- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Lecture 5. Principles of Macroeconomics презентация

Содержание

- 1. Lecture 5. Principles of Macroeconomics

- 2. In this Lecture: Consumer’s consumption/savings decision –

- 3. Intertemporal decisions They involve a trade off

- 4. Our model Two period model: today and

- 5. Budget Constraints The consumer’s current-period budget constraint:

- 6. Budget Constraints The consumer’s future-period budget constraint: Interest rate @antoniomele101

- 7. Simplify Solve the future-period budget constraint for s: @antoniomele101

- 8. Next, Substitute in the current-period budget constraint obtaining lifetime budget constraint: @antoniomele101

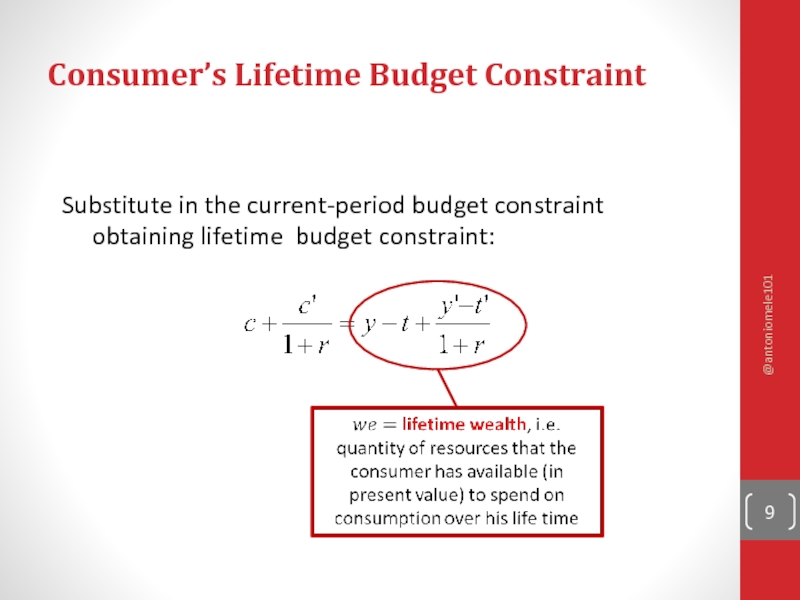

- 9. Consumer’s Lifetime Budget Constraint Substitute in the

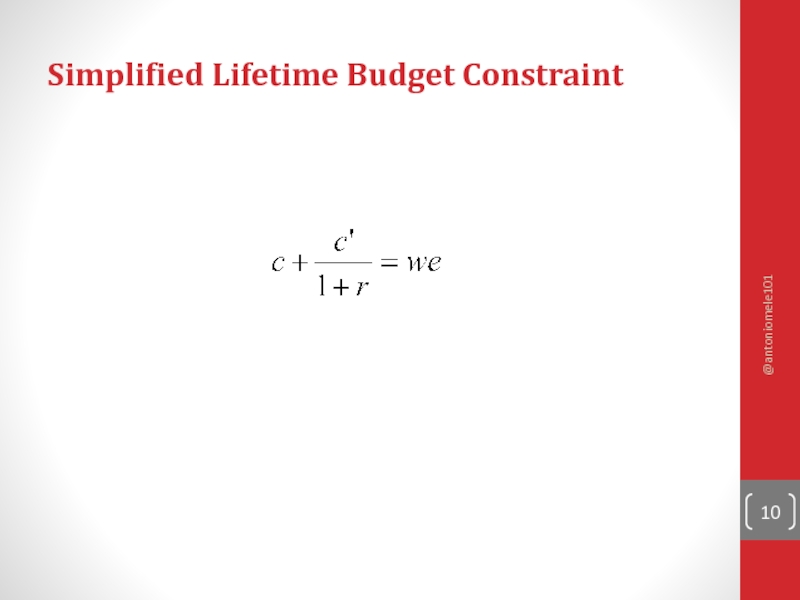

- 10. Simplified Lifetime Budget Constraint @antoniomele101

- 11. Simplified Lifetime Budget Constraint: Slope-Intercept @antoniomele101

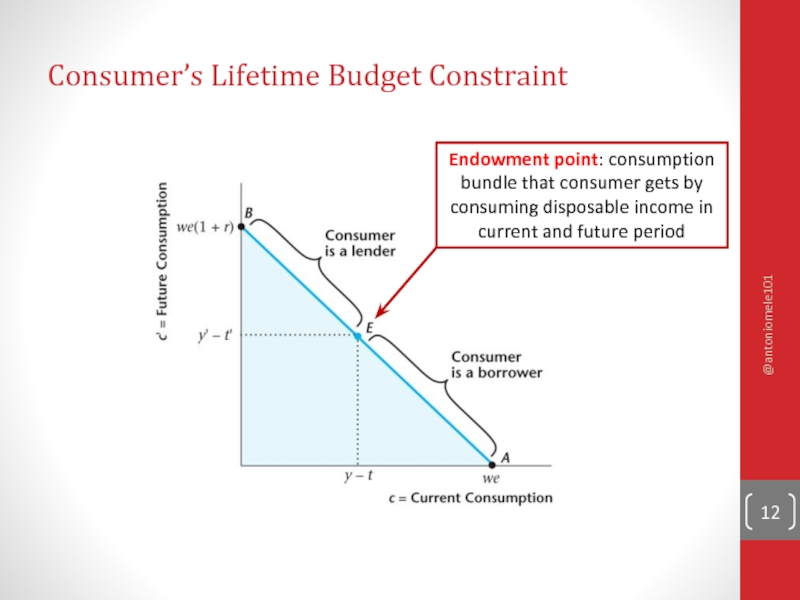

- 12. Consumer’s Lifetime Budget Constraint Endowment point: consumption

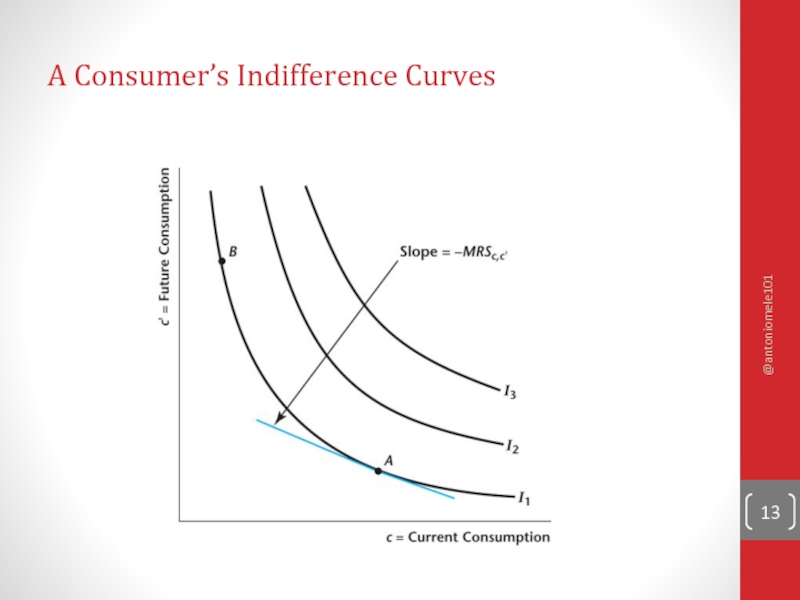

- 13. A Consumer’s Indifference Curves @antoniomele101

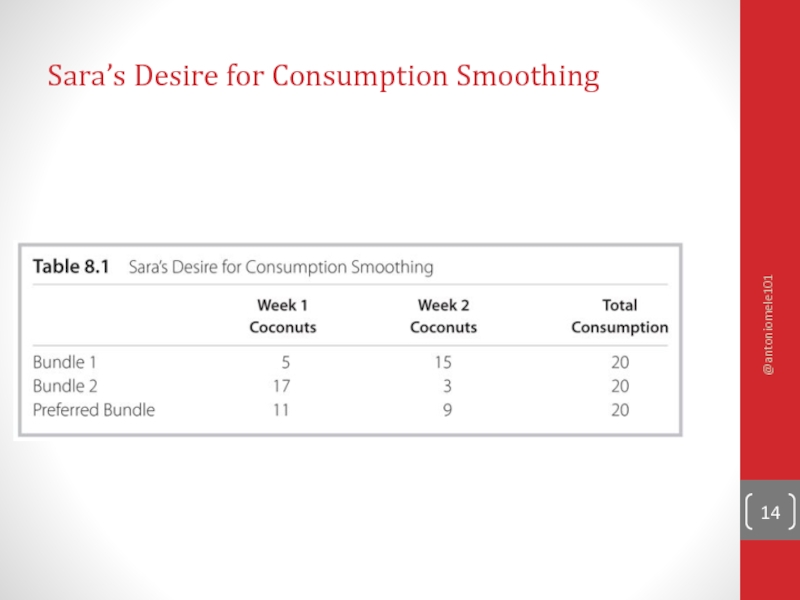

- 14. Sara’s Desire for Consumption Smoothing @antoniomele101

- 15. Optimization Marginal condition that holds when the consumer is optimizing: @antoniomele101

