- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

State of Bitcoin Q3 2014 презентация

Содержание

- 1. State of Bitcoin Q3 2014

- 2. Contents Summary and Adoption Dashboard Price and

- 3. About CoinDesk World leader in digital currency

- 4. State of Bitcoin Q3 2014 Summary and Adoption Dashboard

- 5. Q3 2014 Summary State of Bitcoin Q3

- 6. Key Bitcoin Adoption Metrics State of Bitcoin

- 7. State of Bitcoin Q3 2014 Price and Valuation

- 8. CoinDesk Bitcoin Price Index – Q3

- 9. A Remarkable Coincidence? State of Bitcoin Q3

- 10. Bitcoin’s Price Has Been Declining on Steadily

- 11. Total Exchange Trading Volume Sees Steady Growth State of Bitcoin Q3 2014 Source: CoinDesk, Bitcoinity

- 12. Chinese Yuan (Renminbi) Denominated Bitcoin Trading Continues

- 13. Growing Merchant Adoption Should Not Drive Down

- 14. The Mining Arms Race: A More Plausible

- 15. Other Possible Explanations for Bitcoin’s Price

- 16. State of Altcoins: Number of Altcoins Up

- 17. While Significantly Below March 2014 High, Current

- 18. State of Bitcoin Q3 2014 Media

- 19. Selection of Q3’s Biggest Bitcoin Stories State

- 20. Seven of the Most Popular CoinDesk Q3

- 21. Continued Mainstream Media Interest in Bitcoin State of Bitcoin Q3 2014 Source: respective publishers’ websites

- 22. Innovative Tools are Emerging to Monitor Attitudes

- 23. ‘Bitcoin’ Searches During Q3 Stayed Relatively

- 24. Related ‘Bitcoin’ Searches Are Becoming More

- 25. State of Bitcoin Q3 2014 VC Investment

- 26. Two Biggest Bitcoin VC Deals in Q3

- 27. Q3 Bitcoin Venture Capital Investment Down From

- 28. Europe Heats Up: Gained Overall Investment Share

- 29. While the US Continues to Dominate Bitcoin

- 30. Silicon Valley’s Share of All-Time Bitcoin VC

- 31. Bitcoin VC Investment is Broadening Around

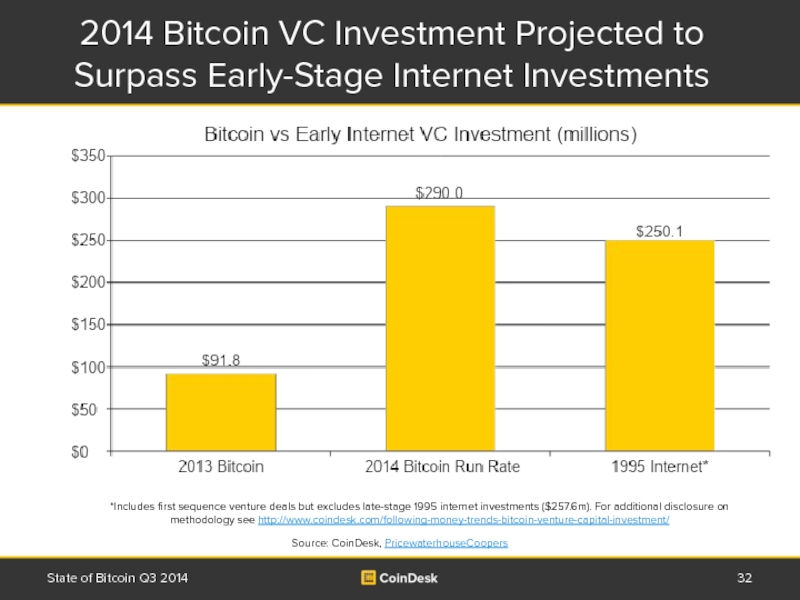

- 32. 2014 Bitcoin VC Investment Projected to Surpass

- 33. The Bitcoin Startup Ecosystem: Six Different Bitcoin Company Categories State of Bitcoin Q3 2014

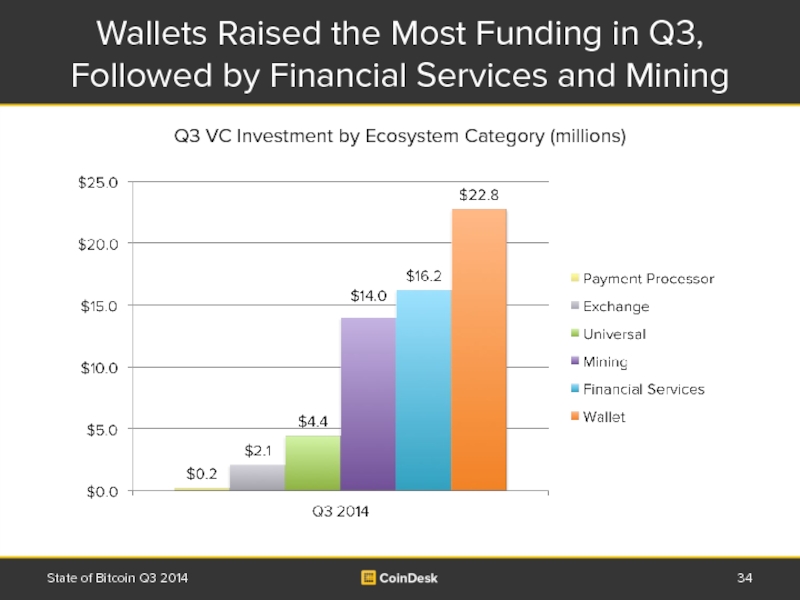

- 34. Wallets Raised the Most Funding in Q3,

- 35. Universals Still Command the Most VC Investment,

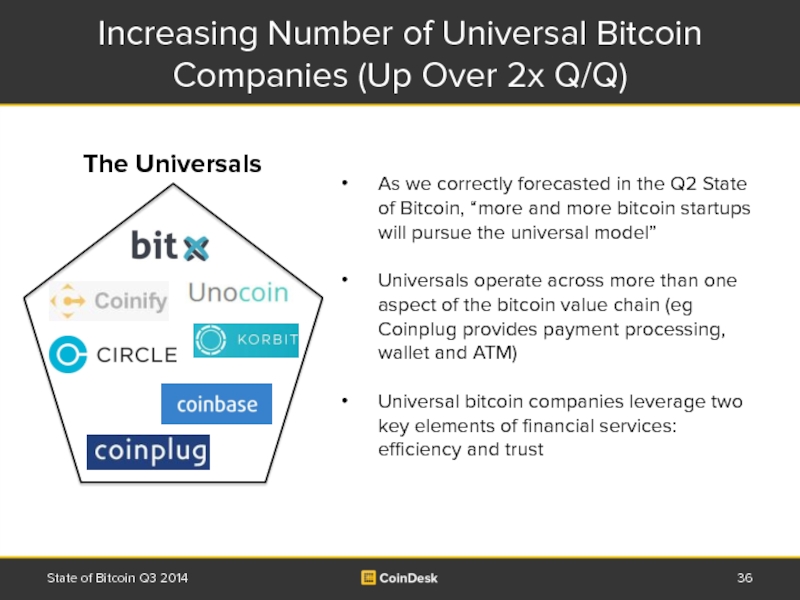

- 36. Increasing Number of Universal Bitcoin Companies (Up

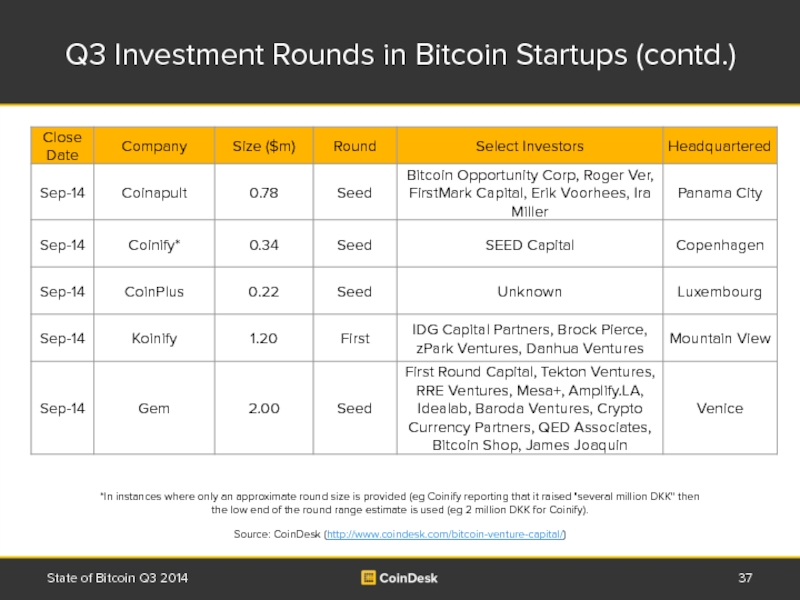

- 37. Q3 Investment Rounds in Bitcoin Startups (contd.) State of Bitcoin Q3 2014 Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

- 38. Q3 Investment Rounds in Bitcoin Startups (contd.) State of Bitcoin Q3 2014 Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

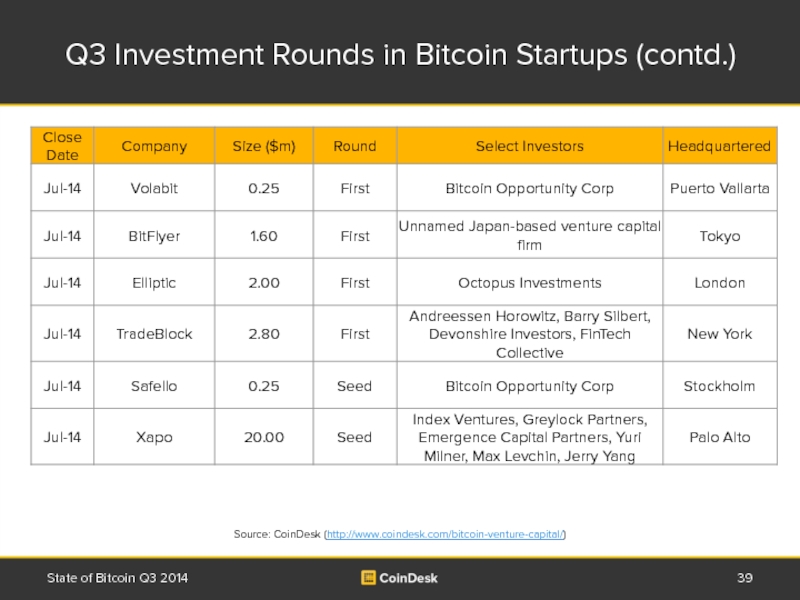

- 39. Q3 Investment Rounds in Bitcoin Startups (contd.) State of Bitcoin Q3 2014 Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

