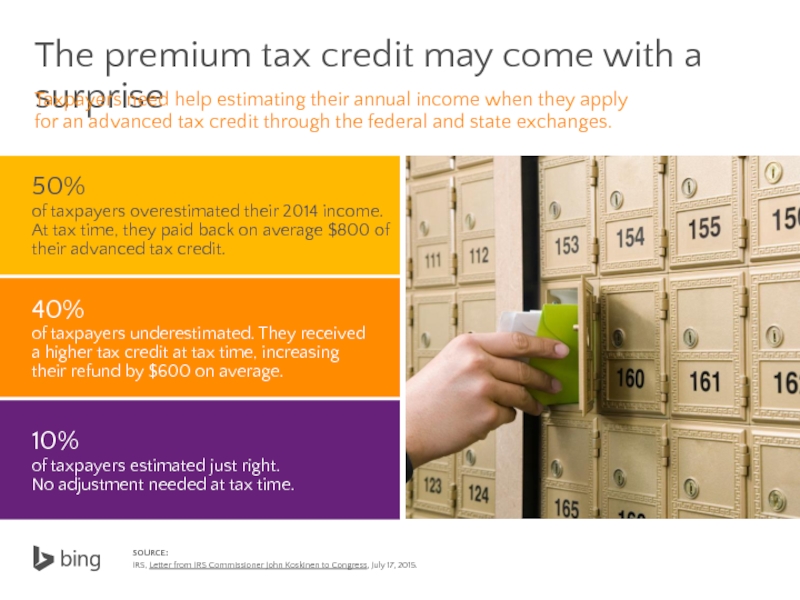

Слайд 9The premium tax credit may come with a surprise

Taxpayers need help

SOURCE:

IRS, Letter from IRS Commissioner John Koskinen to Congress, July 17, 2015.

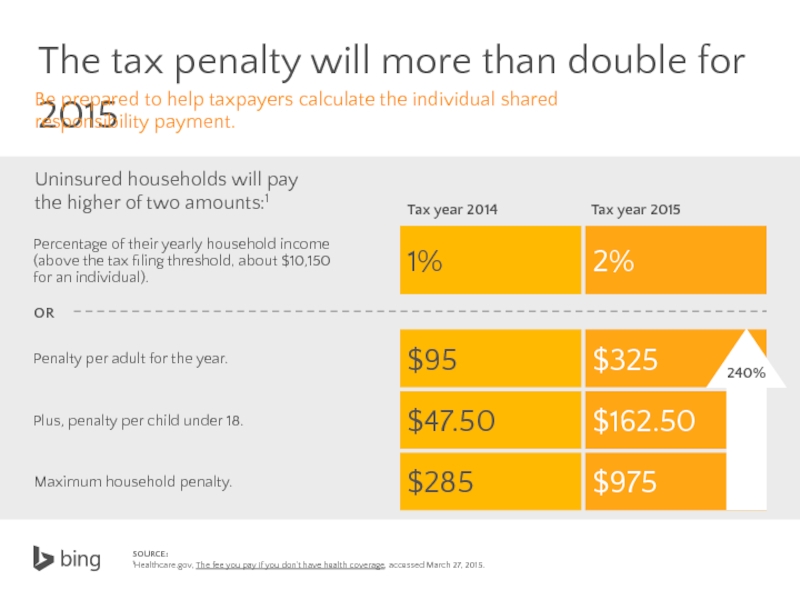

Слайд 10SOURCE: 1Healthcare.gov, The fee you pay if you don't have health

The tax penalty will more than double for 2015

Be prepared to help taxpayers calculate the individual shared responsibility payment.

Tax year 2014

Tax year 2015

1%

2%

$95

$325

$47.50

$162.50

$285

$975

Percentage of their yearly household income

(above the tax filing threshold, about $10,150

for an individual).

Penalty per adult for the year.

Plus, penalty per child under 18.

Maximum household penalty.

Uninsured households will pay

the higher of two amounts:1

240%

OR

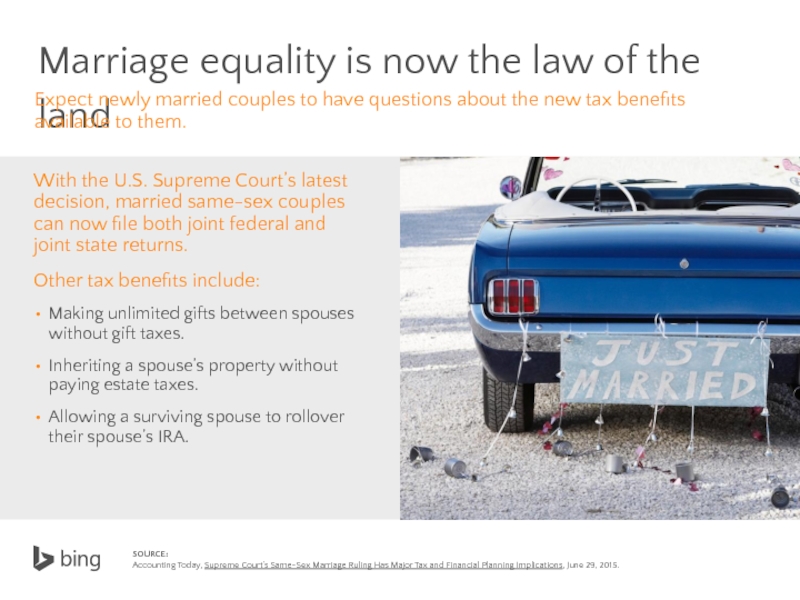

Слайд 11SOURCE: Accounting Today, Supreme Court’s Same-Sex Marriage Ruling Has Major Tax

Marriage equality is now the law of the land

With the U.S. Supreme Court’s latest decision, married same-sex couples

can now file both joint federal and joint state returns.

Other tax benefits include:

Making unlimited gifts between spouses without gift taxes.

Inheriting a spouse’s property without paying estate taxes.

Allowing a surviving spouse to rollover

their spouse’s IRA.

Expect newly married couples to have questions about the new tax benefits available to them.

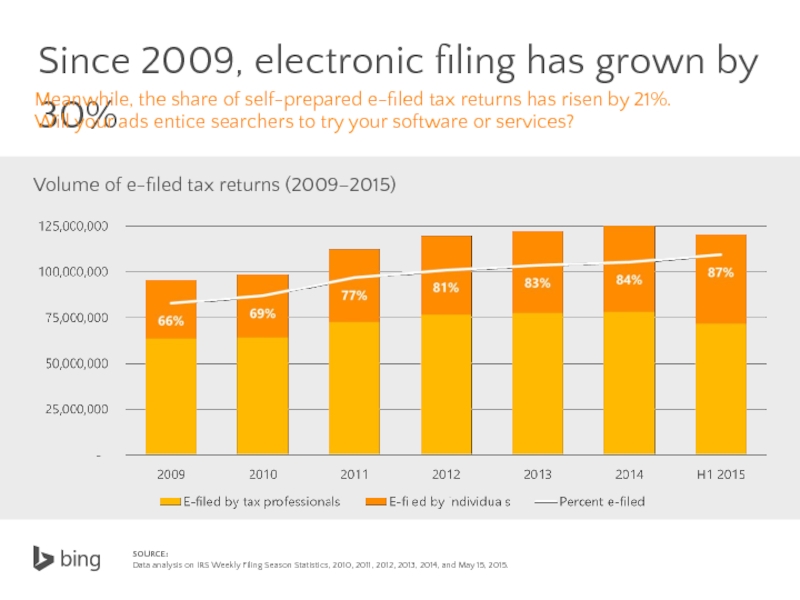

Слайд 12Since 2009, electronic filing has grown by 30%

Meanwhile, the share of

SOURCE:

Data analysis on IRS Weekly Filing Season Statistics, 2010, 2011, 2012, 2013, 2014, and May 15, 2015.

