- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Abbvie Inc. Slumped 13% In September презентация

Содержание

- 1. Why Abbvie Inc. Slumped 13% In September

- 2. What: The large cap biopharma company is

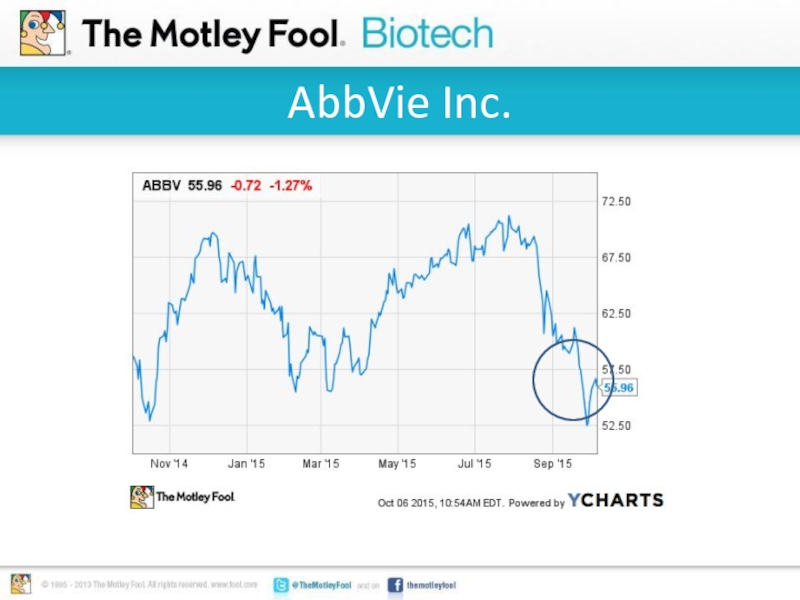

- 3. AbbVie Inc.

- 4. So what: Humira is AbbVie’s top selling

- 5. So what continued:

- 6. So what continued: Gilead Sciences announces positive

- 7. Now what: Humira patent risk looms, but

- 8. Now what continued: Significant opportunity in oncology.

- 9. Now what continued: Absent a Humira successor,

Слайд 2What:

The large cap biopharma company is investing heavily in R&D to

offset risk tied to the looming patent expiration of Humira.

Humira generates more than $12 billion in annual sales.

Humira accounts for 63% of year-to-date revenue.

Expansion into hepatitis C offers billion dollar potential.

Competitor Gilead Sciences reports positive phase 3 data for its pan-genotype hepatitis C drug on September 21.

Shares dropped 12.8% in September.

Humira generates more than $12 billion in annual sales.

Humira accounts for 63% of year-to-date revenue.

Expansion into hepatitis C offers billion dollar potential.

Competitor Gilead Sciences reports positive phase 3 data for its pan-genotype hepatitis C drug on September 21.

Shares dropped 12.8% in September.

Source Juno Therapeutics

Слайд 4So what:

Humira is AbbVie’s top selling therapy.

Sales of $6.6 billion through

the first six months of 2015.

Patent protection ends on Humira in 2016.

AbbVie launched Viekira Pak for hepatitis C in Q1 2015

Viekira Pak Q2 sales tracking at an annualized $1.5 billion pace.

Patent protection ends on Humira in 2016.

AbbVie launched Viekira Pak for hepatitis C in Q1 2015

Viekira Pak Q2 sales tracking at an annualized $1.5 billion pace.

