This training material is the property of the International Monetary Fund (IMF) and is intended for use in IMF’s Institute for Capacity development (ICD) courses. Any reuse requires the permission of ICD.

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Modeling non-stationary variables презентация

Содержание

- 1. Modeling non-stationary variables

- 2. Lecture Objectives Revisit the concept of

- 3. Outline Stationary and non-stationary variables Testing for unit roots Cointegration Testing for cointegration

- 4. Introduction Macro-econometric Forecasting and Analysis Many economic

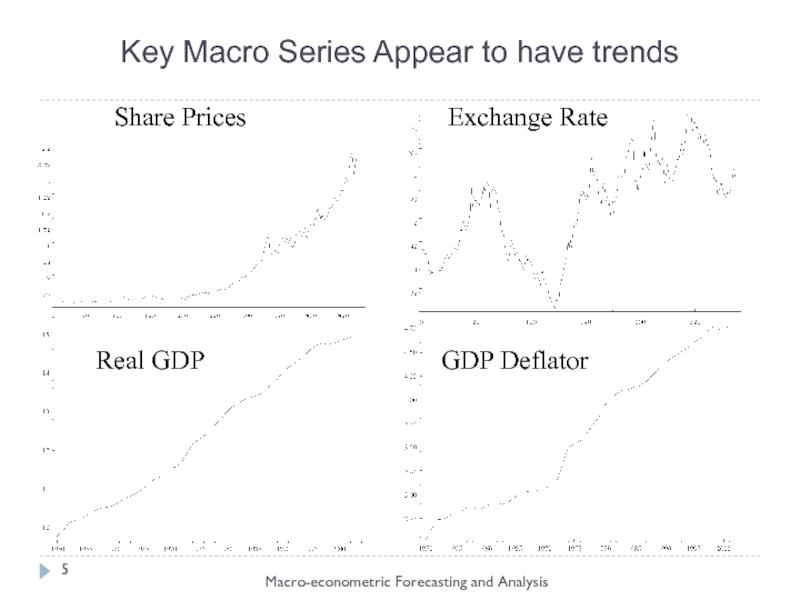

- 5. Key Macro Series Appear to have trends Macro-econometric Forecasting and Analysis

- 6. Deterministic and Stochastic Trends in Data Two

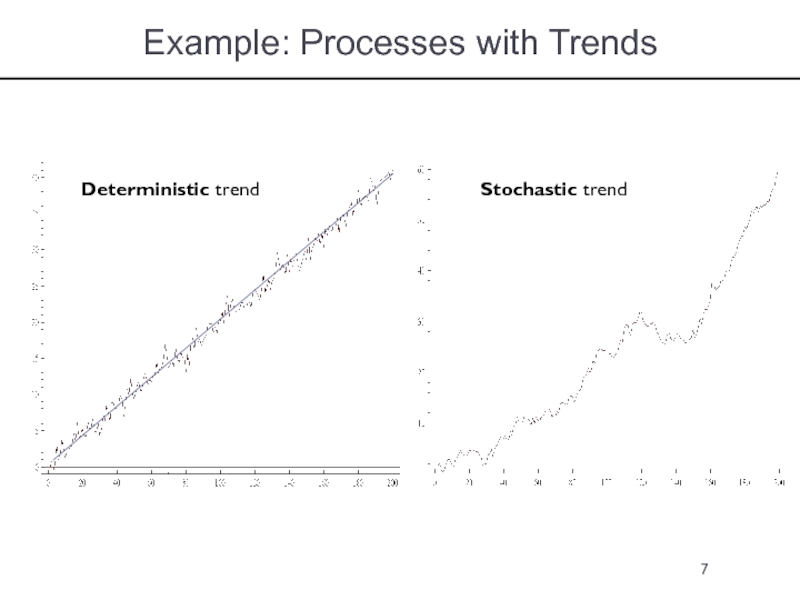

- 7. Example: Processes with Trends Deterministic trend Stochastic trend

- 8. Stationary and non-stationary processes (1) Macro-econometric Forecasting

- 9. Macro-econometric Forecasting and Analysis If

- 10. Reminder: Autoregressive AR(p) Process We shall check

- 11. Stochastic trends, autoregressive models and a unit

- 12. Consider a simple AR(1): yt =

- 13. The Impact of Shocks for Stationary

- 14. Integration Macro-econometric Forecasting and Analysis Another way

- 15. Order of Integration: I(d) Macro-econometric Forecasting and

- 16. Problems due to Stochastic Trends (from a

- 17. Figure 5: Distribution of OLS estimator for θ Macro-econometric Forecasting and Analysis

