- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Luxoft in germany. Open days презентация

Содержание

- 1. Luxoft in germany. Open days

- 2. AGENDA GERMANY AT A GLANCE

- 3. LUXOFT IN

- 4. COMFORTABLE OFFICE 15-minute

- 5. LUXOFT IN BOEBLINGEN, GERMANY 15 MINUTE

- 6. ENVIRONMENT IN BOEBLINGEN http://www.immobilienscout24.de/Suche/S-T/Wohnung-Miete/Baden-Wuerttemberg/Boeblingen-Kreis/Sindelfingen?enteredFrom=one_step_search 2 Werkrealschulen: Eichendorff

- 7. BALL PARK FIGURES ABOUT LIVING IN BOEBLINGEN

- 8. DECISION MAKING TO WORK IN

- 9. WE DEVELOP NEW TECH VALUE

- 10. NEW RELATIONS DIRECT CONTRACT ENGINEE-RING PROJECT OUR

- 11. WHOM WE ARE LOOKING FOR TO JOIN

- 12. Project launching Relocation starting of the first

- 13. HOW IT LOOKS LIKE? https://www.youtube.com/watch?v=Z3vCJgN_5ic Luxoft @ Geneva Motor Show 2015

- 14. MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

- 15. MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

- 16. MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

- 17. MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

- 18. MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

- 19. Germany4U@luxoft.com GERMANY GERMANY FOR YOU! Still have questions?

- 20. APPENDIX: FIRST STEPS IN GERMANY IN DETAILS

- 21. Part of the German social security system

- 22. The health insurance benefits at a glance

- 23. Retirement pension insurance benefits at a glance:

- 24. Unemployment insurance benefits at a glance:

- 25. Long term care insurance benefits at a

- 26. Accident insurance benefits at a glance: Statutory

- 27. In the labor law “Bundesurlaubsgesetz BUrlG” holiday

- 28. In case of illness the employee will

- 29. The maternity leave starts six weeks before

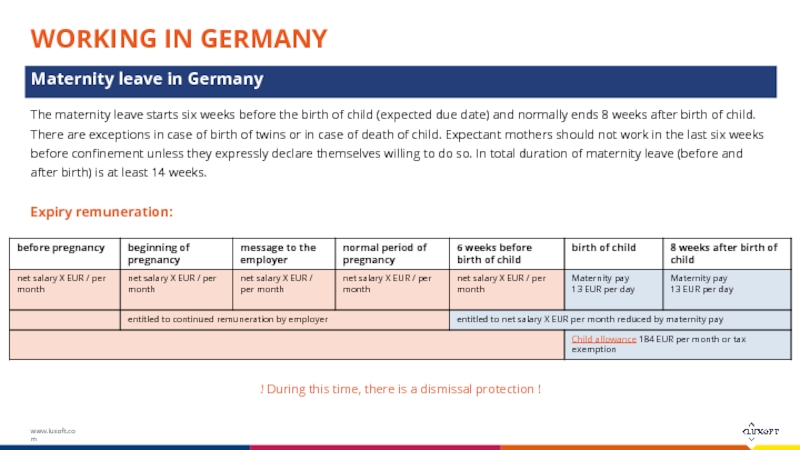

- 30. 1. Mothers and fathers have the possibility

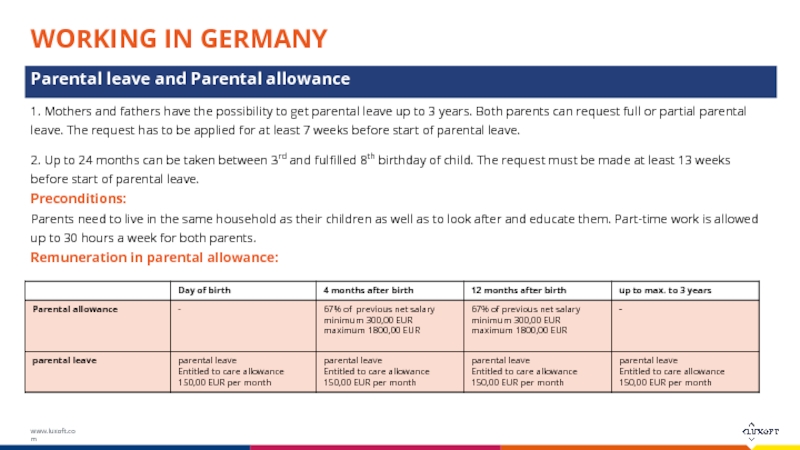

- 31. In case of illness of children or

- 32. The nursing leave act allows employees to

- 33. Tax declaration is mandatory for everybody in

- 34. What benefits will I get from ELSTER?

