Partners: Lenna Bablouzian, Carol Chandor, Robyn Olson

AFT-MA: Andrew Powell

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

City of Peabody презентация

Содержание

- 1. City of Peabody

- 2. Agenda Overview What is the GIC? Medicare

- 3. Overview All City employees and retirees will

- 4. What Is the GIC? The mission of

- 5. Medicare Guidelines Retirees age 65 or older

- 6. Medicare Guidelines (continued) If you (the insured)

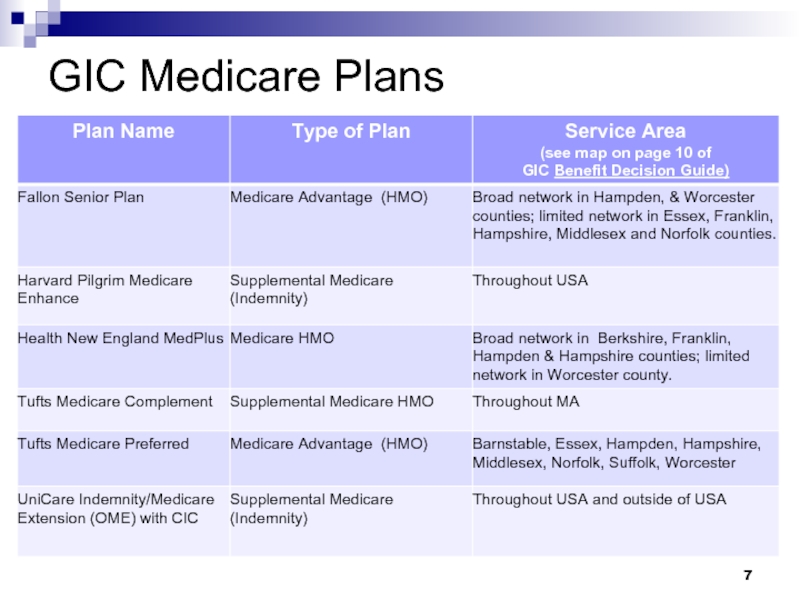

- 7. GIC Medicare Plans

- 8. GIC Medicare Plans Two types – HMO

- 9. GIC Medicare Plans Medicare Retiree Plans with

- 10. GIC Medicare HMO Plans Members must select

- 11. GIC Medicare Supplemental Indemnity Plans Members not

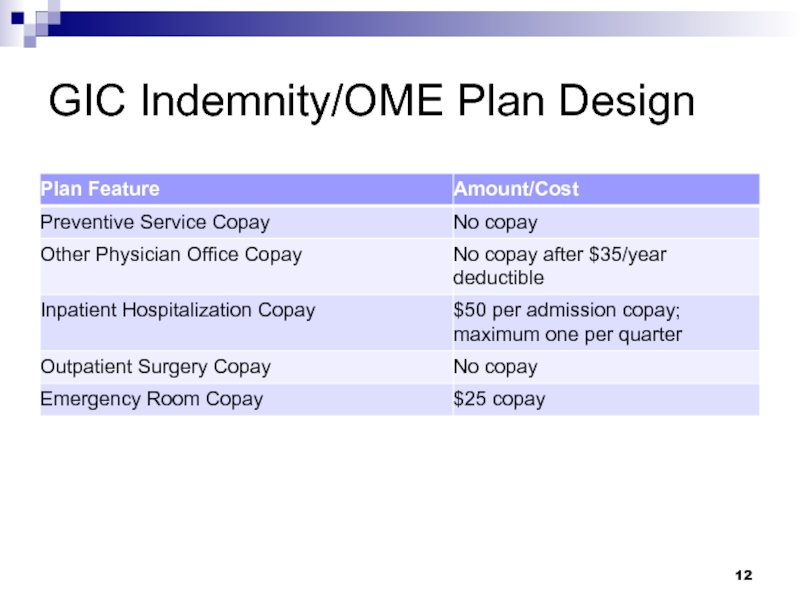

- 12. GIC Indemnity/OME Plan Design

- 13. Prescription Drug Tiering Drug formularies vary by

- 14. Mitigation Plan Public Employee Committee (PEC) and

- 15. Peabody Mitigation Program HRA Part 1 –

- 16. GIC Health Fair October 18th

- 17. Tips for Selecting a GIC Plan Carefully

- 18. Tips for Selecting a GIC Plan Contact

- 19. Tips for Selecting a GIC Plan Contact

- 20. Questions and Answers

Слайд 1City of Peabody

Health Plan Educational Information for

Medicare Retirees

October 2012

Boston Benefit

Слайд 2Agenda

Overview

What is the GIC?

Medicare Highlights

Group Insurance Commission (GIC) Plans

Health Maintenance Organization

(HMO) Plans

Indemnity Plans

Drug Tiering

Peabody’s Mitigation Plan

Tips for Selecting a GIC Medicare Supplement Plan

Indemnity Plans

Drug Tiering

Peabody’s Mitigation Plan

Tips for Selecting a GIC Medicare Supplement Plan

Слайд 3Overview

All City employees and retirees will receive their health insurance through

the Group Insurance Commission (GIC) starting on January 1, 2013 and continuing through June 30, 2016

Current town plans will be in effect until December 31, 2012

Open enrollment will be held from Tuesday, October 9th through Wednesday, October 24th

All employees and retirees MUST enroll in order to have coverage as of January 1, 2013

Marriage licenses, Birth Certificates, Adoption and Guardianship records are required to enroll dependents

Retired Municipal Teachers (RMT’s) will gain access to additional GIC plans but must re-enroll during the Open Enrollment period

Current town plans will be in effect until December 31, 2012

Open enrollment will be held from Tuesday, October 9th through Wednesday, October 24th

