- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Tim Hudak's Jobs Fail презентация

Содержание

- 2. Has Anyone Read

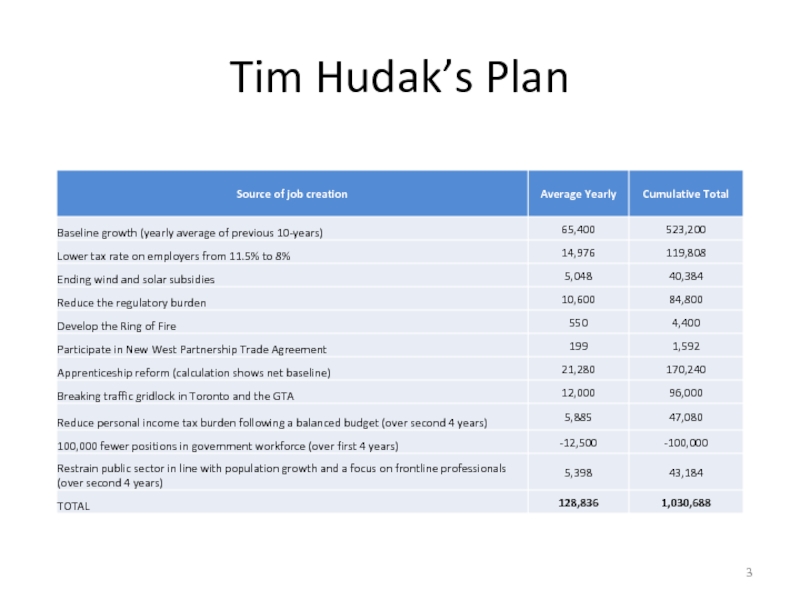

- 3. Tim Hudak’s Plan

- 4. Baseline Growth 523,200 jobs

- 5. Corporate Income Taxes Hudak relies on a

- 6. Corporate Income Taxes – Issue # 1

- 7. Corporate Income Taxes – Issue # 2

- 8. Corporate Income Taxes – Issue

- 9. Wind and Solar subsidies Hudak’s plan

- 10. Reducing the Regulatory Burden The PC plan

- 11. Personal Income Taxes Hudak has said that

- 13. Tim Hudak’s Plan Hudak’s jobs numbers on

- 14. Tim Hudak’s Recession

- 15. Ontario’s Economy Ontario’s nominal GDP is estimated

- 16. Hudak’s Cuts In Hudak’s balanced budget plan,

- 17. Quantifiable Impact on GDP As a share

- 18. Unquantifiable Impact on GDP – 1 Real

- 19. Unquantifiable Impact on GDP – 2

Слайд 2

Has Anyone Read the PC Plan?

When he launched his plan, Tim

Hudak claimed that he had three different economists sign off

There’s one problem: None of them did

“If you read my letter I state that the ‘methodology’ they use to create their fiscal plan is reasonable, not the ‘plan.’ I do not comment on any party’s plans only their methodology.” (Ernie Stokes, iPolitics.ca, May 22, 2014)

“Pedro Antunes, deputy chief economist at the Conference Board, told me in an interview that the Conference Board is not endorsing the Million Jobs plan — nor did it even see the plan.” (iPolitics.ca, May 14, 2014)

“Zycher didn’t study (the PC plan). His work was done months before the current election campaign and it’s not based on the specifics of what Hudak says he would do as premier.” (Ottawa Citizen, May 12, 2014)

There’s one problem: None of them did

“If you read my letter I state that the ‘methodology’ they use to create their fiscal plan is reasonable, not the ‘plan.’ I do not comment on any party’s plans only their methodology.” (Ernie Stokes, iPolitics.ca, May 22, 2014)

“Pedro Antunes, deputy chief economist at the Conference Board, told me in an interview that the Conference Board is not endorsing the Million Jobs plan — nor did it even see the plan.” (iPolitics.ca, May 14, 2014)

“Zycher didn’t study (the PC plan). His work was done months before the current election campaign and it’s not based on the specifics of what Hudak says he would do as premier.” (Ottawa Citizen, May 12, 2014)

Слайд 4

Baseline Growth

523,200 jobs – more than half of the plan –

are from what the PCs call “baseline growth”

These are jobs that “would be created anyway if the province maintained the status quo of the last decade, the Tories acknowledged.” (Canadian Press, May 13, 2014)