Volume of e-filed tax returns (2009–2015)

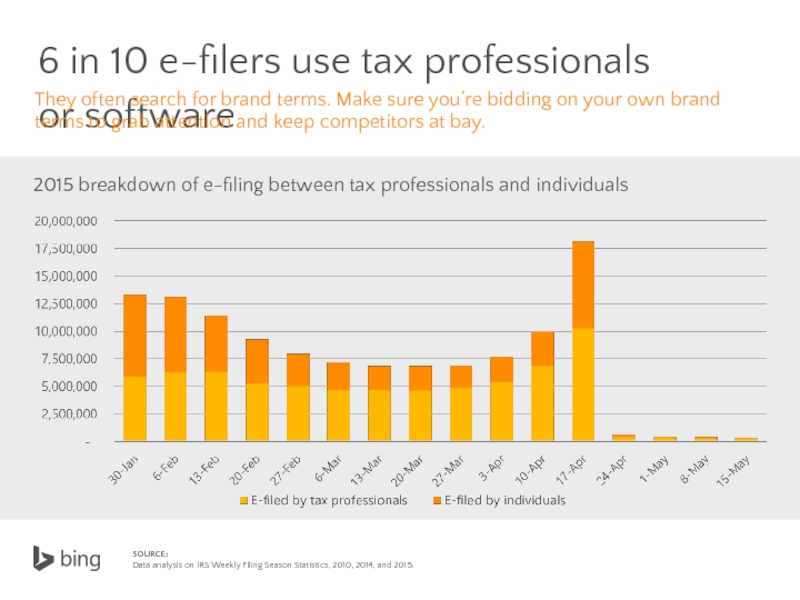

Слайд 13SOURCE: Data analysis on IRS Weekly Filing Season Statistics, 2010, 2014,

2015 breakdown of e-filing between tax professionals and individuals

6 in 10 e-filers use tax professionals or software

They often search for brand terms. Make sure you’re bidding on your own brand terms to grab attention and keep competitors at bay.

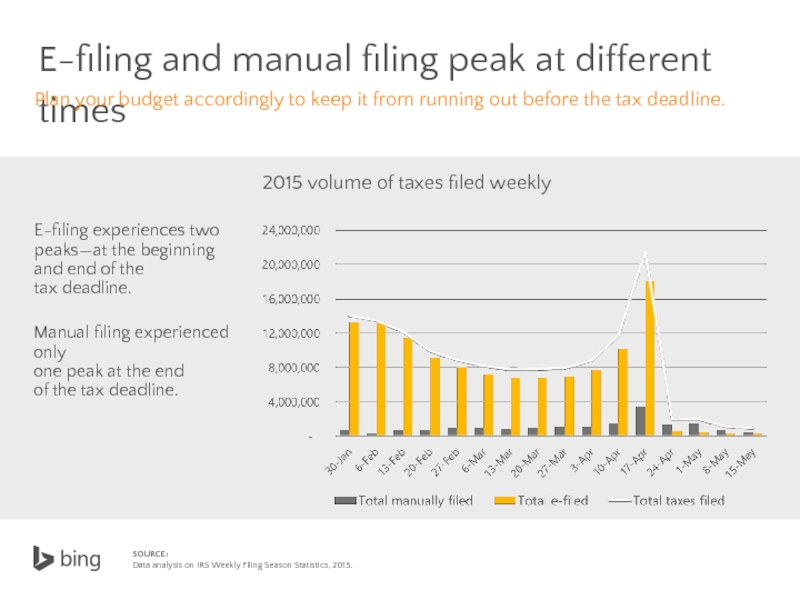

Слайд 14SOURCE:

Data analysis on IRS Weekly Filing Season Statistics, 2015.

2015 volume

E-filing and manual filing peak at different times

Plan your budget accordingly to keep it from running out before the tax deadline.

E-filing experiences two peaks—at the beginning and end of the

tax deadline.

Manual filing experienced only

one peak at the end

of the tax deadline.

Слайд 15Taxpayers are also getting help from

mobile apps

SOURCE:

PC Magazine, The

Tip

Use App Extensions to highlight your mobile offerings for tax assistance, calculators, return filing, and refund status.

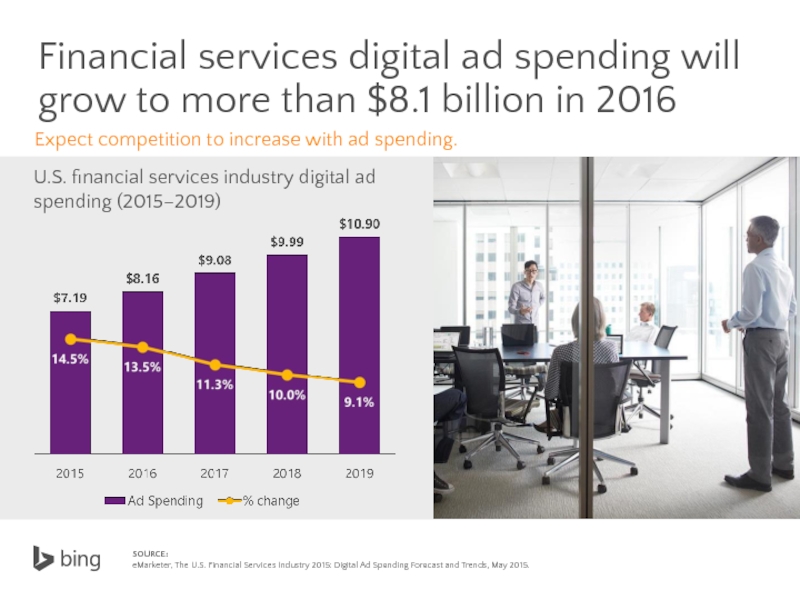

Слайд 16SOURCE: eMarketer, The U.S. Financial Services Industry 2015: Digital Ad Spending

Financial services digital ad spending will grow to more than $8.1 billion in 2016

Expect competition to increase with ad spending.

U.S. financial services industry digital ad spending (2015–2019)

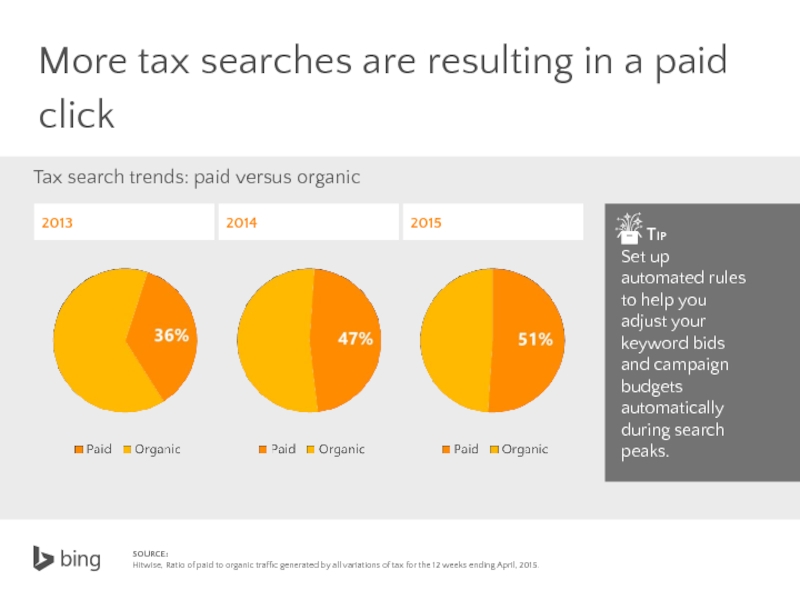

Слайд 17SOURCE: Hitwise, Ratio of paid to organic traffic generated by all

More tax searches are resulting in a paid click

Tax search trends: paid versus organic

Tip

Set up automated rules to help you adjust your keyword bids and campaign budgets automatically during search peaks.

