- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

FUNDING HARDWARE STARTUPS презентация

Содержание

- 1. FUNDING HARDWARE STARTUPS

- 2. ABOUT ME RRE VENTURES | FUNDING HARDWARE

- 3. RRE VENTURES Established 1994 Most active early

- 4. Each investor views the world differently so

- 5. THE BASICS RRE VENTURES | FUNDING HARDWARE STARTUPS

- 6. YOUR FUNDING OPTIONS Debt / Credit

- 7. HOW VC WORKS RRE VENTURES | FUNDING

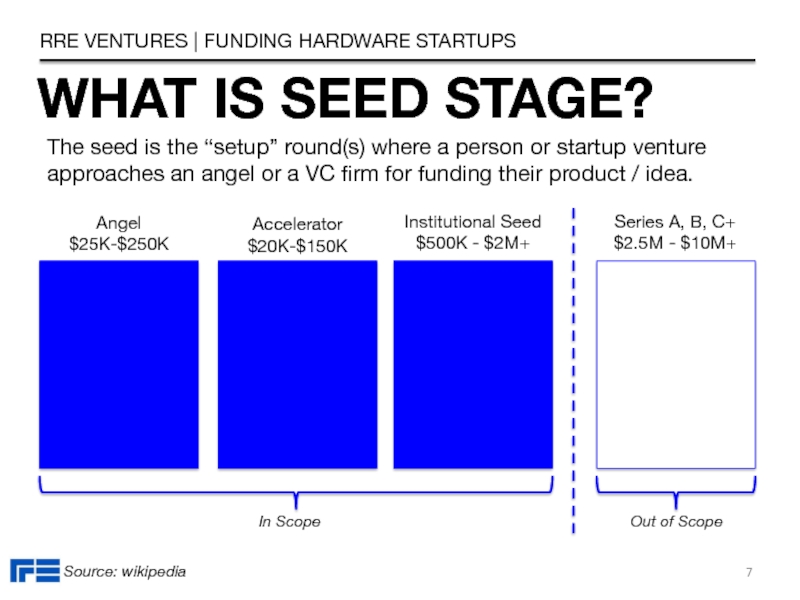

- 8. WHAT IS SEED STAGE? RRE VENTURES

- 9. REASONS TO RAISE RRE VENTURES | FUNDING

- 10. RAISING VC CHANGES EXPECTATIONS RRE VENTURES

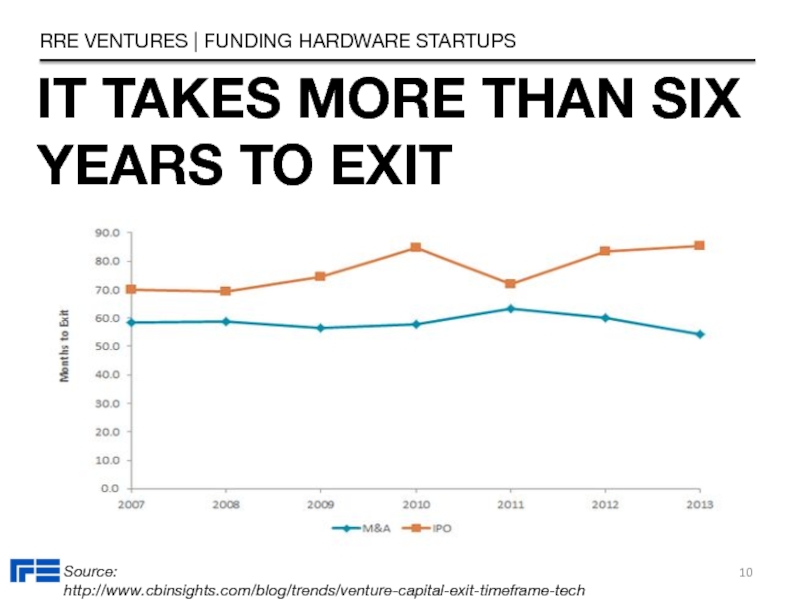

- 11. IT TAKES MORE THAN SIX YEARS TO

- 12. IT’S A ROLLER COASTER RRE VENTURES | FUNDING HARDWARE STARTUPS Back & Forth Struggles Wins

- 13. HUGE EXITS ARE RARE RRE VENTURES | FUNDING HARDWARE STARTUPS Source: http://techcrunch.com/2012/04/09/facebook-to-acquire-instagram-for-1-billion/