- 40. State of Bitcoin Q3 2014 Commerce

- 41. >75K Merchants Now Accept Bitcoin, Up From

- 43. Dell is by Far the Largest Retailer

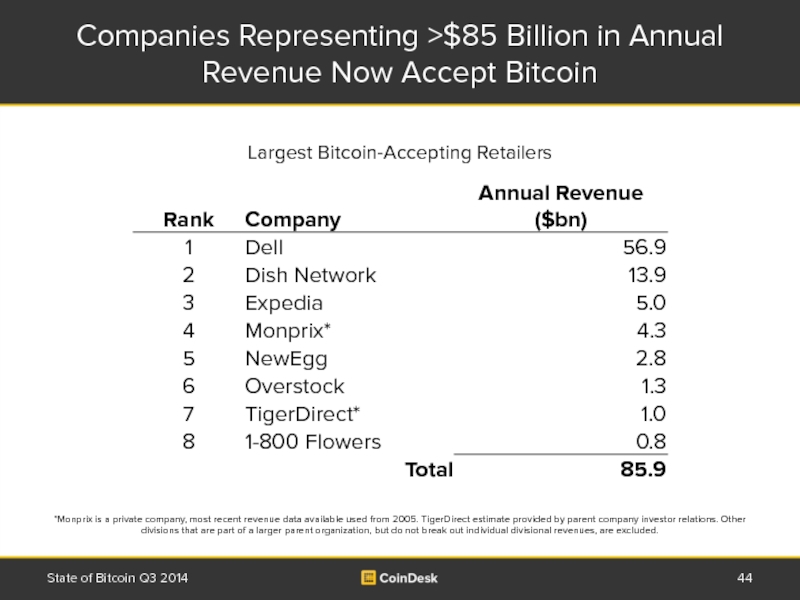

- 44. Companies Representing >$85 Billion in Annual Revenue Now Accept Bitcoin State of Bitcoin Q3 2014