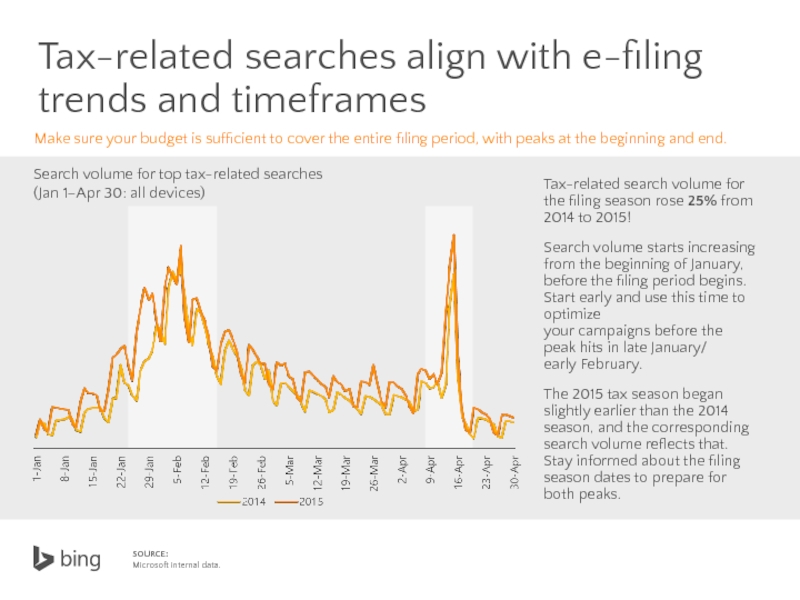

Слайд 19Make sure your budget is sufficient to cover the entire filing

Tax-related searches align with e-filing trends and timeframes

Tax-related search volume for the filing season rose 25% from 2014 to 2015!

Search volume starts increasing from the beginning of January, before the filing period begins. Start early and use this time to optimize

your campaigns before the peak hits in late January/

early February.

The 2015 tax season began slightly earlier than the 2014 season, and the corresponding search volume reflects that. Stay informed about the filing season dates to prepare for both peaks.

Search volume for top tax-related searches

(Jan 1–Apr 30: all devices)

SOURCE:

Microsoft internal data.

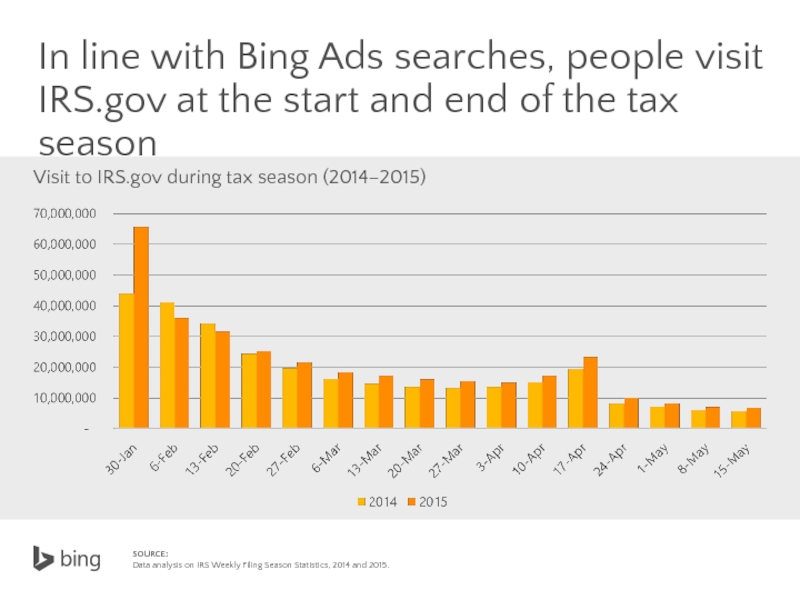

Слайд 20In line with Bing Ads searches, people visit IRS.gov at the

Visit to IRS.gov during tax season (2014–2015)

SOURCE:

Data analysis on IRS Weekly Filing Season Statistics, 2014 and 2015.

Слайд 21

The IRS doesn’t advertise—this presents a unique search advertising bidding opportunity,

SOURCE:

Microsoft internal data.

Слайд 22SOURCE:

Microsoft internal data.

Brand terms and refund-related terms top

the list

PC/tablet searches are heavier on brand terms, while smartphone searches

lean more towards tax refunds.

Popular queries on PC/tablet

Popular queries on smartphones

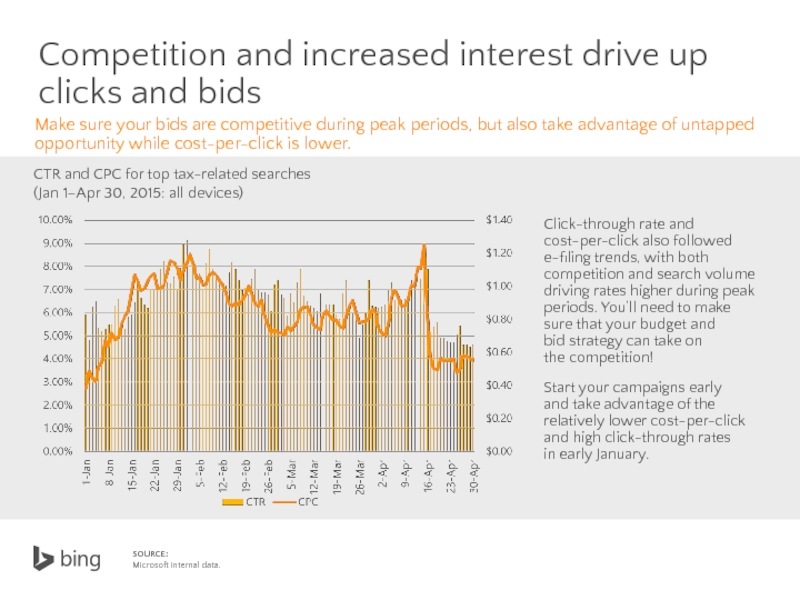

Слайд 23Competition and increased interest drive up

clicks and bids

Make sure your

CTR and CPC for top tax-related searches

(Jan 1–Apr 30, 2015: all devices)

Click-through rate and cost-per-click also followed e-filing trends, with both competition and search volume driving rates higher during peak periods. You’ll need to make sure that your budget and

bid strategy can take on

the competition!

Start your campaigns early

and take advantage of the relatively lower cost-per-click and high click-through rates

in early January.

SOURCE:

Microsoft internal data.

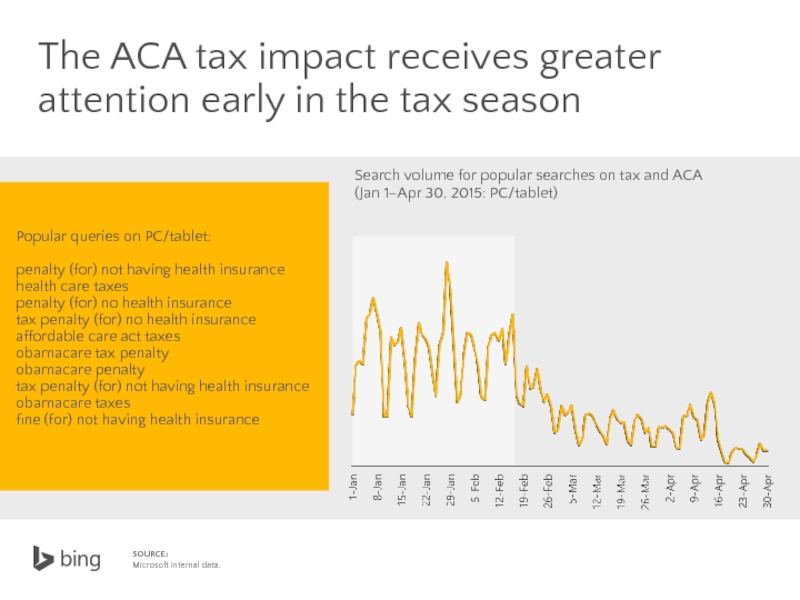

Слайд 24

SOURCE:

Microsoft internal data.