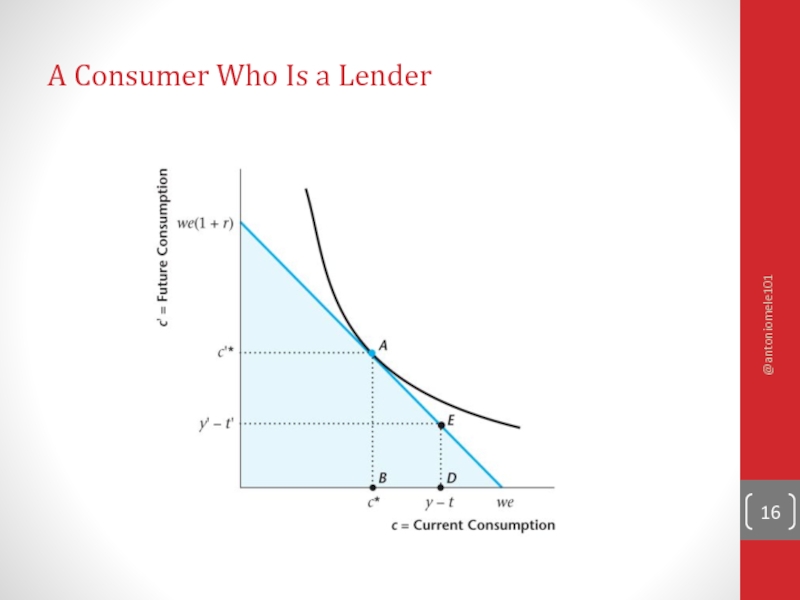

- 16. A Consumer Who Is a Lender @antoniomele101

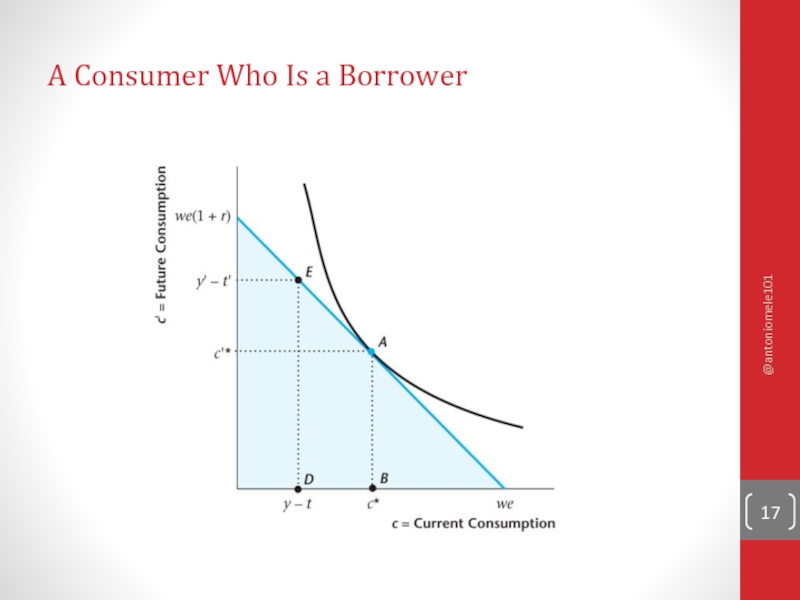

- 17. A Consumer Who Is a Borrower @antoniomele101

- 18. An Increase in Current Income for the

- 19. The Effects of an Increase in Current Income for a Lender @antoniomele101

- 20. Observed Consumption-Smoothing Behavior If all

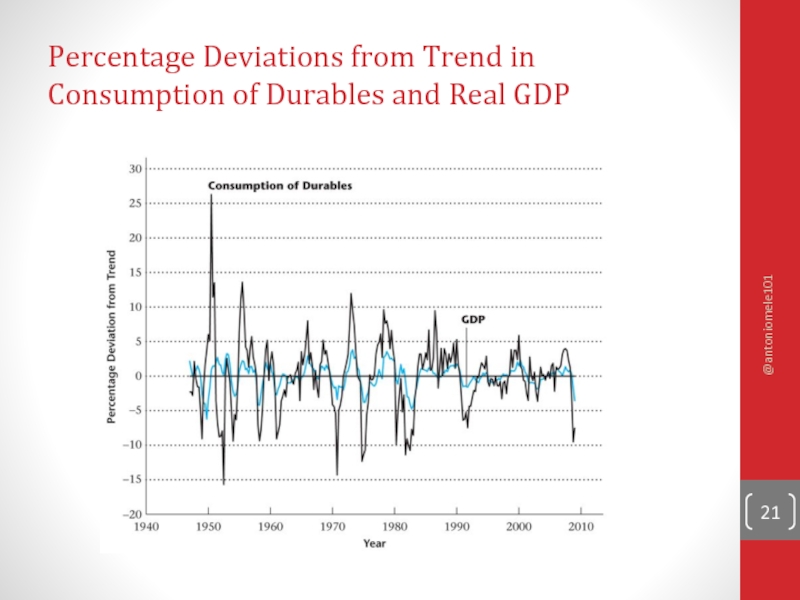

- 21. Percentage Deviations from Trend in Consumption of Durables and Real GDP @antoniomele101

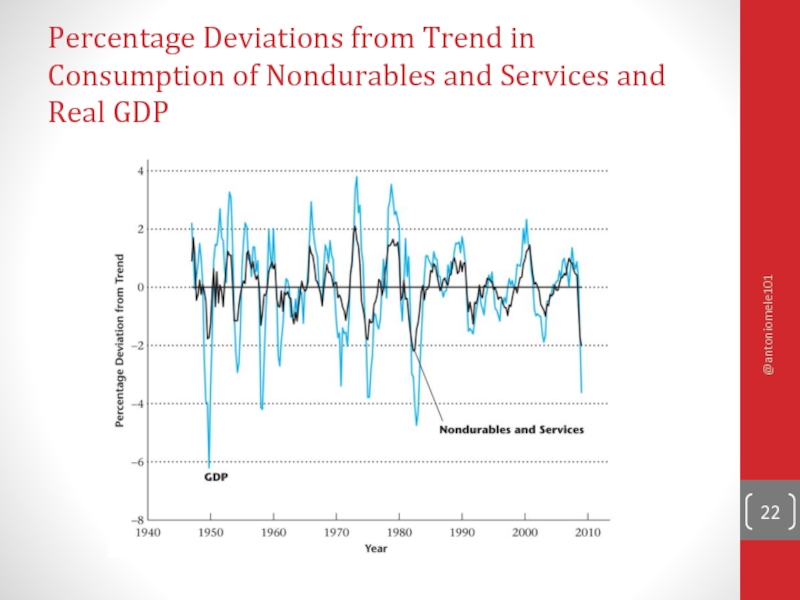

- 22. Percentage Deviations from Trend in Consumption of Nondurables and Services and Real GDP @antoniomele101

