O’Reilly

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Will Keurig Green Mountain’s Cold Brewing System Be a Success? By Sean O’Reilly презентация

Содержание

- 1. Will Keurig Green Mountain’s Cold Brewing System Be a Success? By Sean O’Reilly

- 2. The Kold System The Kold is Keurig

- 3. The Kold System cont. The Kold will

- 4. Why The Kold Is So Important In

- 5. Why The Kold Is So Important Cont.

- 6. Bull Case: The Kold’s Potential Market The

- 7. Bull Case: The Kold’s Potential Market Cont.

- 8. Bear Case: Can Kold Succeed Where Sodastream

- 9. Bear Case: Can Kold Succeed Where Sodastream

- 10. Bear Case: Can Kold Succeed Where Sodastream

- 11. Key Takeaways Keurig Green Mountain has a

Слайд 2The Kold System

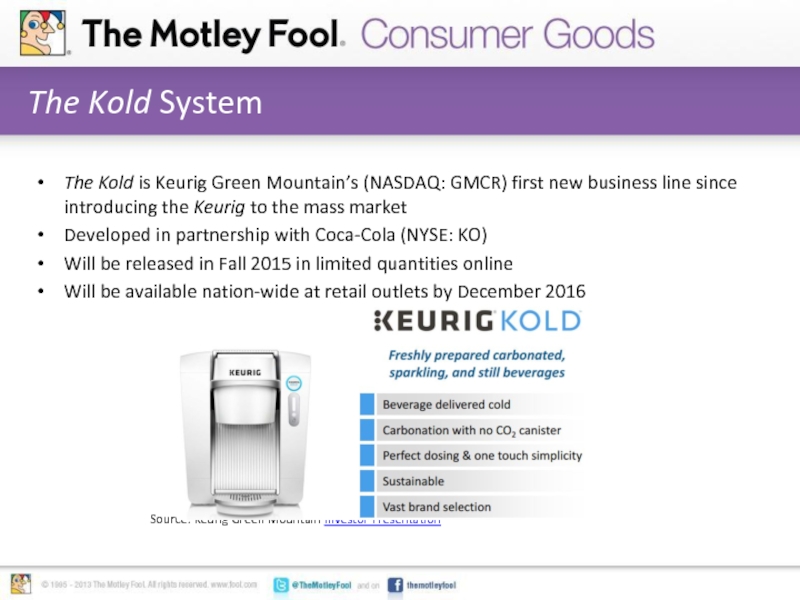

The Kold is Keurig Green Mountain’s (NASDAQ: GMCR) first

new business line since introducing the Keurig to the mass market

Developed in partnership with Coca-Cola (NYSE: KO)

Will be released in Fall 2015 in limited quantities online

Will be available nation-wide at retail outlets by December 2016

Source: Keurig Green Mountain Investor Presentation

Developed in partnership with Coca-Cola (NYSE: KO)

Will be released in Fall 2015 in limited quantities online

Will be available nation-wide at retail outlets by December 2016

Source: Keurig Green Mountain Investor Presentation

Слайд 3The Kold System cont.

The Kold will offer branded products from Coca-Cola

and Dr. Pepper Snapple, as well as GMCR’s own brands of ice tea, lemonade, carbonated water, etc…

GMCR believes that the Kold beverage system will deliver on the same elements as the Keurig® hot beverage system: quality, convenience, choice and simplicity

Source: Keurig Green Mountain Investor Presentation

GMCR believes that the Kold beverage system will deliver on the same elements as the Keurig® hot beverage system: quality, convenience, choice and simplicity

