All Crushed This Week

- Главная

- Разное

- Дизайн

- Бизнес и предпринимательство

- Аналитика

- Образование

- Развлечения

- Красота и здоровье

- Финансы

- Государство

- Путешествия

- Спорт

- Недвижимость

- Армия

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Why Teekay Corporation, California Resources Corp, and Seadrill Partners LLC Were All Crushed This Week презентация

Содержание

- 1. Why Teekay Corporation, California Resources Corp, and Seadrill Partners LLC Were All Crushed This Week

- 2. The energy industry continues to be

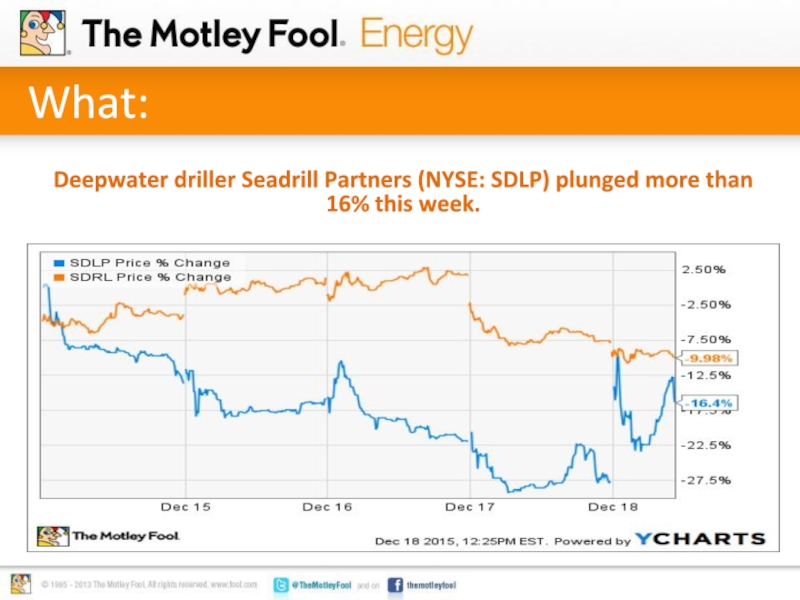

- 3. What: Deepwater driller Seadrill Partners (NYSE: SDLP) plunged more than 16% this week.

- 4. So What: Key driver: Seadrill Partners reduced

- 5. Now What: The company intends to use

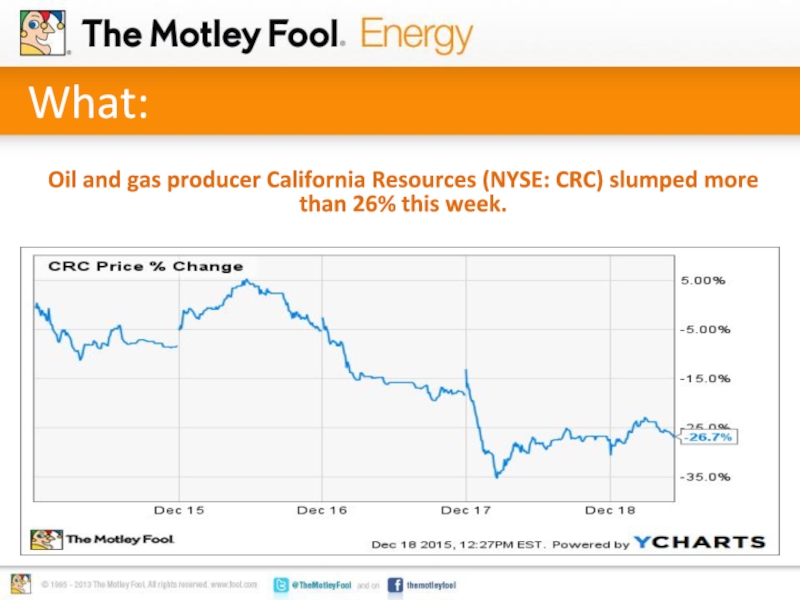

- 6. What: Oil and gas producer California Resources (NYSE: CRC) slumped more than 26% this week.