The ACA tax impact receives greater attention early

Popular queries on PC/tablet:

penalty (for) not having health insurance

health care taxes

penalty (for) no health insurance

tax penalty (for) no health insurance

affordable care act taxes

obamacare tax penalty

obamacare penalty

tax penalty (for) not having health insurance

obamacare taxes

fine (for) not having health insurance

Search volume for popular searches on tax and ACA

(Jan 1–Apr 30, 2015: PC/tablet)

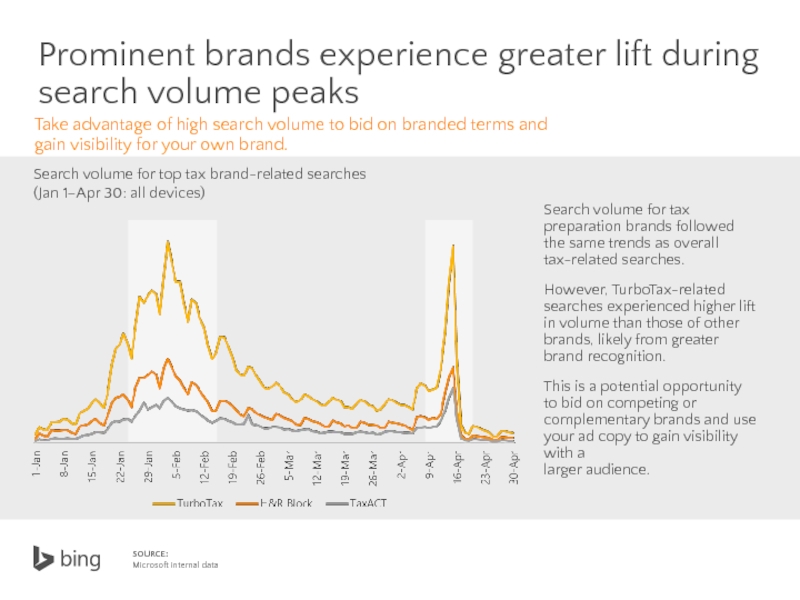

Слайд 25Take advantage of high search volume to bid on branded terms

Prominent brands experience greater lift during search volume peaks

Search volume for tax preparation brands followed the same trends as overall

tax-related searches.

However, TurboTax-related searches experienced higher lift in volume than those of other brands, likely from greater brand recognition.

This is a potential opportunity to bid on competing or complementary brands and use your ad copy to gain visibility with a

larger audience.

Search volume for top tax brand-related searches

(Jan 1–Apr 30: all devices)

SOURCE:

Microsoft internal data

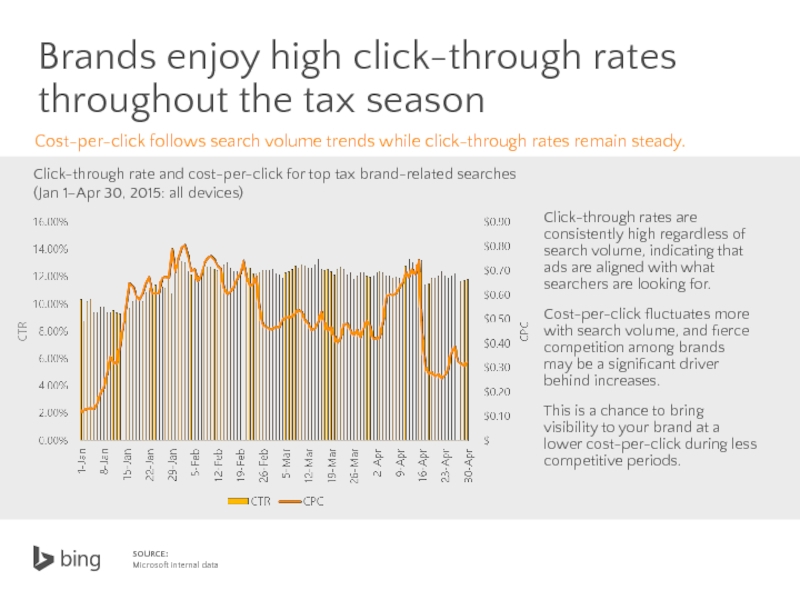

Слайд 26Cost-per-click follows search volume trends while click-through rates remain steady.

Brands enjoy

Click-through rates are consistently high regardless of search volume, indicating that ads are aligned with what searchers are looking for.

Cost-per-click fluctuates more with search volume, and fierce competition among brands may be a significant driver behind increases.

This is a chance to bring visibility to your brand at a lower cost-per-click during less competitive periods.

Click-through rate and cost-per-click for top tax brand-related searches

(Jan 1–Apr 30, 2015: all devices)

SOURCE:

Microsoft internal data

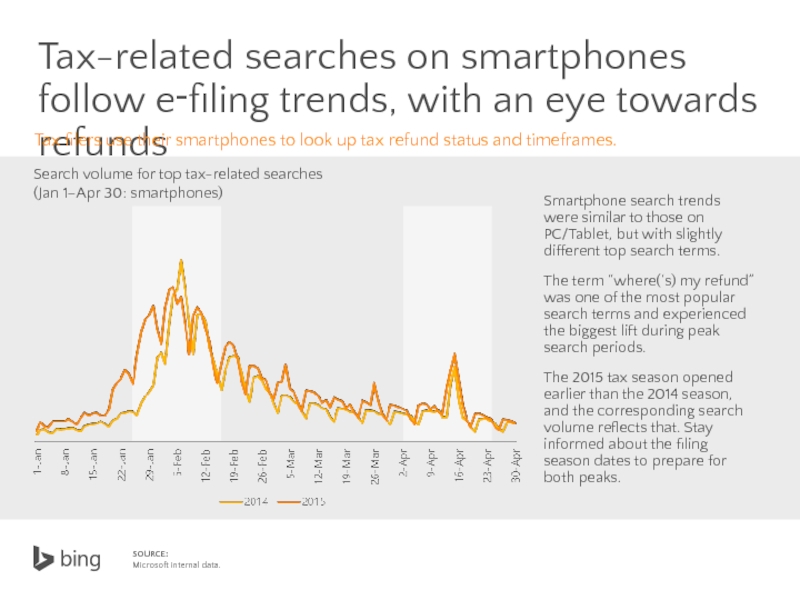

Слайд 28

Tax-related searches on smartphones follow e‑filing trends, with an eye towards

Tax filers use their smartphones to look up tax refund status and timeframes.

Smartphone search trends were similar to those on PC/Tablet, but with slightly different top search terms.

The term “where(‘s) my refund” was one of the most popular search terms and experienced the biggest lift during peak search periods.

The 2015 tax season opened earlier than the 2014 season, and the corresponding search volume reflects that. Stay informed about the filing season dates to prepare for both peaks.

Search volume for top tax-related searches

(Jan 1–Apr 30: smartphones)

SOURCE:

Microsoft internal data.

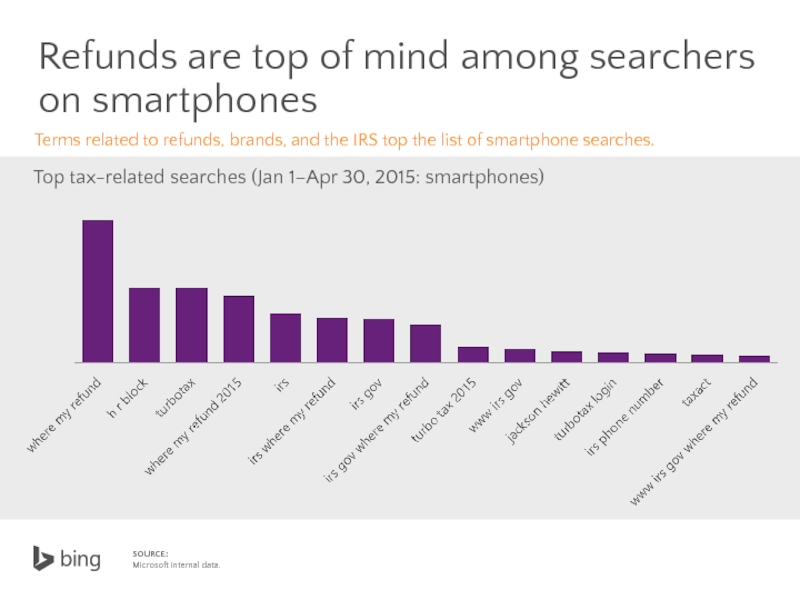

Слайд 29Refunds are top of mind among searchers on smartphones

Terms related to

Top tax-related searches (Jan 1–Apr 30, 2015: smartphones)

SOURCE:

Microsoft internal data.