- 14. HERE’S THE PROOF RRE VENTURES | FUNDING

- 15. WHERE ARE WE? RRE VENTURES | FUNDING HARDWARE STARTUPS

- 16. HARDWARE 1.0 RRE VENTURES | FUNDING HARDWARE

- 17. THE OLD PERCEPTION RRE VENTURES | FUNDING HARDWARE STARTUPS

- 18. A NEW ERA IS HERE RRE VENTURES | FUNDING HARDWARE STARTUPS

- 19. HARDWARE 2.0 RRE VENTURES | FUNDING HARDWARE

- 20. THE NEW PERCEPTION RRE VENTURES | FUNDING HARDWARE STARTUPS

- 21. HERE’S THE PROOF RRE VENTURES | FUNDING

- 22. NEW FRONTIERS RRE VENTURES | FUNDING HARDWARE

- 23. HOW TO PREPARE RRE VENTURES | FUNDING HARDWARE STARTUPS

- 24. BUILD & LEARN RRE VENTURES | FUNDING

- 25. FIND A GOOD LAWYER RRE VENTURES |

- 26. SEEK ADVICE RRE VENTURES | FUNDING HARDWARE

- 27. Location Expertise / Focus Partner Brand Support

- 28. HARDWARE INVESTORS RRE VENTURES | FUNDING HARDWARE

- 29. STRUCTURE A PROCESS RRE VENTURES | FUNDING

- 30. SET ROUND SIZE RRE VENTURES | FUNDING

- 31. KNOW YOUR BRAND RRE VENTURES |

- 32. CRAFT YOUR STORY RRE VENTURES | FUNDING

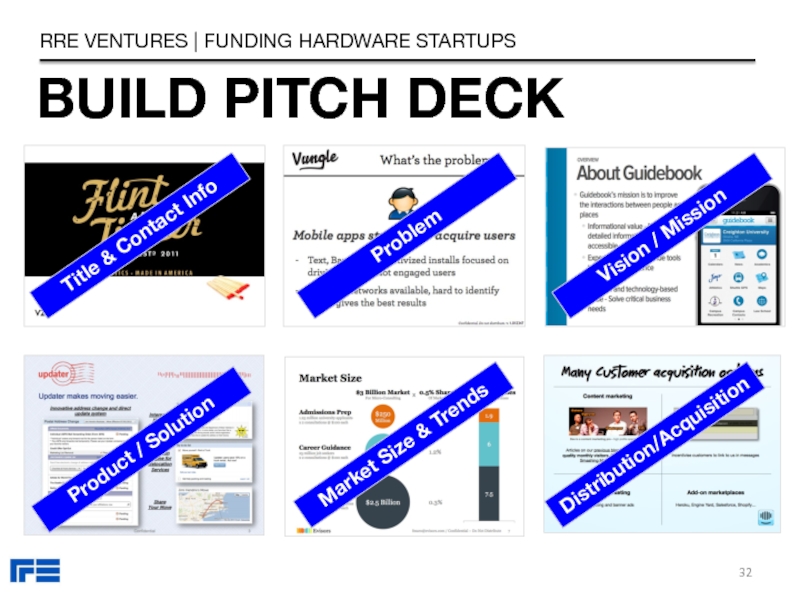

- 33. Title & Contact Info Problem Vision /

- 34. Monetization Roadmap / Timeline Traction / Milestones

- 35. WHERE TO FIND MONEY Events & Classes

- 36. KEEP IN MIND Industry Expertise Find Risk

- 37. THE PITCH RRE VENTURES | FUNDING HARDWARE STARTUPS

- 38. YOUR OBJECTIVE: FOMO* RRE VENTURES | FUNDING

- 39. FIRST IMPRESSION IS KEY RRE VENTURES |

- 40. GETTING TO YES RRE VENTURES | FUNDING

- 41. WHAT I LOOK FOR Complementary Team Story

- 42. WHAT I LOOK FOR (CON’T) ‘Action Not

- 43. QUESTIONS TO ASK RRE VENTURES | FUNDING

- 44. THINGS TO AVOID RRE VENTURES | FUNDING

- 45. AFTER THE PITCH RRE VENTURES | FUNDING HARDWARE STARTUPS

- 46. YOUR ACTION ITEMS Debrief w/ Team Send

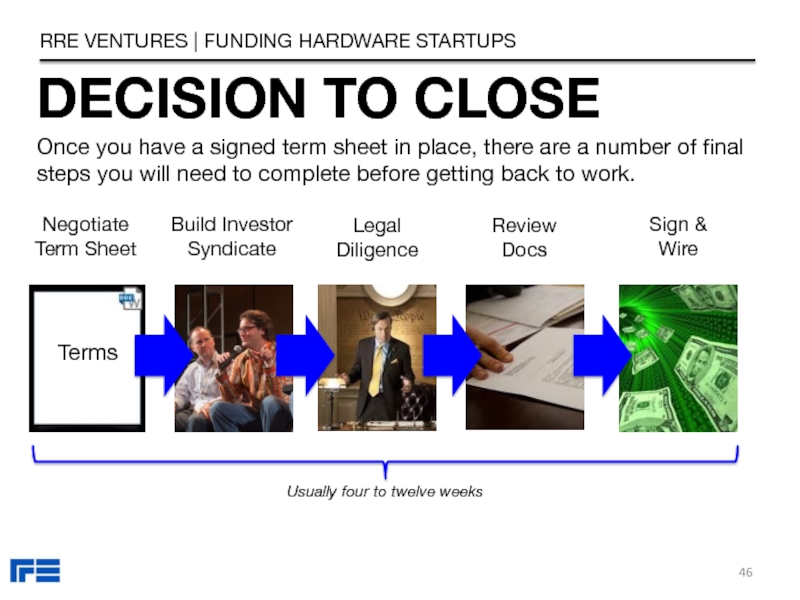

- 47. DECISION TO CLOSE RRE VENTURES | FUNDING

