LLC

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why These 3 Energy Stocks Plunged 10% This Week презентация

Содержание

- 1. Why These 3 Energy Stocks Plunged 10% This Week

- 2. It was a another mixed week

- 3. What: Units of LINN Energy (NASDAQ: LINE) dropped just more than 10% this week.

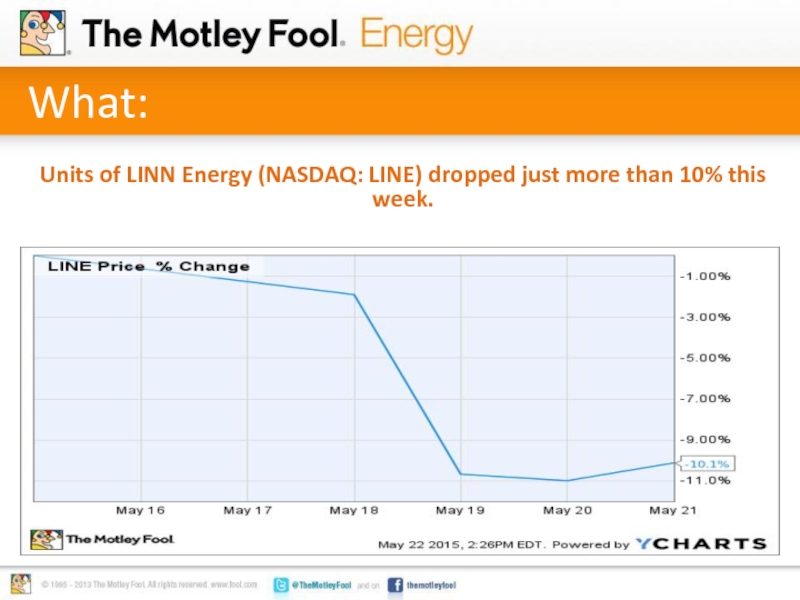

- 4. So What: Key driver: LINN Energy announced

- 5. Now What: LINN used its credit facility

- 6. What: Shares of the upstream MLP Atlas Resource Partners (NYSE: ARP) declined 11.5% this week.

- 7. So What: Key driver: Atlas Resource Partners

- 8. Now What: Deal is expected to be

- 9. What: Shares of coal producer Peabody Energy

- 10. So What: Key driver: Plunging bond prices

- 11. Now What: Peabody issued $1 billion in

- 12. This $19 trillion industry could destroy the

Слайд 2

It was a another mixed week for energy stocks. While several

enjoyed solid gains, others fell on hard times.

Here’s a closer look at three companies that really had a tough week.

Photo credit: TaxRebate.org.uk

Слайд 4So What:

Key driver: LINN Energy announced a public offering of 16

million units

Offering is expected to raise $181 million

That cash will be used to reduce its debt

Offering is expected to raise $181 million

That cash will be used to reduce its debt

Слайд 5Now What:

LINN used its credit facility to buy back $184 million

of its bonds on the open market for $165 million

It’s now issuing equity to pay down its credit facility

Takeaway: Investors don’t like the debt-for-equity swap as it is viewed as a sign of weakness

It’s now issuing equity to pay down its credit facility

Takeaway: Investors don’t like the debt-for-equity swap as it is viewed as a sign of weakness

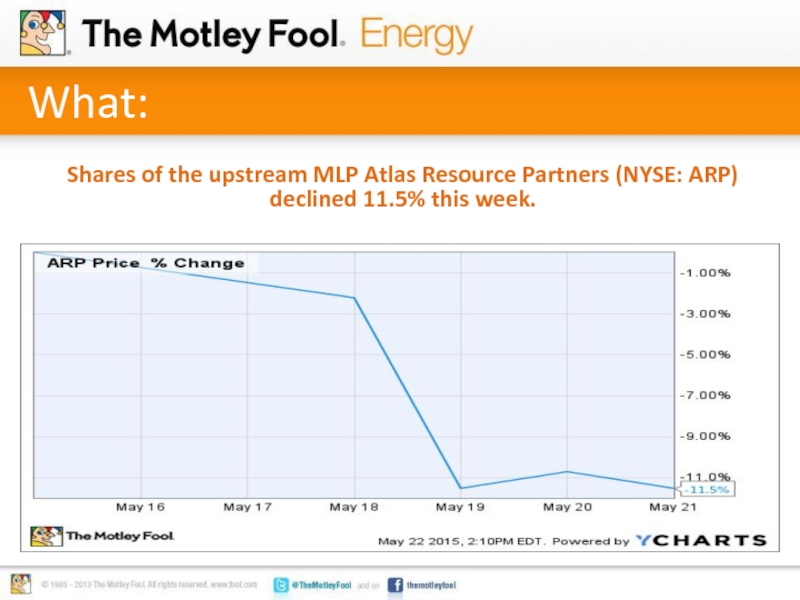

Слайд 6What:

Shares of the upstream MLP Atlas Resource Partners (NYSE: ARP) declined

11.5% this week.

