- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

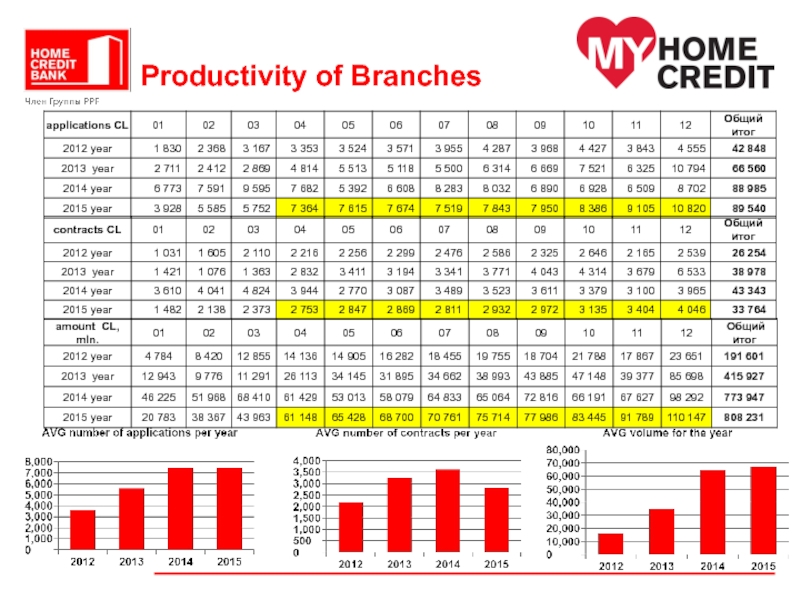

Productivity of Branches Home Credit Bank презентация

Содержание

- 1. Productivity of Branches Home Credit Bank

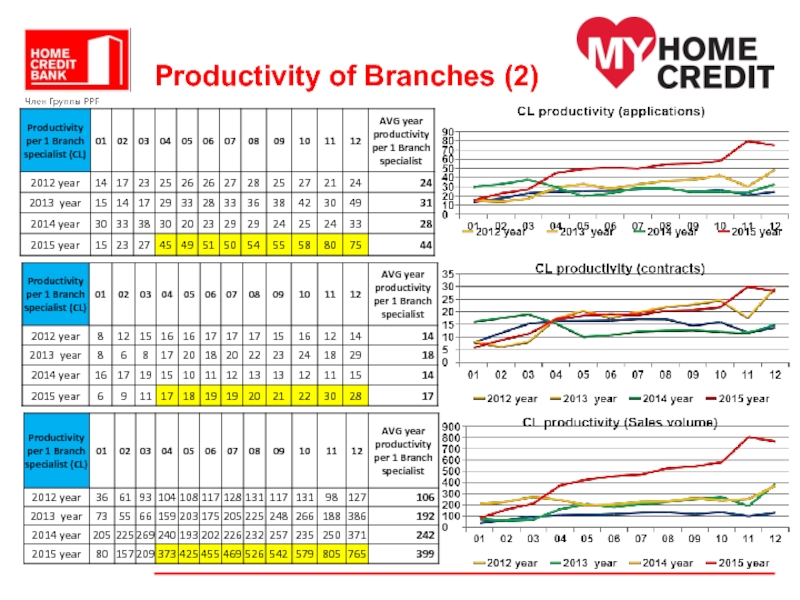

- 2. Productivity of Branches (2)