- 48. SEED FUNDING VEHICLES RRE VENTURES | FUNDING

- 49. Monthly Email Update* Strategy Sessions Network w/

- 50. RESOURCES RRE VENTURES | FUNDING HARDWARE STARTUPS

- 51. SUGGESTED BOOKS RRE VENTURES | FUNDING HARDWARE

- 52. SUGGESTED VC BLOGS RRE VENTURES | FUNDING

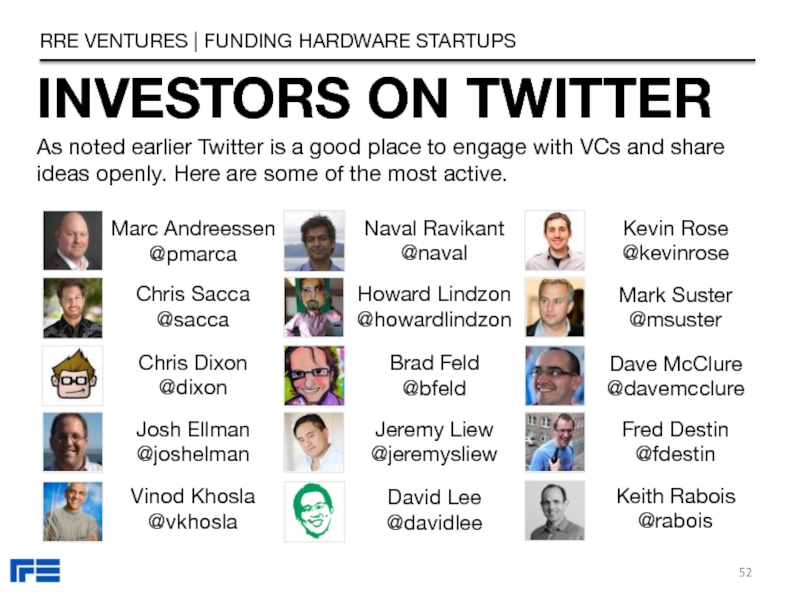

- 53. INVESTORS ON TWITTER RRE VENTURES | FUNDING

- 54. IN SUMMARY RRE VENTURES | FUNDING HARDWARE

- 55. ONE FINAL THOUGHT RRE VENTURES | FUNDING

- 56. GOOD LUCK! RRE VENTURES | FUNDING HARDWARE STARTUPS Steve Schlafman (@schlaf) s@rre.com RRE Ventures

Слайд 1FUNDING HARDWARE STARTUPS

RRE VENTURES | FUNDING HARDWARE STARTUPS

Steve Schlafman

s@rre.com

RRE Ventures

February 27,

Слайд 2ABOUT ME

RRE VENTURES | FUNDING HARDWARE STARTUPS

Principal, RRE Ventures

Raised in Boston,

Focus: Marketplaces, media, SAAS, hardware

Twitter: @schlaf

Blog: Schlaf.me

Hardware Investments: Understory Weather (RRE), SmartThings (LV), Dragon (LV), Romotive (LV)

Слайд 3RRE VENTURES

Established 1994

Most active early stage firm in NYC for nearly

Multi-stage: Seed, Series A, Series B

Current Fund Size: $280M

Initial Investment: $250K - $8M

SAAS, Fin Tech, Hardware, Marketplaces, Mobile Services, Media

Support platform with unique access to Fortune 500

RRE VENTURES | FUNDING HARDWARE STARTUPS

Слайд 4Each investor views the world differently so this is far from

I’m not a lawyer so consult with one before you raise

I couldn’t include every VC and seed fund

This lesson is an adaptation from my class ‘How to Raise Seed Capital’

DISCLAIMERS

RRE VENTURES | FUNDING HARDWARE STARTUPS

Слайд 6YOUR FUNDING OPTIONS

Debt / Credit Cards

Family & Friends

Crowdfunding

Your Customers

Grants

RRE VENTURES

Venture Capital

VC is just one option. There are numerous sources so make sure you evaluate the pros and cons of each.

