- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

25 Reasons Why Warren Buffett Is a Multi-Billionaire презентация

Содержание

- 1. 25 Reasons Why Warren Buffett Is a Multi-Billionaire

- 2. 25. He started investing young Warren Buffett

- 3. 24. He learned from the best As

- 4. 23. He didn’t stop learning Even today,

- 5. 22. He lives by two simple rules

- 6. 21. He owns up to his mistakes

- 7. 20. He found a good business partner

- 8. 19. They got lucky “Charlie and I

- 9. 18. He buys stocks and holds them…

- 10. 17. He lives within his means Despite

- 11. 16. He values reputation “It takes 20

- 12. 15. He loves the unloved Most people

- 13. 14. He waits. And then waits some

- 14. 13. He knows how to be “different”

- 15. 12. He stays within his circle of

- 16. 11. He trusts others Berkshire Hathaway owns

- 17. 10. He focuses on what he can

- 18. 9. He realized the power of insurance

- 19. 8. He is humble If most of

- 20. 7. He doesn’t pay a dividend Dividends

- 21. 6. He doesn’t check stock prices daily

- 22. 5. Rhetoric doesn’t scare him Turn on

- 23. 4. He loves his job You don’t

- 24. 3. He collaborates for success Some powerful

- 25. 2. He thinks in “generations” Warren Buffett

- 26. 1. He never retired Warren Buffett could

- 27. Warren Buffett and Berkshire Hathaway own

Слайд 225. He started investing young

Warren Buffett bought his first stock at

Buffett quickly became hooked on all things business – he bought a paper route at 13 and never looked back.

Слайд 324. He learned from the best

As a 20 year-old, Warren Buffett

Graham is known as the father of “value investing”

Слайд 423. He didn’t stop learning

Even today, Buffett says he spends time

“I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think.”

Photo: Timeless Books

Слайд 621. He owns up to his mistakes

Being a professional investor for

Buffett has made plenty of mistakes, but he owns them and learns from them.

Слайд 720. He found a good business partner

Warren Buffett met Charlie Munger

Meeting Munger changed what Buffett looked for in a stock and company. Munger stressed the importance of qualitative factors – not just the numbers.

Слайд 819. They got lucky

“Charlie and I are extraordinarily lucky. We were

-Buffett

Слайд 918. He buys stocks and holds them… forever

Warren Buffett and Berkshire

Berkshire’s original $1.3 billion position is now worth over $16 billion.

Buffett has said he never plans on selling a single share.

Слайд 1017. He lives within his means

Despite being worth over $60 billion,

Слайд 1116. He values reputation

“It takes 20 years to build a reputation

Слайд 1215. He loves the unloved

Most people get caught up with the

"I will tell you now that we have embraced the 21st century by entering such cutting-edge industries as brick, carpet, insulation and paint. Try to control your excitement.“

-Buffett

Слайд 1314. He waits. And then waits some more

Perhaps no investor is

Buffett bought shares of Washington Post in 1973 for $10 million. Nearly a year after his initial investment, he had endured a 20% unrealized loss on the position.

By 2004, Buffett had an unrealized gain of $1.7 billion on the position.

Waiting paid off.

Слайд 1413. He knows how to be “different”

During the 2008 financial crisis,

Buffett did.

He penned this article for the New York Times and was proved correct when the world didn’t end.

Слайд 1512. He stays within his circle of competence

Warren Buffett isn’t dumb.

He sticks to the industries (banks, insurance, consumer goods) that he knows and avoid the ones (tech) he doesn’t.

Слайд 1611. He trusts others

Berkshire Hathaway owns dozens of subsidiaries.

Warren Buffett

Слайд 1710. He focuses on what he can control

Warren Buffett is an

Buffett only focuses on the factors he can control: His emotions and his own decisions.

Слайд 189. He realized the power of insurance

An insurance policy buyer pays

Buffett calls insurance:

“Berkshire’s core operation and the engine that has consistently propelled our expansion since 1967.”

Слайд 198. He is humble

If most of us had over $60 billion,

Not Buffett. He still sings the praises of others.

Buffett on the head of Berkshire’s insurance operations (Ajit Jain):

"If Charlie, I and Ajit are ever in a sinking boat – and you can only save one of us – swim to Ajit

Слайд 207. He doesn’t pay a dividend

Dividends can be great. It’s cold-hard

But Buffett understood early that he could earn more on that money by keeping in Berkshire’s pockets and rewarding investors by growing the business.

Слайд 216. He doesn’t check stock prices daily

Daily stock prices mean basically

“Games are won by players who focus on the playing field -- not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.”

-Buffett

Photo: Rafael Matsunaga

Слайд 225. Rhetoric doesn’t scare him

Turn on the local or national news,

Buffett looks at the glass half-full.

“Of course, the immediate future is uncertain; America has faced the unknown since 1776.”

Слайд 234. He loves his job

You don’t work for over 60 years

"I found what I love to do very early...when I was seven or eight years old I knew that this particular game really, really intrigued me. And then I had some great teachers along the way."

-Buffett

Слайд 243. He collaborates for success

Some powerful people want to control everything

He recently teamed up with a private equity firm, 3G Capital, to buy Heinz. Buffett saw how 3G could help the company and didn’t let pride stand in the way.

Слайд 252. He thinks in “generations”

Warren Buffett is 83 years old, but

Lesser minds would try to squeeze out all of the glory while they are still around. Berkshire’s big moves into the energy and railroad business show Buffett’s willingness to think beyond most people’s timeframes.

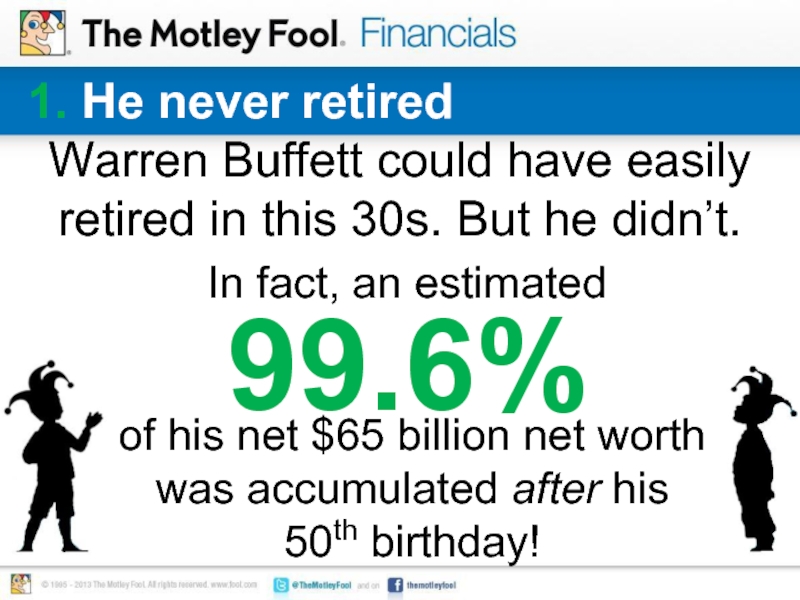

Слайд 261. He never retired

Warren Buffett could have easily retired in this

In fact, an estimated

99.6%

of his net $65 billion net worth was accumulated after his 50th birthday!