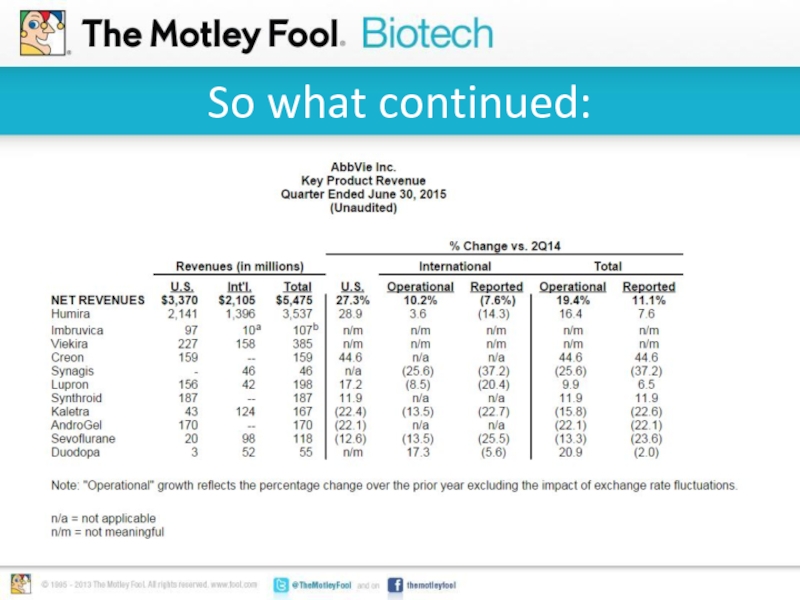

Слайд 6So what continued:

Gilead Sciences announces positive data for next-generation, pan-genotype hepatitis

C therapy.

99% overall cure rate, including 98% rate in genotype 1.

Could reduce demand for Viekira Pak in genotype 1 patients.

Robust efficacy across genotypes 1 to 6.

Could remove need for genotype testing.

Could outmaneuver AbbVie’s pan-genotype next generation therapy: ABT-493 + ABT-530.

99% overall cure rate, including 98% rate in genotype 1.

Could reduce demand for Viekira Pak in genotype 1 patients.

Robust efficacy across genotypes 1 to 6.

Could remove need for genotype testing.

Could outmaneuver AbbVie’s pan-genotype next generation therapy: ABT-493 + ABT-530.

Слайд 7Now what:

Humira patent risk looms, but efforts underway on next-generation autoimmune

drugs.

ABT-494: Advancing into late stage trials by year end.

82% of rheumatoid arthritis patients achieved a 20% or greater improvement in symptoms in phase 2 trials.

In anti-TNF (such as Humira) non-responders, 71% achieved a 20% or greater improvement.

Safety profile potentially better than Humira with most common adverse event being headache.

Oral dosing rather than injection dosing like Humira.

ABT-494: Advancing into late stage trials by year end.

82% of rheumatoid arthritis patients achieved a 20% or greater improvement in symptoms in phase 2 trials.

In anti-TNF (such as Humira) non-responders, 71% achieved a 20% or greater improvement.

Safety profile potentially better than Humira with most common adverse event being headache.

Oral dosing rather than injection dosing like Humira.

Слайд 8Now what continued:

Significant opportunity in oncology.

Acquired Pharmacyclics in May to get

Imbruvica.

Fast growing drug with billion dollar annual sales potential.

Venetoclax potential regulatory filing by year end.

Relapsed/refractory CLL with 17p deletion genetic mutation.

Elotuzumab filed for approval.

Decision expected in February 2016.

Improved progression free survival when added to standard of care.

Fast growing drug with billion dollar annual sales potential.

Venetoclax potential regulatory filing by year end.

Relapsed/refractory CLL with 17p deletion genetic mutation.

Elotuzumab filed for approval.

Decision expected in February 2016.

Improved progression free survival when added to standard of care.

Слайд 9Now what continued:

Absent a Humira successor, significant risk remains.

Continue to monitor

progress on oncology pipeline.

Look for insight into timeline for next-generation pan-genotype HCV therapies during Q3 EPS report.

Recent decline may offer opportunity if company can execute on its plan to overcome Humira risk.

Underweight in portfolios until clarity exists.

Look for insight into timeline for next-generation pan-genotype HCV therapies during Q3 EPS report.

Recent decline may offer opportunity if company can execute on its plan to overcome Humira risk.

Underweight in portfolios until clarity exists.