- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Changing Relationship between Investors and Investments презентация

Содержание

- 1. The Changing Relationship between Investors and Investments

- 2. The changing investment ecosystem: The evolution of the advisor-investor relationship and the trends to watch

- 3. How we used to invest: Change

- 4. Booz & Co Global Wealth Management Outlook 2014/15

- 5. Global HNWI wealth is growing, as is

- 6. Big Banks are trying to react

- 7. Financials services industry is ripe for disruption

- 8. Regulatory Developments: New rules Create

- 9. Regulatory Developments: New rules Create Opportunities

- 10. HNWI want more than Transaction & Information

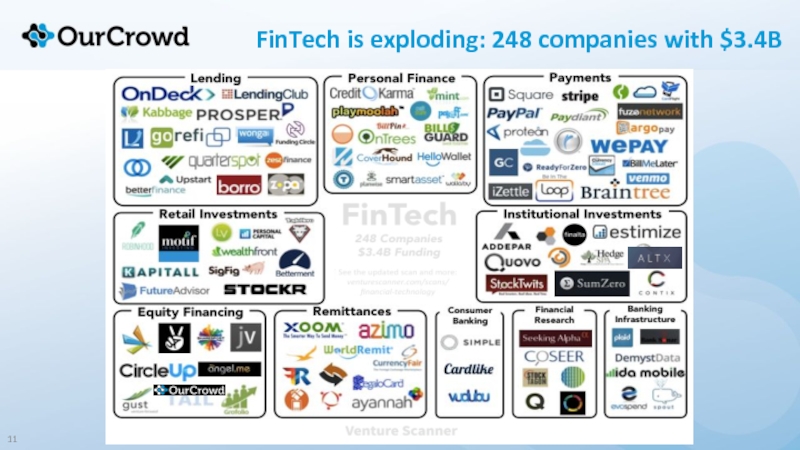

- 11. FinTech is exploding: 248 companies with $3.4B

- 12. For the people, by the people: Moving from passive investing to participatory investing via crowdfunding