- 35. School system in Germany special school

- 36. Primary Level (Primary school – Grundschule) Compulsory

- 37. Secundary Level 2 (Gymnasium) Secondary Level 2

- 38. You have to apply for Bluecard till

- 39. YOUR FIRST STEPS AT LUXOFT GERMANY Registration

- 40. Your registration at “Einwohnermeldeamt” is forwarded to

- 41. As soon as you have registered at

- 42. You need to open a GERMAN banc

- 43. Health insurance: When you work and live

- 44. The following documents have to compulsory be

- 45. …which you can submit either as hard

- 46. YOU NEED TO KNOW Below you find

- 47. Germany has twenty-six regional airports and fourteen

- 48. Thank you Germany4U@luxoft.com

Слайд 3

LUXOFT IN GERMANY

Stadionstraße 66

70771 Leinfelden-Echterdingen, Germany

? + 49 711 490 49

Onsite office, located in Deutsche Bank

(FEP House 5)

Wilhelm-Fay-Str. 31-37

65936 Frankfurt am Main, Germany

SPECIALIZATION

Automotive

EMPLOYEES

65+

MANAGING DIRECTOR OF LUXOFT GERMANY

Dr. Peter Mossack

pmossack@luxoft.com

+ 49 711 490 49 203

STUTTGART OFFICE

LUXOFT GMBH

PROVIDE SERVICES FOR WORLD’S LEADING COMPANIES

embedded systems development

software development

project management

FRANKFURT OFFICE

Слайд 4 COMFORTABLE OFFICE

15-minute by car to client’s office

Big

Outside roofterrasse

Accessibility: good

Public transport: S-Train Station in 3 min

Supermarket: EDEKA Supermarket by foot 3 min

NEW LUXOFT GERMANY OFFICE IN BOEBLINGEN

Слайд 5LUXOFT IN BOEBLINGEN, GERMANY

15 MINUTE TO CLIENT’SOFFICE

20 min

VIA S-BAHN FROM

39,04 sq.km

AREA

45,805

POPULATION

STATE BADEN-WÜRTTEMBERG

ADMIN.REGION STUTTGART

YOUR FAMILY WILL LIKE THIS CITY

GREAT LOCATION TO START CAREER GLOBALLY

Freibad Böblingen

Mineraltherme Böblingen

Stadt Böblingen

SOUTH WEST- EAST GERMANY

BOEBLINGEN IS A CENTER OF BOTH AUTOMOBILE AND COMPUTER INDUSTRIES*

Electronic Test and Measurement

Semiconductors

Computers, Software & Services

Medical Monitors

Electronic Signature Verification

Electronic data recovery

Слайд 6ENVIRONMENT IN BOEBLINGEN

http://www.immobilienscout24.de/Suche/S-T/Wohnung-Miete/Baden-Wuerttemberg/Boeblingen-Kreis/Sindelfingen?enteredFrom=one_step_search

2

Werkrealschulen: Eichendorff (combined with primary school) and Theodor Heuss

2

Realschulen,

4

Gymnasiums, Albert-Einstein, Lise-Meitner, Max-Planck and Otto-Hahn

2

Special-needs schools (Pestalozzischule). Several vocational schools including: The Boeblingen Data Processing Academy, Boeblingen Commercial School, the Biotechnological High School and the Food Sciences High School

8

Primary schools. Other 4 specialized schools. There is an American grade school, called Boeblingen elementary

2

Museums. Tenth-scrub, includes today the Boeblingen urban gallery and the farmer war museum. German butcher museum, in a half timbered house

*http://www.handelsblatt.com/unternehmen/beruf-und-buero/buero-special/gehaltsuebersicht-fuer-2014-tabelle-it-berufe/8934336-5.html