- 23. An Increase in Future Income for the

- 24. An Increase in Future Income @antoniomele101

- 25. Temporary and Permanent Increases in Income

- 26. Temporary Versus Permanent Increases in Income @antoniomele101

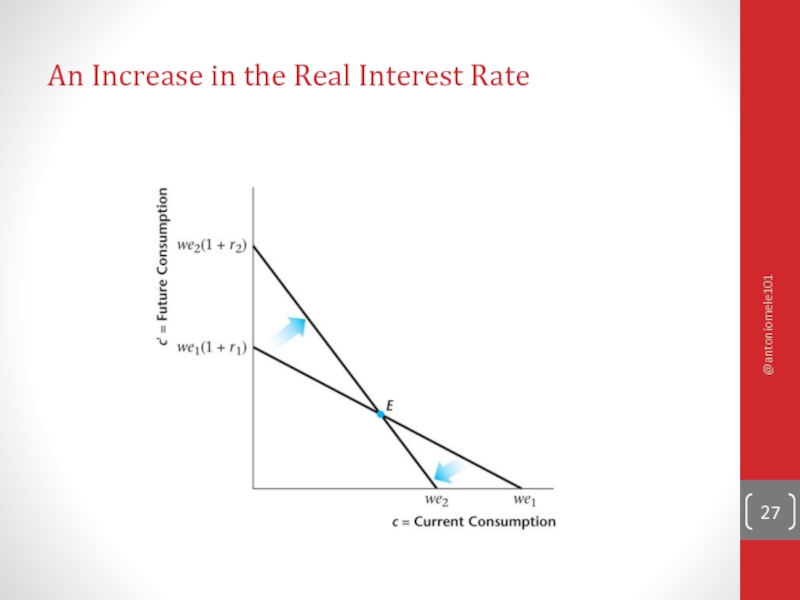

- 27. An Increase in the Real Interest Rate @antoniomele101

- 28. An Increase in the Market Real Interest

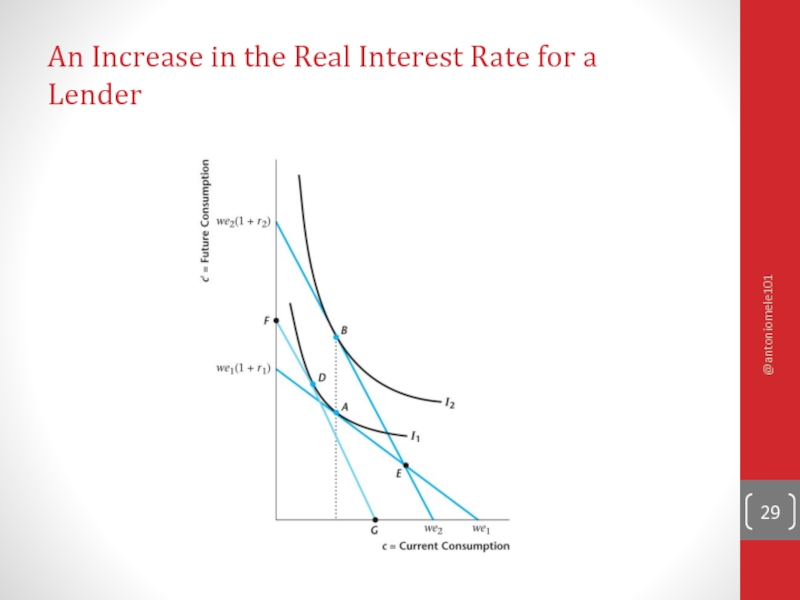

- 29. An Increase in the Real Interest Rate for a Lender @antoniomele101

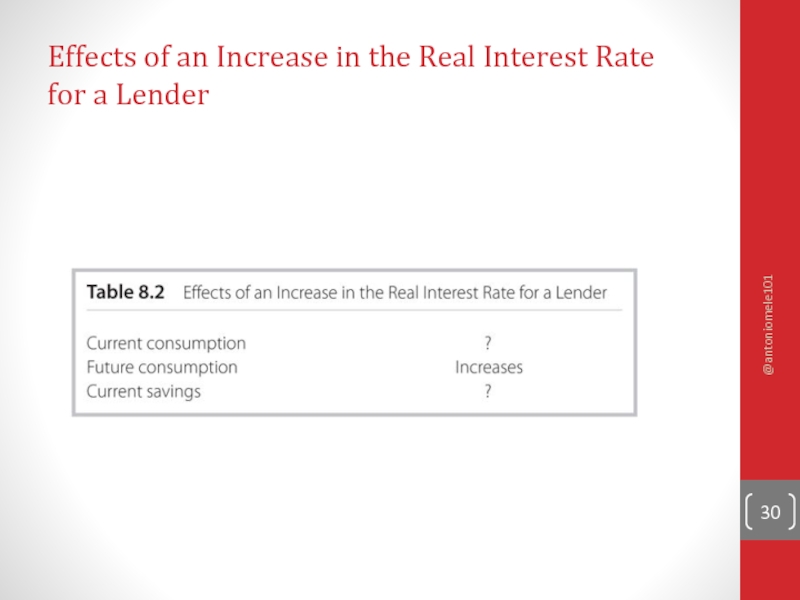