- 18. Testing For Unit Roots Macro-econometric Forecasting and

- 19. Testing for Unit Roots: Procedures Dickey Fuller

- 20. Dickey Fuller Test Fuller (1976), Dickey and

- 21. Dickey-Fuller Test (2) For the purpose of

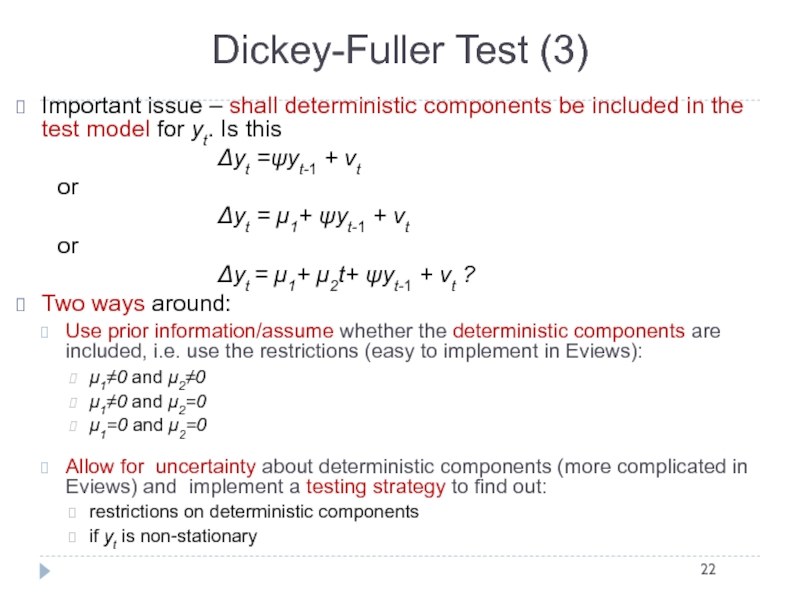

- 22. Dickey-Fuller Test (3) Important issue – shall

- 23. DF-Test (3): Deterministic Components are Known Say,

- 24. If deterministic components are not included in

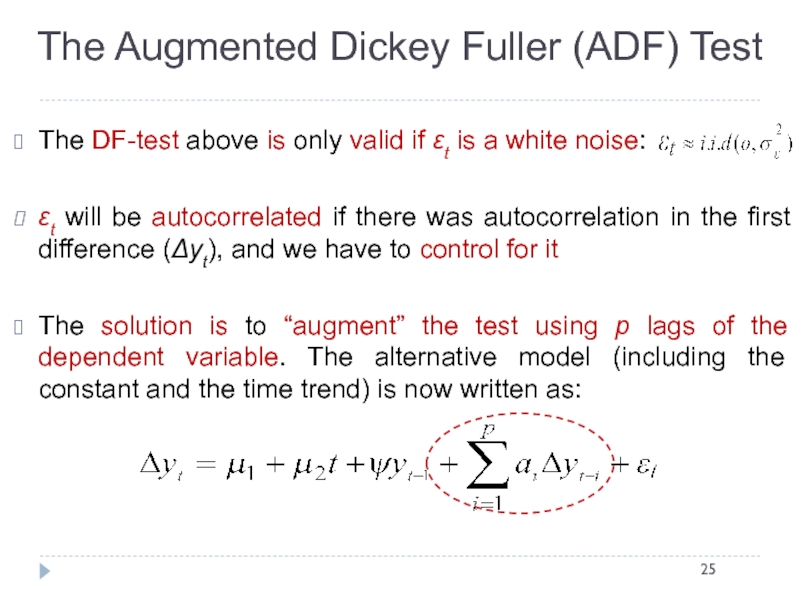

- 25. The Augmented Dickey Fuller (ADF) Test The

- 26. The ADF-Test (2) Again, we have three

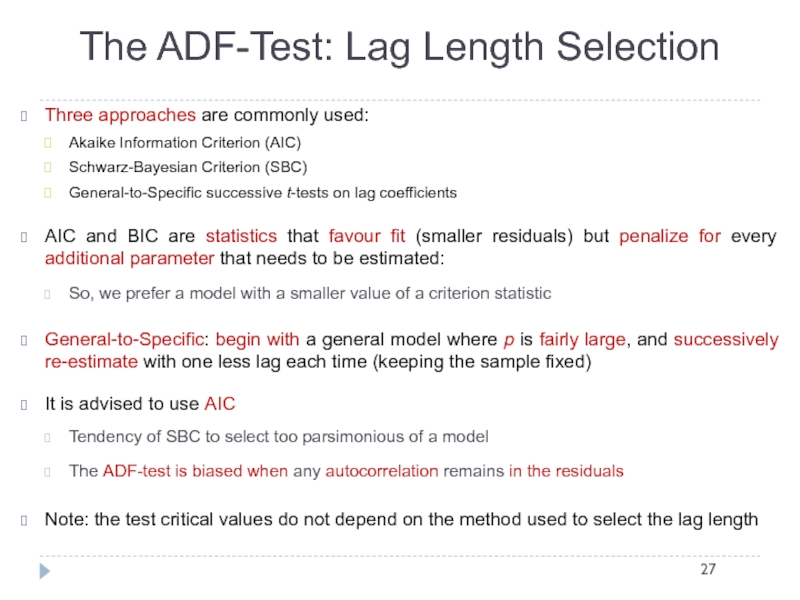

- 27. The ADF-Test: Lag Length Selection Three

- 28. Dickey-Fuller (and ADF) Test: Criticism The power

- 29. The Phillips Perron (PP) test Rather popular

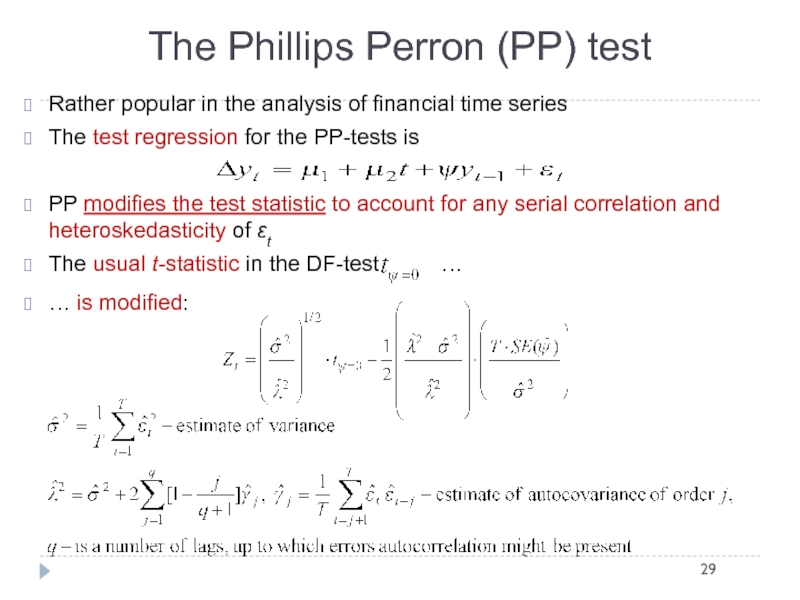

- 30. The PP test (2) Under the null

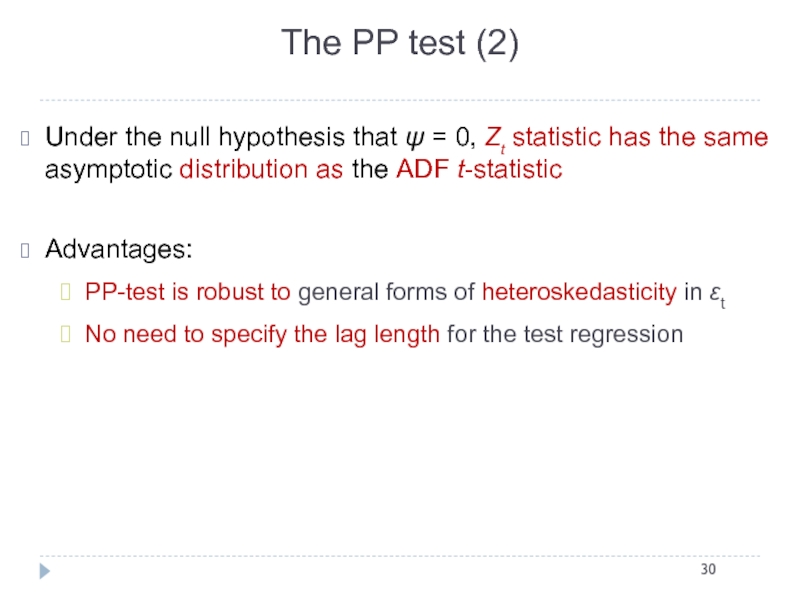

- 31. The Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test The KPSS test

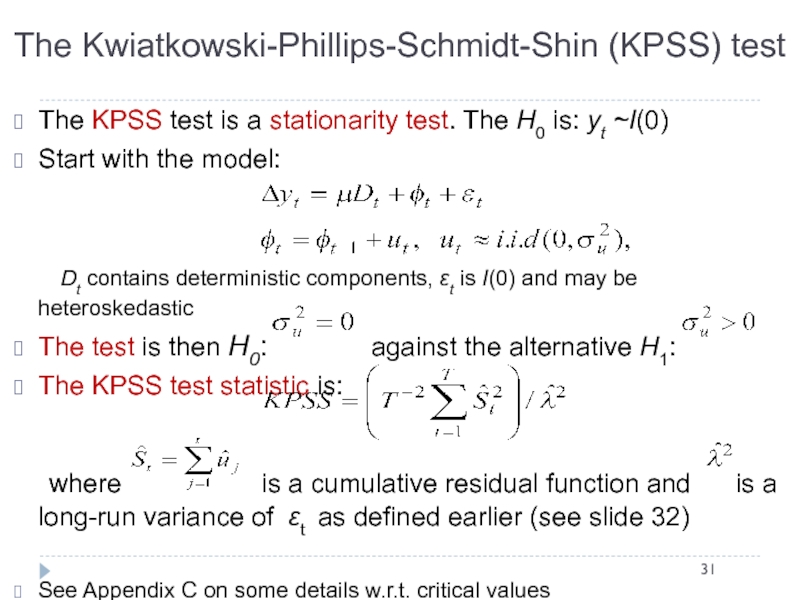

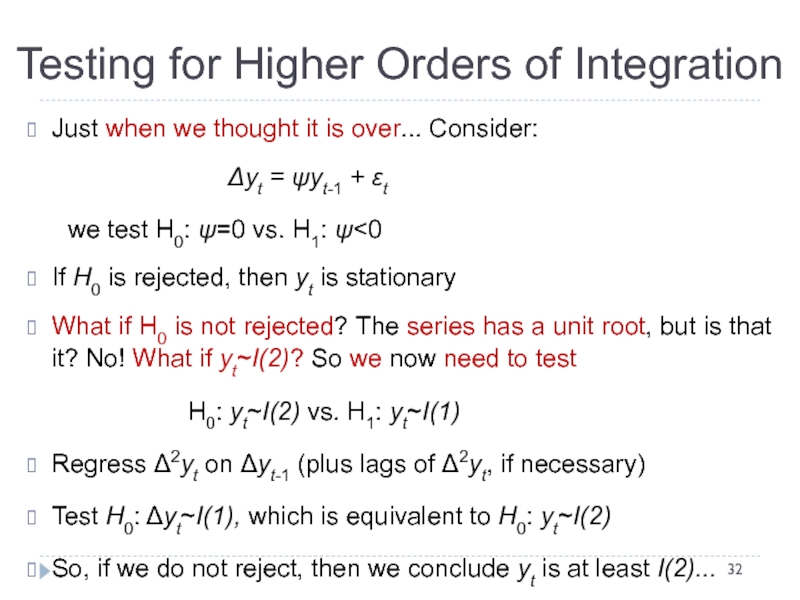

- 32. Testing for Higher Orders of Integration Just

- 33. Working with Non-Stationary Variables Consider a regression

- 34. Cointegration Macro-econometric Forecasting and Analysis Important implication

- 35. Cointegration Macro-econometric Forecasting and Analysis Three main

- 36. Cointegration Macro-econometric Forecasting and Analysis We will

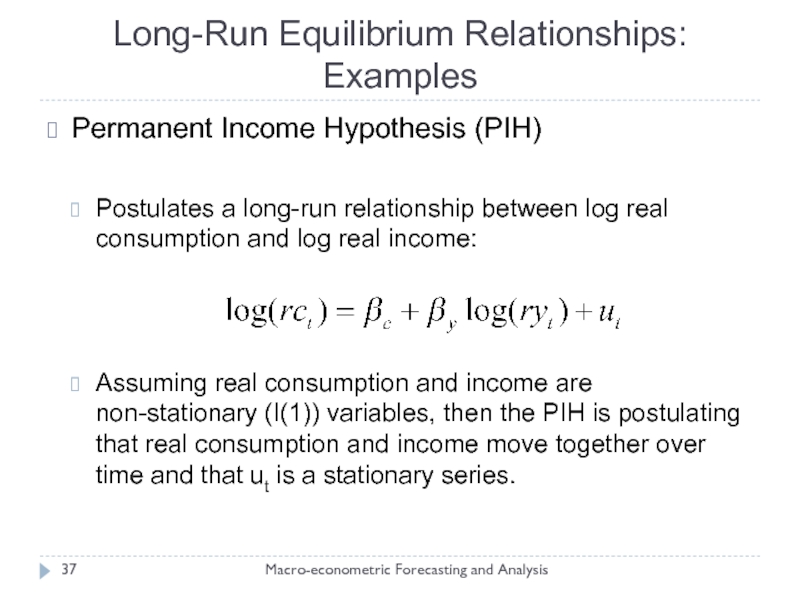

- 37. Long-Run Equilibrium Relationships: Examples Macro-econometric Forecasting and