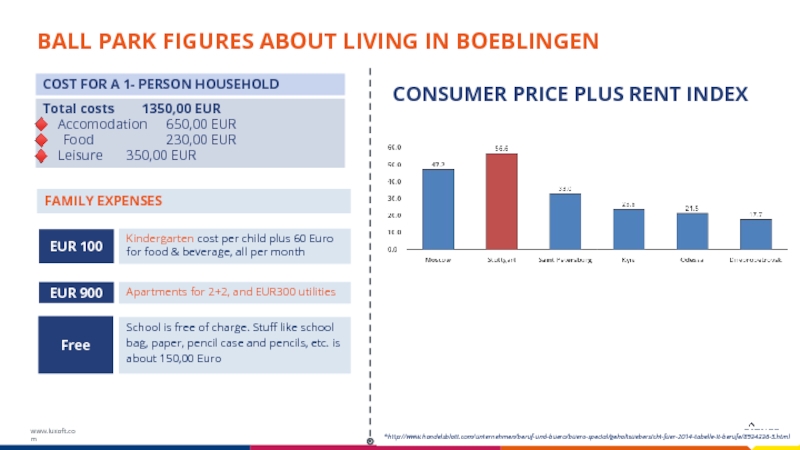

Слайд 7 BALL PARK FIGURES ABOUT LIVING IN BOEBLINGEN

EUR 100

Kindergarten cost per child

CONSUMER PRICE PLUS RENT INDEX

*http://www.handelsblatt.com/unternehmen/beruf-und-buero/buero-special/gehaltsuebersicht-fuer-2014-tabelle-it-berufe/8934336-5.html

FAMILY EXPENSES

EUR 900

Apartments for 2+2, and EUR300 utilities

Free

School is free of charge. Stuff like school bag, paper, pencil case and pencils, etc. is about 150,00 Euro

Слайд 8

DECISION MAKING TO WORK IN NEW PROJECT IN GERMANY

IN CASE YOUR

CONSULT WITH PROJECT’S RECRUI-TERS

DISCUSS WITH THE FAMILY

APPLY FOR THE POSITION

STEP #1

STEP #2

STEP #3

STEP #4

Слайд 9

WE DEVELOP NEW TECH VALUE THROUGH

DESIGN LANGUAGE IN NEW PROJECT

Example

HMI, UI

voice control

infotainment system

high-performance audio

entertainment

information and communication systems

connectivity products for the automotive industry

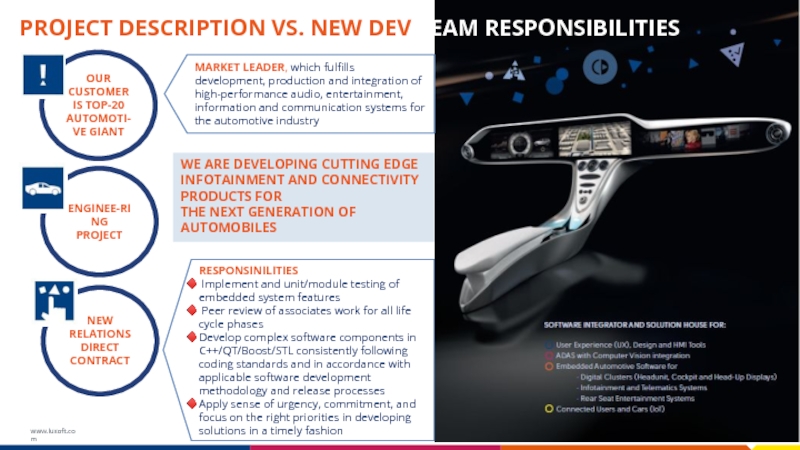

Слайд 10NEW RELATIONS DIRECT CONTRACT

ENGINEE-RING PROJECT

OUR CUSTOMER IS TOP-20 AUTOMOTI-VE GIANT

PROJECT DESCRIPTION

WE ARE DEVELOPING CUTTING EDGE INFOTAINMENT AND CONNECTIVITY PRODUCTS FOR

THE NEXT GENERATION OF AUTOMOBILES

MARKET LEADER, which fulfills development, production and integration of high-performance audio, entertainment, information and communication systems for the automotive industry

RESPONSINILITIES

Implement and unit/module testing of embedded system features

Peer review of associates work for all life cycle phases

Develop complex software components in C++/QT/Boost/STL consistently following coding standards and in accordance with applicable software development methodology and release processes

Apply sense of urgency, commitment, and focus on the right priorities in developing solutions in a timely fashion

Слайд 11WHOM WE ARE LOOKING FOR TO JOIN OUR NEW TEAM IN

5+ years' hands-on development experience in C++/STL on the Linux platform

Experience in building multi-threading applications.

Strong understanding of data structures

Strong understanding of Design Patterns.