- 30. Effects of an Increase in the Real Interest Rate for a Lender @antoniomele101

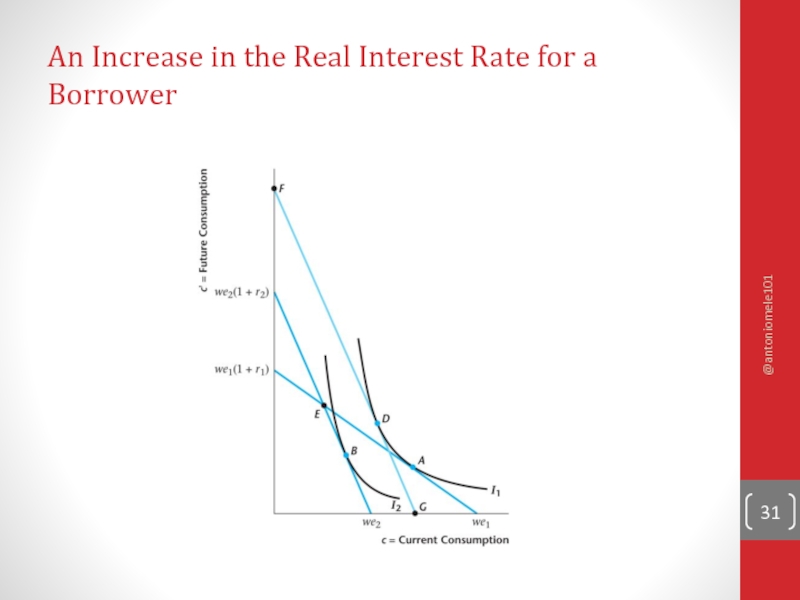

- 31. An Increase in the Real Interest Rate for a Borrower @antoniomele101

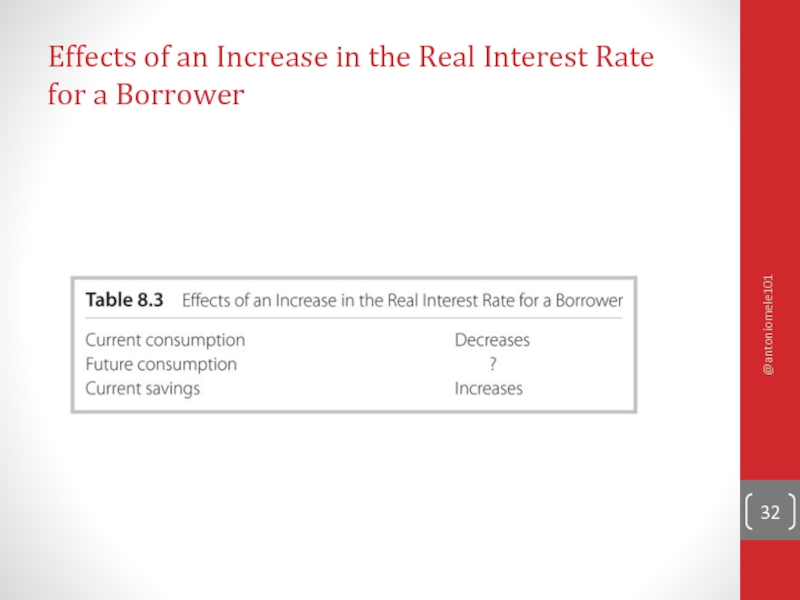

- 32. Effects of an Increase in the Real Interest Rate for a Borrower @antoniomele101

- 33. Introducing the government Government buys G, financed

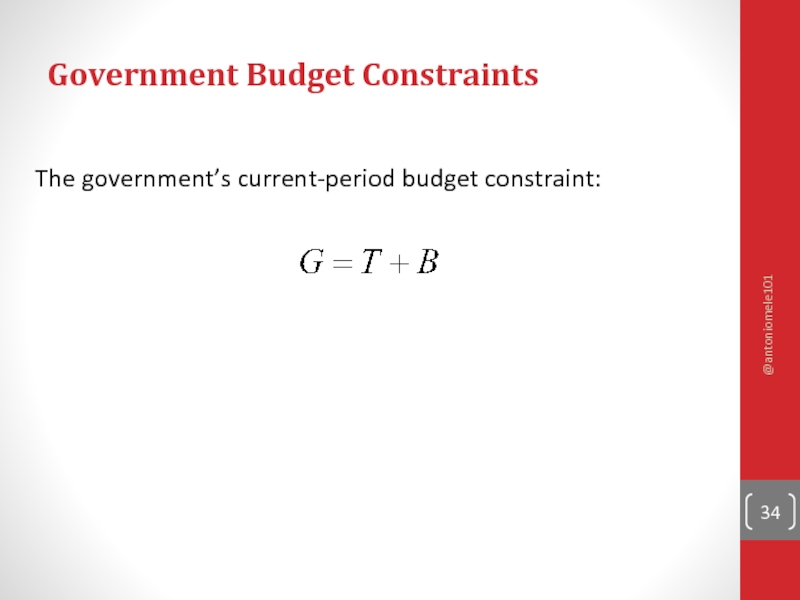

- 34. Government Budget Constraints The government’s current-period budget constraint: @antoniomele101