- 38. Term Structure Of Interest Rates Macro-econometric Forecasting

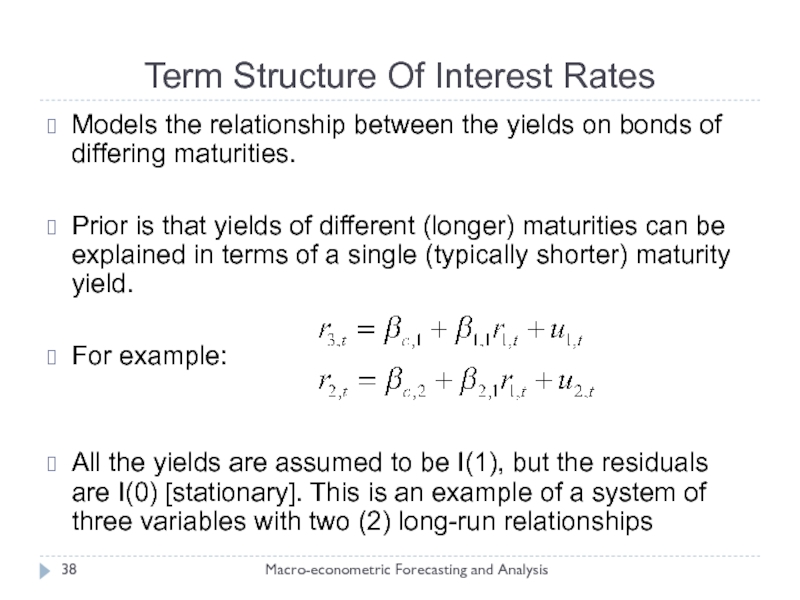

- 39. VECM Macro-econometric Forecasting and Analysis Cointegration postulates

- 40. Bivariate VECMs Macro-econometric Forecasting and Analysis Consider

- 41. Phase Diagram: VECM Macro-econometric Forecasting and Analysis

- 42. Adjusting Back To Equilibrium Macro-econometric Forecasting and

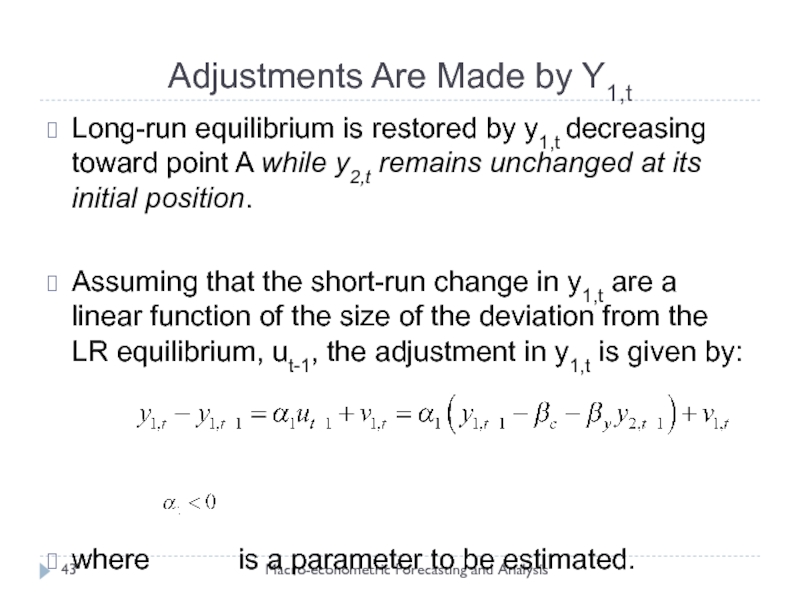

- 43. Adjustments Are Made by Y1,t Macro-econometric Forecasting

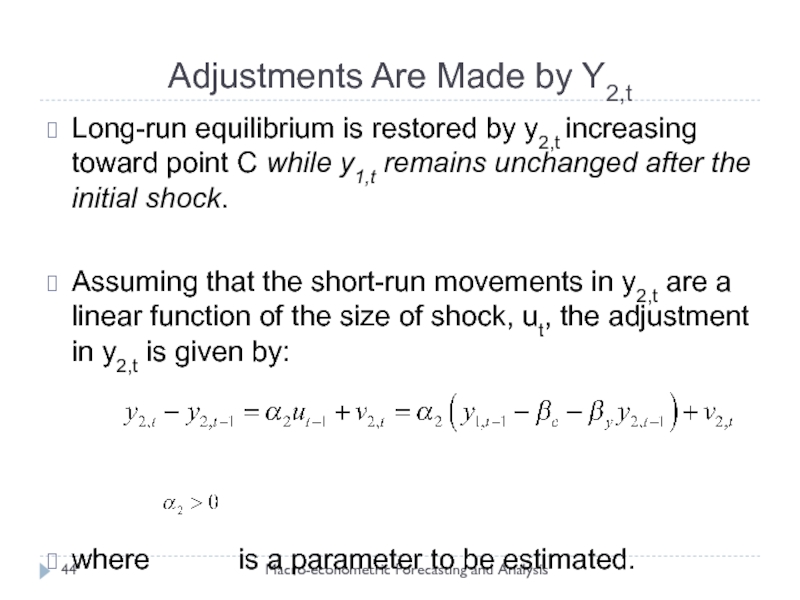

- 44. Adjustments Are Made by Y2,t Macro-econometric Forecasting

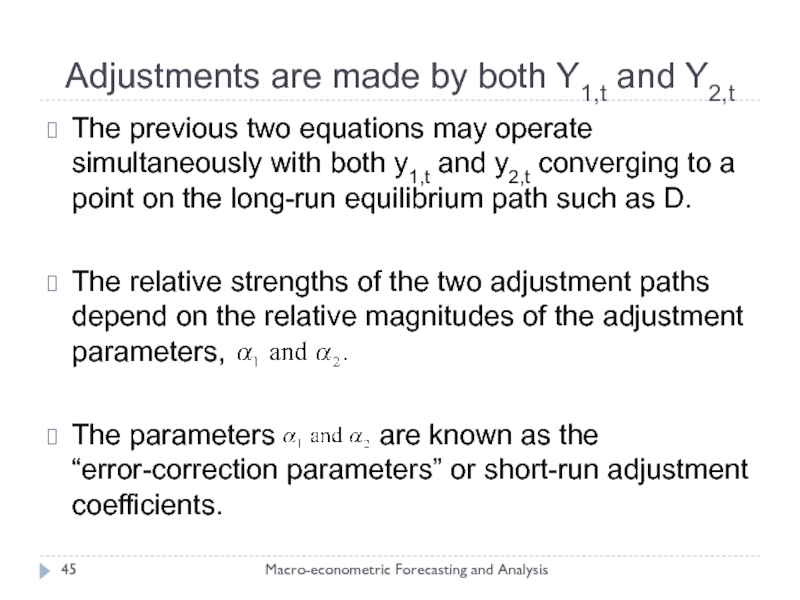

- 45. Adjustments are made by both Y1,t and

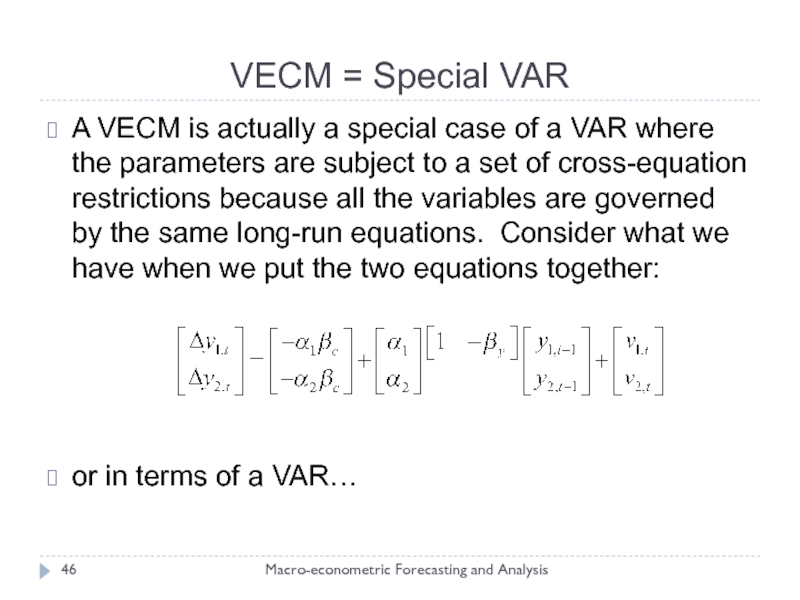

- 46. VECM = Special VAR Macro-econometric Forecasting and

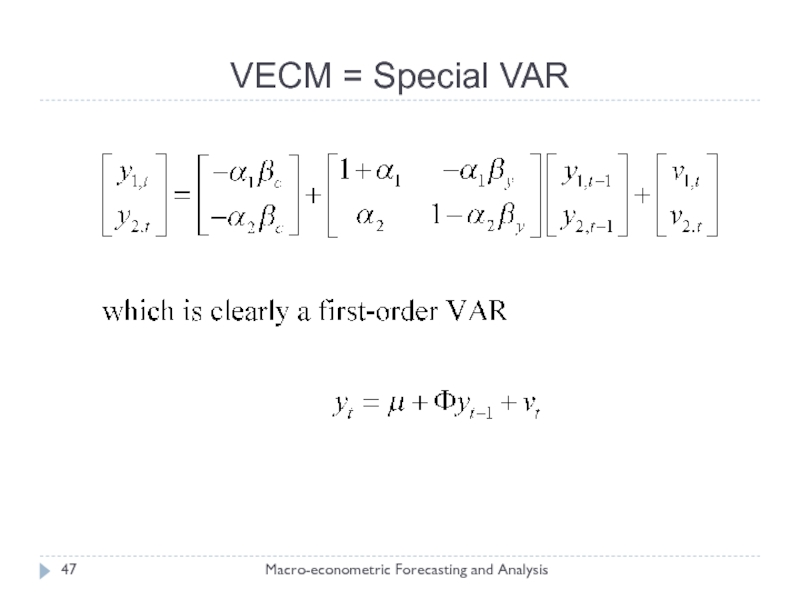

- 47. VECM = Special VAR Macro-econometric Forecasting and Analysis

- 48. VECM = Special VAR Macro-econometric Forecasting and

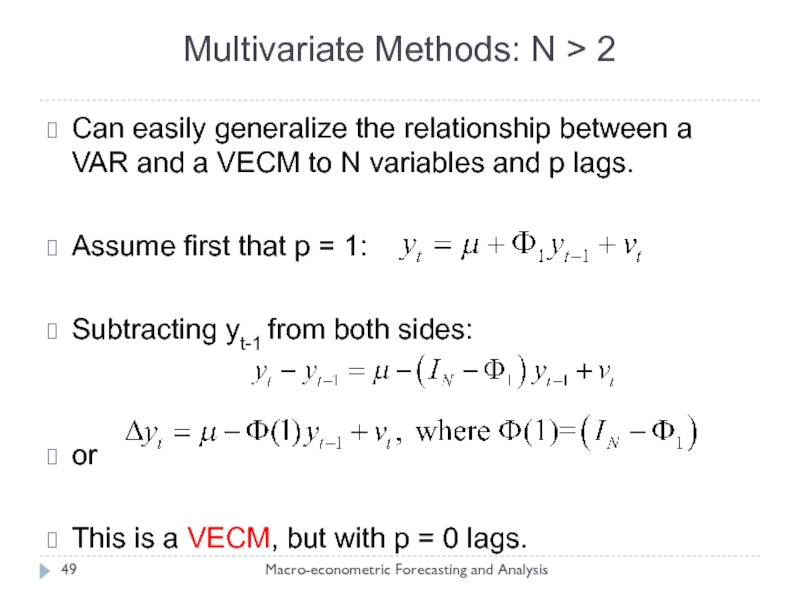

- 49. Multivariate Methods: N > 2 Macro-econometric Forecasting

- 50. VAR with p lags > 1 Macro-econometric

- 51. Cointegration Macro-econometric Forecasting and Analysis If the

- 52. Granger Representation Theorem Macro-econometric Forecasting and Analysis

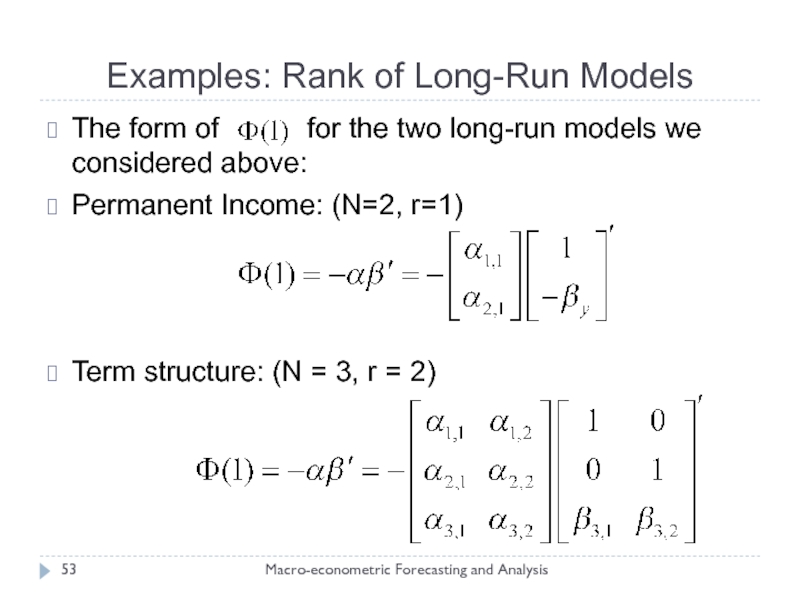

- 53. Examples: Rank of Long-Run Models Macro-econometric Forecasting

- 54. Key Implications of the GE Representation Theorem

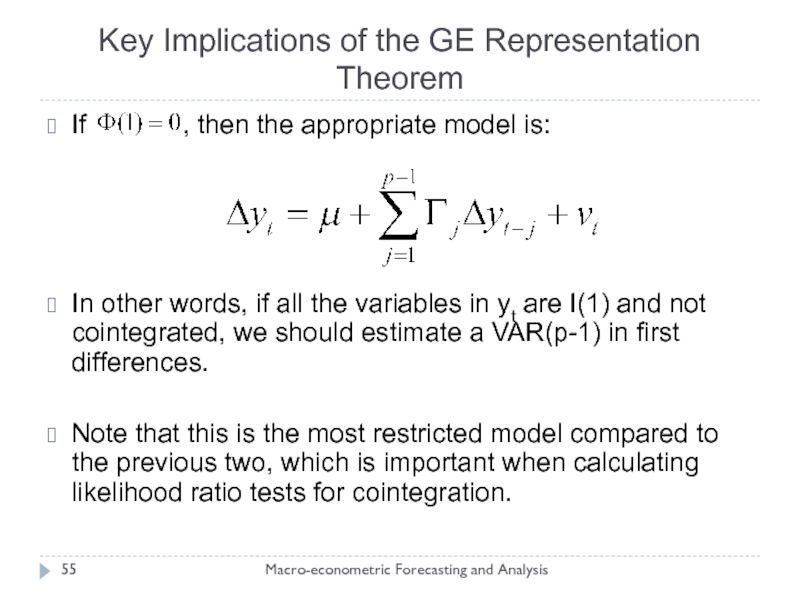

- 55. Key Implications of the GE Representation Theorem

- 56. Dealing With Deterministic Components Macro-econometric Forecasting and

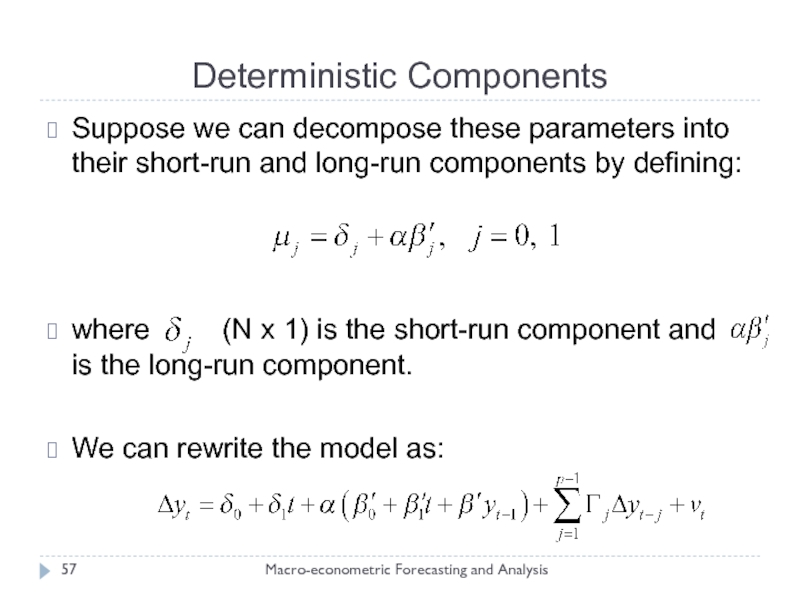

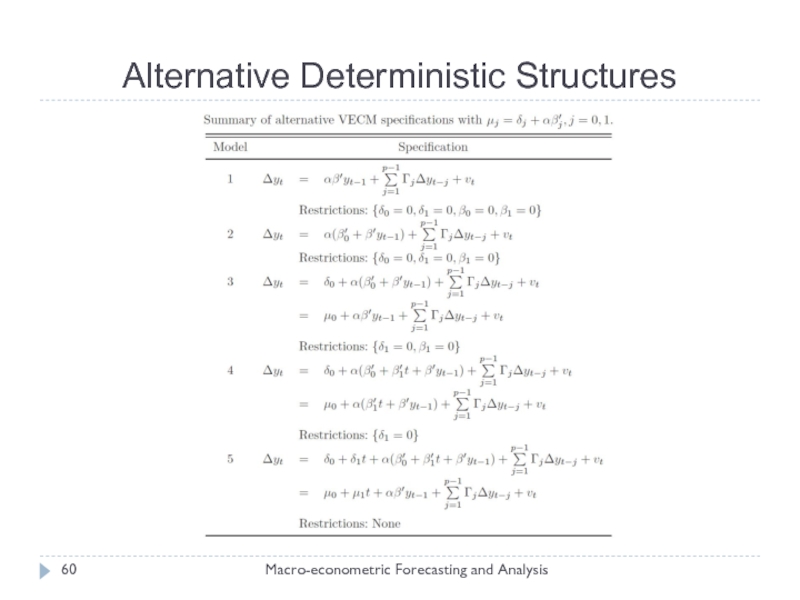

- 57. Deterministic Components Macro-econometric Forecasting and Analysis Suppose

- 58. Deterministic Components Macro-econometric Forecasting and Analysis The

- 59. Deterministic Components Macro-econometric Forecasting and Analysis The

- 60. Alternative Deterministic Structures Macro-econometric Forecasting and Analysis

- 61. Estimating VECM Models Macro-econometric Forecasting and Analysis

- 62. Three Cases:

- 63. Reduced Rank (Cointegration) Case: FIML Macro-econometric Forecasting

- 64. Reduced Rank Case: Johansen Estimator Macro-econometric Forecasting

- 65. Zero-Rank

- 66. Identification Macro-econometric Forecasting and Analysis The Johansen

- 67. Identification: Triangular Restrictions Macro-econometric Forecasting and Analysis

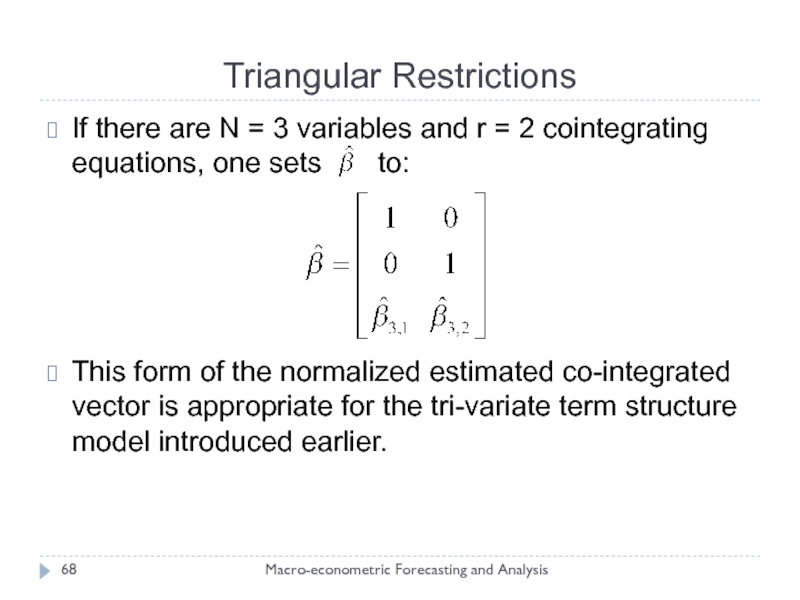

- 68. Triangular Restrictions Macro-econometric Forecasting and Analysis If

- 69. Structural Restrictions Macro-econometric Forecasting and Analysis Traditional