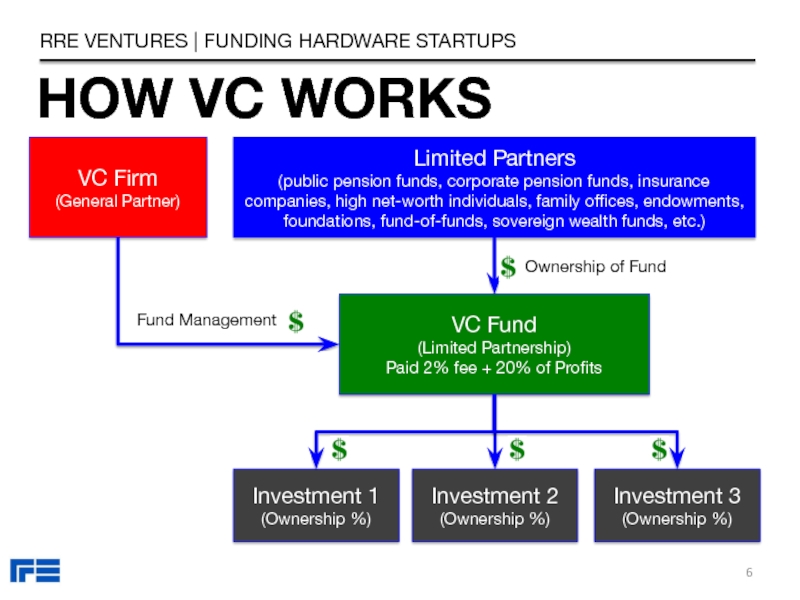

Слайд 7HOW VC WORKS

RRE VENTURES | FUNDING HARDWARE STARTUPS

VC Firm

(General Partner)

VC Fund

(Limited Partnership)

Paid 2% fee + 20% of Profits

Limited Partners

(public pension funds, corporate pension funds, insurance companies, high net-worth individuals, family offices, endowments, foundations, fund-of-funds, sovereign wealth funds, etc.)

Investment 1

(Ownership %)

Investment 2

(Ownership %)

Investment 3

(Ownership %)

Fund Management

Ownership of Fund

Слайд 8WHAT IS SEED STAGE?

RRE VENTURES | FUNDING HARDWARE STARTUPS

Series A,

$2.5M - $10M+

Out of Scope

In Scope

Institutional Seed

$500K - $2M+

Accelerator

$20K-$150K

Angel

$25K-$250K

The seed is the “setup” round(s) where a person or startup venture approaches an angel or a VC firm for funding their product / idea.

Source: wikipedia

Слайд 9REASONS TO RAISE

RRE VENTURES | FUNDING HARDWARE STARTUPS

Your Company

+

VC Funding

=

Grow Faster

2.

3. Timing

Raise to accelerate growth. VC will help you scale but it absolutely will not validate your product and market.

Слайд 10RAISING VC CHANGES EXPECTATIONS

RRE VENTURES | FUNDING HARDWARE STARTUPS

With VC

Without VC Funding

Слайд 11IT TAKES MORE THAN SIX YEARS TO EXIT

RRE VENTURES | FUNDING

Source: http://www.cbinsights.com/blog/trends/venture-capital-exit-timeframe-tech

Слайд 13HUGE EXITS ARE RARE

RRE VENTURES | FUNDING HARDWARE STARTUPS

Source: http://techcrunch.com/2012/04/09/facebook-to-acquire-instagram-for-1-billion/