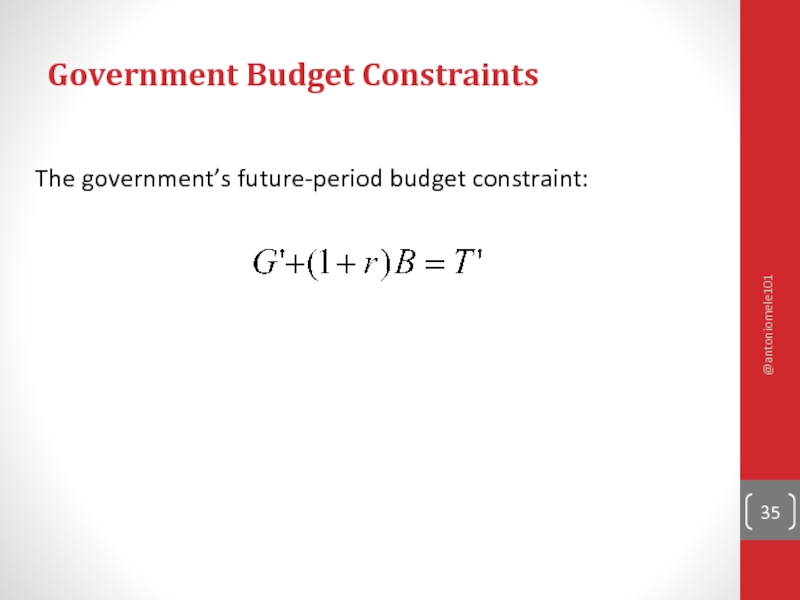

- 35. Government Budget Constraints The government’s future-period budget constraint: @antoniomele101

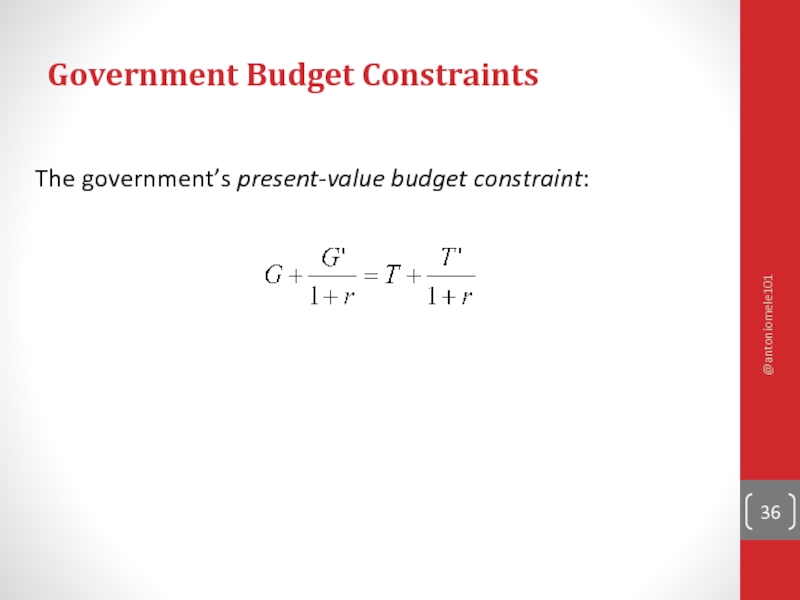

- 36. Government Budget Constraints The government’s present-value budget constraint: @antoniomele101

- 37. Competitive equilibrium Each consumer chooses current and

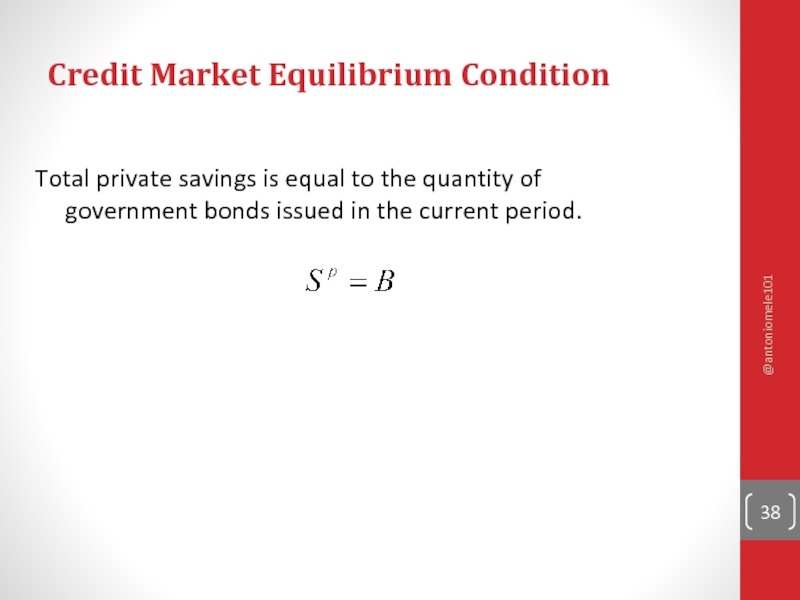

- 38. Credit Market Equilibrium Condition Total

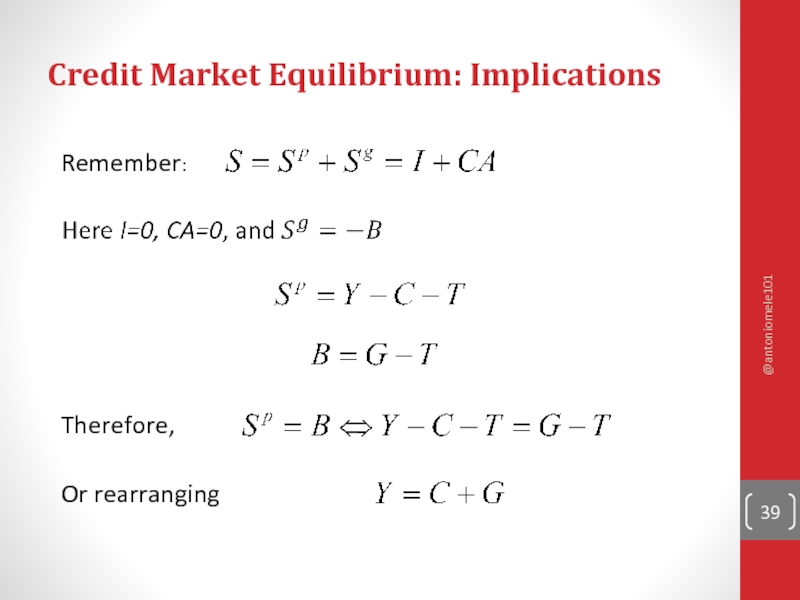

- 39. Credit Market Equilibrium: Implications Remember: Therefore, Or rearranging @antoniomele101