- 3. Status of Branches closing 3 Branches already

- 4. Action plan to increase productivity at

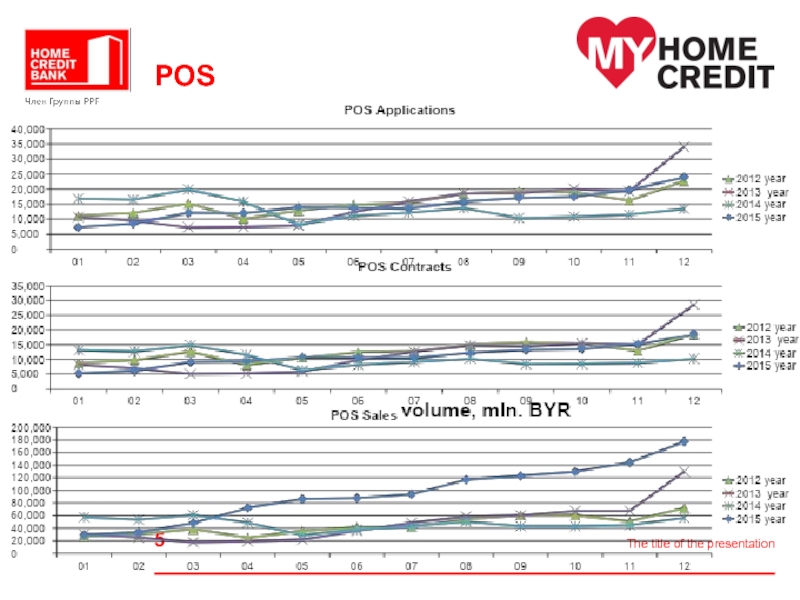

- 5. POS The title of the presentation

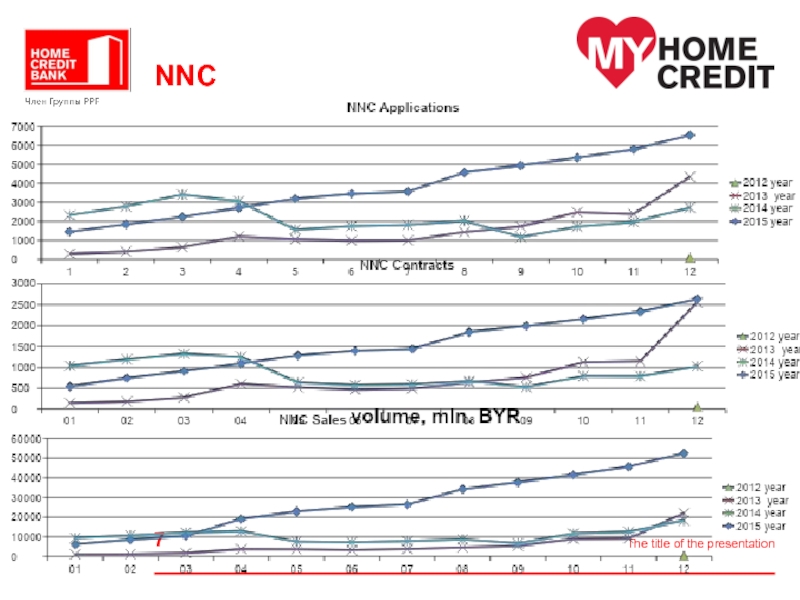

- 6. NNC The title of the presentation

- 7. NNC The title of the presentation

- 8. Actions to increase productivity The introduction of

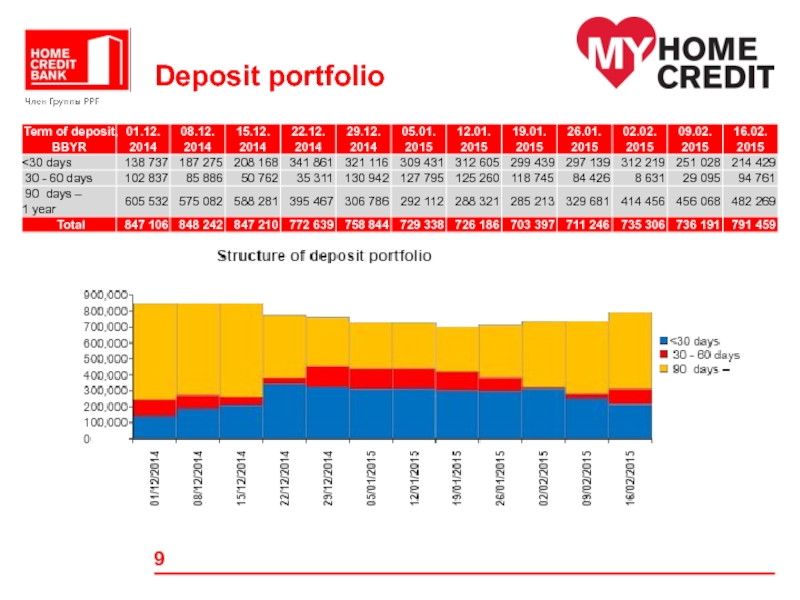

- 9. Deposit portfolio

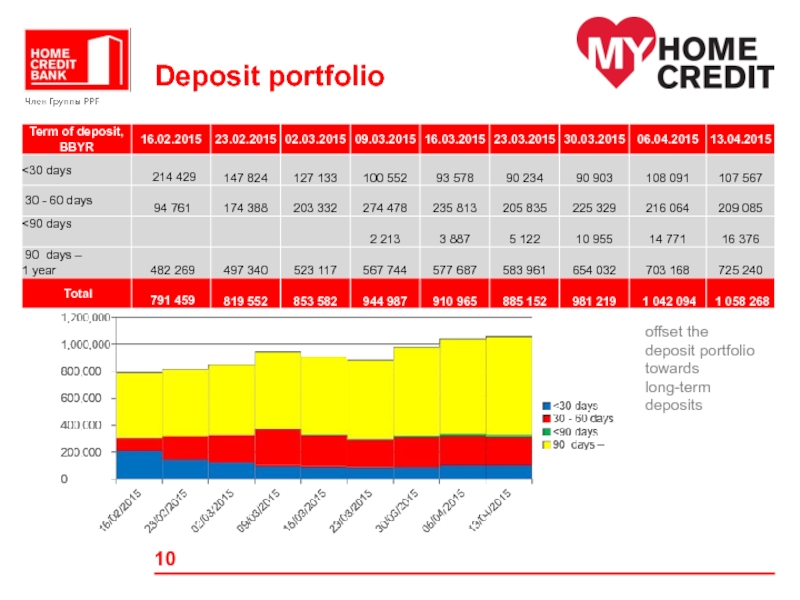

- 10. Deposit portfolio offset the deposit portfolio towards long-term deposits

- 11. Short-term deposit strategy Tasks:

- 12. Deposits of individuals. Action plan 1.To

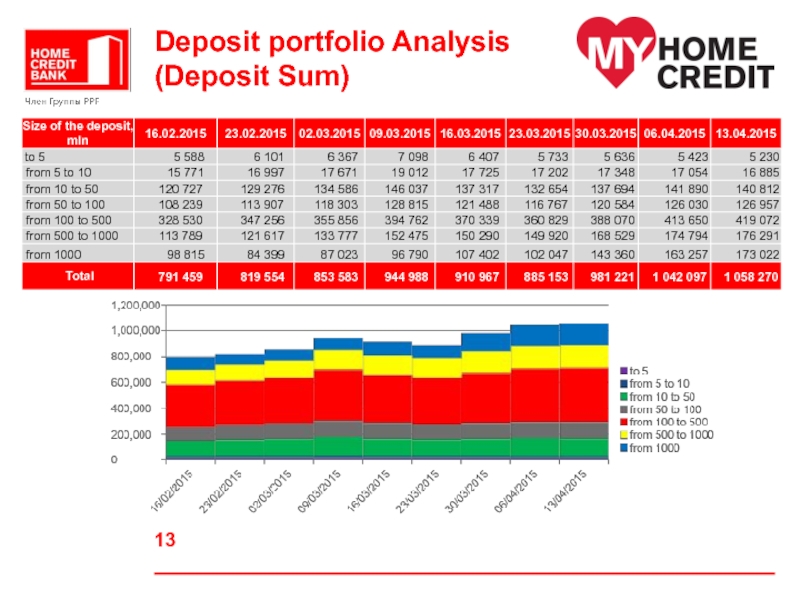

- 13. Deposit portfolio Analysis (Deposit Sum)

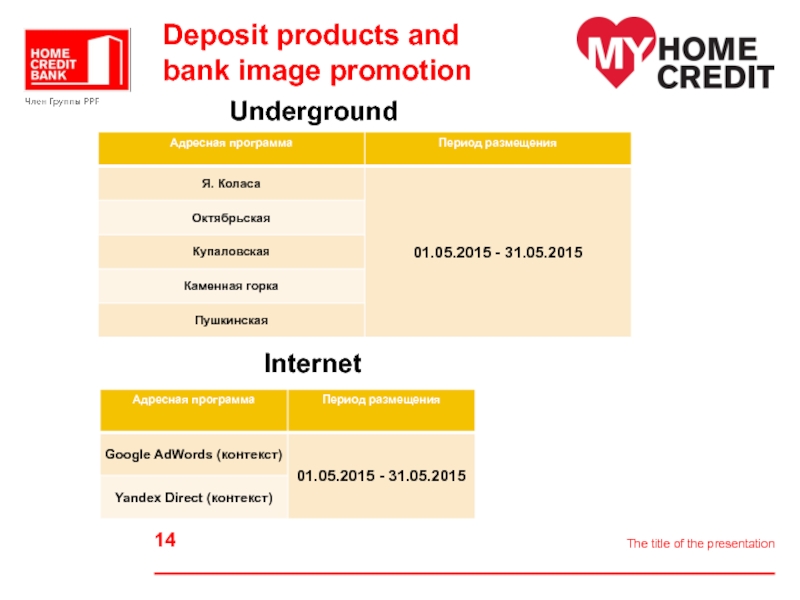

- 14. The title of the presentation Deposit products and bank image promotion Underground Internet

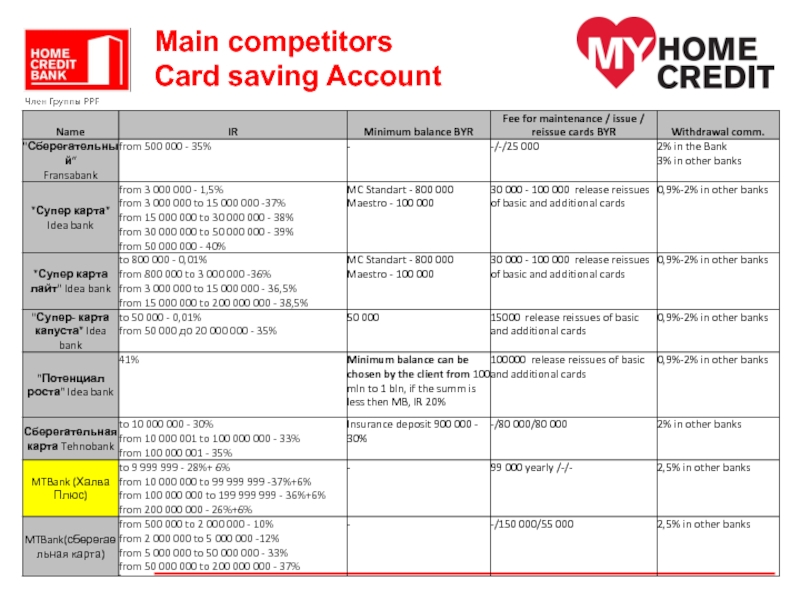

- 15. Main competitors Card saving Account

- 16. Interesting competitors products Deposit card «Халва Плюс»