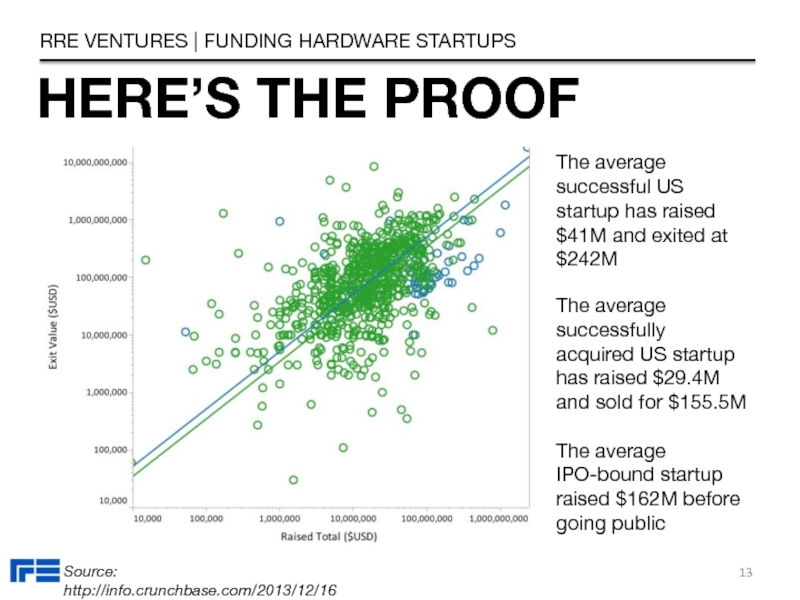

Слайд 14HERE’S THE PROOF

RRE VENTURES | FUNDING HARDWARE STARTUPS

Source: http://info.crunchbase.com/2013/12/16

The average successful

The average successfully acquired US startup has raised $29.4M and sold for $155.5M

The average IPO-bound startup raised $162M before going public

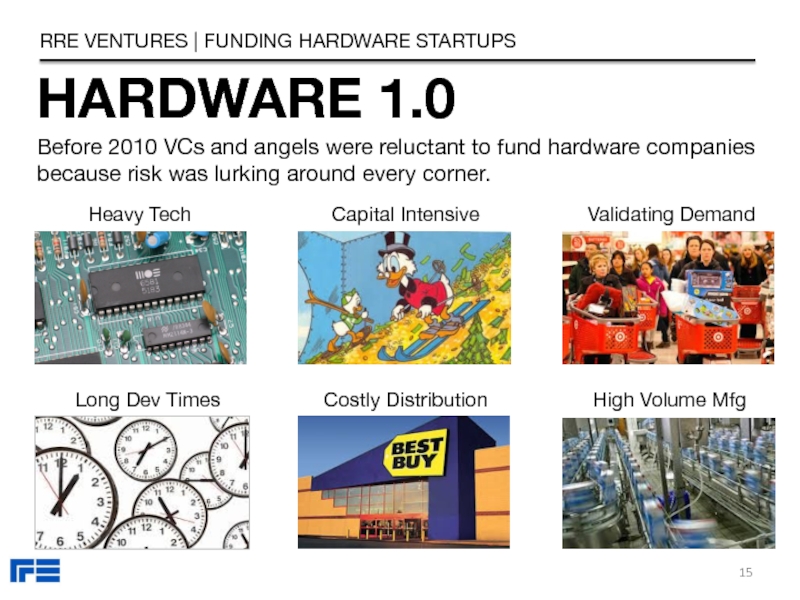

Слайд 16HARDWARE 1.0

RRE VENTURES | FUNDING HARDWARE STARTUPS

Before 2010 VCs and angels

Validating Demand

Capital Intensive

Venture Capital

Long Dev Times

Costly Distribution

Heavy Tech

High Volume Mfg

Слайд 19HARDWARE 2.0

RRE VENTURES | FUNDING HARDWARE STARTUPS

There has been an explosion

Crowdfunding

Software + Connectivity

Rapid Prototyping

Easier Distribution

Open Source

Lean Manufacturing

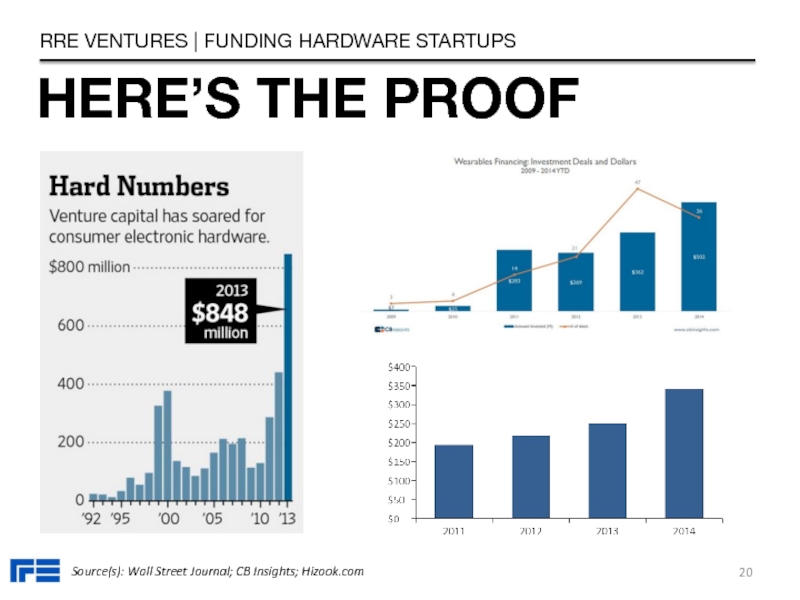

Слайд 21HERE’S THE PROOF

RRE VENTURES | FUNDING HARDWARE STARTUPS

Source(s): Wall Street Journal;