Hudak’s plan will drive Ontario into a recession, ensuring these jobs won’t be created under his leadership

These are jobs that “would be created anyway if the province maintained the status quo of the last decade, the Tories acknowledged.” (Canadian Press, May 13, 2014)

Hudak’s plan will drive Ontario into a recession, ensuring these jobs won’t be created under his leadership

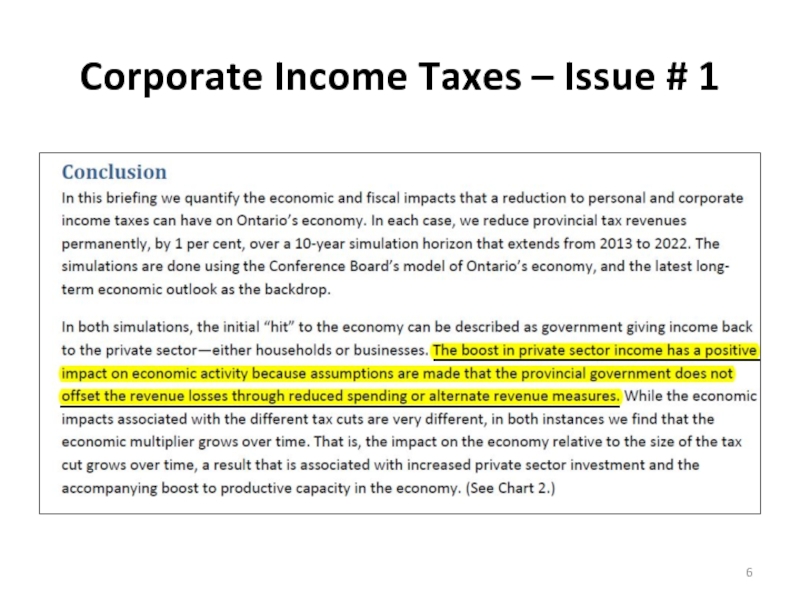

Слайд 5Corporate Income Taxes

Hudak relies on a Conference Board Analysis for support

for his claims about job creation arising from reduced corporate taxes

Using the same document, there are three major issues with the PC plan

Using the same document, there are three major issues with the PC plan

Слайд 7Corporate Income Taxes – Issue # 2

The PCs start with the

Conference Board analysis of an immediate 1% reduction in the Corporate Income Tax rate

Then they multiply the effects by 3.5, to reflect their 3.5% proposed reduction in CIT rates

However, their cuts will be phased in, rather than brought in immediately, so the job impacts predicted by the Conference Board, can’t just be multiplied

Then they multiply the effects by 3.5, to reflect their 3.5% proposed reduction in CIT rates

However, their cuts will be phased in, rather than brought in immediately, so the job impacts predicted by the Conference Board, can’t just be multiplied

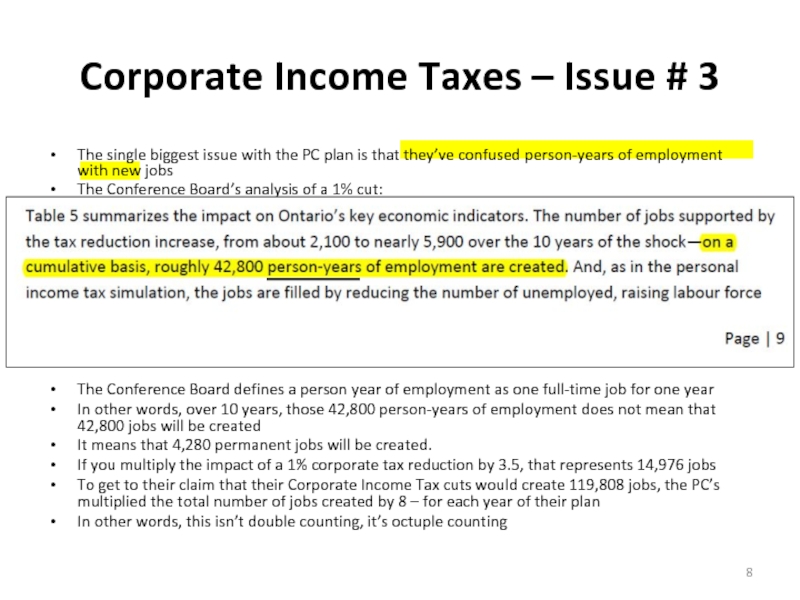

Слайд 8

Corporate Income Taxes – Issue # 3

The single biggest issue with

the PC plan is that they’ve confused person-years of employment with new jobs

The Conference Board’s analysis of a 1% cut:

The Conference Board defines a person year of employment as one full-time job for one year

In other words, over 10 years, those 42,800 person-years of employment does not mean that 42,800 jobs will be created

It means that 4,280 permanent jobs will be created.