Source: Keurig Green Mountain Investor Presentation

Слайд 4Why The Kold Is So Important

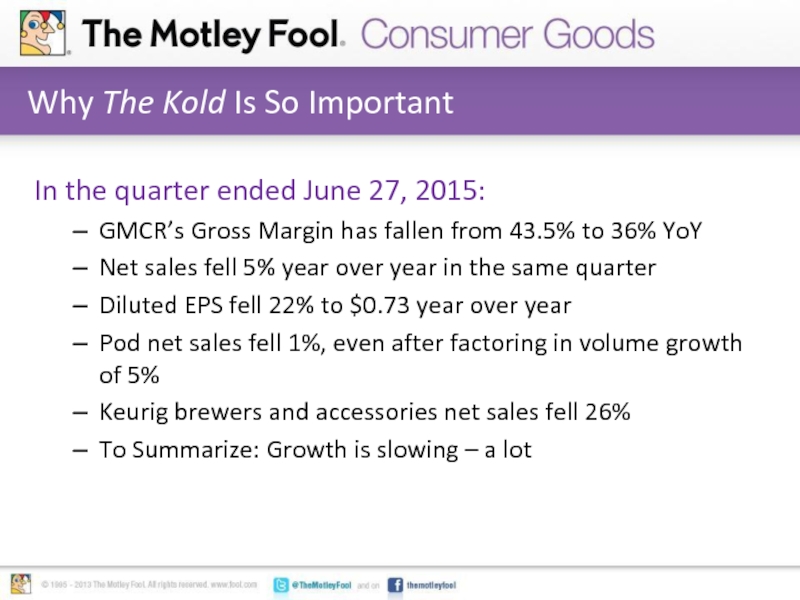

In the quarter ended June 27,

2015:

GMCR’s Gross Margin has fallen from 43.5% to 36% YoY

Net sales fell 5% year over year in the same quarter

Diluted EPS fell 22% to $0.73 year over year

Pod net sales fell 1%, even after factoring in volume growth of 5%

Keurig brewers and accessories net sales fell 26%

To Summarize: Growth is slowing – a lot

GMCR’s Gross Margin has fallen from 43.5% to 36% YoY

Net sales fell 5% year over year in the same quarter

Diluted EPS fell 22% to $0.73 year over year

Pod net sales fell 1%, even after factoring in volume growth of 5%

Keurig brewers and accessories net sales fell 26%

To Summarize: Growth is slowing – a lot

Слайд 5Why The Kold Is So Important Cont.

The Keurig 2.0 – once

thought to be the company’s saving grace - has been a disaster

GMCR continues to generate profits thanks to its pod business, but it’s days of growth appear to be over

In-home coffee brewing business is suffering from both pod price competition and market saturation

Keurig Green Mountain as pinned all of its future growth on The Kold

GMCR continues to generate profits thanks to its pod business, but it’s days of growth appear to be over

In-home coffee brewing business is suffering from both pod price competition and market saturation

Keurig Green Mountain as pinned all of its future growth on The Kold

Слайд 6Bull Case: The Kold’s Potential Market

The Kold was born out of

the company’s partnership with Coca-Cola (NYSE: KO) which also owns 16.8% of GMCR

Partnership with Coca-Cola, the largest and most successful beverage purveyor in the world, is a bullish point