Слайд 22NEW FRONTIERS

RRE VENTURES | FUNDING HARDWARE STARTUPS

Connected SMBs

Consumer Devices

Wearables

VR

Connected Home

Sensors

Transportation

UAVs

3D Printing

Space

Input

Industrial Internet

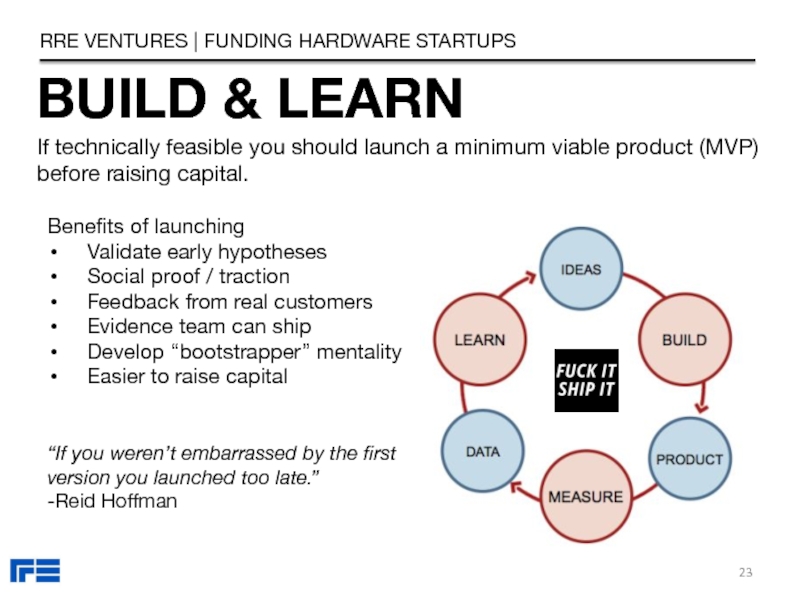

Слайд 24BUILD & LEARN

RRE VENTURES | FUNDING HARDWARE STARTUPS

If technically feasible you

Benefits of launching

Validate early hypotheses

Social proof / traction

Feedback from real customers

Evidence team can ship

Develop “bootstrapper” mentality

Easier to raise capital

“If you weren’t embarrassed by the first version you launched too late.”

-Reid Hoffman

Слайд 25FIND A GOOD LAWYER

RRE VENTURES | FUNDING HARDWARE STARTUPS

Once you determine

Слайд 26SEEK ADVICE

RRE VENTURES | FUNDING HARDWARE STARTUPS

Before you kick off the

Investors

Successful Execs

Venture Capital

Professors

Industry Experts

Founders

Influencers

Слайд 27Location

Expertise / Focus

Partner

Brand

Support & Relationships

Strategy & Stage

CHOOSING YOUR VC

RRE VENTURES |

When selecting your investors there are a variety of factors that should go into the decision making process beyond financial terms.

Слайд 28HARDWARE INVESTORS

RRE VENTURES | FUNDING HARDWARE STARTUPS

Sample of VCs that have

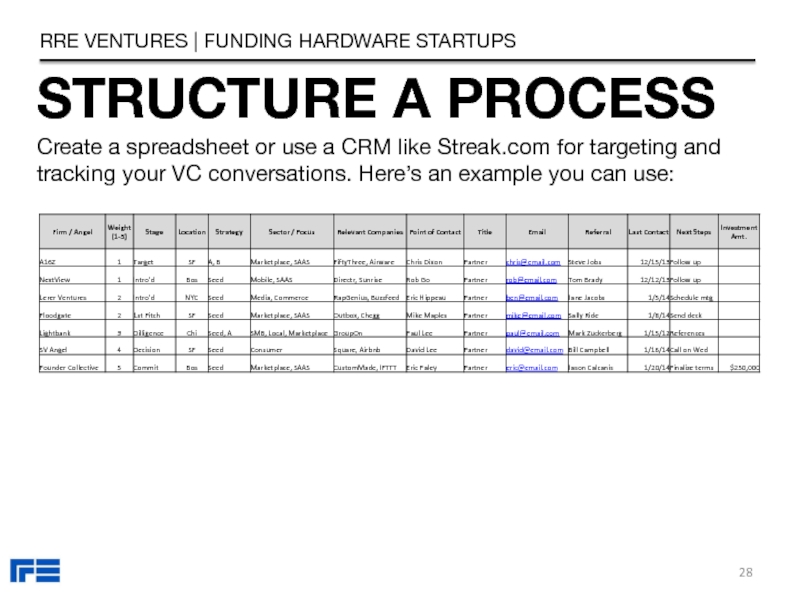

Слайд 29STRUCTURE A PROCESS

RRE VENTURES | FUNDING HARDWARE STARTUPS

Create a spreadsheet or

Слайд 30SET ROUND SIZE

RRE VENTURES | FUNDING HARDWARE STARTUPS

Estimating the amount of

Runway: Raise enough capital to give yourself 12-18 months. Keep in mind it will likely take 3-6 months to raise your next round.