- 13. Crowdfunding: Competitive Landscape There has been

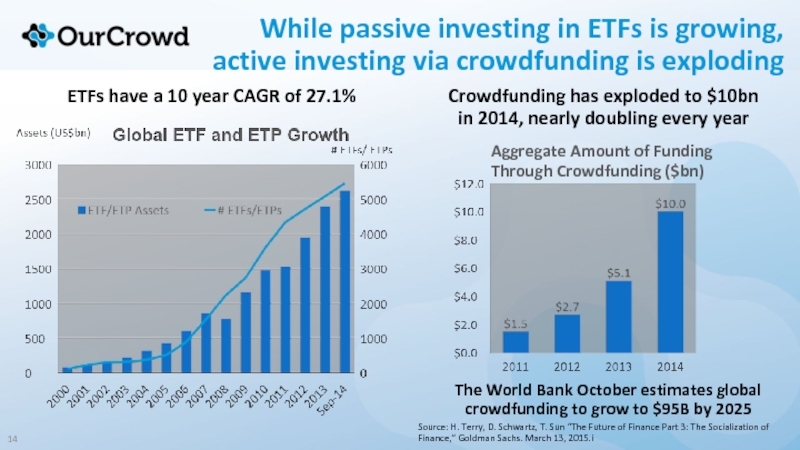

- 14. While passive investing in ETFs is growing,

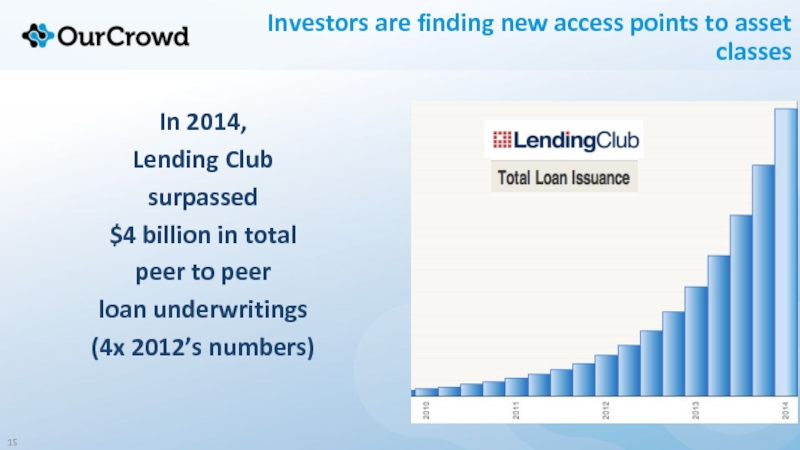

- 15. Investors are finding new access points to

- 16. Fund outflows increase as investors seek alpha

- 17. Selection & due diligence matters even

- 18. Asset Class Drivers Capital Markets Environment Pace

- 19. Wisdom of the crowd: How individual investors

- 20. Of the $4T opportunity created by the

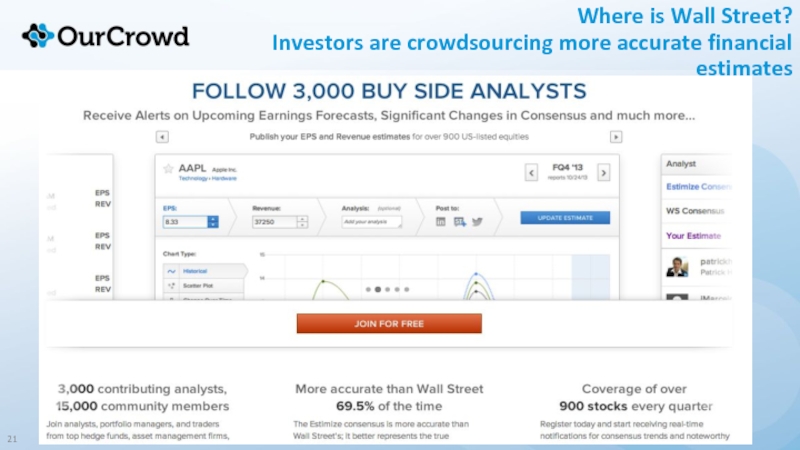

- 21. Where is Wall Street? Investors are crowdsourcing more accurate financial estimates

- 22. Crowdfunding is growing rapidly Crowdfunding is

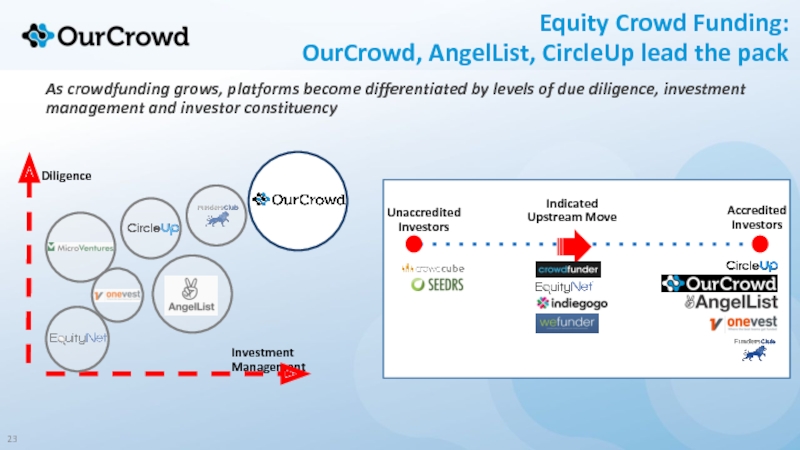

- 23. As crowdfunding grows, platforms become differentiated by

- 24. Israel Case Study: “Move over, Silicon Valley…”

- 25. Israel is one of the world’s top

- 26. The OurCrowd Model

- 27. Creating a new class of investment:

