- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The 10 Highest Paid CEOs on Record презентация

Содержание

- 1. The 10 Highest Paid CEOs on Record

- 2. Notes on Executive Pay All data reflects

- 3. #10: Josh Sapan, AMC Networks Compensation: $40

- 4. #9: Leonard Schleifer, Regeneron Pharmaceuticals Compensation: $42

- 5. #8: Marissa Mayer, Yahoo! Compensation: $42 million

- 6. #7: Jay Brown, MBIA Compensation: $44 million

- 7. #6: Philippe Dauman, Viacom Compensation: $44 million

- 8. #5: Bob Iger, Disney Compensation: $46 million

- 9. #4: Les Moonves, CBS Compensation: $57 million

- 10. #3: Jon Feltheimer, Lions Gate Compensation: $64

- 11. #2: Mario Gabelli, GAMCO Compensation: $89 million

- 12. #1: David Zaslav, Discovery Communications Compensation: $156

- 13. DOES ANYTHING STICK OUT TO YOU ON

- 14. 3 COMPANIES POISED TO EXPLODE WHEN CABLE DIES!

Слайд 2Notes on Executive Pay

All data reflects 2014 compensation.

Compensation includes salary,

CEOs who were on their first year on the job were not included. The first year often includes heavy stock and option compensation which will not continue for the CEO’s tenure.

Compensation figures come from the AFL-CIO database on Executive Pay. Company metrics come from Yahoo! Finance and YCharts. All data regarding company performance is on an annualized basis starting when the CEO took over.

Слайд 3#10: Josh Sapan, AMC Networks

Compensation: $40 million

Stock returns: 17% per year

Revenue

Net income growth: 25% per year

Compensation as % of net income: 15.34%

Sapan’s numbers above are a little skewed. Though he has been CEO since 1995, AMC Networks has only been publicly traded since June of 2011.

Photo: AMC Networks

Слайд 4#9: Leonard Schleifer, Regeneron Pharmaceuticals

Compensation: $42 million

Stock returns: 14% per year

Revenue

Net income growth: 53% per year (since 2004)

Compensation as % of net income: 12.07%

Dr. Schleifer founded Regeneron back in 1988 and has led the company ever since.

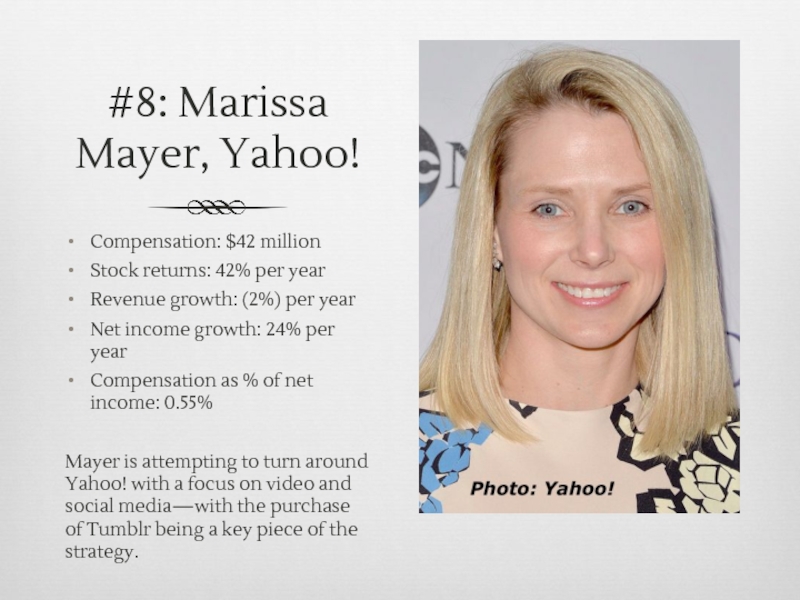

Слайд 5#8: Marissa Mayer, Yahoo!

Compensation: $42 million

Stock returns: 42% per year

Revenue growth:

Net income growth: 24% per year

Compensation as % of net income: 0.55%

Mayer is attempting to turn around Yahoo! with a focus on video and social media—with the purchase of Tumblr being a key piece of the strategy.