Dilution: Every time you raise a round, try to sell no more than 10-25% of the company.

$ Target: Set a modest raise amount. It’s always better to nail your target, say you’re “oversubscribed” and then increase the size of round depending on investor interest and terms / dilution.

Слайд 31KNOW YOUR BRAND

RRE VENTURES | FUNDING HARDWARE STARTUPS

Your brand equals

“In this ever-changing society, the most powerful and enduring brands are built from the heart. They are real and sustainable. Their foundations are strong because they’re built with the strength of the human spirit, not an ad campaign.”

-Howard Schultz, Starbucks

Слайд 32CRAFT YOUR STORY

RRE VENTURES | FUNDING HARDWARE STARTUPS

The “story” behind your

“It’s not what you do, it’s why you do it.”

-Simon Sinek

What was the impetus for starting the company?

Why are you obsessed with solving this problem?

How did the founders meet and decide to partner?

Why are you willing to sacrifice years of your life to work on this?

What is your cause, your belief?

Слайд 33Title & Contact Info

Problem

Vision / Mission

Market Size & Trends

Distribution/Acquisition

Product / Solution

BUILD

RRE VENTURES | FUNDING HARDWARE STARTUPS

Слайд 34Monetization

Roadmap / Timeline

Traction / Milestones

Team / Advisors

Projections / Metrics

Funding

BUILD PITCH DECK

RRE

Слайд 35WHERE TO FIND MONEY

Events & Classes

AngelList

Venture Capital

Your Network

Accelerators

Twitter + Blogs

RRE VENTURES

Founder Intros

Angels and VCs are generally ‘networked’ so it shouldn’t be too hard to find them if you look in the right places and hustle.

Слайд 36KEEP IN MIND

Industry Expertise

Find Risk Takers

Follow Exits

Patience

Stay Close to Home

RRE VENTURES

Set Fair Terms

There are a variety of strategies you can take to increase your odds of finding suitable investors.

Слайд 38YOUR OBJECTIVE: FOMO*

RRE VENTURES | FUNDING HARDWARE STARTUPS

*Fear of missing out

Your

Слайд 39FIRST IMPRESSION IS KEY

RRE VENTURES | FUNDING HARDWARE STARTUPS

Most VCs usually

Traction

You + Team

Social Proof

Product

Слайд 40GETTING TO YES

RRE VENTURES | FUNDING HARDWARE STARTUPS

1. Get “Warm” Intro

2.

3. First Meeting

4. Diligence

4. Partner Meeting

5. Term Sheet / Close

80%

60%

15%

< 1%

Every investor / firm has a different process. Some make a decision in 30 minutes while others take months of diligence. Here’s my process:

30%

Слайд 41WHAT I LOOK FOR

Complementary Team

Story & Purpose

Differentiated Product

Prototype

Interesting Market

RRE VENTURES |

When evaluating early stage hardware investments there are a number of things that I look for and place value on.

Feel for Design

Слайд 42WHAT I LOOK FOR (CON’T)

‘Action Not Analysis’

Business Model

Venture Capital

Data Driven

Hustle /

Real Problem

RRE VENTURES | FUNDING HARDWARE STARTUPS

Here are some additional things that I look for and place value on when meeting with seed stage companies.

