- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Brand B 360 Analysis. Tea market презентация

Содержание

- 1. Brand B 360 Analysis. Tea market

- 2. Сокращения, используемые в презентации в рамках обзора

- 3. “B” brand: Value for money tea brand

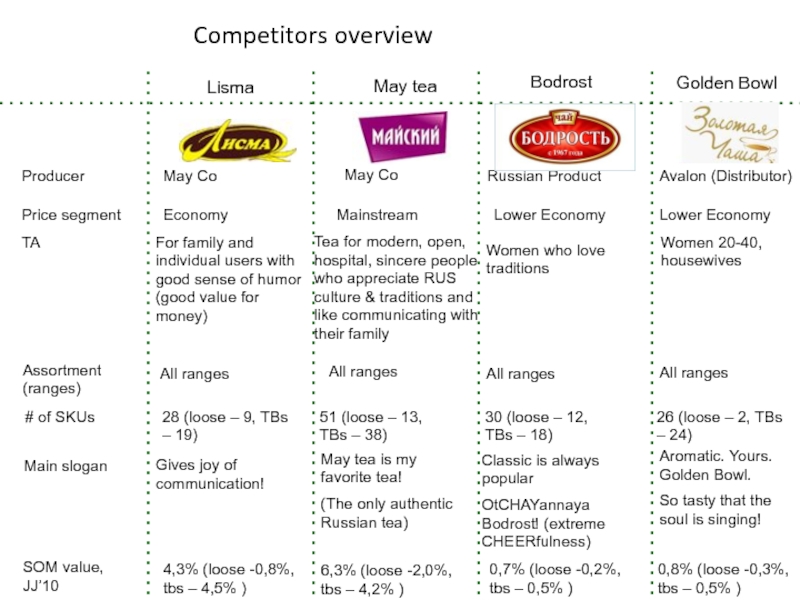

- 4. Competitors overview Princess Noory Princess Java Princess

- 5. Competitors overview May tea Bodrost Golden Bowl

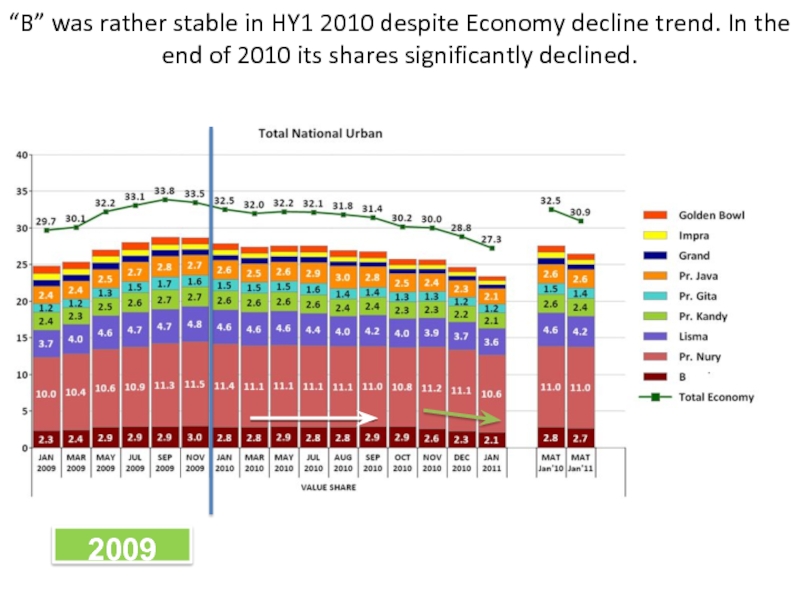

- 6. “B” was rather stable in HY1 2010

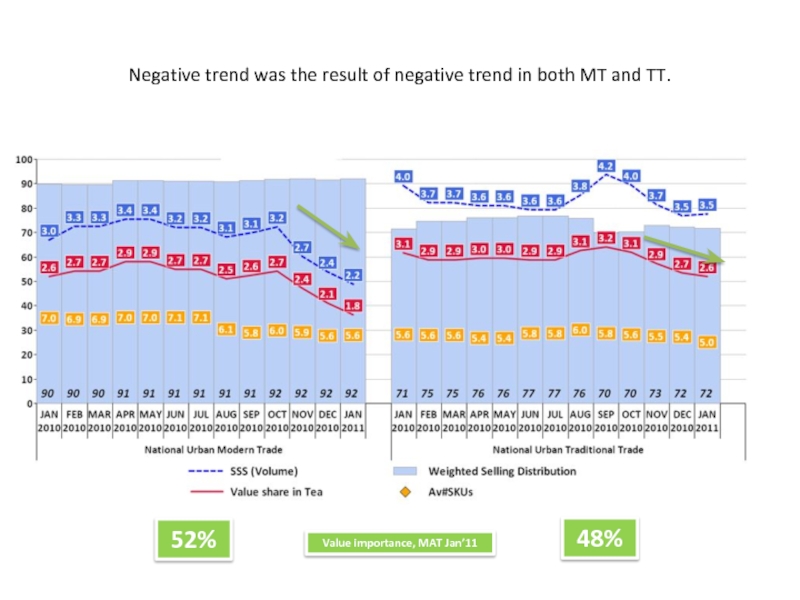

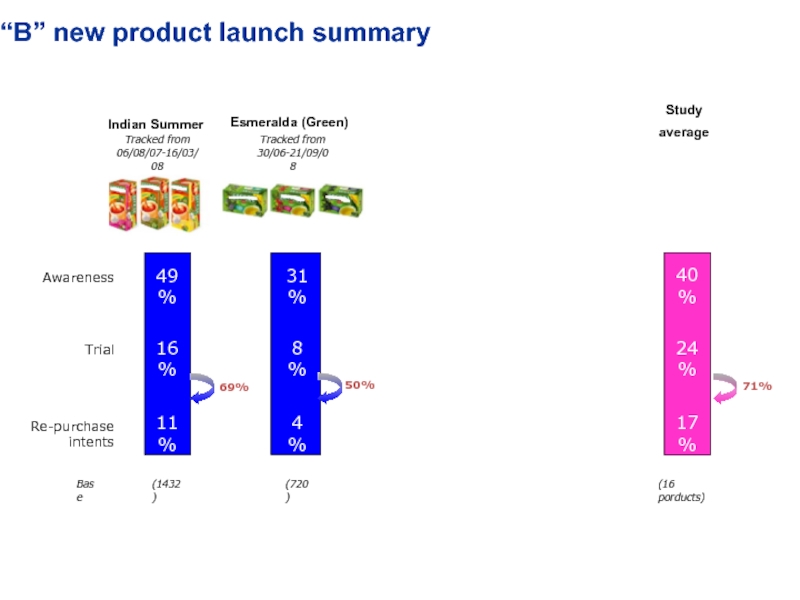

- 7. Negative trend was the result of negative

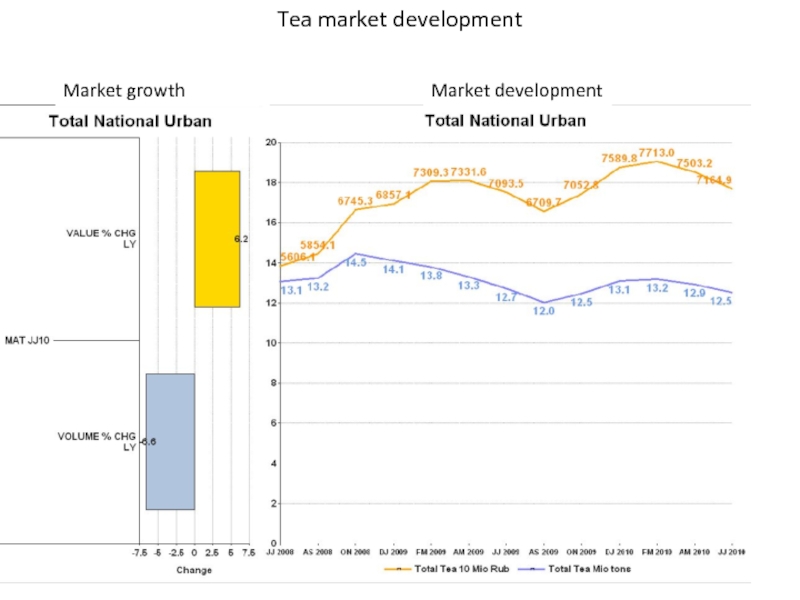

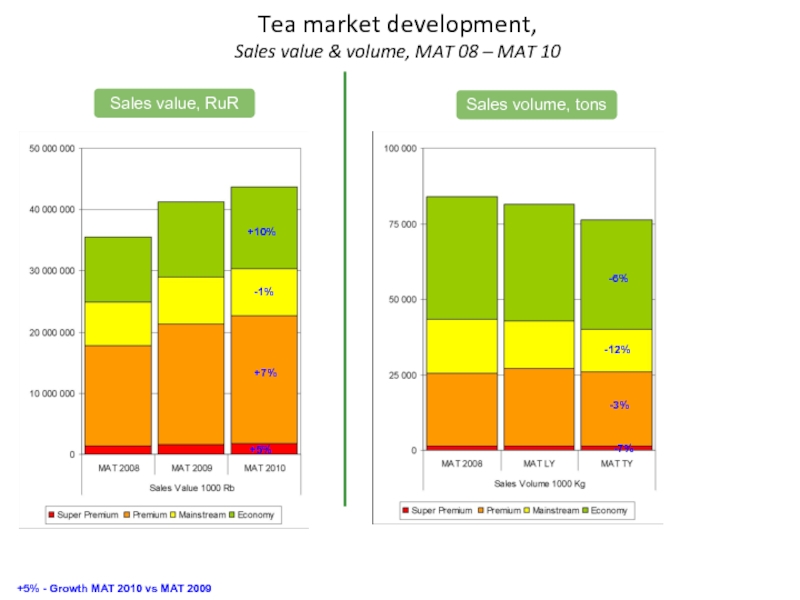

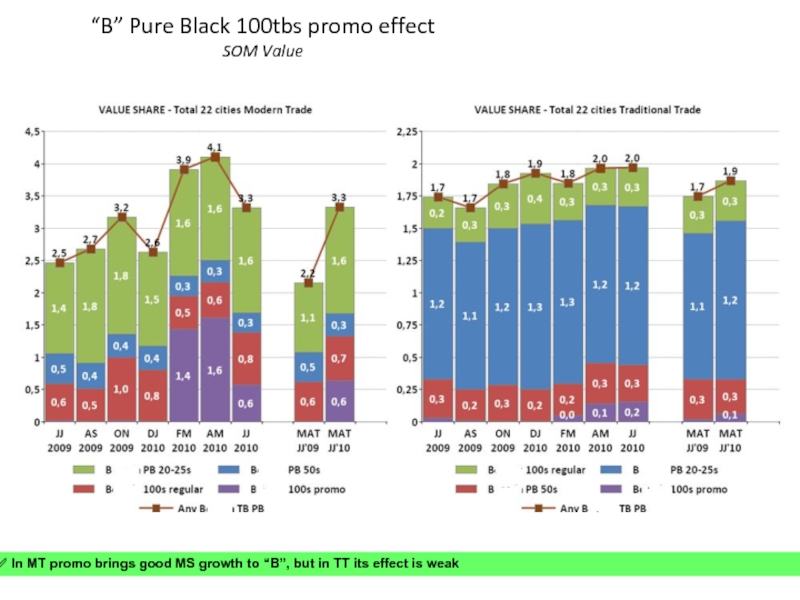

- 8. Tea market development Market growth Market development

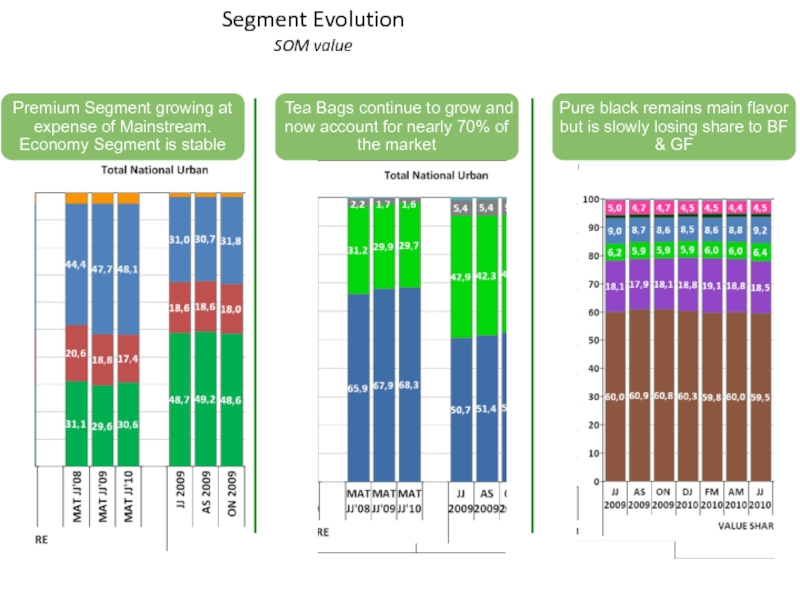

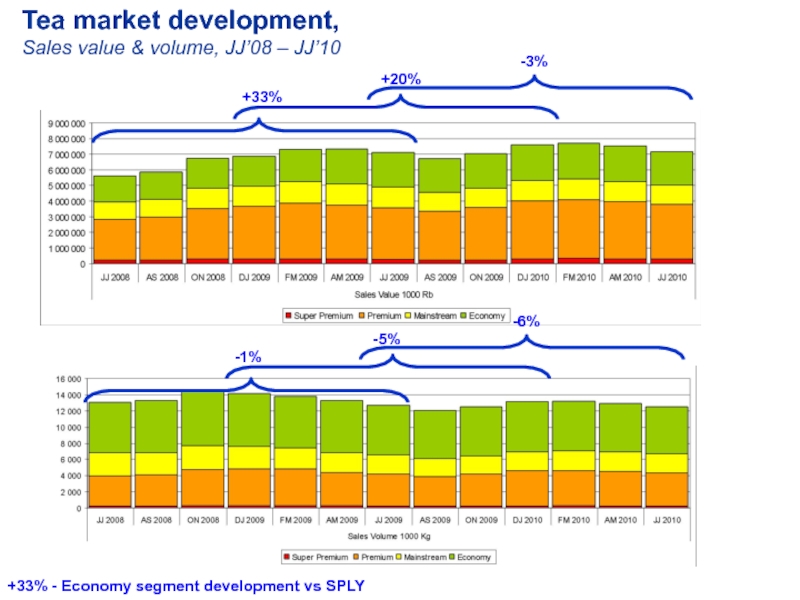

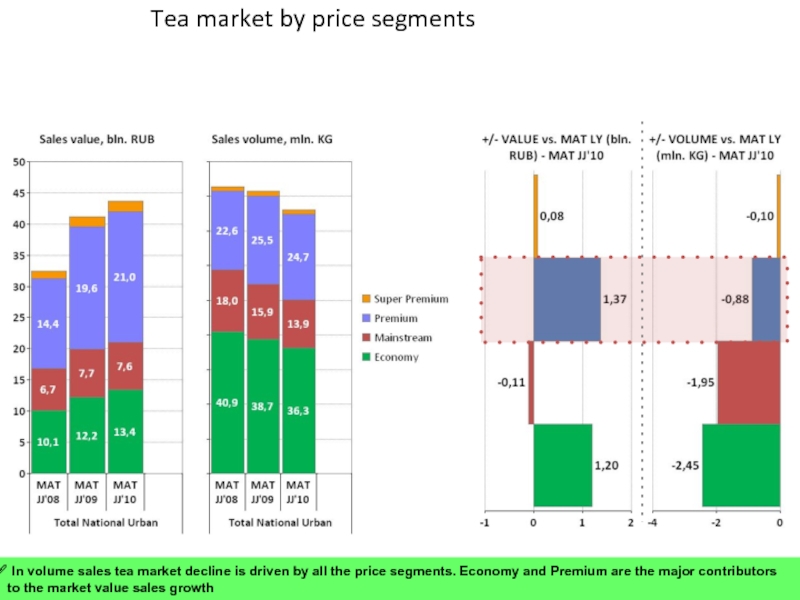

- 9. Segment Evolution SOM value

- 10. Tea market development, Sales value & volume,