SW-Configuration management

SW-Error tracking tool

SW-Module test/Unit test

Operated in an Agile, continuous integration environment

Bachelor's Degree in Computer Science, Electrical Engineering, Mathematics, Physics or related technical fields

Spoken English

Experience with Boost libraries, C++11, and C++14 is a plus

SW-development Embedded Systems (Automotive)

SW-Design with UML (if possible Rhapsody-Tool-experience)

Experience with automotive HW and embedded SW

Methodologies for problem analysis

Self-motivated and enjoys working in a team and across various teams

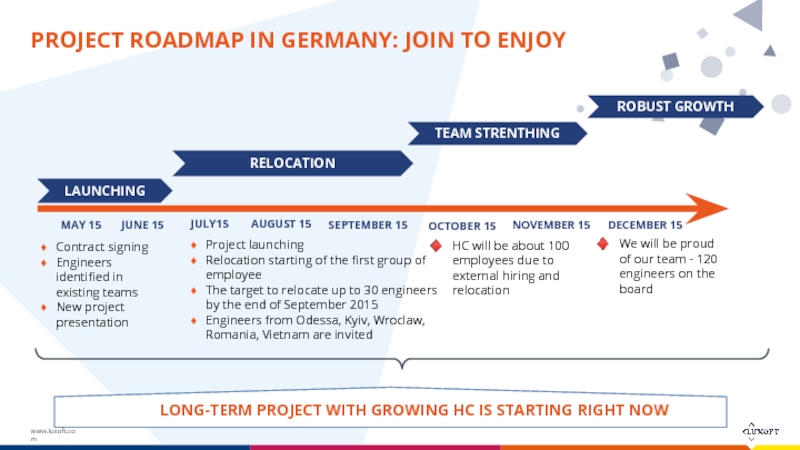

Слайд 12Project launching

Relocation starting of the first group of employee

The target to

Engineers from Odessa, Kyiv, Wroclaw, Romania, Vietnam are invited

HC will be about 100 employees due to external hiring and relocation

Contract signing

Engineers identified in existing teams

New project presentation

JULY15

AUGUST 15

SEPTEMBER 15

OCTOBER 15

MAY 15

NOVEMBER 15

DECEMBER 15

LAUNCHING

RELOCATION

TEAM STRENTHING

ROBUST GROWTH

JUNE 15

We will be proud of our team - 120 engineers on the board

PROJECT ROADMAP IN GERMANY: JOIN TO ENJOY

LONG-TERM PROJECT WITH GROWING HC IS STARTING RIGHT NOW

Слайд 13HOW IT LOOKS LIKE?

https://www.youtube.com/watch?v=Z3vCJgN_5ic

Luxoft @ Geneva Motor Show 2015

Слайд 14MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

KEY MYTHS SOARING

LET’S KILL

The process of employee relocation to Germany too long

From 2 up to 8 weeks, depending on the situation of the employee, his qualification, his papers, etc. These values have been mentioned by employees that have already been relocated.

Information about visa is unclear. What type of visa will be provided for family members?

First employee has to apply for D-Visum (90 days, allows work with company). When employee has arrived in Germany, he starts applying for Blue Card which is valid 4 years and can afterwards be prolonged or changed into permanent work and stay permit. For family will be provided the same visa card with the special notice «family reunification» and they can work in Germany without restrictions

Слайд 15MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

KEY MYTHS SOARING

LET’S KILL

Could employee work in Germany under obtained visa during relocation and afterward under Blue Card and then find another job in Germany?

D-Visum is company-related. Employee cannot work with another company in case project stops within 3 months. Blue card allows to change job and work with another company. In case work contract is finished within Blue card period, employee has 3 months time to find a new employment. In any case he has to announce unemployment to Federal Agency of Work as soon as he has been informed about end of contract.

BLUE CARD REQUIREMENTS

High university degree relevant to the position obtained

For IT-specialists gross salary should be not less than € 37.752 gross annually (€ 3.146 gross per month).

In which currency will be given funds to employee for relocation?

We propose to give funds in the local currency in the country of origin. Some of services (e.g. tickets, accommodation after arrival, outsourcing company services) will be paid by Luxoft

Слайд 16MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

KEY MYTHS SOARING

LET’S KILL

For private purposes such as income tax declaration we have in Germany so called “Steuerberater” (= tax consultants) who can be engaged by employee himself. There’s also kind of organization called “Lohnsteuerhilfeverein” which can also be consult and give advice, charging a small fee for the service. Another possibility is to make tax declaration online (ELSTER). There’s already an English guide, but the program itself is in German language. There are several online programs in www, e.g. http://www.brutto-netto-rechner.info/ which helps you to easily calculate the taxes and deductions from salary. Salary is reduced by: income tax, social security contributions (health, pension, unemployment, health care).

What cost expenses will bear the company having discharge of employee (cancellation of a contract)?

There’s the legal regulation (Civil Code § 622) which determines the notice periods. Upon these notice periods the company may be obliged to pay compensation but it depends on each individual case. As a rule: in case company is obliged to pay it usually pays 0.5 salaries per year of employment.