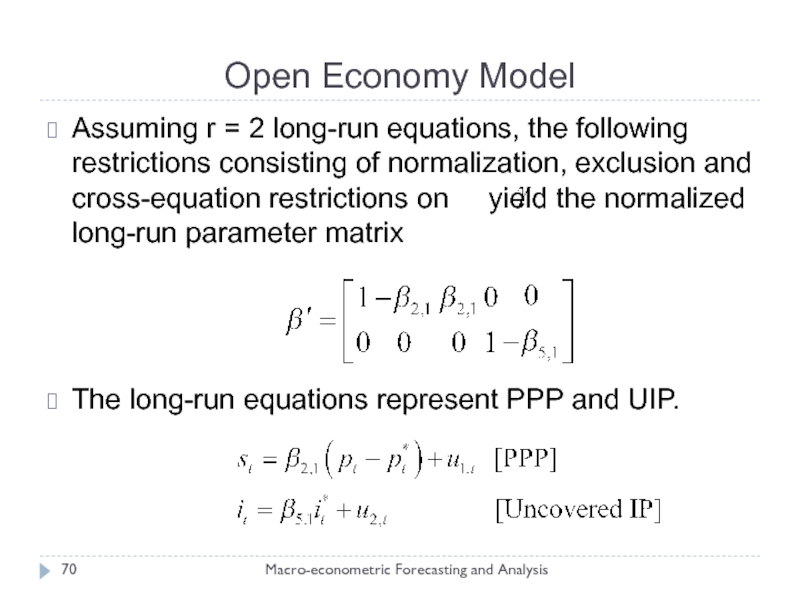

- 70. Open Economy Model Macro-econometric Forecasting and Analysis

- 71. Cointegration Rank Macro-econometric Forecasting and Analysis So

- 72. Cointegration Rank: Likelihood Ratio Test Macro-econometric Forecasting

- 73. Cointegration Rank: Likelihood Ratio Test Macro-econometric Forecasting

- 74. Cointegration Rank: Johansen Approach Macro-econometric Forecasting and

- 75. Critical Values of the Likelihood Ratio Test Macro-econometric Forecasting and Analysis

- 76. Tests on the Cointegrating Vector (Long-Run Parameters)

- 77. Exogeneity Macro-econometric Forecasting and Analysis An important

- 78. Weak versus Strong Exogeneity Macro-econometric Forecasting and

- 79. Example: Exogeneity Macro-econometric Forecasting and Analysis Consider

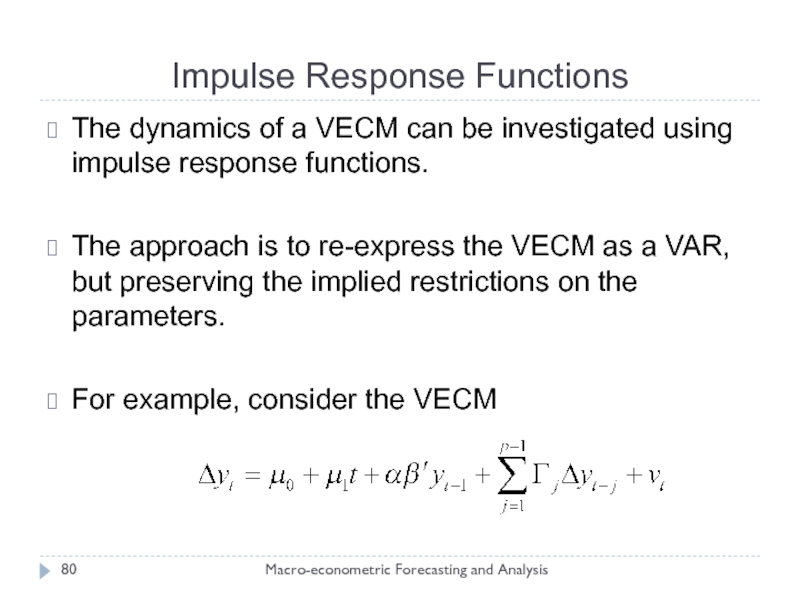

- 80. Impulse Response Functions Macro-econometric Forecasting and Analysis

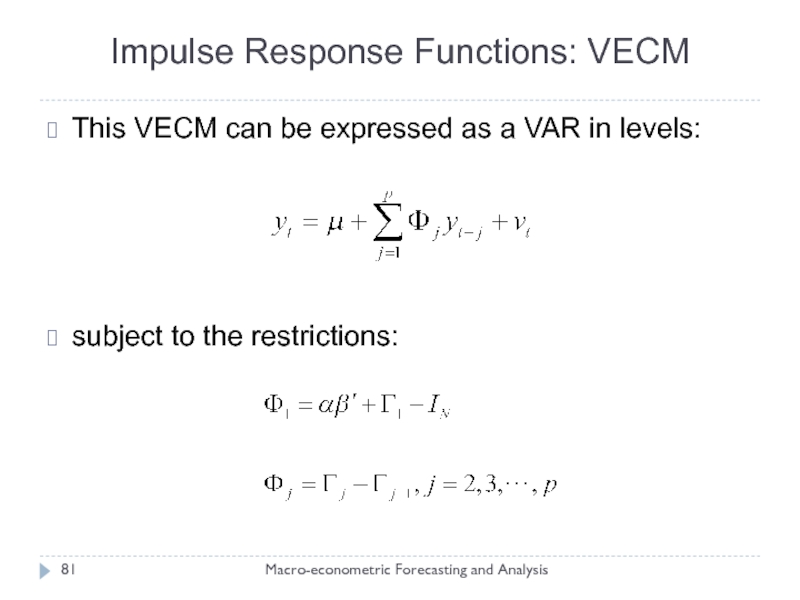

- 81. Impulse Response Functions: VECM Macro-econometric Forecasting and

- 82. Appendices

- 83. Appendix A: Process moments, key results: AR(1)

- 84. Appendix A: Process moments, Simulation of an

- 85. Appendix A: Process moments, key results: AR(1)

- 86. Appendix A: Process moments, simulation of an

- 87. Appendix B: Enders Strategy Test H0: ψ=0

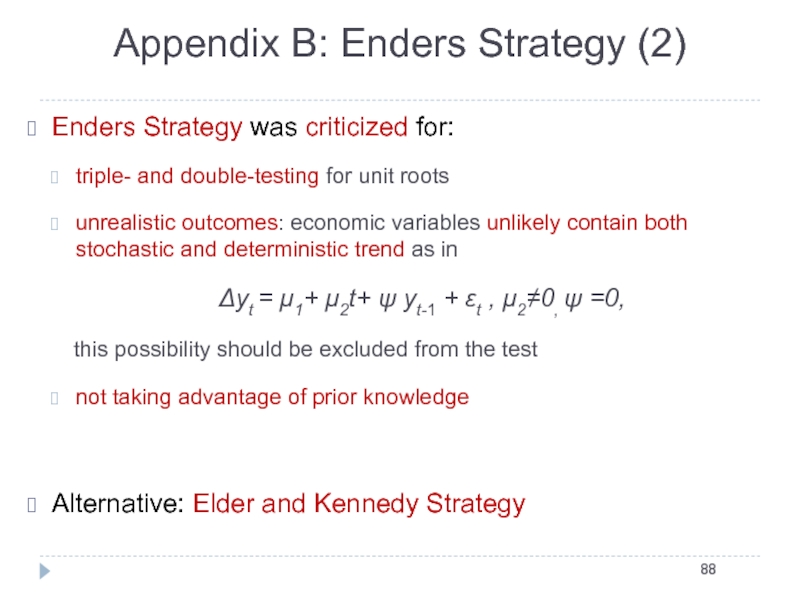

- 88. Enders Strategy was criticized for: triple- and

- 89. Appendix B: Elder and Kennedy Strategy Test

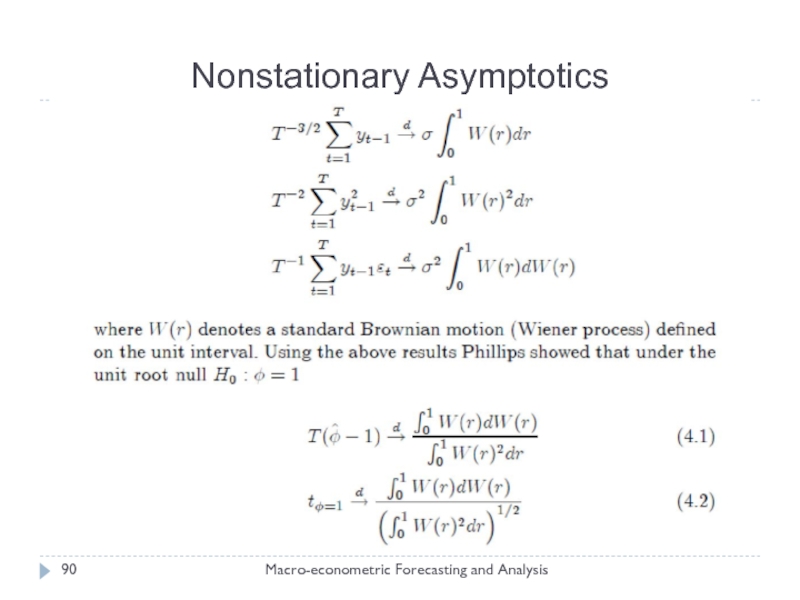

- 90. Nonstationary Asymptotics Macro-econometric Forecasting and Analysis

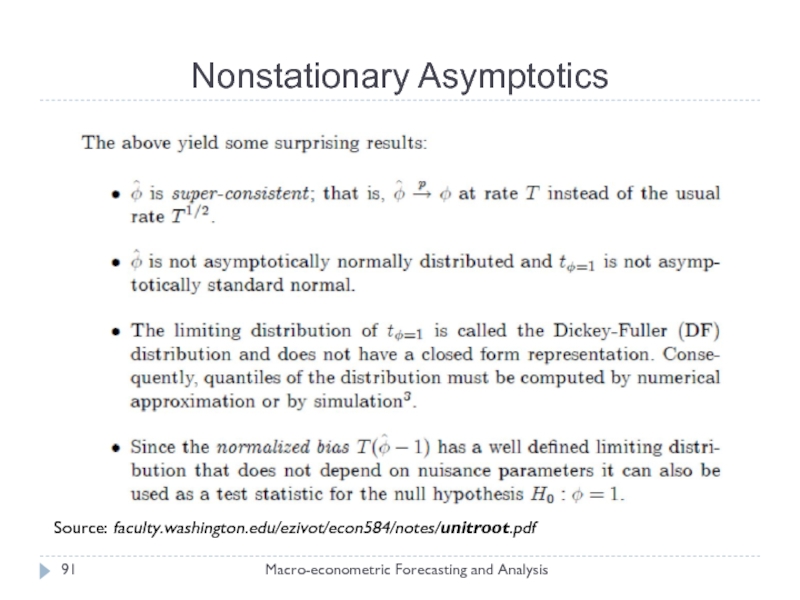

- 91. Nonstationary Asymptotics Source: faculty.washington.edu/ezivot/econ584/notes/unitroot.pdf Macro-econometric Forecasting and Analysis

Слайд 1Modeling Non-stationary Variables

Presenter

Mikhail Pranovich

Joint Vienna Institute/ IMF ICD

Macro-econometric Forecasting and Analysis,

JV16.12,

Слайд 2Lecture Objectives

Revisit the concept of non-stationary (unit root) process and

Understand key tests for unit root

Revisit the concept of cointegration

… and testing for cointegration

Слайд 3Outline

Stationary and non-stationary variables

Testing for unit roots

Cointegration

Testing for cointegration

Слайд 4Introduction

Macro-econometric Forecasting and Analysis

Many economic (macro/financial) variables exhibit trending behavior

e.g.,

Key issue for estimation/forecasting:

the nature of this trend….

… is it deterministic (e.g., linear trend) or stochastic (e.g., random walk)

The nature of the trend has important implications for the model’s parameters and their distributions…

… and thus for the statistical procedures used to conduct inference and forecasting

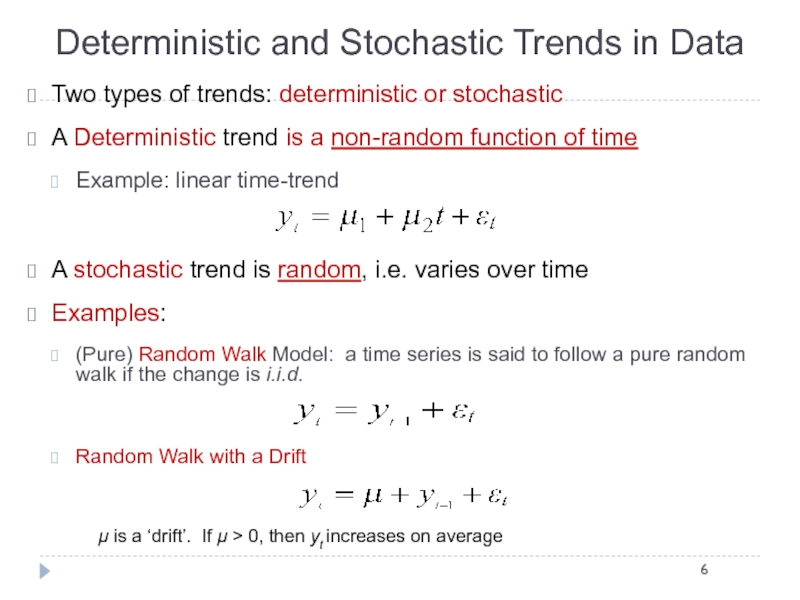

Слайд 6Deterministic and Stochastic Trends in Data

Two types of trends: deterministic or

A Deterministic trend is a non-random function of time

Example: linear time-trend

A stochastic trend is random, i.e. varies over time

Examples:

(Pure) Random Walk Model: a time series is said to follow a pure random walk if the change is i.i.d.