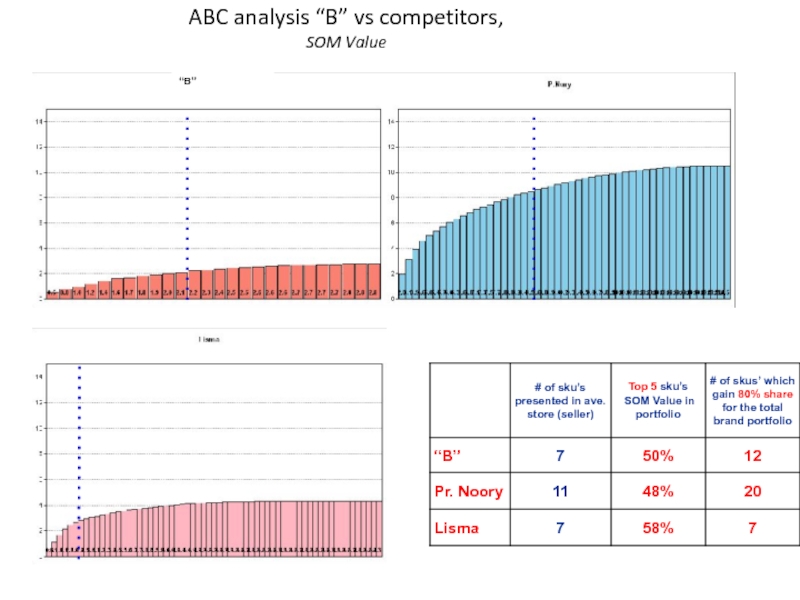

- 11. Tea market development, Sales value & volume,

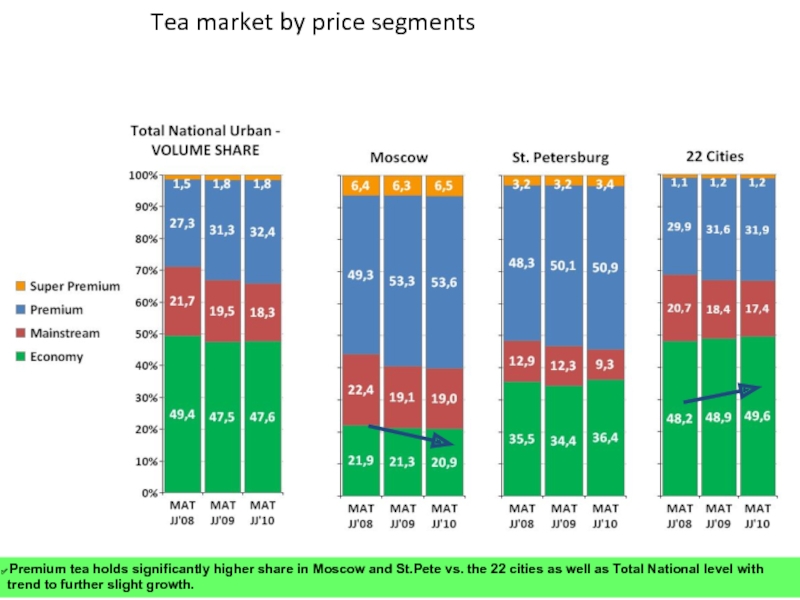

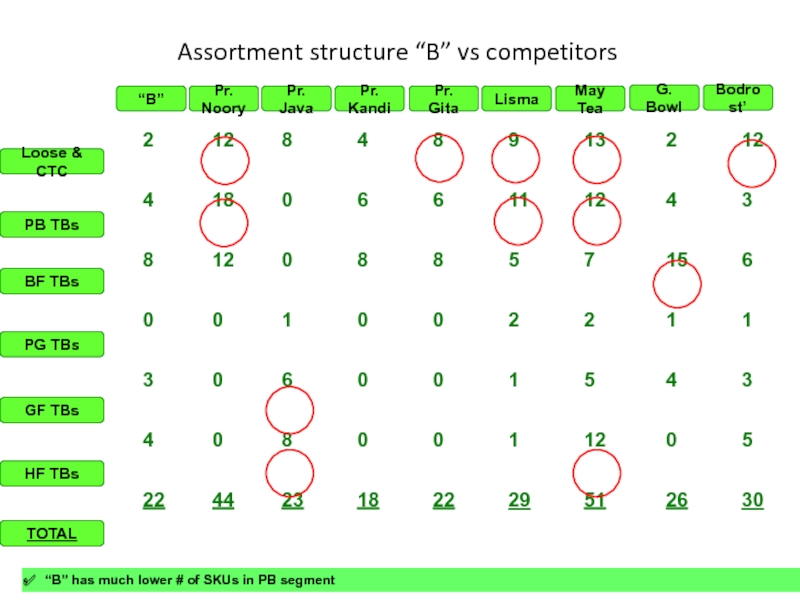

- 12. Tea market by price segments

- 13. Page Tea market by price segments

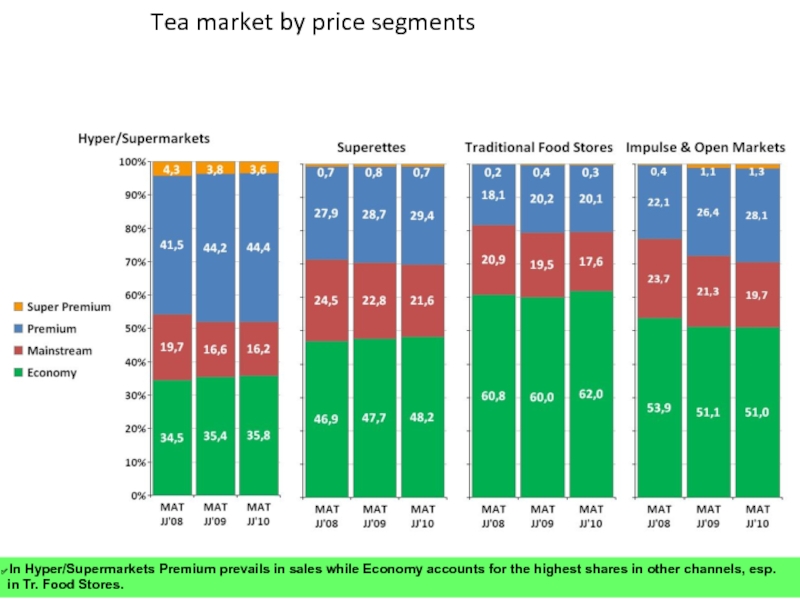

- 14. Page Tea market by price segments

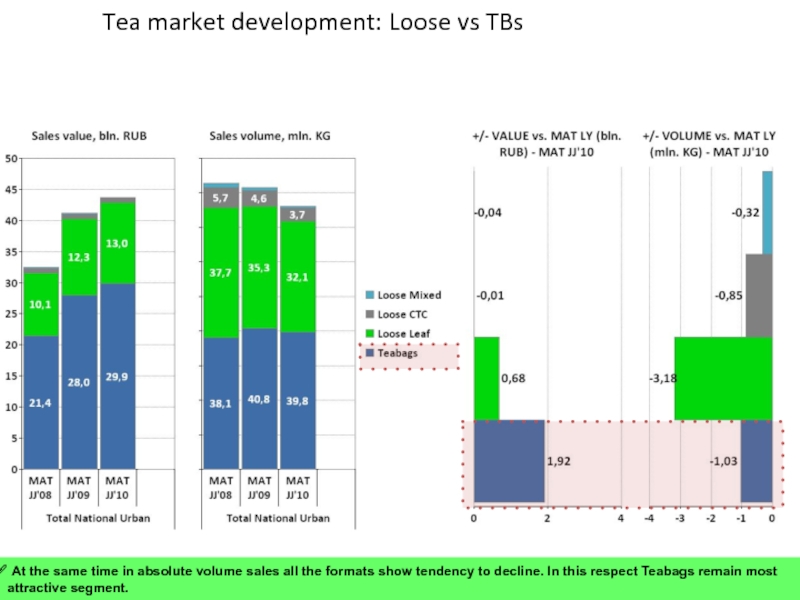

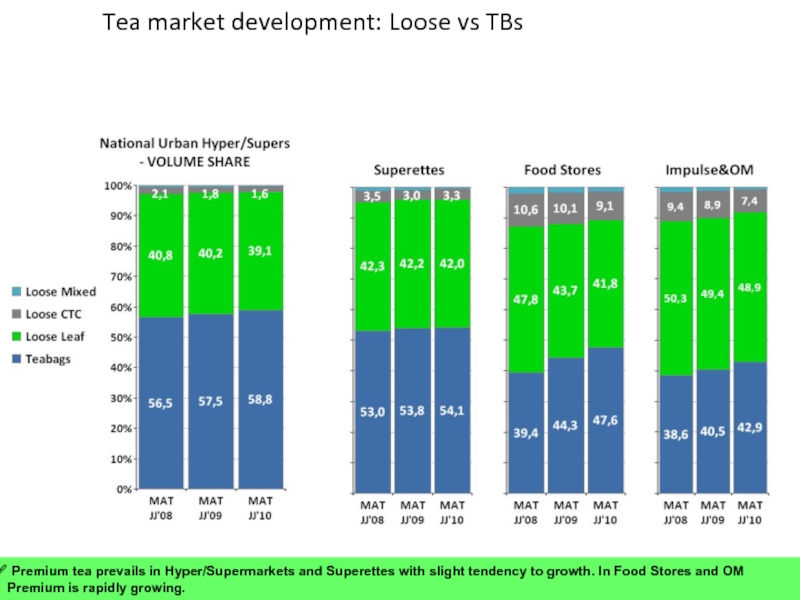

- 15. Page Tea market development: Loose vs

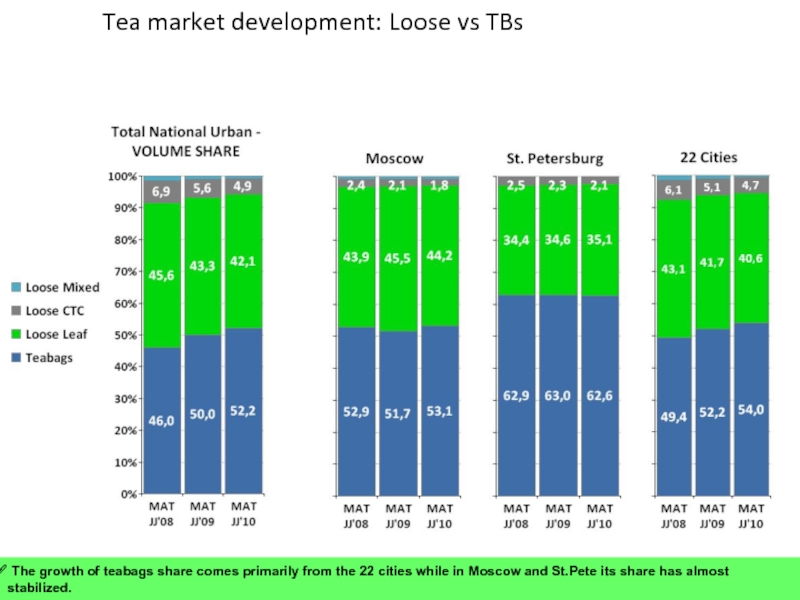

- 16. Page Tea market development: Loose vs

- 17. Page Tea market development: Loose vs

- 18. PLACE

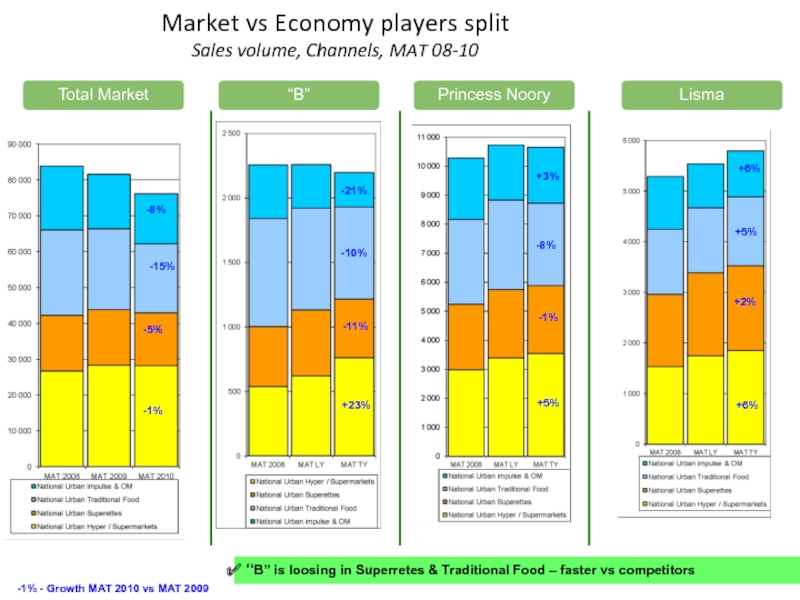

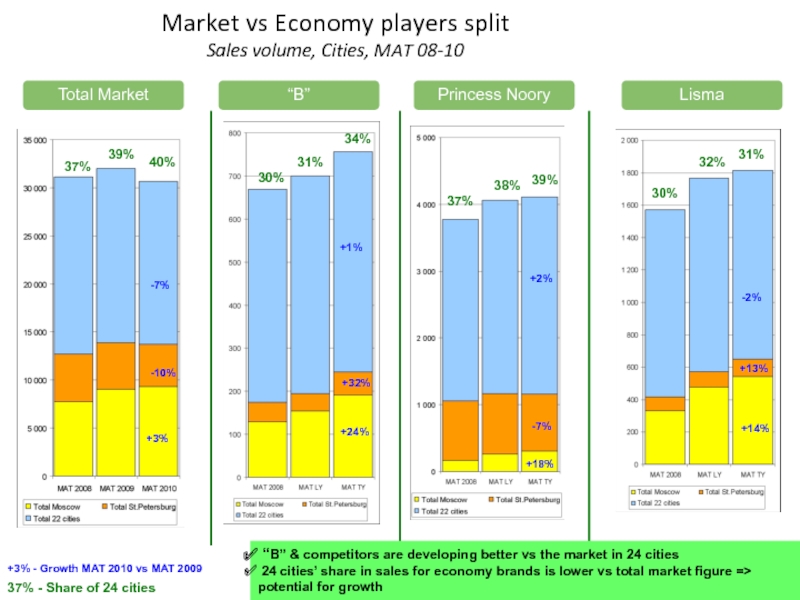

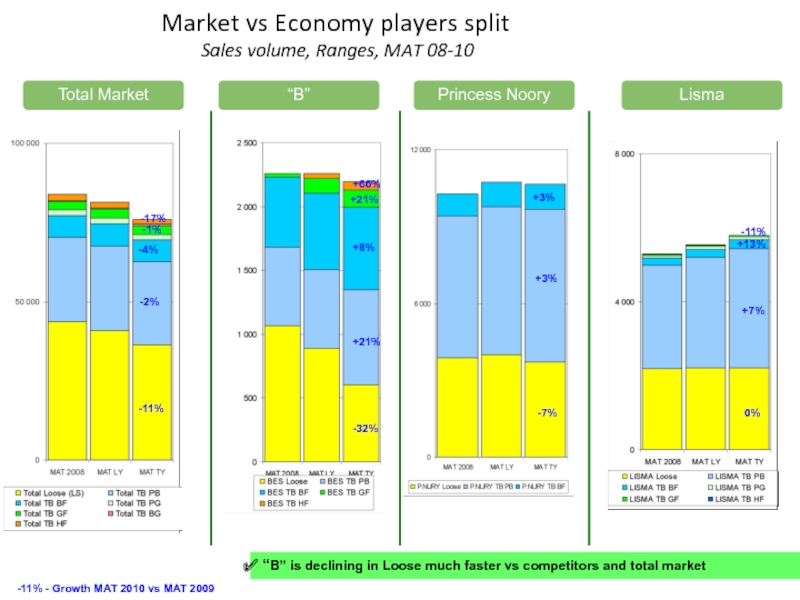

- 19. Market vs Economy players split Sales volume,

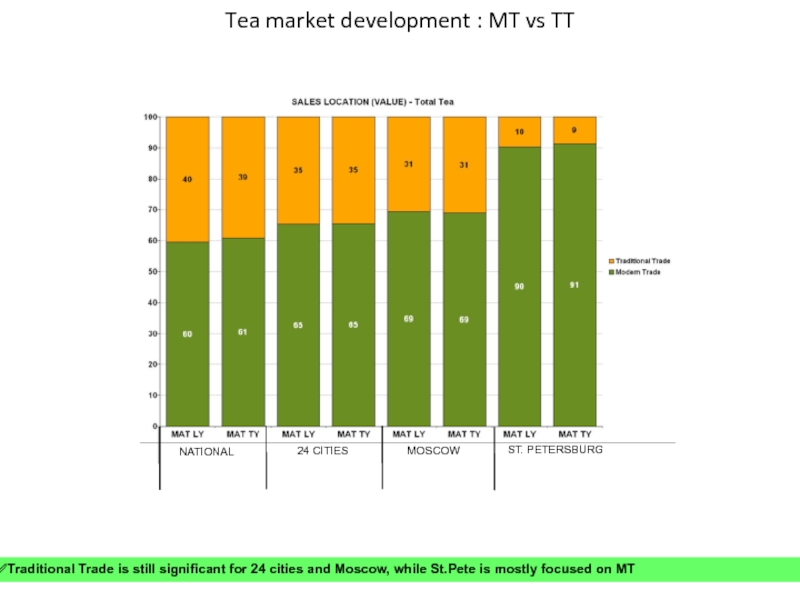

- 20. Tea market development : MT vs TT

- 21. Tea market development : MT vs TT

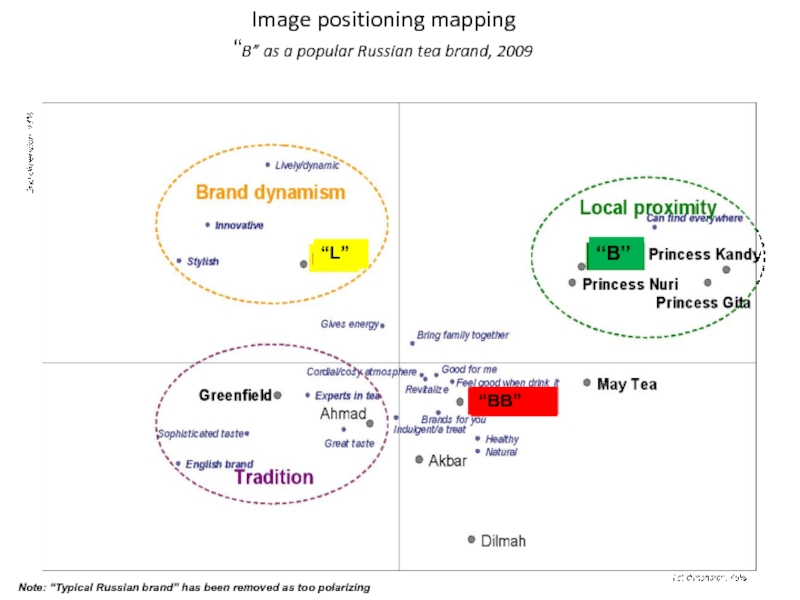

- 22. Market vs Economy players split Sales volume,

