- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

7 High-Dividend REIT Stocks презентация

Содержание

- 1. 7 High-Dividend REIT Stocks

- 2. 1. Realty Income Corp. (NYSE:O) Share Price:

- 3. Realty Income owns more than 4,300 retail

- 4. 2. American Campus Communities (NYSE: ACC) Share

- 5. American Campus Communities builds and operates student

- 6. 3. Chambers Street Properties (NYSE: CSG) Share

- 7. Chambers Street’s portfolio consists of 42% industrial

- 8. 4. Annaly Capital Management (NYSE: NLY) Share

- 9. Annaly invests in high-quality, agency guaranteed mortgages

- 10. 5. PennyMac Mortgage Investment Trust (NYSE: PMT)

- 11. Unlike most mortgage REITs, PennyMac primarily invests

- 12. 6. Health Care REIT Inc (NYSE: HCN)

- 13. Health Care REIT was the first of

- 14. 7. Digital Realty Trust (NYSE: DLR) Share

- 15. Digital Realty Trust owns data centers in

- 16. You might also enjoy… The $19

Слайд 21. Realty Income Corp. (NYSE:O)

Share Price: $52.05

Dividend Yield: 4.37%

Frequency: Monthly

Type of

April 4, 2015

Слайд 3Realty Income owns more than 4,300 retail properties

98.4% occupancy rate, which

Tenants sign long-term leases (15 years or more) with rent increases built in, and pay variable expenses such as taxes, insurance, and maintenance

Since going public in 1994, Realty Income has increased its dividend 80 times, by an average of 4.7% per year

Average annual total returns of 17.1% over the past 20 years

Largest tenants are Walgreen’s, FedEx, and Dollar General

April 4, 2015

Realty Income Corp (NYSE: O)

Слайд 42. American Campus Communities (NYSE: ACC)

Share Price: $43.36

Dividend Yield: 3.51%

Frequency: Quarterly

Type

April 4, 2015

www.audio-luci-store.it via flickr

Слайд 5American Campus Communities builds and operates student housing communities

Currently has 163

Target market is 4-year public institutions with enrollment greater than 15,000

3 largest markets (by income) are Arizona State University, University of Texas at Austin, and Texas A&M

Average occupancy rate of 97.7% and average rental growth of 2.4% annually

Seeks growth through acquisitions, as well as through development of new properties

April 4, 2015

American Campus Communities (NYSE: ACC)

Слайд 63. Chambers Street Properties (NYSE: CSG)

Share Price: $7.92

Dividend Yield: 6.44%

Frequency: Monthly

Type

April 4, 2015

Source: wikipedia

Слайд 7Chambers Street’s portfolio consists of 42% industrial and 58% office properties

128

The portfolio is geographically diverse, as well as diversified across different industries

98.3% occupancy rate

Has been focused on debt reduction and selective acquisitions of new industrial properties

Most tenants are on “triple-net” leases, which means they pay taxes, insurance, and maintenance as part of the rent

Top tenants are Amazon.com, Barclays, and Raytheon

April 4, 2015

Chambers Street Properties (NYSE: CSG)

Слайд 84. Annaly Capital Management (NYSE: NLY)

Share Price: $10.45

Dividend Yield:11.48%

Frequency: Quarterly

Type of

April 4, 2015

Source: 401kcalculator.org

Слайд 9Annaly invests in high-quality, agency guaranteed mortgages

Most of the portfolio (95%)

In order to produce high returns, Annaly uses leverage (borrowed money) to finance its investments

The company’s profit is the “spread” between the interest rate it pays and the interest rate is collects from the mortgages

Current leverage ratio is 5.4:1

The downside is that this business model is very vulnerable to interest rate spikes, since that can cause the spread to narrow

Shares currently trade for a 20% discount to book value

April 4, 2015

Annaly Capital Management (NYSE: NLY)

Слайд 105. PennyMac Mortgage Investment Trust (NYSE: PMT)

Share Price: $21.34

Dividend Yield: 11.43%

Frequency:

Type of real estate investments: Distressed mortgages

April 4, 2015

Слайд 11Unlike most mortgage REITs, PennyMac primarily invests in distressed mortgage loans

Since

Current leverage ratio is 2:1, unlike most mortgage REITs which use 5:1 or higher

PennyMac has increased its dividend consistently since going public

Dividend has risen 7% over the past two years

April 4, 2015

PennyMac Mortgage Investment Trust (NYSE: PMT)

Слайд 126. Health Care REIT Inc (NYSE: HCN)

Share Price: $77.83

Dividend Yield: 4.24%

Frequency:

Type of real estate investments: Health care properties

April 4, 2015

Photo: pixabay

Слайд 13Health Care REIT was the first of its kind, founded in

Currently owns more than 1,300 properties with an enterprise value of $37 billion

Properties include senior housing, LTC facilities, medical offices, and more

Great growth opportunity, as the 75+ population is projected to grow more than five times as fast as the overall U.S. population

Strong balance sheet, good access to capital

16.1% average annual return since inception

April 4, 2015

Health Care REIT Inc (NYSE: HCP)

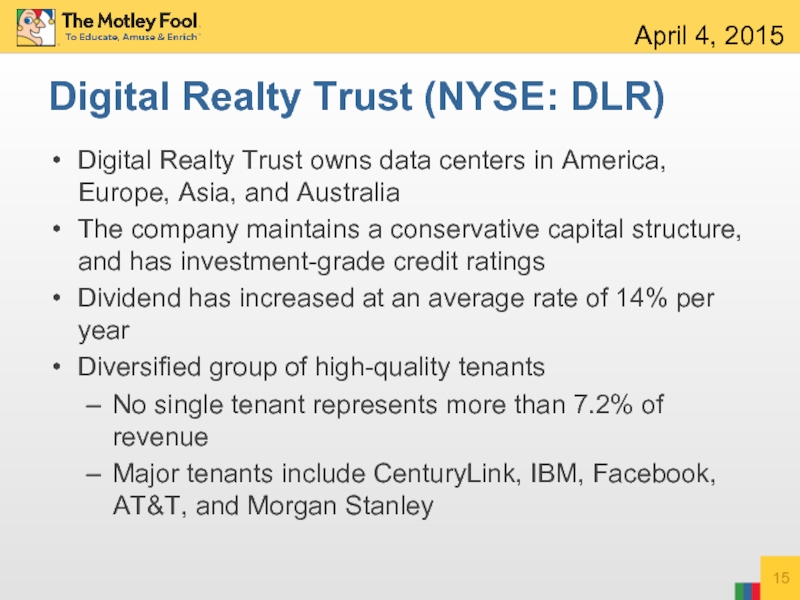

Слайд 147. Digital Realty Trust (NYSE: DLR)

Share Price: $65.84

Dividend Yield: 5.16%

Frequency: Quarterly

Type

April 4, 2015

Photo: wikipedia

Слайд 15Digital Realty Trust owns data centers in America, Europe, Asia, and

The company maintains a conservative capital structure, and has investment-grade credit ratings

Dividend has increased at an average rate of 14% per year

Diversified group of high-quality tenants

No single tenant represents more than 7.2% of revenue

Major tenants include CenturyLink, IBM, Facebook, AT&T, and Morgan Stanley

April 4, 2015

Digital Realty Trust (NYSE: DLR)