Taxation – methods

Слайд 17MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

KEY MYTHS SOARING

LET’S KILL

Insurance in Germany

We support governmental insurance with the wide range of services (including dental care, pregnancy care, child care and so on). The family is ensured via the employee w/o any additional costs. There is a limit of 4.125,00 Euro per month on which is based the deduction for social security. If a person earns more, he may upgrade for special services but he is not obliged to do so.

What is the amount of expenses for kindergarten and schools

There are different offers from private to public kindergartens. Example for public kindergarten: you pay 100 Euro/month per child plus 60 Euro/month for food & beverage. Private kindergartens are more expensive. School itself is free of charge, you have to buy stuff like school bag, paper, pencil case and pencils, etc. We assume the cost will be about 150 Euro/month.

Слайд 18MIGRATION SPECIFICS IN GERMANY: INSIGHTS FROM EMPLOYEES

KEY MYTHS SOARING

LET’S KILL

Specificity of rent apartments

Rent duration: generally unlimited, rent deposit: 1-3 monthly rents

cost of the minimum set of the furniture for one-roomed flat. The minimum amount as per investigation of the social court in Germany is 1.100,00* Euro for one person to buy the most important stuff for living in an apartment.

*http://www.ikea.com/de/de/store/sindelfingen

Слайд 21Part of the German social security system and the health system

Percentage of gross salary which is used for:

health insurance 14,6 % employee 50% employer 50 % pension insurance 18,7 % employee 50% employer 50 % unemployment insurance 3,0 % employee 50% employer 50 % long term care insurance 2,35 % employee 50% employer 50 % accident insurance (VBG) employer 100 %

More information:

http://www.deutsche-sozialversicherung.de/en/index.html

Legal Insurance in Germany

WORKING IN GERMANY

Слайд 22The health insurance benefits at a glance : Regular check-ups for early

Contributions:

stationary stay in hospital: 10 EUR per day for a maximum of 28 days (per year).

medical treatment: 10 % of cost, at least 5 EUR, maximum 10 EUR, not more than actual cost, free of charge for children and teens under the age of 18

They have claim on general care services and are housed in a dormitory. The medications that are prescribed by your doctor, takes over for the most part also your checkout. However, this medication may not be available over the counter. Exceptions for special treatments: deductible of at least 10% or 5 EUR or 10 EUR.

Links to most common health insurances preferred by colleagues: http://www.aok-bv.de/aok/english/ https://en.barmer-gek.de/barmer/web/Portale/English/Best-health-insurance/Service/Overview-Premiums/This-will-change-from-2015/this-will-change-from-2015.html

Legal Insurance in Germany – health insurance

WORKING IN GERMANY

Слайд 23Retirement pension insurance benefits at a glance: The benefits provided by statutory

First: Payment of old-age pensions which is one of the central tasks of the statutory pension insurance system ever since its inception. It covers also substantial protection from the consequences of reduced earning capacity or the death of a spouse.

Second: Rehabilitation which strives to positively influence the ability of ill or disabled persons to participate in gainful employment and - whenever possible - to restore full earning capacity. As a form of income replacement pensions are designed to offer insured persons an adequate livelihood after retiring.

Pensions are usually provided as:

old-age pensions (for example, standard old-age pension),

pensions due to reduced earning capacity, and

pensions due to the insured persons death (for example, widows/widowers pension, orphans pension).

Unlike other branches of statutory social insurance the extent of benefits that can be claimed under retirement pension insurance depends on the amount of contributions paid.

http://www.deutsche-sozialversicherung.de/en/index.html

Legal Insurance in Germany – retirement pension insurance

WORKING IN GERMANY

Слайд 24Unemployment insurance benefits at a glance: A multitude of benefits are provided

Benefits for Employers:

Recruitment of employees (integration subsidies, recruitment subsidy for new businesses, recruitment subsidy for representation)

Promotion of vocational training (wage subsidy for unskilled workers)

Support for people with disabilities in the workplace (vocational rehabilitation, job aids for disabled persons, sample employment of disabled people)

http://www.deutsche-sozialversicherung.de/en/index.html

Legal Insurance in Germany – Unemployment insurance

WORKING IN GERMANY

Слайд 25Long term care insurance benefits at a glance:

Long term care insurance

For more information please visit the following website:

http://www.deutsche-sozialversicherung.de/en/index.html

Legal Insurance in Germany – Long term care insurance

WORKING IN GERMANY

Слайд 26Accident insurance benefits at a glance:

Statutory occupational accident insurance offers workers,

For more information please visit the following website:

http://www.deutsche-sozialversicherung.de/en/index.html

Legal Insurance in Germany – accident insurance

WORKING IN GERMANY

Слайд 27In the labor law “Bundesurlaubsgesetz BUrlG” holiday is considered as special

General minimum of vacation employees: The provisions of leave entitlements are made in the Federal Republic of Germany in Federal Holidays Act (BUrlG). For employees, there are 24 days minimum leave per year. For more information please visit the following website: http://www.bmas.de/EN/Home/home.html

Holidays in Germany

WORKING IN GERMANY

Слайд 28In case of illness the employee will receive salary payment for

Inability to work: The employer must be informed immediately in case of illness by phone or email. In case of an extension of sick leave the employer must also be informed immediately. The medical certificate must be filed immediately. The reason for illness has not to be disclosed to the employer. Getting ill during vacation: The employer must be informed immediately in case of illness by phone or email and a medical certificate has to be handed-in. Days of sick-leave during vacation are credited. New vacation request for these days is obligatory.

Sick leave in Germany

WORKING IN GERMANY

Слайд 29The maternity leave starts six weeks before the birth of child

! During this time, there is a dismissal protection !

Maternity leave in Germany

WORKING IN GERMANY

Слайд 301. Mothers and fathers have the possibility to get parental leave

2. Up to 24 months can be taken between 3rd and fulfilled 8th birthday of child. The request must be made at least 13 weeks before start of parental leave. Preconditions: Parents need to live in the same household as their children as well as to look after and educate them. Part-time work is allowed up to 30 hours a week for both parents. Remuneration in parental allowance:

! During this time, there is a dismissal protection !

Parental leave and Parental allowance

WORKING IN GERMANY

Слайд 31In case of illness of children or child care you are

married status – each parent: 10 days per year for one or two children and up to 25 days for more than two children (only children under the age of 12)

single status: 20 days per year for one child and up to 50 days for more than one child (only children under the age of 12)

Exceptions:

You are entitled to unlimited special leave in case of severe or incurable illness of child or if the child has only a few weeks to live

For allowances during special leave, please refer to your employer and/or the health insurance.

Illness of child or child care

WORKING IN GERMANY

Слайд 32The nursing leave act allows employees to stay from work or

stay away from work up to 10 days in case of an emergency need of care and

extend up to 6 months in order to care for family members in need of long-term care

In both cases there is no salary payment made by the employer. Please refer to your health insurance for more information.

Special leave allowance for care of family members

WORKING IN GERMANY

Слайд 33Tax declaration is mandatory for everybody in Germany. Once you have

What is ELSTER?

ELSTER – the electronic tax return – is an online program with which your tax return can be transmitted electronically via internet to your tax office. In addition, you can use ElsterFormular. The tax office provides you free of charge with this software. The current version is available on www.elsterformular.de.

Which tax returns can I use ELSTER for? Income tax return, Corporate income tax return, Assessment declaration, Trade tax return, Breakdown of the trade tax base amount, VAT return, VAT advance return, Permanent extension of the filing deadline, Wage tax return (PAYE in UK), Wage tax statement, Capital gains tax return.

Certain declarations such as tax returns can be submitted easily online via the ElsterOnline portal on www.elsteronline.de. To do this you do not have to install any programs, you just have to register.

Taxes and tax declaration / ELSTER – sending taxes by mouse and change tax class

WORKING IN GERMANY

Слайд 34What benefits will I get from ELSTER? Submitting your tax return electronically

To change your wage tax classes please fill following document: If married people register in Germany, they are automatically assigned Tax class 4 – provided both of them work. If you want to change tax class from 4/4 to 3/5 you have to request with enclosed form at Finanzamt. Links to Finanzamt: http://www.finanzamt-frankfurt-am-main.de/irj/FA_Frankfurt_Internet?cid=2d1f4abc6d6b296d78776954d06b9381 http://www.fa-stuttgart.de/pb/,Lde/Startseite