All employees and retirees MUST enroll in order to have coverage as of January 1, 2013

Marriage licenses, Birth Certificates, Adoption and Guardianship records are required to enroll dependents

Retired Municipal Teachers (RMT’s) will gain access to additional GIC plans but must re-enroll during the Open Enrollment period

Слайд 4What Is the GIC?

The mission of the GIC is to deliver

high quality care at reasonable costs

GIC was established by the Legislature in 1955

GIC is a quasi-independent state agency governed by a 15-member Commission appointed by the Governor

Commission members include representatives of labor and retirees

GIC's FY12 appropriation is $1.3 billion.

GIC covers 212,000 subscribers and 375,000 lives

GIC was established by the Legislature in 1955

GIC is a quasi-independent state agency governed by a 15-member Commission appointed by the Governor

Commission members include representatives of labor and retirees

GIC's FY12 appropriation is $1.3 billion.

GIC covers 212,000 subscribers and 375,000 lives

Слайд 5Medicare Guidelines

Retirees age 65 or older and certain disabled people who

qualify (40 quarters of paying Medicare taxes)

Medicare Part A - Free

Inpatient hospital care

Some skilled nursing facility care

Hospice

Medicare Part B – Standard monthly premium = $99.90 (calendar year 2012)

Physician care

Diagnostic, x-ray and lab services

Durable medical equipment

GIC Medicare plans coordinate with Medicare to provide you with comprehensive insurance

Medicare Part A - Free

Inpatient hospital care

Some skilled nursing facility care

Hospice

Medicare Part B – Standard monthly premium = $99.90 (calendar year 2012)

Physician care

Diagnostic, x-ray and lab services

Durable medical equipment

GIC Medicare plans coordinate with Medicare to provide you with comprehensive insurance

Слайд 6Medicare Guidelines (continued)

If you (the insured) works beyond age 65, you

should NOT enroll in Medicare Part B until you (the insured) retires

If retired, you must join Medicare and pay Part B premium to have GIC coverage

If your spouse/dependents are under 65, and you are retired, they will stay on an active plan through the GIC

See GIC Benefit Decision Guide, page 9

Do NOT enroll in Medicare Part D plans

See GIC Benefit Decision Guide for more details and special circumstances

If retired, you must join Medicare and pay Part B premium to have GIC coverage

If your spouse/dependents are under 65, and you are retired, they will stay on an active plan through the GIC