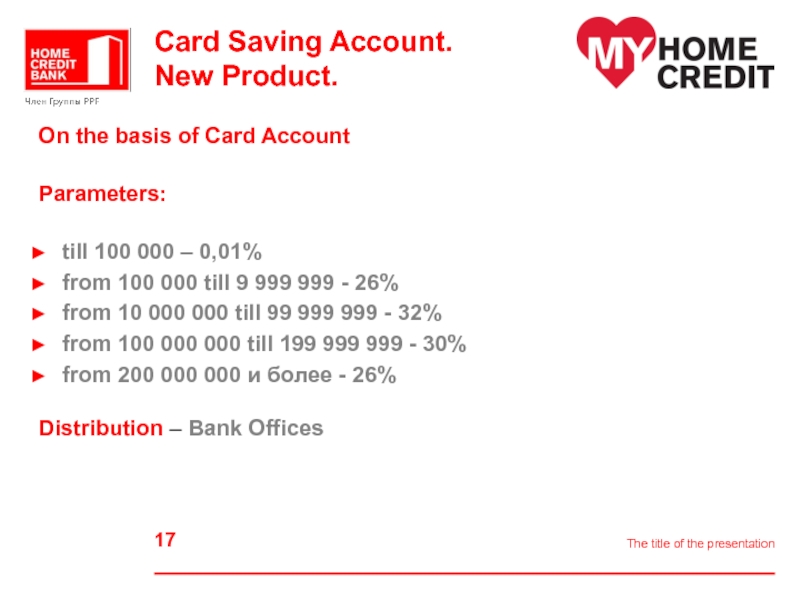

- 17. Card Saving Account. New Product. The

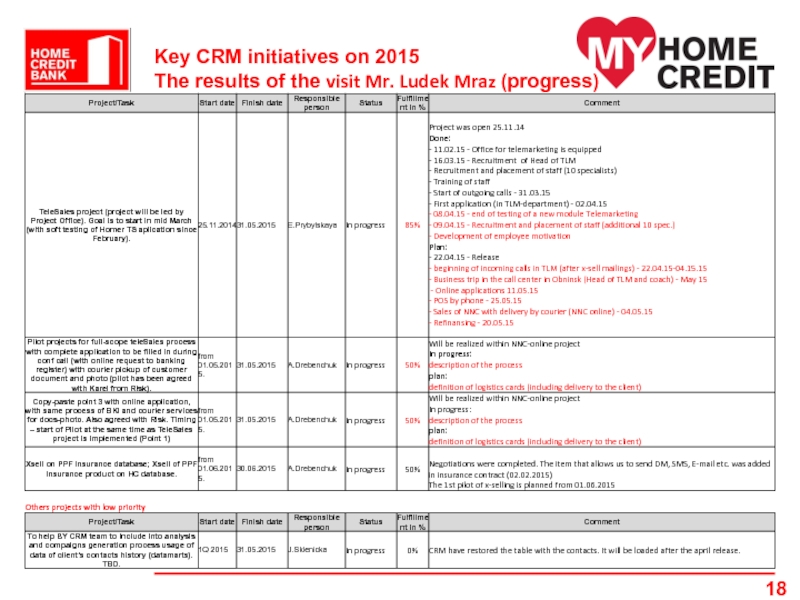

- 18. Key CRM initiatives on 2015 The results of the visit Mr. Ludek Mraz (progress)

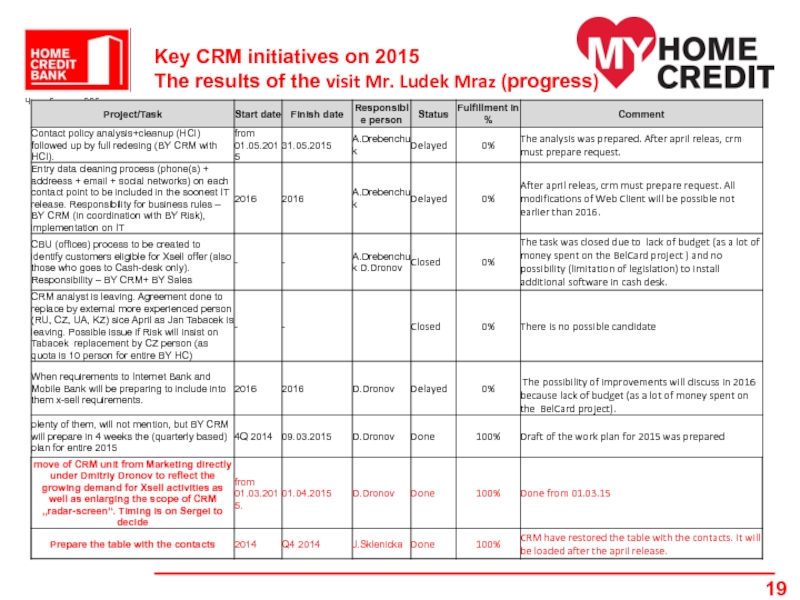

- 19. Key CRM initiatives on 2015 The results of the visit Mr. Ludek Mraz (progress)