Random Walk with a Drift

μ is a ‘drift’. If μ > 0, then yt increases on average

Слайд 8Stationary and non-stationary processes (1)

Macro-econometric Forecasting and Analysis

Consider the data generation

If the variable is stationary (i.e., , has finite mean and variance)

Standard econometric procedures may be used to estimate/forecast this model

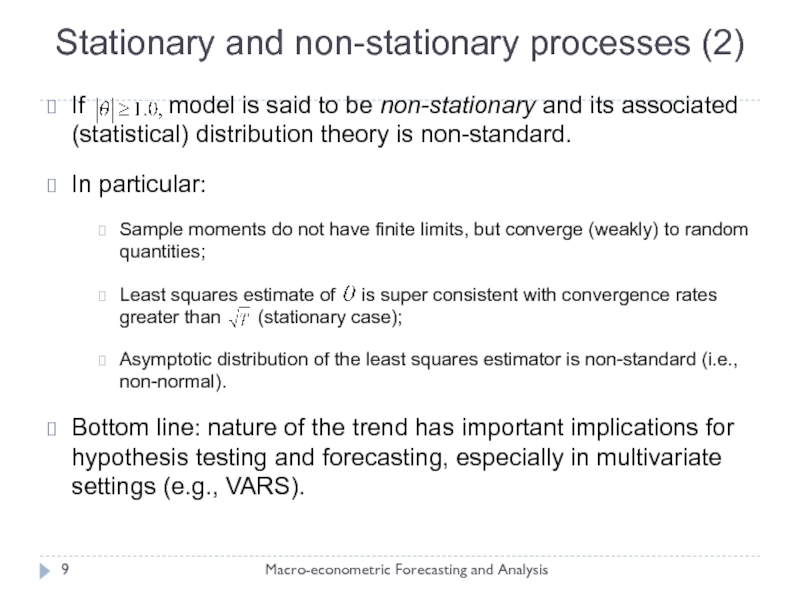

Слайд 9Macro-econometric Forecasting and Analysis

If model is said to

In particular:

Sample moments do not have finite limits, but converge (weakly) to random quantities;

Least squares estimate of is super consistent with convergence rates greater than (stationary case);

Asymptotic distribution of the least squares estimator is non-standard (i.e., non-normal).

Bottom line: nature of the trend has important implications for hypothesis testing and forecasting, especially in multivariate settings (e.g., VARS).

Stationary and non-stationary processes (2)

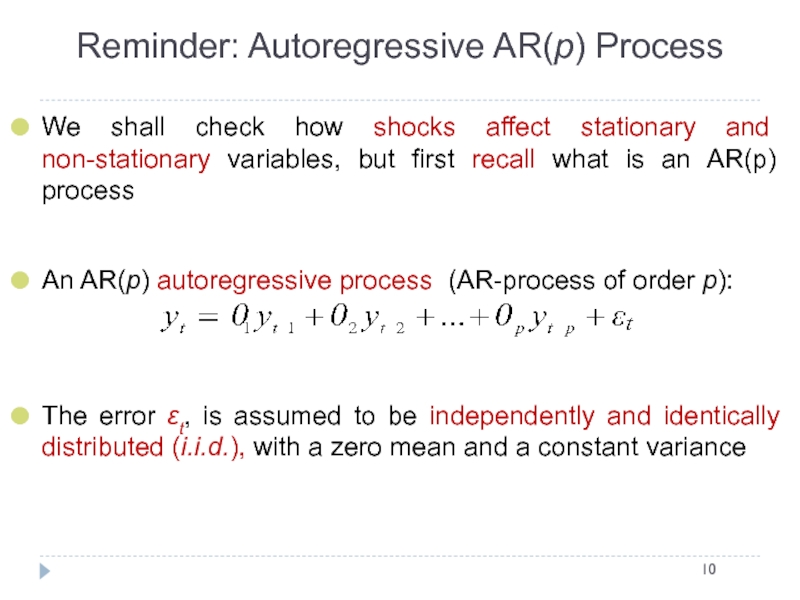

Слайд 10Reminder: Autoregressive AR(p) Process

We shall check how shocks affect stationary and

An AR(p) autoregressive process (AR-process of order p):

The error εt, is assumed to be independently and identically distributed (i.i.d.), with a zero mean and a constant variance

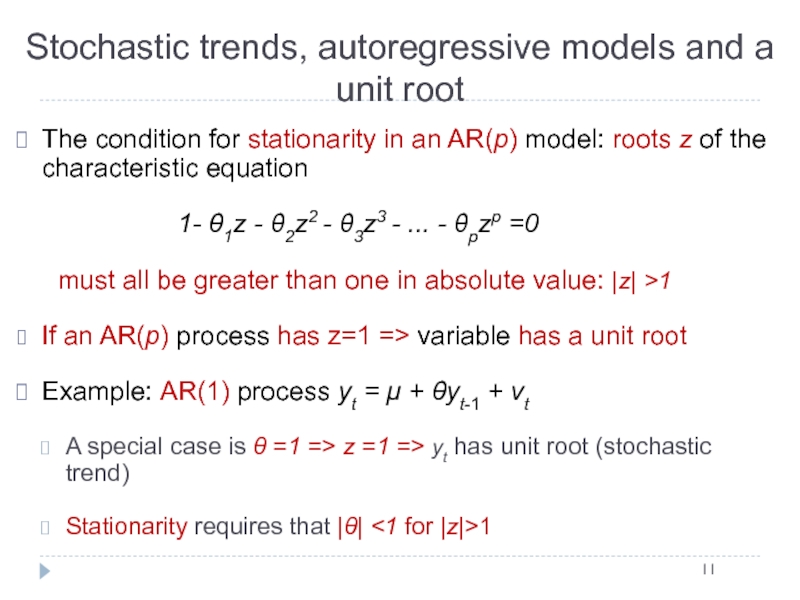

Слайд 11Stochastic trends, autoregressive models and a unit root

The condition for stationarity

1- θ1z - θ2z2 - θ3z3 - ... - θpzp =0

must all be greater than one in absolute value: |z| >1

If an AR(p) process has z=1 => variable has a unit root

Example: AR(1) process yt = μ + θyt-1 + vt

A special case is θ =1 => z =1 => yt has unit root (stochastic trend)

Stationarity requires that |θ| <1 for |z|>1

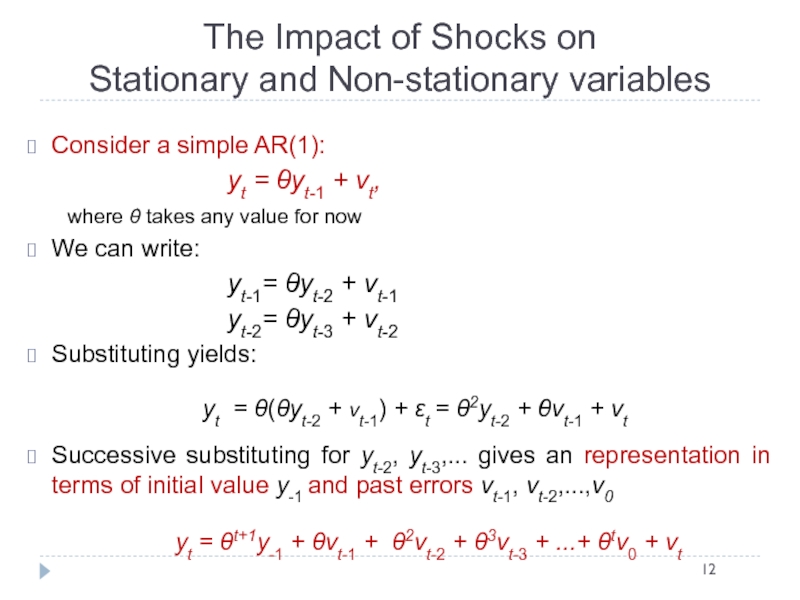

Слайд 12Consider a simple AR(1):

yt = θyt-1 + νt,

where θ takes

We can write:

yt-1= θyt-2 + νt-1

yt-2= θyt-3 + νt-2

Substituting yields:

yt = θ(θyt-2 + νt-1) + εt = θ2yt-2 + θνt-1 + νt

Successive substituting for yt-2, yt-3,... gives an representation in terms of initial value y-1 and past errors νt-1, νt-2,...,ν0

yt = θt+1y-1 + θνt-1 + θ2νt-2 + θ3νt-3 + ...+ θtν0 + νt

The Impact of Shocks on

Stationary and Non-stationary variables

Слайд 13The Impact of Shocks for

Stationary and Non-stationary Series (2)

Representation at

At t =0 the variable is hit by a non-zero shock v0

We have 3 cases (depending on value of θ):

|θ|< 1 ⇒ θT → 0 and θTv0 → 0 as T→ ∞

Shocks have only a transitory effect (gradually dies away with time)

θ = 1 ⇒ θT = 1 and θTv0 = v0 ∀ T

Shocks have a permanent effect in the system and never die away:

... just a sum of past shocks plus some starting value of y-1. The variance grows without bound (Tσ2 →∞) as T→∞

|θ|>1. Now shocks become more influential as time goes on (explosive effect), since if θ>1, then |θ|T>...>|θ|3 > |θ|2 > |θ| etc.

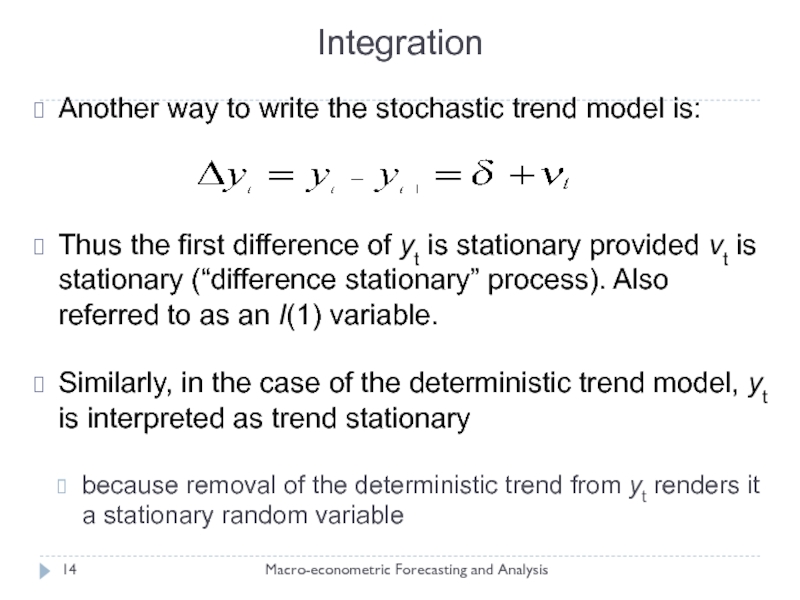

Слайд 14Integration

Macro-econometric Forecasting and Analysis

Another way to write the stochastic trend model

Thus the first difference of yt is stationary provided vt is stationary (“difference stationary” process). Also referred to as an I(1) variable.