If you multiply the impact of a 1% corporate tax reduction by 3.5, that represents 14,976 jobs

To get to their claim that their Corporate Income Tax cuts would create 119,808 jobs, the PC’s multiplied the total number of jobs created by 8 – for each year of their plan

In other words, this isn’t double counting, it’s octuple counting

The Conference Board’s analysis of a 1% cut:

The Conference Board defines a person year of employment as one full-time job for one year

In other words, over 10 years, those 42,800 person-years of employment does not mean that 42,800 jobs will be created

It means that 4,280 permanent jobs will be created.

If you multiply the impact of a 1% corporate tax reduction by 3.5, that represents 14,976 jobs

To get to their claim that their Corporate Income Tax cuts would create 119,808 jobs, the PC’s multiplied the total number of jobs created by 8 – for each year of their plan

In other words, this isn’t double counting, it’s octuple counting

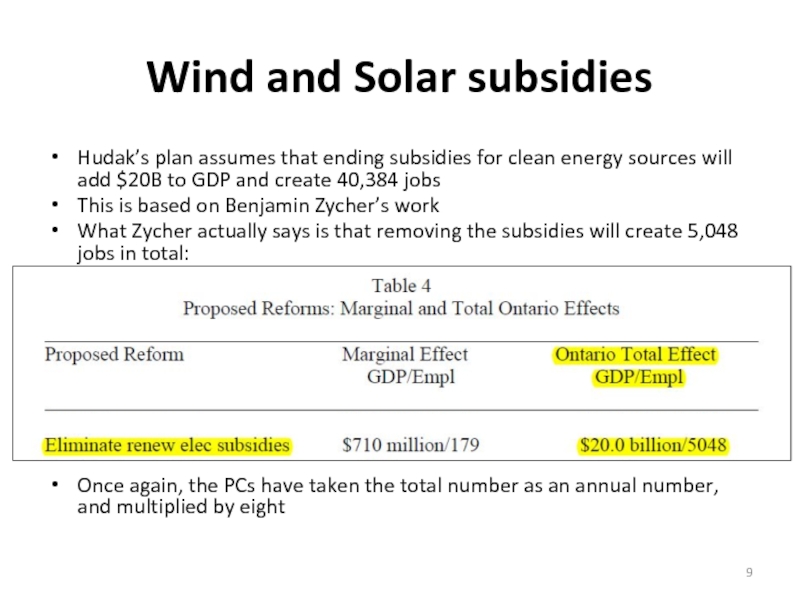

Слайд 9Wind and Solar subsidies

Hudak’s plan assumes that ending subsidies for clean

energy sources will add $20B to GDP and create 40,384 jobs

This is based on Benjamin Zycher’s work

What Zycher actually says is that removing the subsidies will create 5,048 jobs in total:

Once again, the PCs have taken the total number as an annual number, and multiplied by eight

This is based on Benjamin Zycher’s work

What Zycher actually says is that removing the subsidies will create 5,048 jobs in total:

Once again, the PCs have taken the total number as an annual number, and multiplied by eight