Taxes and tax declaration / ELSTER – sending taxes by mouse and change tax class

WORKING IN GERMANY

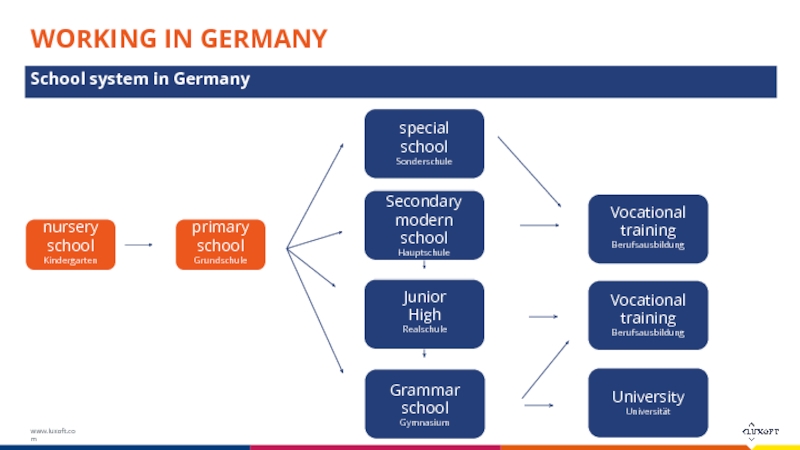

Слайд 35School system in Germany

special school

Sonderschule

Secondary modern

school

Hauptschule

Junior

High

Realschule

Grammar

school

Gymnasium

nursery school

Kindergarten

primary school

Grundschule

Vocational training

Berufsausbildung

University

Universität

Vocational training

Berufsausbildung

WORKING

Слайд 36Primary Level (Primary school – Grundschule) Compulsory education in Germany begins for

The appropriate primary school can be found in every neighborhood in Germany.

Secondary Level 1 (secondary school and junior high) Secondary Step 1 covers all classical school types from class level 6 to 10 such for the secondary school and junior high. The secondary school can be completed at the end of class level 9 with a Certificate of Secondary Education (Hauptschulabschluss – excludes from attending university). The junior high can be completed at the end of class level 10 with a Certificate of Secondary Education (Realschulabschluss – transition to high school is possible)

School system in Germany

WORKING IN GERMANY

Слайд 37Secundary Level 2 (Gymnasium) Secondary Level 2 covers all classical school forms

The aims of this training are

University (Universität) In Germany we have different universities and colleges all with special focus on several different areas. This webpage will helps you to find the right University.

http://www.hochschulkompass.de

School system in Germany

WORKING IN GERMANY

Слайд 38You have to apply for Bluecard till the expiration date of

These documents are required for application:

Valid passport

One new biometric photo: it needs to be 35mm x 45mm and shows the person facing forwards, looking directly into the camera. The applicant needs to have a neutral facial expression and a closed mouth. The background must be bright.

University report: If necessary the valuation of the ZAB “Zentralstelle für ausländisches Bildungswesen”.

Job contract or a concrete job offer.

Form: Application for a (temporary) residence permit (Antrag auf Erteilung eines Aufenthaltstitels). A residence permit may be given only on explicit application.

Form: Application for work permission (Antrag auf Erlaubnis einer Beschäftigung). This is only necessary if the approval of the federal agency for labor is needed.

Form: Job specification (Stellenbeschreibung). This is only necessary if the approval of the federal agency for labor is needed.

More information about blue card: http://www.bluecard-eu.de/eu-blue-card-germany/application.html

Bluecard

WORKING IN GERMANY

Слайд 39YOUR FIRST STEPS AT LUXOFT GERMANY

Registration at resident’s registration office “Einwohnermeldeamt”

Frankfurt: http://www.frankfurt.de/sixcms/detail.php?id=2915

Stuttgart: http://www.stuttgart.de/en/

Leinfelden-Echterdingen: http://www.leinfelden-echterdingen.de/servlet/PB/menu/1209060/index.html?modul=bw

Registration Forms:

Frankfurt: http://www.frankfurt.de/sixcms/media.php/1335/Anmelde-Formular_2012-05-29.pdf

Stuttgart: http://www.stuttgart.de/img/mdb/form/912/7784.pdf

fill-in-help: http://www.stuttgart.de/img/mdb/form/912/32213.pdf

You’ve to register in any case even if you only stay for a couple of weeks in an intermediary apartment or hotel, etc. As soon as you have found an apartment for permanent residence, you have to go the “Einwohnermeldeamt” again and change registration of address again.

After your arrival – First steps – Registration at Residents’ registration office

Слайд 40Your registration at “Einwohnermeldeamt” is forwarded to “Finanzamt”, the financial authority

Finanzamt provides the TID which is individually assigned. Every German resident has a TID in order to pay taxes and make the declaration of income tax at the end of the calendar year, latest on 31st May of the coming year.

You will receive a letter with the TID in approximately 2-6 weeks from registration at “Einwohnermeldeamt”. This letter will be sent to the address you mentioned at “Einwohnermeldeamt”. Once you received the letter, the TID has to be forwarded to HR office latest 13th working day of the current month.

Note: If you do not register, you will not receive a TID and have to be taxed with tax class VI (approx. 50%).