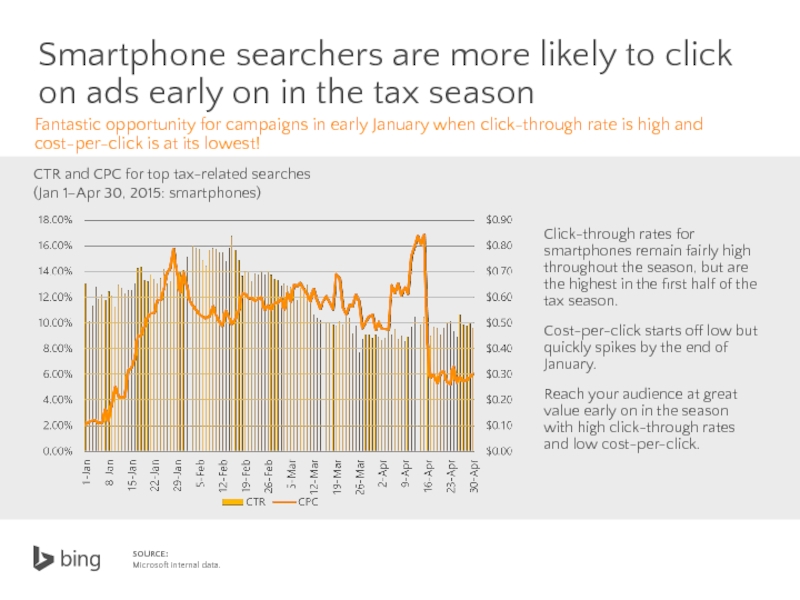

Слайд 30Smartphone searchers are more likely to click on ads early on

Fantastic opportunity for campaigns in early January when click-through rate is high and cost-per-click is at its lowest!

CTR and CPC for top tax-related searches

(Jan 1–Apr 30, 2015: smartphones)

Click-through rates for smartphones remain fairly high throughout the season, but are the highest in the first half of the tax season.

Cost-per-click starts off low but quickly spikes by the end of January.

Reach your audience at great value early on in the season with high click-through rates and low cost-per-click.

SOURCE:

Microsoft internal data.

Слайд 31Some tips to consider for tax season

1

2

3

4

Align budgets and bids to

Test ad copy early in January before the first peak and run with

the best performing ads.

Target mobile searchers at the beginning of the tax season

with refund-related ad copy and appropriate keyword bids.

Align your search campaign timing to the service you’re offering. Brand name searches spike early and late in the season, and vary by

tax professional services and self-serve software.

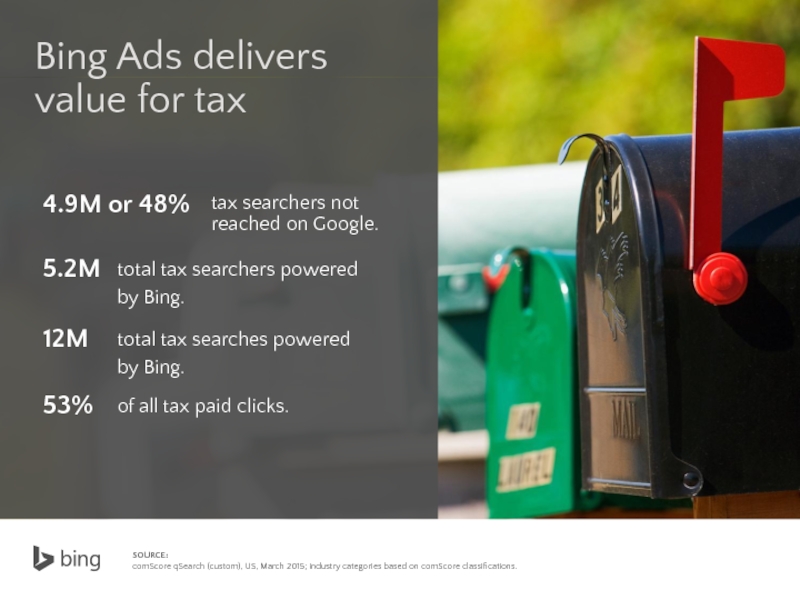

Слайд 33

SOURCE:

comScore qSearch (custom), US, March 2015; industry categories based on

tax searchers not reached on Google.

total tax searchers powered

by Bing.

total tax searches powered

by Bing.

of all tax paid clicks.

Bing Ads delivers value for tax

4.9M or 48%

5.2M

12M

53%

Слайд 34Our audience has a higher propensity

to own personal finance/tax software

Compared

SOURCE:

comScore Plan Metrix, US, March 2015, custom measure created using comScore indices and duplication.

March data was used to reflect the month before tax filings are due.

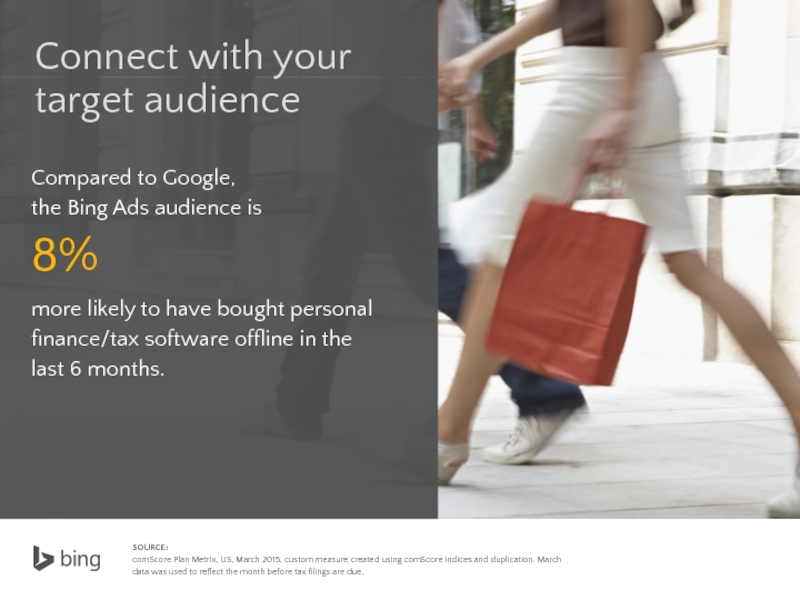

Слайд 35

SOURCE:

comScore Plan Metrix, US, March 2015, custom measure created using

Compared to Google,

the Bing Ads audience is

8%

more likely to have bought personal finance/tax software offline in the last 6 months.

Connect with your target audience

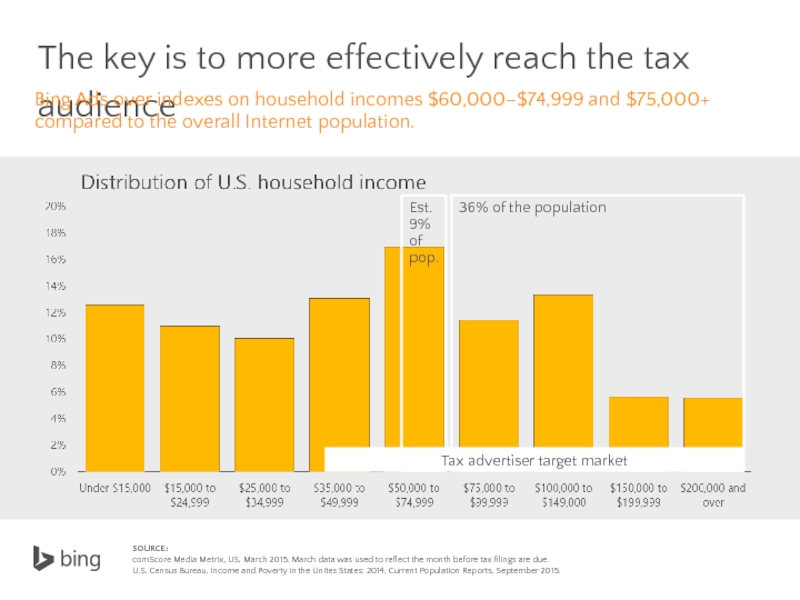

Слайд 36SOURCE: comScore Media Metrix, US, March 2015. March data was used

U.S. Census Bureau, Income and Poverty in the Unites States: 2014, Current Population Reports, September 2015.