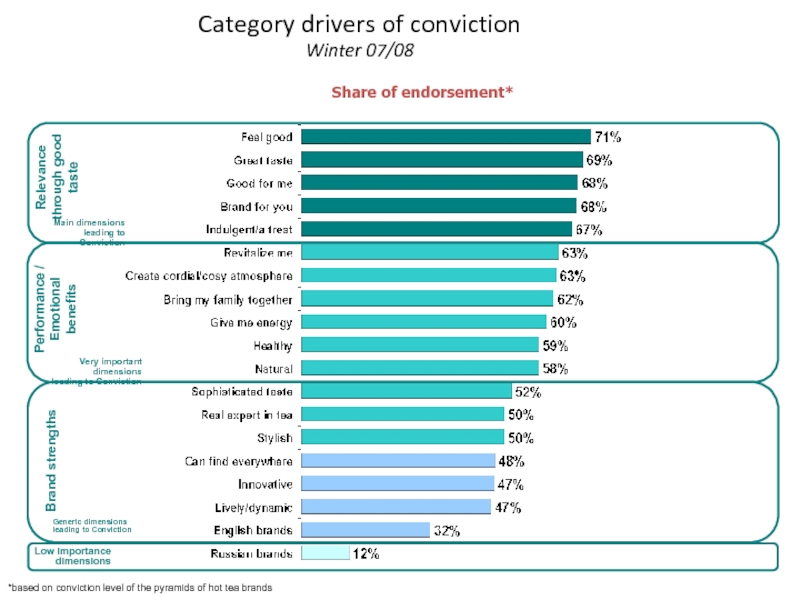

- 23. Market vs Economy players split Sales volume,

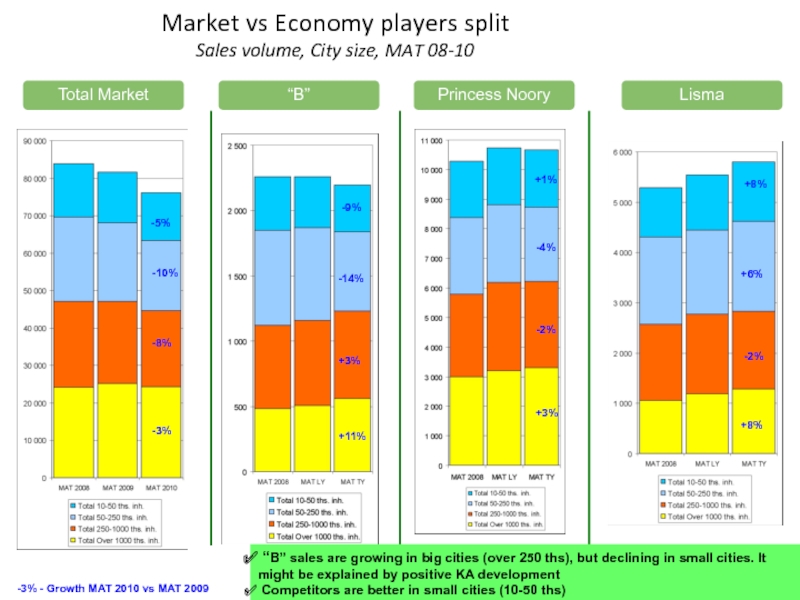

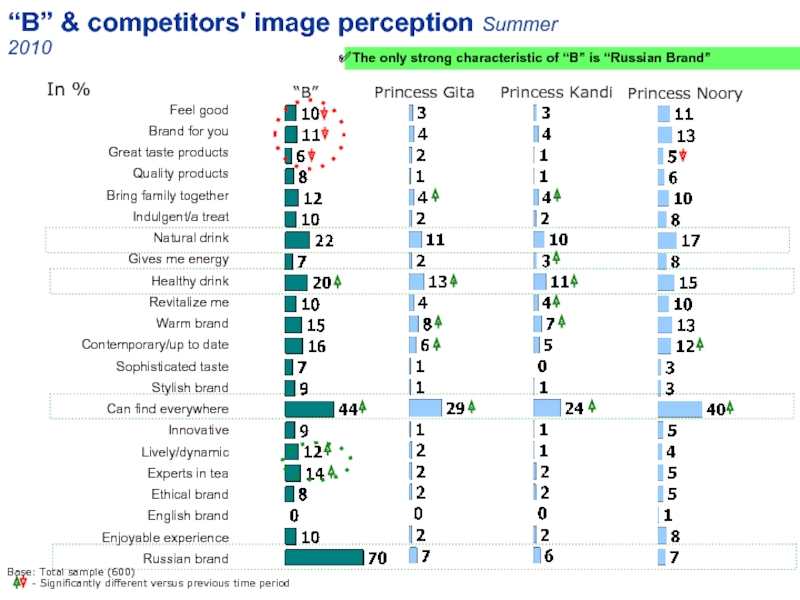

- 24. Market vs Economy players split Volume share,

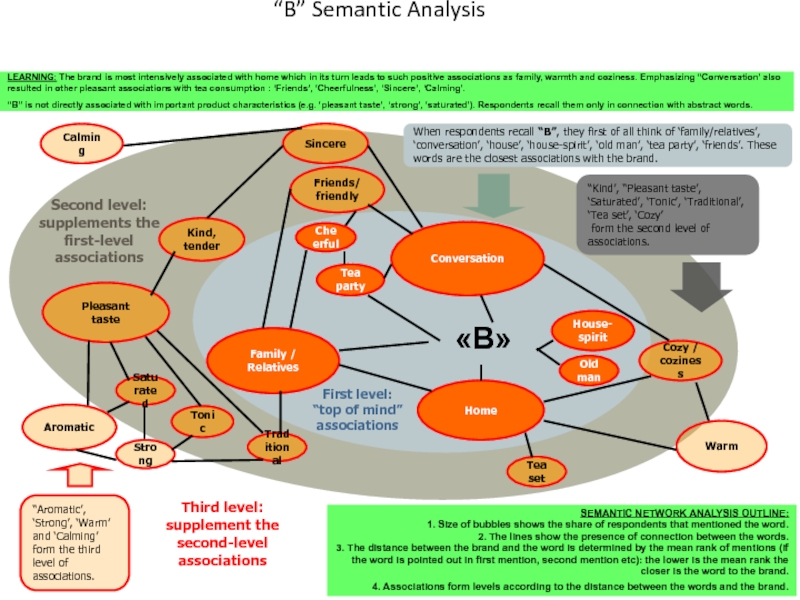

- 25. Market vs Economy players split Sales

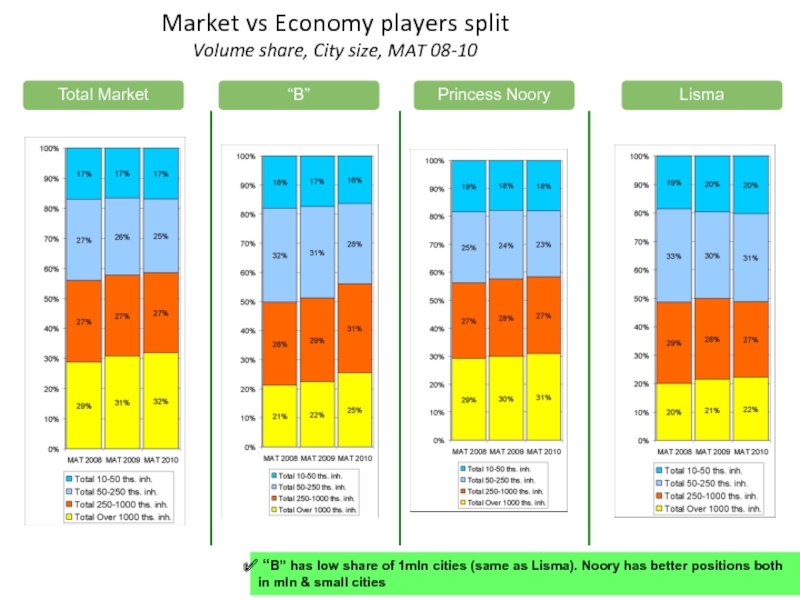

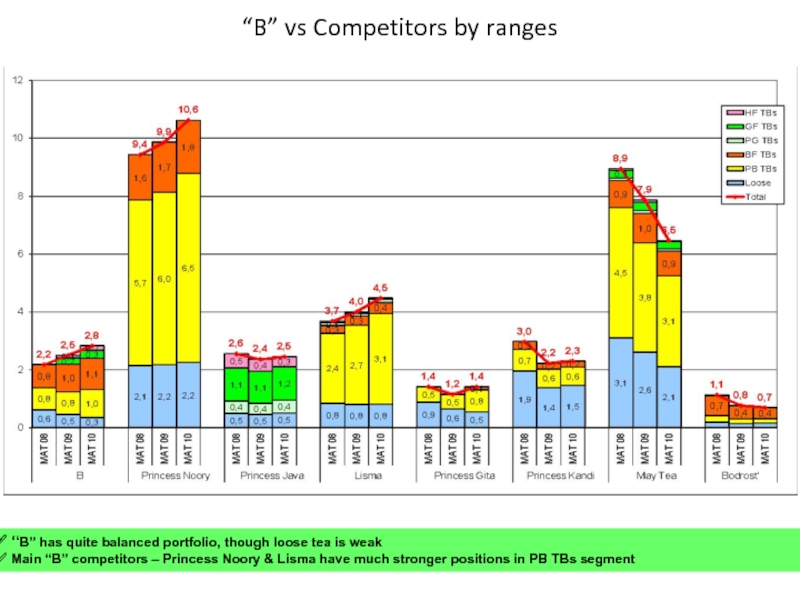

- 26. “B” vs Competitors by ranges

- 27. PRICE

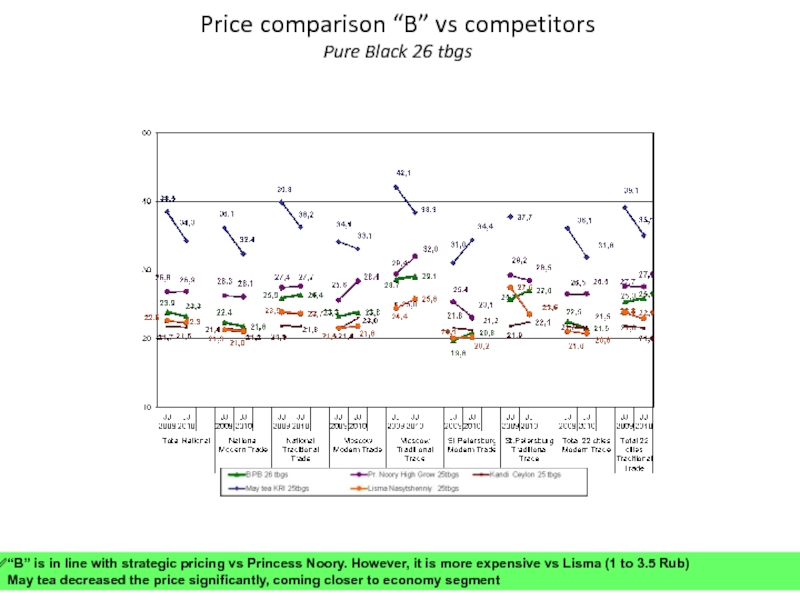

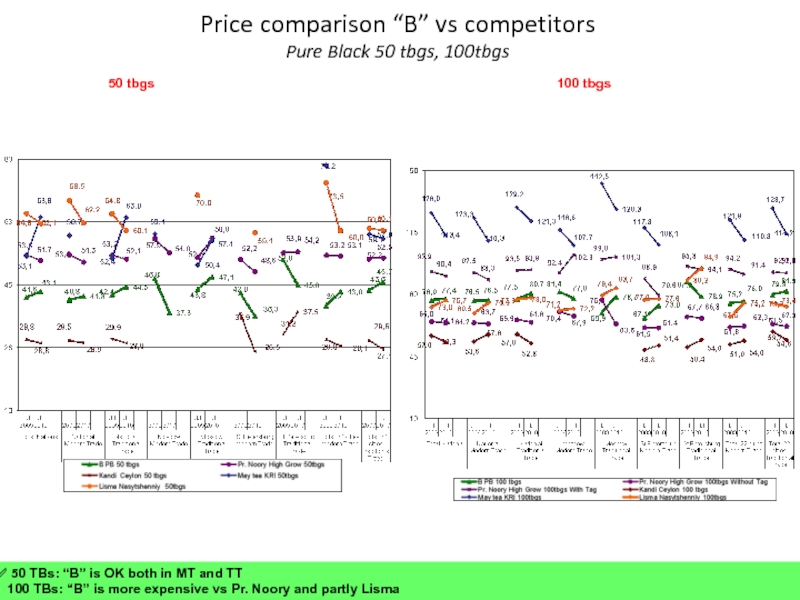

- 28. Price comparison “B” vs competitors Pure Black

- 29. Price comparison “B” vs competitors Pure Black

- 30. 100 tbgs development, SOM Value

- 31. Price comparison “B” vs competitors Loose Pure

- 32. Price comparison “B” vs competitors BF, best

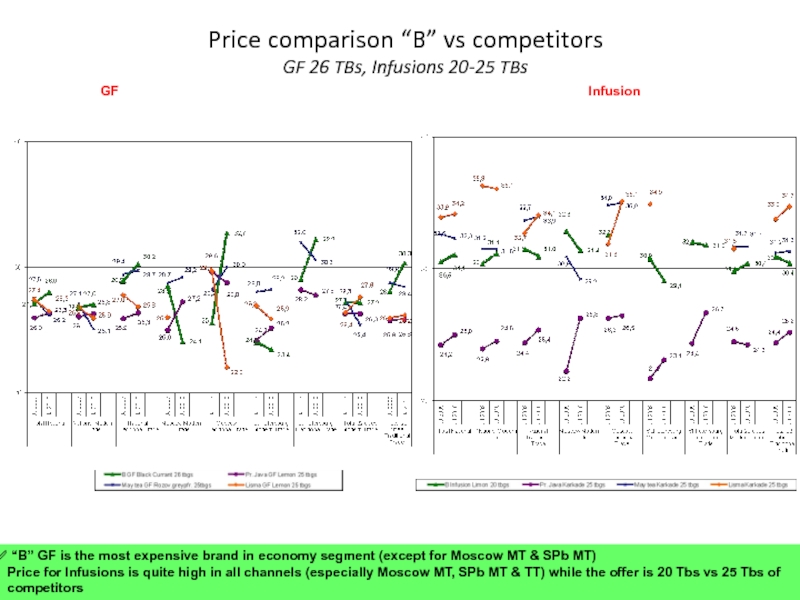

- 33. Price comparison “B” vs competitors GF 26

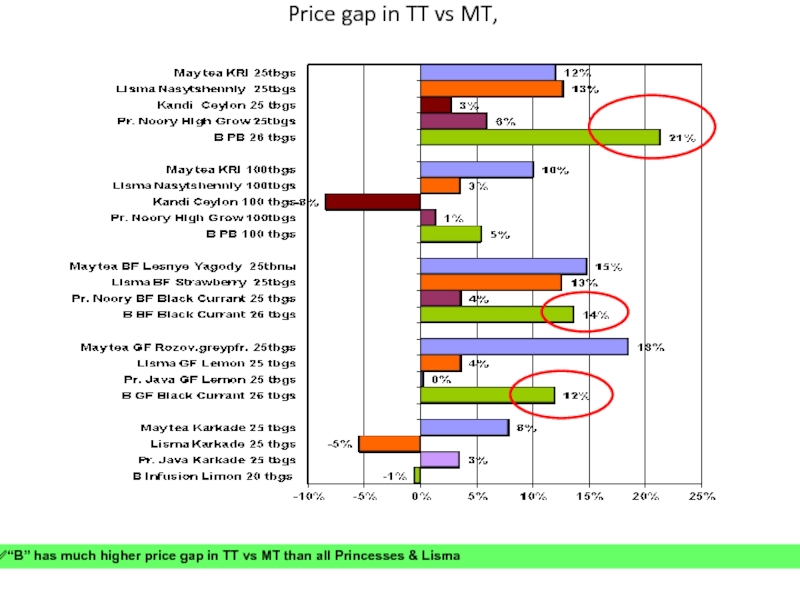

- 34. Price gap in TT vs MT,

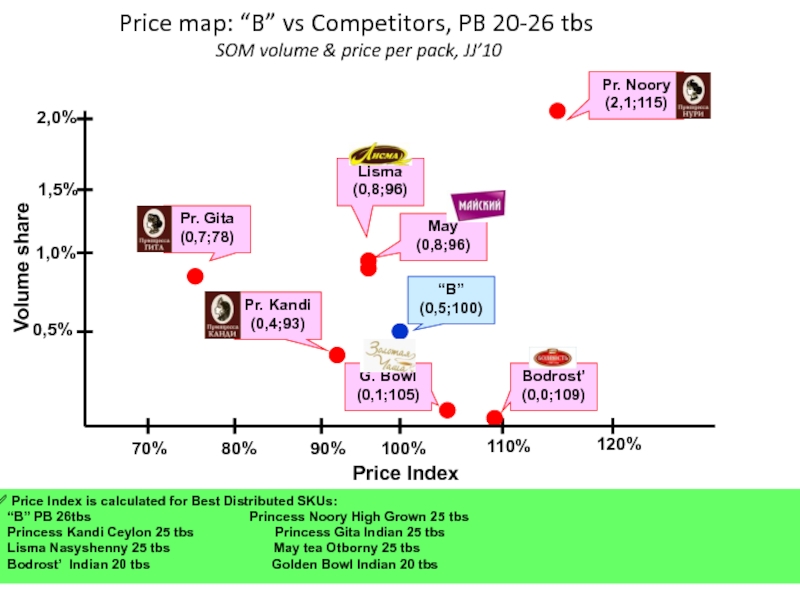