See GIC Benefit Decision Guide, page 9

Do NOT enroll in Medicare Part D plans

See GIC Benefit Decision Guide for more details and special circumstances

Слайд 8GIC Medicare Plans

Two types – HMO and Indemnity

HMO Plans

Primary Care Physician

(PCP) required

Referrals required for specialists for most plans

No coverage for out of network providers (except emergencies)

Medicare Advantage HMO plans have smaller provider networks

Indemnity Plans

Access to any provider that accepts Medicare

Referrals required for specialists for most plans

No coverage for out of network providers (except emergencies)

Medicare Advantage HMO plans have smaller provider networks

Indemnity Plans

Access to any provider that accepts Medicare

Слайд 9GIC Medicare Plans

Medicare Retiree Plans with the most subscribers

UniCare State

Indemnity Plan/Medicare Extension [OME]

Harvard Pilgrim Medicare Enhance

88% of GIC Medicare retirees in these 2 plans, which most closely resemble Peabody’s current Medex plan

Enrollment restrictions

UniCare State Indemnity Plan/ Medicare Extension [OME] available throughout the United States and outside the United States

Harvard Pilgrim Medicare Enhance available throughout the United States

Other plans limited to Massachusetts and certain border counties by plan

Harvard Pilgrim Medicare Enhance

88% of GIC Medicare retirees in these 2 plans, which most closely resemble Peabody’s current Medex plan

Enrollment restrictions

UniCare State Indemnity Plan/ Medicare Extension [OME] available throughout the United States and outside the United States

Harvard Pilgrim Medicare Enhance available throughout the United States

Other plans limited to Massachusetts and certain border counties by plan

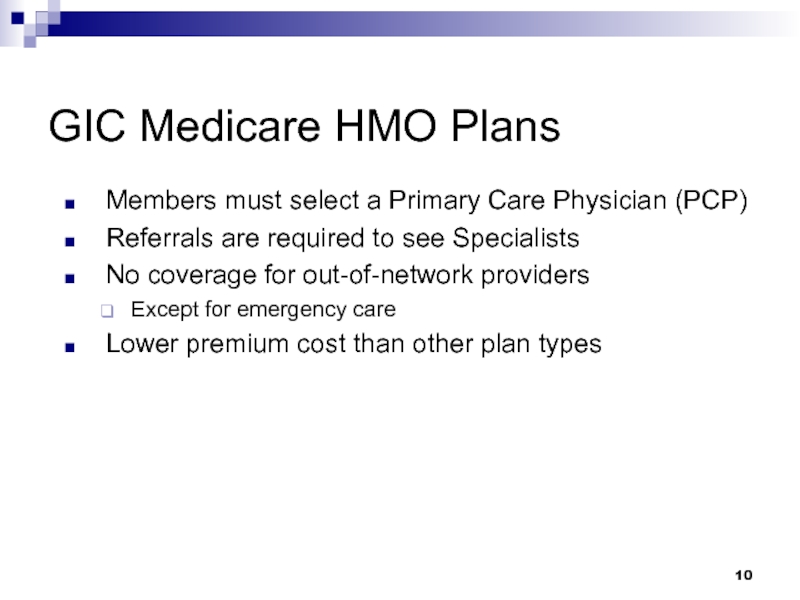

Слайд 10GIC Medicare HMO Plans

Members must select a Primary Care Physician (PCP)