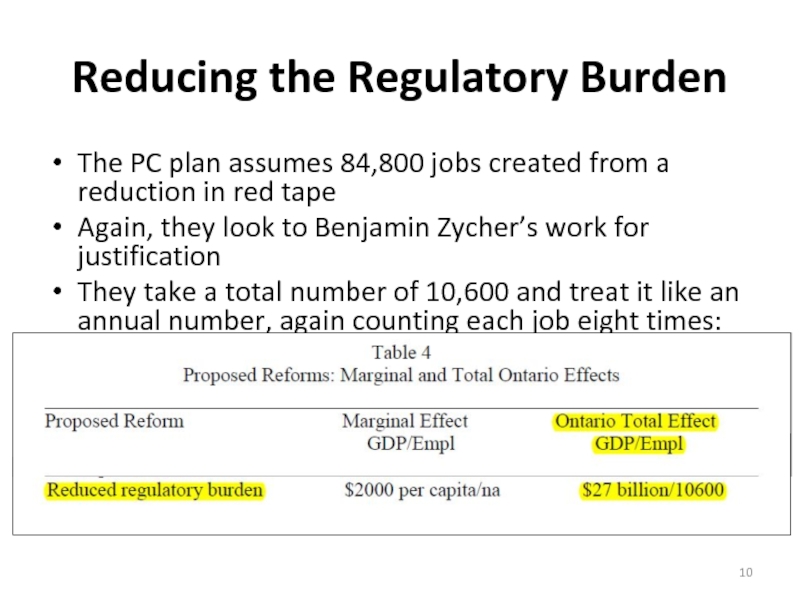

Слайд 10Reducing the Regulatory Burden

The PC plan assumes 84,800 jobs created from

a reduction in red tape

Again, they look to Benjamin Zycher’s work for justification

They take a total number of 10,600 and treat it like an annual number, again counting each job eight times:

m

Again, they look to Benjamin Zycher’s work for justification

They take a total number of 10,600 and treat it like an annual number, again counting each job eight times:

m

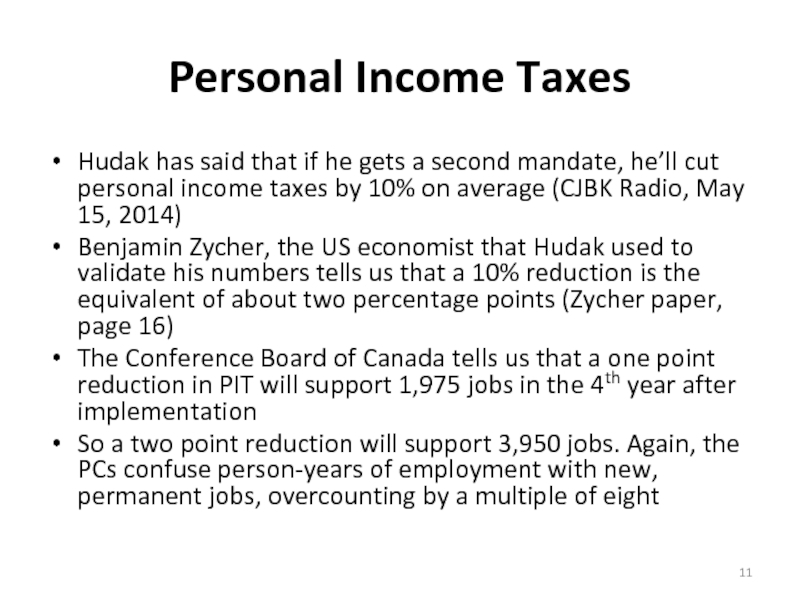

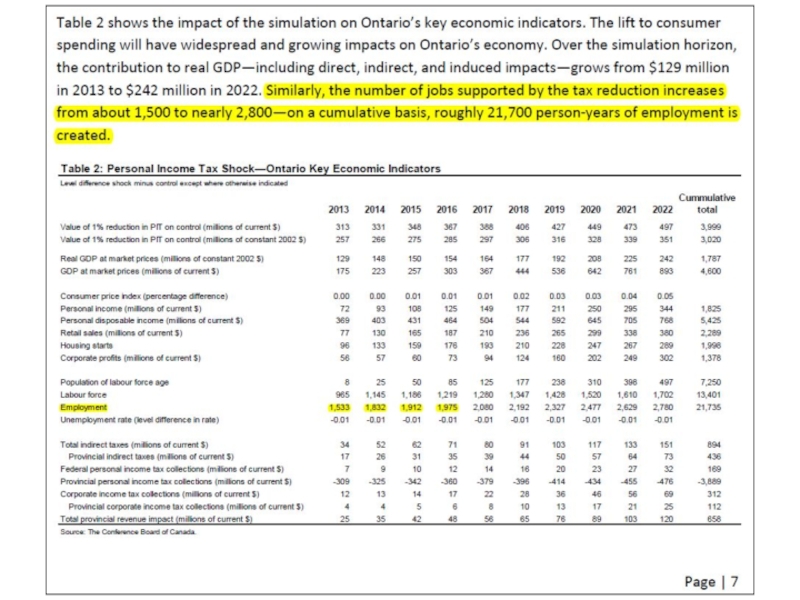

Слайд 11Personal Income Taxes

Hudak has said that if he gets a second

mandate, he’ll cut personal income taxes by 10% on average (CJBK Radio, May 15, 2014)

