- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

The Money Problem Apple Doesn’t Want You To Know About презентация

Содержание

- 1. The Money Problem Apple Doesn’t Want You To Know About

- 2. Apple’s Balance Sheet As of its latest

- 3. Show me the money Apple is avoiding

- 4. That’s a lot of coin Since Apple

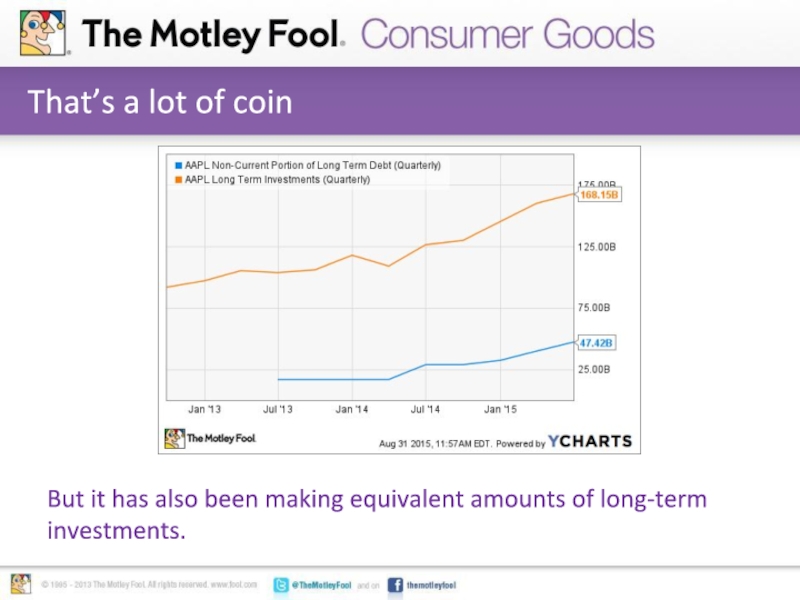

- 5. That’s a lot of coin But it

- 6. It’s not a problem today It’s made

- 7. It’s not a problem today Over the

- 8. But fortunes change The tech industry changes

- 9. Other companies have made the same mistake

- 10. Or a better example Over $3 billion

- 11. Apple isn’t about to turn into Radio

- 12. The Next Billion-Dollar iSecret

Слайд 2Apple’s Balance Sheet

As of its latest quarterly report, it held $203

Activist Carl Icahn has been demanding that the company return more cash to investors.

But there’s a catch.

It’s often cited is one of the stocks’s key strengths

Слайд 3Show me the money

Apple is avoiding American corporate taxes, which could

Instead it’s borrowing money to return capital to shareholders.

But its debt load has ballooned.

Almost 90% of its cash is kept overseas

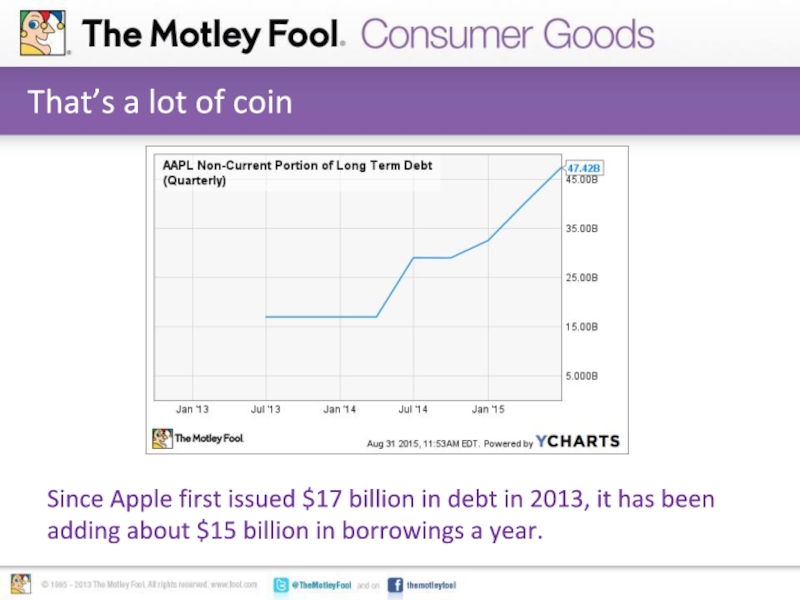

Слайд 4That’s a lot of coin

Since Apple first issued $17 billion in

Слайд 6It’s not a problem today

It’s made $51 billion in the last

Interest expense is approaching $1 billion.

But interest income more than cancels it out.

The company is more profitable than any other in the U.S.

Слайд 7It’s not a problem today

Over the last four quarters it’s returned

That’s equal to its total amount of free cash flow minus investments.

If profits keeps growing that’s not a problem.

But it may not be able to return capital at this pace

Слайд 8But fortunes change

The tech industry changes quickly - just ask its

Its heavily dependent on one product - the iPhone.

The company has swooned before - profits fell 11% in 2013.

Apple has a number of risks

Слайд 9Other companies have made the same mistake

IBM shares have faltered as

Слайд 10Or a better example

Over $3 billion went out the door to

Radio Shack declared bankruptcy earlier this year.

When Radio Shack was flying high around 2000, the company spent liberally on buybacks

Слайд 11Apple isn’t about to turn into Radio Shack

As long as it

But if its performance deteriorates that debt burden could become a significant liability.

But this rate of debt accumulation is not sustainable.