Similarly, in the case of the deterministic trend model, yt is interpreted as trend stationary

because removal of the deterministic trend from yt renders it a stationary random variable

Слайд 15Order of Integration: I(d)

Macro-econometric Forecasting and Analysis

In general, if yt is

If d=0, then the series is already stationary

Слайд 16Problems due to Stochastic Trends (from a statistical perspective)

Non-standard distribution of

Spurious regression:

in a simple linear regression, two (or more) non-stationary time series may appear to be related even though they are not

Need to use special modeling techniques when dealing with non-stationary data (VARs in differences or VECMs)

Need to distinguish btw. stochastic and deterministic trends as it may affect estimates of policy-relevant variables

e.g. estimate of an output gap or of a structural budget deficit

… for that we need unit root tests…

Слайд 18Testing For Unit Roots

Macro-econometric Forecasting and Analysis

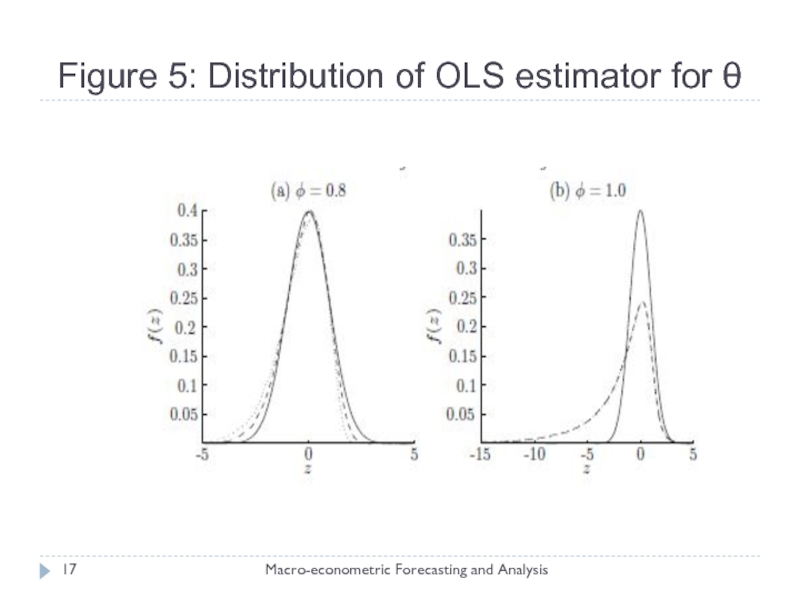

Previous section suggests that I(1)

So how do we identify I(1) processes, i.e., test for unit roots?

Natural test is to consider the t-statistic for the null-hypothesis of a unit root, i.e.,

Given the previous graph, it is not surprising that the t-distribution for is non-normal

Слайд 19Testing for Unit Roots: Procedures

Dickey Fuller

Augmented Dickey Fuller

Phillips Perron

Kwiatkowski, Phillips, Schmidt

Macro-econometric Forecasting and Analysis

Слайд 20Dickey Fuller Test

Fuller (1976), Dickey and Fuller (1979)

Example:

consider a particular

yt = θyt-1 + εt

We test a hypothesis

H0: θ =1 → the series contains a unit root/stochastic trend (is a random walk)

against

H1: |θ| <1 → the series is a zero-mean stationary AR(1)

Слайд 21Dickey-Fuller Test (2)

For the purpose of testing we reformulate the regression:

Δyt

= ψyt-1 + vt

so that the test of H0: θ = 1 ⇔ H0: ψ = 0

The test is based on the t-ratio for ψ

this t-ratio does not have the usual t-distribution under the H0

critical values are derived from Monte Carlo experiments, and are tabulated (known): see appendix A

The test is not invariant to the addition of deterministic components (more general formulation: intercept + time-trend)

Слайд 22Dickey-Fuller Test (3)

Important issue – shall deterministic components be included in

Δyt =ψyt-1 + vt

or

Δyt = μ1+ ψyt-1 + vt

or

Δyt = μ1+ μ2t+ ψyt-1 + vt ?

Two ways around:

Use prior information/assume whether the deterministic components are included, i.e. use the restrictions (easy to implement in Eviews):

μ1≠0 and μ2≠0

μ1≠0 and μ2=0

μ1=0 and μ2=0

Allow for uncertainty about deterministic components (more complicated in Eviews) and implement a testing strategy to find out:

restrictions on deterministic components

if yt is non-stationary

Слайд 23DF-Test (3): Deterministic Components are Known

Say, we assume yt includes an

yt = μ1+ θyt-1 + vt

We test a hypothesis:

H0: θ =1 → the series has a unit root/stochastic trend

against

H1: |θ| <1 → the series is zero-mean stationary AR(1)

Reformulate:

Δyt = μ1+ ψyt-1 + vt

Test H0: ψ =0 → the series has a unit root (stochastic trend) against

H1: ψ < 0 → the series has no unit root (is stationary)

This way is easy – it is ready for you in Eviews

But, there are risks involved...

Слайд 24If deterministic components are not included in the test, when they

The test will reject the H0: ψ =0, although it is in fact true and should not be rejected (yt is non-stationary) – type I error

If deterministic components are included but they should not be, then the test has low power (especially in finite (short) samples):

The test will not reject the H0: ψ =0, although it is false and must be rejected (yt is stationary) – type II error

This is why we may prefer (a degree of) uncertainty about deterministic components and use testing strategies (see appendix A for details):

Enders Strategy

Elder and Kennedy Strategy

DF-Test (4): Risks Posed by Deterministic Components

Слайд 25The Augmented Dickey Fuller (ADF) Test

The DF-test above is only valid

εt will be autocorrelated if there was autocorrelation in the first difference (Δyt), and we have to control for it

The solution is to “augment” the test using p lags of the dependent variable. The alternative model (including the constant and the time trend) is now written as:

Слайд 26The ADF-Test (2)

Again, we have three choices:

(1) include neither a constant

(2) include a constant

(3) include a constant and a time trend

Again, we either:

use prior information and impose a model from the beginning, or

remain uncertain about deterministic components and follow one of the Strategies

Useful result: Critical values for the ADF-test are the same as for DF-test

Note, however, that the test statistics are sensitive to the lag length p

Слайд 27The ADF-Test: Lag Length Selection

Three approaches are commonly used:

Akaike Information

Schwarz-Bayesian Criterion (SBC)

General-to-Specific successive t-tests on lag coefficients

AIC and BIC are statistics that favour fit (smaller residuals) but penalize for every additional parameter that needs to be estimated:

So, we prefer a model with a smaller value of a criterion statistic

General-to-Specific: begin with a general model where p is fairly large, and successively re-estimate with one less lag each time (keeping the sample fixed)

It is advised to use AIC

Tendency of SBC to select too parsimonious of a model

The ADF-test is biased when any autocorrelation remains in the residuals

Note: the test critical values do not depend on the method used to select the lag length

Слайд 28Dickey-Fuller (and ADF) Test: Criticism

The power of the tests is low

e.g. the test is poor at rejecting θ = 1 (ψ=0), when the true data generating process is

yt = 0.95yt-1 + εt

This problem is particularly pronounced in small samples

Слайд 29The Phillips Perron (PP) test

Rather popular in the analysis of financial

The test regression for the PP-tests is

PP modifies the test statistic to account for any serial correlation and heteroskedasticity of εt

The usual t-statistic in the DF-test …

… is modified:

Слайд 30The PP test (2)

Under the null hypothesis that ψ = 0,

Advantages:

PP-test is robust to general forms of heteroskedasticity in εt

No need to specify the lag length for the test regression

Слайд 31The Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test

The KPSS test is a stationarity test. The

Start with the model:

Dt contains deterministic components, εt is I(0) and may be heteroskedastic

The test is then H0: against the alternative H1:

The KPSS test statistic is:

where is a cumulative residual function and is a long-run variance of εt as defined earlier (see slide 32)

See Appendix C on some details w.r.t. critical values

Слайд 32Testing for Higher Orders of Integration

Just when we thought it is

Δyt = ψyt-1 + εt

we test H0: ψ=0 vs. H1: ψ<0

If H0 is rejected, then yt is stationary

What if H0 is not rejected? The series has a unit root, but is that it? No! What if yt~I(2)? So we now need to test

H0: yt~I(2) vs. H1: yt~I(1)

Regress Δ2yt on Δyt-1 (plus lags of Δ2yt, if necessary)

Test H0: Δyt~I(1), which is equivalent to H0: yt~I(2)

So, if we do not reject, then we conclude yt is at least I(2)...

Слайд 33Working with Non-Stationary Variables

Consider a regression model with two variables; there

Case 1: Both variables are stationary=> classical regression model is valid

Case 2: The variables are integrated of different orders=> unbalanced (meaningless) regression

Case 3: Both variables are integrated of the same order; regression residuals contain a stochastic trend=> spurious regression

Case 4: Both variables are integrated of the same order; the residual series is stationary=> y and x are said to be cointegrated and…

You will have more on this in L-5, L-8 and L-9

Слайд 34Cointegration

Macro-econometric Forecasting and Analysis

Important implication is that non-stationary time series can

Now we turn to the case of N>1 (i.e., multiple variables)

An alternative approach to achieving stationarity is to form linear combinations of the I(1) series – this is the essence of “cointegration” [Engle and Granger (1987)]

Слайд 35Cointegration

Macro-econometric Forecasting and Analysis

Three main implications of cointegration:

Existence of cointegration implies

The OLS estimates of the weights converge to their population values at a super-consistent rate of “T” compared to the usual rate of convergence,

Modeling a system of cointegrated variables allows for specification of both the long-run and short-run dynamics. The end result is called a “Vector Error Correction Model (VECM)”.

Слайд 36Cointegration

Macro-econometric Forecasting and Analysis

We will see that cointegrated systems (VECMs) are

Specifically, cointegration implies a set of non-linear cross-equation restrictions on the VAR.

Easiest/most flexible way to estimate VECM’s is by full-information maximum likelihood.

Слайд 37Long-Run Equilibrium Relationships: Examples

Macro-econometric Forecasting and Analysis

Permanent Income Hypothesis (PIH)

Postulates a

Assuming real consumption and income are non-stationary (I(1)) variables, then the PIH is postulating that real consumption and income move together over time and that ut is a stationary series.

Слайд 38Term Structure Of Interest Rates

Macro-econometric Forecasting and Analysis

Models the relationship between

Prior is that yields of different (longer) maturities can be explained in terms of a single (typically shorter) maturity yield.

For example:

All the yields are assumed to be I(1), but the residuals are I(0) [stationary]. This is an example of a system of three variables with two (2) long-run relationships

Слайд 39VECM

Macro-econometric Forecasting and Analysis

Cointegration postulates the existence of long-run equilibrium relationships

What is the underlying economic model?

How do we estimate such a model?

Слайд 40Bivariate VECMs

Macro-econometric Forecasting and Analysis

Consider a bivariate model containing two I(1)

Assume the long-run relationship is given by

Here represents the long-run equilibrium, and ut represents the short-run deviations from the long-run equilibrium (see next slide).

Слайд 42Adjusting Back To Equilibrium

Macro-econometric Forecasting and Analysis

Suppose there is a positive

How can the system converge back to its long-run equilibrium?

There are three possible trajectories…

Слайд 43Adjustments Are Made by Y1,t

Macro-econometric Forecasting and Analysis

Long-run equilibrium is restored

Assuming that the short-run change in y1,t are a linear function of the size of the deviation from the LR equilibrium, ut-1, the adjustment in y1,t is given by:

where is a parameter to be estimated.

Слайд 44Adjustments Are Made by Y2,t

Macro-econometric Forecasting and Analysis

Long-run equilibrium is restored

Assuming that the short-run movements in y2,t are a linear function of the size of shock, ut, the adjustment in y2,t is given by:

where is a parameter to be estimated.

Слайд 45Adjustments are made by both Y1,t and Y2,t

Macro-econometric Forecasting and Analysis

The

The relative strengths of the two adjustment paths depend on the relative magnitudes of the adjustment parameters,

The parameters are known as the “error-correction parameters” or short-run adjustment coefficients.

Слайд 46VECM = Special VAR

Macro-econometric Forecasting and Analysis

A VECM is actually a

or in terms of a VAR…

Слайд 48VECM = Special VAR

Macro-econometric Forecasting and Analysis

Obviously, we have a first

In an unconstrained VAR of order one, no cross-equation restrictions are imposed, implying 6 unknown parameters.

However, a VECM – owing to the cross-equation restrictions – has only four unknown parameters. Less restrictions are needed to identify the model.

Слайд 49Multivariate Methods: N > 2

Macro-econometric Forecasting and Analysis

Can easily generalize the

Assume first that p = 1:

Subtracting yt-1 from both sides:

or

This is a VECM, but with p = 0 lags.

Слайд 50VAR with p lags > 1

Macro-econometric Forecasting and Analysis

Allowing for p

where vt is an N dimensional vector of iid disturbances and is a p-th order polynomial in the lag operator.

The resulting VECM has p-1 lags given by:

Слайд 51Cointegration

Macro-econometric Forecasting and Analysis

If the vector time series yt is assumed

are I(0).

The dimension “r” is called the cointegrating rank and the columns of are called the co-integrating vectors.

This implies that (N – r) common trends exist that are I(1).

Слайд 52Granger Representation Theorem

Macro-econometric Forecasting and Analysis

Suppose yt, which can be I(1)

Three important cases:

(a) If has full rank, i.e., r = N, then yt is I(0)

(b) If has reduced rank 0 < r < N,

then yt is I(1) and is I(0) with cointegrating vectors given by the columns of

(c) if has zero rank, r = 0, and yt is I(1) and not cointegrated.

Слайд 53Examples: Rank of Long-Run Models

Macro-econometric Forecasting and Analysis

The form of

Permanent Income: (N=2, r=1)

Term structure: (N = 3, r = 2)

Слайд 54Key Implications of the GE Representation Theorem

Macro-econometric Forecasting and Analysis

The Granger-Engle

If has full rank, N, then all the time series must be stationary, and the original VAR should be specified in levels. This is the “unrestricted model”.

If has reduced rank, with 0 < r < N, then a VECM should be estimated subject to the restrictions

Слайд 55Key Implications of the GE Representation Theorem

Macro-econometric Forecasting and Analysis

If

In other words, if all the variables in yt are I(1) and not cointegrated, we should estimate a VAR(p-1) in first differences.