Benjamin Zycher, the US economist that Hudak used to validate his numbers tells us that a 10% reduction is the equivalent of about two percentage points (Zycher paper, page 16)

The Conference Board of Canada tells us that a one point reduction in PIT will support 1,975 jobs in the 4th year after implementation

So a two point reduction will support 3,950 jobs. Again, the PCs confuse person-years of employment with new, permanent jobs, overcounting by a multiple of eight

Benjamin Zycher, the US economist that Hudak used to validate his numbers tells us that a 10% reduction is the equivalent of about two percentage points (Zycher paper, page 16)

The Conference Board of Canada tells us that a one point reduction in PIT will support 1,975 jobs in the 4th year after implementation

So a two point reduction will support 3,950 jobs. Again, the PCs confuse person-years of employment with new, permanent jobs, overcounting by a multiple of eight

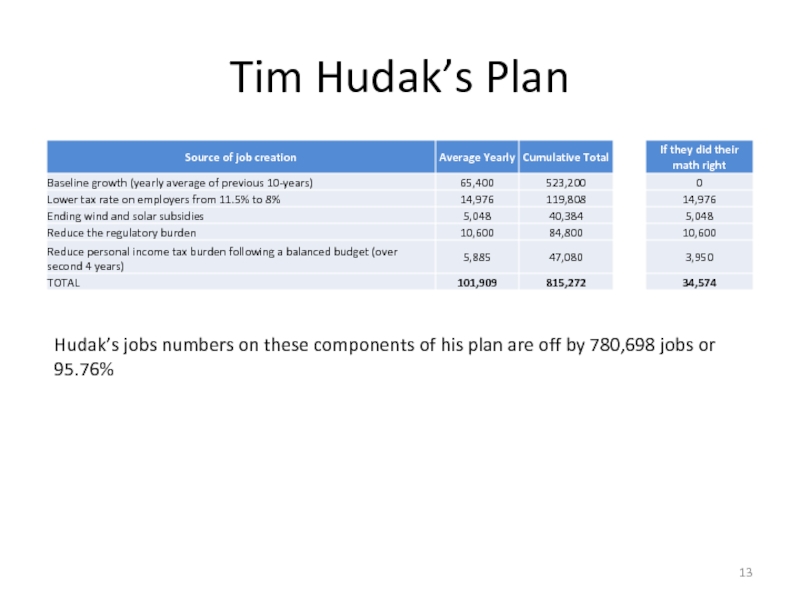

Слайд 13Tim Hudak’s Plan

Hudak’s jobs numbers on these components of his plan

are off by 780,698 jobs or 95.76%

Слайд 15Ontario’s Economy

Ontario’s nominal GDP is estimated to be $685.5 billion in

2015-2016

Government program spending of $120 billion is 17.5% of GDP, or more than $1 out of every $6

Government program spending of $120 billion is 17.5% of GDP, or more than $1 out of every $6

Слайд 16Hudak’s Cuts

In Hudak’s balanced budget plan, he plans to reduce spending

by $6.457B in 2015/16

But he’s also accounted for $2.15B in savings, because of a public sector wage freeze

The problem is that the 2014 budget does not build in any additional funding for wage increases

As a result of this error, Hudak’s 2015/16 cuts will actually be $8.697B

But he’s also accounted for $2.15B in savings, because of a public sector wage freeze

The problem is that the 2014 budget does not build in any additional funding for wage increases

As a result of this error, Hudak’s 2015/16 cuts will actually be $8.697B

Слайд 17Quantifiable Impact on GDP

As a share of provincial GDP, the $8.697B

cut is 1.27%

That is spending that will be taken directly out of the economy

There’s also an indirect, spin-off impact

The Federal government estimates the multiplier for government austerity to be 1.5

So the total impact of Hudak’s cuts will be 1.9%

Projected real GDP growth in 2015/16 is 2.5%

That leaves you with just 0.6% real growth

That is spending that will be taken directly out of the economy

There’s also an indirect, spin-off impact

The Federal government estimates the multiplier for government austerity to be 1.5