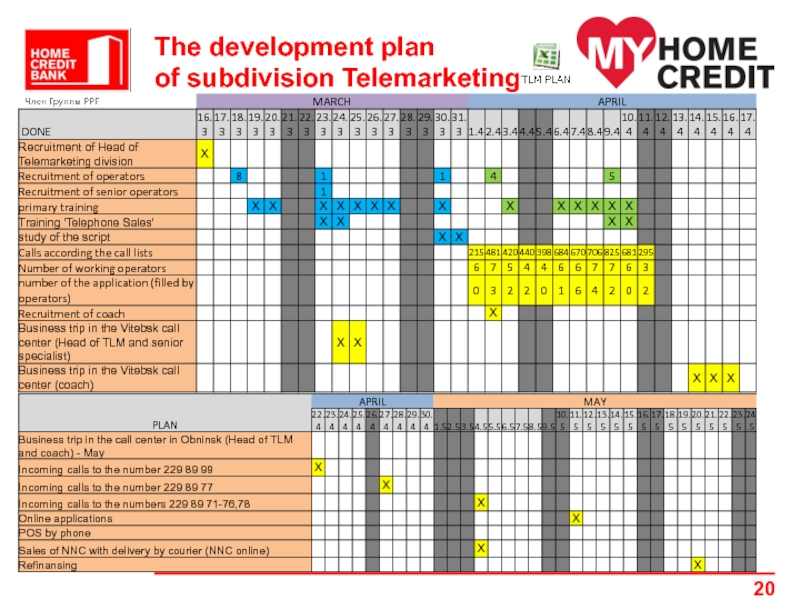

- 20. The development plan of subdivision Telemarketing

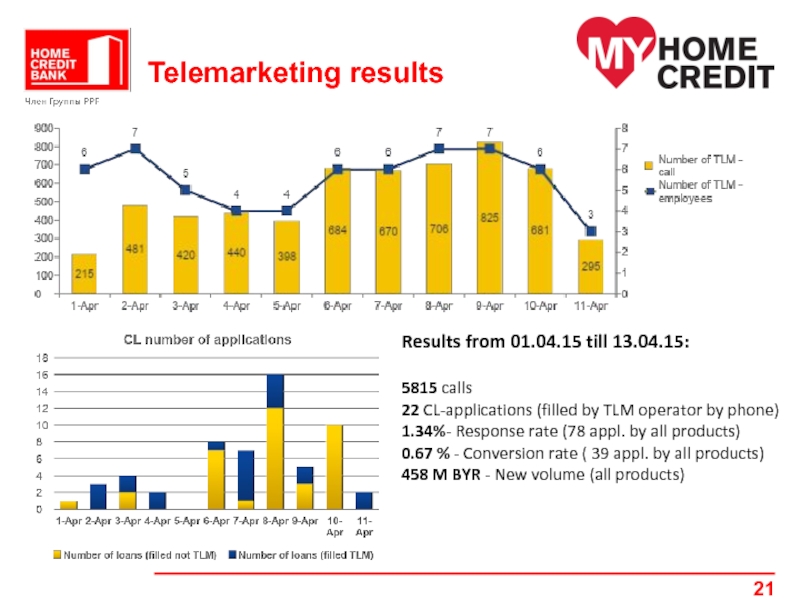

- 21. Telemarketing results Results from

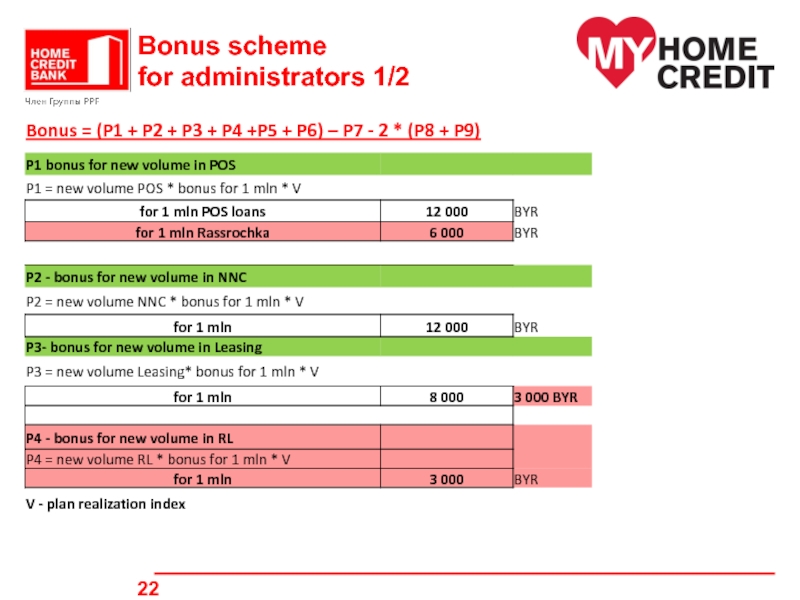

- 22. Bonus scheme for administrators 1/2

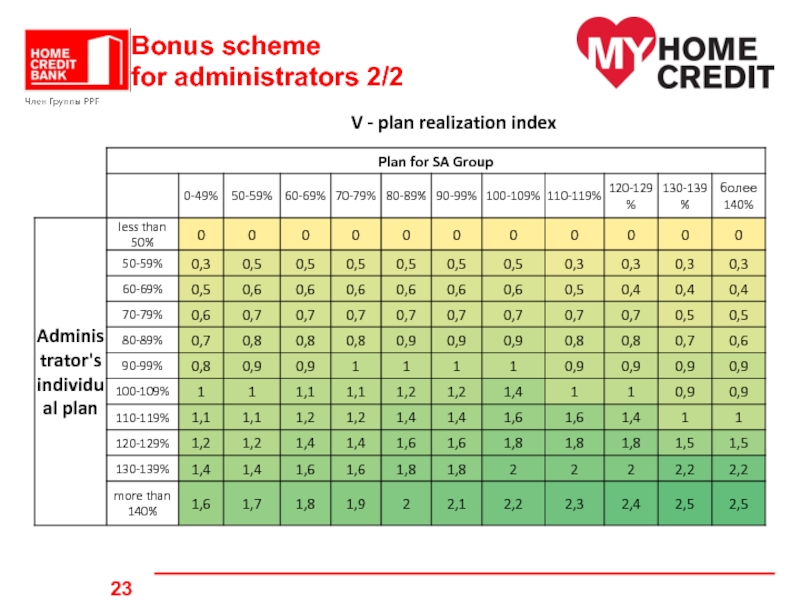

- 23. Bonus scheme for administrators 2/2 V - plan realization index

- 24. Bonus scheme for administrators 3/2

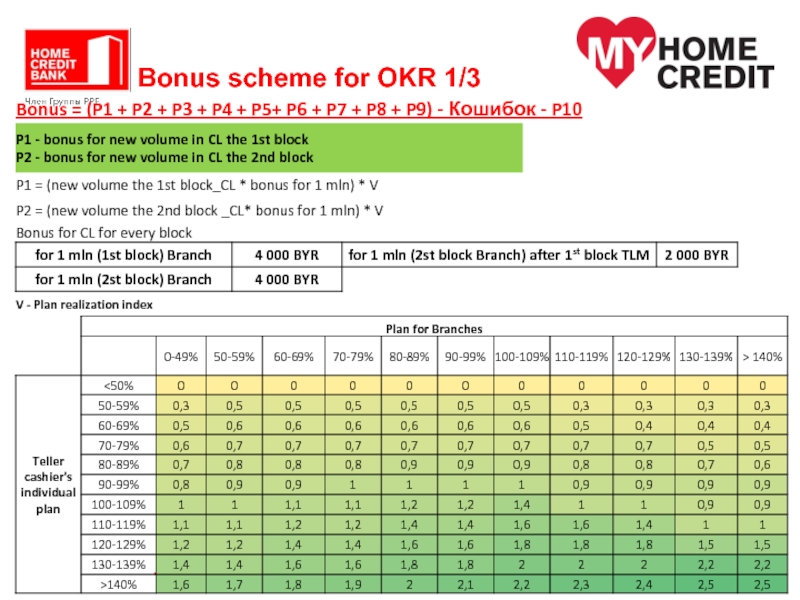

- 25. Bonus scheme for OKR 1/3

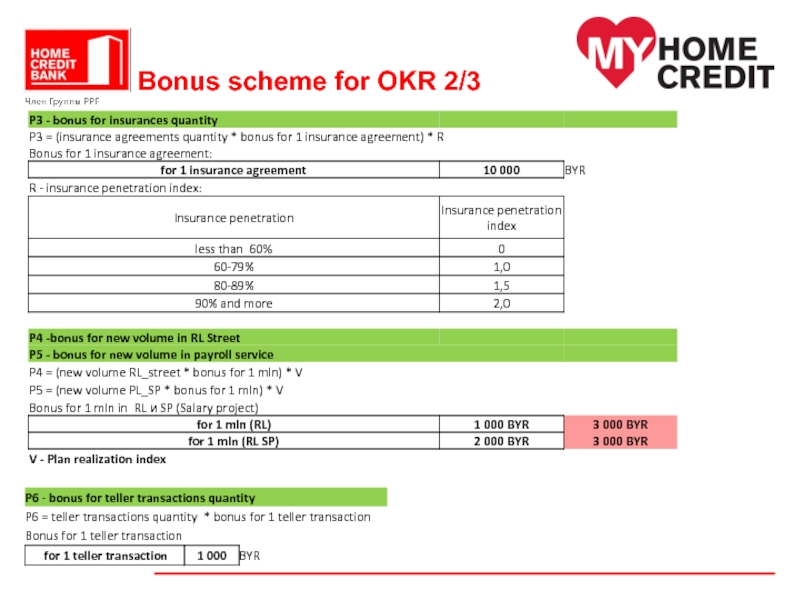

- 26. Bonus scheme for OKR 2/3

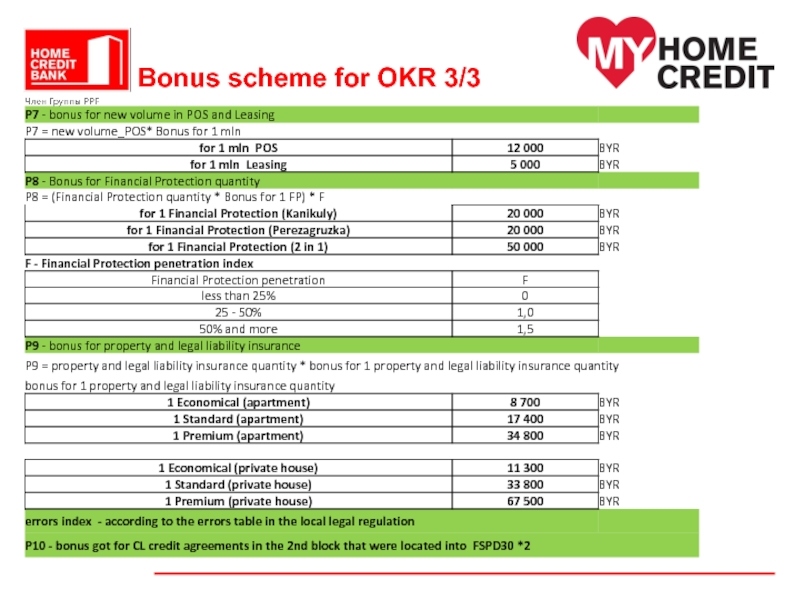

- 27. Bonus scheme for OKR 3/3

Слайд 3Status of Branches closing

3 Branches already closed

2 Branches – will be

closed in April

3 Branches – will be closed in May

1 Branches – will be closed in June

1 Branches – will be closed in August

3 Branches – will be closed in May

1 Branches – will be closed in June

1 Branches – will be closed in August

Слайд 4Action plan to increase

productivity at Branches

Change chart with coefficients in

bonuses of Branch specialists – since April 2015

Regular monitoring of Ratings (report) of Branches and specialists – since March 2015

Optimization of work processes with activities to attract client (setting goals and monitoring) – since May 2015

Introduction of a system of mentoring – since June 2015

Development of project «Service standards». Cultivation in the minds of people that «Standards = additional sales». Adoption of standards by all employees of the Branches – in 2-3 quarter 2015

Closure of 10 Branches – till August 2015

Relocation of 6 Branches to better placement

Advertising promotion of products – hole 2015 year

Regular monitoring of Ratings (report) of Branches and specialists – since March 2015

Optimization of work processes with activities to attract client (setting goals and monitoring) – since May 2015

Introduction of a system of mentoring – since June 2015