- 45. Some Merchants are Seeing Significant Sales in

- 46. A Growing Number of Compelling Reasons to

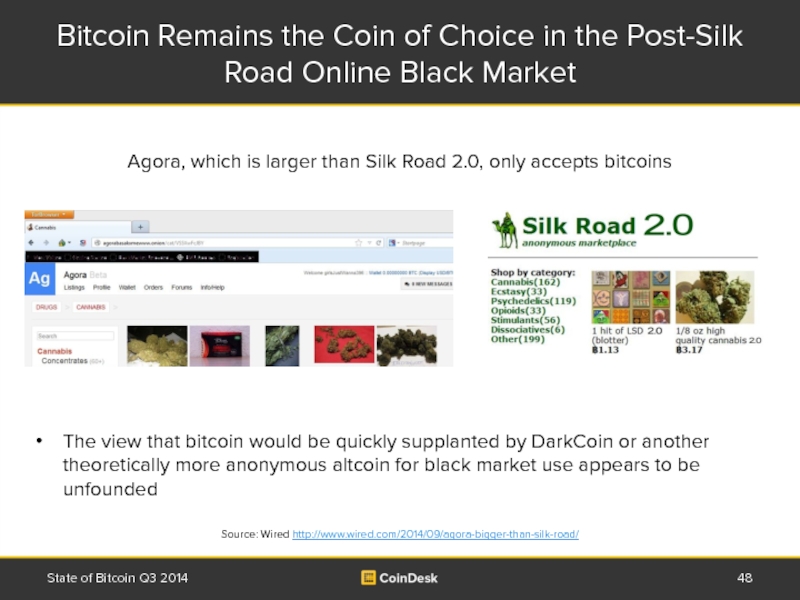

- 48. Bitcoin Remains the Coin of Choice in

- 49. More and More Bitcoin Companies are Advertising

- 50. Now Over 260 Bitcoin ATMs Around the

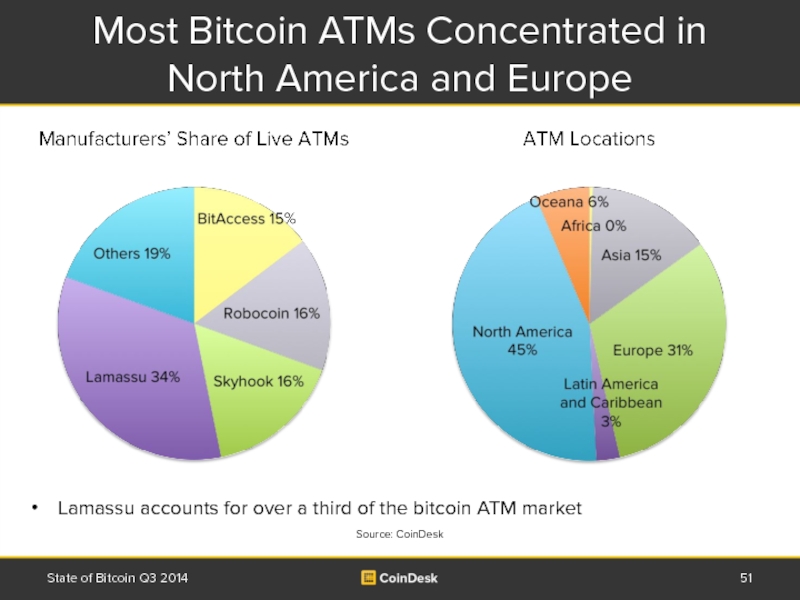

- 51. Most Bitcoin ATMs Concentrated in North America

- 52. State of Bitcoin Q3 2014 Technology

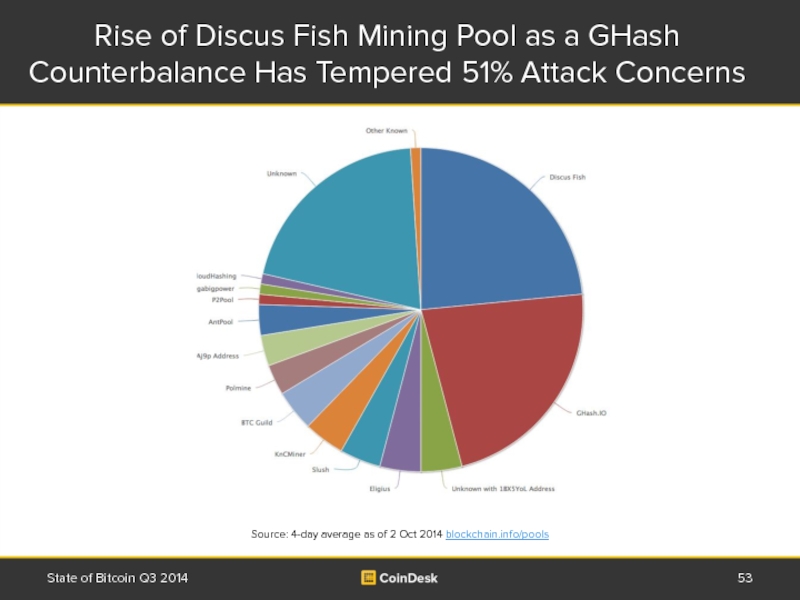

- 53. Rise of Discus Fish Mining Pool as

- 54. Bitcoin Developer Ecosystem Continues to Grow, but

- 55. Will the Decline in the Number of

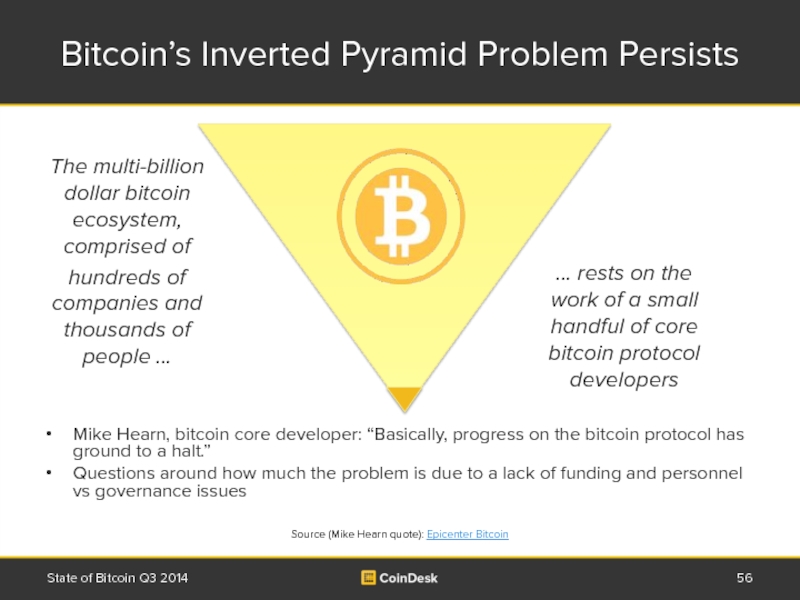

- 56. Bitcoin’s Inverted Pyramid Problem Persists State of

- 57. Bitcoin 2.0: Possible ‘Native Apps’ State of

- 58. State of Bitcoin Q3 2014 Regulation and Macro

- 59. Launch of New Bitcoin Advocacy Groups Emphasizes

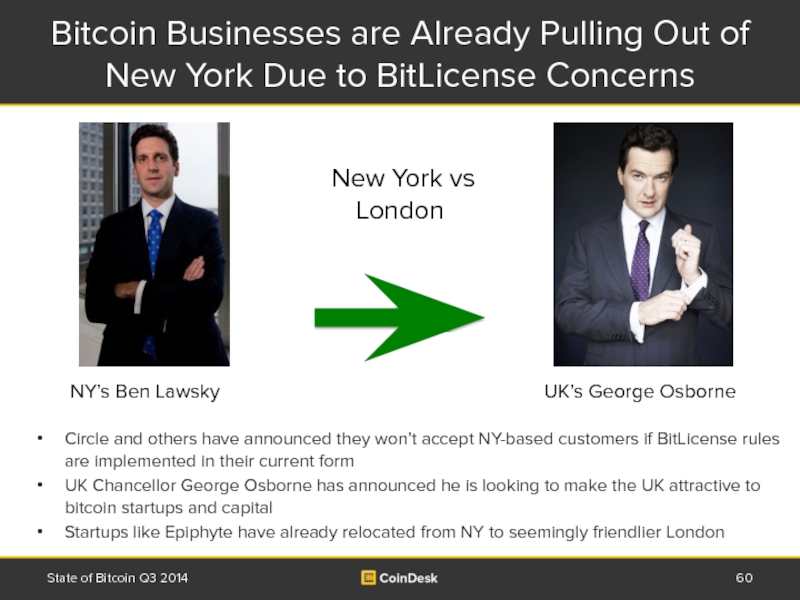

- 60. Bitcoin Businesses are Already Pulling Out of

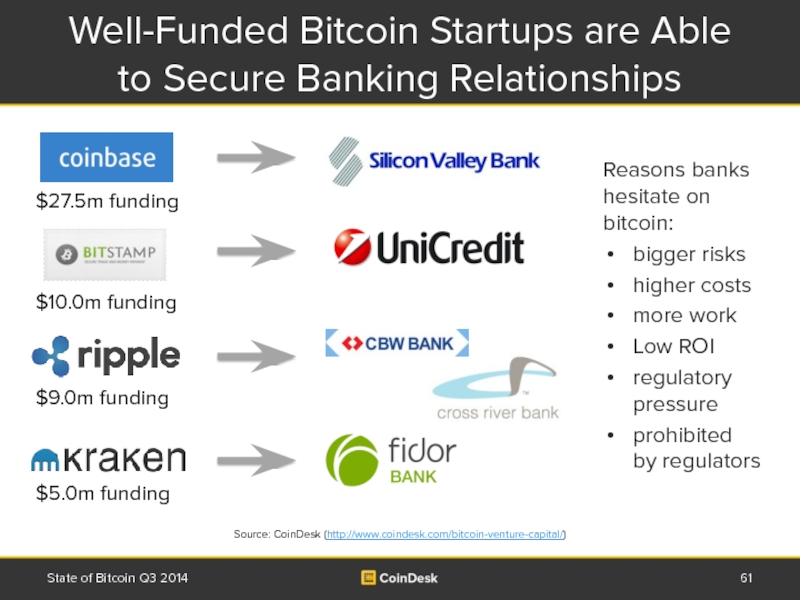

- 61. Well-Funded Bitcoin Startups are Able to Secure

- 62. Secession Votes Prompt Monetary Questions and Could

- 63. New Index Ranks 177 Countries by Relative

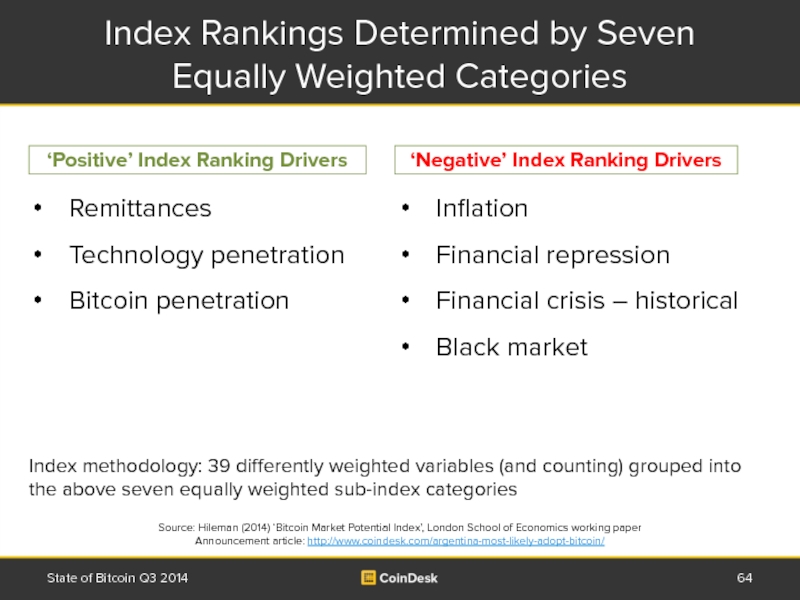

- 64. Index Rankings Determined by Seven Equally Weighted

- 65. Latin America Most Fertile Region for Bitcoin,

- 66. BMPI Heat Map (Interactive Version at BitcoinIQ.info)

- 67. When people write the history of this

- 68. Appendix - CoinDesk Find out more at

- 69. Disclaimer CoinDesk makes every effort to ensure

Слайд 2Contents

Summary and Adoption Dashboard

Price and Valuation

Media

VC Investment

Commerce

Technology

Regulation and Macro

State of Bitcoin

Слайд 3About CoinDesk

World leader in digital currency news, prices and information

Our Bitcoin

London-based and remote team with a global focus

Our editors are based in London, Boston, San Francisco and Tokyo

State of Bitcoin Q3 2014

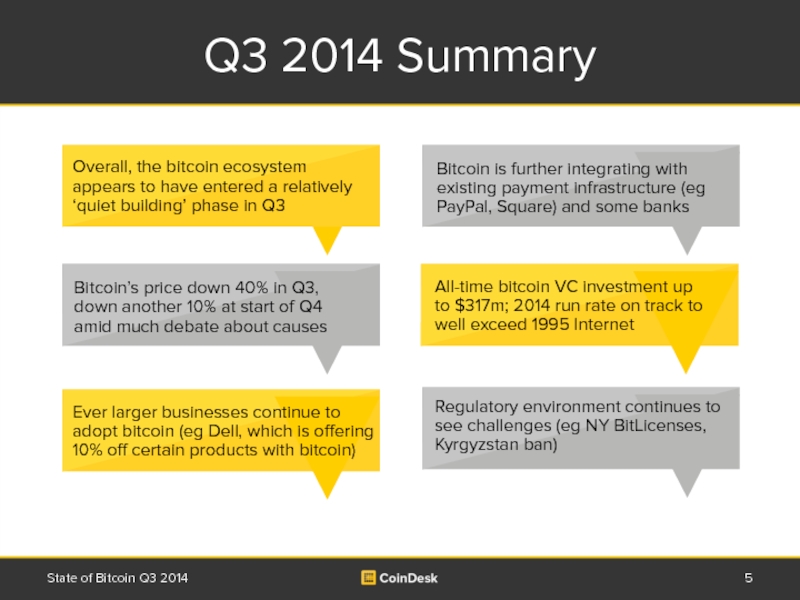

Слайд 5Q3 2014 Summary

State of Bitcoin Q3 2014

Bitcoin is further integrating with

Overall, the bitcoin ecosystem appears to have entered a relatively ‘quiet building’ phase in Q3

All-time bitcoin VC investment up to $317m; 2014 run rate on track to well exceed 1995 Internet

Regulatory environment continues to see challenges (eg NY BitLicenses, Kyrgyzstan ban)

Ever larger businesses continue to adopt bitcoin (eg Dell, which is offering 10% off certain products with bitcoin)

Bitcoin’s price down 40% in Q3, down another 10% at start of Q4 amid much debate about causes

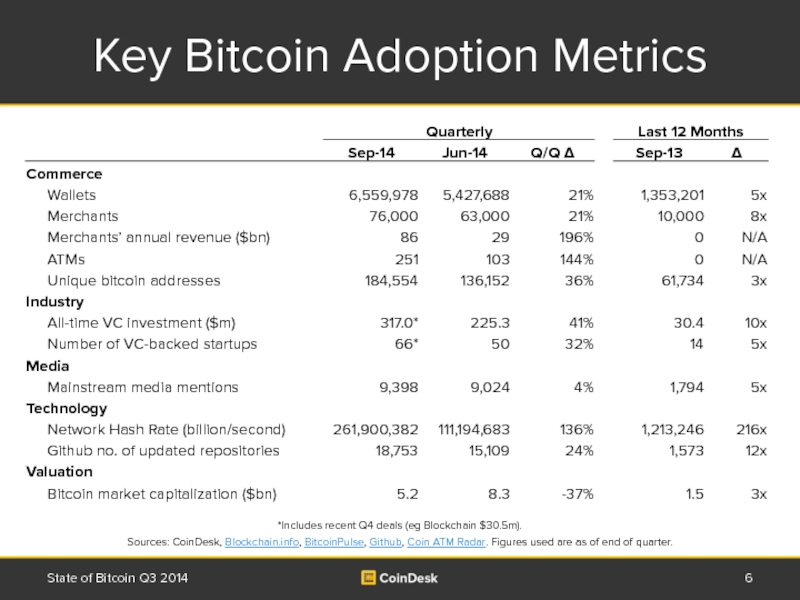

Слайд 6Key Bitcoin Adoption Metrics

State of Bitcoin Q3 2014

Sources: CoinDesk, Blockchain.info, BitcoinPulse,

*Includes recent Q4 deals (eg Blockchain $30.5m).