Referrals

are required to see Specialists

No coverage for out-of-network providers

Except for emergency care

Lower premium cost than other plan types

No coverage for out-of-network providers

Except for emergency care

Lower premium cost than other plan types

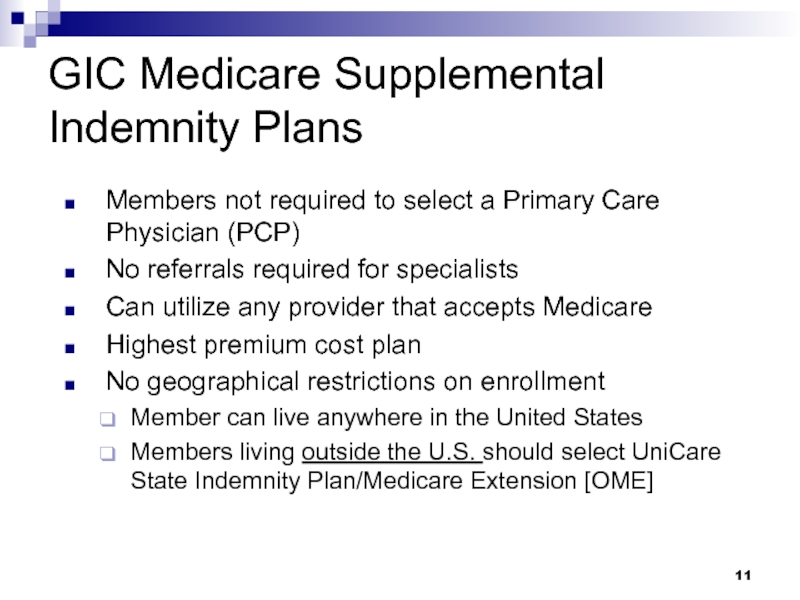

Слайд 11GIC Medicare Supplemental Indemnity Plans

Members not required to select a Primary

Care Physician (PCP)

No referrals required for specialists

Can utilize any provider that accepts Medicare

Highest premium cost plan

No geographical restrictions on enrollment

Member can live anywhere in the United States

Members living outside the U.S. should select UniCare State Indemnity Plan/Medicare Extension [OME]

No referrals required for specialists

Can utilize any provider that accepts Medicare

Highest premium cost plan

No geographical restrictions on enrollment

Member can live anywhere in the United States

Members living outside the U.S. should select UniCare State Indemnity Plan/Medicare Extension [OME]

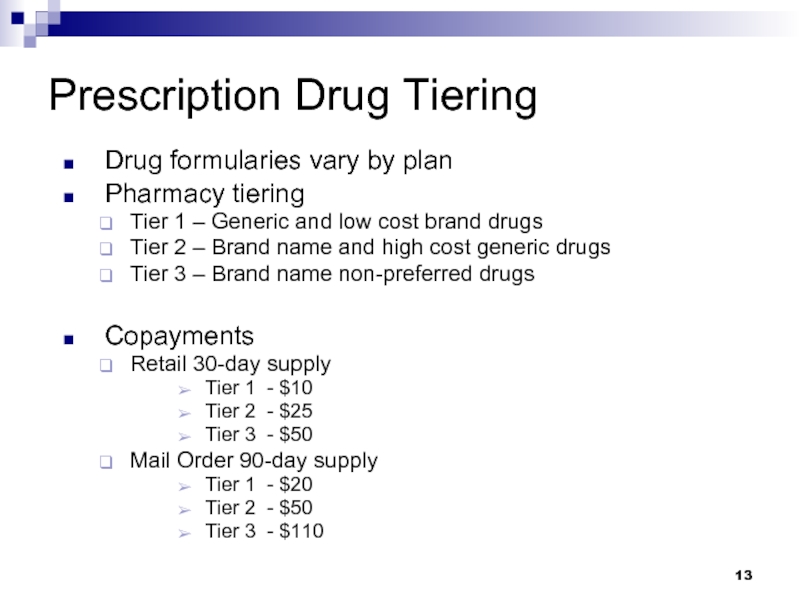

Слайд 13Prescription Drug Tiering

Drug formularies vary by plan

Pharmacy tiering

Tier 1 –

Generic and low cost brand drugs

Tier 2 – Brand name and high cost generic drugs

Tier 3 – Brand name non-preferred drugs

Copayments

Retail 30-day supply

Tier 1 - $10

Tier 2 - $25

Tier 3 - $50

Mail Order 90-day supply

Tier 1 - $20

Tier 2 - $50

Tier 3 - $110

Tier 2 – Brand name and high cost generic drugs

Tier 3 – Brand name non-preferred drugs

Copayments

Retail 30-day supply

Tier 1 - $10

Tier 2 - $25

Tier 3 - $50

Mail Order 90-day supply

Tier 1 - $20

Tier 2 - $50

Tier 3 - $110

Слайд 14Mitigation Plan

Public Employee Committee (PEC) and City Negotiated a Mitigation Program:

PEC

Agreement creates 3½ -Year, City-funded Employee Health Mitigation Fund [EHMF]

Medicare eligible retirees will pay 1% of premium costs and those retired before 7/1/09 will receive a subsidy of their supplemental plan premium for 3 ½ years

A separate rate sheet for Medicare eligible RMTS is available

Medicare retirees have access to two separate health reimbursement account (HRA) programs:

HRA Part 1 – Reimbursement of new GIC copays

HRA Part 2 – Reimbursement of high out-of-pocket costs

Medicare eligible retirees will pay 1% of premium costs and those retired before 7/1/09 will receive a subsidy of their supplemental plan premium for 3 ½ years

A separate rate sheet for Medicare eligible RMTS is available

Medicare retirees have access to two separate health reimbursement account (HRA) programs:

HRA Part 1 – Reimbursement of new GIC copays

HRA Part 2 – Reimbursement of high out-of-pocket costs

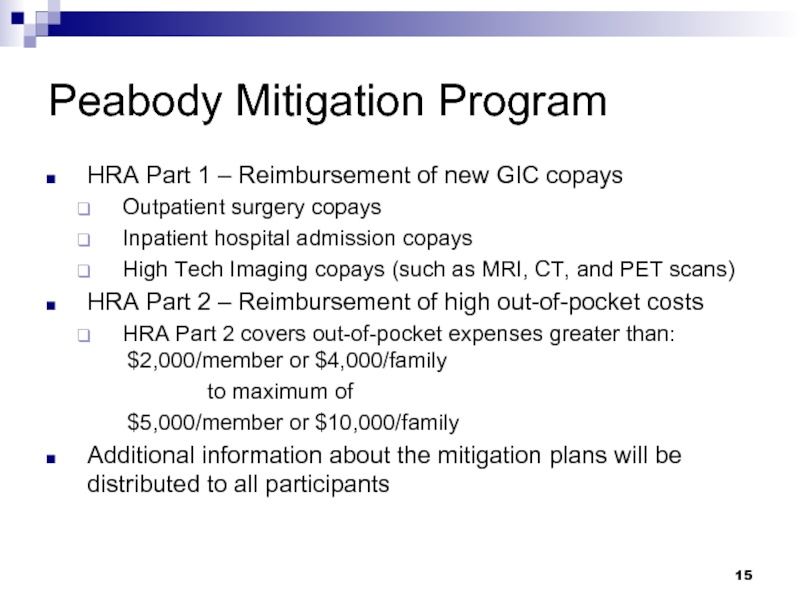

Слайд 15Peabody Mitigation Program

HRA Part 1 – Reimbursement of new GIC copays

Outpatient

surgery copays

Inpatient hospital admission copays

High Tech Imaging copays (such as MRI, CT, and PET scans)

HRA Part 2 – Reimbursement of high out-of-pocket costs

HRA Part 2 covers out-of-pocket expenses greater than: $2,000/member or $4,000/family

to maximum of

$5,000/member or $10,000/family

Additional information about the mitigation plans will be distributed to all participants

Inpatient hospital admission copays

High Tech Imaging copays (such as MRI, CT, and PET scans)

HRA Part 2 – Reimbursement of high out-of-pocket costs

HRA Part 2 covers out-of-pocket expenses greater than: $2,000/member or $4,000/family

to maximum of

$5,000/member or $10,000/family

Additional information about the mitigation plans will be distributed to all participants