Development of project «Service standards». Cultivation in the minds of people that «Standards = additional sales». Adoption of standards by all employees of the Branches – in 2-3 quarter 2015

Closure of 10 Branches – till August 2015

Relocation of 6 Branches to better placement

Advertising promotion of products – hole 2015 year

Слайд 8Actions to increase productivity

The introduction of ratings for SA and group

VA - launch of the project in May 2015 (in progress)

Continuation of the project in April to replace the top 10 administrators at the AP at the 10 worst administrators at the AP, the pilot started in Vitebsk and Gomel. (Acting administrators)

Permanent employment at AP with big sales as extra motivation administrators. (In work).

Opening new AP due to the transfer of unprofitable AP.

Replacement SA unable to cope with the plans of sales. (Due to the administrators Delta Bank)

Development of the project "Service Standards". Adoption workers thought "Standards = additional sales." Carrying out the "first wave" began in February 2015 and will end in June 2015. It is planned two waves per year.

Since April planned permanent attraction at the expense of the borrower bonus offers from third parties (cosmetics stores - IVRoshe, DNK, food Euroopt).

Continuation of the project in April to replace the top 10 administrators at the AP at the 10 worst administrators at the AP, the pilot started in Vitebsk and Gomel. (Acting administrators)

Permanent employment at AP with big sales as extra motivation administrators. (In work).

Opening new AP due to the transfer of unprofitable AP.

Replacement SA unable to cope with the plans of sales. (Due to the administrators Delta Bank)

Development of the project "Service Standards". Adoption workers thought "Standards = additional sales." Carrying out the "first wave" began in February 2015 and will end in June 2015. It is planned two waves per year.