Слайд 8CoinDesk Bitcoin Price Index –

Q3 & YTD by the Numbers

Source:

www.coindesk.com/price

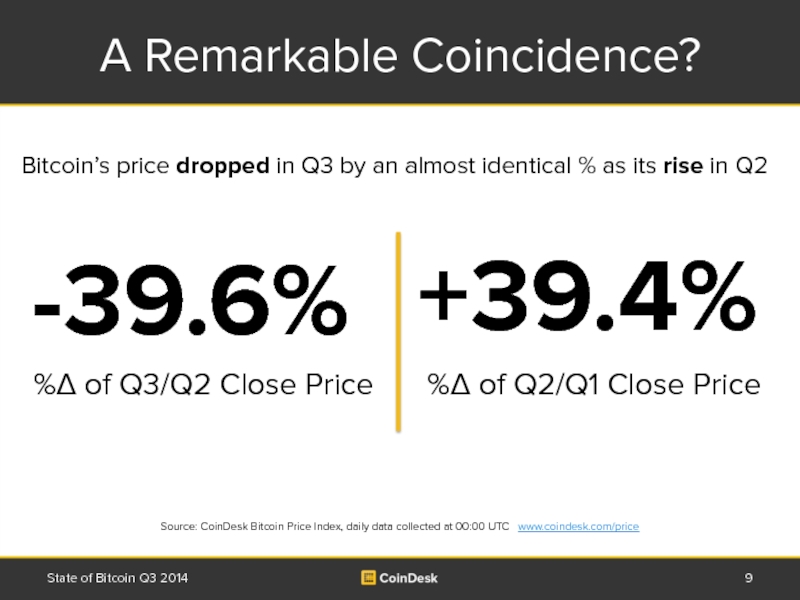

Слайд 9A Remarkable Coincidence?

State of Bitcoin Q3 2014

+39.4%

-39.6%

Bitcoin’s price dropped in

%Δ of Q3/Q2 Close Price

%Δ of Q2/Q1 Close Price

Source: CoinDesk Bitcoin Price Index, daily data collected at 00:00 UTC www.coindesk.com/price

Слайд 10Bitcoin’s Price Has Been Declining on Steadily Rising Trading Volume

State of

18 Aug

Bitcoin price suddenly drops in ‘flash crash’

11 Aug

18 Jul

Dell announces it will accept bitcoin

Blockchain first company to pass over 2m bitcoin wallets

22-23 Sep

PayPal and Square announce bitcoin integration

8 Jul

Xapo announces $20m funding round

Source: CoinDesk Bitcoin Price Index, daily data collected at 00:00 UTC www.coindesk.com/price

9 Jul

Bitcoin industry discussion of concerns over mining pool 51% network control

Following complaints, NY extends BitLicense comment period

21 Aug

9 Sep

Supposed Satoshi Nakamoto email account ‘hack’, blackmail attempt

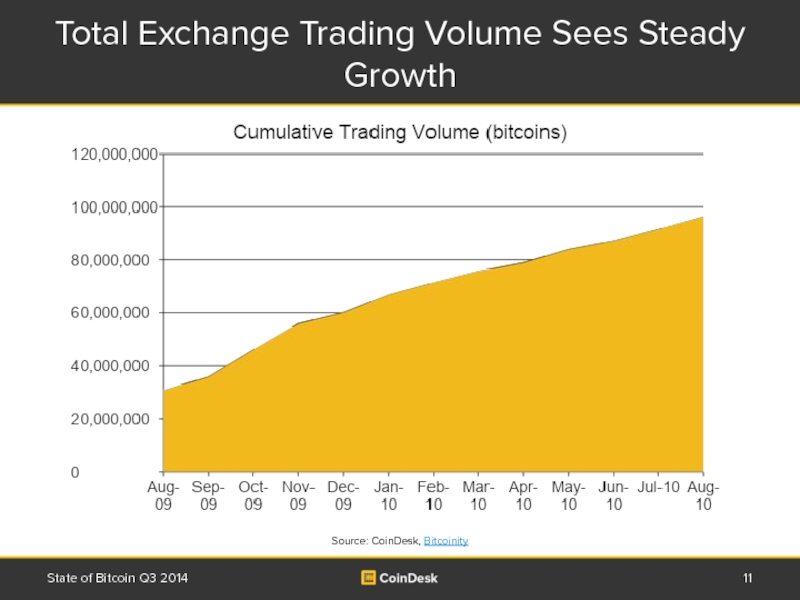

Слайд 11Total Exchange Trading Volume Sees Steady Growth

State of Bitcoin Q3 2014

Source:

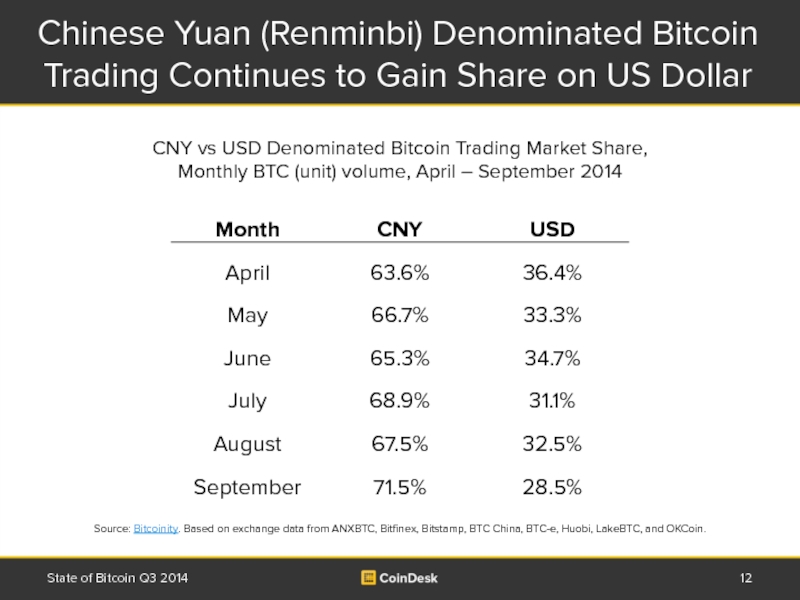

Слайд 12Chinese Yuan (Renminbi) Denominated Bitcoin Trading Continues to Gain Share on

State of Bitcoin Q3 2014

CNY vs USD Denominated Bitcoin Trading Market Share, Monthly BTC (unit) volume, April – September 2014

Source: Bitcoinity. Based on exchange data from ANXBTC, Bitfinex, Bitstamp, BTC China, BTC-e, Huobi, LakeBTC, and OKCoin.

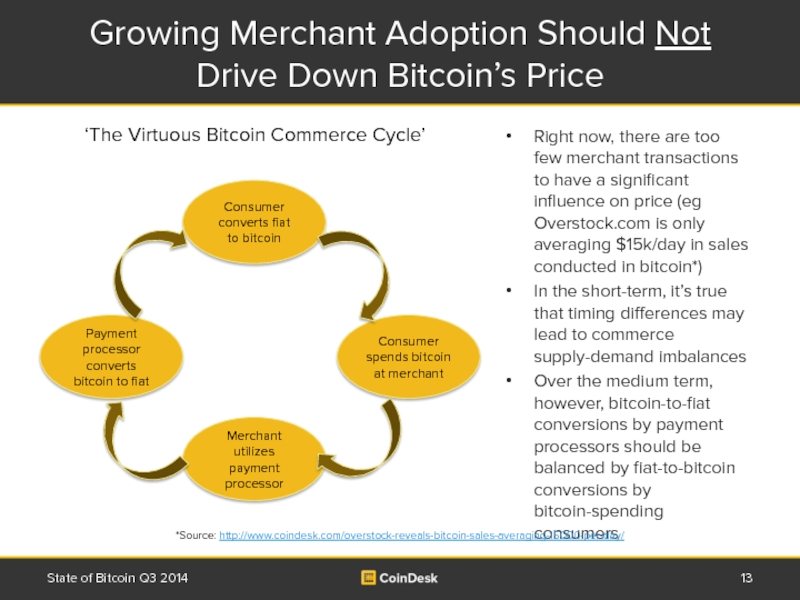

Слайд 13Growing Merchant Adoption Should Not Drive Down Bitcoin’s Price

State of Bitcoin

Consumer converts fiat to bitcoin

Consumer spends bitcoin at merchant

Merchant utilizes payment processor

Payment processor converts bitcoin to fiat

‘The Virtuous Bitcoin Commerce Cycle’

Right now, there are too few merchant transactions to have a significant influence on price (eg Overstock.com is only averaging $15k/day in sales conducted in bitcoin*)

In the short-term, it’s true that timing differences may lead to commerce supply-demand imbalances

Over the medium term, however, bitcoin-to-fiat conversions by payment processors should be balanced by fiat-to-bitcoin conversions by bitcoin-spending consumers

*Source: http://www.coindesk.com/overstock-reveals-bitcoin-sales-averaging-15000-per-day/

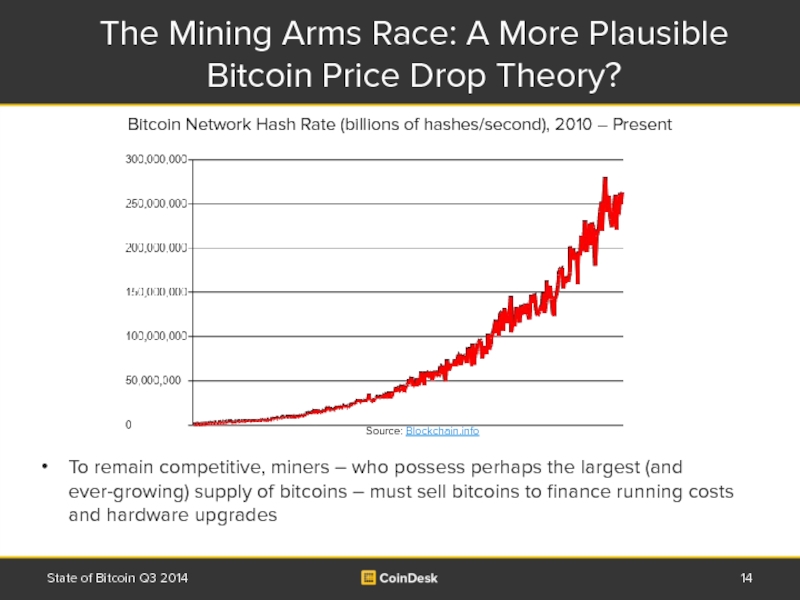

Слайд 14The Mining Arms Race: A More Plausible Bitcoin Price Drop Theory?