- 28. Why OurCrowd Clients want

- 29. Foundation/Brand Founded in “Start-up Nation,” Israel, home

- 30. We do not invest alone—and increasingly our

- 31. We’ve invested in 62 companies with ~30 follow on rounds OurCrowd’s portfolio

Слайд 2The changing investment ecosystem:

The evolution of the advisor-investor relationship and the

Слайд 3How we used to invest: Change is not new in our

Brokerage, Commission-Trading, & Asymmetry of Information

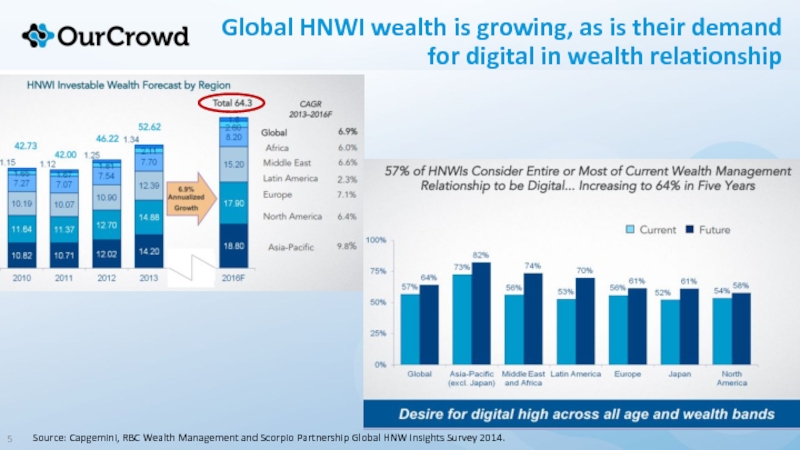

Слайд 5Global HNWI wealth is growing, as is their demand for digital

Source: Capgemini, RBC Wealth Management and Scorpio Partnership Global HNW Insights Survey 2014.

Слайд 7Financials services industry is ripe for disruption

According to the yearly Edelman

Finance is the least trusted of all industries

Слайд 8

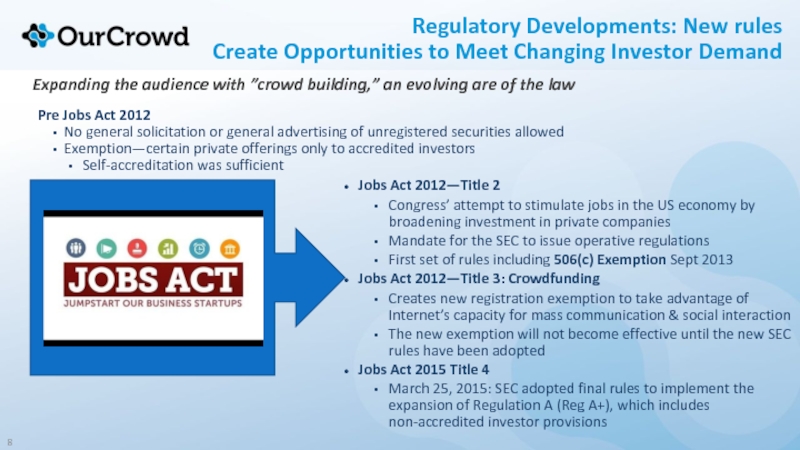

Regulatory Developments: New rules

Create Opportunities to Meet Changing Investor Demand

Expanding

Pre Jobs Act 2012

No general solicitation or general advertising of unregistered securities allowed

Exemption—certain private offerings only to accredited investors

Self-accreditation was sufficient

Jobs Act 2012—Title 2

Congress’ attempt to stimulate jobs in the US economy by broadening investment in private companies

Mandate for the SEC to issue operative regulations

First set of rules including 506(c) Exemption Sept 2013

Jobs Act 2012—Title 3: Crowdfunding

Creates new registration exemption to take advantage of Internet’s capacity for mass communication & social interaction

The new exemption will not become effective until the new SEC rules have been adopted