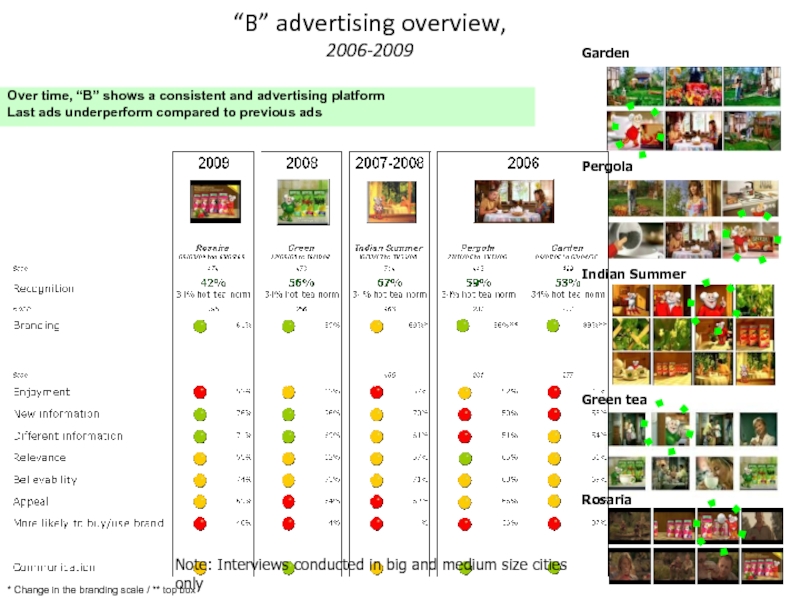

- 35. Price map: “B” vs Competitors, PB 20-26

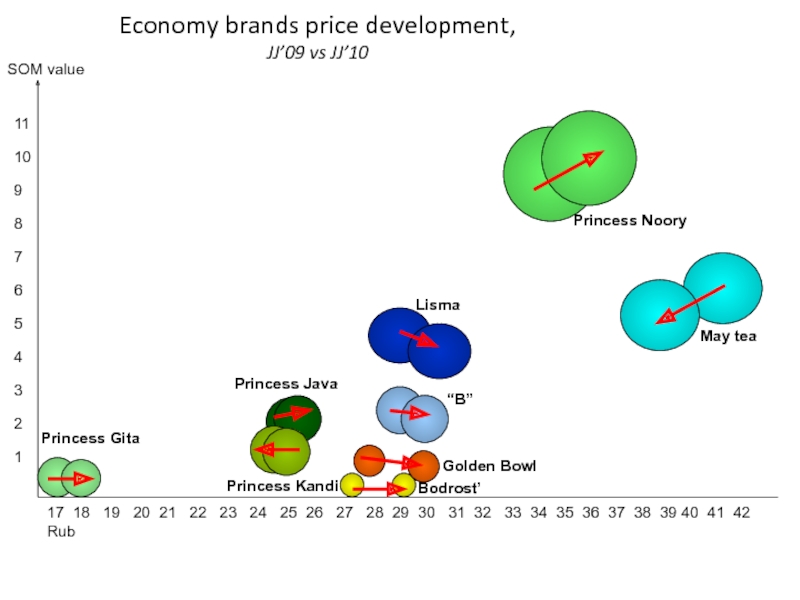

- 36. Economy brands price development, JJ’09 vs JJ’10

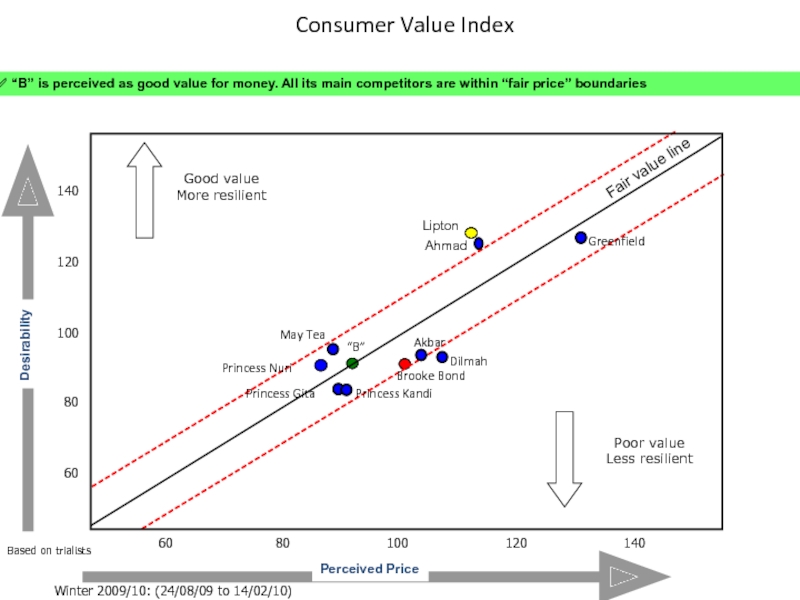

- 37. Consumer Value Index Winter 2009/10:

- 38. PROMOTION

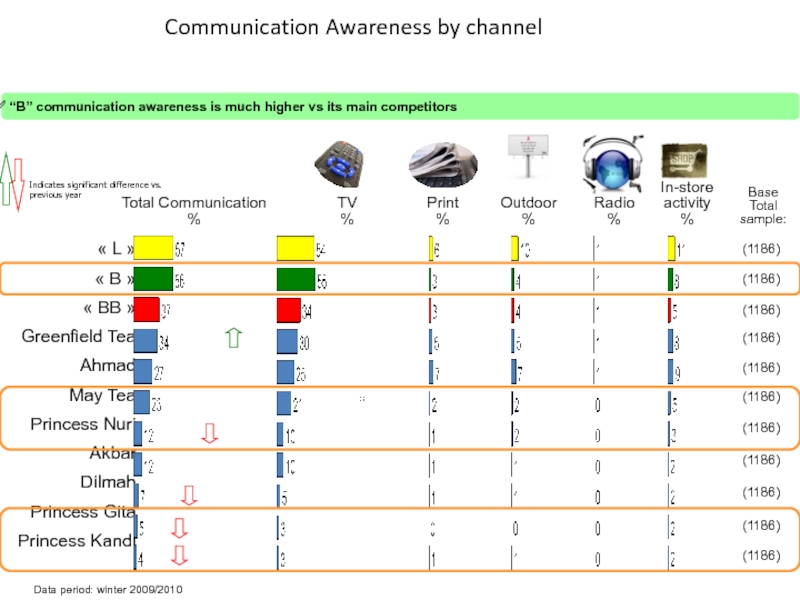

- 39. « L » « B » « BB » Greenfield Tea Ahmad May

- 40. “B” activities, 2008-2010 TV Launches Promo

- 41. “B” advertising overview, 2006-2009 Over time, “B”

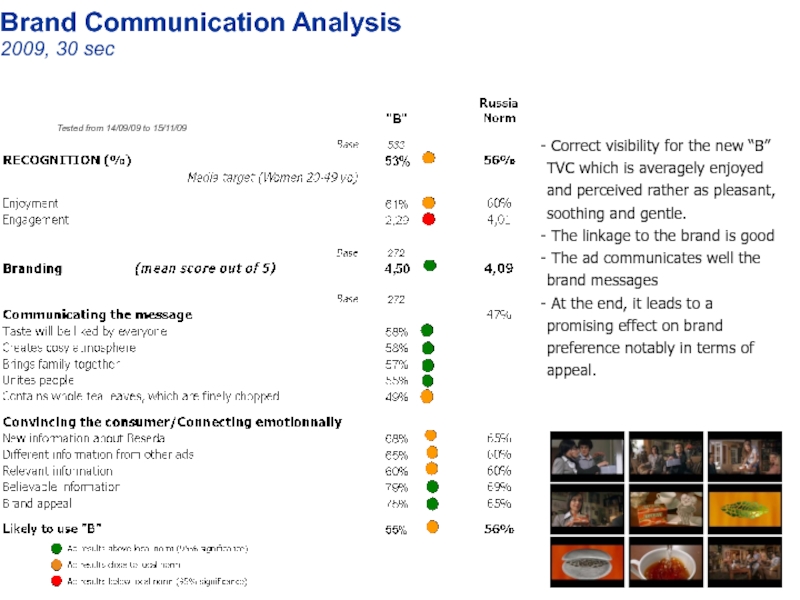

- 42. Brand Communication Analysis 2009, 30 sec

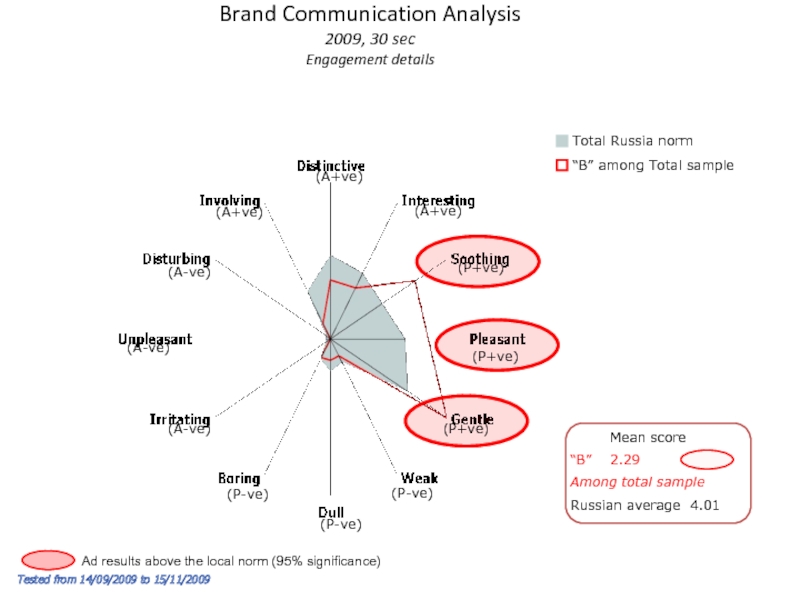

- 43. Mean score “B” 2.29 Among total sample Russian

- 44. PostView TV – “B” ‘Teddy Bears’

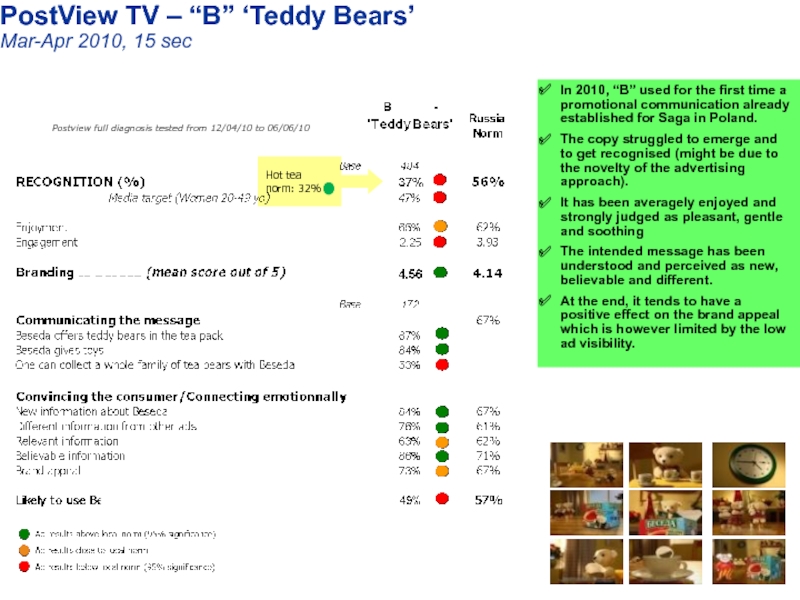

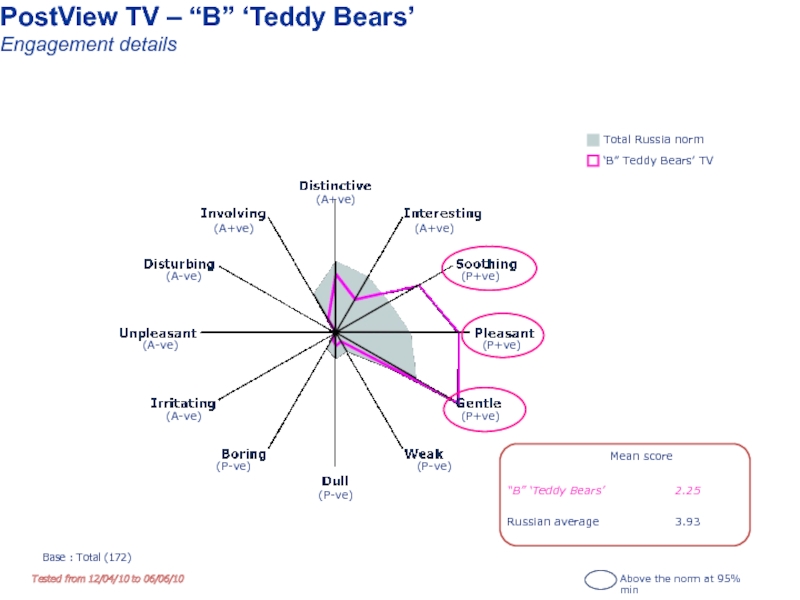

- 45. (P-ve) (A+ve) (A+ve) (P+ve) (P+ve) (P+ve) (P-ve)

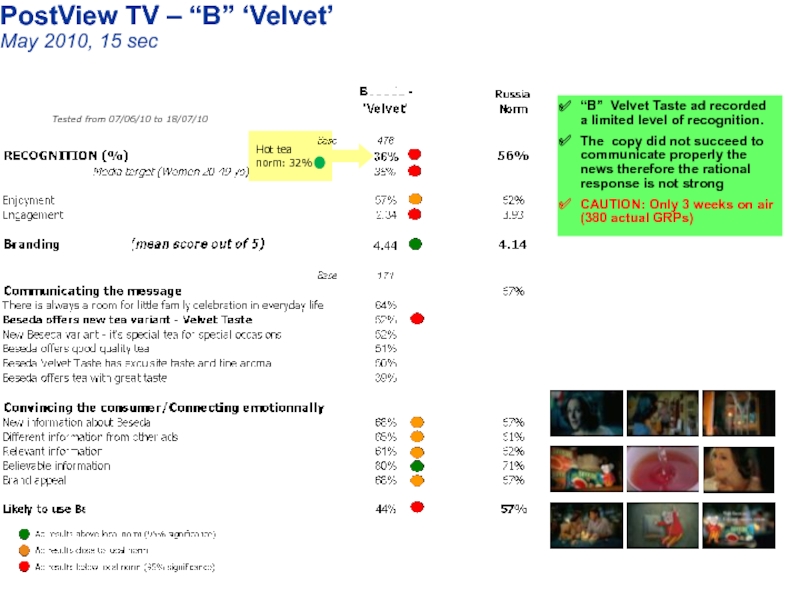

- 46. PostView TV – “B” ‘Velvet’ May

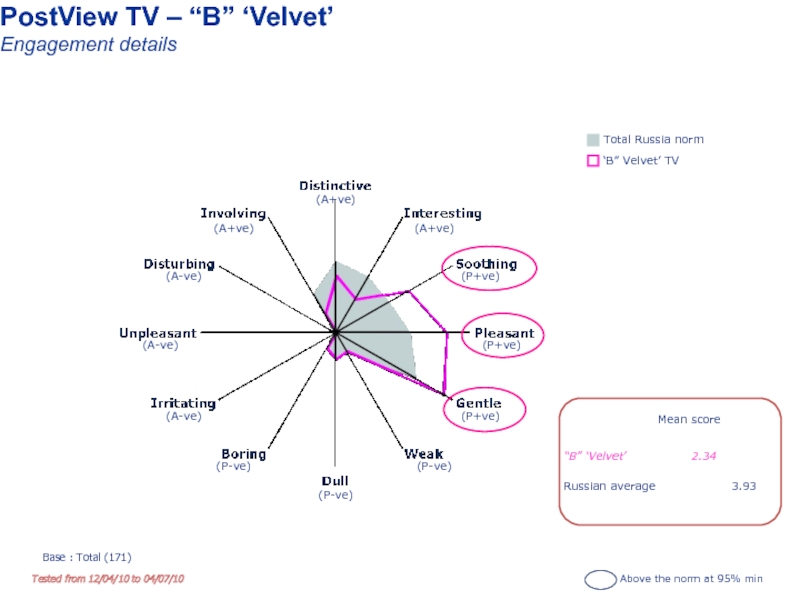

- 47. (P-ve) (A+ve) (A+ve) (P+ve) (P+ve) (P+ve) (P-ve)