The key is to more effectively reach the tax audience

Bing Ads over indexes on household incomes $60,000–$74,999 and $75,000+ compared to the overall Internet population.

Est. 9% of pop.

36% of the population

Tax advertiser target market

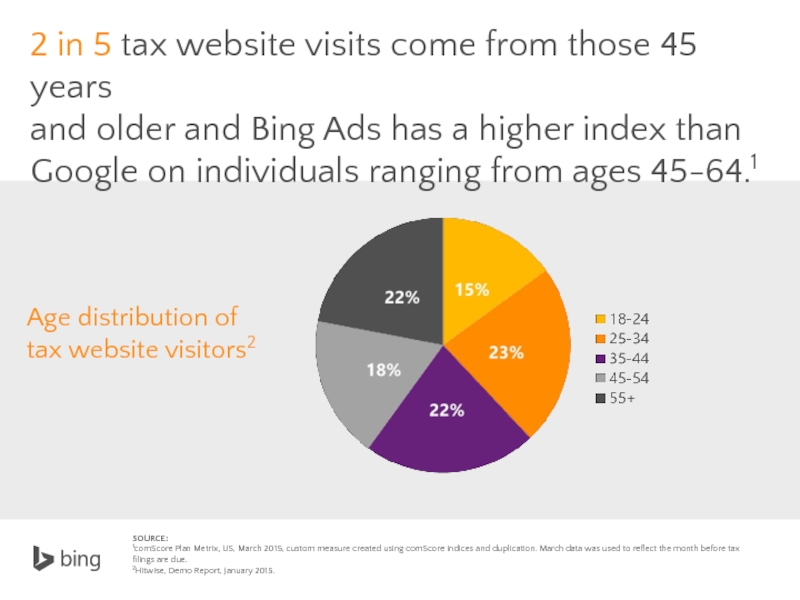

Слайд 37

2 in 5 tax website visits come from those 45 years

Age distribution of

tax website visitors2

SOURCE:

1comScore Plan Metrix, US, March 2015, custom measure created using comScore indices and duplication. March data was used to reflect the month before tax filings are due.

2Hitwise, Demo Report, January 2015.

Слайд 39

M

M

M

M

M

M

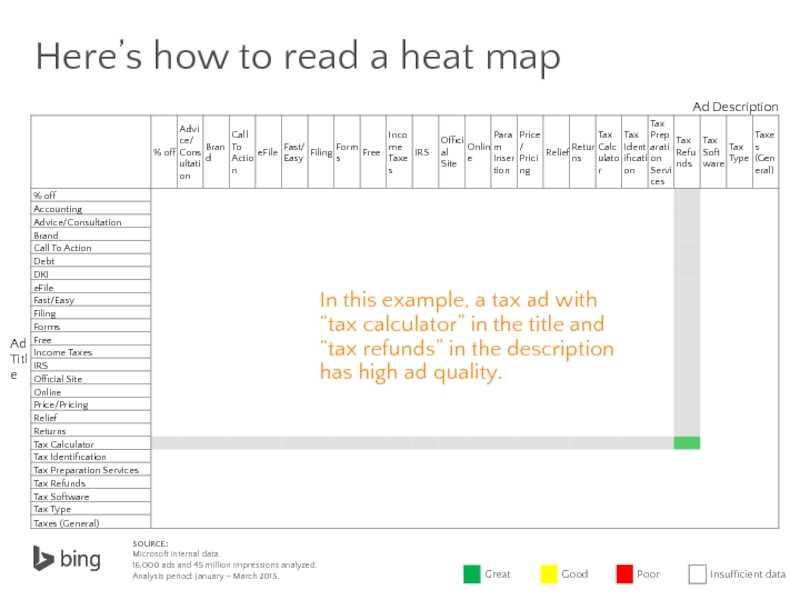

Here’s how to read a heat map

SOURCE:

Microsoft internal data.

16,000 ads

Analysis period: January – March 2015.

In this example, a tax ad with “tax calculator” in the title and “tax refunds” in the description has high ad quality.

Слайд 40

M

M

M

M

M

M

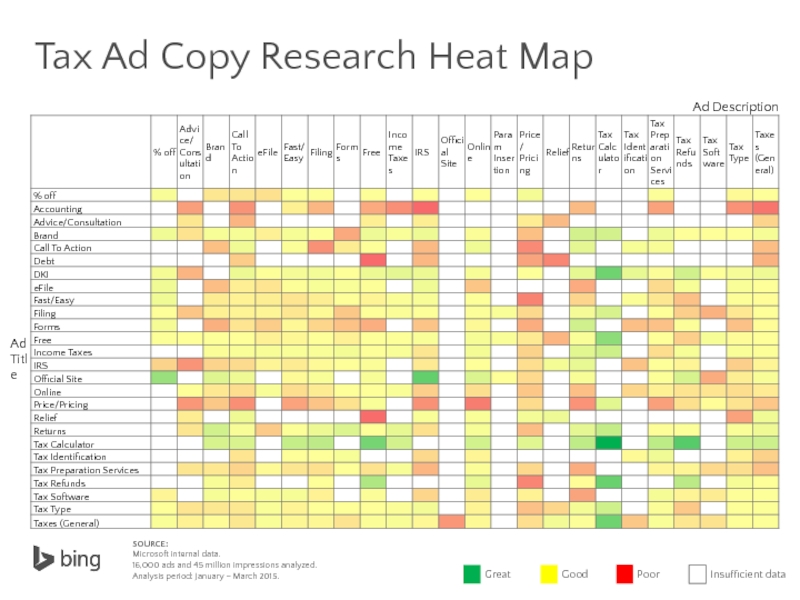

Tax Ad Copy Research Heat Map

SOURCE:

Microsoft internal data.

16,000 ads and

Analysis period: January – March 2015.

Слайд 41

M

M

M

M

M

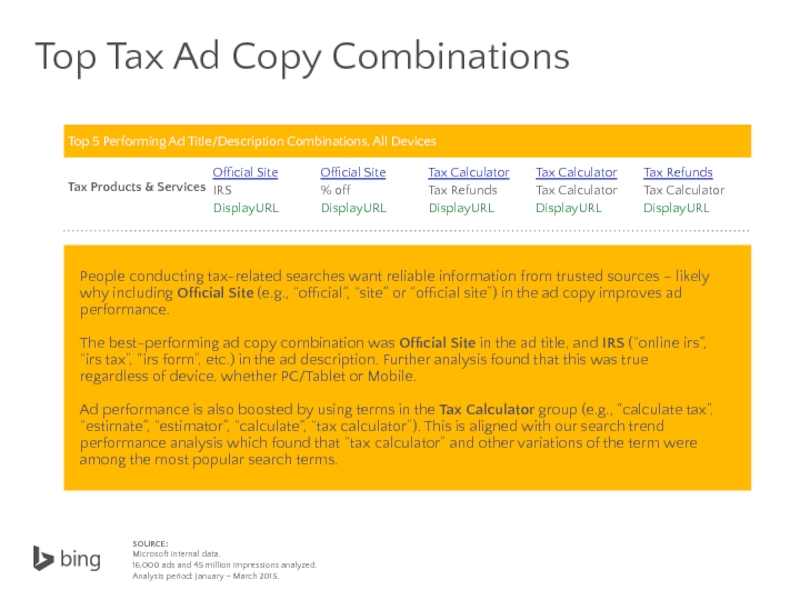

Top Tax Ad Copy Combinations

SOURCE:

Microsoft internal data.

16,000 ads and 45

Analysis period: January – March 2015.

People conducting tax-related searches want reliable information from trusted sources – likely why including Official Site (e.g., “official”, “site” or “official site”) in the ad copy improves ad performance.

The best-performing ad copy combination was Official Site in the ad title, and IRS (“online irs”, “irs tax”, “irs form”, etc.) in the ad description. Further analysis found that this was true regardless of device, whether PC/Tablet or Mobile.