Jobs Act 2015 Title 4

March 25, 2015: SEC adopted final rules to implement the expansion of Regulation A (Reg A+), which includes non-accredited investor provisions

Слайд 9Regulatory Developments: New rules

Create Opportunities to Meet Changing Investor Demand

Rule

General solicitation and general advertising allowed

All US residents now able to see & attend meetings with actively funding companies (whether accredited or not)

Web site to contain limited information on funding companies for US users only

Only accredited investors can actually purchase

Definition of accredited investor remains the same

Self Accreditation no longer enough—need to implement verification procedure

New Rule requires each US investor to provide certification letter

Issued by registered broker-dealer, RIA, licensed attorney or CPA

Needs to be renewed periodically

Confirm it is still accurate at the time of each investment

Relates to US residents only

Bad

Actor

Bad actor Provision

Issuers can only use Rule 506 offerings if no “bad actors” associated with them

SEC issued clear guidelines: get bad guys off the street → more investor protections

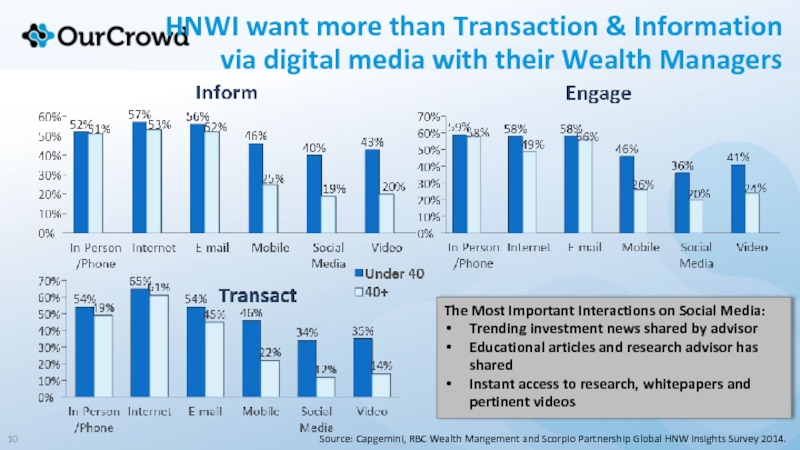

Слайд 10HNWI want more than Transaction & Information via digital media with

Source: Capgemini, RBC Wealth Mangement and Scorpio Partnership Global HNW Insights Survey 2014.

The Most Important Interactions on Social Media:

Trending investment news shared by advisor

Educational articles and research advisor has shared

Instant access to research, whitepapers and pertinent videos

Слайд 12For the people, by the people:

Moving from passive investing to participatory

Слайд 13Crowdfunding: Competitive Landscape

There has been a proliferation of platforms

Source: A

Слайд 14While passive investing in ETFs is growing, active investing via crowdfunding

Source: H. Terry, D. Schwartz, T. Sun “The Future of Finance Part 3: The Socialization of Finance,” Goldman Sachs. March 13, 2015.i

Crowdfunding has exploded to $10bn in 2014, nearly doubling every year

Aggregate Amount of Funding

Through Crowdfunding ($bn)

The World Bank October estimates global crowdfunding to grow to $95B by 2025

ETFs have a 10 year CAGR of 27.1%

Слайд 15Investors are finding new access points to asset classes

In 2014,

Lending

surpassed

$4 billion in total

peer to peer

loan underwritings

(4x 2012’s numbers)