- 40. Income-Expenditure Identity Credit market equilibrium

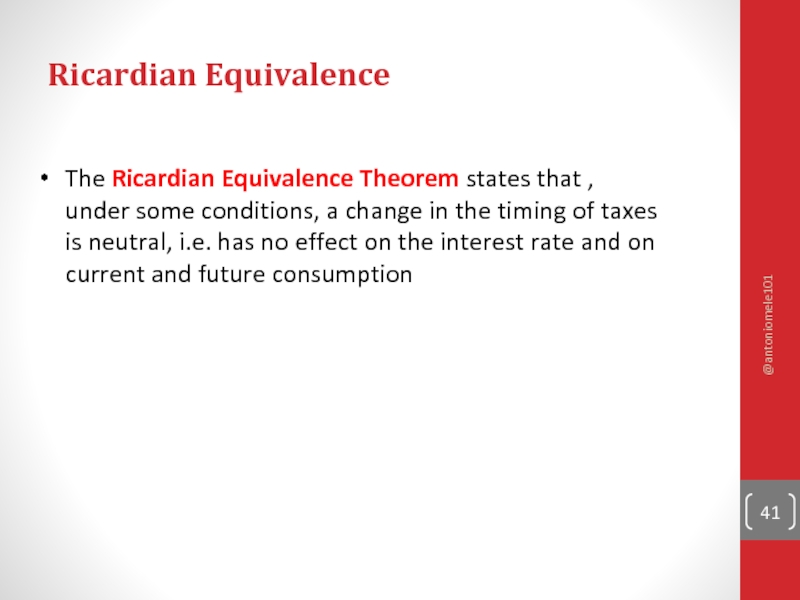

- 41. Ricardian Equivalence The Ricardian Equivalence

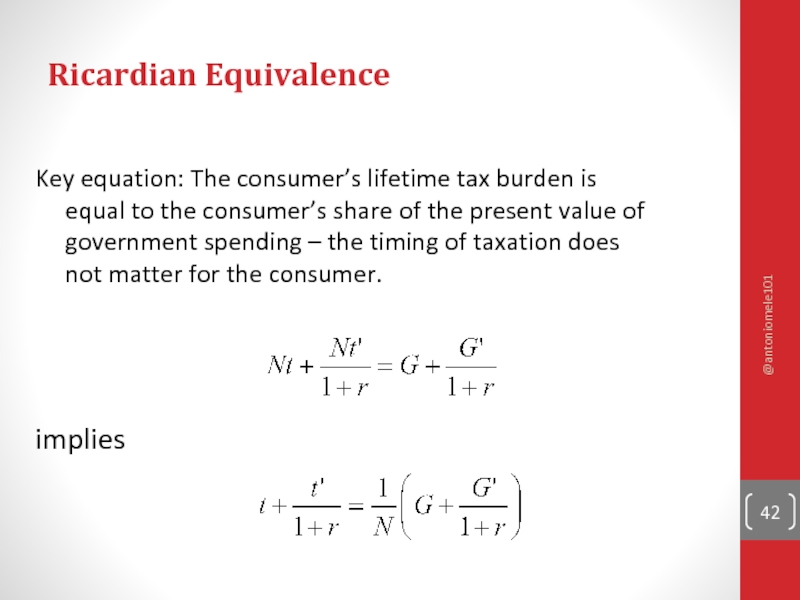

- 42. Ricardian Equivalence Key equation: The

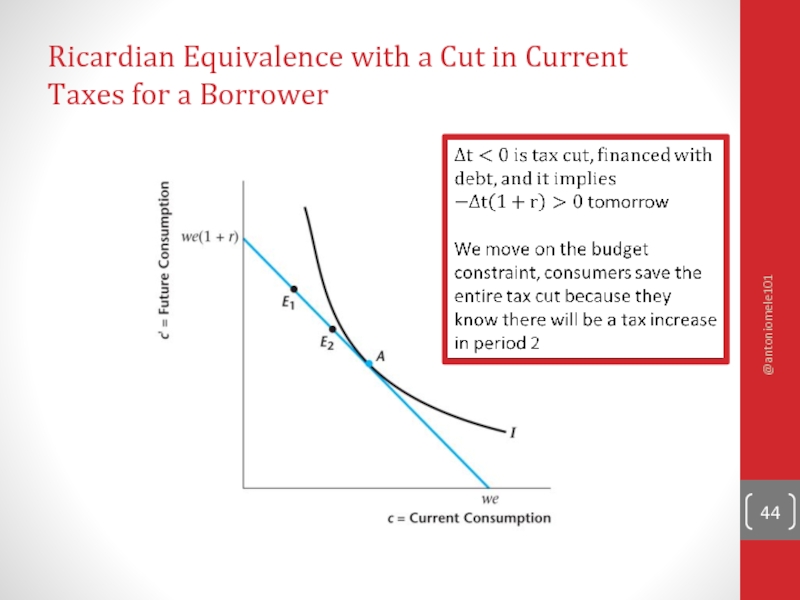

- 43. Ricardian Equivalence Then, substitute in

- 44. Ricardian Equivalence with a Cut in Current Taxes for a Borrower @antoniomele101