Ad performance is also boosted by using terms in the Tax Calculator group (e.g., “calculate tax”, “estimate”, “estimator”, “calculate”, “tax calculator”). This is aligned with our search trend performance analysis which found that “tax calculator” and other variations of the term were among the most popular search terms.

Слайд 42

M

M

M

M

M

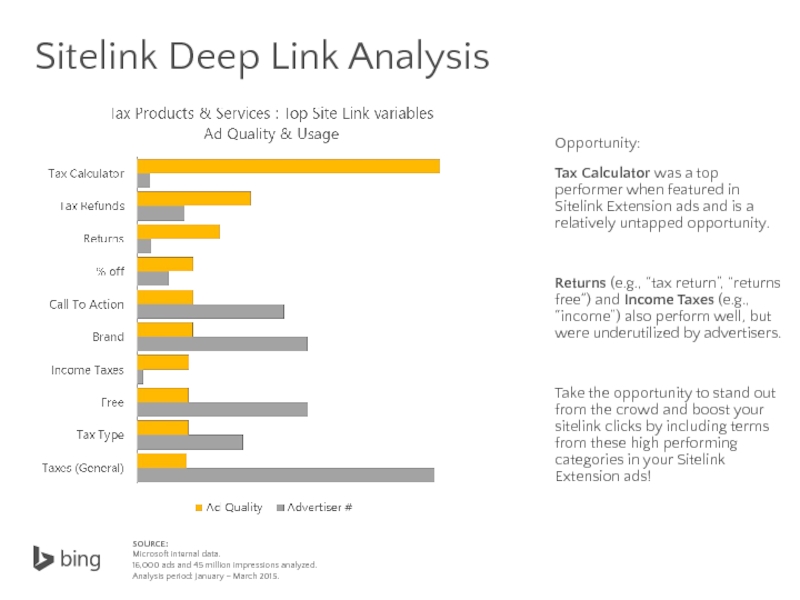

Sitelink Deep Link Analysis

SOURCE:

Microsoft internal data.

16,000 ads and 45 million

Analysis period: January – March 2015.

Opportunity:

Tax Calculator was a top performer when featured in Sitelink Extension ads and is a relatively untapped opportunity.

Returns (e.g., “tax return”, “returns free”) and Income Taxes (e.g., “income”) also perform well, but were underutilized by advertisers.

Take the opportunity to stand out from the crowd and boost your sitelink clicks by including terms from these high performing categories in your Sitelink Extension ads!

Слайд 43Should I bid on

my brand terms?

To bid or not to

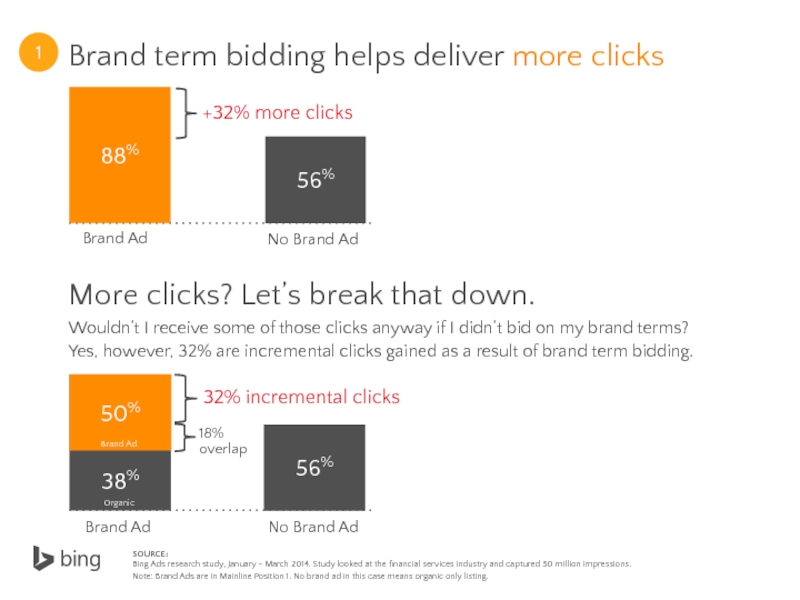

Слайд 44More clicks? Let’s break that down.

Wouldn’t I receive some of those

Yes, however, 32% are incremental clicks gained as a result of brand term bidding.

SOURCE:

Bing Ads research study, January - March 2014. Study looked at the financial services industry and captured 50 million impressions.

Note: Brand Ads are in Mainline Position 1. No brand ad in this case means organic only listing.

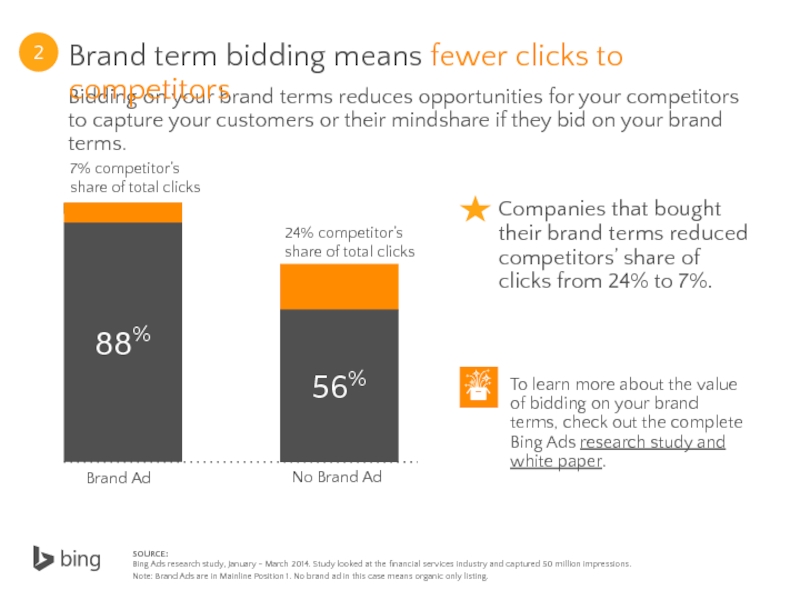

Слайд 45Bidding on your brand terms reduces opportunities for your competitors to

2

Brand term bidding means fewer clicks to competitors

To learn more about the value of bidding on your brand terms, check out the complete Bing Ads research study and white paper.

Companies that bought their brand terms reduced competitors’ share of clicks from 24% to 7%.

SOURCE:

Bing Ads research study, January - March 2014. Study looked at the financial services industry and captured 50 million impressions.

Note: Brand Ads are in Mainline Position 1. No brand ad in this case means organic only listing.

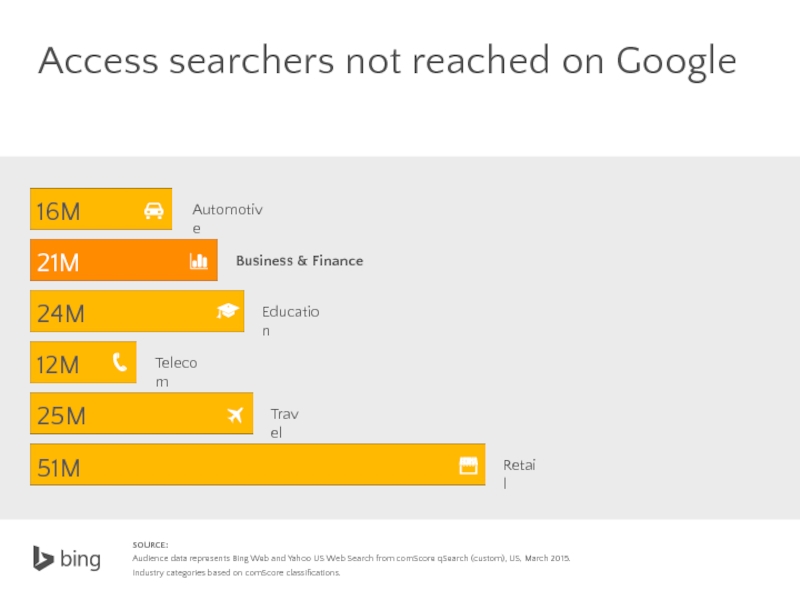

Слайд 47Access searchers not reached on Google

SOURCE:

Audience data represents Bing

Industry categories based on comScore classifications.