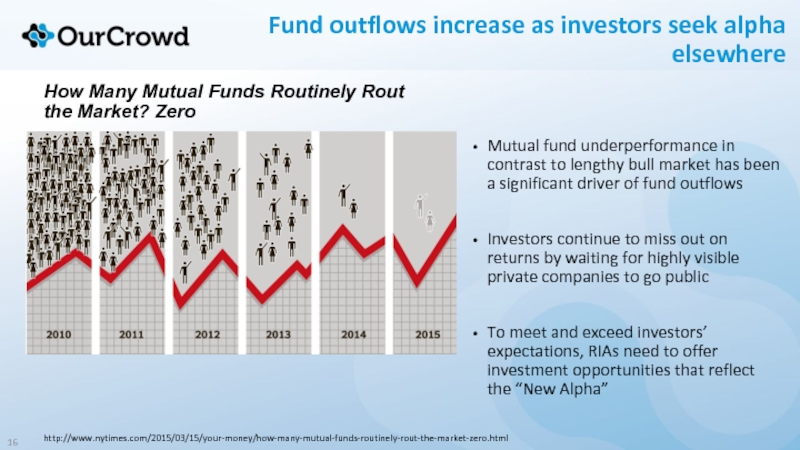

Слайд 16Fund outflows increase as investors seek alpha elsewhere

Mutual fund underperformance in

Investors continue to miss out on returns by waiting for highly visible private companies to go public

To meet and exceed investors’ expectations, RIAs need to offer investment opportunities that reflect the “New Alpha”

How Many Mutual Funds Routinely Rout the Market? Zero

http://www.nytimes.com/2015/03/15/your-money/how-many-mutual-funds-routinely-rout-the-market-zero.html

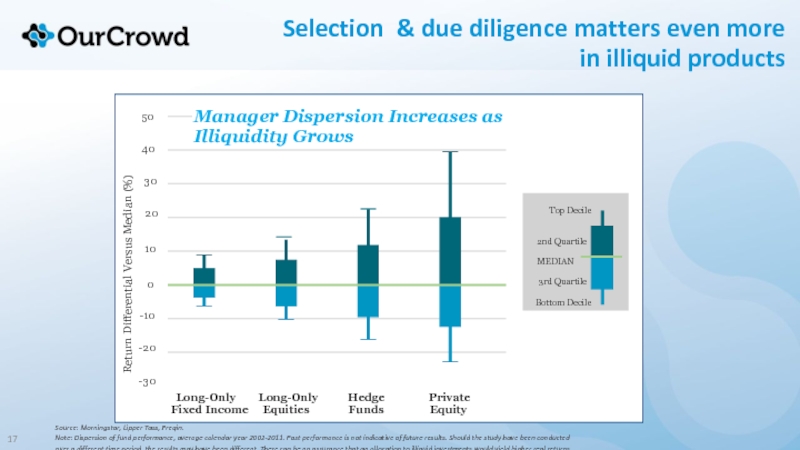

Слайд 17

Selection & due diligence matters even more

in illiquid products

Source: Morningstar,

Note: Dispersion of fund performance, average calendar year 2002-2011. Past performance is not indicative of future results. Should the study have been conducted

over a different time period, the results may have been different. There can be no assurance that an allocation to illiquid investments would yield higher real returns.

Manager Dispersion Increases as Illiquidity Grows

Слайд 18Asset Class Drivers

Capital Markets Environment

Pace of Innovation

Venture capital flows

Manager Specific Drivers

Ability

Access to attractive deals

Ability to create value through active involvement in portfolio company

Breaking Down Venture Capital Risk and Return

Слайд 19Wisdom of the crowd:

How individual investors as a collective are driving

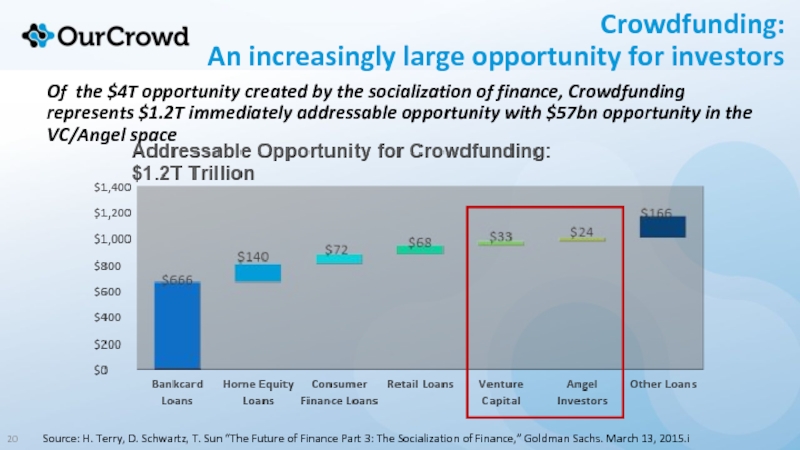

Слайд 20Of the $4T opportunity created by the socialization of finance, Crowdfunding