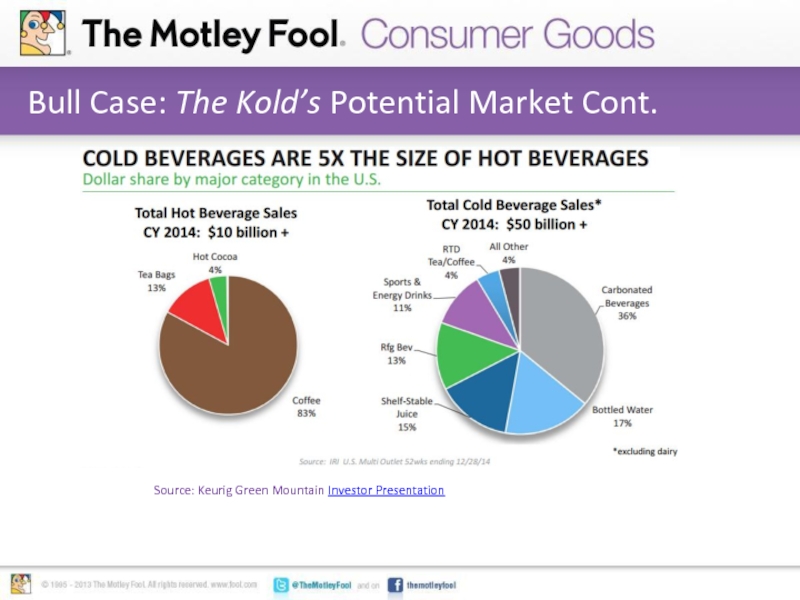

The potential market for cold beverage is multiples of the hot beverage market

Another potential use for the Kold is in-home alcoholic cocktail creation

Partnership with Coca-Cola, the largest and most successful beverage purveyor in the world, is a bullish point

The potential market for cold beverage is multiples of the hot beverage market

Another potential use for the Kold is in-home alcoholic cocktail creation

Слайд 7Bull Case: The Kold’s Potential Market Cont.

Source: Keurig Green Mountain Investor

Presentation

Слайд 8Bear Case: Can Kold Succeed Where Sodastream Failed?

Investors already have a

case study for in-home cold beverage systems – Sodastream (NASDAQ: SODA)

Sodastream too offered investors two somewhat separate businesses

A stable, profitable, European-based carbonated water business

A new U.S. focused soda business that offered investors a good deal of potential upside IF the American consumer bought in

The results of Sodastream’s U.S. push were not good

Sodastream too offered investors two somewhat separate businesses

A stable, profitable, European-based carbonated water business

A new U.S. focused soda business that offered investors a good deal of potential upside IF the American consumer bought in

The results of Sodastream’s U.S. push were not good

Слайд 9Bear Case: Can Kold Succeed Where Sodastream Failed? Cont.

For its FY

2014:

Revenues fell 9% YoY to $511.77 mil.

Net income fell from $42.03 mil. to a depressing 12.3 mil.

Losses marred by inventory write downs in anticipation of U.S.-division sales that never materialized

For the quarter ended June 30, 2015:

Revenues fell 28% to 101.7 mil.

Net Income fell from $9.2 mil. To $3.5 mil. YoY

Sodastream has more or less thrown in the towel as an in-home soda system company, opting to become a “ ’Water brand’ behind a health and wellness positioning” according to CEO Daniel Birnbaum in SODA’s Q2 Conference call

Revenues fell 9% YoY to $511.77 mil.

Net income fell from $42.03 mil. to a depressing 12.3 mil.

Losses marred by inventory write downs in anticipation of U.S.-division sales that never materialized

For the quarter ended June 30, 2015:

Revenues fell 28% to 101.7 mil.

Net Income fell from $9.2 mil. To $3.5 mil. YoY

Sodastream has more or less thrown in the towel as an in-home soda system company, opting to become a “ ’Water brand’ behind a health and wellness positioning” according to CEO Daniel Birnbaum in SODA’s Q2 Conference call

Слайд 10Bear Case: Can Kold Succeed Where Sodastream Failed? Cont.

The Kold will

be priced at $299

Coca-Cola flavored cold beverage pods are estimated to cost $0.99 to $1.29 per pod at retail

This pricing does not compare well with Sodastream’s models which start at $80

Coca-Cola flavored cold beverage pods are estimated to cost $0.99 to $1.29 per pod at retail

This pricing does not compare well with Sodastream’s models which start at $80

Слайд 11Key Takeaways

Keurig Green Mountain has a lot riding on the Kold

It’s

hot-beverage Keurig based business is still profitable but it’s days of growth are gone

The weight of the evidence seems to imply that the Kold has a steep hill to climb

Investors hoping for the days of growth in both the company’s top and bottom lines need to have a high opinion of the Kold’s prospects

The weight of the evidence seems to imply that the Kold has a steep hill to climb

Investors hoping for the days of growth in both the company’s top and bottom lines need to have a high opinion of the Kold’s prospects