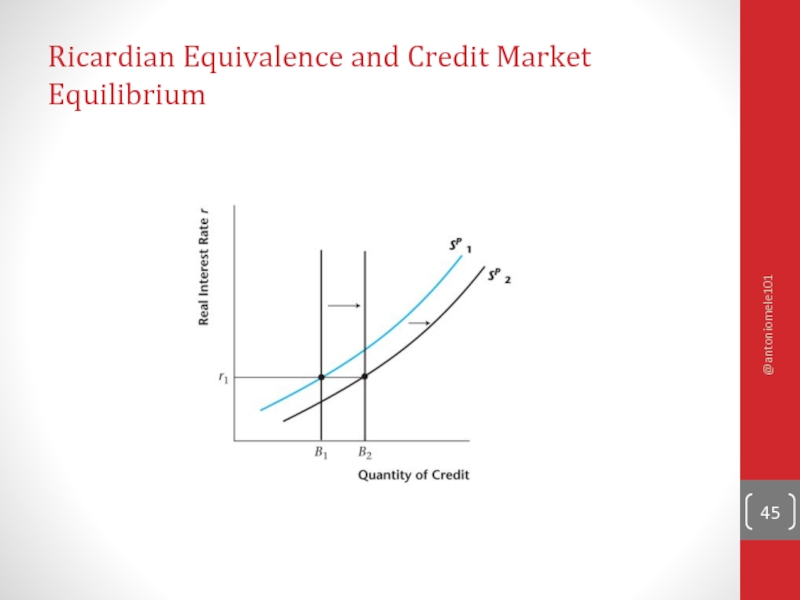

- 45. Ricardian Equivalence and Credit Market Equilibrium @antoniomele101

- 46. Discussion of the assumptions Ricardian equivalence theorems

- 47. Readings Savings are generally a good idea

Слайд 1Principles of Macroeconomics

ECO 1019 Lecture 5

Antonio Mele meleantonio@gmail.com

@antoniomele101

Слайд 2In this Lecture:

Consumer’s consumption/savings decision – responses of consumer to changes

Government budget deficits and the Ricardian Equivalence Theorem.

@antoniomele101

Слайд 3Intertemporal decisions

They involve a trade off across periods of time: between

In Solow model: arbitrary intertemporal decision rule, constant saving rate

We use microeconomic principles to have a more detailed analysis

@antoniomele101

Слайд 4Our model

Two period model: today and tomorrow

For simplicity: income is exogenous

Lump sum taxes

@antoniomele101

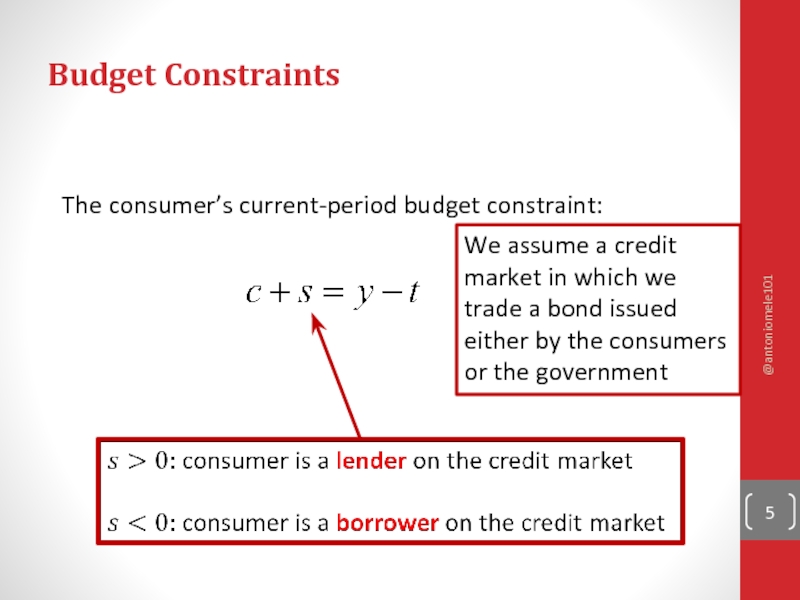

Слайд 5Budget Constraints

The consumer’s current-period budget constraint:

We assume a credit market in

@antoniomele101

Слайд 6Budget Constraints

The consumer’s future-period budget constraint:

Interest rate

@antoniomele101

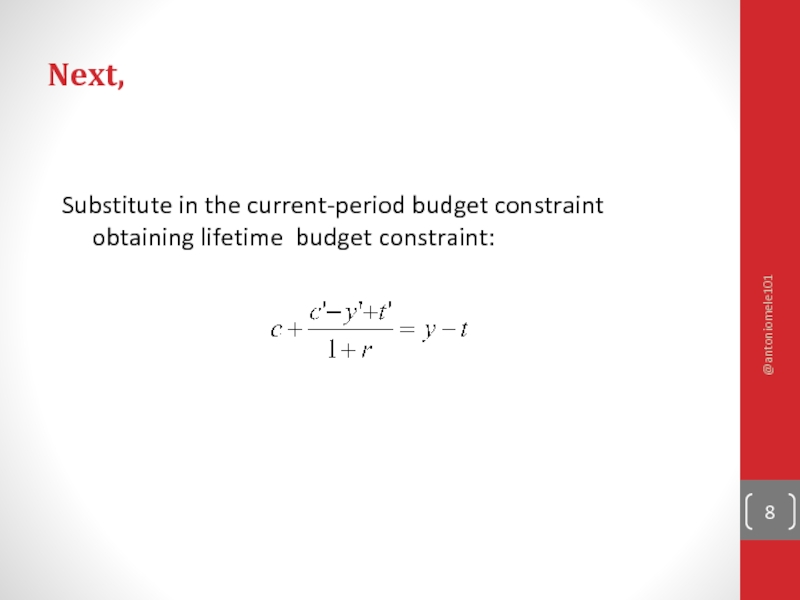

Слайд 8Next,

Substitute in the current-period budget constraint obtaining lifetime budget constraint:

@antoniomele101

Слайд 9Consumer’s Lifetime Budget Constraint

Substitute in the current-period budget constraint obtaining lifetime

@antoniomele101

Слайд 12Consumer’s Lifetime Budget Constraint

Endowment point: consumption bundle that consumer gets by

@antoniomele101

Слайд 18An Increase in Current Income for the Consumer

Current and future consumption

Saving increases.

The consumer acts to smooth consumption over time.

@antoniomele101

Слайд 20Observed Consumption-Smoothing Behavior

If all consumers try to smooth consumption overtime, we

Aggregate consumption of non-durables and services is smooth relative to aggregate income, but the consumption of durables is more volatile than income.

This is because durables consumption is economically more like investment than consumption.