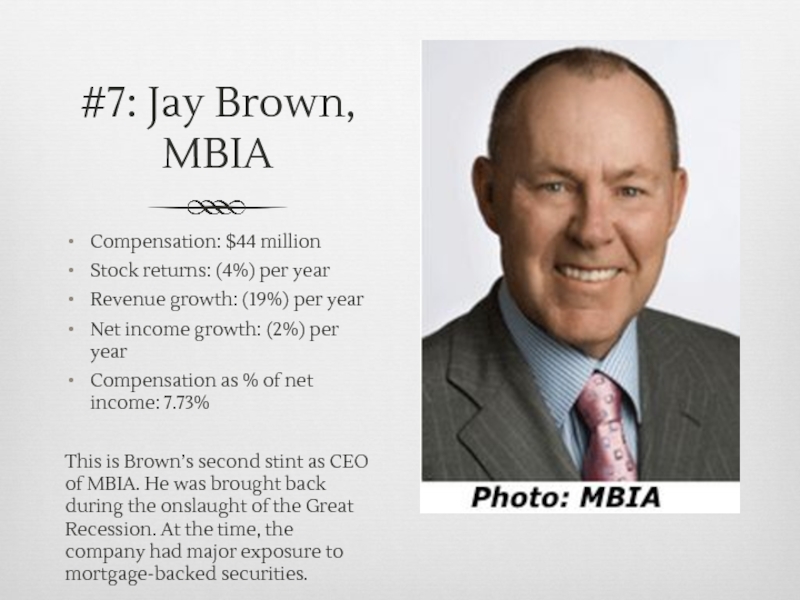

Слайд 6#7: Jay Brown, MBIA

Compensation: $44 million

Stock returns: (4%) per year

Revenue growth:

Net income growth: (2%) per year

Compensation as % of net income: 7.73%

This is Brown’s second stint as CEO of MBIA. He was brought back during the onslaught of the Great Recession. At the time, the company had major exposure to mortgage-backed securities.

Слайд 7#6: Philippe Dauman, Viacom

Compensation: $44 million

Stock returns: 6% per year

Revenue growth:

Net income growth: 4% per year

Compensation as % of net income: 1.84%

Dauman has run Viacom since it became a public company. It owns many popular networks, including MTV, SPIKE, Nickelodeon, and Comedy Central.

Photo: Joi, via Wikimedia Commons

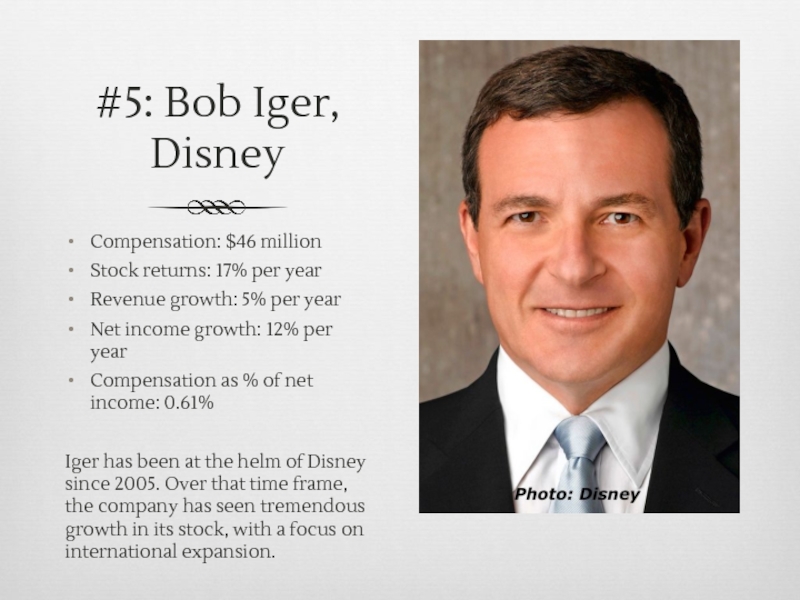

Слайд 8#5: Bob Iger, Disney

Compensation: $46 million

Stock returns: 17% per year

Revenue growth:

Net income growth: 12% per year

Compensation as % of net income: 0.61%

Iger has been at the helm of Disney since 2005. Over that time frame, the company has seen tremendous growth in its stock, with a focus on international expansion.

