- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Is Novartis’ Dividend Safe? презентация

Содержание

- 1. Is Novartis’ Dividend Safe?

- 2. Is Novartis’ dividend safe? Novartis is

- 3. Patent Risk Let’s

- 4. Reasons for dividend optimism Fast growing therapies

- 5. Reasons for dividend optimism A rich platform

- 6. Cash dividend payout ratio Novartis’

- 7. Dividend growth Novartis paid

- 8. Current yield Novartis’ dividend yield is 3%;

- 9. . The smartest investors know that

Слайд 2Is Novartis’ dividend safe?

Novartis is one of the largest global drug

$14 billion in first quarter sales.

50 marketed products across 5 segments:

Pharmaceuticals: $7.8 billion in Q1 sales.

Alcon: An eye care portfolio with $2.6 billion in Q1 sales.

Sandoz: A generics manufacturer with $2.3 billion in Q1 sales.

Vaccines: $215 million in Q1 sales (exiting).

Consumer healthcare: $1 billion in Q1 sales (shifting to a joint venture).

However, Novartis’ faces patent risk.

Diovan

Sales fell 20% in 2013.

Sales fell 13% year-over-year to $803 million in Q1.

Diovan monotherapy generic expected to enter U.S. market in Q3.

Diovan monotherapy represents 90% of U.S. Diovan sales.

Zometa

Sales fell 53% in 2013.

Sales fell 69% to $74 million in Q1.

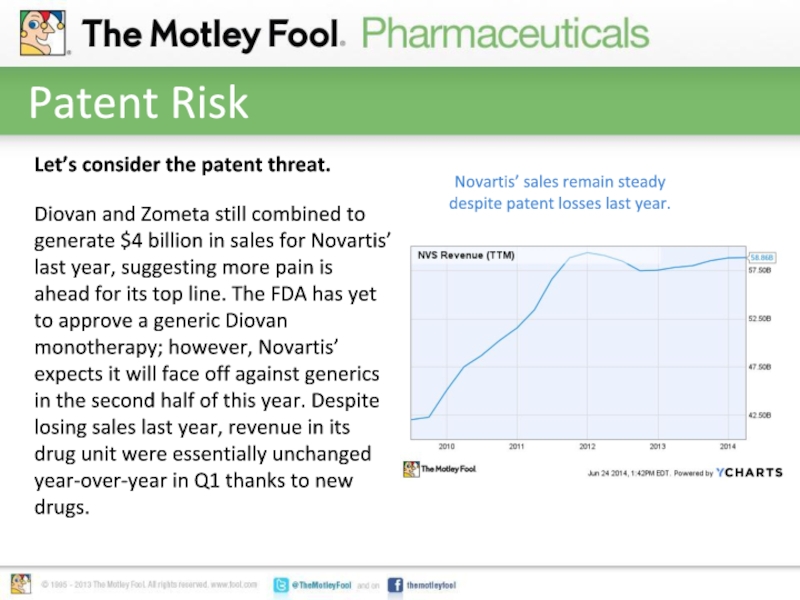

Слайд 3Patent Risk

Let’s consider the patent threat.

Diovan and Zometa still combined to

Novartis’ sales remain steady despite patent losses last year.

Слайд 4Reasons for dividend optimism

Fast growing therapies in the first quarter:

Gilenya: An

Sales up 31% to $552 million in Q1

Faces stiff competition this year from Biogen’s Tecfidera and Sanofi’s Aubagio.

Tasigna: A therapy for chronic myeloid leukemia.

Sales up 19% to $337 million in Q1.

Galvus: A diabetes drug sold overseas.

Sales up 15% to $308 million

A rich platform of products and a solid pipeline of potential new therapies.

Restructuring for growth:

A deal with GlaxoSmithKline offers an opportunity to focus on growth markets.

Novartis’ acquires Glaxo’s cancer products.

$1.6 billion in 2013 sales.

Will pay $16 billion to Glaxo.

Novartis’ divests non-flu vaccines.

Receives $5.3 billion from Glaxo.

Creates a consumer health joint venture.

Sells its animal health business.

Receives $5.4 billion from Eli Lilly.

Net cash outflow = $7.6 billion.

Pipeline opportunity:

28 phase 3 or pivotal programs.

6 new molecules.

Significant biosimilars program.

http://www.novartis.com/downloads/investors/event-calendar/2014/2014-04-22-presentation.pdf

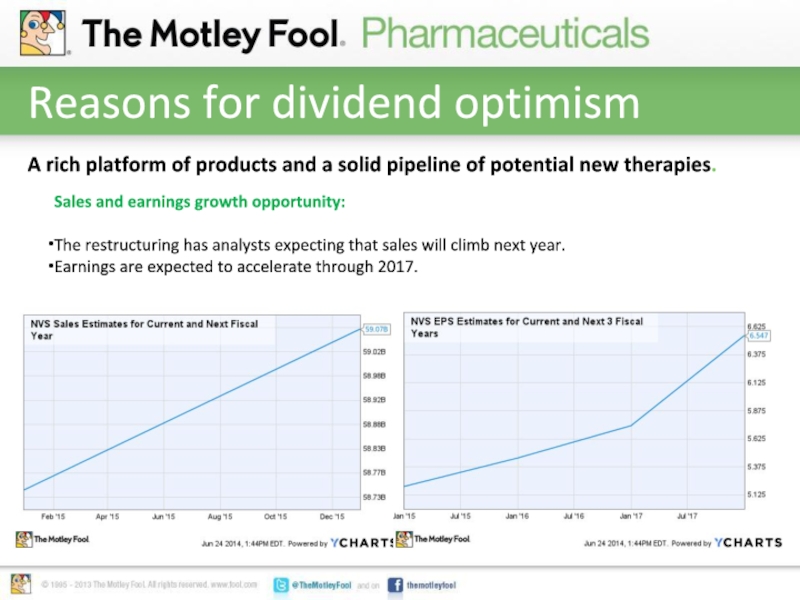

Слайд 5Reasons for dividend optimism

A rich platform of products and a solid

Sales and earnings growth opportunity:

The restructuring has analysts expecting that sales will climb next year.