Automotive

Business & Finance

Education

Telecom

Travel

Retail

51M

24M

12M

25M

16M

21M

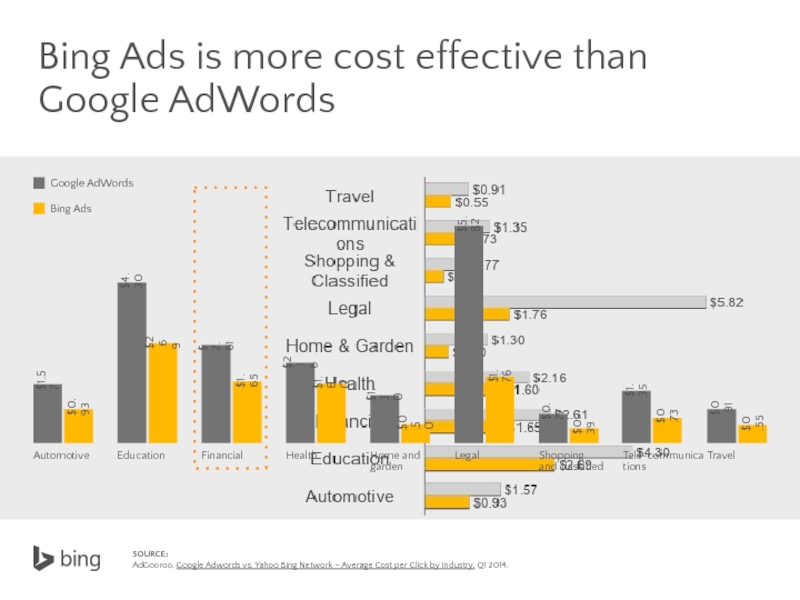

Слайд 48Bing Ads is more cost effective than

Google AdWords

Automotive

Education

Financial

Health

Home and garden

Legal

Shopping

Tele-communications

Travel

$1.57

$0.93

$4.30

$2.69

$2.61

$1.65

$2.16

$1.60

$1.30

$0.50

$5.82

$1.76

$0.77

$0.39

$1.35

$0.73

$0.91

$0.55

SOURCE:

AdGooroo, Google Adwords vs. Yahoo Bing Network – Average Cost per Click by Industry, Q1 2014.

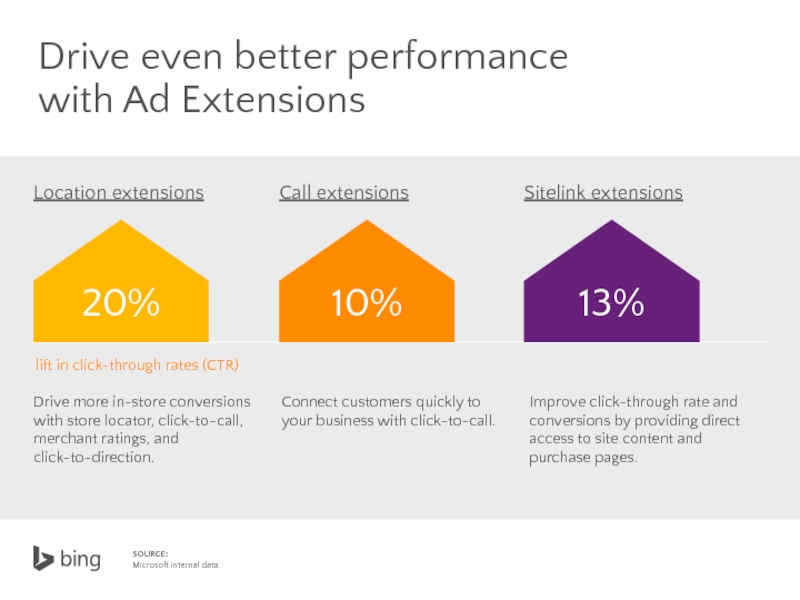

Слайд 49Sitelink extensions

Location extensions

lift in click-through rates (CTR)

Call extensions

Improve click-through

Drive more in-store conversions with store locator, click-to-call, merchant ratings, and

click-to-direction.

Connect customers quickly to your business with click-to-call.

Drive even better performance

with Ad Extensions

20%

10%

13%

SOURCE:

Microsoft internal data.

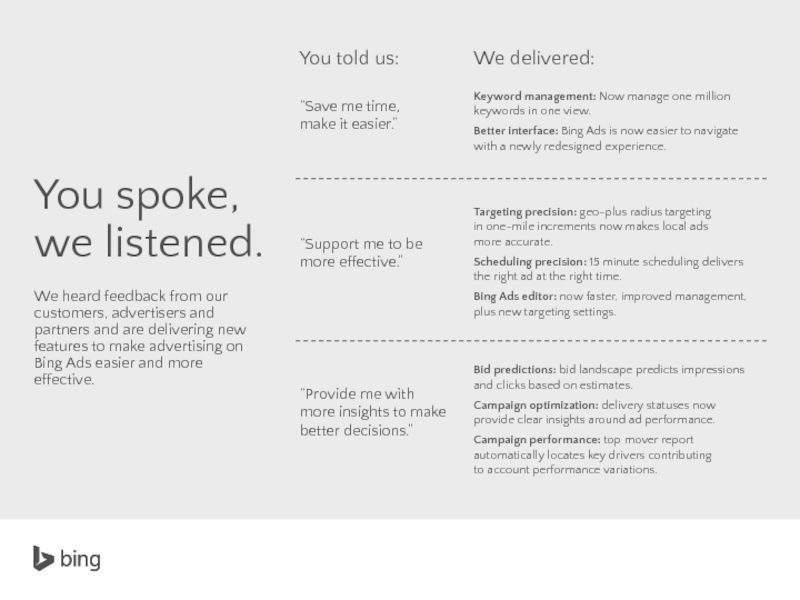

Слайд 50You spoke, we listened.

We heard feedback from our customers, advertisers and

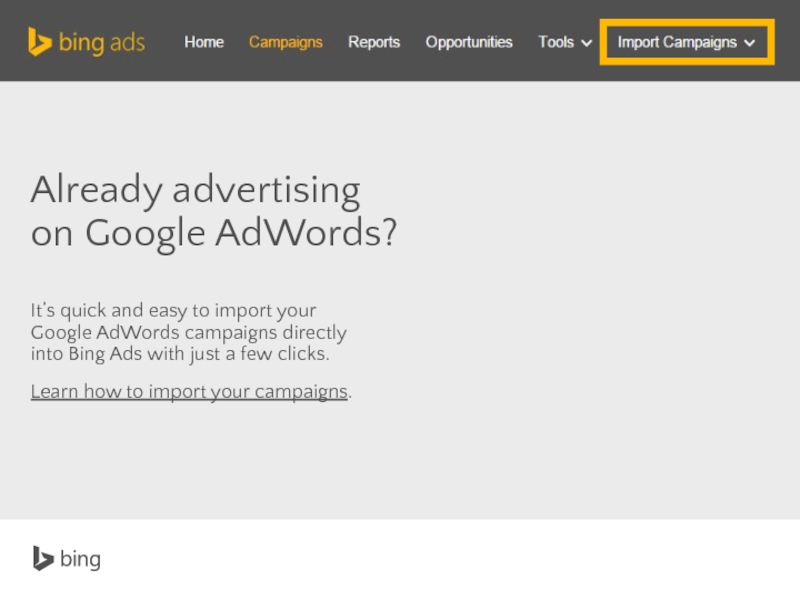

Слайд 51It’s quick and easy to import your Google AdWords campaigns directly

Learn how to import your campaigns.

Already advertising

on Google AdWords?

Слайд 52

@bingads

linkedIn.com/company/bing-ads

facebook.com/bingads

blog.bingads.com

instagram.com/bingads

slideshare.net/bingads

youtube.com/bingads

Connect with a Search Specialist who can help you get started

Call 1-800-518-5689 or check out

Getting started.