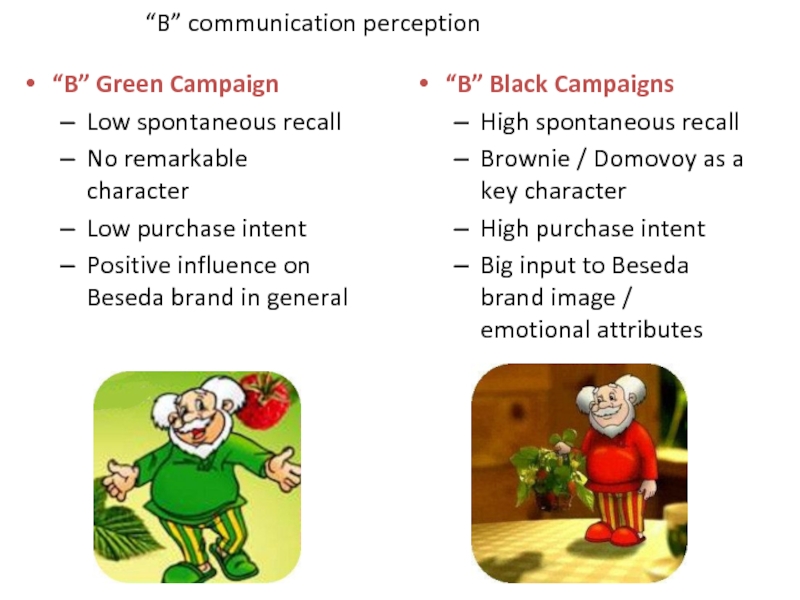

- 48. “B” communication perception “B” Green Campaign

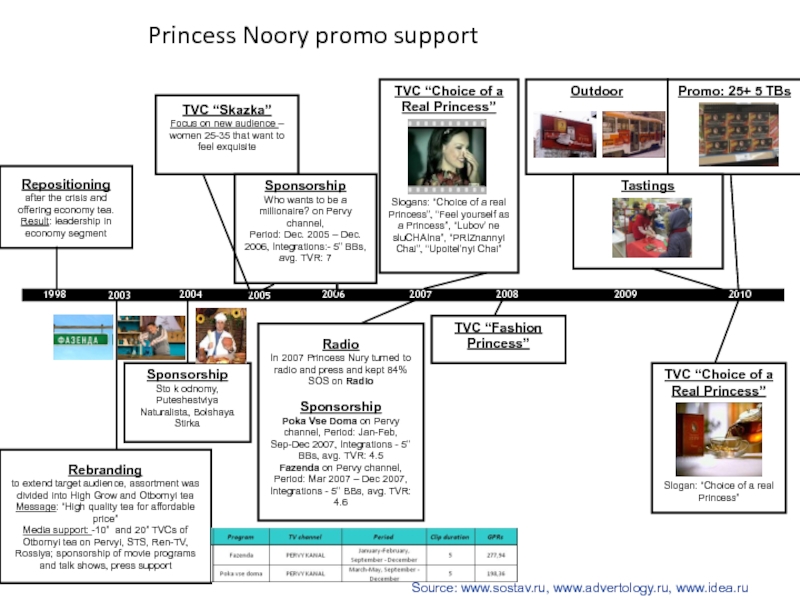

- 49. Princess Noory promo support 1998 2007

- 50. “B” sponsorship (Social Mission) Sponsor jingle 10

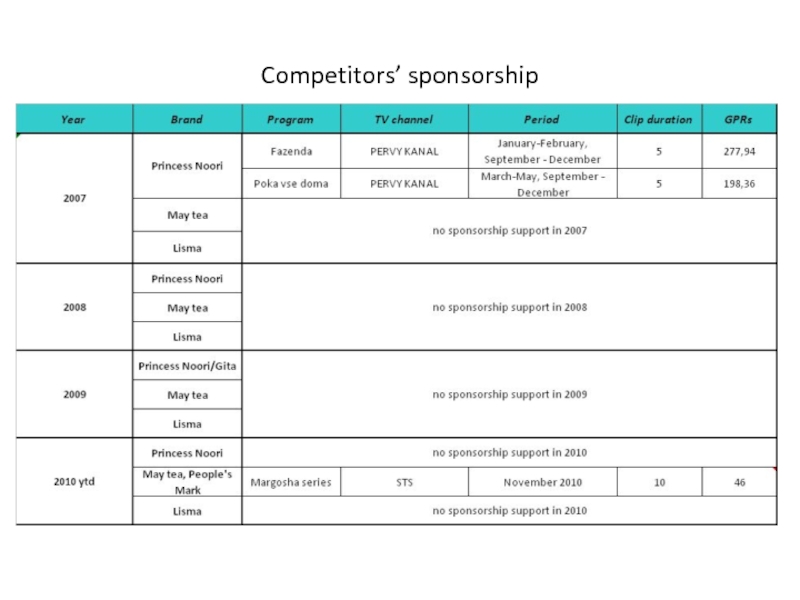

- 51. Competitors’ sponsorship

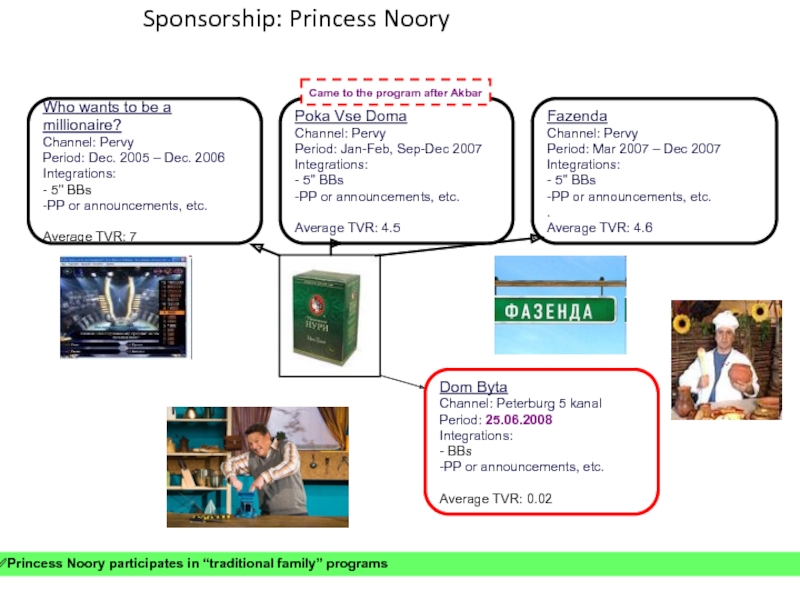

- 52. Sponsorship: Princess Noory Who wants to

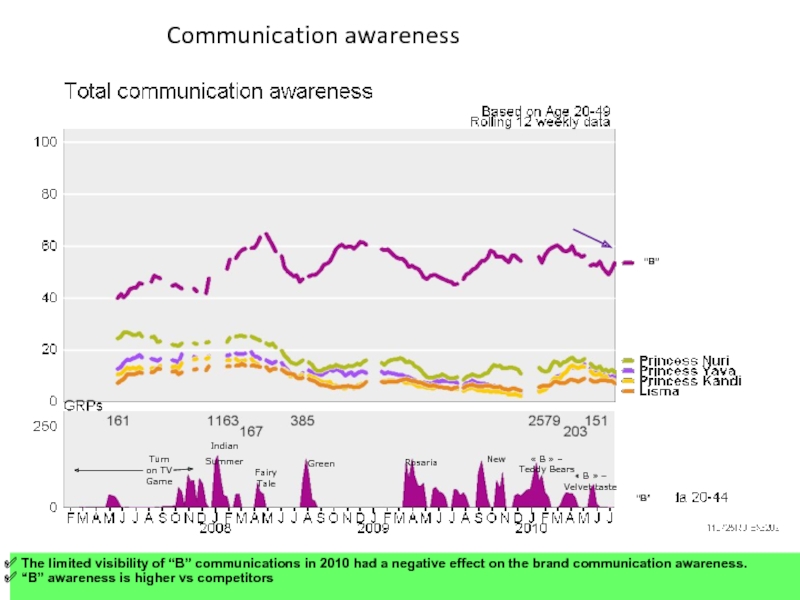

- 53. Green Rosaria New Indian Summer Fairy Tale

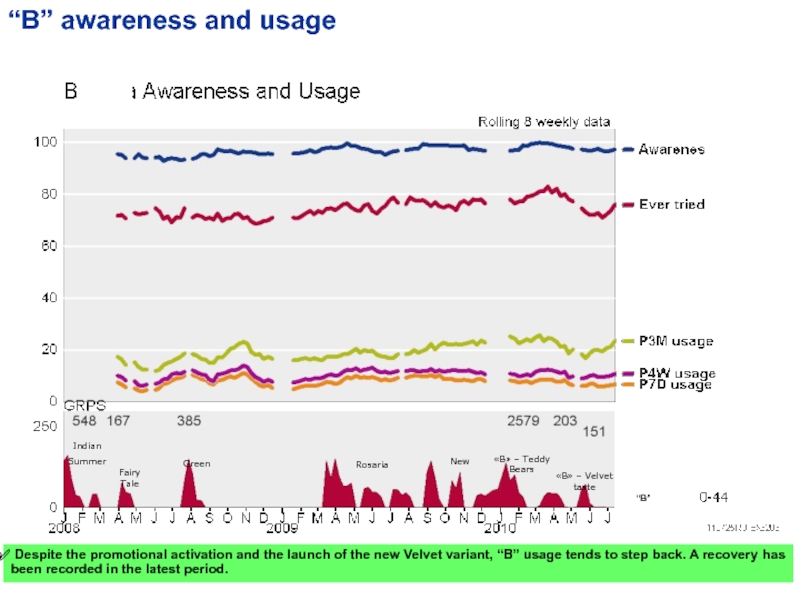

- 54. Green Indian Summer Fairy Tale Rosaria New

- 55. 49% 16% 11% Awareness Re-purchase intents

- 56. “B” Pure Black 100tbs promo effect SOM

- 57. “B” 100tbs Bears promo

- 58. PRODUCT

- 59. ABC analysis “B” vs competitors, SOM Value “B”

- 60. Assortment structure “B” vs competitors “B” Pr.

- 61. “B” vs competitors PB Loose tea tasting

- 62. “B” vs competitors PB TBs tasting results,

- 63. PROPOSITION

- 64. Tea category perception GENERAL CATEGORY BENEFITS Tonic/

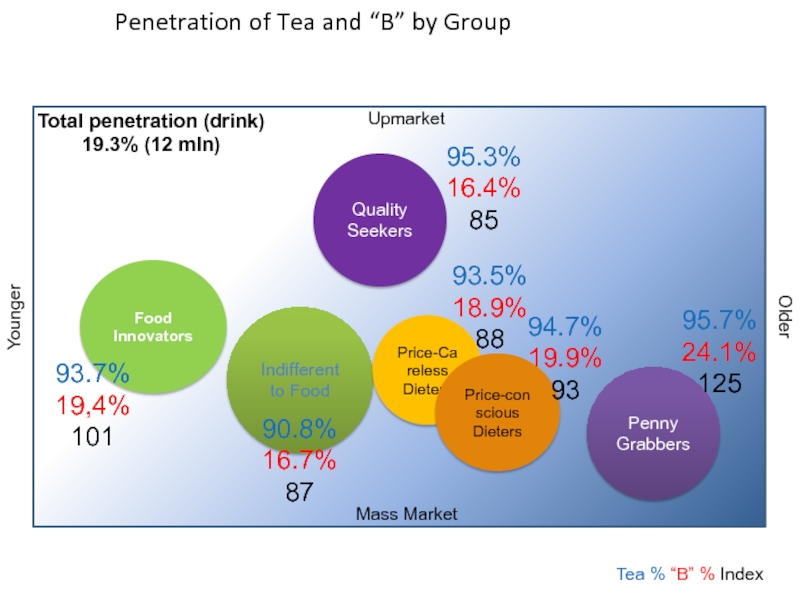

- 65. Penetration of Tea and “B” by Group

- 66. “B” is interesting for… Dieters

- 67. Food Innovators Price-conscious Dieters “B” target audience,

- 68. “B” % Princess Noory % Princess Gita

- 69. Better quality Taste/perform

- 70. Image positioning mapping “B” as a

- 71. Category drivers of conviction Winter 07/08

- 72. Base: Total sample (600)

- 73. “B” Semantic Analysis Conversation

- 74. “B” Brand Perception Ipsos, Sep 2009 Well-known

- 75. PACKAGE

- 76. Players in PB segment: package comparison “B”

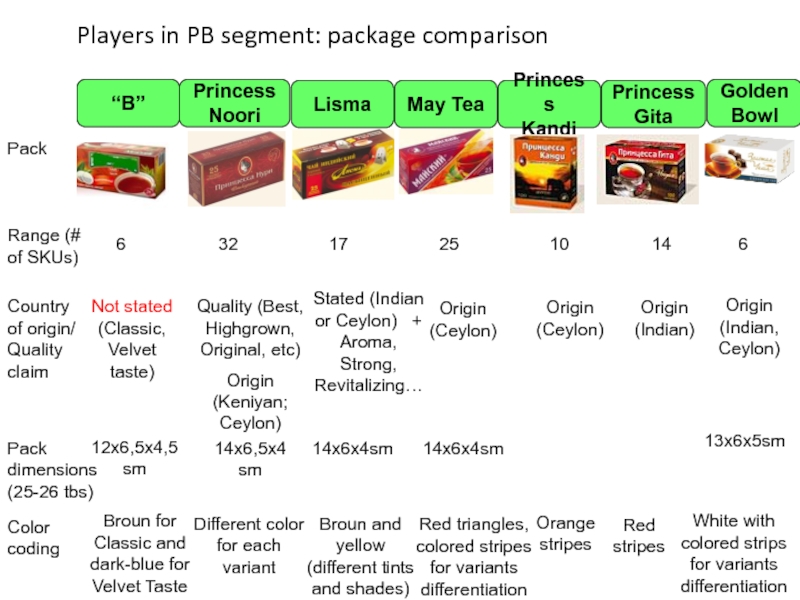

- 77. Players in BF segment: package comparison “B”

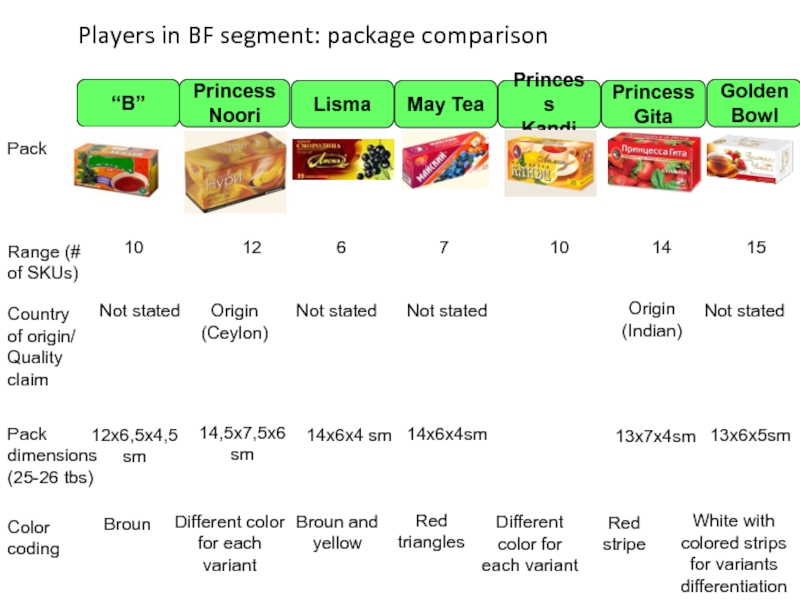

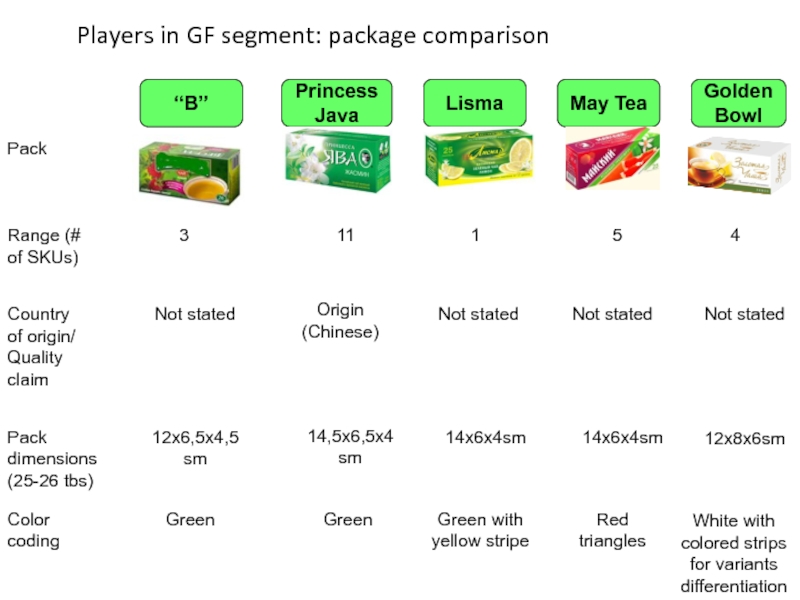

- 78. Players in GF segment: package comparison “B”

