This Week

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why EXCO Resources, Peabody Energy, and W&T Offshore Made Huge Moves This Week презентация

Содержание

- 1. Why EXCO Resources, Peabody Energy, and W&T Offshore Made Huge Moves This Week

- 2. Despite a lot of movement, the

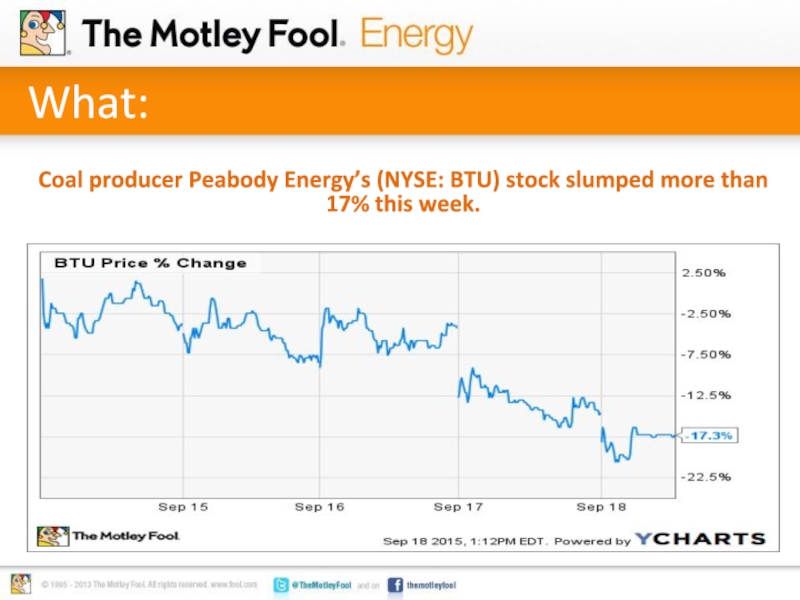

- 3. What: Coal producer Peabody Energy’s (NYSE: BTU) stock slumped more than 17% this week.

- 4. So What: Key driver: Peabody Energy announced

- 5. Now What: Recent news that actually mattered:

- 6. What: Oil producer W&T Offshore (NYSE: WTI) leapt more than 18% this week.

- 7. So What: Key driver: Oil prices and

- 8. Now What: Recent news that actually mattered:

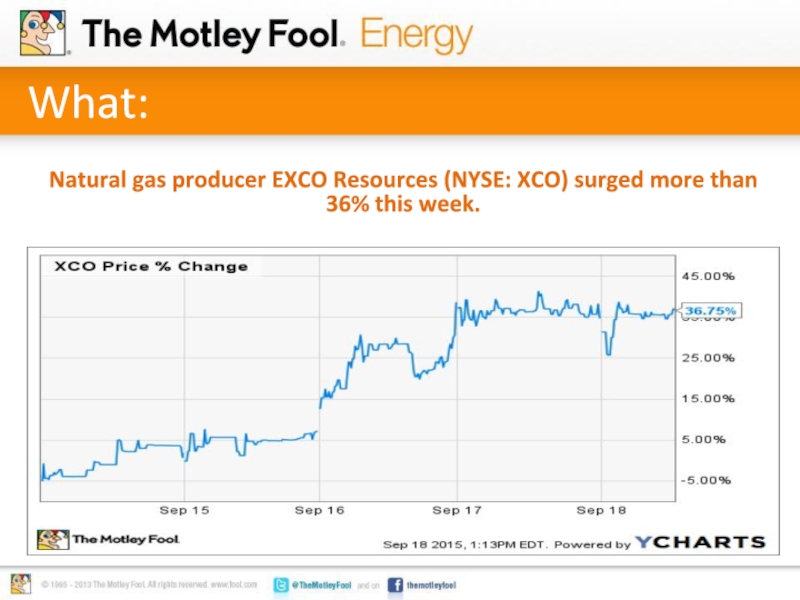

- 9. What: Natural gas producer EXCO Resources (NYSE: XCO) surged more than 36% this week.

- 10. So What: Key driver: Similar to W&T

- 11. Now What: Recent news that actually mattered:

- 12. This could be the next billion-dollar iSecret

Слайд 2

Despite a lot of movement, the market pretty much ended the

week where it left off. Oddly enough, the price of oil did the same. After bounding higher mid-week after oil inventories, crude settled right around $45 a barrel, which is pretty much where it started the week.

This led to some really strange moves among energy stocks with dozens up double-digits, while others fizzled out. In fact, there was little, if any, news driving these huge moves other than market movements. As such, the biggest percentage moves made this week had no news of substance. Still, the three largest movers this week, according to S&P Capital IQ data, present an interesting case study. That's why we'll still venture closer to see why EXCO Resources (NYSE: XCO), Peabody Energy (NYSE: BTU), and W&T Offshore (NYSE: WTI) went on such a wild ride this week.

This led to some really strange moves among energy stocks with dozens up double-digits, while others fizzled out. In fact, there was little, if any, news driving these huge moves other than market movements. As such, the biggest percentage moves made this week had no news of substance. Still, the three largest movers this week, according to S&P Capital IQ data, present an interesting case study. That's why we'll still venture closer to see why EXCO Resources (NYSE: XCO), Peabody Energy (NYSE: BTU), and W&T Offshore (NYSE: WTI) went on such a wild ride this week.

Слайд 4So What:

Key driver: Peabody Energy announced a 1-for-15 reverse stock split

The split will push Peabody Energy’s stock price out of the single digits and likely mute some of its recent double digit volatility

Слайд 5Now What:

Recent news that actually mattered: Peabody Energy has reportedly hired

a bank to advise it on how to restructure its debt outside of bankruptcy

Key takeaway: Stock splits are meaningless, it’s Peabody Energy’s balance sheet moves that matter right now

Key takeaway: Stock splits are meaningless, it’s Peabody Energy’s balance sheet moves that matter right now

Слайд 7So What:

Key driver: Oil prices and possible short covering

W&T Offshore has

more than 33% of its shares sold short, so it will be quite volatile when oil prices rally as short sellers need to buy to cover their short position

Слайд 8Now What:

Recent news that actually mattered: W&T recently improved its financial

position having announced the sale of its Yellow Rose field for $376 million

Key takeaway: While higher oil prices will help, fixing its balance sheet is the key to W&T Offshore’s long-term success

Key takeaway: While higher oil prices will help, fixing its balance sheet is the key to W&T Offshore’s long-term success

Слайд 10So What:

Key driver: Similar to W&T Offshore, as oil and short

covering likely fueled this week’s gains

While higher oil prices will help, that’s not what will save EXCO Resources in the long-term

While higher oil prices will help, that’s not what will save EXCO Resources in the long-term

Слайд 11Now What:

Recent news that actually mattered: EXCO Resources recently closed a

services and investment agreement with Bluescape Resources

Agreement provides executive leadership, a strategic plan, and a small equity infusion

Key takeaway: EXCO needed a turnaround plan and cash, this deal provides both

Agreement provides executive leadership, a strategic plan, and a small equity infusion

Key takeaway: EXCO needed a turnaround plan and cash, this deal provides both