State

To remain competitive, miners – who possess perhaps the largest (and ever-growing) supply of bitcoins – must sell bitcoins to finance running costs and hardware upgrades

Bitcoin Network Hash Rate (billions of hashes/second), 2010 – Present

Source: Blockchain.info

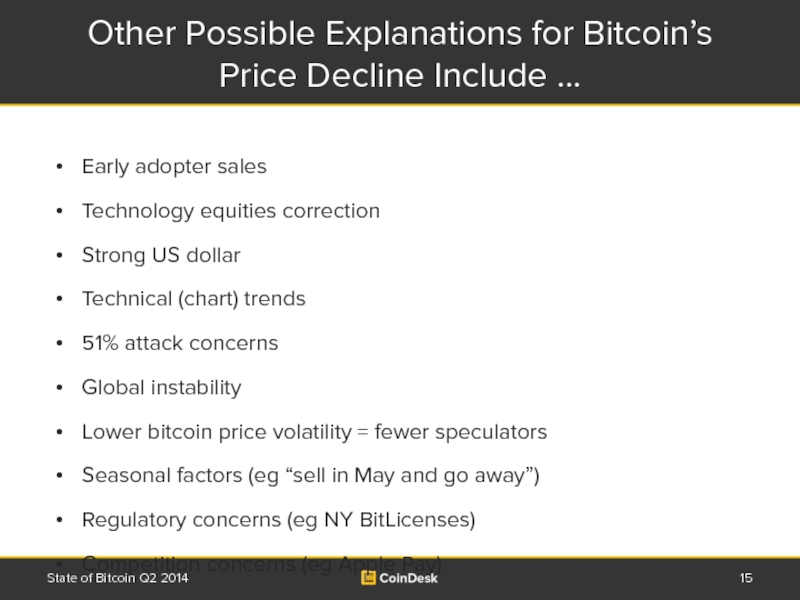

Слайд 15Other Possible Explanations for Bitcoin’s

Price Decline Include …

Early adopter sales

Technology

Strong US dollar

Technical (chart) trends

51% attack concerns

Global instability

Lower bitcoin price volatility = fewer speculators

Seasonal factors (eg “sell in May and go away”)

Regulatory concerns (eg NY BitLicenses)

Competition concerns (eg Apple Pay)

State of Bitcoin Q2 2014

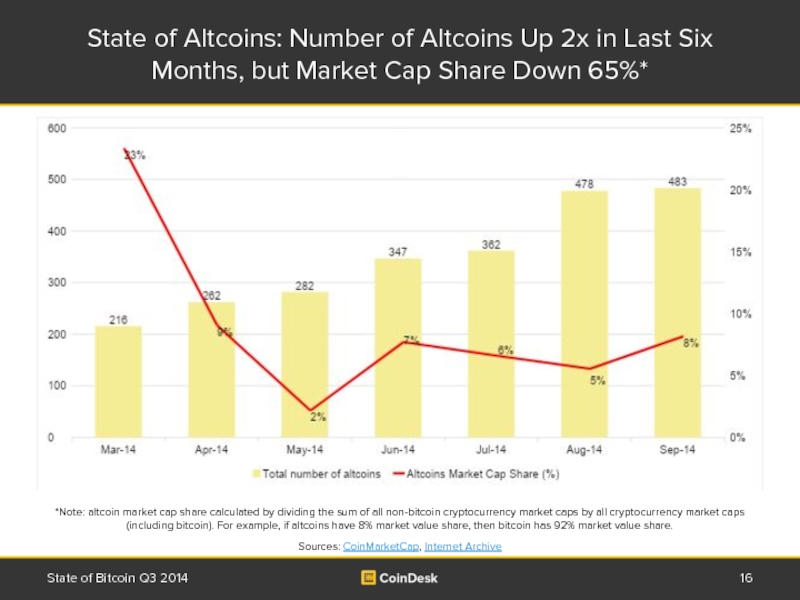

Слайд 16State of Altcoins: Number of Altcoins Up 2x in Last Six

State of Bitcoin Q3 2014

Sources: CoinMarketCap, Internet Archive

*Note: altcoin market cap share calculated by dividing the sum of all non-bitcoin cryptocurrency market caps by all cryptocurrency market caps (including bitcoin). For example, if altcoins have 8% market value share, then bitcoin has 92% market value share.

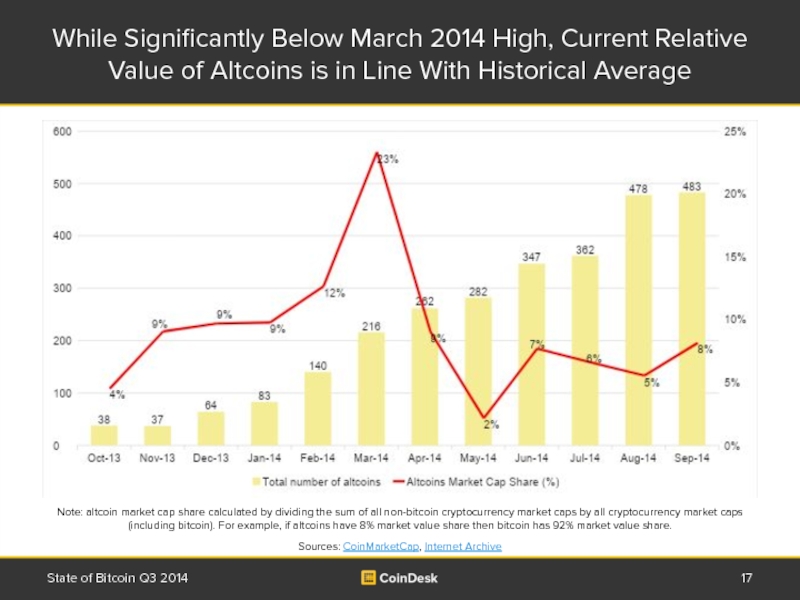

Слайд 17While Significantly Below March 2014 High, Current Relative Value of Altcoins

State of Bitcoin Q3 2014

Note: altcoin market cap share calculated by dividing the sum of all non-bitcoin cryptocurrency market caps by all cryptocurrency market caps (including bitcoin). For example, if altcoins have 8% market value share then bitcoin has 92% market value share.

Sources: CoinMarketCap, Internet Archive

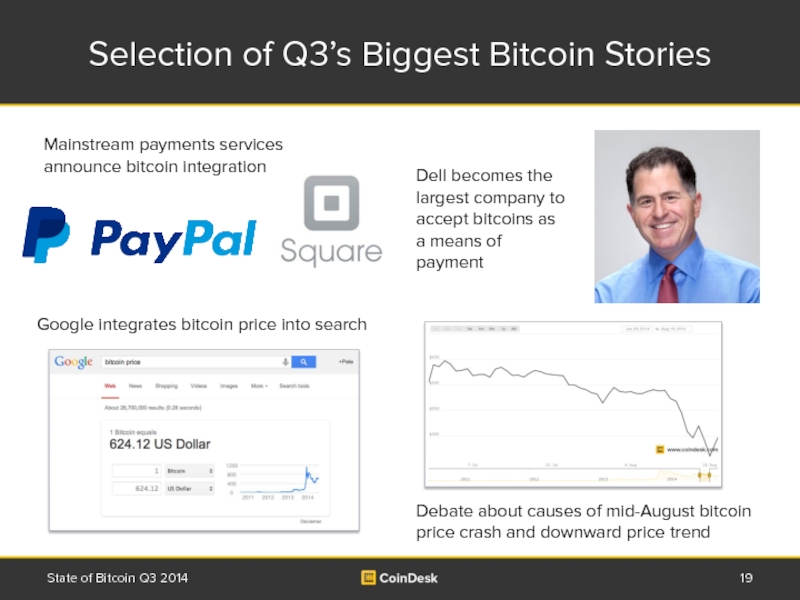

Слайд 19Selection of Q3’s Biggest Bitcoin Stories

State of Bitcoin Q3 2014

Debate about

Mainstream payments services announce bitcoin integration

Dell becomes the largest company to accept bitcoins as a means of payment

Google integrates bitcoin price into search

Слайд 20Seven of the Most Popular CoinDesk Q3 Stories About Bitcoin’s Price

State of Bitcoin Q3 2014

Source: CoinDesk

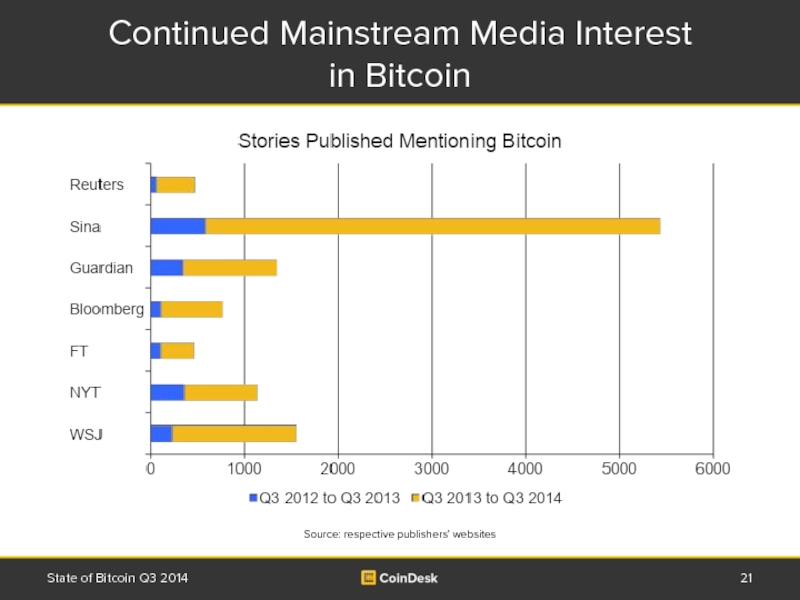

Слайд 21Continued Mainstream Media Interest

in Bitcoin

State of Bitcoin Q3 2014

Source: respective publishers’