Слайд 7So What:

Key driver: Atlas Resource Partners announced that it was issuing

6.5 million common units

Raised a total of $49.5 million

Plans to use $35.5 million to buy natural gas properties from its parent Atlas Energy (NYSE: ATLS)

Balance of cash raised to be used to pay down its credit facility

Raised a total of $49.5 million

Plans to use $35.5 million to buy natural gas properties from its parent Atlas Energy (NYSE: ATLS)

Balance of cash raised to be used to pay down its credit facility

Слайд 8Now What:

Deal is expected to be accretive to Atlas Resource Partners’

cash flow per unit

Company also bolstered its balance sheet by raising additional equity to pay down some of its credit facility

Takeaway: Despite the positives of the deal, investors weren’t thrilled as these are natural gas assets and really don’t move the needle for the company

Company also bolstered its balance sheet by raising additional equity to pay down some of its credit facility

Takeaway: Despite the positives of the deal, investors weren’t thrilled as these are natural gas assets and really don’t move the needle for the company

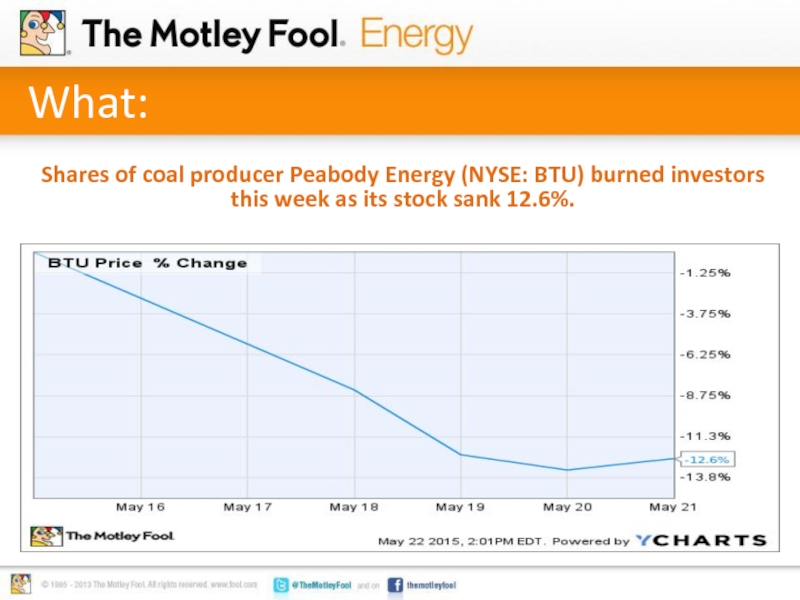

Слайд 9What:

Shares of coal producer Peabody Energy (NYSE: BTU) burned investors this

week as its stock sank 12.6%.

Слайд 10So What:

Key driver: Plunging bond prices

Bloomberg reported on May 19 that

Peabody Energy’s bonds, just issued two months ago, are already down 18%

Слайд 11Now What:

Peabody issued $1 billion in 10% bonds to bolster its

cash position to weather the storm in the coal market

However, the continued weakening in the coal market has weakened Peabody’s financial outlook

Takeaway: Peabody is trying to stay afloat, but the rapid descent of its recent bond offering doesn’t bode well for its future

However, the continued weakening in the coal market has weakened Peabody’s financial outlook

Takeaway: Peabody is trying to stay afloat, but the rapid descent of its recent bond offering doesn’t bode well for its future

Слайд 12This $19 trillion industry could destroy the Internet

One bleeding-edge technology is

about to put the World Wide Web to bed. And if you act right away, it could make you wildly rich. Experts are calling it the single largest business opportunity in the history of capitalism... The Economist is calling it "transformative"... But you'll probably just call it "how I made my millions." Don't be too late to the party -- click below for one stock to own when the Web goes dark.