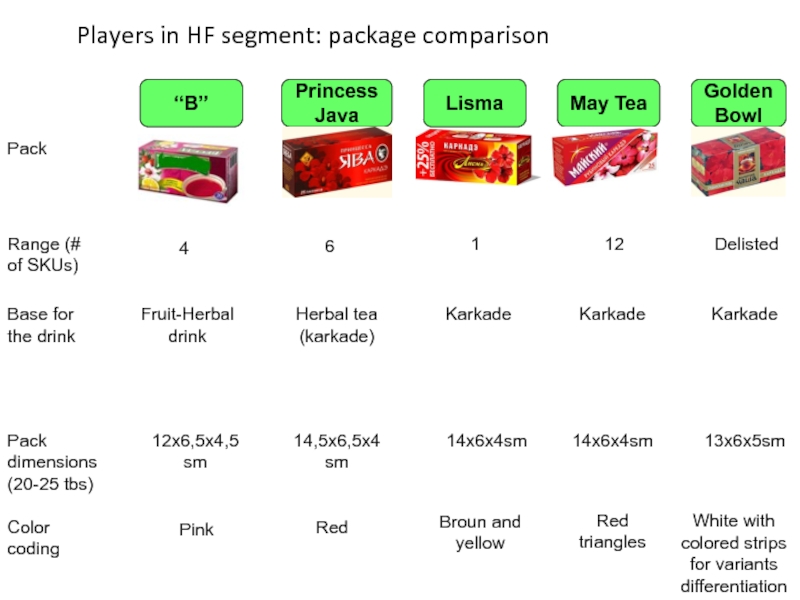

- 79. Players in HF segment: package comparison “B”

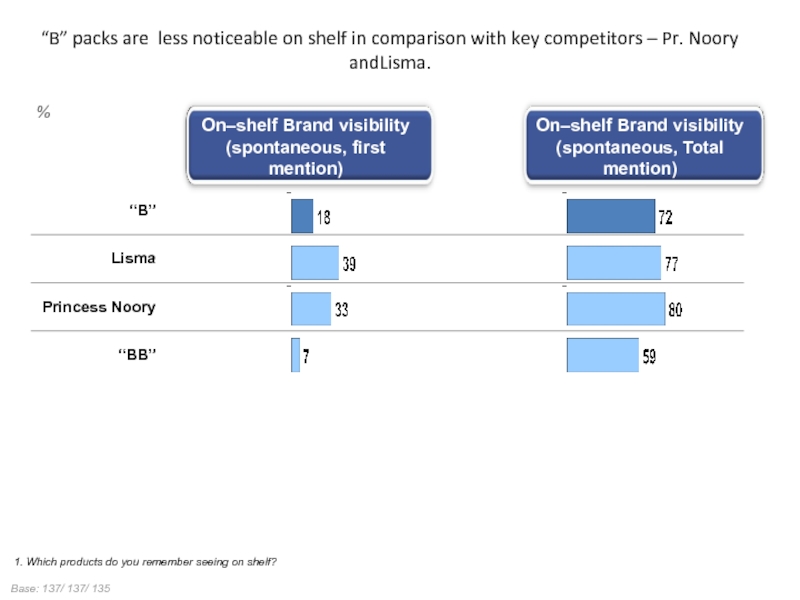

- 80. “B” packs are less noticeable on shelf

- 81. Thank you!

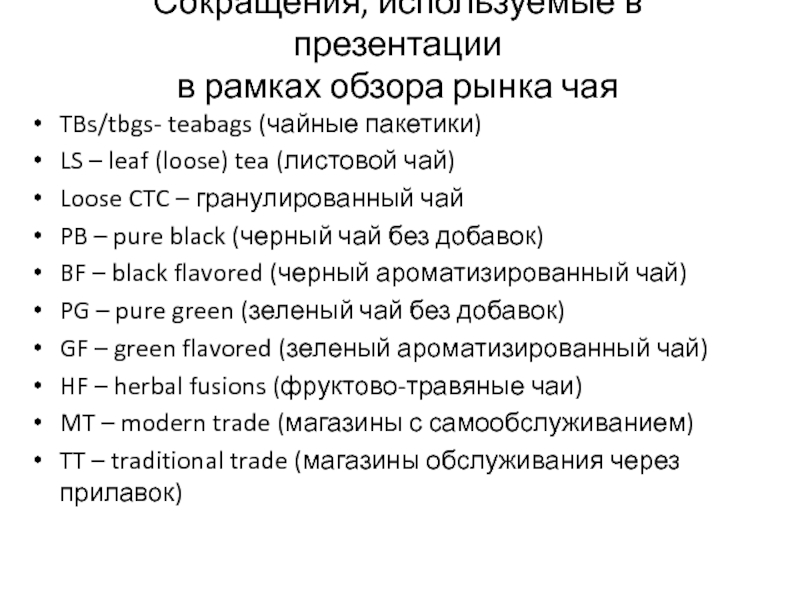

Слайд 2Сокращения, используемые в презентации

в рамках обзора рынка чая

TBs/tbgs- teabags (чайные пакетики)

LS

Loose CTC – гранулированный чай

PB – pure black (черный чай без добавок)

BF – black flavored (черный ароматизированный чай)

PG – pure green (зеленый чай без добавок)

GF – green flavored (зеленый ароматизированный чай)

HF – herbal fusions (фруктово-травяные чаи)

MT – modern trade (магазины с самообслуживанием)

TT – traditional trade (магазины обслуживания через прилавок)

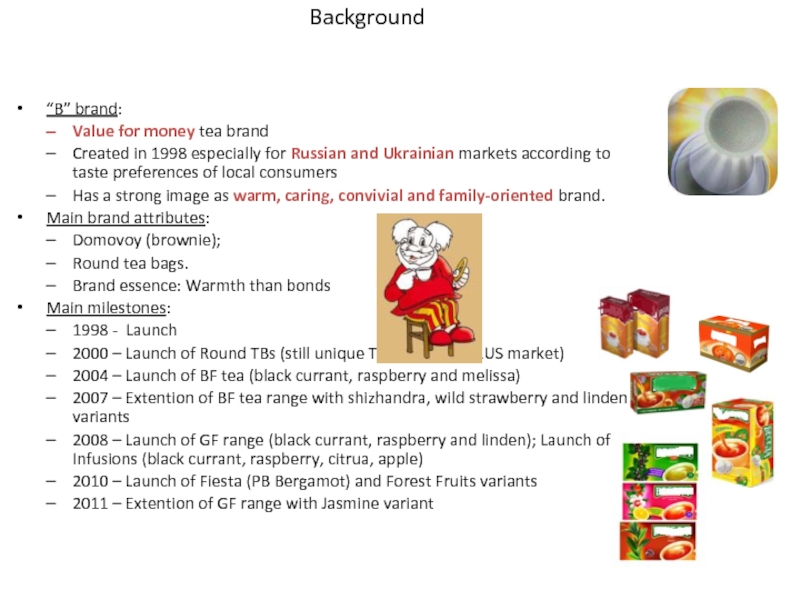

Слайд 3“B” brand:

Value for money tea brand

Created in 1998 especially for Russian

Has a strong image as warm, caring, convivial and family-oriented brand.

Main brand attributes:

Domovoy (brownie);

Round tea bags.

Brand essence: Warmth than bonds

Main milestones:

1998 - Launch

2000 – Launch of Round TBs (still unique TBs format on RUS market)

2004 – Launch of BF tea (black currant, raspberry and melissa)

2007 – Extention of BF tea range with shizhandra, wild strawberry and linden variants

2008 – Launch of GF range (black currant, raspberry and linden); Launch of Infusions (black currant, raspberry, citrua, apple)

2010 – Launch of Fiesta (PB Bergamot) and Forest Fruits variants

2011 – Extention of GF range with Jasmine variant

Background

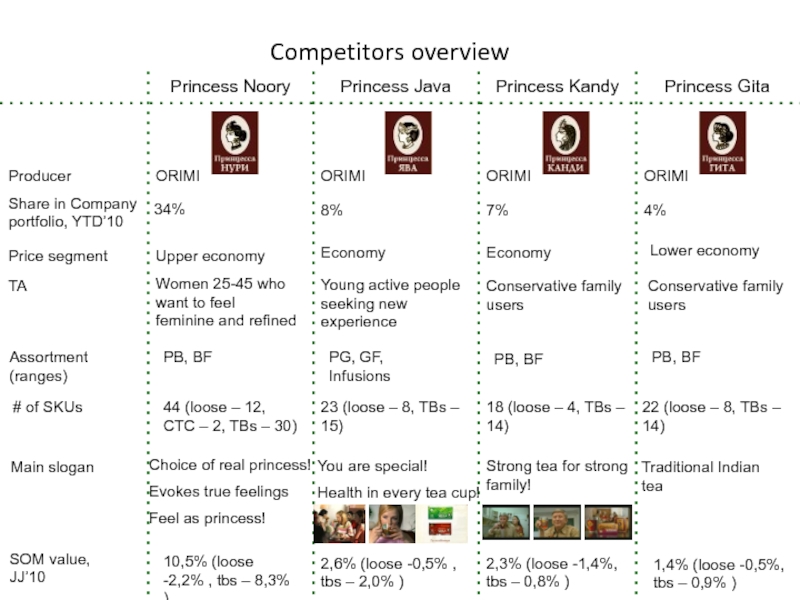

Слайд 4Competitors overview

Princess Noory

Princess Java

Princess Kandy

Princess Gita

Producer

ORIMI

ORIMI

ORIMI

ORIMI

Price segment

Upper economy

Economy

Economy

Lower economy

TA

Assortment (ranges)

Main slogan

SOM

10,5% (loose -2,2% , tbs – 8,3% )

PB, BF

# of SKUs

PG, GF, Infusions

PB, BF

PB, BF

44 (loose – 12, CTC – 2, TBs – 30)

23 (loose – 8, TBs – 15)

18 (loose – 4, TBs – 14)

22 (loose – 8, TBs – 14)

Conservative family users

Young active people seeking new experience

2,6% (loose -0,5% , tbs – 2,0% )

2,3% (loose -1,4%, tbs – 0,8% )

1,4% (loose -0,5%, tbs – 0,9% )

Choice of real princess!

Evokes true feelings

Feel as princess!

You are special!

Health in every tea cup!

Strong tea for strong family!

Women 25-45 who want to feel feminine and refined

Traditional Indian tea

Conservative family users

Share in Company portfolio, YTD’10

34%

8%

7%

4%

Слайд 5Competitors overview

May tea

Bodrost

Golden Bowl

Lisma

Producer

Price segment

TA

Assortment (ranges)

Main slogan

SOM value, JJ’10

# of SKUs

All

All ranges

28 (loose – 9, TBs – 19)

51 (loose – 13, TBs – 38)

30 (loose – 12, TBs – 18)

26 (loose – 2, TBs – 24)

4,3% (loose -0,8%, tbs – 4,5% )

6,3% (loose -2,0%, tbs – 4,2% )

0,7% (loose -0,2%, tbs – 0,5% )

0,8% (loose -0,3%, tbs – 0,5% )

May tea is my favorite tea!

(The only authentic Russian tea)

May Co

May Co

Aromatic. Yours. Golden Bowl.

So tasty that the soul is singing!

Russian Product

Classic is always popular

OtCHAYannaya Bodrost! (extreme CHEERfulness)

Tea for modern, open, hospital, sincere people who appreciate RUS culture & traditions and like communicating with their family

Avalon (Distributor)

Economy

Mainstream

Lower Economy

Lower Economy

All ranges

All ranges

Gives joy of communication!

For family and individual users with good sense of humor (good value for money)

Women 20-40, housewives

Women who love traditions

Слайд 6“B” was rather stable in HY1 2010 despite Economy decline trend.

2009

Слайд 7Negative trend was the result of negative trend in both MT

52%

48%

Value importance, MAT Jan’11

Слайд 10Tea market development,

Sales value & volume, MAT 08 – MAT 10

+5%

+5%

+7%

-1%

+10%

-7%

-3%

-12%

-6%

Слайд 11Tea market development,

Sales value & volume, JJ’08 – JJ’10

+33%

+20%

-3%

-1%

-5%

-6%

+33% - Economy

Слайд 12Tea market by price segments

In volume sales tea market decline

Слайд 13Page

Tea market by price segments

Premium tea holds significantly higher

Слайд 14Page

Tea market by price segments

In Hyper/Supermarkets Premium prevails in

Слайд 15Page

Tea market development: Loose vs TBs

At the same time

Слайд 16Page

Tea market development: Loose vs TBs

The growth of teabags

Слайд 17Page

Tea market development: Loose vs TBs

Premium tea prevails in

Слайд 19Market vs Economy players split

Sales volume, Channels, MAT 08-10

-1%

-5%

-15%

-8%

-1% - Growth

+23%

-11%

-10%

-21%

+5%

-1%

-8%

+3%

+6%

+2%

+5%

+6%

“B” is loosing in Superretes & Traditional Food – faster vs competitors

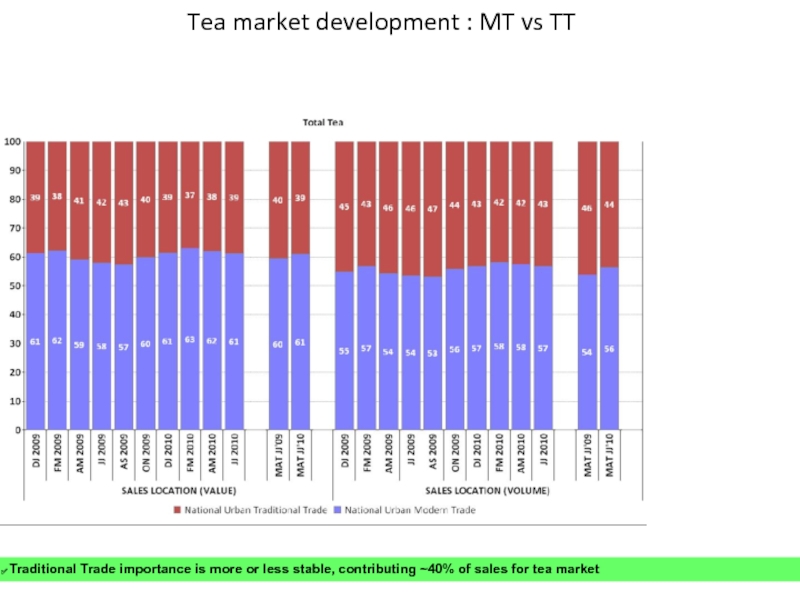

Слайд 20Tea market development : MT vs TT

Traditional Trade importance is

Слайд 21Tea market development : MT vs TT

Traditional Trade is still significant

Слайд 22Market vs Economy players split

Sales volume, Cities, MAT 08-10

+3% - Growth

+3%

-10%

-7%

+24%

+32%

+1%

+18%

-7%

+2%

+14%

+13%

-2%

37% - Share of 24 cities

39%

40%

37%

30%

31%

34%

37%

38%

39%

30%

32%

31%

“B” & competitors are developing better vs the market in 24 cities

24 cities’ share in sales for economy brands is lower vs total market figure => potential for growth

Слайд 23Market vs Economy players split

Sales volume, City size, MAT 08-10

-3% -

-3%

-8%

-10%

-5%

+11%

+3%

-14%

-9%

+3%

-2%

-4%

+1%

+8%

-2%

+6%

+8%

“B” sales are growing in big cities (over 250 ths), but declining in small cities. It might be explained by positive KA development

Competitors are better in small cities (10-50 ths)

Слайд 24Market vs Economy players split

Volume share, City size, MAT 08-10

“B”

Слайд 25Market vs Economy players split

Sales volume, Ranges, MAT 08-10

-11% -

-11%

-2%

-4%

-1%

-17%

-32%

+21%

+8%

+21%

+66%

-7%

+3%

+3%

0%

+7%

+13%

-11%

“B” is declining in Loose much faster vs competitors and total market

Слайд 26“B” vs Competitors by ranges

“B” has quite balanced portfolio, though

Main “B” competitors – Princess Noory & Lisma have much stronger positions in PB TBs segment