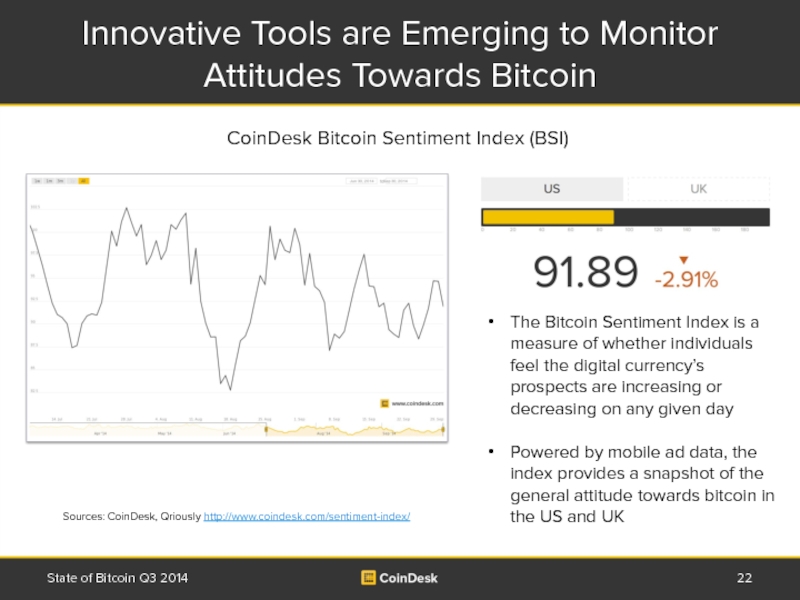

Слайд 22Innovative Tools are Emerging to Monitor Attitudes Towards Bitcoin

State of Bitcoin

Sources: CoinDesk, Qriously http://www.coindesk.com/sentiment-index/

CoinDesk Bitcoin Sentiment Index (BSI)

The Bitcoin Sentiment Index is a measure of whether individuals feel the digital currency’s prospects are increasing or decreasing on any given day

Powered by mobile ad data, the index provides a snapshot of the general attitude towards bitcoin in the US and UK

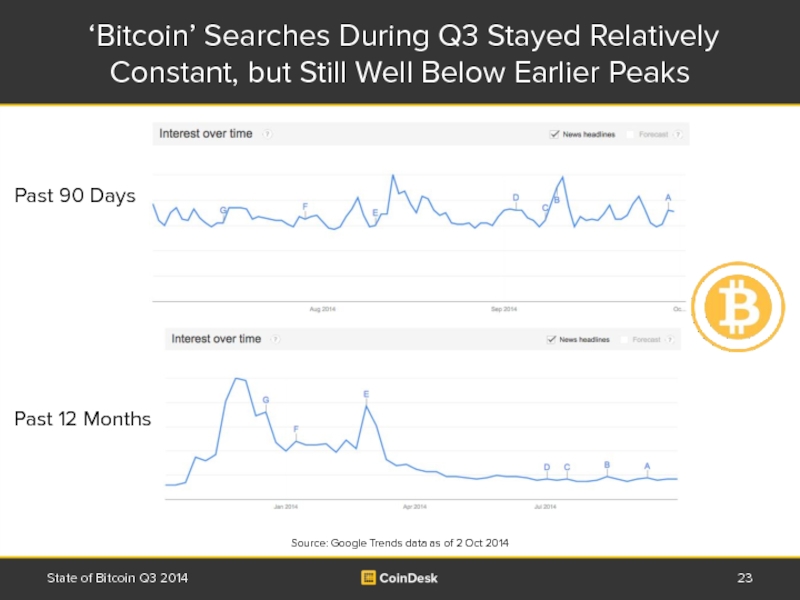

Слайд 23 ‘Bitcoin’ Searches During Q3 Stayed Relatively Constant, but Still Well

State of Bitcoin Q3 2014

Past 90 Days

Past 12 Months

Source: Google Trends data as of 2 Oct 2014

Слайд 24 Related ‘Bitcoin’ Searches Are Becoming More Sophisticated, Evolving Beyond ‘What

State of Bitcoin Q3 2014

Source: Google Trends data as of 2 Oct. 2014

Past 90 Days

Past 12 Months

Related Searches: Top

Related Searches: Rising

Слайд 26Two Biggest Bitcoin VC Deals in Q3

State of Bitcoin Q3 2014

$20m

$14m

(Series A) September 2014

(Series A) July 2014

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

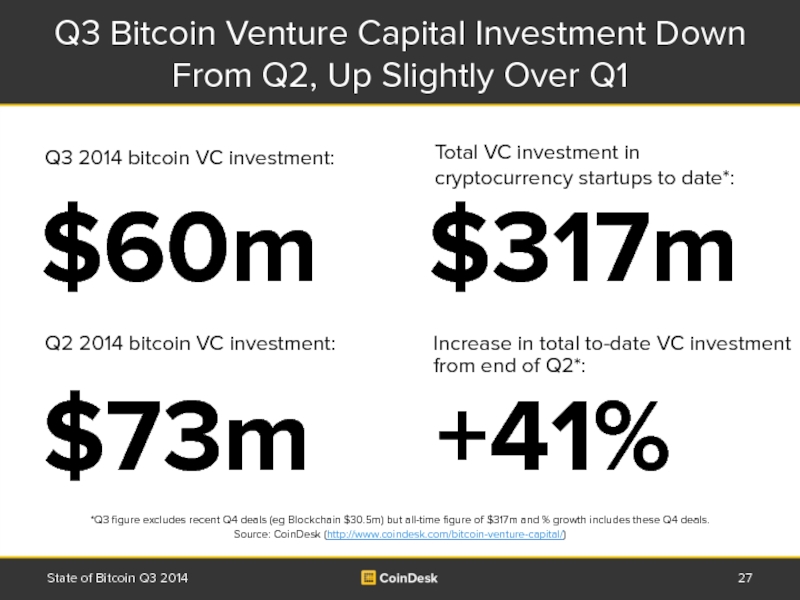

Слайд 27Q3 Bitcoin Venture Capital Investment Down From Q2, Up Slightly Over

State of Bitcoin Q3 2014

$317m

$60m

Total VC investment in cryptocurrency startups to date*:

Q3 2014 bitcoin VC investment:

$73m

Q2 2014 bitcoin VC investment:

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

+41%

Increase in total to-date VC investment from end of Q2*:

*Q3 figure excludes recent Q4 deals (eg Blockchain $30.5m) but all-time figure of $317m and % growth includes these Q4 deals.

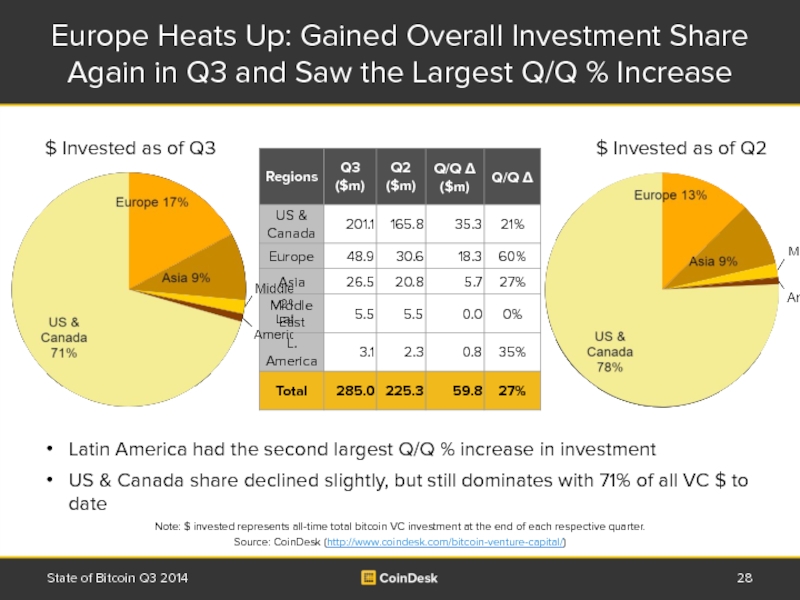

Слайд 28Europe Heats Up: Gained Overall Investment Share Again in Q3 and

State of Bitcoin Q3 2014

$ Invested as of Q2

Latin America had the second largest Q/Q % increase in investment

US & Canada share declined slightly, but still dominates with 71% of all VC $ to date

Note: $ invested represents all-time total bitcoin VC investment at the end of each respective quarter.