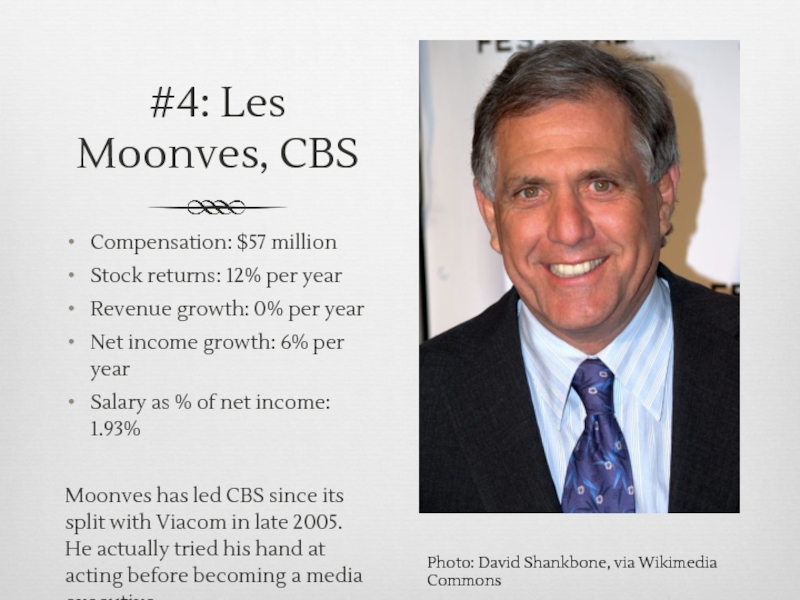

Слайд 9#4: Les Moonves, CBS

Compensation: $57 million

Stock returns: 12% per year

Revenue growth:

Net income growth: 6% per year

Salary as % of net income: 1.93%

Moonves has led CBS since its split with Viacom in late 2005. He actually tried his hand at acting before becoming a media executive.

Photo: David Shankbone, via Wikimedia Commons

Слайд 10#3: Jon Feltheimer, Lions Gate

Compensation: $64 million

Stock returns: 19% per year

Revenue

Net income growth: 43% per year

Compensation as % of net income: 35.16%

Feltheimer has been calling the shots at Lions Gate since 2000. During that timeframe, the company’s popular hits include Hunger Games and Breaking Bad.

Photo: Lions Gate

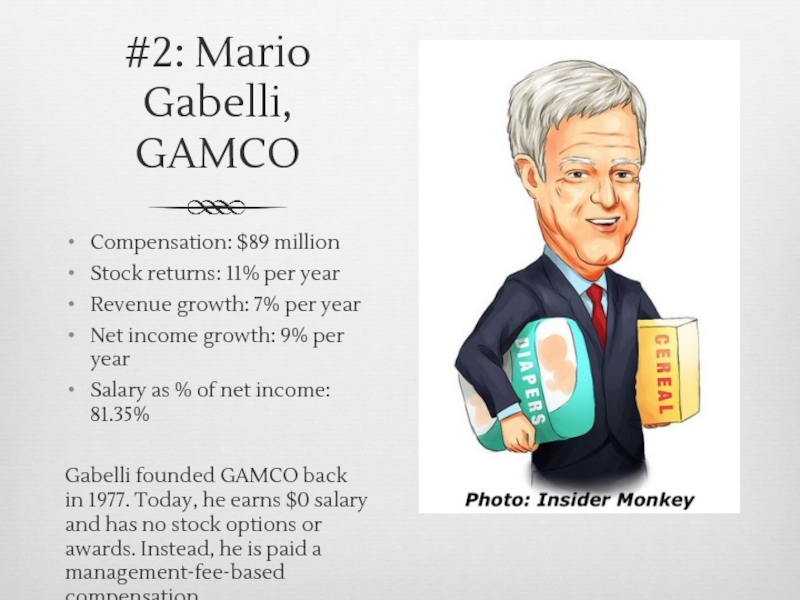

Слайд 11#2: Mario Gabelli, GAMCO

Compensation: $89 million

Stock returns: 11% per year

Revenue growth:

Net income growth: 9% per year

Salary as % of net income: 81.35%

Gabelli founded GAMCO back in 1977. Today, he earns $0 salary and has no stock options or awards. Instead, he is paid a management-fee-based compensation.

Слайд 12#1: David Zaslav, Discovery Communications

Compensation: $156 million

Stock returns: 16% per year

Revenue

Net income growth: 49% per year

Compensation as % of net income: 13.70%

Zaslav has run Discovery since early 2007. He has expanded the company’s reach with the TLC and Oprah’s OWN networks.

Photo: Discovery Communications

Слайд 13DOES ANYTHING STICK OUT TO YOU ON THIS LIST?

CEOs of media

That’s interesting, because if there’s any industry ripe for disruption, it’s media.

In fact, we believe that there are three companies that are set to dominate the new age of television and movies. Some of them have already been mentioned here. To find out which ones, continue on to the next slide.