Crowdfunding:

An increasingly large opportunity for investors

Source: H. Terry, D. Schwartz, T. Sun “The Future of Finance Part 3: The Socialization of Finance,” Goldman Sachs. March 13, 2015.i

Слайд 22Crowdfunding is growing rapidly

Crowdfunding is truly global

Investors are responding by participating

Слайд 23As crowdfunding grows, platforms become differentiated by levels of due diligence,

Equity Crowd Funding:

OurCrowd, AngelList, CircleUp lead the pack

Слайд 24Israel Case Study: “Move over, Silicon Valley…”

As seen in the Economist

Israel is #2

Слайд 25Israel is one of the world’s top marketplaces for innovation

In the

these companies

all bought

at least one Israeli

start-up.

Слайд 27Creating a new class of investment:

Crowdsourced Equity Capital Investing

OurCrowd’s platform

Equity Crowd Funding at the core of OurCrowd’s model

Creating content & communities of investors, experts & alumni

Utilize voting/polling of experts as part of due diligence

Harnessing the wisdom of crowds and expert groups

Funding

Voting

Wisdom

Creating

Слайд 28

Why OurCrowd

Clients want unique opportunities, diversified across sector and stage,

delivered

which produces performance at a fair cost,

all wrapped in a world class networking/client experience

Entrepreneurs want efficient and fair access to capital,

a process they can trust, enabled through a system

that raises their profile and leverages their marketing efforts,

while supporting their growth and development

Democratizing Wealth Creation and Access to Capital

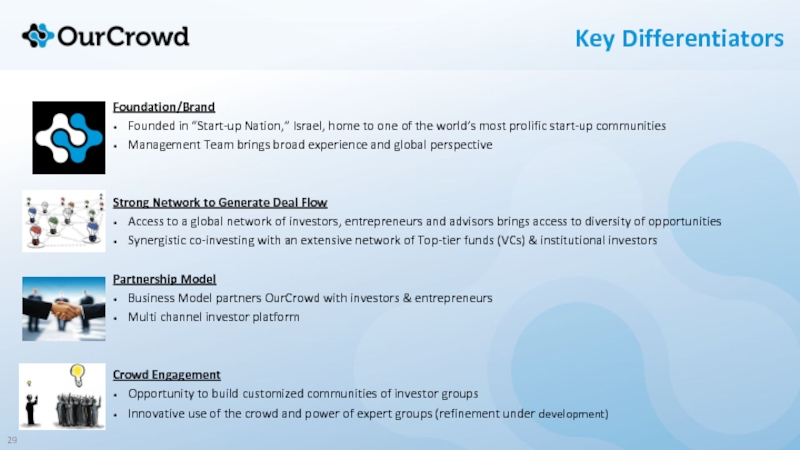

Слайд 29Foundation/Brand

Founded in “Start-up Nation,” Israel, home to one of the world’s

Management Team brings broad experience and global perspective

Strong Network to Generate Deal Flow

Access to a global network of investors, entrepreneurs and advisors brings access to diversity of opportunities

Synergistic co-investing with an extensive network of Top-tier funds (VCs) & institutional investors

Partnership Model

Business Model partners OurCrowd with investors & entrepreneurs

Multi channel investor platform

Crowd Engagement

Opportunity to build customized communities of investor groups

Innovative use of the crowd and power of expert groups (refinement under development)

Key Differentiators

Слайд 30We do not invest alone—and increasingly our partners want to access

OurCrowd: Partnering With Leading Institutions