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

$ Invested as of Q3

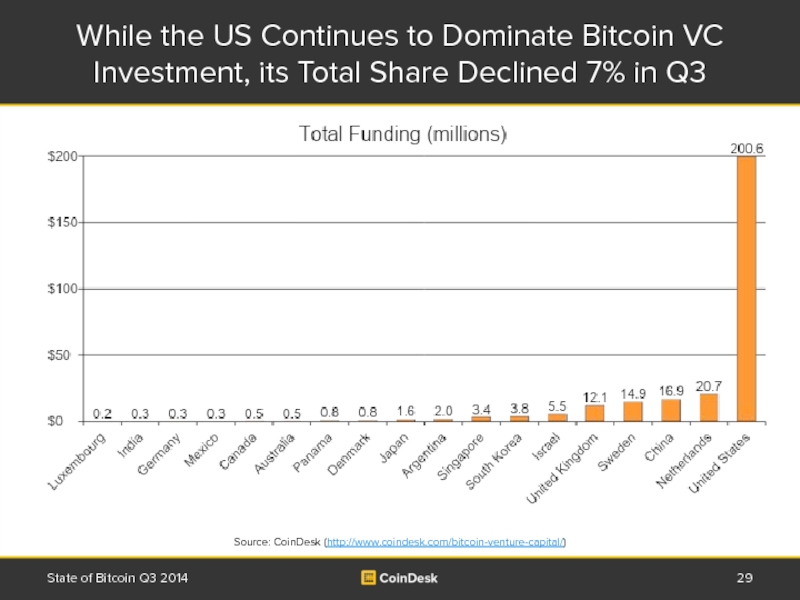

Слайд 29While the US Continues to Dominate Bitcoin VC Investment, its Total

State of Bitcoin Q3 2014

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

Слайд 30Silicon Valley’s Share of All-Time Bitcoin VC Investment Slipped Slightly From

State of Bitcoin Q3 2014

Share of VC-backed bitcoin companies based in Silicon Valley continues to slide, down from 37% in Q2 to 33% in Q3

Total number of VC-backed bitcoin companies increased from 49 in Q2 to 64 in Q3, a 31% increase

$ Invested

No. of Companies

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

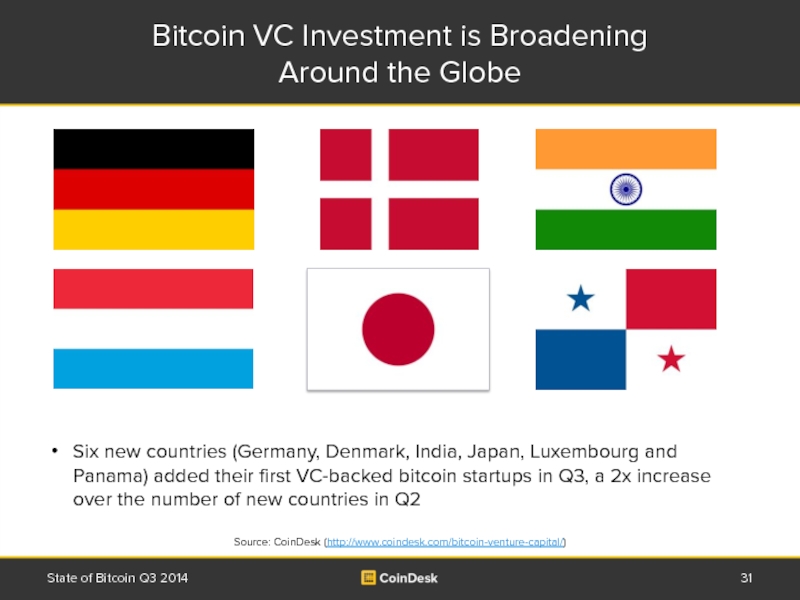

Слайд 31Bitcoin VC Investment is Broadening

Around the Globe

State of Bitcoin Q3

Six new countries (Germany, Denmark, India, Japan, Luxembourg and Panama) added their first VC-backed bitcoin startups in Q3, a 2x increase over the number of new countries in Q2

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

Слайд 322014 Bitcoin VC Investment Projected to Surpass Early-Stage Internet Investments

State of

Source: CoinDesk, PricewaterhouseCoopers

Слайд 33The Bitcoin Startup Ecosystem:

Six Different Bitcoin Company Categories

State of Bitcoin

Слайд 34Wallets Raised the Most Funding in Q3, Followed by Financial Services

State of Bitcoin Q3 2014

Слайд 35Universals Still Command the Most VC Investment, but Share Slipped by

State of Bitcoin Q3 2014

Wallets, Financial Services, and Mining sectors continued to receive the lion’s share of investment in Q3

Exchanges have only received a combined $4 million over the last two quarters

$ Invested as of Q2

$ Invested as of Q3

Note: $ invested represents all-time total bitcoin VC investment at the end of each respective quarter.

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

Слайд 36Increasing Number of Universal Bitcoin Companies (Up Over 2x Q/Q)

State of

As we correctly forecasted in the Q2 State of Bitcoin, “more and more bitcoin startups will pursue the universal model”

Universals operate across more than one aspect of the bitcoin value chain (eg Coinplug provides payment processing, wallet and ATM)

Universal bitcoin companies leverage two key elements of financial services: efficiency and trust

The Universals

Слайд 37Q3 Investment Rounds in Bitcoin Startups (contd.)

State of Bitcoin Q3 2014

Source:

Слайд 38Q3 Investment Rounds in Bitcoin Startups (contd.)

State of Bitcoin Q3 2014

Source:

Слайд 39Q3 Investment Rounds in Bitcoin Startups (contd.)

State of Bitcoin Q3 2014

Source:

Слайд 41>75K Merchants Now Accept Bitcoin, Up From 63K in Q2 (+19%)

State

40K

35K

Source: Coinbase and BitPay

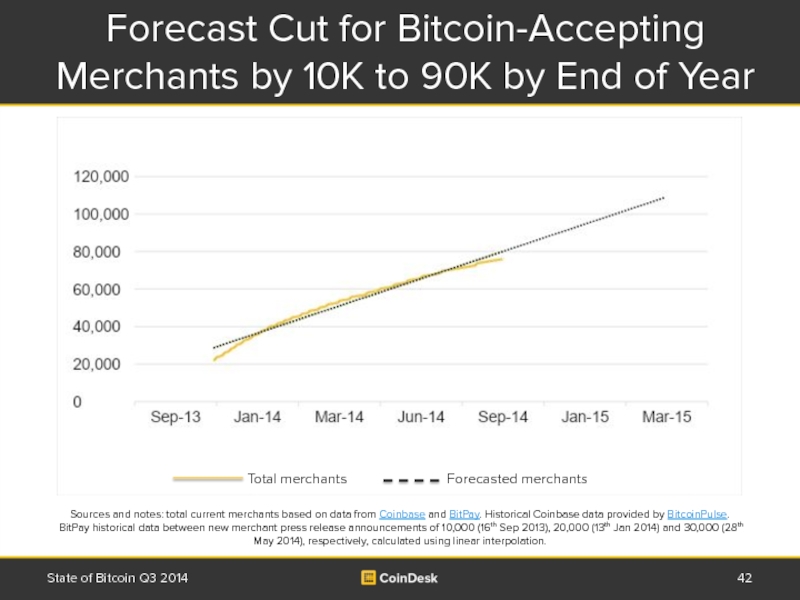

Слайд 42 Total merchants

Forecast Cut for Bitcoin-Accepting Merchants by 10K to 90K by End of Year

State of Bitcoin Q3 2014

Sources and notes: total current merchants based on data from Coinbase and BitPay. Historical Coinbase data provided by BitcoinPulse. BitPay historical data between new merchant press release announcements of 10,000 (16th Sep 2013), 20,000 (13th Jan 2014) and 30,000 (28th May 2014), respectively, calculated using linear interpolation.

Слайд 43Dell is by Far the Largest Retailer to Date to Accept

State of Bitcoin Q3 2014

@Dell tweet:

If you’re a retailer, there’s really no reason not to accept bitcoin at this point

“

”

Source: CoinDesk, Absolute Return

$56.9 billion annual revenue

Слайд 44Companies Representing >$85 Billion in Annual Revenue Now Accept Bitcoin

State of

Слайд 45Some Merchants are Seeing Significant Sales in Bitcoin

State of Bitcoin Q3

Overstock.com is averaging $15k per day in goods sold for bitcoin and is forecasting over $1m per month by fourth quarter in 2014

Patrick Byrne, Overstock

+233%

Source: http://www.coindesk.com/overstock-reveals-bitcoin-sales-averaging-15000-per-day/

Слайд 46A Growing Number of Compelling Reasons to Use Bitcoin to Make

State of Bitcoin Q3 2014

Dell is offering up to 10% off certain products for purchases made with bitcoin

Purse.io customers often save 10-25% on Amazon Wish List items purchased by third parties seeking to acquire bitcoins for fiat

Слайд 47 Total Wallets Forecasted

Approximately 8 Million Bitcoin Wallets Still Forecasted by End of Year

State of Bitcoin Q3 2014

R2 = 0.9365

Sources and notes: total wallets based on data from Blockchain.info, MultiBit, Coinbase, Andreas Schildbach (Android Bitcoin Wallet developer). Historical Coinbase data provided by BitcoinPulse.

Слайд 48Bitcoin Remains the Coin of Choice in the Post-Silk Road Online

State of Bitcoin Q3 2014

The view that bitcoin would be quickly supplanted by DarkCoin or another theoretically more anonymous altcoin for black market use appears to be unfounded

Source: Wired http://www.wired.com/2014/09/agora-bigger-than-silk-road/

Agora, which is larger than Silk Road 2.0, only accepts bitcoins

Слайд 49More and More Bitcoin Companies are Advertising Their Insurance Protection to

State of Bitcoin Q3 2014

However, the question remains whether companies that have bypassed insurance (eg Blockchain), or openly eschew it (eg BitReserve), will see lower customer adoption

Insured by Aon

Insured by Marsh

Insured through London specialist market, brokered by CBC Insurance

Insured by Meridian

Слайд 50Now Over 260 Bitcoin ATMs

Around the World

State of Bitcoin Q3 2014

Source:

Слайд 51Most Bitcoin ATMs Concentrated in North America and Europe

State of Bitcoin

Lamassu accounts for over a third of the bitcoin ATM market

Source: CoinDesk

Слайд 53Rise of Discus Fish Mining Pool as a GHash Counterbalance Has

State of Bitcoin Q3 2014

Source: 4-day average as of 2 Oct 2014 blockchain.info/pools

Слайд 54Bitcoin Developer Ecosystem Continues to Grow, but Has Slowed Recently

State of

Developer engagement on open-source projects is tapering

Source: BitcoinPulse

Слайд 55Will the Decline in the Number of Bitcoin Nodes Leave Bitcoin

State of Bitcoin Q3 2014

Source: BitcoinPulse

Bitcoin network nodes are needed to ensure all valid bitcoin transactions that occur are broadcasted in a timely manner

The number of bitcoin nodes has fallen from a peak of 250k at the end of 2013 to under 7k

Слайд 56Bitcoin’s Inverted Pyramid Problem Persists

State of Bitcoin Q3 2014

Mike Hearn, bitcoin

Questions around how much the problem is due to a lack of funding and personnel vs governance issues

The multi-billion dollar bitcoin ecosystem, comprised of

hundreds of companies and thousands of people …

… rests on the work of a small handful of core bitcoin protocol developers

Source (Mike Hearn quote): Epicenter Bitcoin

Слайд 57Bitcoin 2.0: Possible ‘Native Apps’