Earnings are expected to accelerate through 2017.

Слайд 6Cash dividend payout ratio

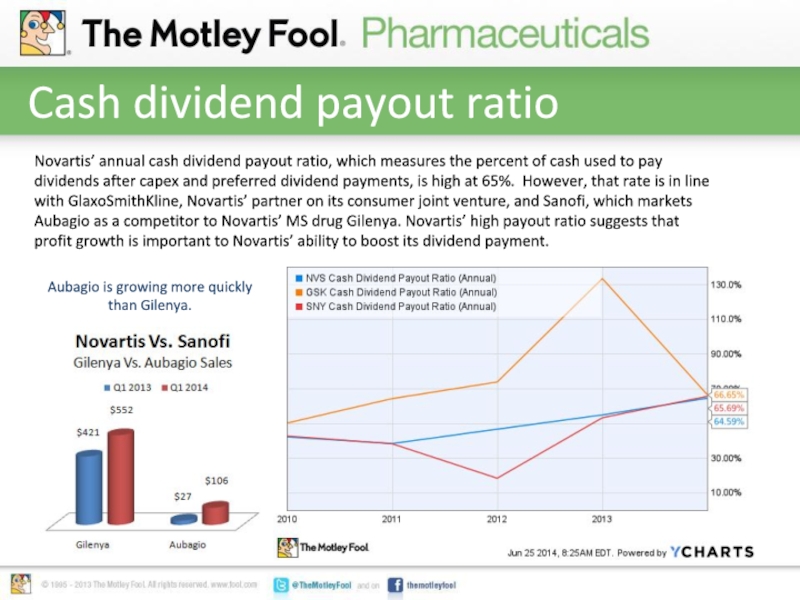

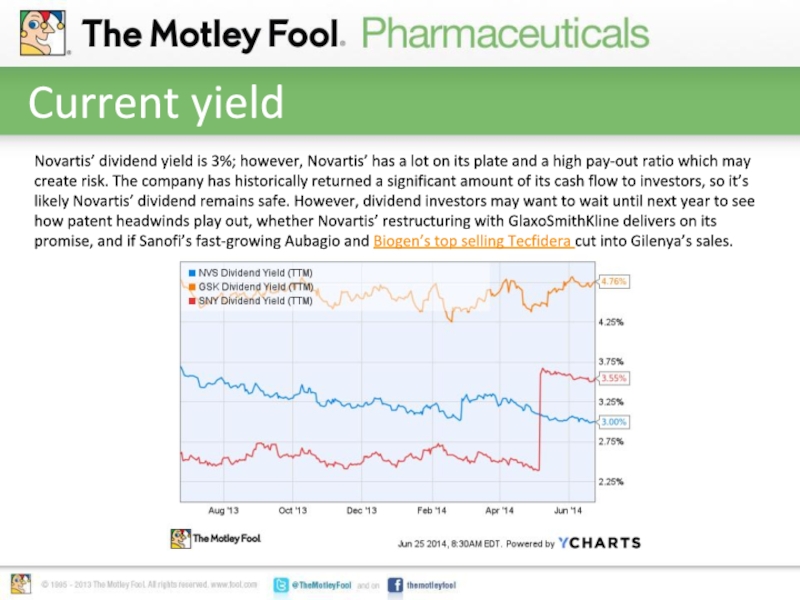

Novartis’ annual cash dividend payout ratio, which measures

Aubagio is growing more quickly than Gilenya.

Слайд 7Dividend growth

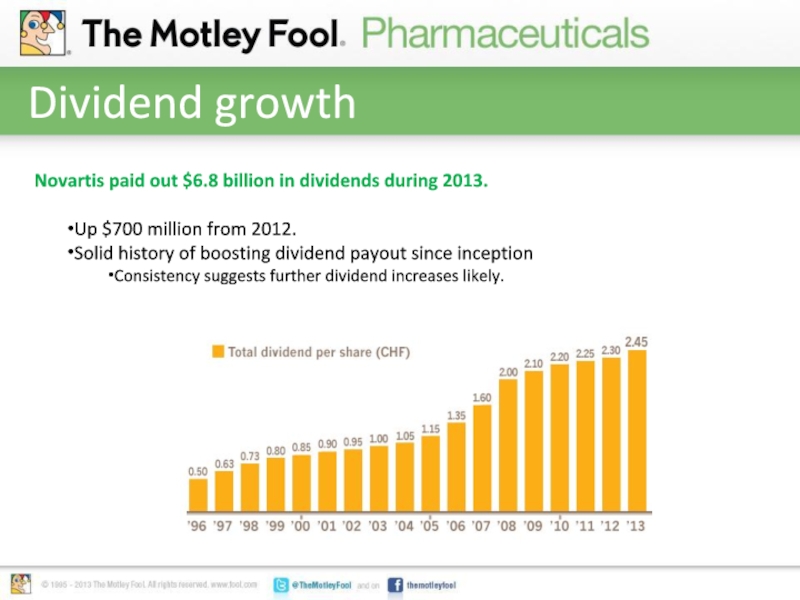

Novartis paid out $6.8 billion in dividends during 2013.

Up

Solid history of boosting dividend payout since inception

Consistency suggests further dividend increases likely.