So the total impact of Hudak’s cuts will be 1.9%

Projected real GDP growth in 2015/16 is 2.5%

That leaves you with just 0.6% real growth

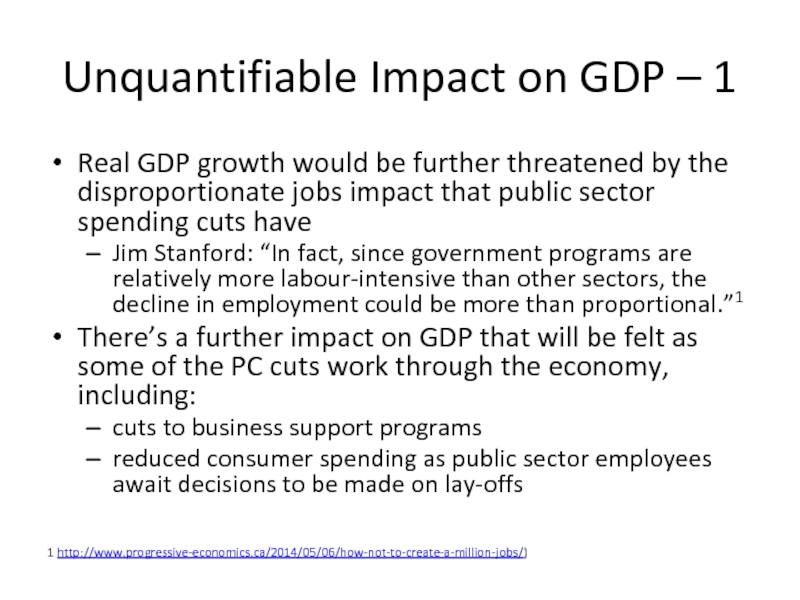

Слайд 18Unquantifiable Impact on GDP – 1

Real GDP growth would be further

threatened by the disproportionate jobs impact that public sector spending cuts have

Jim Stanford: “In fact, since government programs are relatively more labour-intensive than other sectors, the decline in employment could be more than proportional.”1

There’s a further impact on GDP that will be felt as some of the PC cuts work through the economy, including:

cuts to business support programs

reduced consumer spending as public sector employees await decisions to be made on lay-offs

Jim Stanford: “In fact, since government programs are relatively more labour-intensive than other sectors, the decline in employment could be more than proportional.”1

There’s a further impact on GDP that will be felt as some of the PC cuts work through the economy, including:

cuts to business support programs

reduced consumer spending as public sector employees await decisions to be made on lay-offs

1 http://www.progressive-economics.ca/2014/05/06/how-not-to-create-a-million-jobs/)

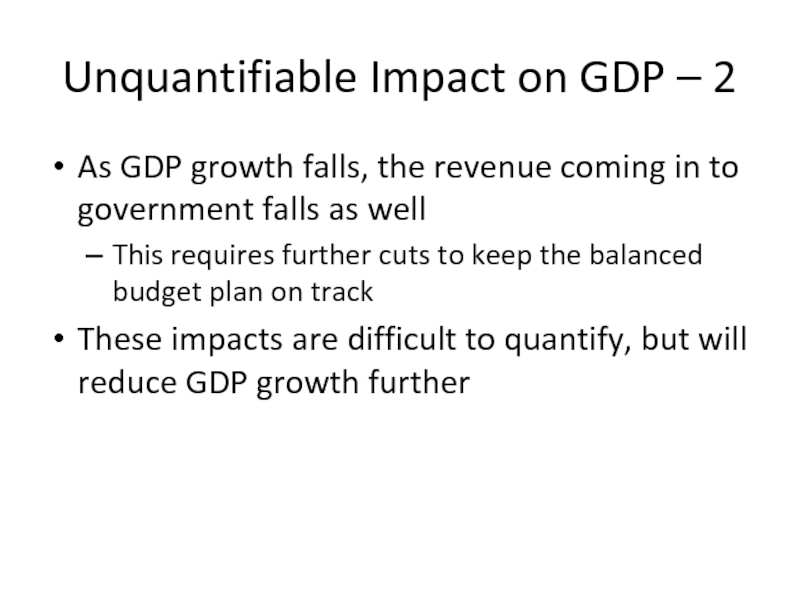

Слайд 19Unquantifiable Impact on GDP – 2

As GDP growth falls, the

revenue coming in to government falls as well

This requires further cuts to keep the balanced budget plan on track

These impacts are difficult to quantify, but will reduce GDP growth further

This requires further cuts to keep the balanced budget plan on track

These impacts are difficult to quantify, but will reduce GDP growth further