State of Bitcoin Q3 2014

Allocating bandwidth, storage,

Smart marketplaces: open up access to crowdfunding and crowd labor services (oDesk, 99 Designs, Beacon Reader, Mechanical Turk) to anyone with a smartphone

Micropayments: enabling micropayments on the web and not just for mobile in-app payments

Incentivized social software: supplementing likes, followers, karma, upvotes etc with monetary incentives

Sources: http://avc.com/2014/09/the-bitcoin-hype-cycle/ and http://cdixon.org/2014/10/04/some-ideas-for-native-bitcoin-apps/

“I am thinking that we will start to see native applications of bitcoin. These would be things that simply could not exist without this technology.” – Fred Wilson

Слайд 59Launch of New Bitcoin Advocacy Groups Emphasizes Ongoing Regulatory Challenges

State of

Jerry Brito, Coin Center

Questions exist around how related Coin Center’s launch is with ongoing controversy surrounding the Bitcoin Foundation

Jon Matonis, Bitcoin Foundation

Perianne Boring, Chamber of Digital Commerce

Слайд 60Bitcoin Businesses are Already Pulling Out of New York Due to

State of Bitcoin Q3 2014

NY’s Ben Lawsky

UK’s George Osborne

New York vs

London

Circle and others have announced they won’t accept NY-based customers if BitLicense rules are implemented in their current form

UK Chancellor George Osborne has announced he is looking to make the UK attractive to bitcoin startups and capital

Startups like Epiphyte have already relocated from NY to seemingly friendlier London

Слайд 61Well-Funded Bitcoin Startups are Able to Secure Banking Relationships

State of Bitcoin

Source: CoinDesk (http://www.coindesk.com/bitcoin-venture-capital/)

$27.5m funding

$10.0m funding

$9.0m funding

$5.0m funding

Reasons banks hesitate on bitcoin:

bigger risks

higher costs

more work

Low ROI

regulatory pressure

prohibited by regulators

Слайд 62Secession Votes Prompt Monetary Questions and Could Create Openings for Alternative

State of Bitcoin Q3 2014

Debate over currency was at the forefront of Scotland’s independence campaign

Catalan independence vote scheduled to take place on 9th November

Слайд 63New Index Ranks 177 Countries by Relative Potential to Adopt Bitcoin

State

Source: Hileman (2014) ‘Bitcoin Market Potential Index’, London School of Economics working paper.

Announcement article: http://www.coindesk.com/argentina-most-likely-adopt-bitcoin/

Rank Country

1 Argentina

2 Venezuela

3 Zimbabwe

4 India

5 Nigeria

6 Brazil

7 United States

8 Nicaragua

9 Russia

10 Iceland

Cristina Fernández de Kirchner’s Argentina is #1

The Bitcoin Market Potential Index™ (BMPI) – The Top 10

Слайд 64Index Rankings Determined by Seven Equally Weighted Categories

State of Bitcoin Q3

Index methodology: 39 differently weighted variables (and counting) grouped into the above seven equally weighted sub-index categories

Source: Hileman (2014) ‘Bitcoin Market Potential Index’, London School of Economics working paper

Announcement article: http://www.coindesk.com/argentina-most-likely-adopt-bitcoin/

‘Positive’ Index Ranking Drivers

‘Negative’ Index Ranking Drivers

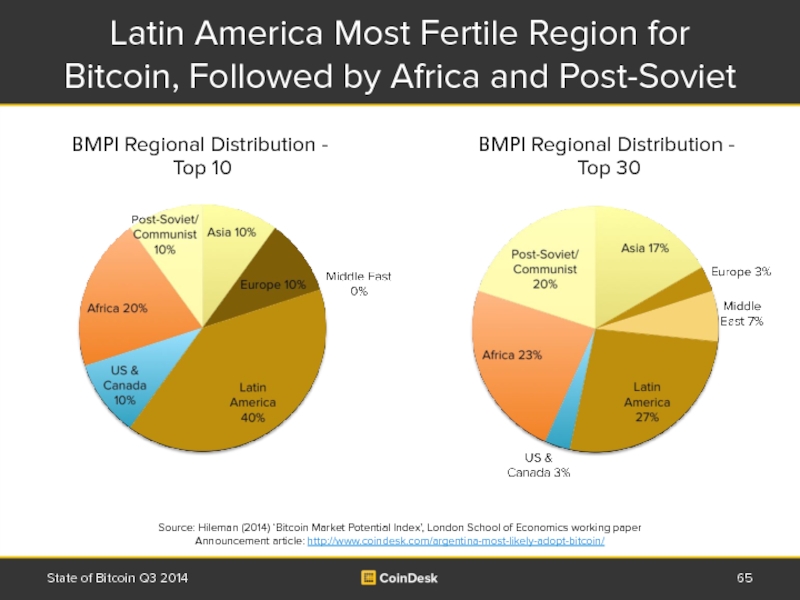

Слайд 65Latin America Most Fertile Region for Bitcoin, Followed by Africa and

State of Bitcoin Q3 2014

Source: Hileman (2014) ‘Bitcoin Market Potential Index’, London School of Economics working paper

Announcement article: http://www.coindesk.com/argentina-most-likely-adopt-bitcoin/

BMPI Regional Distribution -

Top 30

BMPI Regional Distribution -

Top 10

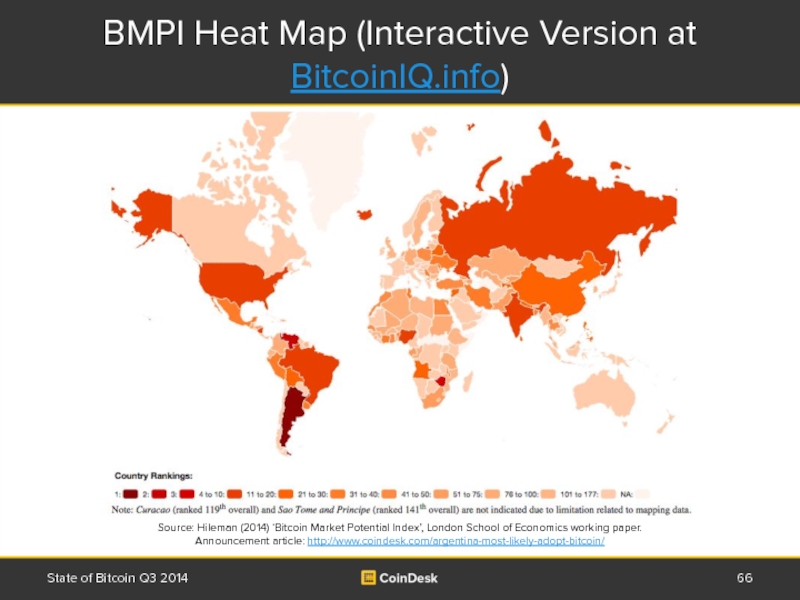

Слайд 66BMPI Heat Map (Interactive Version at BitcoinIQ.info)

State of Bitcoin Q3

Source: Hileman (2014) ‘Bitcoin Market Potential Index’, London School of Economics working paper.

Announcement article: http://www.coindesk.com/argentina-most-likely-adopt-bitcoin/

BitcoinIQ.info

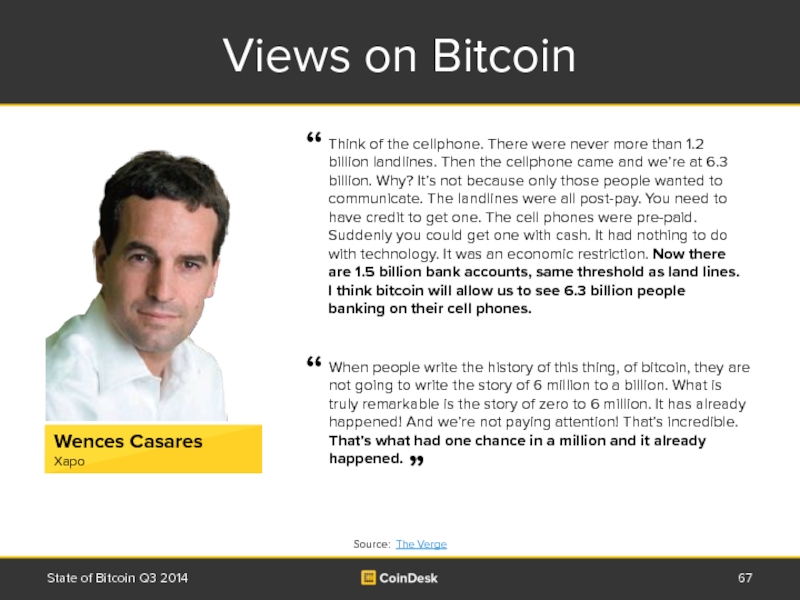

Слайд 67When people write the history of this thing, of bitcoin, they

Views on Bitcoin

State of Bitcoin Q3 2014

Think of the cellphone. There were never more than 1.2 billion landlines. Then the cellphone came and we’re at 6.3 billion. Why? It’s not because only those people wanted to communicate. The landlines were all post-pay. You need to have credit to get one. The cell phones were pre-paid. Suddenly you could get one with cash. It had nothing to do with technology. It was an economic restriction. Now there are 1.5 billion bank accounts, same threshold as land lines. I think bitcoin will allow us to see 6.3 billion people banking on their cell phones.

“

“

”

Source: The Verge

Wences Casares

Xapo

Слайд 68Appendix - CoinDesk

Find out more at www.coindesk.com

Follow us on Twitter: @coindesk

Subscribe

If you have data you think should be included in future State of Bitcoin reports, email stateofbitcoin@coindesk.com

We also welcome any feedback you have on the report

State of Bitcoin Q3 2014

Слайд 69Disclaimer

CoinDesk makes every effort to ensure that the information in this

This presentation does not constitute financial advice or an investment recommendation in any way whatsoever. It is recommended that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

State of Bitcoin Q3 2014