Слайд 28Price comparison “B” vs competitors

Pure Black 26 tbgs

“B” is in line

Слайд 29Price comparison “B” vs competitors

Pure Black 50 tbgs, 100tbgs

50 TBs:

50 tbgs

100 tbgs

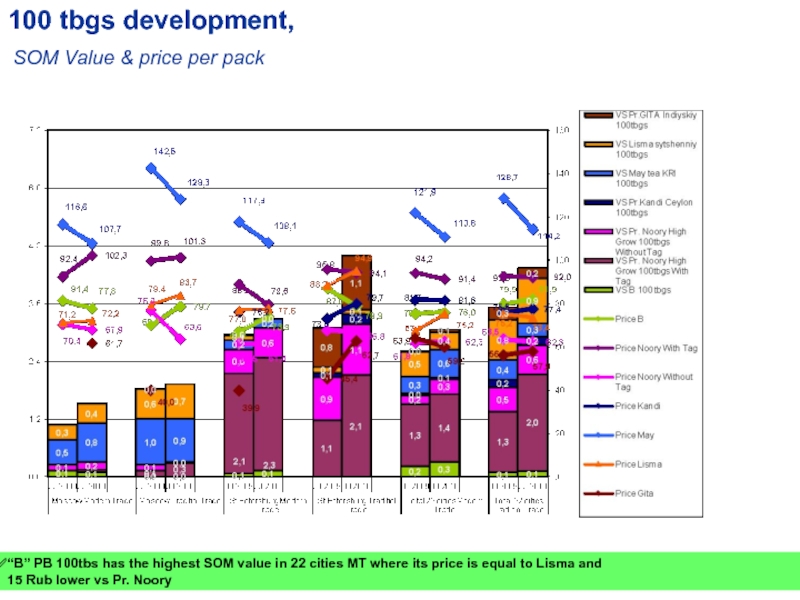

Слайд 30100 tbgs development,

SOM Value & price per pack

“B” PB

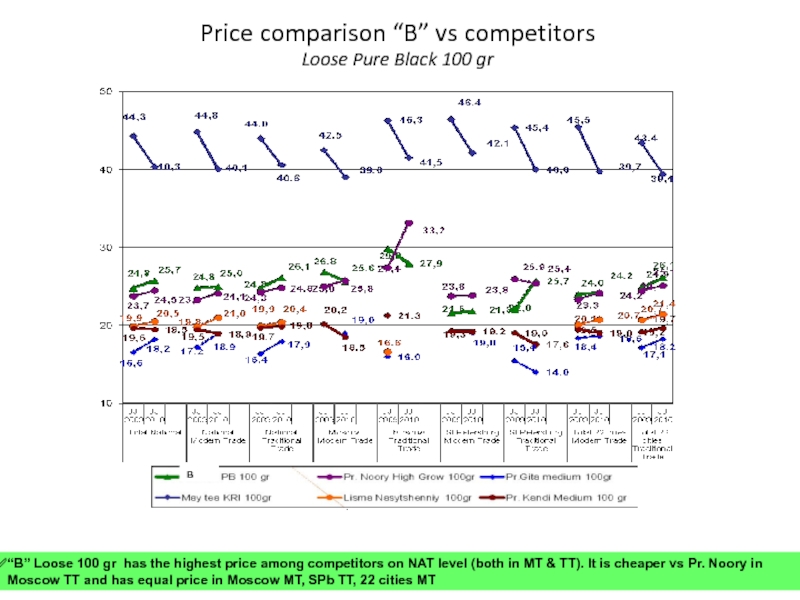

Слайд 31Price comparison “B” vs competitors

Loose Pure Black 100 gr

“B” Loose 100

В

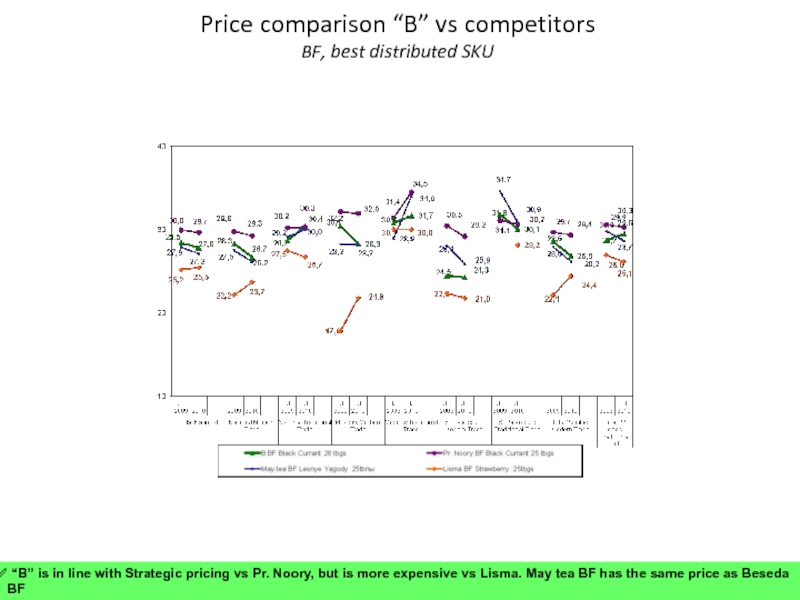

Слайд 32Price comparison “B” vs competitors

BF, best distributed SKU

“B” is in

Слайд 33Price comparison “B” vs competitors

GF 26 TBs, Infusions 20-25 TBs

“B”

GF

Infusion

Слайд 34Price gap in TT vs MT,

“B” has much higher price gap

Слайд 35Price map: “B” vs Competitors, PB 20-26 tbs SOM volume

“B” (0,5;100)

Pr. Noory (2,1;115)

Lisma (0,8;96)

Pr. Gita (0,7;78)

Pr. Kandi (0,4;93)

May (0,8;96)

Bodrost’ (0,0;109)

G. Bowl (0,1;105)

Price Index is calculated for Best Distributed SKUs:

“B” PB 26tbs Princess Noory High Grown 25 tbs

Princess Kandi Ceylon 25 tbs Princess Gita Indian 25 tbs

Lisma Nasyshenny 25 tbs May tea Otborny 25 tbs

Bodrost’ Indian 20 tbs Golden Bowl Indian 20 tbs

Слайд 36Economy brands price development,

JJ’09 vs JJ’10

17 18 19 20

11

10

9

8

7

6

5

4

3

2

1

“B”

Princess Noory

Princess Java

Princess Gita

Princess Kandi

May tea

Lisma

Bodrost’

Golden Bowl

SOM value

Слайд 37Consumer Value Index

Winter 2009/10: (24/08/09 to 14/02/10)

Fair value line

Good value

More resilient

Poor

Less resilient

Based on trialists

60

80

100

120

140

60

80

100

120

140

Ahmad

Akbar

“B”

Brooke Bond

Dilmah

Greenfield

Lipton

May Tea

Princess Nuri

Princess Gita

Princess Kandi

“B” is perceived as good value for money. All its main competitors are within “fair price” boundaries

Слайд 39« L »

« B »

« BB »

Greenfield Tea

Ahmad

May Tea

Princess Nuri

Akbar

Dilmah

Princess Gita

Princess Kandi

Data period: winter 2009/2010

Total Communication

%

TV

%

Print

%

Outdoor

%

Radio

%

In-store

activity

%

(1186)

Base

Total

sample:

Communication

“B” communication awareness is much higher vs its main competitors

(1186)

(1186)

(1186)

(1186)

(1186)

(1186)

(1186)

(1186)

(1186)

(1186)

Слайд 40“B” activities,

2008-2010

TV

Launches

Promo

TV support for promo

Fairy Tale 2

160 GRPs

7/04-27/04

Green

480 GRPs

2/805-08/06

Rosaria

860

16/03-03/05

Masterbrand

1099 GRPs

31/08 – 21/09, 01-31/12

Media target: women 25 to 45 yo

GRPs – Adjusted 30”

“B” Green range

“B” Rosaria

“B” Fiesta

“B” Forest Fruits

Fairy Tale (Second wave)

Fairy Tale (Forth wave)

Fairy Tale Pushkin (Third wave)

“B” Core

707 GRPs

01/01 – 15/02

Bears promo

410 GRPs

08/03- 26/04

Velvet taste

253 GRPs

17/05-31/05

Green

345 GRPs

21/07-25/08

Bears

BF 2+1

Smeshariki CD

Smeshariki CD

GF 2+1 (exclusive for OK)

Indian summer

452 GRPs

1/01-3/03

Indian Summer

331 GRPs

01/10-17/11

TV support for promo

Fairy Tale 3

150 GRPs

29/09-20/10

Слайд 41“B” advertising overview,

2006-2009

Over time, “B” shows a consistent and advertising platform

Last

Pergola

Garden

Indian Summer

Green tea

* Change in the branding scale / ** top box

Rosaria

Note: Interviews conducted in big and medium size cities only

Слайд 42Brand Communication Analysis

2009, 30 sec

Tested from 14/09/09 to 15/11/09

Correct

The linkage to the brand is good

The ad communicates well the brand messages

At the end, it leads to a promising effect on brand preference notably in terms of appeal.

Слайд 43 Mean score

“B” 2.29

Among total sample

Russian average 4.01

Brand Communication Analysis

2009, 30 sec

Engagement details

(P-ve)

(A+ve)

(A+ve)

(P+ve)

(P+ve)

(P+ve)

(P-ve)

(P-ve)

(A-ve)

(A-ve)

(A-ve)

(A+ve)

“B”

Total Russia norm

Ad results above the local norm (95% significance)

Слайд 44PostView TV – “B” ‘Teddy Bears’

Mar-Apr 2010, 15 sec

Postview full

Hot tea norm: 32%

In 2010, “B” used for the first time a promotional communication already established for Saga in Poland.

The copy struggled to emerge and to get recognised (might be due to the novelty of the advertising approach).

It has been averagely enjoyed and strongly judged as pleasant, gentle and soothing

The intended message has been understood and perceived as new, believable and different.

At the end, it tends to have a positive effect on the brand appeal which is however limited by the low ad visibility.

Слайд 45(P-ve)

(A+ve)

(A+ve)

(P+ve)

(P+ve)

(P+ve)

(P-ve)

(P-ve)

(A-ve)

(A-ve)

(A-ve)

(A+ve)

Total Russia norm

Mean

“B” ‘Teddy Bears’ 2.25

Russian average 3.93

‘B” Teddy Bears’ TV

Above the norm at 95% min

Base : Total (172)

PostView TV – “B” ‘Teddy Bears’

Engagement details

Слайд 46PostView TV – “B” ‘Velvet’

May 2010, 15 sec

Tested from 07/06/10

Hot tea norm: 32%

“B” Velvet Taste ad recorded a limited level of recognition.

The copy did not succeed to communicate properly the news therefore the rational response is not strong

CAUTION: Only 3 weeks on air (380 actual GRPs)

Слайд 47(P-ve)

(A+ve)

(A+ve)

(P+ve)

(P+ve)

(P+ve)

(P-ve)

(P-ve)

(A-ve)

(A-ve)

(A-ve)

(A+ve)

Total Russia norm

Mean score

“B” ‘Velvet’

Russian average 3.93

‘B” Velvet’ TV

Above the norm at 95% min

Base : Total (171)

PostView TV – “B” ‘Velvet’

Engagement details

Слайд 48“B” communication perception

“B” Green Campaign

Low spontaneous recall

No remarkable character

Low purchase intent

Positive

“B” Black Campaigns

High spontaneous recall

Brownie / Domovoy as a key character

High purchase intent

Big input to Beseda brand image / emotional attributes

Слайд 49Princess Noory promo support

1998

2007

2003

2005

2006

2004

2009

2010

Repositioning

after the crisis and offering economy

Result: leadership in economy segment

Rebranding

to extend target audience, assortment was divided into High Grow and Otbornyi tea

Message: “High quality tea for affordable price”

Media support: -10” and 20” TVCs of Otbornyi tea on Pervyi, STS, Ren-TV, Rossiya; sponsorship of movie programs and talk shows, press support

Sponsorship

Sto k odnomy, Puteshestviya Naturalista, Bolshaya Stirka

TVC “Skazka”

Focus on new audience – women 25-35 that want to feel exquisite

Sponsorship

Who wants to be a millionaire? on Pervy channel,

Period: Dec. 2005 – Dec. 2006, Integrations:- 5’’ BBs, avg. TVR: 7

2008

Radio

In 2007 Princess Nury turned to radio and press and kept 84% SOS on Radio

Sponsorship

Poka Vse Doma on Pervy channel, Period: Jan-Feb, Sep-Dec 2007, Integrations - 5’’ BBs, avg. TVR: 4.5

Fazenda on Pervy channel, Period: Mar 2007 – Dec 2007, Integrations - 5’’ BBs, avg. TVR: 4.6

TVC “Choice of a Real Princess”

Slogans: “Choice of a real Princess”, “Feel yourself as a Princess”, “Lubov’ ne sluCHAIna”, “PRIZnannyi Chai”, “Upoitel’nyi Chai”

Source: www.sostav.ru, www.advertology.ru, www.idea.ru

Promo: 25+ 5 TBs

Tastings

Outdoor

TVC “Choice of a Real Princess”

Slogan: “Choice of a real Princess”

TVC “Fashion Princess”

Слайд 50“B” sponsorship (Social Mission)

Sponsor jingle 10 sec (“B” brand Video)

Branded cups

(3 hours)

Special Social Mission topic to be covered in story/ or special guest once a week

Government Channel, has high credibility among TA

National channel with largest coverage

High affinity

Period: May-June’2010

Слайд 52Sponsorship: Princess Noory

Who wants to be a millionaire?

Channel: Pervy

Period: Dec. 2005

Integrations:

- 5’’ BBs

-PP or announcements, etc.

Average TVR: 7

Fazenda

Channel: Pervy

Period: Mar 2007 – Dec 2007

Integrations:

- 5’’ BBs

-PP or announcements, etc.

.

Average TVR: 4.6

Poka Vse Doma

Channel: Pervy

Period: Jan-Feb, Sep-Dec 2007

Integrations:

- 5’’ BBs

-PP or announcements, etc.

Average TVR: 4.5

Came to the program after Akbar

Dom Byta

Channel: Peterburg 5 kanal

Period: 25.06.2008

Integrations:

- BBs

-PP or announcements, etc.

Average TVR: 0.02

Princess Noory participates in “traditional family” programs

Слайд 53Green

Rosaria

New

Indian

Summer

Fairy Tale

Turn on TV Game

« B » – Teddy Bears

« B » – Velvet taste

“B” awareness is higher vs competitors

Communication awareness

Слайд 54Green

Indian

Summer

Fairy Tale

Rosaria

New

«B» – Teddy Bears

«B» – Velvet taste

Despite the promotional

“B” awareness and usage

“B”

Слайд 55

49%

16%

11%

Awareness

Re-purchase intents

Trial

31%

8%

4%

“B” new product launch summary

Indian Summer

Esmeralda (Green)

69%

50%

40%

24%

17%

Study

average

(1432)

(720)

Tracked from

06/08/07-16/03/08

Tracked from

30/06-21/09/08

Base

(16 porducts)

71%

Слайд 56“B” Pure Black 100tbs promo effect

SOM Value

In MT promo brings

Слайд 57“B” 100tbs Bears promo

“B” PB 100tbs promo has low WSD

Слайд 60Assortment structure “B” vs competitors

“B”

Pr. Noory

Pr. Java

Pr. Kandi

Pr. Gita

Lisma

May Tea

G. Bowl

Bodrost’

Loose

PB TBs

BF TBs

PG TBs

GF TBs

HF TBs

2

4

8

0

3

4

22

12

18

12

0

0

0

44

8

0

0

1

6

8

23

4

6

8

0

0

0

18

8

6

8

0

0

0

22

9

11

5

2

1

1

29

13

12

7

2

5

12

51

2

4

15

1

4

0

26

12

3

6

1

3

5

30

TOTAL

“B” has much lower # of SKUs in PB segment

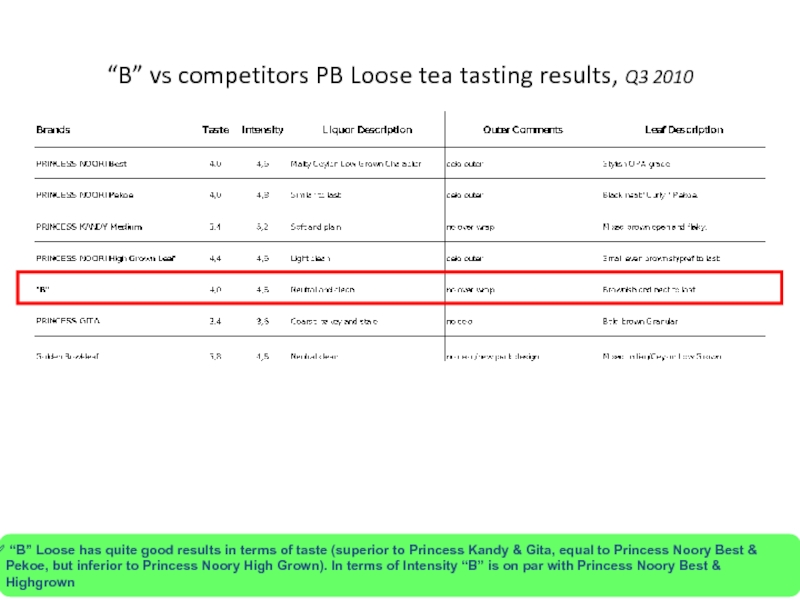

Слайд 61“B” vs competitors PB Loose tea tasting results, Q3 2010

“B”