Note that this is the most restricted model compared to the previous two, which is important when calculating likelihood ratio tests for cointegration.

Слайд 56Dealing With Deterministic Components

Macro-econometric Forecasting and Analysis

We can easily extend the

where now are (N x 1) vectors of parameters associated with the intercept and time trend.

The deterministic components can contribute both to the short-run and the long-run components of yt

Слайд 57Deterministic Components

Macro-econometric Forecasting and Analysis

Suppose we can decompose these parameters into

where (N x 1) is the short-run component and is the long-run component.

We can rewrite the model as:

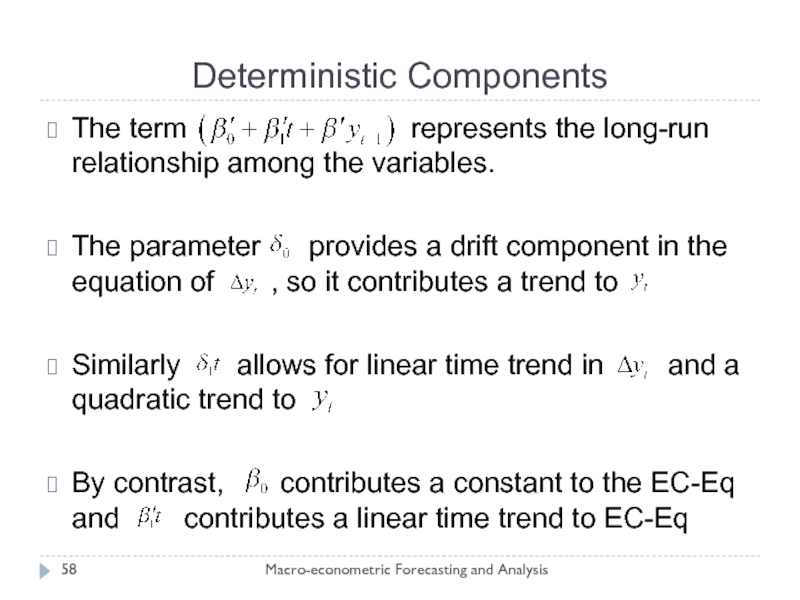

Слайд 58Deterministic Components

Macro-econometric Forecasting and Analysis

The term

The parameter provides a drift component in the equation of , so it contributes a trend to

Similarly allows for linear time trend in and a quadratic trend to

By contrast, contributes a constant to the EC-Eq and contributes a linear time trend to EC-Eq

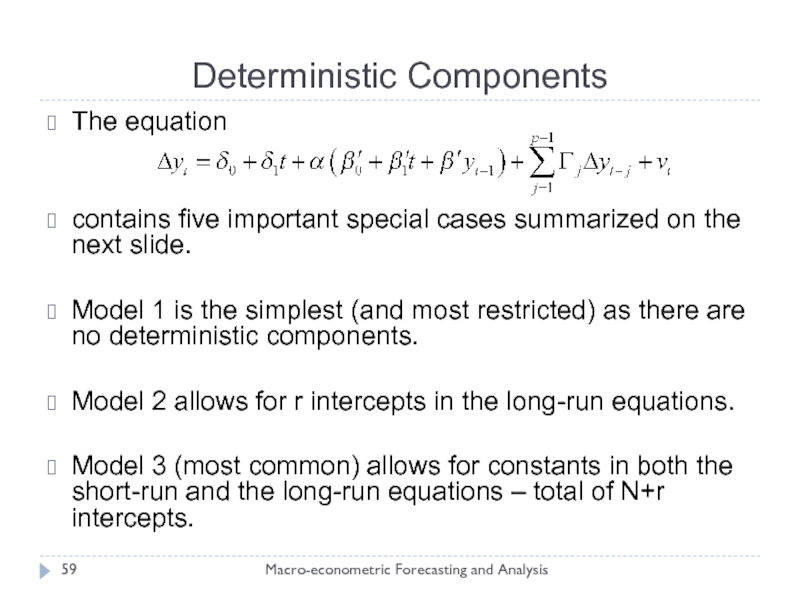

Слайд 59Deterministic Components

Macro-econometric Forecasting and Analysis

The equation

contains five important special cases summarized

Model 1 is the simplest (and most restricted) as there are no deterministic components.

Model 2 allows for r intercepts in the long-run equations.

Model 3 (most common) allows for constants in both the short-run and the long-run equations – total of N+r intercepts.

Слайд 61Estimating VECM Models

Macro-econometric Forecasting and Analysis

If you are willing to assume

Basically, one estimates a traditional VAR subject to the cross-equation restrictions implied by cointegration.

Using FIML is the most flexible approach, but it requires one to ensure that the parameters of the overall model are identified (via exclusion restrictions). More on this later.

Слайд 62 Three Cases:

Macro-econometric Forecasting and Analysis

VECM is

Maximum likelihood estimator is obtained by applying OLS to each equation separately.

The estimator is applied to the levels of the data, since they are (must be) stationary.

Слайд 63Reduced Rank (Cointegration) Case: FIML

Macro-econometric Forecasting and Analysis

If

The VECM is a restricted model compared to the unconstrained VAR.

Слайд 64Reduced Rank Case: Johansen Estimator

Macro-econometric Forecasting and Analysis

We can also use

This differs from FIML in that the cross-equation identifying restrictions are NOT imposed on the model before estimation.

The Johansen approach estimates a basis for the vector space spanned by the cointegrating vectors, and THEN imposes identification on the coefficients.

Слайд 65 Zero-Rank Case for

Macro-econometric Forecasting and

When , the VECM reduces to a VAR in first differences.

As with the full-rank model, the maximum likelihood estimator is the ordinary least squares estimator applied to each equation separately.

This is the most constrained model compared to a VECM/unconstrained VAR in levels.

Слайд 66Identification

Macro-econometric Forecasting and Analysis

The Johansen procedure requires one to normalize the

In the bi-variate term structure and the permanent income example, the normalization takes the form of designating one of variables in the system as the dependent variable.

Слайд 67Identification: Triangular Restrictions

Macro-econometric Forecasting and Analysis

Suppose there are r long-run relationships.

Identification can be achieved by transforming the top (r x r) block of (the long-run parameters) to the identity matrix.

If r = 1, this corresponds to normalizing one the coefficients to unity.

Слайд 68Triangular Restrictions

Macro-econometric Forecasting and Analysis

If there are N = 3 variables

This form of the normalized estimated co-integrated vector is appropriate for the tri-variate term structure model introduced earlier.

Слайд 69Structural Restrictions

Macro-econometric Forecasting and Analysis

Traditional identification methods can also be used

Example: Johansen and Juselius(1992) propose an open economy model in which represents, respectively, the spot exchange rate, the domestic price level, the foreign price, the domestic interest rate and the foreign interest rate.

Thus, N = 5.

Слайд 70Open Economy Model

Macro-econometric Forecasting and Analysis

Assuming r = 2 long-run equations,

The long-run equations represent PPP and UIP.

Слайд 71Cointegration Rank

Macro-econometric Forecasting and Analysis

So far we have taken the rank

Simple approach is to estimate models of different rank and then do a formal likelihood ratio test to decide whether restricted model (i.e., the model with rank r less than N) is appropriate.

Specifically, one would estimate the most restricted model (r = 0), a model that assumes (r=1), then a model that assumes r = 2, etc. The process ends when we cannot reject the null (r = r0).

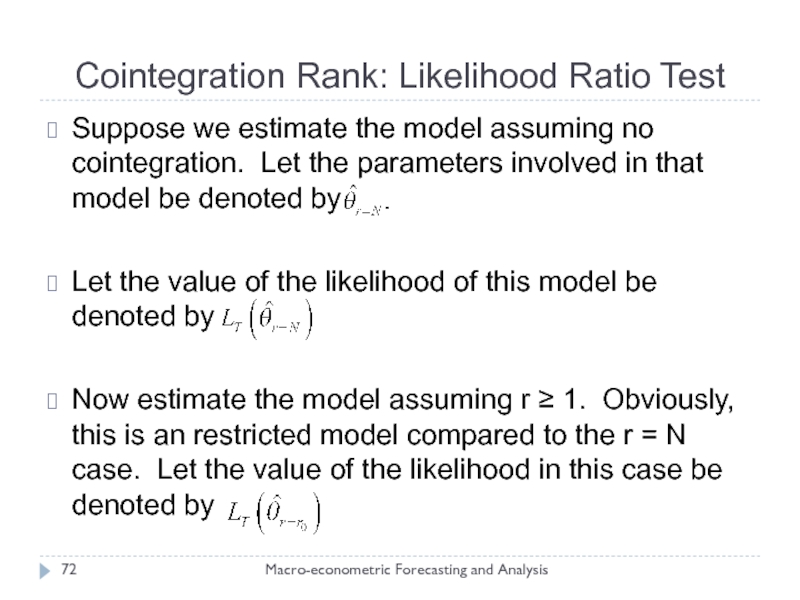

Слайд 72Cointegration Rank: Likelihood Ratio Test

Macro-econometric Forecasting and Analysis

Suppose we estimate the

Let the value of the likelihood of this model be denoted by

Now estimate the model assuming r ≥ 1. Obviously, this is an restricted model compared to the r = N case. Let the value of the likelihood in this case be denoted by

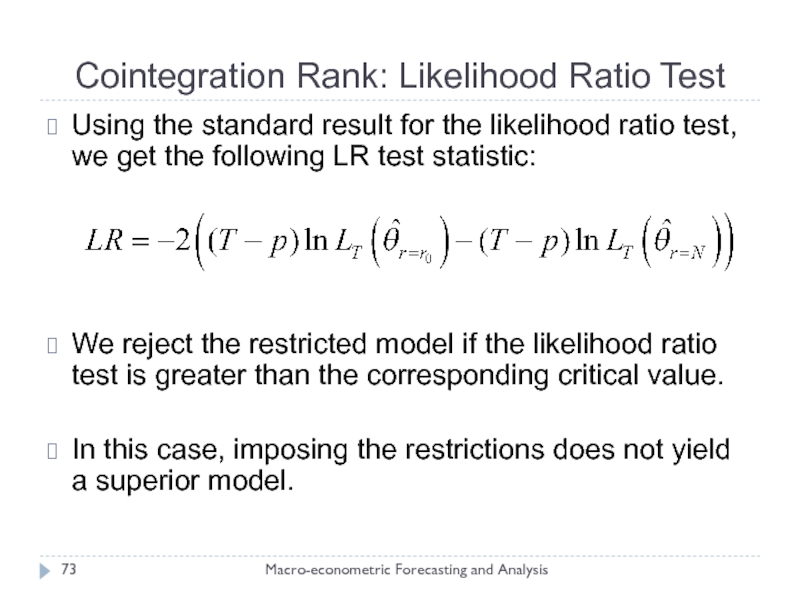

Слайд 73Cointegration Rank: Likelihood Ratio Test

Macro-econometric Forecasting and Analysis

Using the standard result

We reject the restricted model if the likelihood ratio test is greater than the corresponding critical value.

In this case, imposing the restrictions does not yield a superior model.

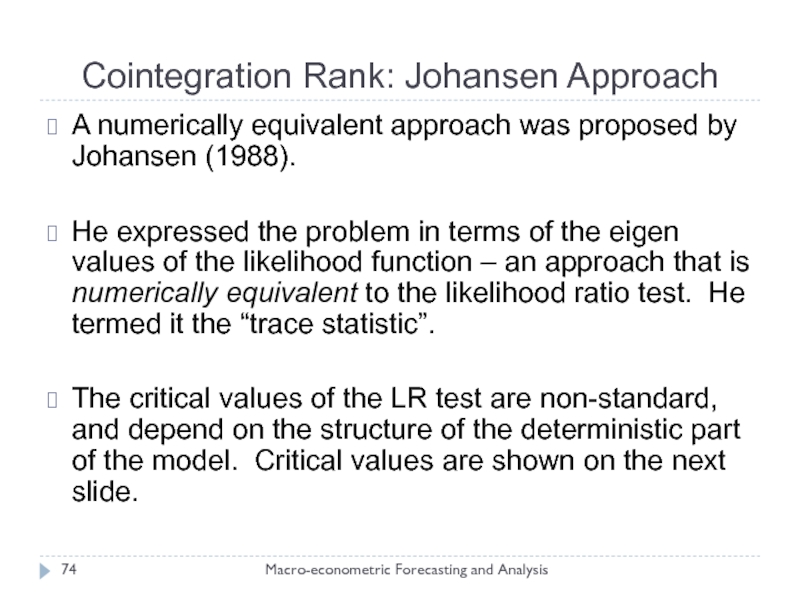

Слайд 74Cointegration Rank: Johansen Approach

Macro-econometric Forecasting and Analysis

A numerically equivalent approach was

He expressed the problem in terms of the eigen values of the likelihood function – an approach that is numerically equivalent to the likelihood ratio test. He termed it the “trace statistic”.