- 7. So What: Key driver: California Resources closed

- 8. Now What: Despite the lower principal, the

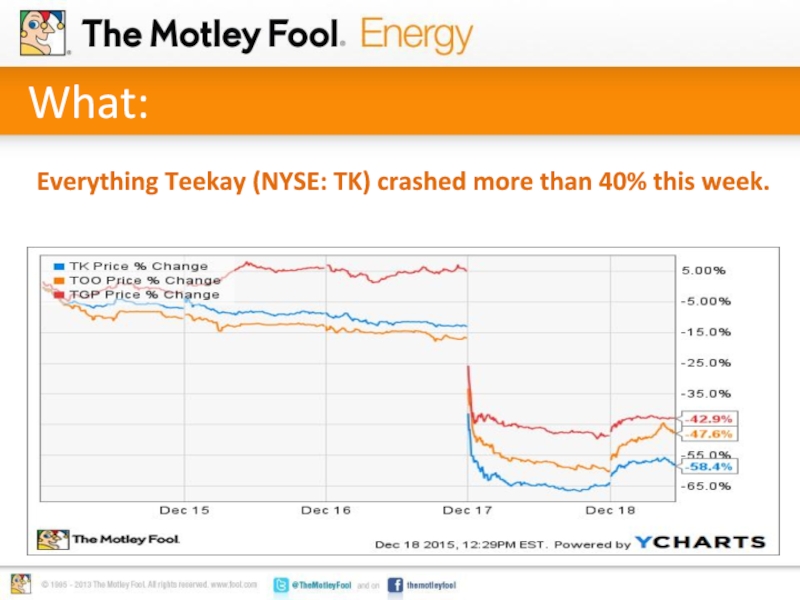

- 9. What: Everything Teekay (NYSE: TK) crashed more than 40% this week.

- 10. So What: Key driver: Teekay, Teekay Offshore,

- 11. Now What: Adding to the selling pressure

- 12. This could be the next billion-dollar iSecret

Слайд 2

The energy industry continues to be pummeled by weak oil prices,

which have renewed their slide in recent weeks. This weakness is really starting to spill over into the credit market, making it tougher for energy companies to get funding. These credit worries are weighing down energy stocks that either rely on debt as a key funding source, or have a lot of it on their balance sheet. That was clear by looking closer at the three most beaten down energy stocks this week, which according to S&P Capital IQ data, were Seadrill Partners (NYSE: SDLP), California Resources Corp (NYSE: CRC), and Teekay Corporation (NYSE: TK).

Слайд 4So What:

Key driver: Seadrill Partners reduced its quarterly distribution by 55%

Yielding

to market pressure, the offshore driller reduced its distribution despite more than adequate coverage

Слайд 5Now What:

The company intends to use the cash to increase its

financial flexibility

Key takeaway: Investors actually cheered the move after it was announced, but even with that rally shares are down substantially over the past few weeks, suggesting its troubles are far from over

Key takeaway: Investors actually cheered the move after it was announced, but even with that rally shares are down substantially over the past few weeks, suggesting its troubles are far from over

Слайд 7So What:

Key driver: California Resources closed its bond exchange

The company exchanged

$2.8 billion of its old notes for new second lien notes

The exchange reduced its principal amount by $563 million

The exchange reduced its principal amount by $563 million

Слайд 8Now What:

Despite the lower principal, the company’s interest costs will rise

by $21 million due to the higher rate on the new notes

Key takeaway: The company still has a lot of debt left to address, but doesn’t see any more moves this year due to the renewed weakness in commodity prices

Key takeaway: The company still has a lot of debt left to address, but doesn’t see any more moves this year due to the renewed weakness in commodity prices

Слайд 10So What:

Key driver: Teekay, Teekay Offshore, and Teekay LNG Partners all

announced significant distribution cuts

The companies said they plan to use the cash to invest in growth projects and reduce debt

The companies said they plan to use the cash to invest in growth projects and reduce debt

Слайд 11Now What:

Adding to the selling pressure were a number of analyst

downgrades

Key takeaway: Investors see the steepness of the cuts suggesting that it was getting difficult for the Teekay companies to get funding by the market

Key takeaway: Investors see the steepness of the cuts suggesting that it was getting difficult for the Teekay companies to get funding by the market