Слайд 16GIC Health Fair

October 18th

Thursday

11:00 AM - 4:00 PM

Kiley School Administration

Building

21 Johnson Street

21 Johnson Street

Слайд 17Tips for Selecting a GIC Plan

Carefully review the GIC Benefit Decision

Guide

Complete a questionnaire and estimate your utilization of medical services

Discuss the GIC plans with family, friends and your physician(s)

Complete a questionnaire and estimate your utilization of medical services

Discuss the GIC plans with family, friends and your physician(s)

Слайд 18Tips for Selecting a GIC Plan

Contact the carriers on the telephone

or using the Internet. Ask the carriers about:

The physicians who treat you

The hospitals where you get care

The prescription drugs that you take

Any Durable Medical Equipment or Device that you use

Attend a GIC Health Fair

The physicians who treat you

The hospitals where you get care

The prescription drugs that you take

Any Durable Medical Equipment or Device that you use

Attend a GIC Health Fair

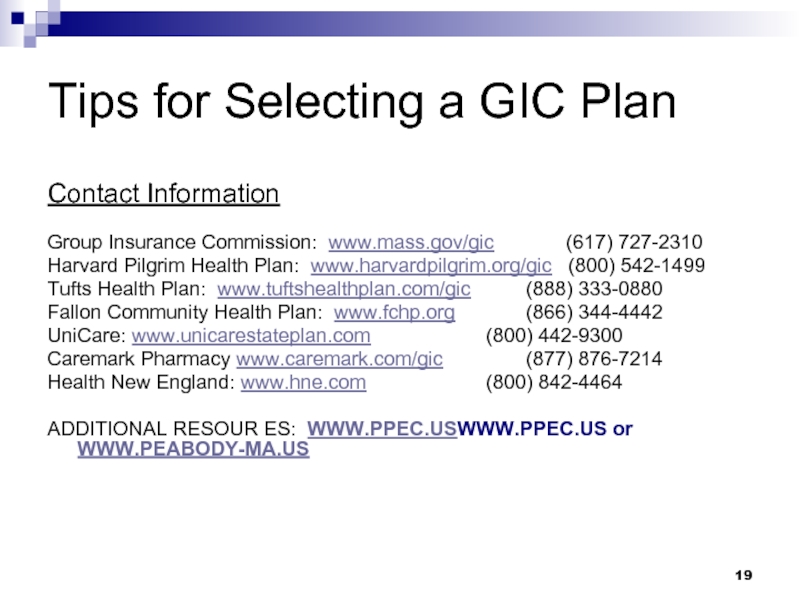

Слайд 19Tips for Selecting a GIC Plan

Contact Information

Group Insurance Commission: www.mass.gov/gic

(617) 727-2310

Harvard Pilgrim Health Plan: www.harvardpilgrim.org/gic (800) 542-1499

Tufts Health Plan: www.tuftshealthplan.com/gic (888) 333-0880

Fallon Community Health Plan: www.fchp.org (866) 344-4442

UniCare: www.unicarestateplan.com (800) 442-9300

Caremark Pharmacy www.caremark.com/gic (877) 876-7214

Health New England: www.hne.com (800) 842-4464

ADDITIONAL RESOUR ES: WWW.PPEC.USWWW.PPEC.US or WWW.PEABODY-MA.US

Harvard Pilgrim Health Plan: www.harvardpilgrim.org/gic (800) 542-1499

Tufts Health Plan: www.tuftshealthplan.com/gic (888) 333-0880

Fallon Community Health Plan: www.fchp.org (866) 344-4442

UniCare: www.unicarestateplan.com (800) 442-9300

Caremark Pharmacy www.caremark.com/gic (877) 876-7214

Health New England: www.hne.com (800) 842-4464

ADDITIONAL RESOUR ES: WWW.PPEC.USWWW.PPEC.US or WWW.PEABODY-MA.US

![GIC Medicare PlansMedicare Retiree Plans with the most subscribers UniCare State Indemnity Plan/Medicare Extension [OME]Harvard](/img/tmb/1/4011/44d72f079be34e6b4b39d18f9384a582-800x.jpg)