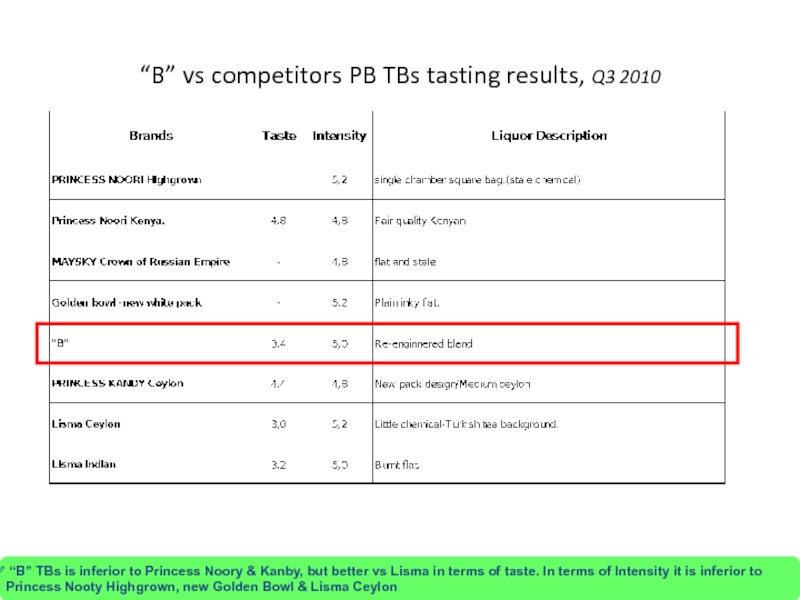

Слайд 62“B” vs competitors PB TBs tasting results, Q3 2010

“B” TBs

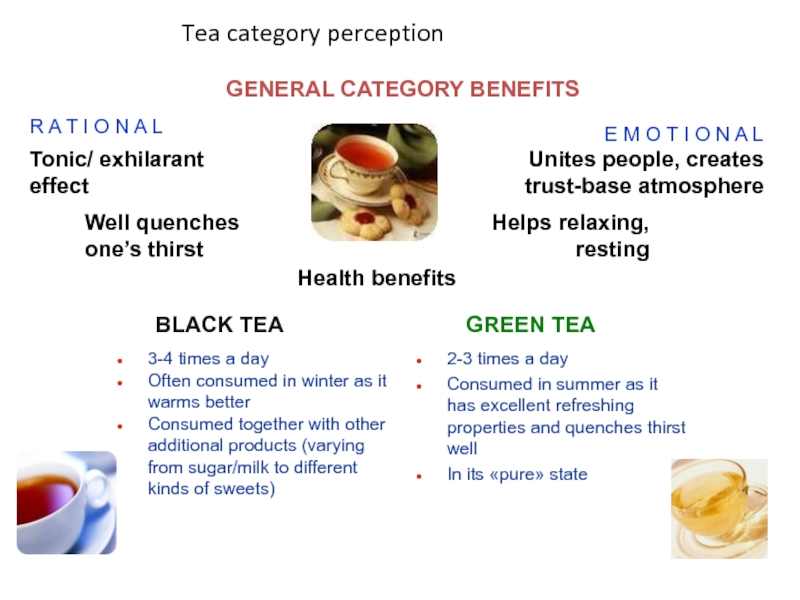

Слайд 64Tea category perception

GENERAL CATEGORY BENEFITS

Tonic/ exhilarant effect

Well quenches one’s thirst

Health benefits

Unites

Helps relaxing, resting

R A T I O N A L

E M O T I O N A L

GREEN TEA

BLACK TEA

2-3 times a day

Consumed in summer as it has excellent refreshing properties and quenches thirst well

In its «pure» state

3-4 times a day

Often consumed in winter as it warms better

Consumed together with other additional products (varying from sugar/milk to different kinds of sweets)

Слайд 65Penetration of Tea and “B” by Group

Food Innovators

Quality Seekers

Penny Grabbers

Indifferent to

Mass Market

Upmarket

Older

Younger

Price-Careless

Dieters

Price-conscious

Dieters

95.3%

16.4%

85

93.7%

19,4%

101

90.8%

16.7%

87

Tea % “B” % Index

95.7%

24.1%

125

94.7%

19.9%

93

93.5%

18.9%

88

Total penetration (drink)

19.3% (12 mln)

Слайд 66“B” is interesting for…

Dieters try to care about their body, need

Food innovators buy food products out of curiosity. Much of their consumption depends on their mood and is not strongly influenced by price. Beseda here can satisfy their need in “warmth” and difference with infusions proposition

Penny-Grabbers prefer Russian products and care about price much. They value the time, spent with their near and dear and are a bit “crazy” about family issues

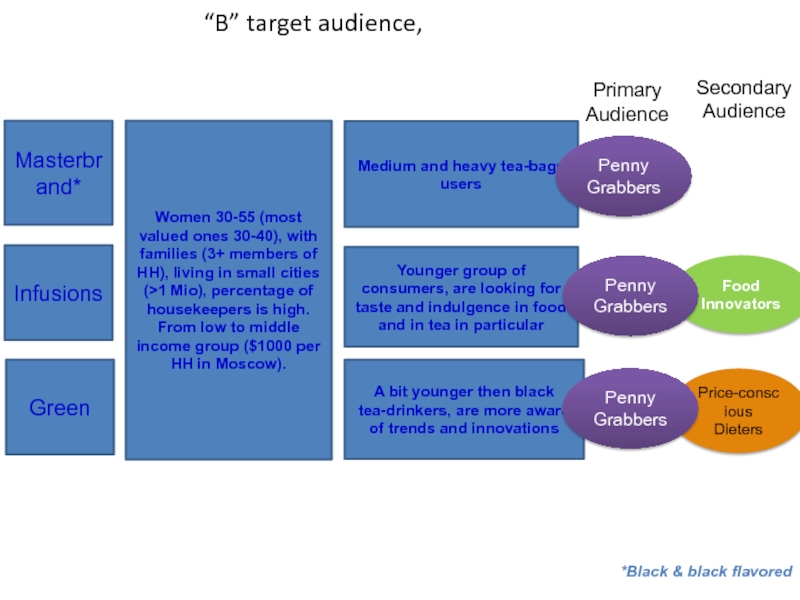

Слайд 67Food Innovators

Price-conscious

Dieters

“B” target audience,

Women 30-55 (most valued ones 30-40), with families

From low to middle income group ($1000 per HH in Moscow).

Masterbrand*

Infusions

Green

*Black & black flavored

Medium and heavy tea-bags users

Younger group of consumers, are looking for taste and indulgence in food and in tea in particular

A bit younger then black tea-drinkers, are more aware of trends and innovations

Penny Grabbers

Penny Grabbers

Penny Grabbers

Primary

Audience

Secondary

Audience

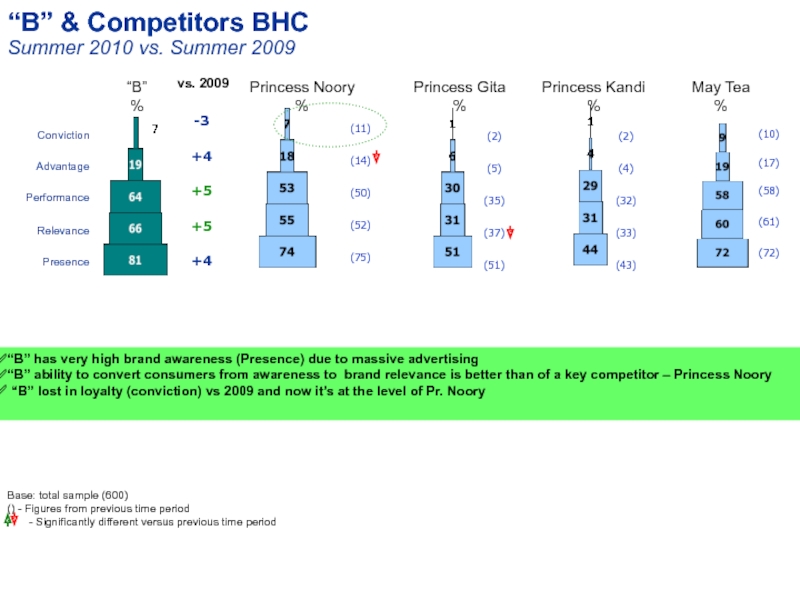

Слайд 68“B”

%

Princess Noory

%

Princess Gita

%

Base: total sample (600)

() - Figures from previous time

- Significantly different versus previous time period

Princess Kandi

%

“B” & Competitors BHC

Summer 2010 vs. Summer 2009

“B” has very high brand awareness (Presence) due to massive advertising

“B” ability to convert consumers from awareness to brand relevance is better than of a key competitor – Princess Noory

“B” lost in loyalty (conviction) vs 2009 and now it’s at the level of Pr. Noory

vs. 2009

May Tea

%

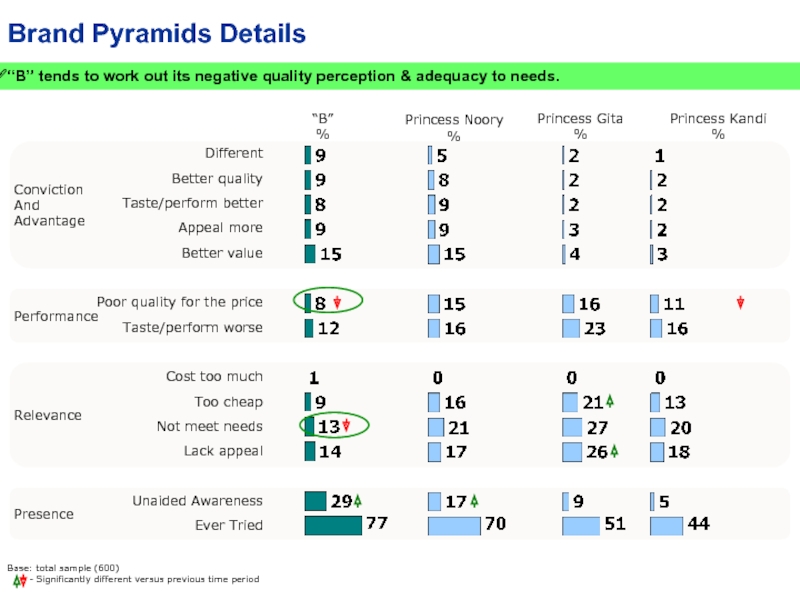

Слайд 69

Better quality

Taste/perform better

Appeal more

Different

Better value

Cost too much

Too cheap

Poor quality for the

Not meet needs

Taste/perform worse

Lack appeal

Ever Tried

Unaided Awareness

Presence

Conviction

And

Advantage

Relevance

Performance

Base: total sample (600)

- Significantly different versus previous time period

Princess Kandi

%

“B”

%

Princess Noory

%

Princess Gita

%

Brand Pyramids Details

“B” tends to work out its negative quality perception & adequacy to needs.

Слайд 70Image positioning mapping

“B” as a popular Russian tea brand, 2009

Note:

Typical Russian brand which can be found everywhere

= Beseda brand keys

Слайд 71Category drivers of conviction

Winter 07/08

Share of endorsement*

Relevance through good

Performance / Emotional benefits

*based on conviction level of the pyramids of hot tea brands

Brand strengths

Low importance dimensions

Main dimensions

leading to Conviction

Very important dimensions

leading to Conviction

Generic dimensions

leading to Conviction

Слайд 72Base: Total sample (600)

- Significantly different versus

“B”

Princess Noory

Princess Gita

Princess Kandi

In %

“B” & competitors' image perception Summer 2010

The only strong characteristic of “B” is “Russian Brand”

Слайд 73“B” Semantic Analysis

Conversation

Tea party

Friends/ friendly

Family / Relatives

Old man

House-spirit

Home

Sincere

Cozy / coziness

Warm

Kind, tender

Pleasant

Traditional

Saturated

Tonic

Tea

set

Aromatic

Strong

When respondents recall “B”, they first of all think of ‘family/relatives’, ‘conversation’, ‘house’, ‘house-spirit’, ‘old man’, ‘tea party’, ‘friends’. These words are the closest associations with the brand.

“Kind’, “Pleasant taste’, ‘Saturated’, ‘Tonic’, ‘Traditional’, ‘Tea set’, ‘Cozy’

form the second level of associations.

“Aromatic’, ‘Strong’, ‘Warm’ and ‘Calming’ form the third level of associations.

Cheerful

Calming

SEMANTIC NETWORK ANALYSIS OUTLINE:

1. Size of bubbles shows the share of respondents that mentioned the word.

2. The lines show the presence of connection between the words.

3. The distance between the brand and the word is determined by the mean rank of mentions (if the word is pointed out in first mention, second mention etc): the lower is the mean rank the closer is the word to the brand.

4. Associations form levels according to the distance between the words and the brand.

Second level: supplements the first-level associations

First level: “top of mind” associations

Third level: supplement the second-level associations

LEARNING: The brand is most intensively associated with home which in its turn leads to such positive associations as family, warmth and coziness. Emphasizing “Conversation’ also resulted in other pleasant associations with tea consumption : ‘Friends’, ‘Cheerfulness’, ‘Sincere’, ‘Calming’.

“B” is not directly associated with important product characteristics (e.g. ‘pleasant taste’, ‘strong’, ‘saturated’). Respondents recall them only in connection with abstract words.

«В»

Слайд 74“B” Brand Perception

Ipsos, Sep 2009

Well-known brand with a history

Strong and original

Good-natured image of the main hero –Domovoy

The brand name is well-known for many consumers and supports the positive perception and is directly related with tea category, means the main tea consumption occasion, traditional for Russia: a heart talk while having a cup of tea in the kitchen.

Слайд 76Players in PB segment: package comparison

“B”

Princess

Noori

May Tea

Lisma

Princess

Kandi

Princess

Gita

Golden

Bowl

Pack

Range

Country of origin/ Quality claim

Pack dimensions (25-26 tbs)

Color coding

6

32

17

10

25

14

6

Not stated (Classic, Velvet taste)

Quality (Best, Highgrown, Original, etc)

Origin (Keniyan; Ceylon)

Stated (Indian or Ceylon) + Aroma, Strong, Revitalizing…

Origin (Ceylon)

Origin (Ceylon)

Origin (Indian)

Origin (Indian, Ceylon)

14x6x4sm

13x6x5sm

12x6,5x4,5sm

14x6,5x4 sm

14x6x4sm

White with colored strips for variants differentiation

Broun for Classic and dark-blue for Velvet Taste

Different color for each variant

Broun and yellow (different tints and shades)

Red triangles, colored stripes for variants differentiation

Orange stripes

Red stripes

Слайд 77Players in BF segment: package comparison

“B”

Princess

Noori

May Tea

Lisma

Princess

Kandi

Princess

Gita

Golden

Bowl

Pack

Range

Country of origin/ Quality claim

Pack dimensions (25-26 tbs)

Color coding

10

12

6

7

10

14

15

Not stated

Not stated

Not stated

Origin (Indian)

Origin (Ceylon)

14,5x7,5x6sm

14x6x4sm

13x6x5sm

13x7x4sm

12x6,5x4,5sm

14x6x4 sm

Not stated

White with colored strips for variants differentiation

Broun

Different color for each variant

Broun and yellow

Red triangles

Different color for each variant

Red stripe

Слайд 78Players in GF segment: package comparison

“B”

Princess

Java

May Tea

Lisma

Golden

Bowl

Pack

Range (# of

Country of origin/ Quality claim

Pack dimensions (25-26 tbs)

Color coding

3

11

1

5

4

Origin (Chinese)

Not stated

14,5x6,5x4sm

14x6x4sm

12x8x6sm

12x6,5x4,5sm

14x6x4sm

Not stated

Not stated

Not stated

White with colored strips for variants differentiation

Green

Green with yellow stripe

Green

Red triangles

Слайд 79Players in HF segment: package comparison

“B”

Princess

Java

May Tea

Lisma

Golden

Bowl

Pack

Range (# of

Base for the drink

Pack dimensions (20-25 tbs)

Color coding

6

12

1

Delisted

4

14,5x6,5x4sm

14x6x4sm

13x6x5sm

12x6,5x4,5sm

14x6x4sm

Herbal tea (karkade)

Fruit-Herbal drink

Karkade

Karkade

Karkade

White with colored strips for variants differentiation

Pink

Red triangles

Broun and yellow

Red

Слайд 80“B” packs are less noticeable on shelf in comparison with key

1. Which products do you remember seeing on shelf?

On–shelf Brand visibility (spontaneous, first mention)

Base: 137/ 137/ 135

%

On–shelf Brand visibility (spontaneous, Total mention)