@antoniomele101

Слайд 22Percentage Deviations from Trend in Consumption of Nondurables and Services and

@antoniomele101

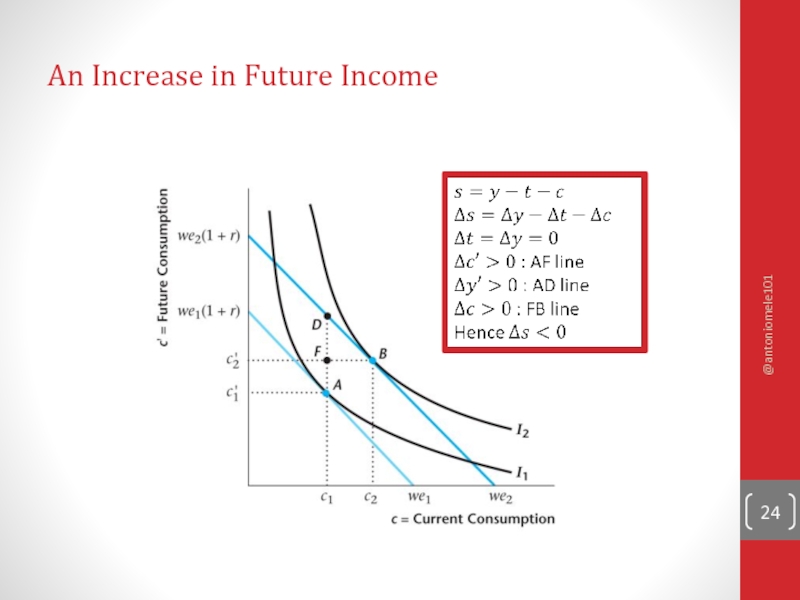

Слайд 23An Increase in Future Income for the Consumer

Current and future consumption

Saving decreases.

The consumer acts to smooth consumption over time.

@antoniomele101

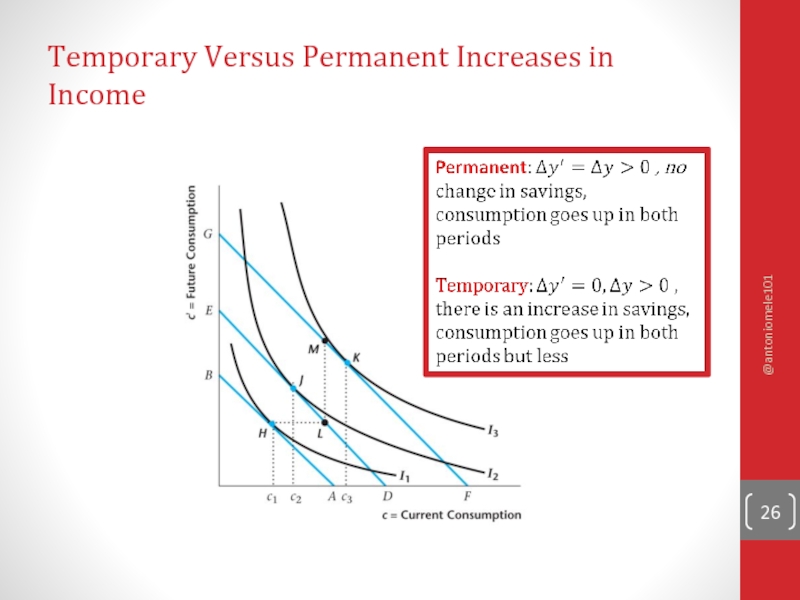

Слайд 25Temporary and Permanent Increases in Income

As a permanent increase in income

A consumer will tend to save most of a purely temporary income increase.

This is the permanent income hypothesis by Milton Friedman

@antoniomele101

Слайд 28An Increase in the Market Real Interest Rate

An increase in the

@antoniomele101

Слайд 33Introducing the government

Government buys G, financed either with taxes or debt.

T=Nt, T’=Nt’

Private and government bonds are indistinguishable, have same interest rate r

@antoniomele101

Слайд 34Government Budget Constraints

The government’s current-period budget constraint:

@antoniomele101

Слайд 35Government Budget Constraints

The government’s future-period budget constraint:

@antoniomele101

Слайд 36Government Budget Constraints

The government’s present-value budget constraint:

@antoniomele101

Слайд 37Competitive equilibrium

Each consumer chooses current and future consumption and savings optimally

The government present-value budget constraint holds

The credit market clears

@antoniomele101

Слайд 38Credit Market Equilibrium Condition

Total private savings is equal to the quantity

@antoniomele101

Слайд 40Income-Expenditure Identity

Credit market equilibrium implies that the income-expenditure identity holds.

@antoniomele101

Слайд 41Ricardian Equivalence

The Ricardian Equivalence Theorem states that , under some conditions,

@antoniomele101

Слайд 42Ricardian Equivalence

Key equation: The consumer’s lifetime tax burden is equal to

implies

@antoniomele101

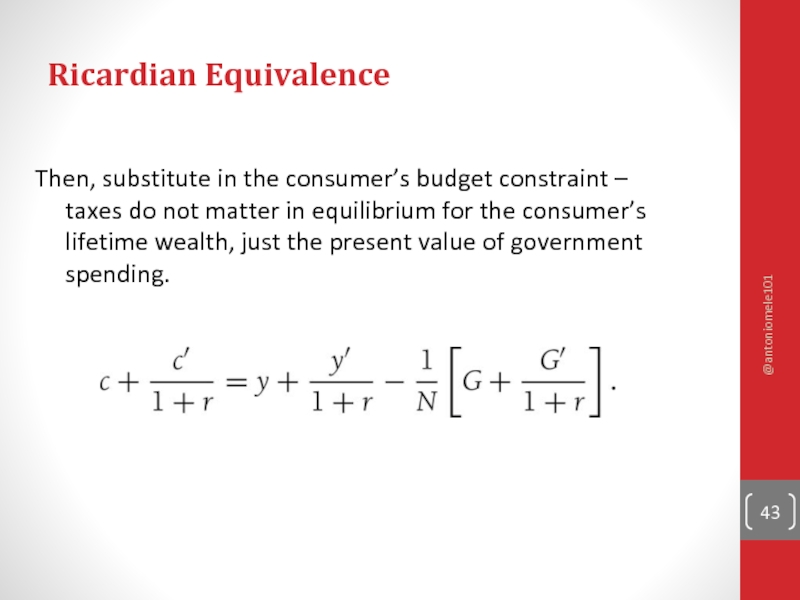

Слайд 43Ricardian Equivalence

Then, substitute in the consumer’s budget constraint – taxes do

@antoniomele101

Слайд 46Discussion of the assumptions

Ricardian equivalence theorems says government debt represents our

It’s a good benchmark to start thinking about government debt, however some of the assumptions are very strong!

Situations in which it might not hold:

Heterogeneity: different taxes for different people

Finite lifetimes

Distortionary taxes

Imperfections in the credit markets

@antoniomele101

Слайд 47Readings

Savings are generally a good idea http://www.youtube.com/watch?v=C_8TGTKdrlY

The cost of repair http://www.economist.com/node/17173933?story_id=17173933

Economists

@antoniomele101