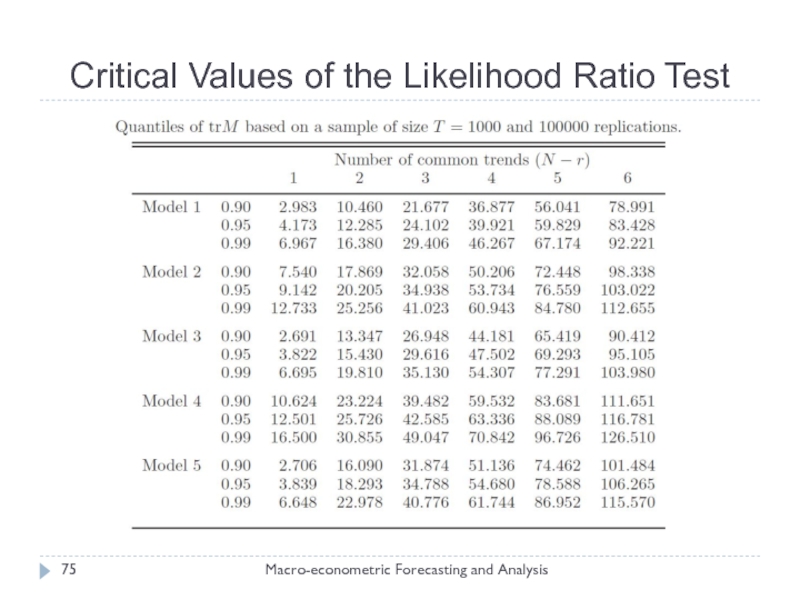

The critical values of the LR test are non-standard, and depend on the structure of the deterministic part of the model. Critical values are shown on the next slide.

Слайд 76Tests on the Cointegrating Vector (Long-Run Parameters)

Macro-econometric Forecasting and Analysis

Hypothesis tests

In contrast to the cointegration rank tests, the asymptotic distribution of the Wald, Likelihood Ratio and Lagrange Multiplier tests is under the null hypothesis that the restrictions are valid.

Слайд 77Exogeneity

Macro-econometric Forecasting and Analysis

An important feature of a VECM is that

When the system is out of equilibrium, all the variables interact with each other to move the system back into equilibrium,

In a VECM, this process occurs (as we saw) through the impact of lagged variables so that yi,t is affected by the lags of the other variables either through the error correction term, ut-1, or through the lags of

Слайд 78Weak versus Strong Exogeneity

Macro-econometric Forecasting and Analysis

If the first channel does

If the first and second channels do not exist, then only the lagged values of a variable can be used to explain its changes. In this case, we say that that variable is strongly exogenous.

Strong exogeneity testing is equivalent to Granger causality testing.

Слайд 79Example: Exogeneity

Macro-econometric Forecasting and Analysis

Consider the bi-variate term structure model with

The ten-year interest rate, , is said to be weakly exogenous if

Strong exogeneity amounts to the requirement that

Слайд 80Impulse Response Functions

Macro-econometric Forecasting and Analysis

The dynamics of a VECM can

The approach is to re-express the VECM as a VAR, but preserving the implied restrictions on the parameters.

For example, consider the VECM

Слайд 81Impulse Response Functions: VECM

Macro-econometric Forecasting and Analysis

This VECM can be expressed

subject to the restrictions:

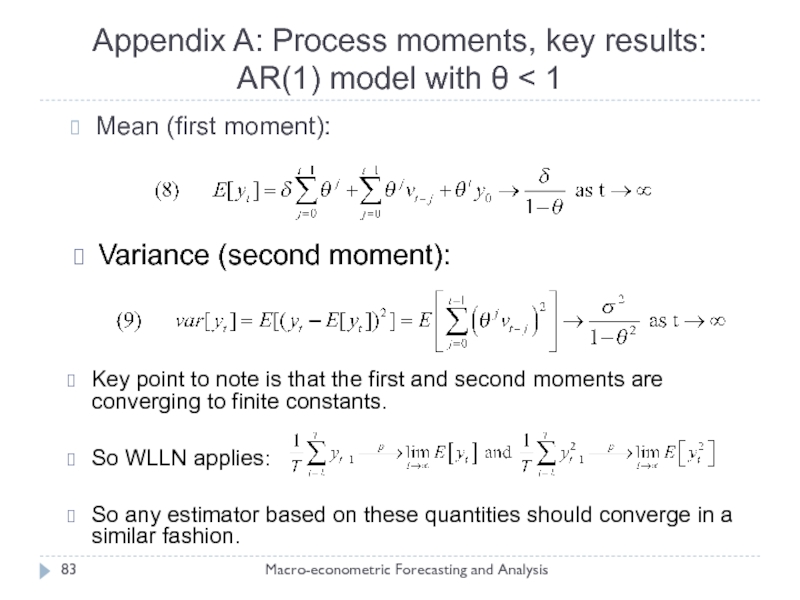

Слайд 83Appendix A: Process moments, key results: AR(1) model with θ

Macro-econometric Forecasting and Analysis

Mean (first moment):

Variance (second moment):

Key point to note is that the first and second moments are converging to finite constants.

So WLLN applies:

So any estimator based on these quantities should converge in a similar fashion.

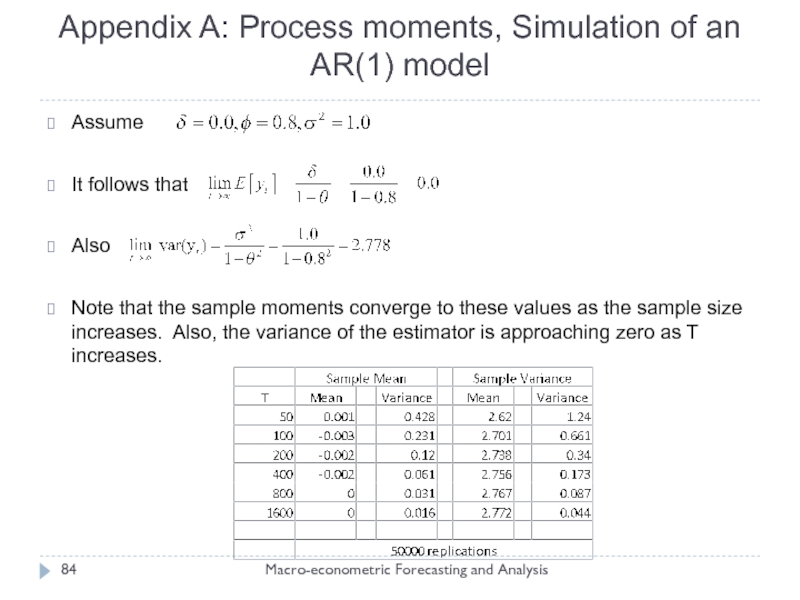

Слайд 84Appendix A: Process moments, Simulation of an AR(1) model

Macro-econometric Forecasting and

Assume

It follows that

Also

Note that the sample moments converge to these values as the sample size increases. Also, the variance of the estimator is approaching zero as T increases.

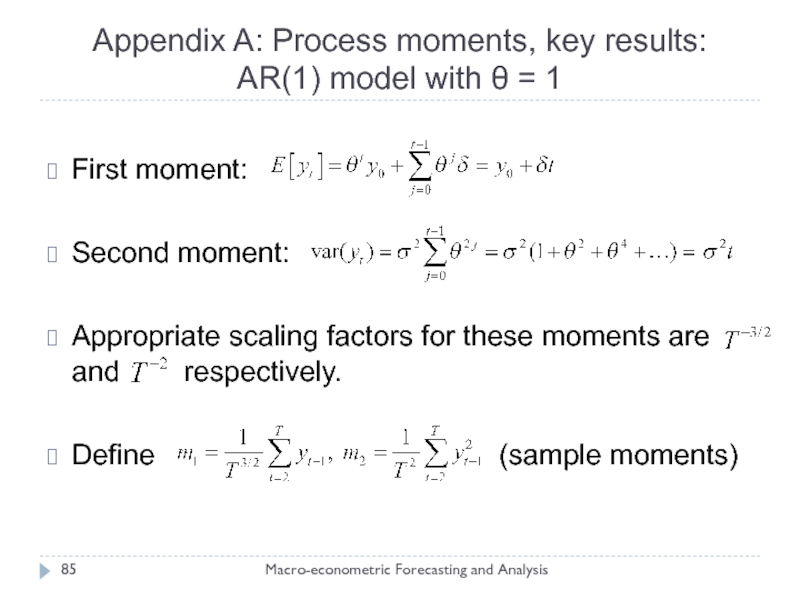

Слайд 85Appendix A: Process moments, key results: AR(1) model with θ =

Macro-econometric Forecasting and Analysis

First moment:

Second moment:

Appropriate scaling factors for these moments are and respectively.

Define (sample moments)

Слайд 86Appendix A: Process moments, simulation of an I(1) Process

Macro-econometric Forecasting and

Notice that the variances of the first two sample moments do not fall as the sample size is increased (Columns 2 and 4).

The variances converge to 1/3, so m1 and m2 converge to random variables in the limit.

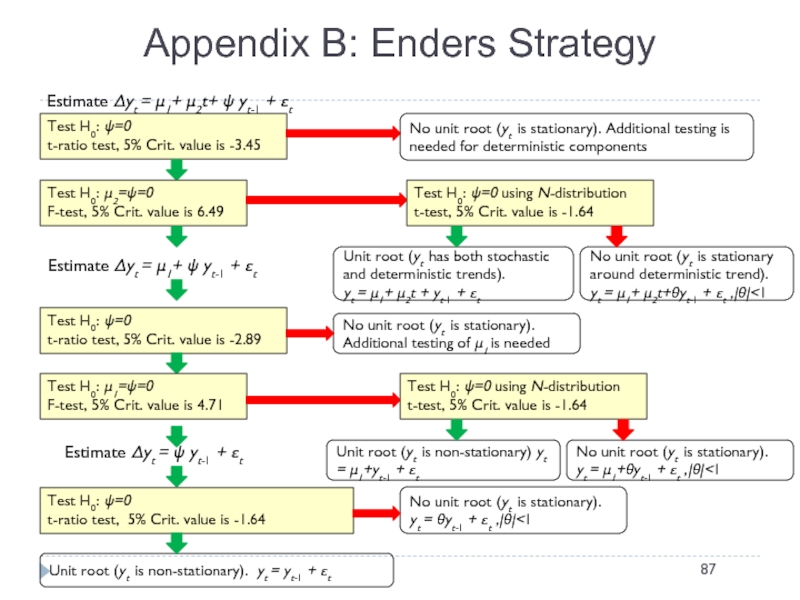

Слайд 87Appendix B: Enders Strategy

Test H0: ψ=0

t-ratio test, 5% Crit. value is

Estimate Δyt = μ1+ μ2t+ ψ yt-1 + εt

Test H0: μ2=ψ=0

F-test, 5% Crit. value is 6.49

No unit root (yt is stationary). Additional testing is needed for deterministic components

Estimate Δyt = μ1+ ψ yt-1 + εt

Test H0: ψ=0

t-ratio test, 5% Crit. value is -2.89

Test H0: μ1=ψ=0

F-test, 5% Crit. value is 4.71

Estimate Δyt = ψ yt-1 + εt

Test H0: ψ=0

t-ratio test, 5% Crit. value is -1.64

No unit root (yt is stationary).

yt = θyt-1 + εt ,|θ|<1

Unit root (yt is non-stationary). yt = yt-1 + εt

Test H0: ψ=0 using N-distribution

t-test, 5% Crit. value is -1.64

No unit root (yt is stationary around deterministic trend).

yt = μ1+ μ2t+θyt-1 + εt ,|θ|<1

Unit root (yt has both stochastic and deterministic trends).

yt = μ1+ μ2t + yt-1 + εt

No unit root (yt is stationary). Additional testing of μ1 is needed

Test H0: ψ=0 using N-distribution

t-test, 5% Crit. value is -1.64

No unit root (yt is stationary).

yt = μ1+θyt-1 + εt ,|θ|<1

Unit root (yt is non-stationary) yt = μ1+yt-1 + εt

Слайд 88Enders Strategy was criticized for:

triple- and double-testing for unit roots

unrealistic outcomes:

Δyt = μ1+ μ2t+ ψ yt-1 + εt , μ2≠0, ψ =0,

this possibility should be excluded from the test

not taking advantage of prior knowledge

Alternative: Elder and Kennedy Strategy

Appendix B: Enders Strategy (2)

Слайд 89Appendix B: Elder and Kennedy Strategy

Test H0: ψ=0

t-ratio test, 5% Crit.

Estimate Δyt = μ1+ μ2t+ ψ yt-1 + εt

No unit root (yt is stationary).

Estimate Δyt = μ1+ εt

No unit root (yt is stationary around deterministic trend).

yt = μ1+ μ2t+θyt-1 + εt ,|θ|<1

No unit root (yt is stationary without deterministic trend):

yt = μ1+ θyt-1 + εt ,|θ|<1

Unit root (yt is non-stationary).

Test H0: μ2=0 Test H0: μ1=0 Unit root (yt is non-stationary with intercept). Unit root (yt is non-stationary without intercept):

double sided t-test,

5% Crit. values are -1.95

double sided t-test,

5% Crit. values are -1.95

yt = μ1+ yt-1 + εt

yt = yt-1 + εt