Copy has to be forwarded to HR in Luxoft GmbH, mail: lkollek@luxoft.com

After your arrival – First steps – Getting Tax Identification Number

YOUR FIRST STEPS AT LUXOFT GERMANY

Слайд 41As soon as you have registered at “Einwohnermeldeamt” you have to

Passport + Visum + Residence permit + Employment contract + Rental agreement + Biometric photograph + 100 Euro cash

Authorities:

Frankfurt: http://www.frankfurt.de/sixcms/detail.php?id=2943&_ffmpar%5B_id_inhalt%5D=102250

Stuttgart: http://www.stuttgart.de/item/show/318412

Leinfelden-Echterdingen: http://www.leinfelden-echterdingen.de/servlet/PB/menu/1209060/index.html?modul=bw

Registration Forms:

Frankfurt: http://www.frankfurt.de/sixcms/media.php/1335/Online-AE-Vordruck11-2010.pdf

Stuttgart: http://www.stuttgart.de/img/mdb/form/912/7784.pdf

Copy has to be forwarded to HR in Luxoft GmbH, mail: lkollek@luxoft.com

After your arrival – First steps – Application for Blue Card

YOUR FIRST STEPS AT LUXOFT GERMANY

Слайд 42You need to open a GERMAN banc account and submit “IBAN”

We cannot make transfer of salary to banc accounts in Russia or Ukraine or anywhere else abroad.

Following documents are generally required:

Passport

Residence permit

Employment contract

In order to transfer monthly salary at the end of the month to you, we need you banc data latest by 13th working day of current month.

Copy has to be forwarded to HR in Luxoft GmbH, mail: lkollek@luxoft.com

After your arrival – First steps – German banc account

YOUR FIRST STEPS AT LUXOFT GERMANY

Слайд 43Health insurance: When you work and live in Germany, you have

They also provide their services in English language – so you can inform yourself upfront. The registration will be made with the help of local HR manager

After registration at health insurance you’ll get the so-called “social security number” (= Sozialversicherungsnummer) that remains with you for a lifetime and never changes. This number is forwarded either to you and to us through the health insurance company.

You will also receive a “Gesundheitskarte” which confirms

your registration with health insurance.

Copy has to be forwarded to HR in Luxoft GmbH, mail: lkollek@luxoft.com

After your arrival – First steps – Registration with health insurance

YOUR FIRST STEPS AT LUXOFT GERMANY

Слайд 44The following documents have to compulsory be filled, signed and handed

Luxoft Personnel Questionnaire

Luxoft Tax Laws Germany Information

Luxoft Data Privacy Agreement I

Luxoft Data Privacy Statement II

List of required documents

Luxoft Code of Conduct - last page with signature

Gifts and Anti-Bribery General Policy

Insider Trading Policy

Whistle Blowing Policy

YOUR FIRST STEPS AT LUXOFT GERMANY

Слайд 45…which you can submit either as hard or soft copy by

Statement of Registration of Address - you’ll get from the “Einwohnermeldeamt”

Birth Certificate of Children - if your children relocate with you

Work Permission /Residence Permit - NON EU countries

Visum or Blue Card – if you come from Russia or Ukraine

Copy of Certificate of Health Insurance, e.g. AOK www.aok.de or other

Copy of Social Security Statement or Social Security number (will be provided by health insurance)

German bank account: SWIFT (BIC) code and IBAN number

Tax Identification Number and Tax class

Copy of identity card or passport

Additional information required for onboarding

YOUR FIRST STEPS AT LUXOFT GERMANY

Слайд 46YOU NEED TO KNOW

Below you find the most popular webpages with

Immobilienscout 24 http://www.immobilienscout24.de

Immowelt http://www.immowelt.de

Immonet http://www.immonet.de

Ebay-Kleinanzeigen http://kleinanzeigen.ebay.de

Meinestadt.de http://www.meinestadt.de

Wohnungsbörse http://www.wohnungsboerse.net

Wohnungsmarkt 24 http://www.wohnungsmarkt24.de

You can search on your own or use service of a broker. Please take into consideration that

brokers charge a fee in the amount of up to 3 months’ rent

you may have to make deposits of up to 3 months’ rent to the landlord; these will be returned to you after you have left the apartment

How to find an apartment

Слайд 47Germany has twenty-six regional airports and fourteen

international airports.

International

Hamburg, Bremen, Hanover, Berlin-Tegel, Schönfeld, Münster/Osnabrück, Düsseldorf, Köln/Bonn, Frankfurt am Main, Erfurt, Leipzig, Dresden, Saarbrücken, Nürnberg, Stuttgart, Munich

International Airports

YOU NEED TO KNOW