Since April planned permanent attraction at the expense of the borrower bonus offers from third parties (cosmetics stores - IVRoshe, DNK, food Euroopt).

Слайд 11

Short-term deposit strategy

Tasks:

1.To stop deposits outflow. To manage portfolio

for optimal volume to be self-funded with optimal cost of funds - Done

2.To make branches self-funded

3.To change structure of deposits portfolio. To move short-term deposits (less 30 days) to mid-term deposits (90, 180 max) - Done

4.To decrease dependency of “speculated deposit players”, mostly located in Minsk:

•To start activities for clients attraction with more stable behavior

May 2015 – Advertising in Underground and Internet

•To increase share of non-Minsk branches in deposit portfolio – in progress

To launch Card Saving Account - May 2015

2.To make branches self-funded

3.To change structure of deposits portfolio. To move short-term deposits (less 30 days) to mid-term deposits (90, 180 max) - Done

4.To decrease dependency of “speculated deposit players”, mostly located in Minsk:

•To start activities for clients attraction with more stable behavior

May 2015 – Advertising in Underground and Internet

•To increase share of non-Minsk branches in deposit portfolio – in progress

To launch Card Saving Account - May 2015

The title of the presentation

Слайд 12Deposits of individuals. Action plan

1.To make analysis of each region/branch

by the following aspects: portfolio structure dynamic, customer profile, profitability incl.deposit portfolio, potential of branch location – 13.02.2015. - done

2.To develop deposit portfolio plan for each region/branch - 20.02.2015 – in progress

3.To make changes in motivation system (to include bonus dependence from the deposits portfolio plan fulfillment) – 2.03.2015 - in progress

4.To develop action plan for deposit’s products and bank image promotion as sustainable and reliable (to do in most effective promotion channels – internet, transport, etc.) – in Plan May 2015 – Slide 7