Customer Obsession

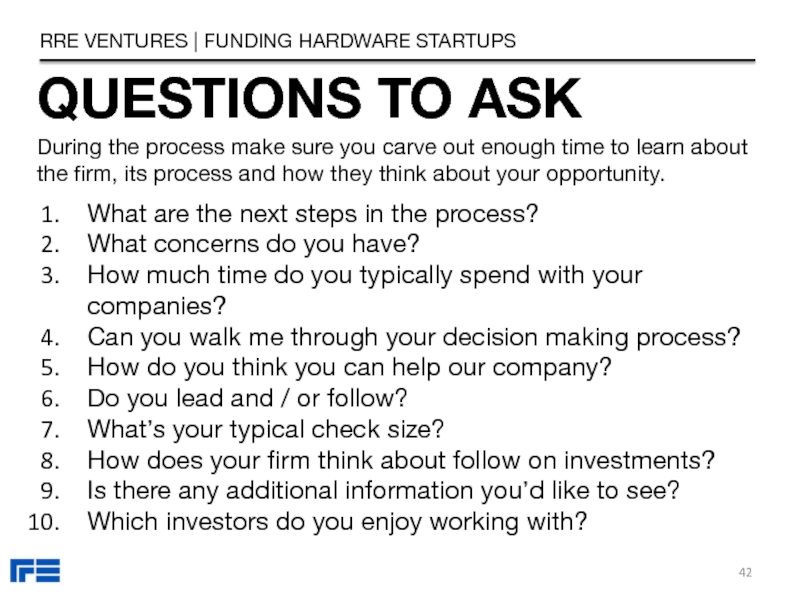

Слайд 43QUESTIONS TO ASK

RRE VENTURES | FUNDING HARDWARE STARTUPS

What are the next

What concerns do you have?

How much time do you typically spend with your companies?

Can you walk me through your decision making process?

How do you think you can help our company?

Do you lead and / or follow?

What’s your typical check size?

How does your firm think about follow on investments?

Is there any additional information you’d like to see?

Which investors do you enjoy working with?

During the process make sure you carve out enough time to learn about the firm, its process and how they think about your opportunity.

Слайд 44THINGS TO AVOID

RRE VENTURES | FUNDING HARDWARE STARTUPS

As I mentioned earlier

Product demos that don’t work

Derivative product and positioning

Long answers filled w/ buzzwords

Trying to have all the answers

Long pitch decks

Don’t have clear raise amount

Asking for investor intros after one passes

Overemphasizing PR and press

No product team in place

Pitching different partners in firm after a pass

Bringing non-founders to 1st meeting

Too many emails / follow ups

Слайд 46YOUR ACTION ITEMS

Debrief w/ Team

Send VC Requests

Review Pitch Notes

Note Questions /

Edit Pitch Deck

Update VC Pipeline

RRE VENTURES | FUNDING HARDWARE STARTUPS

Immediately following each pitch session there are some best practices you can implement which should help you throughout the process.

Слайд 47DECISION TO CLOSE

RRE VENTURES | FUNDING HARDWARE STARTUPS

Once you have a

Negotiate Term Sheet

Build Investor Syndicate

Review Docs

Sign & Wire

Legal Diligence

Usually four to twelve weeks

Слайд 48SEED FUNDING VEHICLES

RRE VENTURES | FUNDING HARDWARE STARTUPS

When a startup raises

Preferred Equity

SAFE

Convertible Debt

Слайд 49Monthly Email Update*

Strategy Sessions

Network w/ Portfolio

Real-time Crisis Mgmt

Share Hiring Plan

POST INVESTMENT

RRE

So you closed your round and have cash in the bank. Now what? Here are some way to engage with and get value from your investors:

*Include what’s going well / not well, key metrics, hiring update, financing update, roadmap, help wanted

Specific Intros

Слайд 51SUGGESTED BOOKS

RRE VENTURES | FUNDING HARDWARE STARTUPS

Before you start the fundraising

Слайд 52SUGGESTED VC BLOGS

RRE VENTURES | FUNDING HARDWARE STARTUPS

Chris Dixon, A16Z: cdixon.org

Roger

Brad Feld, Foundry Group: feld.com

First Round Review: firstround.com/review

Paul Graham, Y Combinator: paulgraham.com

Semil Shah, Angel: semilshah.com

David Skok, Matrix: forentrepreneurs.com

Mark Suster, Upfront: bothsidesofthetable.com

Tom Tunguz, Redpoint: tomtunguz.com

Hunter Walk, Homebrew: hunterwalk.com

Fred Wilson, Union Square Ventures: avc.com

Слайд 53INVESTORS ON TWITTER

RRE VENTURES | FUNDING HARDWARE STARTUPS

As noted earlier Twitter

Marc Andreessen

@pmarca

Chris Sacca

@sacca

Chris Dixon

@dixon

Josh Ellman

@joshelman

Vinod Khosla

@vkhosla

Naval Ravikant

@naval

Kevin Rose

@kevinrose

Howard Lindzon

@howardlindzon

Brad Feld

@bfeld

Jeremy Liew

@jeremysliew

David Lee

@davidlee

Mark Suster

@msuster

Dave McClure

@davemcclure

Fred Destin

@fdestin

Keith Rabois

@rabois

Слайд 54IN SUMMARY

RRE VENTURES | FUNDING HARDWARE STARTUPS

Raising any amount of capital

VC is just one financing option to consider

Raise to accelerate growth

Investors come in difference sizes and flavors

Prepare, work your ass off and hustle

Take advantage of resources on the web

The real work begins after you close your round

Слайд 55ONE FINAL THOUGHT

RRE VENTURES | FUNDING HARDWARE STARTUPS

“The magic in business

-Mark Cuban