5.To develop action plan for each branch (clients and deposits attraction at the local level) – 2.03.2015 - in progress

6.To redesign sales logic and scripts, training course for deposit sale – 2.03.2015 – in progress

7.To make SMS campaign for existing deposit and salary clients (who have relatively high regular balance on their accounts) – 2.03.2015 - in progress

8.To redevelop deposits products to achieve key targets (increase portfolio and increase share of longer terms deposits, decrease of interest rate, promotion to more stable clients) – 2.03.2015 - Done. Slide 3 - offset the deposit portfolio towards long-term deposits

9. to avoid mistakes of past years with the introduction of the Deposit product for a long time under a big bet

To launch Card Saving Account - May 2015

2.To develop deposit portfolio plan for each region/branch - 20.02.2015 – in progress

3.To make changes in motivation system (to include bonus dependence from the deposits portfolio plan fulfillment) – 2.03.2015 - in progress

4.To develop action plan for deposit’s products and bank image promotion as sustainable and reliable (to do in most effective promotion channels – internet, transport, etc.) – in Plan May 2015 – Slide 7

5.To develop action plan for each branch (clients and deposits attraction at the local level) – 2.03.2015 - in progress

6.To redesign sales logic and scripts, training course for deposit sale – 2.03.2015 – in progress

7.To make SMS campaign for existing deposit and salary clients (who have relatively high regular balance on their accounts) – 2.03.2015 - in progress

8.To redevelop deposits products to achieve key targets (increase portfolio and increase share of longer terms deposits, decrease of interest rate, promotion to more stable clients) – 2.03.2015 - Done. Slide 3 - offset the deposit portfolio towards long-term deposits

9. to avoid mistakes of past years with the introduction of the Deposit product for a long time under a big bet

To launch Card Saving Account - May 2015

The title of the presentation

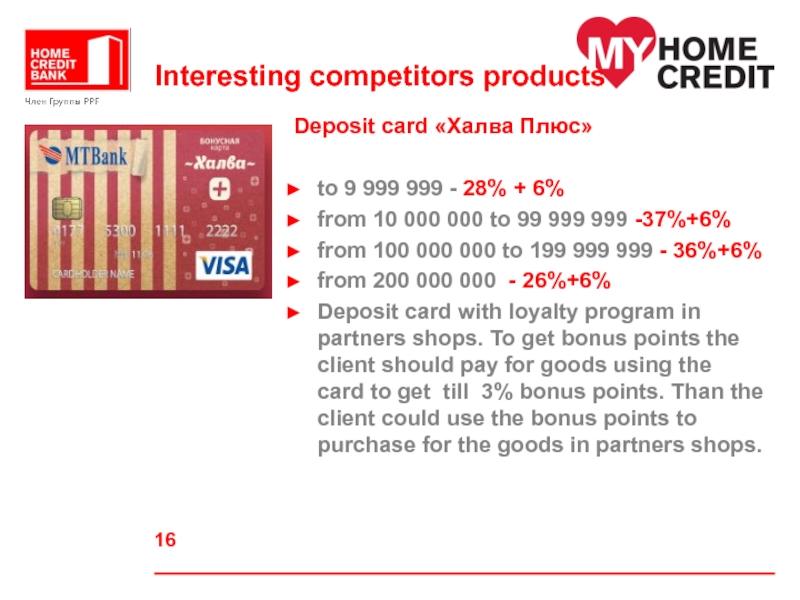

Слайд 16Interesting competitors products

Deposit card «Халва Плюс»

to 9 999 999 -

28% + 6%

from 10 000 000 to 99 999 999 -37%+6%

from 100 000 000 to 199 999 999 - 36%+6%

from 200 000 000 - 26%+6%

Deposit card with loyalty program in partners shops. To get bonus points the client should pay for goods using the card to get till 3% bonus points. Than the client could use the bonus points to purchase for the goods in partners shops.

from 10 000 000 to 99 999 999 -37%+6%

from 100 000 000 to 199 999 999 - 36%+6%

from 200 000 000 - 26%+6%

Deposit card with loyalty program in partners shops. To get bonus points the client should pay for goods using the card to get till 3% bonus points. Than the client could use the bonus points to purchase for the goods in partners shops.

Слайд 17

Card Saving Account.

New Product.

The title of the presentation

On the basis of

Card Account

Parameters:

till 100 000 – 0,01%

from 100 000 till 9 999 999 - 26%

from 10 000 000 till 99 999 999 - 32%

from 100 000 000 till 199 999 999 - 30%

from 200 000 000 и более - 26%

Distribution – Bank Offices

Parameters:

till 100 000 – 0,01%

from 100 000 till 9 999 999 - 26%

from 10 000 000 till 99 999 999 - 32%

from 100 000 000 till 199 999 999 - 30%

from 200 000 000 и более - 26%

Distribution – Bank Offices

Слайд 21Telemarketing results

Results from 01.04.15 till 13.04.15:

5815 calls

22 CL-applications (filled by

TLM operator by phone)

1.34%- Response rate (78 appl. by all products)

0.67 % - Conversion rate ( 39 appl. by all products)

458 M BYR - New volume (all products)

1.34%- Response rate (78 appl. by all products)

0.67 % - Conversion rate ( 39 appl. by all products)

458 M BYR - New volume (all products)